Both Dems senators and RNC take their latest stands on GSEs – from investorhub

Senate Democrats urged Treasury and the Federal Housing Finance Agency to allow Fannie Mae and Freddie Mac to build cash to prevent another taxpayer bailout of the mortgage giants.

The Democratic appeal came on the heels of a policy shift by the Republican National Committee, which last month adopted a resolution calling for recapitalization of the companies, which have long been vilified by free-market and fiscal conservatives.

Combined, the positions could signal a shift in thinking on the companies, which are in limbo after receiving a $187 billion government bailout during the housing collapse.

After being targeted for elimination in the wake of the subprime lending crisis, Fannie and Freddie have largely returned to health and consistently generate revenue for taxpayers. While under government conservatorship, they’ve sent nearly $273 billion in earnings to the Treasury, money that has been used to help drive down the budget deficit. But their capital will be exhausted by the end of this year as part of their bailout deal, raising the risk that they’ll need another injection of taxpayer aid.

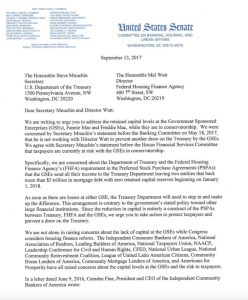

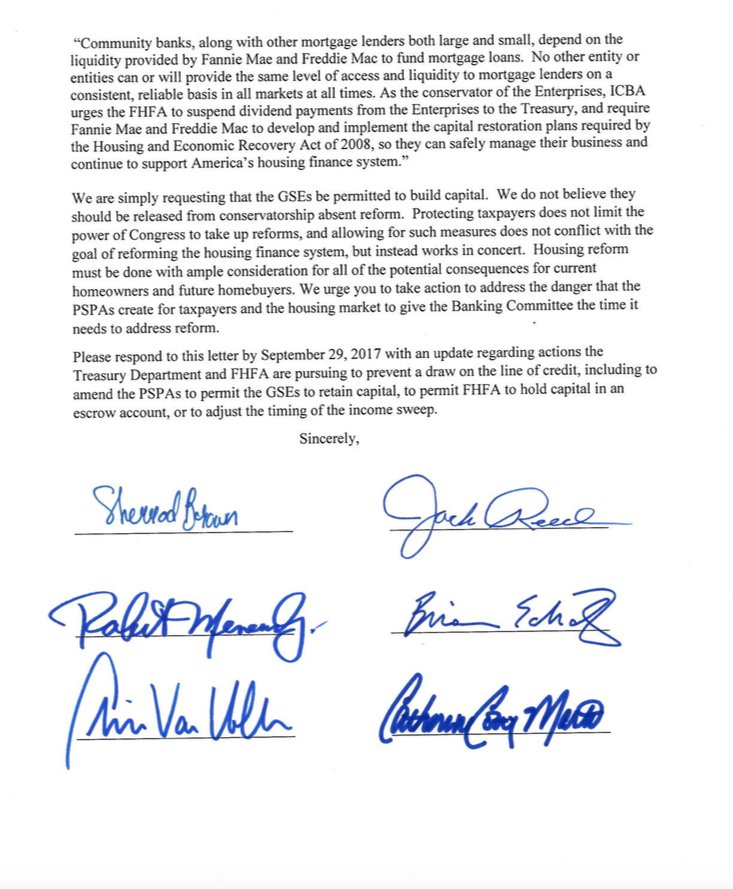

In a Sept. 13 letter to Treasury Secretary Steven Mnuchin and FHFA Director Mel Watt, Senate Democrats said the government-sponsored enterprises, or GSEs, should be allowed to amass capital to avoid another bailout.

“We are simply requesting that the GSEs be permitted to build capital,” the senators wrote. “Protecting taxpayers does not limit the power of Congress to take up reforms.”

The letter was signed by Senate Banking Committee Democrats Sherrod Brown of Ohio, the panel’s ranking member, Jack Reed of Rhode Island, Bob Menendez of New Jersey, Brian Schatz of Hawaii, Chris Van Hollen of Maryland and Catherine Cortez Masto of Nevada.

Last month, the RNC went a step further, saying the government’s stake in the companies could be sold for a profit.

“The Republican National Committee recognizes that no financial institution in the United States can safely operate without adequate capital, and that taxpayers will not be sufficiently protected until Fannie Mae and Freddie Mac are permitted to rebuild equity capital,” the committee wrote.

Taxpayers can generate an estimated $100 billion in “additional cash profits” if Treasury sells the 79.9 percent of the companies the government seized during the housing collapse, the RNC wrote.

That position is an abrupt departure for the party. Just last year, the RNC questioned the value of the companies, saying they were based on “corrupt business models”.

“The utility of both agencies should be reconsidered as a Republican administration clears away the jumble of subsidies and controls that complicate and distort home-buying,” the RNC wrote in its 2016 platform.

Both the RNC resolution (Resolution on GSE) and the Democratic letter cited the position of a GSE reform coalition that includes the Independent Community Bankers of America, National Urban League, National Community Reinvestment Coalition and others.

“There is a bipartisan consensus that allowing Fannie and Freddie to operate with no capital is irresponsible,” said Josh Rosner, managing director at Graham Fisher & Co. “There’s also a consensus that the GSEs shouldn’t be released without further reforms, which suggests agreement that the GSEs should ultimately be released.”

It has come to light this evening that the RNC as of 8/31/17 has changed their platform. Here is a link to the document