Study of CHK

- 02/03/2021 – good to see cost reduction on CHK

Chesapeake Energy laying off 15% of employees

OKLAHOMA CITY (KFOR) – Officials with Chesapeake Energy say they are restructuring, which has resulted in hundreds of layoffs.

In an email to Chesapeake employees, CEO Doug Lawler said that the restructuring process began last summer in order to help the business “emerge a stronger and more competitive enterprise.”

Lawler says in order to continue to strive toward efficiency, the company will be reducing its workforce by approximately 15%. Most of those layoffs are occurring in Oklahoma City.

- 02/02/2021 – watch out the reemerge of CHK, watch out new commons and right offering

Bankrupt Chesapeake Energy Shareholders Need A Reality Check Because They Still Are Getting No Recovery (from SA Oct. 14, 2020)

- Shareholders are still getting no recovery under the recently filed amended Ch.11 reorganization plan.

- Recovery estimates and financial projections were included in the updated disclosure statement.

- The long-term business model is based on a non-growth expectation.

- It seems retail 2lien noteholders will be able to participate in the rights offer.

- Chesapeake is now expected to exit bankruptcy in late December.

- New presentation today indicates the week of Feb. 8 for emergence http://investors.chk.com/presentations

- Week of February 8, 2021: Emerge from bankruptcy (Plan Effective Date)” So it could be as late as Feb 14.

Amended Reorganization Plan and Disclosure Statement

The amended reorganization plan and disclosure statement (docket 1331) that were filed on October 8, are based on the Restructuring Support Agreement – RSA – (contained in docket 37) filed on June 28. The latest disclosure statement contains a number of interesting updates, but one item remains the same:

(Class 10) On the Effective Date, each holder of an Existing Equity Interest shall have such Interest cancelled, released, and extinguished without any distribution.

First, the Enterprise Value of $3.25 billion contained in the RSA and is being used to price the rights offering, differs from the mid-point Enterprise Value prepared by Intrepid Partners in the Valuation Exhibit. The Enterprise Value was estimated to be $3.5 billion to $4.7 billion with a mid-point of $4.1 billion. At first glance, this may seem great, but most of the increase in value is due to a very large increase in expected net debt from approximately $1.050 billion to $1.794 billion.

This significant increase in debt/leverage compares to an estimated equity value range of $1.7 billion to $2.9 billion with a mid-point of $2.3 billion. (Note: The $2.3 billion includes the new equity raised via a $600 million rights offer with a 35% discount purchase price.) Net debt is increasing from 32.3% of the Enterprise Value to 43.8%. With too much debt after exiting bankruptcy, Chesapeake could join a long list of bankrupt companies that went back into bankruptcy soon after exiting.

Second, the updated disclosure statement contains estimated recovery by class. These estimates are, however, a little confusing. The estimated recovery for FLLO Term Loan Facility’s $1.525 billion claim is 39.3% to 79.3%. These term loan holders are getting 76% of the new stock, subject to significant dilution, and participation in the rights offering. Since rights offer participation are usually not considered part of recovery estimates, the implied new total equity value received is $0.599 billion (0.393 x $1.525 billion) to $1.209 billion (0.793 x $1.525 billion). Since they are getting 76% of the new stock, subject to dilution, the total new equity value (this is not total equity of the new company) received by the three classes who are getting new stock is $0.789 billion ($0.599 billion/.76) to $1.591 billion ($1.209 billion/.76).

The low recovery of 39.3% to 79.3% is somewhat misleading because FLLO claim holders can participate in the rights offer to purchase new shares at a 35% discount. The FLLO claim holders are being allocated $382.5 million of the $600 million rights offer. $150 million is allocated for Backstop Parties, who are also getting $60 million Put Option Premium payable in cash. (Originally, it was to be a $60 million backstop commitment fee payable in new equity.) 2lien holders are allocated $67.5 million.

I used the $0.789 billion and $1.591 billion equity values to compare the estimated recoveries for holders of $3.404 billion unsecured note claims who are getting 12% of the new stock, subject to the same dilution as FLLO claim holders, and there seems to be a problem either with their estimates or I am missing some additional information and, therefore, incorrect in my analysis. The total new equity for unsecured noteholders is $94.8 million (0.12 x $0.789 billion) to $191 million (0.12 x $1.591 billion). Using the $3.404 billion unsecured note claim, the resulting recovery estimates would be 2.79% to 5.61% for just new stock and not including C Warrants, which unsecured noteholders are also getting. The disclosure statement shows only 2.3% to 4.4%, including the C warrants. I am not able to explain the difference. (This compares to the recent trading prices for unsecured notes of 3.5 to 4.5.)

(The second lien notes discussion is further below.)

- 01/15/2021 – need to look closely once CHK exits bankruptcy. What about new share offering? any opportunities here?

Chesapeake Energy to emerge from bankruptcy court as a $5.13 billion enterprise

Chesapeake will emerge from bankruptcy with about $3 billion in new financing, a $7 billion reduction in debt, and $1.7 billion cut from gas processing and pipeline costs.

- 06/28/2020 – good for CHK to eliminate majority of debt with BK.

Shale pioneer Chesapeake Energy files for bankruptcy

NEW YORK (Reuters) – Chesapeake Energy Corp (CHK.N) filed for Chapter 11 on Sunday, becoming the largest U.S. oil and gas producer to seek bankruptcy protection in recent years as it bowed to heavy debts and the impact of the coronavirus outbreak on energy markets.

The Oklahoma City-based shale pioneer, co-founded by late wildcatter Aubrey McClendon, submitted the Chapter 11 filing in the U.S. Bankruptcy Court for the Southern District of Texas, according to a company statement.

“Chesapeake intends to use the proceedings to strengthen its balance sheet and restructure its legacy contractual obligations to achieve a more sustainable capital structure,” the statement said, adding its operations would continue during the process.

Under the restructuring plan, Chesapeake will aim to eliminate approximately $7 billion of its debt. The company has entered into a restructuring support agreement, which has the full backing of lenders to its main revolving credit facility as well as varying degrees of support from other creditor classes.

As part of the agreement, Chesapeake has secured $925 million of debtor-in-possession (DIP) financing that will help support its operations during the bankruptcy proceedings.

Chesapeake also has agreed the principal terms for a $2.5 billion exit financing, while some of its lenders and secured note holders have agreed to backstop a $600 million offering of new shares, to take place upon exiting the Chapter 11 process, the statement added.

- 06/08/2020 – CHK seems like a very speculative idea

Chesapeake Plans Bankruptcy With Exits Closing on Shale Pioneer

(Bloomberg) — Chesapeake Energy Corp. is preparing a potential bankruptcy filing that could hand control of one of the leading lights of the U.S. shale revolution to senior lenders, according to people with knowledge of the matter.

The dwindling options for a powerhouse that once rivaled Exxon Mobil Corp. for title of king of American natural gas comes after Chief Executive Officer Doug Lawler’s 7-year effort to untangle the financial and legal legacies of Chesapeake’s late founder, Aubrey McClendon.

Lawler’s denouement, in turn, would signal the deep peril facing a shale industry largely built according to McClendon’s blueprint for Chesapeake: amassing incredible debts to pursue aggressive drilling programs that ultimately unearthed too little treasure to reward investors.

Gordon Pennoyer, a spokesman for Chesapeake, declined to comment. The talks with lenders come almost seven years to the date that Lawler assumed the helm at the Oklahoma City-based company at the behest of Carl Icahn and O. Mason Hawkins, at the time two of the driller’s biggest investors.

Chesapeake is negotiating a restructuring support agreement that could see holders of its so-called FILO term loan take a majority of the equity in bankruptcy, said the people, who asked not to be identified discussing confidential matters. The support agreement remains fluid and the terms could change, the people said.

Chesapeake, which owes about $9 billion, is debating whether to skip interest payments due on June 15 and invoke a grace period while it talks with creditors, the people said. No final decision has been made. The company has also begun soliciting lenders to provide debtor-in-possession financing to fund its operations during bankruptcy, according to one of the people.

Ripple Effects

A bankruptcy filing by Chesapeake would reverberate well beyond its investors and employees because it will put millions of dollars in pipeline, fracking and other contracts at risk.

The stock, whose shrunken price was boosted by a 1-for-200 reverse stock split earlier this year, more than tripled at one point Monday to $84.75, then plunged to $52.05 after Bloomberg reported the potential Chapter 11 filing. A bankruptcy typically wipes out existing shareholders.

Chesapeake, the brainchild of McClendon and co-founder Tom Ward, was one of the first to aggressively combine breakthroughs in horizontal drilling and high-intensity hydraulic fracturing to shale rock long ignored by geologists looking for gas or oil.

That gamble provided trailblazers like Chesapeake, Continental Resources Inc. and EOG Resources Inc. a head start over industry titans like Exxon and Chevron Corp. in dominating the burgeoning shale sector. Years later, companies like Exxon would pay dearly to gain footholds in shale.

Lawler’s efforts to rescue Chesapeake have included across-the-board belt-tightening at the company’s once-lavish corporate headquarters, along with tens of thousands of job cuts. A years-long campaign to transform the gas giant into an oil company never gained traction.

Pre-Covid

The driller recorded $8.5 billion in impairments for the first three months of the year as the value of its fields, a sand mine and other assets plunged along with commodity prices.

Chesapeake was already in a precarious position before the Covid-19 outbreak sent crude demand plummeting. At its height more than a decade ago, the producer was a $37.5 billion juggernaut commanded by McClendon, an outspoken advocate for the gas industry. But Chesapeake’s success at extracting the fuel from deeply buried rock contributed to a massive gas glut.

Kirkland & Ellis and Rothschild & Co. are advising Chesapeake, according to people with knowledge of the matter. The FILO lenders are organized with Davis Polk & Wardwell and Perella Weinberg Partners LP, the people said. Franklin Resources Inc. is organized with Akin, Gump, Strauss, Hauer & Feld LLP, according to one of the people.

Representatives for Rothschild, Perella Weinberg and Franklin declined to comment, while representatives for Kirkland & Ellis, Davis Polk, and Akin Gump didn’t immediately comment.

- 06/08/2020 – basic knowledge of BK – WLL filed BK request on April 24, CHK might file BK soon. The short interests of them are quite high. The short term option is very attractive (>10x increase). Bonds are also attractive.

Chapter 11 is a form of bankruptcy that involves a reorganization of a debtor’s business affairs, debts, and assets, and for that reason is known as “reorganization” bankruptcy. Named after the U.S. bankruptcy code 11, corporations generally file Chapter 11 if they require time to restructure their debts. This version of bankruptcy gives the debtor a fresh start. However, the terms are subject to the debtor’s fulfillment of its obligations under the plan of reorganization.

- 02/03/2020 – four positive catalysts for CHK. Remember it is expected to report earnings on 02/26/2020 before market open.

Four Reasons Why CHK Stock Could Have a Huge Turnaround

With the right combination of catalysts, all is not lost for CHK stock

- Locking in Oil Prices

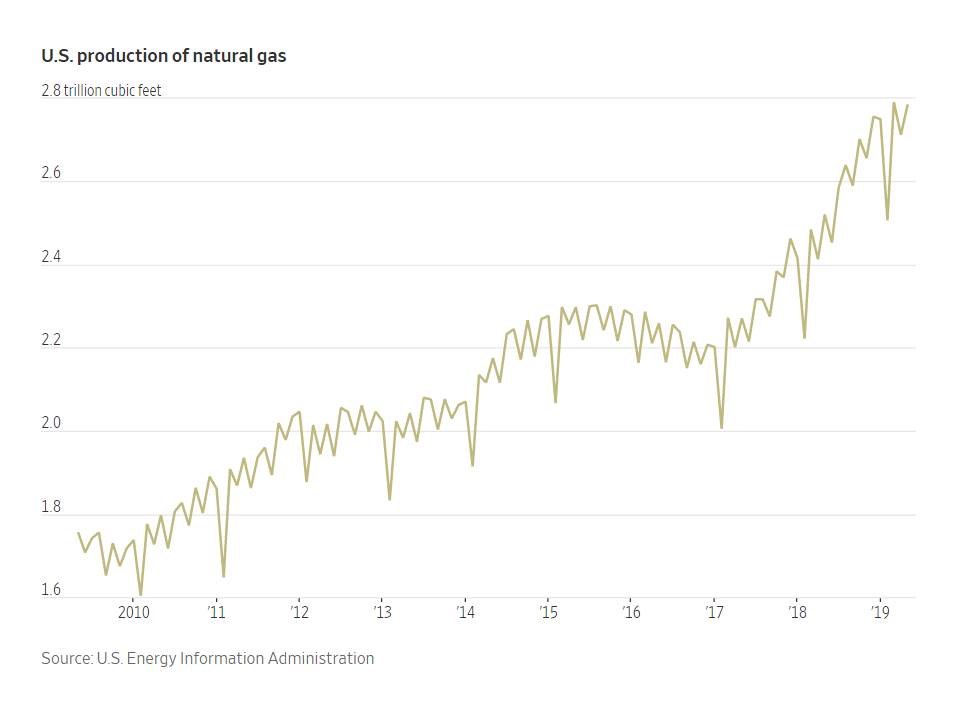

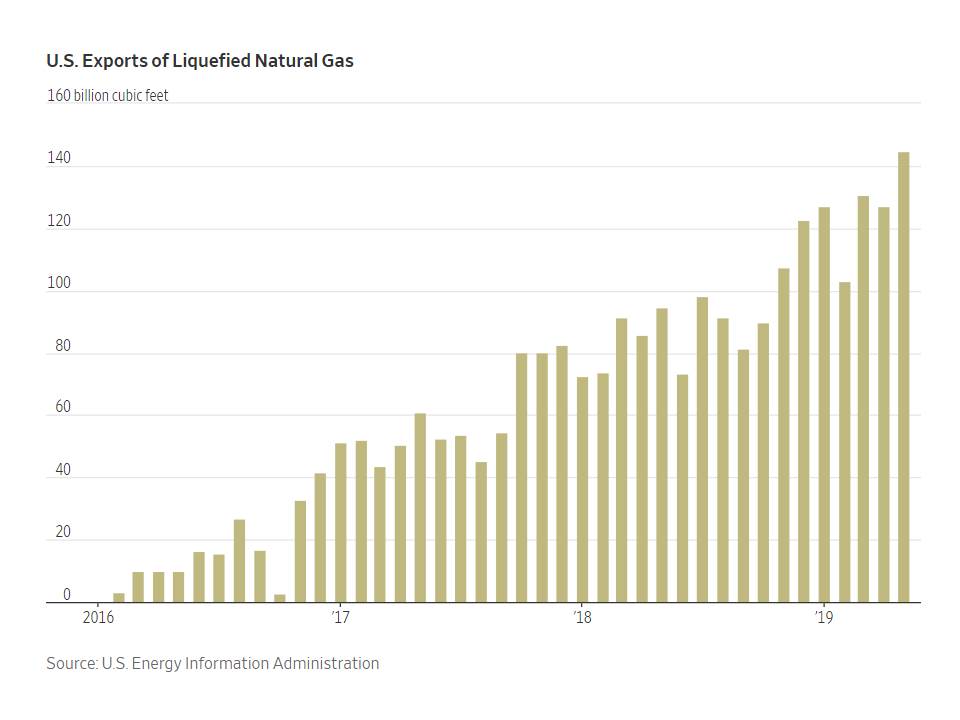

- Natural Gas Prices Could Be Boosted by Exports

- Possible Asset Sales

- Good Q4 News: “Our strong results in the fourth quarter have continued into early 2020 and are setting the foundation for the company to reach free cash flow this year,” said CEO Doug Lawler.

- 04/24/2020 – reorg plan of WLL. Reorg plan aims to reduce $2.3 bil (out of total $3.45 bil debt). Significantly boost the balance sheet.

Company intends to convert over $2.3 Billion of its Unsecured Notes and Certain Other Claims into a 97% ownership interest in the newly reorganized Company and exit Chapter 11 within the next 5 months

DENVER–(BUSINESS WIRE)– Whiting Petroleum Corporation (WLL) and certain subsidiaries (collectively, “Whiting” or the “Company”) today announced that they have entered into a restructuring support agreement (the “RSA”) with certain holders (the “Supporting Noteholders”) of its 1.25% convertible senior notes due 2020, 5.750% senior notes due 2021, 6.250% senior notes due 2023 and 6.625% senior notes due 2026 (collectively, the “Senior Notes”). In addition, the Company has filed a consensual chapter 11 plan of reorganization (the “Plan”) and a related disclosure statement (the “Disclosure Statement”) with the United States Bankruptcy Court for the Southern District of Texas (the “Court”). The Plan outlines a proposed path to strengthen the Company’s balance sheet, reducing debt and improving liquidity in order to emerge from bankruptcy as a financially stronger company in accordance with the terms of the RSA.

The RSA and the Plan provide for, among other things: (1) significant de-leveraging of the Company’s capital structure by over $2.3 billion through the exchange of all of the Senior Notes as well as certain other general unsecured claims for 97% of the new equity of the reorganized Company to be issued pursuant to the Plan; (2) payment in full of the Company’s revolving credit facility, other secured creditors, tax and other priority claimants, employees, working interest partners and certain trade creditors (other than litigation and rejection damages claimants); and (3) existing equity holders to receive 3% of the new equity of the reorganized Company and warrants to purchase additional equity of the reorganized Company. Consummation of the Plan will be subject to confirmation by the Court in addition to other conditions to be set forth in the Plan, the RSA and related transaction documents.

Bradley J. Holly, the Company’s Chairman, President and CEO, commented, “We are pleased to have secured a highly constructive RSA with certain holders of our Senior Notes. Through the proposed terms of the plan of reorganization, we believe a right-sized balance sheet will enable us to capitalize on our enhanced cost structure, high-quality asset base and successfully compete in the current environment.”

A hearing will be scheduled with the Court to consider approval of the Disclosure Statement related to the Plan. Following Court approval of the Disclosure Statement, the Company will distribute the Plan and Disclosure Statement to voting creditors and other parties in interest for their consideration.

This press release is not intended as solicitation for a vote on the Plan.

Moelis & Company is acting as financial advisor for the Company, Kirkland & Ellis and Jackson Walker are acting as legal advisors, Alvarez & Marsal is acting as restructuring advisor and Jeffrey S. Stein of Stein Advisors LLC is the Company’s Chief Restructuring Officer.

PJT Partners is acting as financial advisor for the Ad Hoc Committee of Noteholders and Paul, Weiss, Rifkind, Wharton & Garrison LLP and Porter Hedges LLP are acting as legal advisors.

For inquiries regarding the restructuring, please call the hotline established by the Company’s noticing agent, Stretto, at (800) 330-2531 (toll-free domestic). The full terms of the Plan and Disclosure Statement, as well as the related pleadings, are available online at cases.stretto.com/whitingpetroleum.

- 01/29/2020 – CHK is making solid progress in production, capex guidance, balance sheet improvement and cost reduction

Doug Lawler, Chesapeake’s President and Chief Executive Officer, commented, “We delivered strong cash flow during the quarter on lower costs and higher oil volumes. Natural gas and natural gas liquids volumes were sequentially lower due to our decisions to direct capital to the highest-margin opportunities in our portfolio, enhancing our profitability. Our strong results in the fourth quarter have continued into early 2020 and are setting the foundation for the company to reach free cash flow this year. We remain committed to achieving further meaningful debt reduction through asset sales, capital markets transactions and cost discipline.”

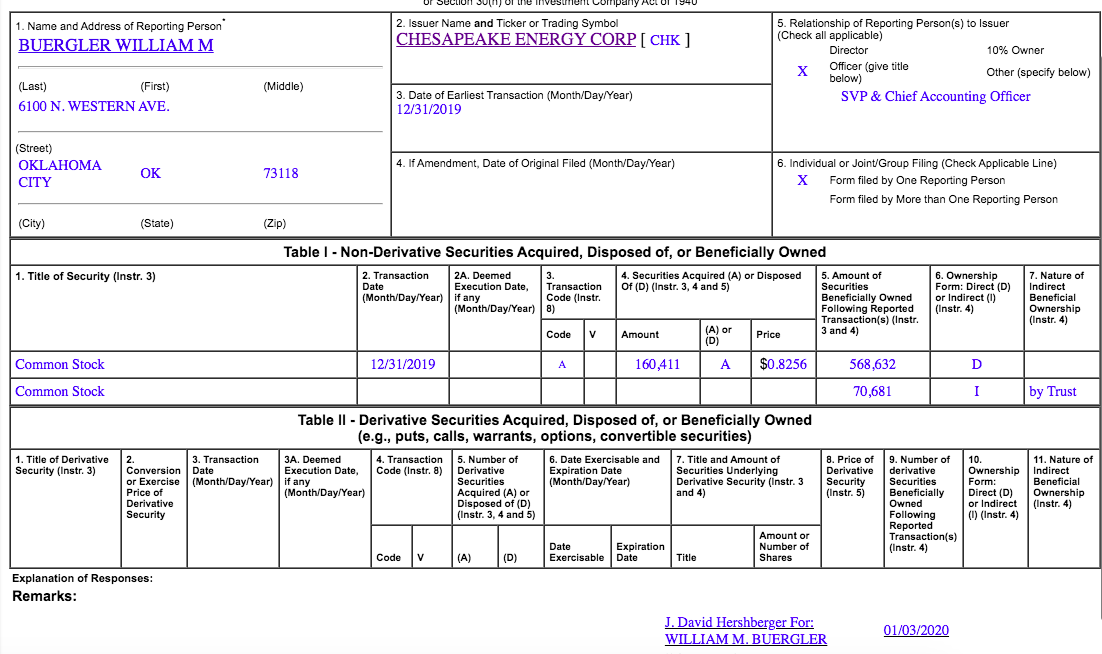

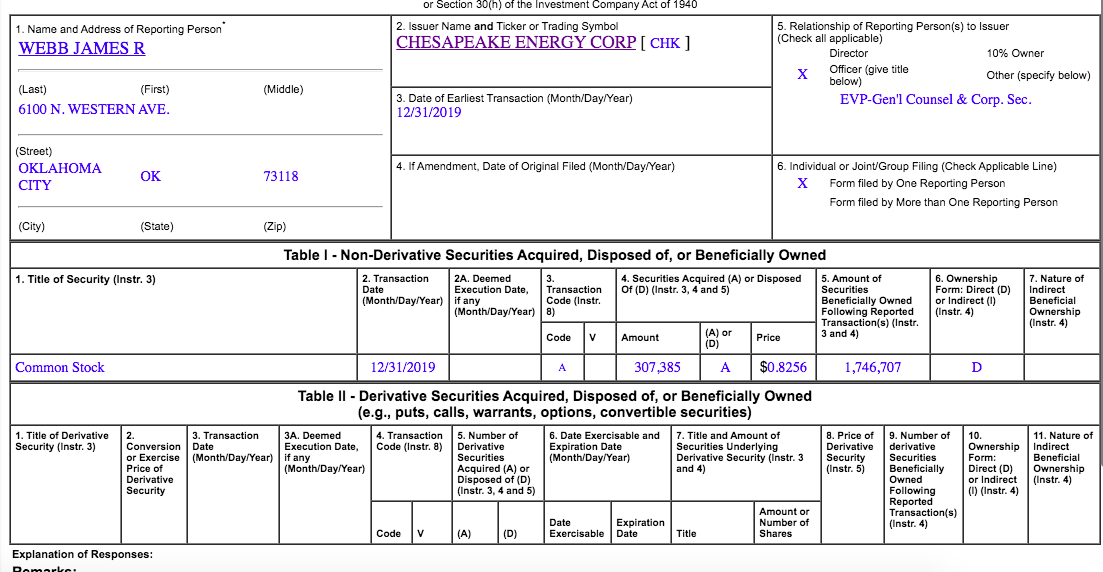

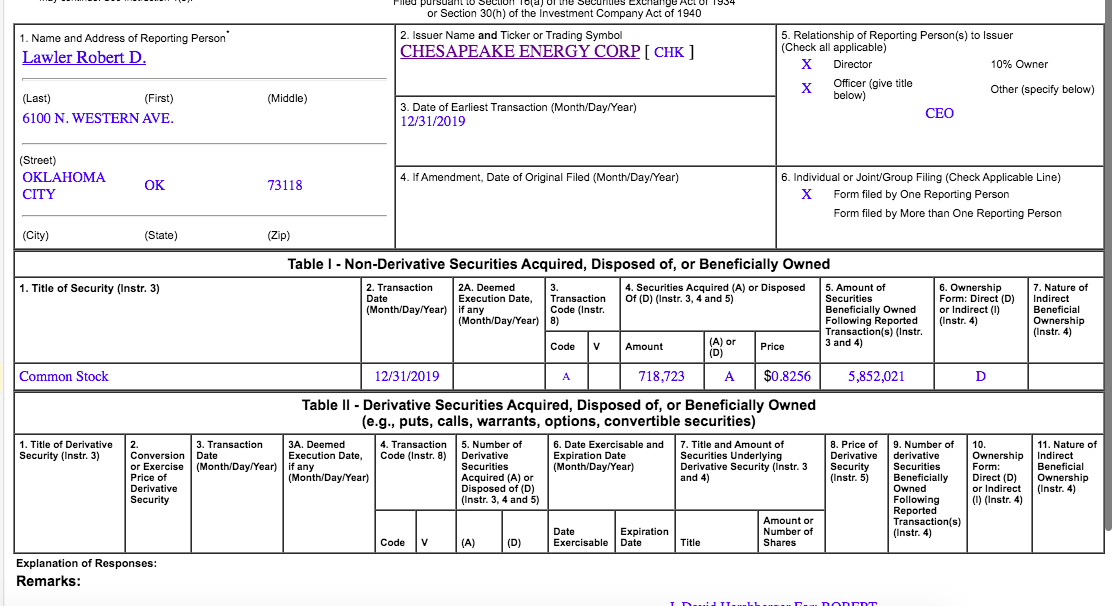

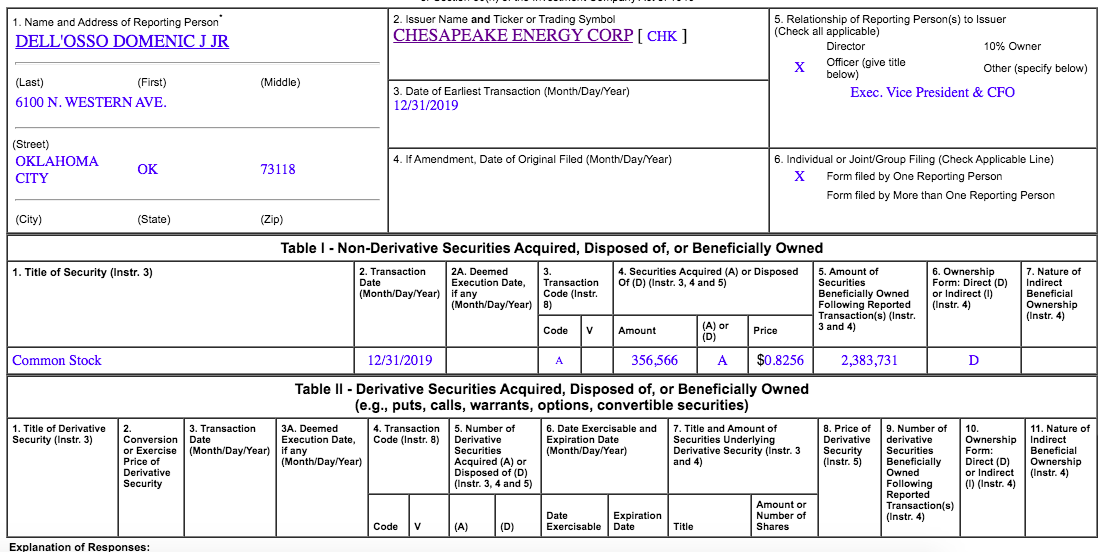

- 01/04/2020 – 1.4 million shares were bought by CEO and 3 other executives in the open market in the end of year 2019. It seems like bullish sign here.

- 12/27/2019 – weather forecasts dropped CHK price by 10% today. Obviously, everyone is very short term focused,

Natural-Gas Prices Fall on Changing Weather Forecasts

Volatility in temperature predictions can cause natural-gas futures to swing day-to-day.

Weather models predicted on Thursday that the country would see slightly colder temperatures in the next 11 to 15 days, driving natural-gas futures up 5.6%. But prices on Friday quickly gave back those gains after forecasts changed overnight and predicted warmer weather to come instead.

“Weather models are volatile,” said Brian Lovern, chief meteorologist at Bespoke Weather Services. “You have to understand that it’s a very inexact science.”

That volatility can cause natural-gas futures to swing day-to-day, depending on the weather predictions that day. Futures on Friday fell 5.9% to $2.158 per million British thermal units.

- 12/14/2019 – background knowledge

The 5 Companies Dominating the Haynesville Shale Play

- 11/13/2019 – It looks promising that JJ might invest $1.1 bil cash in CHK. If that happens, CHK will fly.

Chesapeake Energy Might Get a $1 Billion Lifeline From the Dallas Cowboy’s Owner

The Jerry Jones-backed Comstock Resources is in talks to buy assets from Chesapeake.

The bank of Jerry Jones

In August of last year, Jerry Jones sold his oil-producing properties in the Bakken Shale of North Dakota to Comstock in a deal valuing the assets at $620 million. However, instead of paying cash, Comstock issued 88.6 million new shares to Jones, giving him an 84% stake in the company. He has since helped Comstock grow its oil and gas operations by providing it with funds to also acquire Covey Park Energy. Jones agreed to invest another $475 million into Comstock to facilitate that transaction, which transformed it into the largest producer in the Haynesville shale.

Jones also made it clear that he would continue to support Comstock’s growth. He told the company’s management that he could potentially invest another $1.1 billion “when the right opportunity presents itself.” Given Chesapeake’s precarious situation, it seems as though one might be ripe for the taking.

History of Haynesville shale

The 5 Companies Dominating the Haynesville Shale Play; The Haynesville shale might be down, but improving drilling returns and rising LNG exports put it in the position to once again be a major growth driver for producers.

- 11/12/2019 – Snow has comes in Fall, which might be good for oil/gas companies

A brutal arctic blast is making its descent on the U.S. and is expected to bring dangerously cold conditions to more than half of the country. Winter weather and winter storm alerts are in effect across more than a dozen states.

- 11/12/2019 – the company believes that by swapping debt to common (in Sept 2019) and continue to cut cost can rectify the going concern note. We will see.

Is Chesapeake Energy Stock a Buy?

Insiders are scooping up shares of the plunging oil and gas driller.

Insiders will often make open market purchases like that to make a statement, which in this case is likely that the company’s recent sell-off was an overreaction. There are several reasons why they might hold this view. For starters, debt did improve from the second quarter’s level of $10.2 billion. That’s after the company completed an exchange transaction that eliminated $773 million in debt and preferred stock obligations by swapping some of its common stock. While that deal diluted its existing investors, it will reduce future interest expenses as well as the total amount it owes.

Meanwhile, its balance sheet should improve further next year. In response to the weakening in oil and gas prices over the past few months, Chesapeake cut its 2020 spending plan by around 30% to between $1.3 billion and $1.6 billion. That should enable the company to generate some free cash flow next year, which it can use to pay off more debt.

The company noted in its third-quarter earnings release that it believes that these two moves “will reduce its debt levels and improve the ratios under the covenants in the company’s revolving credit facility.” That should allow it to remain a going concern, especially if oil and gas prices stabilize.

- 11/11/2019 – this might be the real reason CHK dropped 10% today – oil dropped 0.42%, natural gas dropped 5.45%. Saudi Arabia will push for further cuts as it prepares to kick off the massive IPO.

U.S. oil sinks as China trade tensions flare up; Natural-gas prices skid 5.5% lower

Oil futures settled lower Monday as recent developments in Sino-American trade negotiations reignited some fears about demand for energy assets in the face of a prolonged tariff scuffle.

West Texas Intermediate crude for December delivery CLZ19, +0.33% fell 38 cents, or 0.7%, to reach $56.86 a barrel on the New York Mercantile Exchange after crude put in a nearly 1.9% gain for the week ended Friday and traded around its highest levels since Sept. 24, according to Dow Jones Market Data.

According to Bloomberg, Oman’s Oil Minister Mohammed Al Rumhy said OPEC and its partners were unlikely to announce deeper production cuts when they meet in December, elevating concerns that the market may hit a level of oversupply that would further weigh on prices.

However, further reports have suggested that de facto oil OPEC leader Saudi Arabia will push for further cuts as it prepares to kick off the massive initial public offering of its Saudi Aramco oil-processing facility, potentially worth some $2 trillion.

“The Saudis have openly stated that they will recommend OPEC members to increase production cuts, a move we think will absorb excess supplies. We remain confident that $60 oil is not far away, in spite of the recent setback,” wrote Peter Cardillo, chief market economist at Spartan Capital Securities in a Monday research note.

December natural gas NGZ19, +0.11%, meanwhile, tumbled 15.20 cents, or 5.45%, to $2.637 per million British thermal units, after registering a weekly advance of 2.8% on Friday. Monday’s decline represented its steepest dollar and percentage decline since Jan. 28, according to Dow Jones Market Data and its lowest settlement value since Oct. 31.

- 11/07/2019 – Epitome of America’s Shale Gas Boom Now Warns It May Go Bust – CHK’s profit dropped mainly due to the extra expense on more well completion. These more wells might help drive profit higher next year. So it might be a good thing.

(Bloomberg) — Chesapeake Energy Corp. — once the epitome of America’s shale-gas fortunes — is warning it may not be able to outlast low fuel prices.

Though Chesapeake plans to reduce spending by almost a third next year as it seeks to generate free cash flow, its third-quarter capital expenditures rose 16% from a year earlier as it completed more wells. The producer is standing by its budget guidance for full-year 2019.

Chesapeake has already taken some steps to cut debt. In September, the company announced a $588 million debt-for-equity swap. In an earnings statement earlier Tuesday, Chesapeake said it had restructured gas gathering and crude transportation contracts in South Texas and the Brazos Valley to improve future returns.

“They need to walk people through how they plan to get free cash flow,” Sameer Panjwani, an analyst at Tudor, Pickering, Holt & Co., said by phone. “A big part of it could be asset sales. They’ve talked about it before on a high level, but how far along are they in some of these processes?”

- 11/07/2019 – another Barrons’ article on CHK: Chesapeake Energy Stock Got Crushed After Raising ‘Going Concern’ Risks. Here’s What That Means.

“Going concern comments are not uncommon, particularly in the case of an excessively leveraged company,” accounting expert Robert Willens said. “That’s because going concern commentary and disclosure is required when it becomes more likely than not—or becomes probable—that an entity will be unable to meet its financial obligations within 24 months of the financial-statement date.”

Still, “going concern” spooked equity investors. Even bond investors got the jitters. Chesapeake bonds that Barron’s checked fell from about 67 cents on the dollar to 53 cents this week. The bonds yield more than 20%. At either price, however, it is clear the bond market doesn’t have a lot of faith in the future of Chesapeake as it is structured.

The next step in the financial filings would be to go from “going concern” to preparing financial statements on a “liquidation basis,” according to Willens. It would record its assets at liquidation value instead of historical cost, as other financial reports require. Liquidation value is the current sale price less cost to sell the assets.

“Almost any company that files a petition in bankruptcy would warrant such disclosures and commentary,” Willens said. “For example, PG&E [PCG] is in that mode and has even received a going concern opinion from its auditors.”

- 11/06/2019 – Barron’s news on CHK today: Chesapeake Stock Tumbled — and That’s Bad News for MLPs

Chesapeake has a monster amount of debt—some $8.37 billion in net debt, according to Bloomberg. That debt comes with rules, known as covenants, that can limit Chesapeake’s actions if its debt grows too large relative to certain financial metrics. In this case, it is earnings before interest, taxes, depreciation, and amortization, or Ebitda.

“CHK’s credit facility contains a leverage covenant that begins at 5.5x for allowable leverage, and ramps down quarter beginning in 4Q19 by 25 basis points each quarter. On a total asset basis, we estimate that the company could brush up against this covenant in 3Q20 with our estimated net debt to LTM EBITDA of ~4.5x in 3Q20 vs. covenant restriction of 4.5x, after which we forecast the company to be out of compliance with the covenant,” writes SunTrust analyst Neal Dingmann. “We believe the company will explore all options for asset monetization and additional strategies for leverage reduction given the ongoing concerns with debt levels, difficult high-yield markets, and decreasing covenant restrictions.”

Chesapeake’s bad news has carried over to master limited partnerships, i.e. the pipeline companies who carry its oil, writes Mizuho’s Paul Sankey, who listed “scary new language from Chesapeake (CHK, NC)…in its 10-Q…on concerns of the knock on transport effect of CHK’s contracted positions” as one of the reason that group of stocks got hit. The Alerian MLP ETF (AMLP) fell 1.2% to $8.50 on Wednesday.

Who’s most at risk? East Daley Capital’s Ryan Smith and Zack Van Everen point to Crestwood Equity Partners (CEQP) and Williams (WMB), among others. They estimate that Chesapeake’s reduced drilling could knock $120 million off Crestwood’s adjusted Ebitda in fiscal 2023, while Williams could see above-market rates get knocked to normal levels, which could result in a $140 million dent in its earnings. Energy Transfer (ET), Kinder Morgan (KMI) and Plains All American Pipeline (PAA) also have exposure to Chesapeake, Smith and Van Everen write, though it is much smaller.

- 11/06/2019 – article from SA on CHK: Chesapeake Energy: Much Ado About Nothing

- The company is still in compliance with bank covenants.

- Over the next year, weak gas prices may cause a covenant violation (maybe).

- A roughly 5% debt swap, capital budget decrease, and other cost cutting should avoid this outcome.

- The dry gas basins or areas rig counts and completion crews numbers are declining quickly. Therefore, the seeds of a gas price recovery are already planted.

- A bank waiver is normally granted in the event of a covenant violation. The extreme case of default is an extremely rare outcome unless management shows inaction the whole time.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Get started today »

- 11/06/2019 – 300,000 shares of insider buying today, it seems like the concern of “going concern” is overblown? – I therefore bought some 2 yrs LEAPs

- 11/06/2019 – Davidson’s comments on oil and gas – it seems like oil and gas price will bounce back, which might be good for CHK

“Davidson” submits:

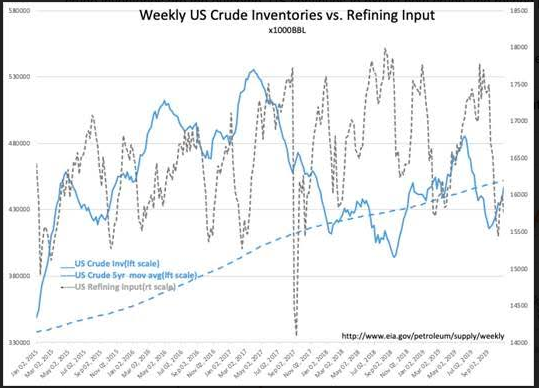

- US Crude Inventories rose 7.9mil BBL leaving current levels 6mil BBL below the 5yr mov avg.

- Refining Input fell 0.6mil BBL/Day

- US Crude Prod held steady 12.6mil BBL/Day

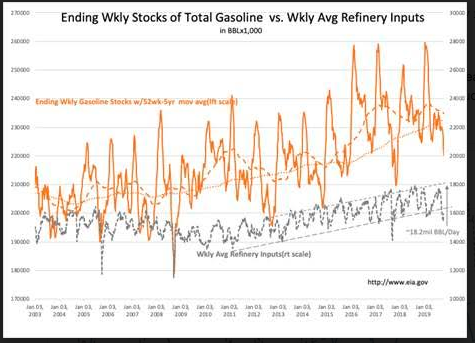

- US Gasoline Inv fall to 4yr lows(not counting 2017 hurricane refining shutdown period)

The rise in US Crude Inventories has been interpreted as an over-supply condition triggering some to slowing economic demand and lower prices. This perspective is countered by the current facts that weaker than historical refining inputs are driving crude inventories higher during this seasonal fuel blend change-over period which has resulted in the lowest gasoline inventories in 4yrs if we ignore the 2017 hurricane period which saw significant refinery capacity shut-in.

Several companies indicated 2017 would be a period to upgrade/expand facilities and lower refinery inputs, falling gasoline inventories and rising crude inventories are the outcome. US continues to export both crude and refined products. Lows /highs in respective gasoline/crude inventories occur seasonally mid-Nov to mid-Dec.Conditions are poised for a return to trend for refining input followed by lower crude inventories and expectations of higher oil prices.

- 11/05/2019 – Todd’s comments on CHK – I therefore bought some LEAPs today

So CHK issued a standard “going concern” notice in the 10Q today. It is not anything to panic about. there are roughly 2100 of these filings annually for listed stocks and in 2018, only 30 went under. This reminds me of the “going concern” notice ACAS got when we bought it. This was automatically triggered by debt covenant ratios and can and should be rectified soon.

Chesapeake invested total capital expenditures of approximately $640 million during the 2019 third quarter, including capitalized interest of $6 million, compared to approximately $551 million in the 2018 third quarter. The increase in capital expenditures in the 2019 third quarter was largely attributable to an increase in net wells spud, completed and connected. – operation loss due to larger capex which will benefit profit in the long run

As of October 31, 2019, including October and November derivative contracts that have settled, approximately 80% of the company’s remaining 2019 forecasted oil, natural gas and NGL production revenue was hedged, including approximately 74% and 75% of its remaining 2019 forecasted oil and natural gas production at average prices of $59.34 per bbl and $2.83 per thousand cubic feet (mcf), respectively. Additionally, Chesapeake has basis protection swaps on approximately 2 million barrels (mmbbls) of its remaining projected 2019 Eagle Ford oil production at a premium to WTI of approximately $5.67 per bbl. In 2020, Chesapeake currently has downside protection on a portion of its 2020 projected oil production at an average price of $59.28 per bbl and on a portion of its 2020 projected gas production at an average price of $2.76 per mcf. – NG and oil prices are hedged, so reduces the downside risk

- 10/30/2019 – Gas price might jump soon due to seasonal high demand, I need to prepare for investing more in CHK.“Davidson” submits:

- US Crude Production steady 12.6mil BBL/Day

- US Crude Inv rise 5.7mil BBL as refinery inputs remain below trend for Summer/Winter Blend change over shutdown

- US Gasoline Inv continue a sharp decline as demand out-paces refining production-lowest inventory in 2yrs.

- US Crude Inv even with a temp rise the past several weekly reports, remains 12.7mil BB below the 5yr move avg which has sparked higher $WTI in the past

Many solely interpret US Crude Inv for Supply/Demand trends, but with seasonal maintenance and blend adjustment periods no single measure captures the overall picture. US continues to raise exports of crude and refined products to meet global demand. Gasoline inv are drawn down during periods of maintenance while crude oil inv rise.

- 10/29/2019 – Cold weather forecast, restrained production lift natural gas names

Natural gas prices (UNG +3.8%) are surging, thanks to a huge cold front forecast to sweep down over much of the U.S. as well as gas producers who are dialing back production in response to depressed prices.

U.S. natural gas futures for November delivery recently +6.6% to $2.61/MMBtu, following a 6.3% jump yesterday which was the best day for futures since January.

At the same time, executives with CNX Resources and others have said low gas prices were causing the companies to cut back; even if prices rise this winter, they said they are likely to use the extra cash to continue buying back shares and to repay debt rather than raise production.

- Management knocked the long-term debt levels down about 5% with the latest debt for equity swap.

- A new major shareholder like Franklin Advisors is probably good news to shareholder.

- The percentage of oil produced should continue to rise and increase cash flow along with that rising oil production.

- Operating costs are finally coming into range with competitors in the various basins.

- 09/21/2019 – Yemeni Rebels Warn Iran Plans Another Strike Soon

The information has been passed along to the Saudis and the U.S., according to people briefed on the warnings - 09/15/2019 – Crude Prices Soar After Saudi Oil Disruption, Threatening Global Growth

Global and U.S. oil futures soar; prices likely to remain volatile as trading volumes increase

Crude prices surged Sunday evening following an attack on Saudi Arabia’s oil infrastructure and an announcement from President Trump that he has authorized the release of oil from the Strategic Petroleum Reserve.

U.S. oil futures advanced about 11% to $60.98 a barrel, maintaining gains from just after trading opened at 6 p.m. ET. Brent crude, the global gauge of oil prices, soared 13% to $68.13 a barrel. If those moves held, they would mark some of the biggest intraday for crude in years and put oil at its highest level in months. Both gauges surged about 11% in February 2016 when oil was in the midst of a sharp plunge on fears of excess supply, per a Dow Jones Market Data analysis of figures from FactSet.

- 09/14/2019 – Saudi Oil Attack: This Is the Big One

The technological sophistication and audacity of Saturday’s attack will linger over the energy market

Saudi Arabia Shuts Down About Half Its Oil Output After Drone Strikes

Shutdown amounts to a loss of some five million barrels a day, roughly 5% of the world’s daily production of crude

- 08/31/2019 – Oil and Gas Bankruptcies Grow as Investors Lose Appetite for Shale

Smaller drillers, which account for sizable part of U.S. oil production, are struggling to pay off hefty debt burdens

Twenty-six U.S. oil-and-gas producers including Sanchez Energy Corp. and Halcón Resources Corp. have filed for bankruptcy this year, according to an August report by the law firm Haynes & Boone LLP. That nearly matches the 28 producer bankruptcies in all of 2018, and the number is expected to rise as companies face mounting debt maturities.

Unlike several years ago, the current round of bankruptcies isn’t driven by a collapse in crude prices. The U.S. benchmark oil price has roughly doubled since 2016, when crude bottomed out below $30 a barrel. That year, 70 U.S. and Canadian oil-and-gas companies filed for bankruptcy, according to Haynes & Boone.

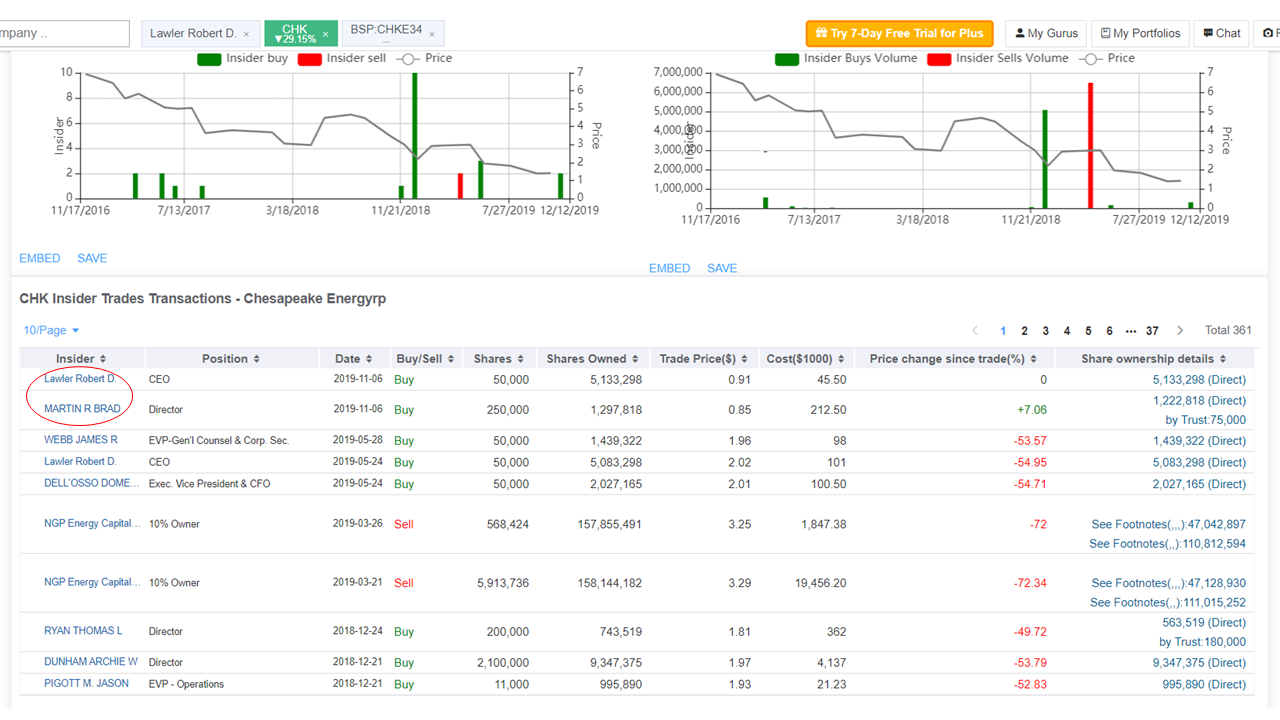

- 08/27/2019 – U.S. Glut in Natural-Gas Supply Goes Global

In a blow to producers, prices in Europe and Asia plummet to historic lows

The reliance of U.S. producers on demand around the world is a stark change from just a few years ago, when domestic gas prices were isolated from global markets and depended mostly on weather-related demand.

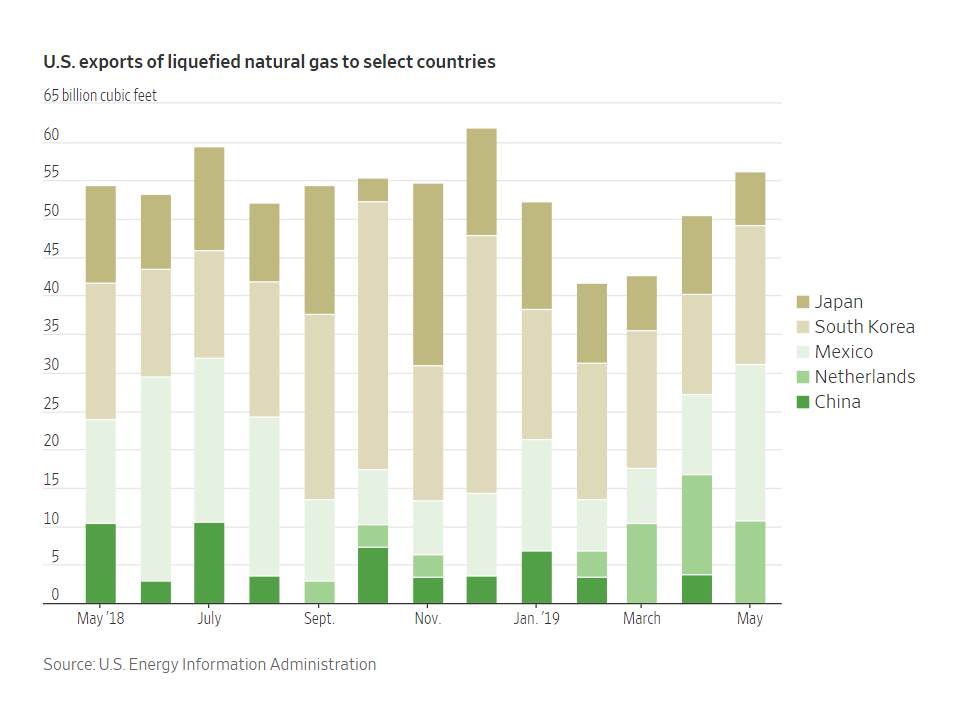

These days, though, U.S. gas prices take into account a range of overseas factors, such as Japan’s nuclear-reactor output, trade negotiations with Beijing and Dutch stockpiles.

The EIA, for instance, has estimated that Japan’s imports of LNG will decline by as much as 10% this year as nuclear reactors that were shut down after 2011’s Fukushima accident return to service.

At the same time, shipments to China essentially ended after the country placed a 10% tariff on U.S. LNG last September and boosted the levy to 25% in June in its tit-for-tat trade dispute with President Trump. Meanwhile, EIA data shows an increase in shipments to European countries, including the Netherlands and Spain, where gas is stored for later use.

Many of those facilities are reaching capacity, however, and some analysts have expressed concern that buyers in those European markets may become sated until inventories are drawn down to heat homes this winter.

- 08/18/2019 – overview of oil industry: Barron’s cover story, Wall Street Has Abandoned Oil and Gas Stocks. You Shouldn’t, is a comprehensive look at the possibility of a rebound. There are plenty of ideas in various subsectors. Those interested in this sector should take a look. Key quote:

What’s more, even if there is a global growth slowdown, near-term oil demand isn’t likely to fall much, if at all. Demand has risen steadily in recent decades, showing resiliency even during deep recessions such as the one that accompanied the financial crisis.

Kirk Spano explains the factors which might drive oil prices higher.

- 08/16/2019 – a balanced analysis on CHK from gurufocus

Value Idea Contest: Chesapeake Energy May Be a Good Pick to Go Long Energy Prices

Despite decent 2nd-quarter results, Chesapeake’s stock bounces off 20-year low

Chesapeake Energy , a pioneering Oklahoma-based oil and natural gas producer, has struggled under a substantial debt load for years. But Morgan Stanley analyst Devin McDermott thinks the company is in good position to pay down that debt and benefit from asset sales in the months ahead.

McDermott resumed coverage on the stock with an Overweight rating and a $2.75 price target, more than 40% above current prices. Chesapeake Energy stock (ticker: CHK) was up 2.4% to $1.93 in midday trading on Friday. It was trading over $5 a year ago but has slid more than 60% since. Investors have been skeptical of the company’s decision last year to buy Houston-based oil producer WildHorse Resource Development Corp. Its largest holder has also been selling stock.

Chesapeake has historically been known more for its natural gas production, but it’s been shifting more toward oil, which McDermott thinks will drive better margins at the company—and means it deserves a better valuation than peers. Natural-gas prices have been hurt in recent weeks because the summer started with mild weather. There’s also been anxiety about a supply glut.

McDermott predicts that the company will produce negative annual free cash flow until 2023, when it will just about break even. While he acknowledges the company’s leverage is still relatively high, he writes that “we see a clear strategic plan to further reduce debt, which we believe the market is underestimating.”

- 04/05/2019 – Chesapeake Energy CEO got a 51% raise to $22.7 million last year, while the stock plunged 47%

Chesapeake Energy Corp. CHK, +3.83% Chief Executive Robert Lawler got a 51% raise in 2018, as the oil and natural gas company surpassed many of its performance targets his compensation was based on, while investors suffered a 47% drop in the stock.

- 12/20/2018 – Is Chesapeake Energy Corporation a Buy?

The struggling oil and gas producer is hoping a risky bet will pay off in 2019. Do sliding energy prices suggest otherwise? - 11/26/2018 – Chesapeake Energy Is Worth a Peek – But there are many unique elements in Chesapeake that make it worth an investor’s time to get to grips with this company. In particular, investors should understand the consequences of Chesapeake’s recent merger with WildHorse Resource Development. The combined entity has a lot going on that could prove enticing to a serious value investor.

The merger with WildHorse offers some intriguing possibilities for the long term - 11/13/2018 – If You Must Own CHK Stock at Least Buy It as Part of This ETF

Too much debt is only the beginning of the trouble with CHK stock – the merge with WildHorse significantly diluted the share price of CHK, but it might give CHK some synergy and growth potential

Proof of that, the author suggests, is Chesapeake Energy’s nearly $4 billion acquisition of WildHorse Resource Development (NYSE:WRD), which gives WildHorse shareholders either 5.989 shares of CHK stock per WildHorse share or 5.336 shares and $3 cash. The offer includes the assumption of $930 million in debt.

Most important, it significantly dilutes Chesapeake shareholders, which isn’t a good thing when you consider Chesapeake Energy stock has gone sideways for the past 30 months.

The Deal Makes Chesapeake Stronger

The company made several arguments when announcing the acquisition:

- It increases the company’s oil production from 19% overall (81% natural gas) to 30% overall. With oil prices rising and natural gas prices declining, it’s a move in the right direction.

- The deal increases its profitability by adding 420,000 high margin acres that will see Chesapeake’s EBITDA margins per barrel of oil equivalent (Boe) increase 15 percentage points to 50% by 2020.

- The deal will generate as much as $280 million in annual cost savings. By 2023, those savings are projected to add up to as much as $1.5 billion on a cumulative basis.

- The acquisition delivers higher profitability for the company which enables it to reduce its debt levels to 2.8 times EBITDA by 2020 from 4.2 times today.

- 10/30/2018 – Having Gone ‘Through Hell,’ Chesapeake Energy CEO Has ‘No Doubt’ It’s Time To Grow Again – story of CEO