Here is my study of PAH

- 01/25/2019 – $3.4B company (current debt $5.3 bil) that by 12/31/2018 will have debt reduced to 3.5X EBITDA and have a buyback authorization to repurchase 25% of the company (at current share price)

Wait for Monday 01/28 call, if price of PAH increases to intrinsic value ~$16.39, then I will sell my call.

- 01/24/2019 – final approval of sale is completed – I need to get ready to sell once the price jumps

Platform Specialty Products Corporation (NYSE: PAH) (“Platform”), a global specialty chemicals company, announced today that all regulatory approvals necessary to complete the previously-announced sale of Platform’s Agricultural Solutions business, which consists of Arysta LifeScience Inc. and its subsidiaries (collectively “Arysta”), to UPL Corporation Ltd have been obtained. The Arysta sale is expected to close on January 31, 2019.

Platform also announced today that it will host a conference call for investors on Monday, January 28, 2019 at 8:30 a.m. (Eastern Time) to provide preliminary estimated unaudited fourth quarter and full year 2018 financial results. Platform will also discuss its 2019 fiscal year outlook and longer-term vision for the company following completion of the Arysta transaction.

To listen to the call by telephone, please dial 877-876-9173 (domestic) or 785-424-1667 (international) and provide the Conference ID: PAHQ418. The call will be simultaneously webcast at www.platformspecialtyproducts.com. A replay of the call will be available for three weeks shortly after completion of the live call at www.platformspecialtyproducts.com.

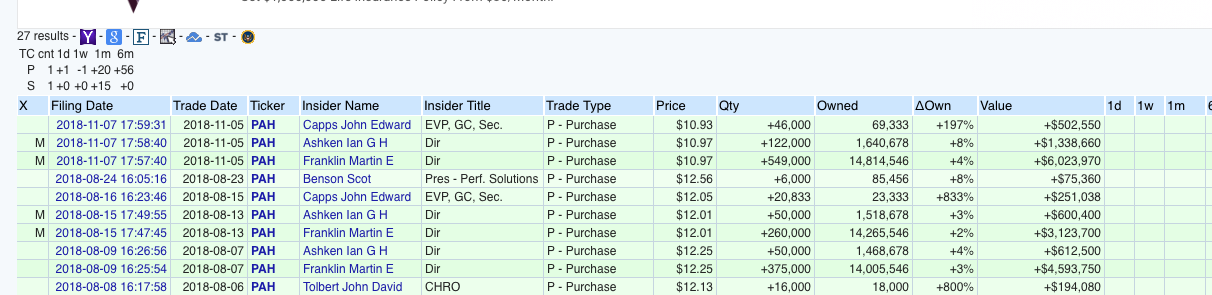

- 11/07/2018 – a lot of insider buys, good sign of PAH

- 11/03/2018 – from Valueplays

$3.4B company that by 12/31 will have debt reduced to 3.5X EBITDA and have a buyback authorization to repuchase 25% of the company (at current share price)

It’s cheap….

So, solid if unspectacular results. Guidance reaffirmed, the company is growing and the debt load they are carrying will be materially reduced post sale which should give a boost to shares. The disappointment here is the Arysta sale not being completed until year end vs earlier expectations of a Q3 closing. It’s not a dealbreaker or the end of the world by any means it is just we’ve been waiting for this for a long time since it was announced.

- 11/03/2018 It seems like from Ackman’s thesis, PAH is a screaming buy,

In July, Platform announced the sale of its Ag Solutions business for $4.2 billion in cash to UPL Corp. Limited, an Indian agrochemical company, a price which represents full value for the business. The transaction will significantly reduce the company’s leverage levels from six times EBITDA to less than 2.5 times and will result in a more focused business with attractive growth and cash flow characteristics. Platform also announced a $750 million share repurchase authorization (~20% of company’s current market value) conditioned upon the closing of the transaction, which it expects to occur in late 2018 or early 2019.

In August, Platform reported another quarter of strong earnings growth. Organic revenue increased 7% and organic EBITDA grew 8%. Performance Solutions organic revenue grew 5% due to broad-based growth across its regions and end markets. Organic EBITDA grew 10% due to margin expansion resulting from strong sales growth of higher margin products and cost savings from supply chain initiatives. Ag Solutions organic revenue grew 10% due to strength in the Latin and North American markets. Organic EBITDA grew 6% as margins declined due to input cost inflation that was partially offset by price increases and cost savings. Overall, Platform’s EBITDA grew 10% due to a 2% boost from foreign exchange and EPS grew 30%.

While Platform’s share price has increased ~25% this year, it still trades at a discount to the peer set in light of its high leverage and transaction uncertainty until deal closure. If Platform were to trade at a multiple that is similar to its peers after the closing of the Ag Solutions sale, the company’s shares should appreciate significantly from current levels.

From Bill Ackman (Trades, Portfolio)’s second quarter 2018 Pershing Square shareholder letter.

Published 7:45 AM ET Fri, 20 July 2018, Globe Newswire

Platform has signed a definitive agreement to sell Arysta LifeScience Inc. to UPL Corporation Ltd. for $4.2 billion in cash, subject to customary closing adjustments Closing expected in late 2018 or early 2019, subject to regulatory approvals and other customary closing conditions