Will Jan 2, 2018 be the day GSE’s conservatorship will be ended? If so, should I well position in preferred before this day?

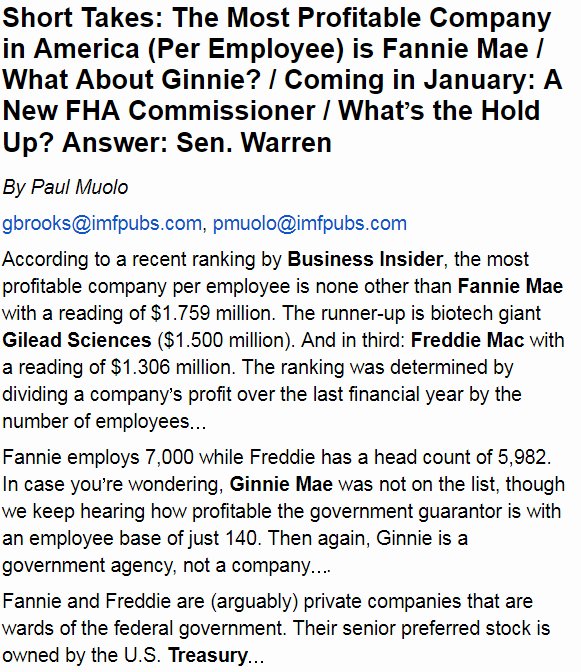

Even IMF news mentioned about the recap,

By Paul Muolo

pmuolo@imfpubs.com

The mortgage industry is beginning to get a whiff of what reform of the nation’s housing-finance system might look like next year: a federal guarantee on a new breed of conventional MBS but no backing – at all – of the entities that issue guaranteed securities.

Also, according to interviews conducted with stakeholders over the past week, it seems possible that the cost to be a guarantor may not be so prohibitive after all. Some contend an initial capitalization for a new book of business could be as low as $2 billion.

But capitalization requirements would increase as a guarantor’s book of business grows larger.

Of course, it’s still early in the legislative process. Staffers working for Sens. Bob Corker, R-TN, and Mark Warner, D-VA, and other elected officials are quietly showing drafts of legislative language to industry participants, but nothing is set in stone. For more details see Inside MBS & ABS, now available online.

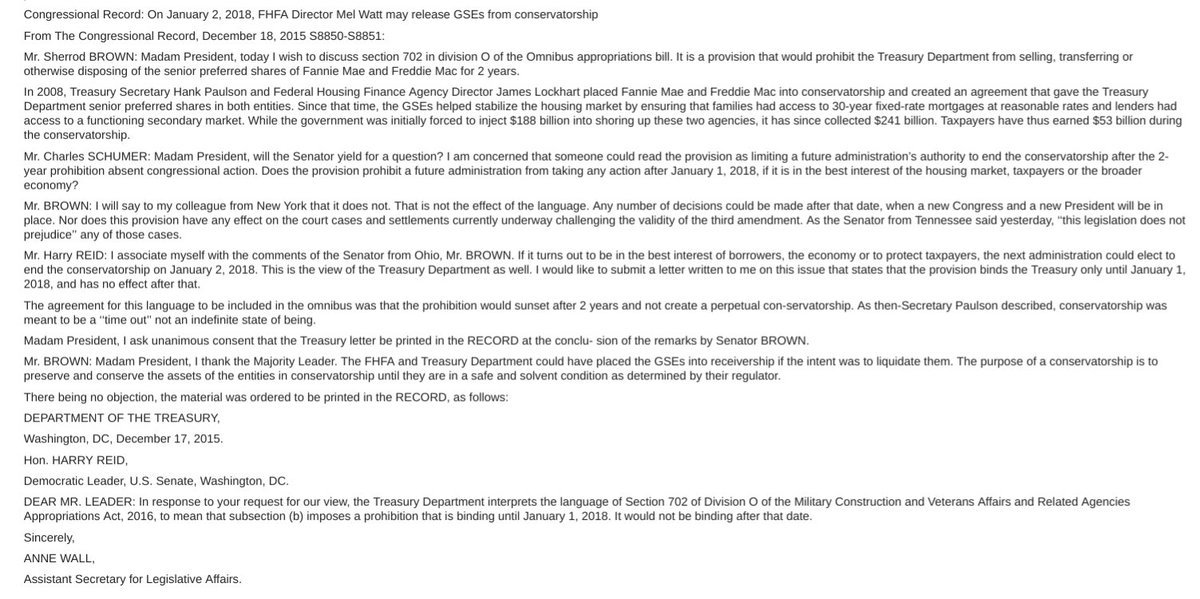

here is a portion of the transcript

Of course, in 2012 the government changed the deal, turning the 10% preferred dividend to a payment to the Treasury of essentially all Fannie and Freddie’s net profit instead. To compare that to the original deal, one must ask when the revised payments would become equivalent to Treasury’s receiving a full 10% yield, plus enough cash to retire all the senior preferred stock at par.

The answer is easily determined. Take all the cash flows between Fannie and Freddie and the Treasury, and calculate the Treasury’s internal rate of return on its investment. When the IRR reaches 10%, Fannie and Freddie have sent in cash economically equivalent to paying the 10% dividend plus retiring 100% of the principal.

This I call the “10% Moment.”

Freddie reached its 10% Moment in the second quarter of 2017. With the $3 billion dividend Fannie was previously planning to pay on December 31, the Treasury’s IRR on Fannie would have reached 10.06%.

The new Treasury-FHFA deal will postpone Fannie’s 10% Moment a bit, but it will come. As it approaches, Treasury should exercise its warrants and become the actual owner of the shares to which it and the taxpayers are entitled. When added to that, Fannie reaches its 10% Moment, then payment in full of the original bailout deal will have been achieved, economically speaking.

That will make 2018 an opportune time for fundamental reform.

Any real reform must address two essential factors. First, Fannie and Freddie are and will continue to be absolutely dependent on the de facto guarantee of their obligations by the U.S. Treasury, thus the taxpayers. They could not function even for a minute without that. The guarantee needs to be fairly paid for, as nothing is more distortive than a free government guarantee. A good way to set the necessary fee would be to mirror what the Federal Deposit Insurance Corp. would charge for deposit insurance of a huge bank with 0.1% capital and a 100% concentration in real estate risk. Treasury and Congress should ask the FDIC what this price would be.

Second, Fannie and Freddie have demonstrated their ability to put the entire financial system at risk. They are with no doubt whatsoever systemically important financial institutions. Indeed, if anyone at all is a SIFI, then it is the GSEs. If Fannie and Freddie are not SIFIs, then no one is a SIFI. They should be formally designated as such in the first quarter of 2018, by the Financial Stability Oversight Council —and that FSOC has not already so designated them is an egregious and arguably reckless failure.

When Fannie and Freddie are making a fair payment for their de facto government guarantee, have become formally designated and regulated as SIFIs, and have reached the 10% Moment, Treasury should agree that its senior preferred stock has been fully retired.

Then Fannie and Freddie would begin to accumulate additional retained earnings in a sound framework. Of course, 79.9% of those would belong to the Treasury as 79.9% owner of their common stock. Fannie and Freddie would still be woefully undercapitalized, but progress toward building the capital appropriate for a SIFI would begin. As capital increased, the fair price for the taxpayers’ guarantee would decrease.

The New Year provides the occasion for fundamental reform of the GSEs in a straightforward way.

About Timeless Investor

My name is Samual Lau. I am a long-term value investor and a zealous disciple of Ben Graham. And I am a MBA graduated in May 2010 from Carnegie Mellon University. My concentrations are Finance, Strategy and Marketing.

TimelessInvestor

TimelessInvestor

Congressional Record from Dec 2015 discussing GSE Jumpstart will be done by Jan 2, 2018

Will Jan 2, 2018 be the day GSE’s conservatorship will be ended? If so, should I well position in preferred before this day?

Even IMF news mentioned about the recap,

Expected on GSE Reform: Reconstituted Versions of Fannie and Freddie but…

By Paul Muolo

pmuolo@imfpubs.com

The mortgage industry is beginning to get a whiff of what reform of the nation’s housing-finance system might look like next year: a federal guarantee on a new breed of conventional MBS but no backing – at all – of the entities that issue guaranteed securities.

Also, according to interviews conducted with stakeholders over the past week, it seems possible that the cost to be a guarantor may not be so prohibitive after all. Some contend an initial capitalization for a new book of business could be as low as $2 billion.

But capitalization requirements would increase as a guarantor’s book of business grows larger.

Of course, it’s still early in the legislative process. Staffers working for Sens. Bob Corker, R-TN, and Mark Warner, D-VA, and other elected officials are quietly showing drafts of legislative language to industry participants, but nothing is set in stone. For more details see Inside MBS & ABS, now available online.

R Streey’s Pollock has great discussion on Jumpstart and capital reserves – Ep. 5 R Street’s Pollock on Jumpstart Legislation, Capital Reserves for SIFIs. Is there really a 10% moment?

here is a portion of the transcript

About Timeless Investor

My name is Samual Lau. I am a long-term value investor and a zealous disciple of Ben Graham. And I am a MBA graduated in May 2010 from Carnegie Mellon University. My concentrations are Finance, Strategy and Marketing.