Study of GME alike stocks with meme character and extra high short interest – I can buy call option before short squeeze and put once squeeze is done. check Memeberg Terminal near the end of each day and buy 2 weeks ~ 12 months short term option, study the fundamentals and upside (downside) possibility of each company. Buy options with premium less than 0.05., prefer 0.01.

- 06/12/2021 –

To The Moon, Part 4: Diamond Hands – The Journal. – WSJ Podcasts

- 06/09/2021 – It is great to learn the lesson from these podcasts

‘To The Moon’ – WSJ

‘To The Moon’

How did a bunch of amateurs take Wall Street by surprise? Our five-part podcast series goes inside the GameStop saga.

New episodes of ‘To The Moon’ will publish over the next four Sundays. Listen and follow on Spotify, Apple Podcasts or your favorite podcast player.

Our five-part special podcast series, “To The Moon,” tells the full story of the GameStop saga, and invites listeners onto the roller-coaster ride that was GameStop—to feel what it was like for the individual investors who were suddenly making hundreds of thousands of dollars overnight, and to hear why they wanted to risk their life savings in the first place.

- 06/09/2021 – Great discussion on GME alike, what should I do?

To the moon! Deeper dive into meme stock trading

- The meme trade is transforming into something new as retail traders continue to make waves in the broader markets. The ability to pool together their collective research or sentiment is lending credence to a new investment strategy, which is generating so much buzz that brokerages, hedge funds and institutions didn’t see it coming. With more stocks being added to the category by the day, volatility is even affecting rebalancing decisions of market indexes like the Russell 2000 (NYSEARCA:IWM), which was once considered a stable benchmark for mutual funds before all the action.

- The old meme list that headlined favorites AMC (NYSE:AMC), BlackBerry (NYSE:BB) and GameStop (NYSE:GME) is changing. Over the last few sessions, we’ve seen big run-ups and falls in names like Clover Health (NASDAQ:CLOV), ContextLogic (NASDAQ:WISH), Clean Energy Fuels (NASDAQ:CLNE), GEO Group (NYSE:GEO) and even Wendy’s (NASDAQ:WEN). The fast-food chain was added to the group yesterday, which marked a notable departure from the classic meme mold that featured high short interest in order to squeeze a stock.

- Backdrop: The meme trade began with GameStop back in January and was partly a strategy (short squeeze), partly a gamble (remember binary options?) and partly a middle finger to Wall Street (little guy vs. the suits). The strategy was an outgrowth of the YOLO trade, which was popularized on the WallStreetBets forum to reach financial freedom overnight. Retail bros would throw all of their savings into one stock without caring about risk management or diversification. The method was compounded by waves of swarm trading, as well as gamification of stock apps and access to commission-free trading.

- Remember the Hertz (OTCPK:HTZGQ) bankruptcy bid-up that occurred last summer and the Kodak (NYSE:KODK) craze that followed? What about Tesla (NASDAQ:TSLA) once being worth more than every carmaker on Earth despite a fraction of their sales? Do we dare mention Bitcoin (BTC-USD), Dogecoin (DOGE-USD) or other cryptos?

- Go deeper: If meme trading is the new casino gambling, then timing is everything until the last trader is left holding the bag. Some still swear by the technicals, which have created countless day trading channels and messaging platforms. Others are quick to point to the eye-popping fortunes being posted online, but don’t forget the whopping losses that get far less coverage. It also leads one to wonder about the broader public markets, where every share is only worth as much as people are prepared to pay for it. With the meme trade spreading to new sectors and industries, will stock fundamentals still hold water? Did they ever?

- Tilray’s CEO is welcoming Reddit users and Generation Z as investors. Is cannabis the next meme-stock target?

- 06/08/2021 – There are 4495 mentions and 600.16% change on CLOV, 538 mentions and 2518.75% change on WEN , and they cause the big spike in them. Watch out. – idea: check Memeberg Terminal near the end of each day and buy 2 weeks ~ 6 months short term option, study the fundamentals and upside (downside) possibility of each company

Clover Health’s Stock Price Surges After Becoming New Reddit Darling – WSJ

Individual investors are targeting the SPAC-listed company, hoping it catches similar momentum to AMC and GameStop

https://www.memebergterminal.com/

- 06/06/2021 – Tilson’s short list for the meme stocks – should I buy out for AMC? today’s AMC’s short interest ratio is 21%

I never would have believed it, but the recklessness of a segment of retail investors appears to have no bounds in this market…

After falling by more than 50%, the 25 stocks in the “Short Squeeze Bubble Basket” that I identified in my January 27 e-mail have rallied and are now “only” down 28% on average (versus a 12% gain for the S&P 500 Index).

This type of short-term rally is to be expected, and for stocks like these, this is an opportunity to add to a short or put position because it’s clearly a dead-cat bounce.

Thus, I’m officially calling another short-term top – but since I don’t have time to re-do my work on all 25 stocks, this time I’m only going to name the 10 most obvious turds in the basket:

|

Company |

6/1 Price |

|

GameStop (GME) |

$249.02 |

|

AMC Entertainment (AMC) |

$32.04 |

|

BlackBerry (BB) |

$11.56 |

|

Bed Bath & Beyond (BBBY) |

$27.26 |

|

Koss (KOSS) |

$24.15 |

|

Nikola (NKLA) |

$15.44 |

|

Workhorse (WKHS) |

$9.63 |

|

Nano-X Imaging (NNOX) |

$26.71 |

|

GSX Techedu (GOTU) |

$18.08 |

|

Plug Power (PLUG) |

$30.89 |

Mark my words: these stocks will fall 25% within a month (probably much sooner), 50% within three months, and 75% within a year. I will be tracking them and will report back to you periodically.

- 06/04/2021 – Whether recycled memes (such as AMC and GME) can outperform repurposed boxes remains to be seen.

AMC and Other Meme Stocks Boom Again. What Will Erupt Next? – MarketWatch

Are meme traders running out of fresh ironic picks? AMC Entertainment Holdings just went on its second madcap run-up in less than six months. As a rotary native in a digital world, I can’t hope to keep up with the young, idle, and fiscally stimulated capitalists monetizing their ability to quickly spot chat-room microtrends in off-the-radar assets. But if the Reddit and Robinhood set has started recycling old jokes, well, that’s something I know a thing or two about.

Meme-trade sequels can be just as action-packed as the originals, as AMC (ticker: AMC) has proved. The theater chain started this year at $2 a share, and hit $20 during the GameStop (GME) frenzy in late January. Then, it cooled to single digits late last month, before exploding to over $70 at one point this past week. The rise this time, like last, was linked to punch-line posting on Reddit, elevated short interest ripe for squeezing, and high volume in call options.

Whether recycled memes can outperform repurposed boxes remains to be seen.

- 06/04/2021 – good websites to track meme stocks

Reddit loves its meme stocks and it loves to short squeeze hedge funds. It helps that those squeezes also typically send share prices soaring, which benefits the traders as they hold and buy more shares to continue the cycle.

Wednesday is no different with the WallStreetBets subreddit full of chatter about the top meme stocks. Let’s take a look at those getting the most attention today and how the stocks are moving as well.

Reddit WSB Meme Stocks

- BlackBerry (NYSE:BB) stock starts off the list with 4,261 mentions on the subreddit over the last 24 hours. The stock is up more than 12% with 65 million shares moving as of this writing.

- AMC Entertainment (NYSE:AMC) shares are up next with 4,235 mentions in the last 24 hours. The stock is up more than 24% with 174 million shares moving as of this writing.

- GameStop (NYSE:GME) stock continues to be a favorite with 1,484 mentions over a 24-hour period. The stock is up slightly with 2 million shares moving as of this writing.

- Microvision (NASDAQ:MVIS) shares are where we see mentions trail off as it reaches 218 in the most recent 24 hours. The stock is up a little with 9 million shares moving as of this writing.

- Sundial Growers (NASDAQ:SNDL) stock is right behind it with 212 mentions in the last 24 hours. The stock is up more than 3% with 78 million shares moving as of this writing.

- SPDR S&P 500 ETF Trust (NYSEARCA:SPY) shares have 191 mentions over a 24-hour period. The stock is up slightly with 7 million shares moving as of this writing.

- Palantir Technologies (NYSE:PLTR) stock has 185 mentions over 24 hours on the WSB subreddit. The stock is down slightly with 10 million shares moving as of this writing.

- Tilray (NASDAQ:TLRY) shares join the list with 175 mentions in the last 24 hours. The stock is up more than 3% with 7 million shares moving as of this writing.

- Nokia (NYSE:NOK) is among Reddit’s favorite meme stocks but it only has 164 mentions in the last 24 hours. The stock is up more than 3% with 26 million shares moving as of this writing.

- Nio (NYSE:NIO) closes out the meme stocks list with 140 mentions in the most recent 24 hours. The stock is down slightly with 24 million shares moving as of this

2. Memeberg Terminal for reddit

The Memeberg Terminal analyzes data from stock based subreddits to display trending stocks. Inspired by the GME short squeeze of 2021.

Disclaimer: This website is not financial advice and we do not guarantee the accuracy of any information, use at your own risk.

- 06/03/2021 – try to find the names most mentioned on Reddit and short interest rate is higher than 5%

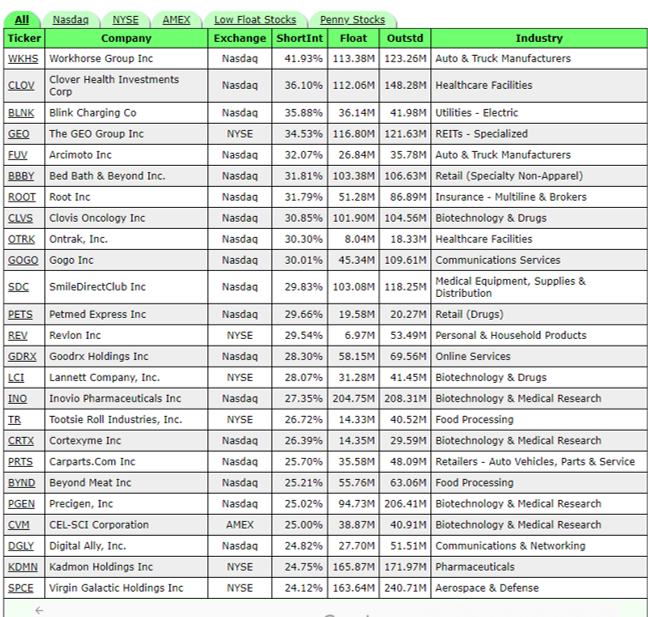

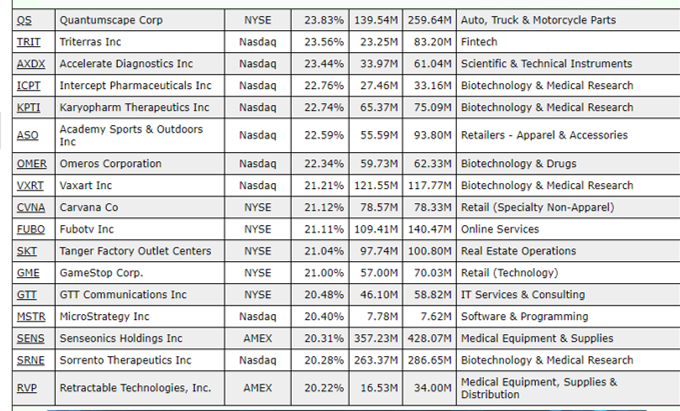

High Short Interest Stocks

HighShortInterest.com provides a convenient sorted database of stocks which have a short interest of over 20 percent. Additional key data such as the float, number of outstanding shares, and company industry is displayed. Data is presented for the Nasdaq Stock Market, the New York Stock Exchange, and the American Stock Exchange. You can view the data for all exchanges together or only view exchanges of interest by clicking on the appropriate tab.

Stocks with high short interest are often very volatile and are well known for making explosive upside moves (known as a short squeeze). Stock traders will often flock to such stocks for no reason other than the fact that they have a high short interest and the price can potentially move up very quickly as traders with open short positions move to cover.

AMC Shorts Hang Tight During Epic Rally in Break From January

With meme stocks on the move again, these are the next Reddit stocks to watch

Meme stocks are grabbing the spotlight once again, and Bank of America said to watch out for a handful of new names seeing a pickup in chatter.

So-called Reddit stocks came back from the dead with double-digit rallies this week, as investors poured back into speculative names with the stock market near record highs. Shares of GameStop soared nearly 16% on Wednesday, pushing its gains this week to 37%. Another Reddit chat room favorite, AMC Entertainment, rallied more than 19%, bringing its weekly advance to more than 60%. Both were in the green again Thursday.

Bank of America is identifying the potential up-and-coming WallStreetBets targets by analyzing for clients how many mentions each stock gets on Reddit, among other things like short interest.

“We believe some of the new retail activity may be here to stay given zero commissions, more time at home, and high savings rates — but we do expect a moderation this year amid peak stimulus, re-opening and any potential regulatory action,” Bank of America equity and quant strategist Jill Carey Hall told clients in a note.

Bank of America gave clients a list of the top small- to mid-cap stocks to watch during the return of the meme stock craze. The listed names have the most mentions on Reddit and short interest above the 5% average for the S&P 500.

Take a look at the list here.