Study of GME

- 01/15/2021 – big short squeeze (138% Short Interest) could be the main reason for stock soaring. I might need to learn to watch out the short squeeeze opportunities,

With 138% Short Interest, Board Change Sends GameStop Stock Soaring

GameStop — which sells video games mostly through physical stores — enjoyed a 57% pop in its stock price on January 13, according to the Wall Street Journal.

This rise happened despite a 30% decline in revenues for the most recent quarter, negative free cash flow and no forecast for the future, according to GameStop’s third quarter earnings conference call transcript.

Does this price spike reflect a sudden reassessment of the current value of its future cash flows? I think it does not. Instead, it reflects a buying panic resulting from news about changes on GameStop’s board of directors.

GameStop’s Phenomenal Stock Price Spike

GameStop shares have enjoyed a huge rise in the last 12 months — the stock was up 583% in the last year — from $4.60 in January 13, 2020 to $31.40 this Wednesday.

Much of that increase was triggered by news that pet supplier Chewy’s “co-founder Ryan Cohen [— who owns 13% of GameStop’s stock —] and two of his former colleagues” are joining GameStop’s board, noted the Journal.

GameStop, Bed Bath & Beyond shares are surging from short busting, Jim Cramer says

Shares of Bed Bath & Beyond surged nearly 19% during the session, a number that was bested by the 27% rally in GameStop, whose shares have posted double-digit gains three times this week alone to levels not seen in about six years.

“Like it or not, right now we’ve got a bull market in short busting, and I bet you’ll see more stories like GameStop and Bed Bath,” the “Mad Money” host said. “I don’t recommend trying to game them.”

More than 60% of Bed Bath & Beyond shares are in short interest, while about 140% of GameStop shares have been sold short, according to data compiled by FactSet.

- 01/15/2021 – GME increases 10X in a year, if I bought LEAPs by following Burry’s idea (and fully understand it), that will be huge profit. GME is one of the largest position of Burry, I should have spent more time to understand his rational!

Why GameStop’s Shares Jumped 93.7% Today

Video games are hot again!

What happened

Shares of video game retailer GameStop (NYSE:GME) continued its incredible run on Wednesday, climbing as much as 93.7% in morning trading. By midday, shares had settled slightly and were “only” up 63.2% at 12:55 p.m. EST.

So what

The biggest reason for GameStop’s rise this week was a Monday announcement of holiday sales and new board members. Holiday quarter sales rose 4.8% on a comparable-store basis and e-commerce sales jumped 308%. Management didn’t give guidance for the full quarter, but did say it expected comparable-store sales and profits to rise in the fourth quarter of fiscal 2020.

Also on Monday, GameStop announced three new directors with e-commerce and technology experience. This was part of an agreement with RC Ventures, the company’s largest stockholder, to expand the board of directors from 10 members to 13.

The performance, particularly in online sales, reinforces management’s move to put more people with e-commerce experience in leadership positions. GameStop clearly has an opportunity to grow its business as a new generation of consoles reaches the market and it has new reasons to interact with consumers. And that bullish outlook is what the market is reacting to today.

Now what

For years, console and video game makers have been transitioning to digital sales of products rather than disks or cartridges. And in theory that should hurt GameStop’s business. But the company has become a go-to location to get the hottest video game items and can add in accessories for gamers as well. If it’s successful in becoming the go-to place for gamers online, this stock run could continue. But after more than doubling in the last three days I am wary of a pullback in this hot video game retailer because the hype could end as quickly as it came.

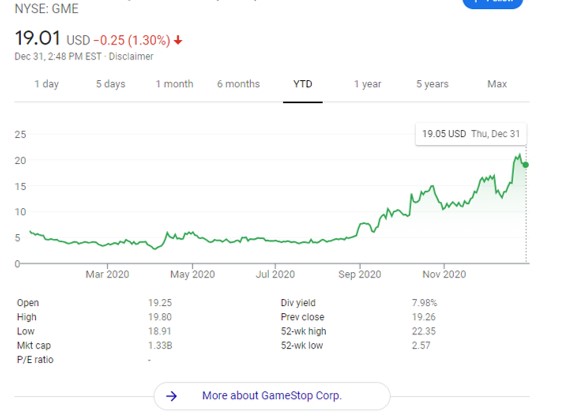

- 12/31/2020 – what a year for GME, Burry is right again and I missed it

- 10/20/2019 – PS5 release date news: PlayStation 5 launch line-up REVEALED? Major PS4 sequels included

- 10/08/2019 – Sony Confirms PS5 Name, Controller Details, 2020 Release Date Window, The PlayStation 5 is on the way next year.

- 10/01/2019 – history and detailed background of Gamestop

- 10/01/2019 – GameStop’s Reinvented Business Model

- 09/29/2019 – GameStop Corp. (GME)FORM 10-Q 2019| Quarterly Report

GameStop Corp. (GME) CEO George Sherman on Q2 2019 Results – Earnings Call Transcript

- 09/29/2019 – PC Gaming vs Console Gaming: Which is the Ultimate Winner?

Daniel Horowitz|July 21, 2018- background knowledge on console gaming vs streaming gaming

- 09/29/2019 – Console gaming is at a crossroads

The PlayStation 5 and all-digital Xbox One S represent disparate futures.

09/29/2019 – What is the life-cycle of a console?

using the above data, we can say that the average life-cycle of today’s consoles might be around 7-8 years. Please do remember that these predictions are purely arbitrary, and I cannot predict the future (or can I?)

Gamestop Overall Satisfaction Rating 3.2/5

Gamestop Reviews and Complaints 1.7/5

reseller ratings 1.0/10

The next Xbox is expected to arrive in 2020 — here’s what we know

Ben Gilbert Dec 18, 2018, 9:22 AM

The Xbox Two Release Date will be in November 15, 2020 (Updated Release Date) or sooner. The Xbox One X represents the first iterative console release within a single generation, but it’s not a next generation console.

Microsoft’s own Aaron Greenberg spoke with Engadget about Scorpio and they asked him if this was the final console generation.

To this, Greenberg said:

“I think it is. For us, we think the future is without console generations. We think that the ability to build a library, a community, to be able to iterate with the hardware–we’re making a pretty big bet on that with Project Scorpio. We’re basically saying, ‘This isn’t a new generation; everything you have continues forward and it works.’ We think of this as a family of devices.”

The PS5 Release Date will be in November 2020. We predicted this date back in 2014! With the now officially confirmed PS5 the release is expected to dominate gaming consoles once again!

- 09/29/2019 – GameStop: Bonus Round

- GameStop is misunderstood, and its stock is underpriced by any metric of value.

- Recent profit improvement initiatives set the stage for explosive growth when the new console cycle begins in late 2020.

- Share buybacks are likely underway and will contribute to share price appreciation longer term.

- 09/29/2019 – GameStop Stock Has Been Blown to Bits, but Insiders Are Scooping Up Shares

- 09/24/2019 – gurufocus report on GME (GuruFocus_Report_GME)

- 09/16/2019 – 4 Cheap Value Stocks Trading Below Book Value With Net Cash

- 08/26/2019 – A Famous Investor Bets Big on GameStop — but Will It Pay Off?

- 08/22/2019 – Michael Burry as activist investor? Scion re-enters GameStop, sends letter to management

Scion previously closed-out a stake in GameStop during Q2 2019. Burry has now repurchased GME at lower prices.

This is not Scion’s first go round with GameStop. In the hedge fund’s Q4 2018 report — it’s first in two years — Burry disclosed a 536,862 position in GME. That represented 6.54% of the fund’s portfolio, Scion’s 9th largest position. GME closed 2018 at $12.20.

Q1 2019’s 13F report revealed that Burry had increased his GME position by 21% to 650,000.

But then, just last August 14, Scion’s Q2 13F showed Burry had liquidated GME, selling all 650,000 shares in the quarter ending June 30.

| Reported via | Event Date | Name | Ticker | Shares * | Change | % of Portfolio | Estimated Event Date Price |

| 13F | 12/31/18 | Gamestop Corp., Class A | GME | 536,862 | New | 6.54 | 12.62 |

| 13F | 3/31/19 | Gamestop Corp., Class A | GME | 650,000 | 113,138 | 6.73 | 10.16 |

| 13F | 6/30/19 | Gamestop Corp., Class A | GME | 0 | -650,000 |

It should be noted that a 3% stake does not require Scion to file with the SEC. Only after a fund controls 5% of a stock must the position be publicly disclosed. A passive 5%+ investment requires a 13G filing. An activist — someone looking to catalyze changes with a company — must file a 13D.

Michael Burry as activist investor: GME could “pull off perhaps the most consequential and shareholder-friendly buyback in stock market history with elegance and stealth.”

In his letter to GameStop management, Burry states that GME could “pull off perhaps the most consequential and shareholder-friendly buyback in stock market history with elegance and stealth.”

“Given the market capitalization of GameStop at $290 million at the close on August 15th, completing the authorization would retire over 80% of GameStop’s outstanding shares. Depending on the timing and quality of execution, such a repurchase would increase earnings per share dramatically – far more than any other possible action on a per share basis.

The numbers are striking and demand action. We estimate that GameStop now has in excess of $480 million of cash, more than enough to complete the share repurchase authorization and still invest in the business and pay down debt.”

Burry believes that, given GME’s high liquidity, the company could easily pull off the “game-changing” buyback.

He also points out that short interest in GameStop stock was 57,226,706 shares as of July 31 — about 63% of the 90.26 million outstanding GameStop shares at last report.

This is a bold public move for Michael Burry. One wonders if he really wants to be an activist investor–the guy who stands in a hostile boardroom and demands things. However, in The Big Short book Michael Lewis quotes Burry after he studied Warren Buffett: “The lesson of Buffett is, to succeed in a spectacular fashion you have to be spectacularly unusual.” Michael Burry as activist investor is certainly that.

In a shocking move, Michael Burry’s firm, Scion Asset Management, now owns 3 percent of GameStop’s shares. GameStop’s shares dropped to almost one-fourth of their value this year, so Scion decided to snag them while they’re cheap. With this bold move, GameStop’s shares promptly spiked more than 11 percent. Burry believes that, despite the grim outlook, GameStop has a “balance sheet [that’s] actually in very good shape.” He also noted that both the PlayStation 5 and Microsoft’s Project Scarlett will be able to use physical discs, meaning that brick-and-mortar stores will still have use even in the next generation. He seems to think that 2019 will be the final year of GameStop’s downward spiral and it will pick right back up within the next year.

- balance sheet is actually in very good shape, I believe they will have the cash flow to justify a much higher share price

- market is overly pessimistic over the videogame retailer’s prospects, noting that both Sony ’s (SNE) and Microsoft ’s (MSFT) next-generation consoles, which are widely expected next year, are likely to have physical optical disk drives. He also played down concerns over competition from new videogame streaming competitors like Alphabet ’s (GOOGL) Stadia.

- 90% of GameStop’s roughly 5,700 stores are free-cash-flow positive. He explained how during the previous video-game console cycle, its free-cash flow tumbled in the last year before rebounding smartly the following years. He thinks 2019 will be the bottom for this cycle.

- Next year’s consoles still using optical disk drives “is going to extend GameStop’s life significantly,” Burry said. “The streaming narrative dovetailing with the cycle is creating a perfect storm where things look terrible. [But] it looks worse than it really is.”

- He noted there may be mechanical selling by quant-oriented funds because of new lease accounting guidelines that went into effect earlier this year. The new guidelines drove GameStop’s leverage ratios higher, he says, while nothing has changed fundamentally.

- Burry added that he is concerned GameStop’s management may make a bad acquisition, citing its ill-fated move into wireless stores around 2013, instead of returning capital to shareholders.

- 08/19/2019 – Scion Asset Management Urges GameStop to Buy Back $238 Million of Stock with Cash on Hand

GameStop stock at all-time lows this month – Scion seeks full execution of March 2019 $300 million share repurchase authorization

CUPERTINO, Calif.–(BUSINESS WIRE)–On August 16th, Scion Asset Management sent a letter to the Board of Directors of GameStop Corp. urging the Board to direct the full execution of its March 4th, 2019 $300 million share repurchase authorization. GameStop’s market capitalization hovering around $310 million compares to $237.6 million remaining on the buyback authorization. Scion estimates GameStop has cash on hand in excess of $480 million, meaning the repurchase could be completed with less than half of the cash on hand. Scion points to the very high volume in GameStop stock magnifying the practical opportunity at present. Scion believes the opportunity for a game-changing buyback cannot be missed and recommends the Board act to ensure the completion of the authorized buyback in a timely manner.

As of August 19, 2019, Scion Asset Management and its affiliates own 3,000,000 shares, or 3.3%, of GameStop Corp. common stock:

August 16, 2019

Dear Members of the Board,

Scion Asset Management, LLC and its affiliates (“Scion”) own approximately 2,750,000 shares, or about 3.05%, of GameStop, Inc. (“GameStop”) common stock.

As mentioned in our previous letter to the board, we have concerns regarding capital management at GameStop. Given recent GameStop common stock prices under $4 per share, we must re-state that GameStop complete the remaining $237,600,000 share repurchase at once and with urgency.

Given the market capitalization of GameStop at $290 million at the close on August 15th, completing the authorization would retire over 80% of GameStop’s outstanding shares. Depending on the timing and quality of execution, such a repurchase would increase earnings per share dramatically – far more than any other possible action on a per share basis.

The numbers are striking and demand action. We estimate that GameStop now has in excess of $480 million of cash, more than enough to complete the share repurchase authorization and still invest in the business and pay down debt.

Through August 15th, a total of 11 trading days, 50,399,534 shares have traded. At this rate, for the month of August and for the third month in a row, the number of shares traded will exceed the total number of shares outstanding. Because of such high volume, we maintain that GameStop could pull off perhaps the most consequential and shareholder-friendly buyback in stock market history with elegance and stealth.

Shareholders staring at all-time lows in GameStop stock see little evidence that GameStop has effectively leveraged its elite position in the gaming universe as the new paradigm came into clear view over the last five years.

The unfortunate reality is that Amazon, not GameStop, bought Twitch in 2014. Instead, in 2014, GameStop started buying wireless store assets. And in 2017, Amazon, not GameStop, bought GameSparks – while less than a year ago GameStop reversed course and sold its wireless store assets. Shareholders are right to worry.

We expect GameStop’s business will perk up a bit during 2020 and 2021 as the new console cycle, with associated software updates and introductions, finally gets underway. But what is happening now in the stock is about more than late cycle doldrums or even the streaming paradigm – shareholders do not have faith in current management, and have not been inspired by new leadership policies.

Notably, as of July 31st, 2019, Bloomberg reports short interest in GameStop stock at 57,226,706 shares – this is about 63% of the 90,268,940 outstanding GameStop shares at last report.

We submit that when share prices are at or near all-time lows and more than 60% of the shares are shorted despite cash levels much higher than the current market capitalization, lack of faith in management’s capital allocation is the default conclusion.

All of this creates the opportunity to enter 2020 with a dramatically reduced share count along with multi-fold greater impact per share for every single other achievement of management. Consider as just one example that if the turnaround is successful, and if GameStop were able to shrink its shares outstanding to 30 million through the share repurchase, the $157 million dividend that was just eliminated would pay out around $5.25 per share.

The Board deemed up to $6.00 per share a good price for a buyback less than two months ago, and the price of the stock today is nearly half that amount.

We again advise the Board to represent shareholders well, and to ensure the execution of the remaining repurchase authorization in full.

Sincerely,

Dr. Michael J. Burry

- 04/17/2019 – GameStop’s New CEO Will Have His Hands Full

Transforming an analog retailer in a digital gaming world will be no easy task.

Changing how we think about GameStop

The executive, who has held various senior positions at Advance Auto Parts, Best Buy, Target, and Home Depot, has the unenviable task of reshaping a company that has seen its industry transform itself. GameStop has essentially been stuck in an analog world that has gone digital.

A report by the website VentureBeat says GameStop is angling to become a “cultural experience” that can build on its history and expertise in gaming. As part of an initiative that’s been dubbed GameStop 2.0, the retailer intends to deploy TVs to give gamers a place to try out a title before buying it. Instead of having posters on the wall promoting a title, GameStop will immerse customers in the milieu by putting the game in their hands and (it hopes) convincing them to buy it.

It will also apparently include more membership programs that enhance the retailer’s existing PowerUp Rewards loyalty program that lets members earn points for every dollar they spend. For paying “pro” members, there are augmented benefits like discounts on game titles and a subscription to Game Informer magazine. GameStop’s rewards program boasts 37 million members, some 6.3 million of whom are paying $15 a year, indicating almost $95 million in annually recurring revenue from the service.

Check out the latest earnings call transcript for GameStop.

Tight quarters

It’s a good base to start from, but the number of paying members has been stuck at around 6 million for the past five years and is down from around 8 million members at its peak.

Sherman is also going to have difficulty reimagining GameStop stores because they are small, around 1,700 square feet on average, and already incorporate areas to let gamers try out games. Adding more space to allow gamers to lounge around and play games will be difficult without increasing a store’s physical footprint. Further, beyond its efforts to make trying games in its stores easier, Gamestop will still need to reinvigorate its membership growth and game sales.

The advent of online gameplay and downloadable games has put GameStop in the predicament of considering whether it should sell itself. It came away from a strategic analysis deciding to remain a stand-alone company and develop these initiatives on its own, which Sherman is now tasked with implementing. But online gaming is only getting bigger.

Being left behind

Alphabet‘s (NASDAQ:GOOG)(NASDAQ:GOOGL) Google just announced it will be launching Stadia, a new digital, on-demand video game streaming service that will allow individuals to play any game on any connected device. It will be able to stream games in 4K HDR at 60 frames per second, and it doesn’t require you to update the game or download it. Because the games reside in Google’s cloud, you just log on and play. It’s a powerful business model to compete against, one that Microsoft, Nintendo, and Sony have already staked out, and one which Amazon.com is rumored to be considering, too.

GameStop has been relegated to being the Blockbuster Video to this new “Netflix of gaming” model, forcing it to close down stores as the digital marketplace ate into its business. It closed 131 video game stores in 2017 and another 58 through the first three quarters of 2018.

It still has almost 3,800 stores in the U.S. (and almost another 2,000 internationally), giving it a footprint to try out some of these ideas. But 80% of the leases on GameStop stores expire between the end of January this year and 2021, so we’re likely to see a large number of additional closures in the near future.

The key investment takeaway

As more technology companies like Google and Amazon enter the gaming world, it makes it more difficult for GameStop to remain relevant. So its new CEO still has the same old problems that aren’t easily resolved.

- 03/21/2019 – GameStop’s new CEO is expected to lead a major overhaul – the transformation plan does not seem that compelling to me

According to VentureBeat, sources familiar with the company say Sherman’s hiring is part of the company’s “GameStop 2.0” plan that will shift the company from a retailer to a “cultural experience.” The company reportedly plans to focus on membership programs that encourage trade-ins and purchases of pre-owned games. GamesStop may also explore turning stores into an environment in which gamers can come in, hang out, and try out games before buying them.

11/23/2018 – GameStop Stock Is Falling Because the Sale of a Unit Isn’t a Magic Bullet

By Teresa Rivas

Updated Nov. 23, 2018 3:58 pm ET / Original Nov. 23, 2018 11:50 am ET

10/02/2017 – Is GameStop The Next Blockbuster?