MB’s twitters – Part II

Another MB achieve site, (https://twitter.com/BurryArchive, )

another one (https://threadreaderapp.com/thread/1365827162205417476.html)

- 06/17/2021 –

- 06/16/2021 – on FOMC’s statement

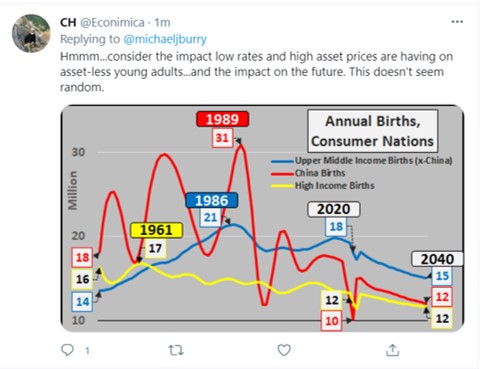

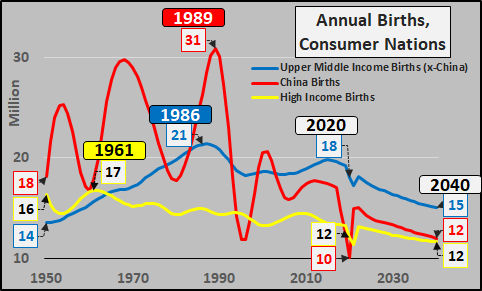

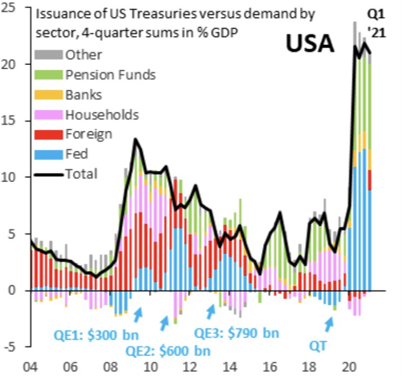

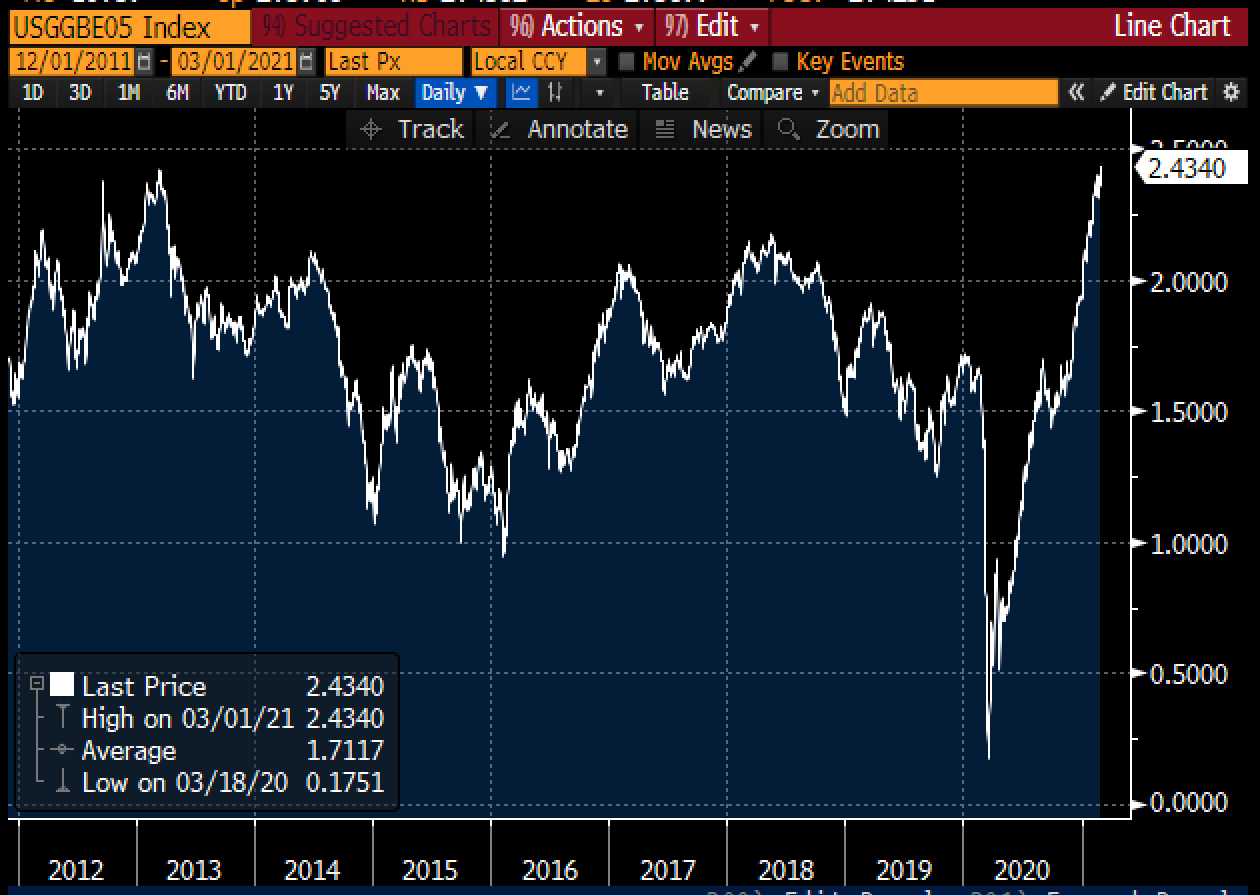

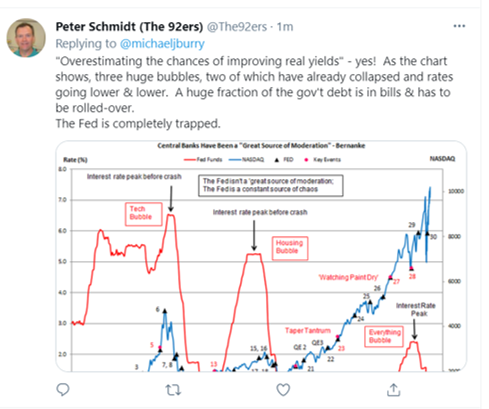

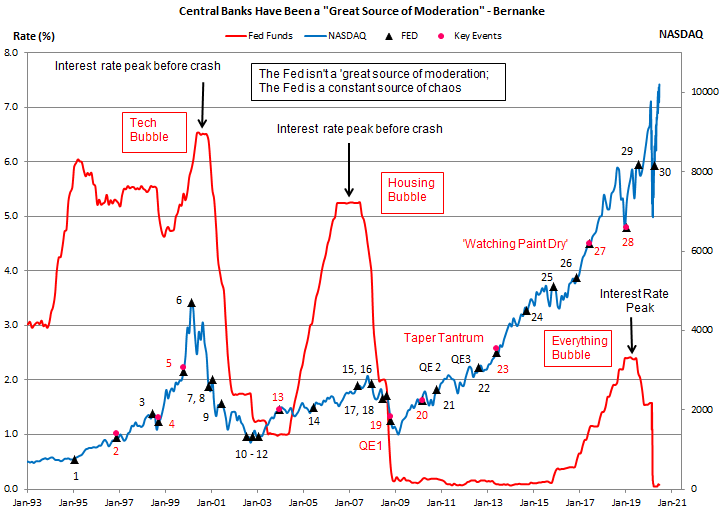

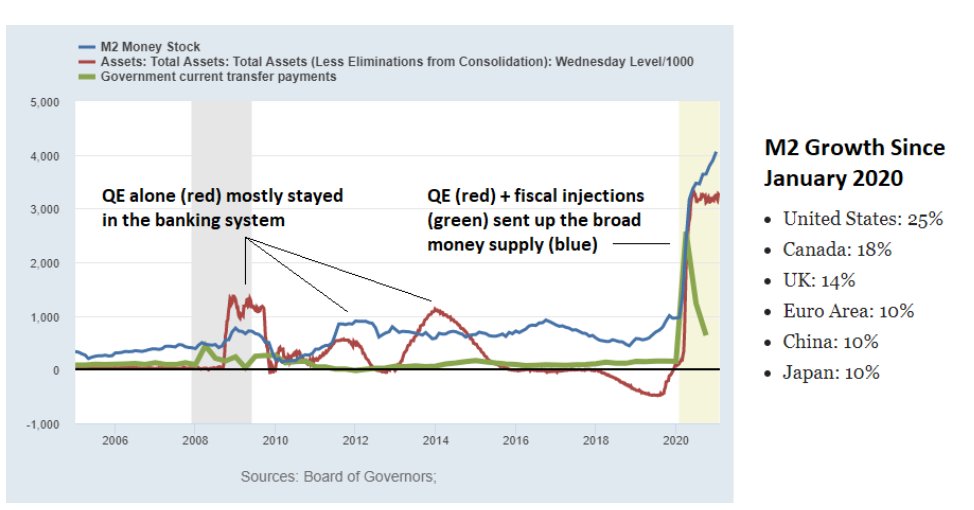

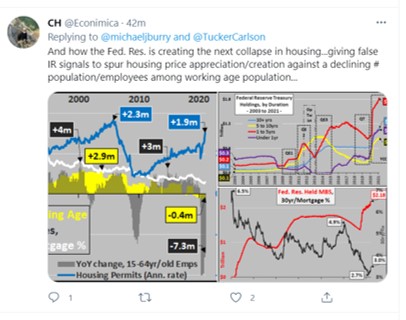

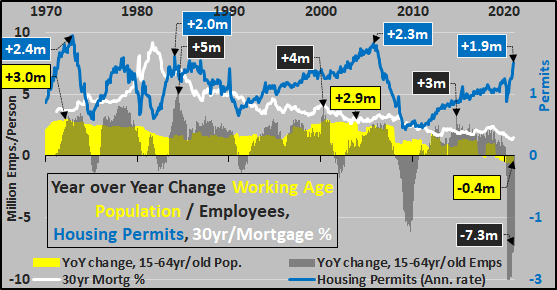

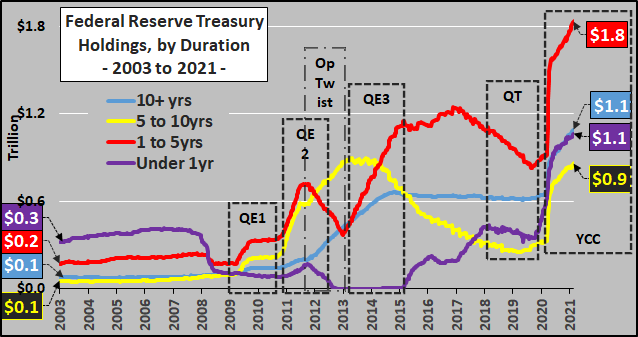

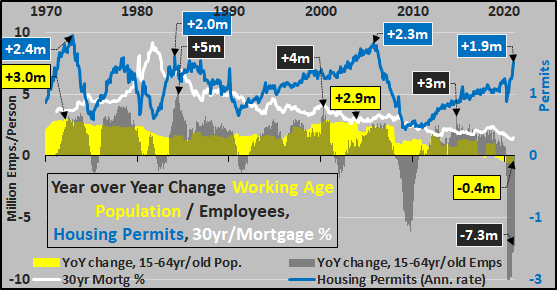

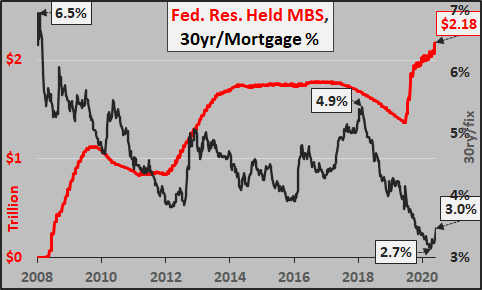

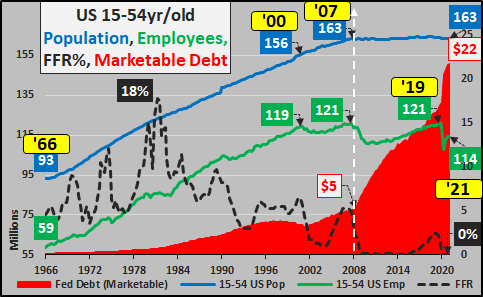

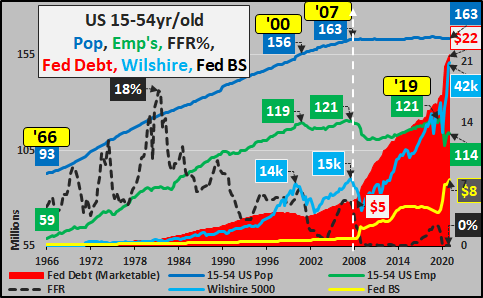

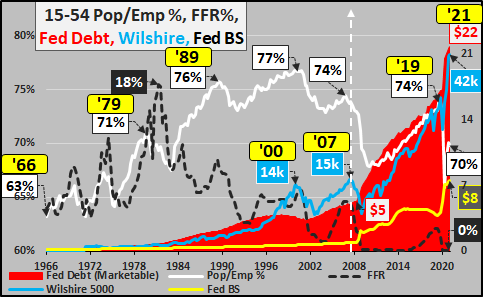

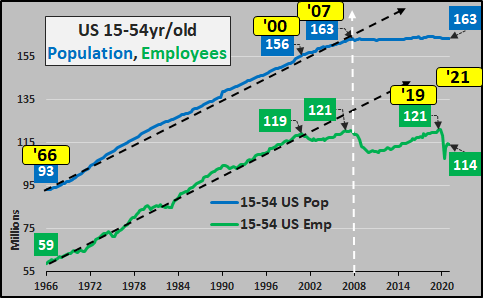

one viewer’s comment: How about this chart? Yield Curve Control incoming. Buyers of treasury buyers are drying up.

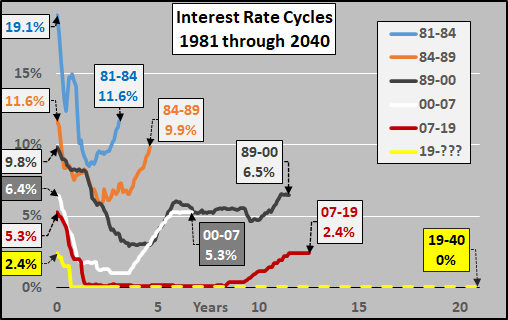

another viewer’s comment: There is clear method to their madness…lower, for longer, with less recovery in each IR cycle. But it’s the why that need be determined…determining what exactly is the destination?

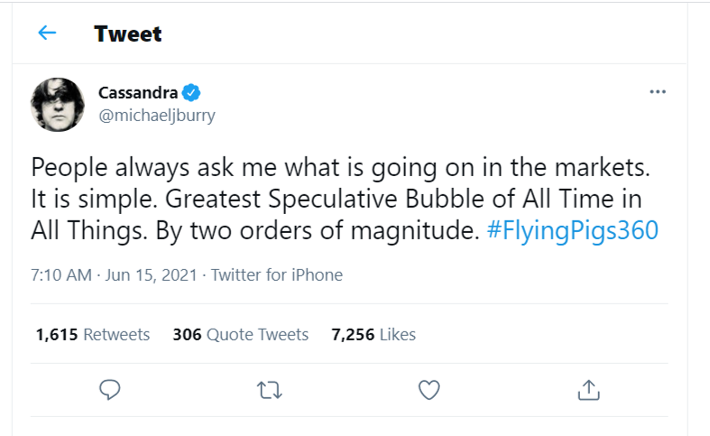

- 06/15/2021 – market condition

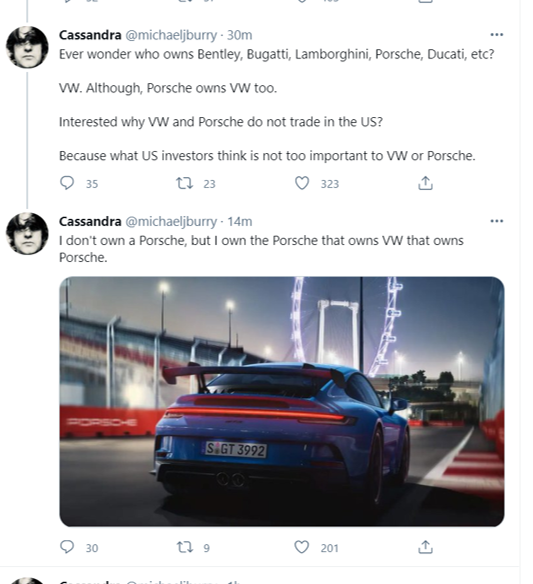

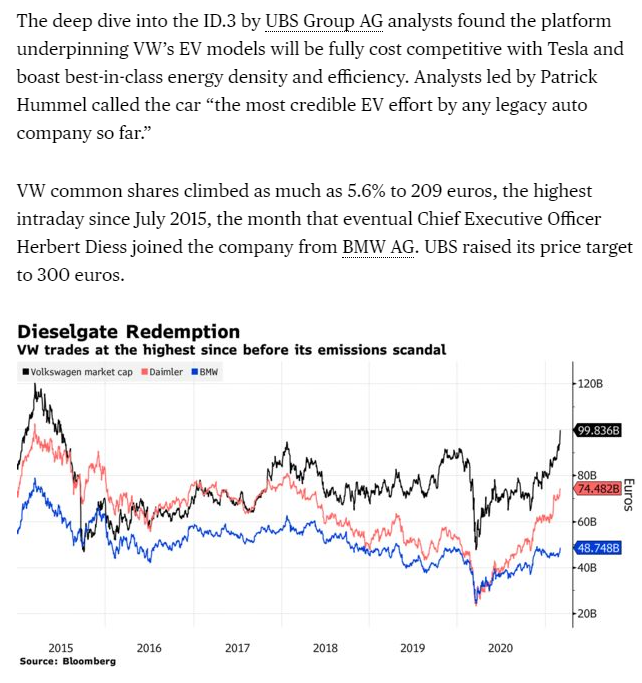

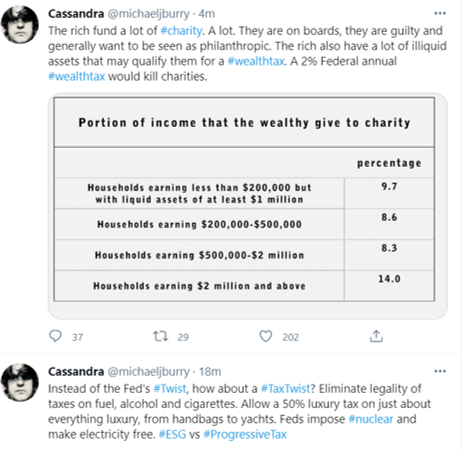

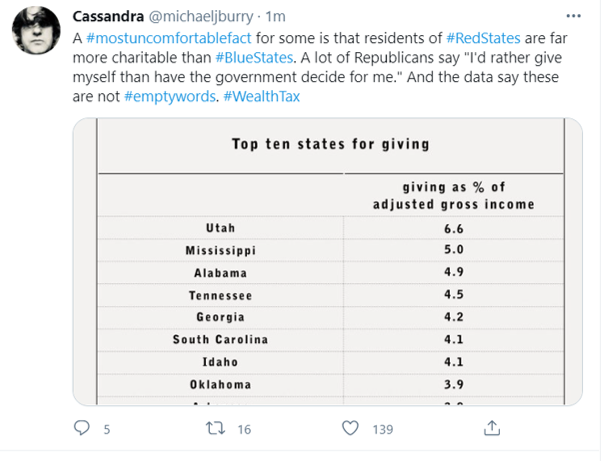

- 03/03/2021 – TSLA, short, charity

https://www.bloomberg.com/news/articles/2021-03-03/vw-s-electric-car-stacks-up-well-against-tesla-in-ubs-teardown

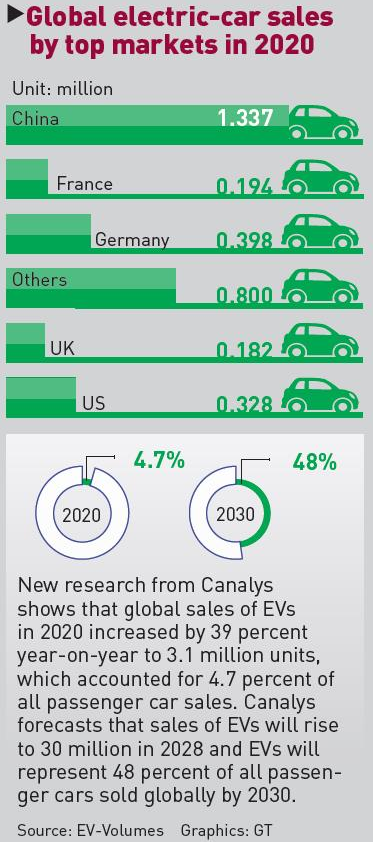

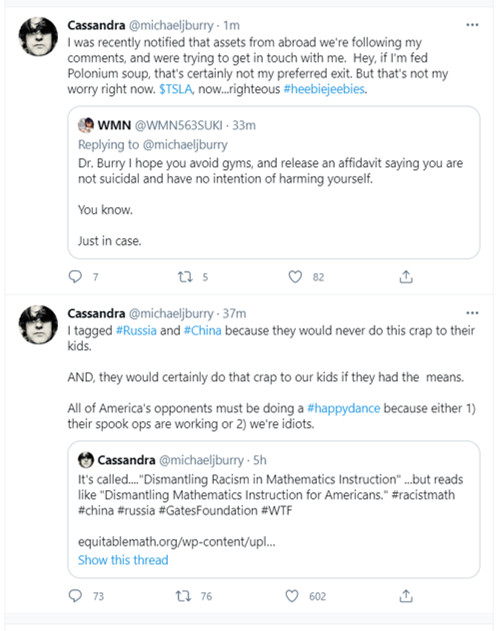

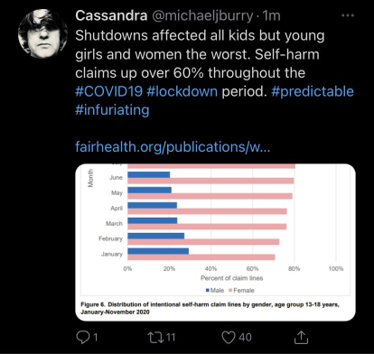

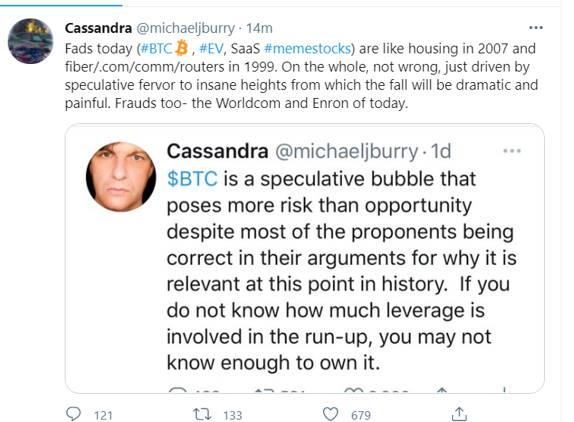

- 03/02/2021 – BTC, China, Gates, lockdown

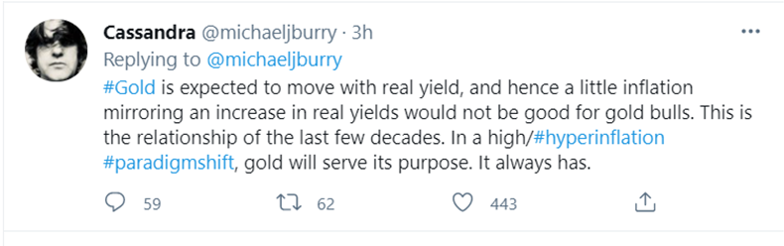

- 03/01/2021 – tired of melt-up yet? math = white supremacy? QE, direct payment, inflation, TSLA, GOLD, China

https://www.marketwatch.com/story/teslas-market-share-in-europe-keeps-crumbling-as-china-reclaims-top-spot-in-global-ev-race-11614621780

Cassandra: Tired of melt-up yet?

https://www.washingtonexaminer.com/news/gates-foundation-white-supremacy-math-instruction

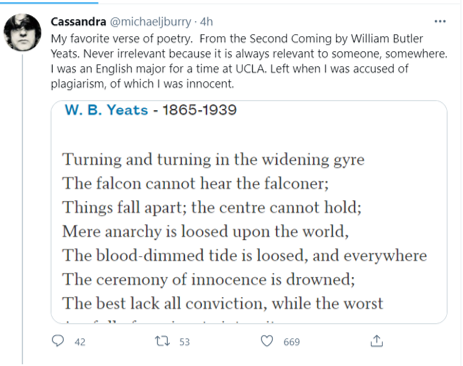

- 02/29/2021 – Yeats’s poem, Cathie Wood

Cassandra: “the availability of EVs with familiar brand names is also pushing sales. Hallgeir Langeland, a 65-year-old Norwegian hasn’t owned a car for 25 years, but when Ford rolled out a fully electrical car, …

https://www.bloomberg.com/news/articles/2021-02-27/cathie-wood-s-power-in-some-stocks-is-even-bigger-than-it-seems

zsn

@zsnw100

1h

Replying to

@michaeljburry

Hi

@michaeljburry

, do you have any updates on book recommendation? I remember the last 4 were The Intelligent Investor, Common Stocks and Uncommon Profits, Why Stocks Go Up and Down, Buffettology. Any new ones that you think are good?

These are some additional ones he’s recommended: Value Investing Made Easy Janet Lowe Security Analysis Benjamin Graham (1951 Edition) You Can Be A Stock Market Genius Joel Greenblatt

https://www.barrons.com/articles/this-is-where-the-real-stock-market-bubble-is-51613388601

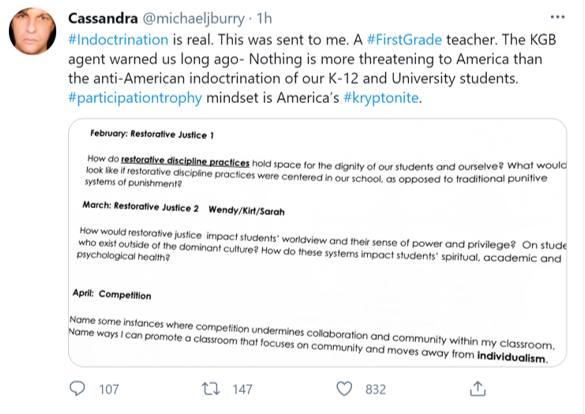

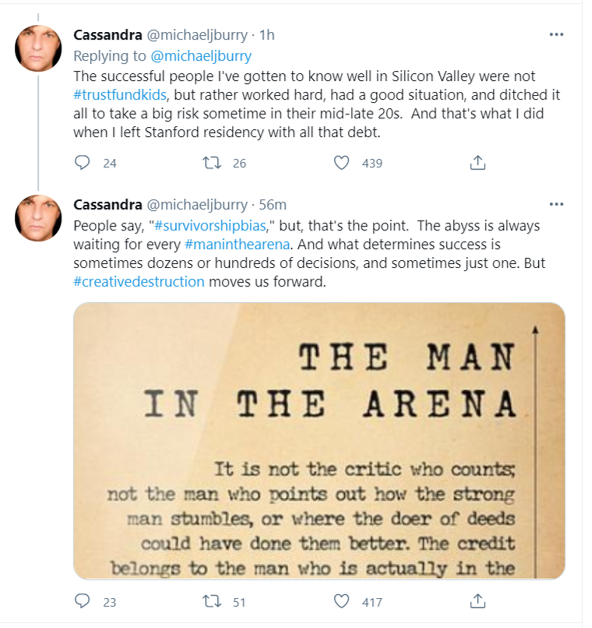

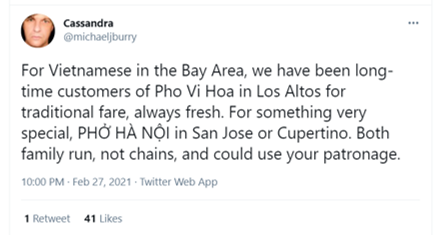

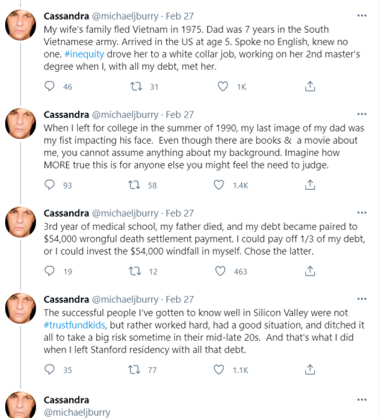

- 02/27/2021 – poem, family root, inflation, BTC

fiestadelmar.hrpos.heartland.us/menu

https://phohanoisanjose.com/

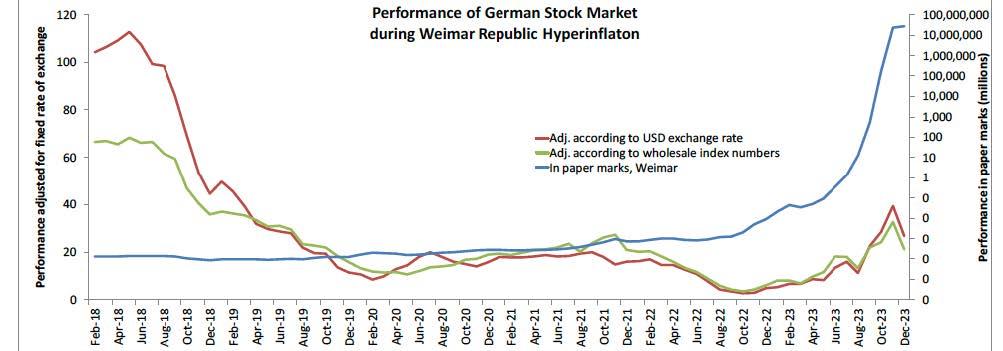

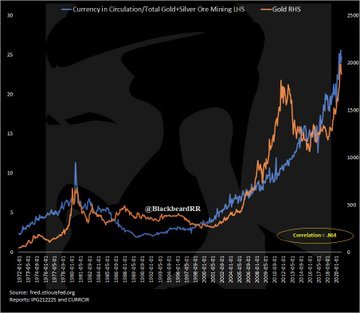

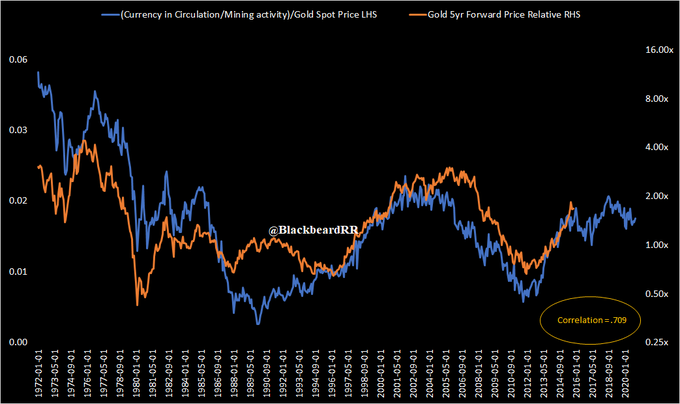

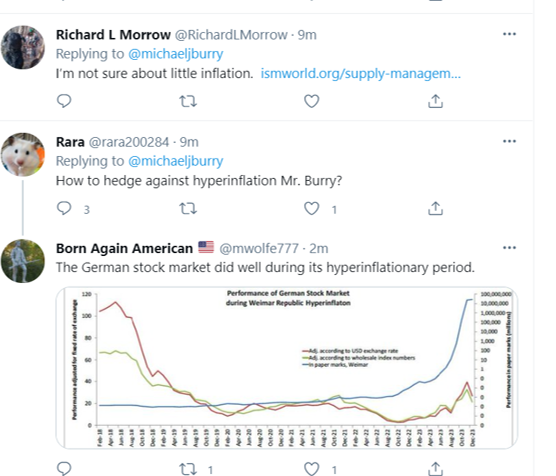

Background knowledge on German inflation

http://www.phmc.state.pa.us/portal/communities/pa-heritage/who-are-these-anthracite-people-pennsylvania-anthracite-heritage-museum.html

comments: https://hbr.org/2017/03/when-america-was-most-innovative-and-why

https://www.nationalreview.com/2021/01/the-feds-tipsy-portfolio-and-inflation-expectations/

Parliam3nt Tulip

@Parliam3nt

20m

Replying to

@michaeljburry

How do i get a bloomberg terminal? It “feels” like they are 25k a year to keep folks out Loudly crying face. If I had a Bb terminal, id play a game of 4d chess thats never been seen before

https://datamish.com/btcusd/7d

Anand

@Anand56995323

1m

Replying to

@michaeljburry

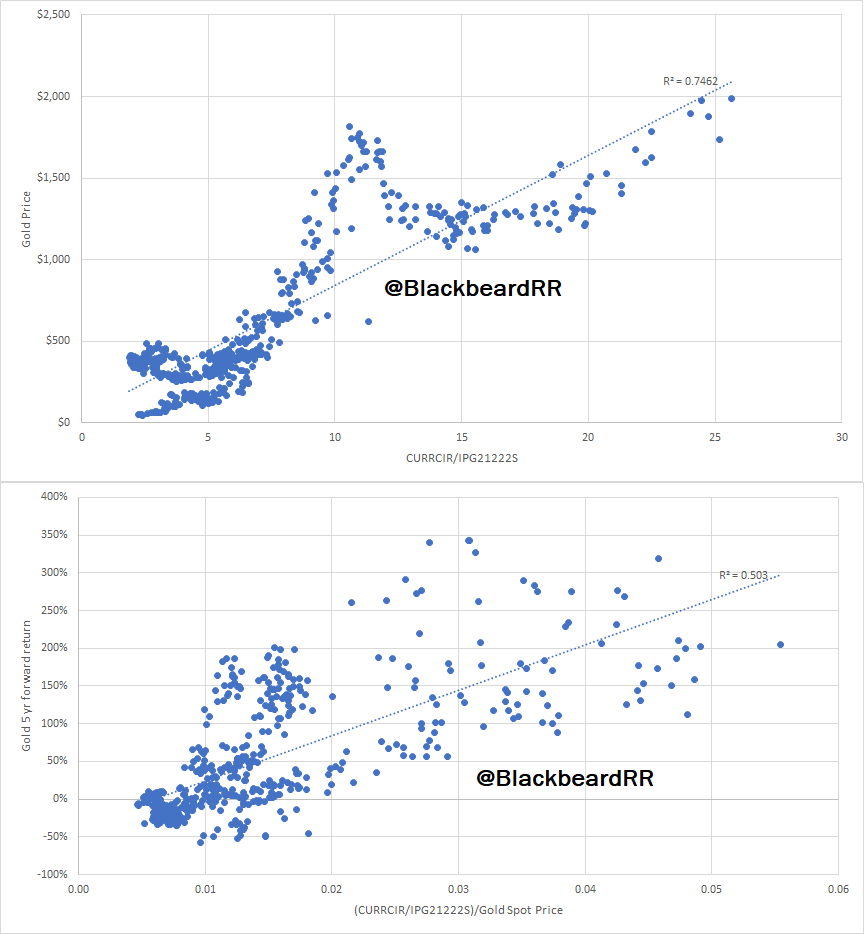

Thank you so much Michael! All your holdings are just brilliant. Alcohol, internet and incarceration. All are essential with low supply chain risks and guaranteed monthly payments. Won’t gold miners(with dividends) do well even if governments squash/prohibit gold ownership?

https://fortune.com/2020/04/07/big-short-michael-burry-subprime-mortgage-coronavirus-lockdowns/

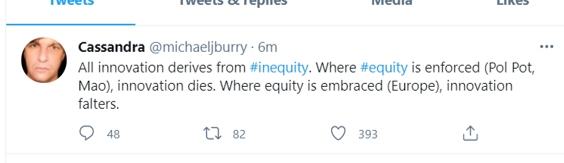

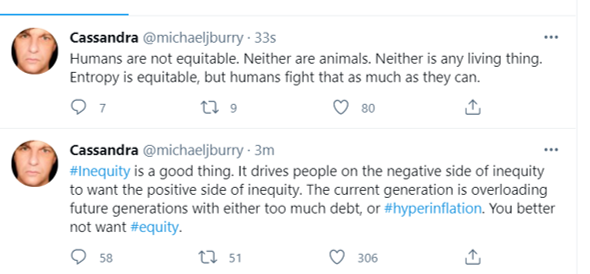

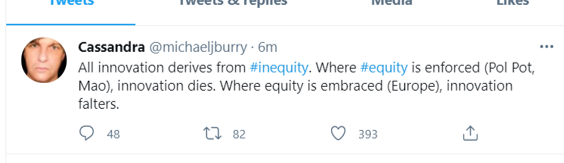

- 02/26/2021 – perhaps lastgasp of bull, equality

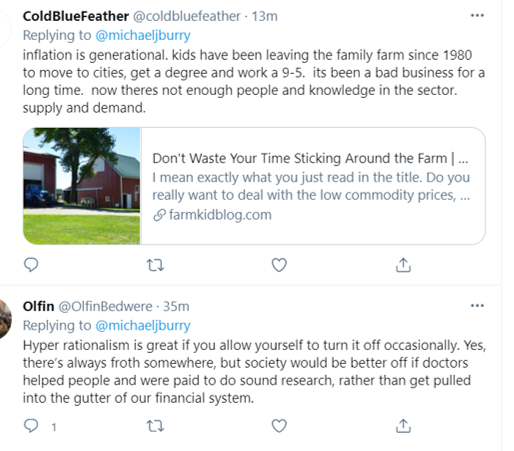

Zac Surprenant @Zachanot ·4h Replying to @michaeljburry Would love your thoughts on current state of ETFs like XRT… BB rating… raided multiple times for GME… the underlying stocks price discovery seems out of whack… the list goes on.

https://www.bloomberg.com/news/articles/2019-09-04/michael-burry-explains-why-index-funds-are-like-subprime-cdos

Richard M. Falvo Jr. @richardmfalvojr 2h Replying to @michaeljburry

Which books would you (or anyone else in this thread) recommend for a young mind that would like to learn more about financial history?

Leoforher @Leoforher1 1h Extraordinary popular delusions and the madness of crowds. Mckay Or A short history of Financial Euphoria by John Kenneth Galbraith

Only books you need to read.

Premature Accumulation Murder Hornet MicroScalper @MoMoBagholder3h

Replying to @michaeljburry

Many people don’t understand that prior generations thought the exact same things: this time is different because of technology/advancements, other factors. Human behavior has been a steady repeating cycle for thousands of years.

Andy Josuweit @andy_josuweit 2h

Replying to @michaeljburry

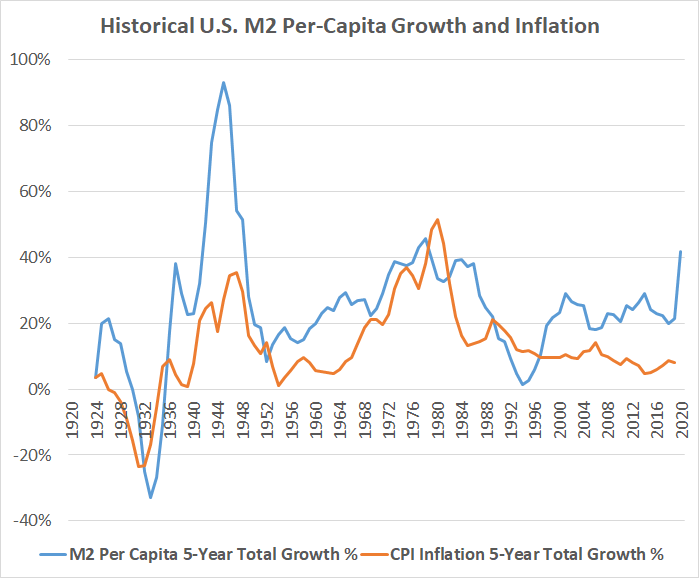

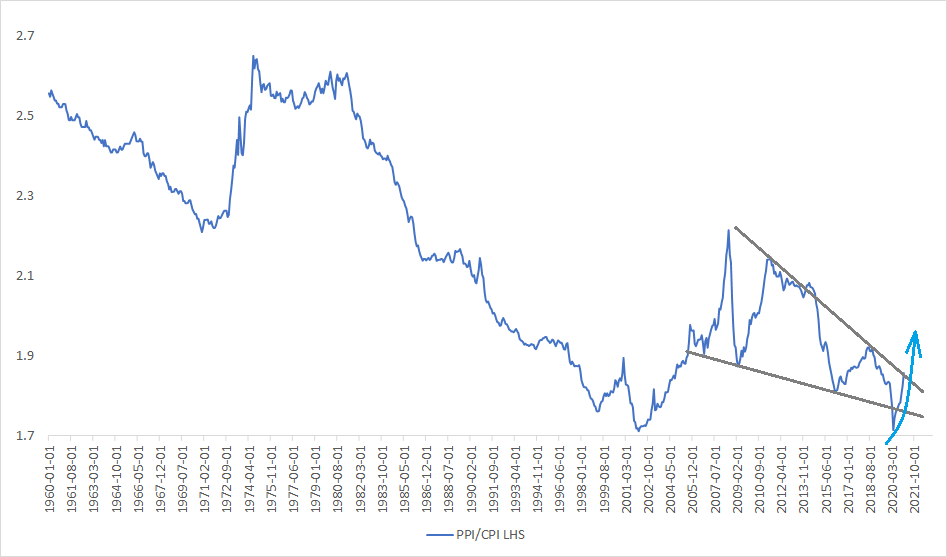

Sorry is this about inflation or a long bear market? I read it as inflation, but comments are pointing to bear. My view is 5-8% inflation is coming and will lead to massive bull market. Someone please correct me….

I am gonna bite. Who is singer ?Daniel Gosselin @dan13456 3h

https://en.wikipedia.org/wiki/Paul_Singer_(businessman)

Replying to @michaeljburry

“Another lesson I learned early is that there is nothing new in Wall Street. There can’t be

because speculation is as old as the hills. Whatever happens in the stock market to-day

has happened before and will happen again.”

-Reminiscences of s Stock Operator

M @anotherdumbdumb 4h Replying to @michaeljburry

My only thought is that it will be further on the horizon given the coming stimulus and frozen interest rates? Inflation until bust?

Igor Duna Mansour @igordunamansour 3h Replying to @michaeljburry

people really dont grasp the depth of the quote history doesnt repeat but rhymes. in chart analysis we call it fractals. cycles repeat in a similar but not exactly the same form to fool those who dont want to study history and look for the patterns.

Ampm @amdupont 13m Replying to @michaeljburry

Exactly Michel Burry. I have watched and shared your UCLA 2012 commencement speech with many. Your words/warnings then are coming to fruition. God bless you!!

Donald J. Trump @EnemyOfTheWoke_ 4h Replying to @michaeljburry

Dr. Burry we believe but you have to help us on how to play inflation. I’ve set up in commodities (steel, oil) and precious metals miners (gold, copper) and I am getting absolutely shelled! Will these turn around under inflation or do they go down with the ship bc they’re stocks?

Hephaestus @gaze1412 2h Replying to @michaeljburry

will the fed ever let it crash at this point? even the slightest hint at a rise in interest rates will cause a 10% correction at least. they keep digging themselves into a bigger hole

Carsten @Carsten09294241@michaeljburry

“The line separating investment and speculation, which is never bright and clear, becomes blurred still further when most market participants have recently enjoyed triumphs. Nothing sedates rationality like large doses of effortless money.” Berkshire Hathaway Letter 2000.

tom durek @DurekTom 3h Replying to @michaeljburry

million dollar question: how long can all this go on until it collapses?

Endland @Endland17 4h Replying to @michaeljburry

$USD is the next Big Short? Is it time to start buying?#ShortSqueeze #wallstreetbets

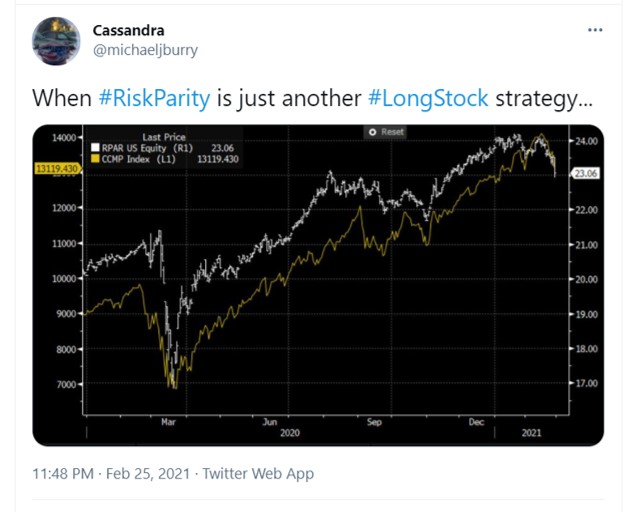

- 02/25/2021 -riskparity and CCMP index, IOER

What Is Risk Parity?

It is a portfolio allocation strategy that uses risk to determine allocations across various components of an investment portfolio. The risk parity strategy modifies the modern portfolio theory (MPT) approach to investing through the use of leverage.

https://www.investopedia.com/terms/r/risk-parity.asp

Does Burry want to say that the movement of Nasdaq is in sync with risk parity portfolio allocation? so what is the risk parity portfolio will be after interest rate and inflation increase?