Study of TSLA

- 05/23/2022 – I need to study more about Tesla’s risk on firing

Elon scorching the earth. Indeed. https://t.co/e5AnWcTs3s

— M.J. Pollick (@MJPollick) May 21, 2022

- 04/07/2022 – another Giga factor

Tesla CEO Elon Musk hosts ‘Cyber Rodeo’ party to open Austin factory

- Tesla CEO Elon Musk spoke at a grand opening event for its new vehicle assembly plant in Austin, Texas, on Thursday.

- At the “Cyber Rodeo” party hosted by Tesla, Musk said the Austin factory is aiming to make 500,000 Model Y vehicles per year once production has ramped up there.

- Musk also teased products that are still in development, including the Cybertruck, which Tesla aims to produce next year, and a new “robotaxi” which he said would look “quite futuristic.”

This mini documentary takes a look at Elon Musk and his thoughts on artificial intelligence. Giving examples on how it is being used today – from Tesla cars to Facebook, and Instagram. And what the future of artificial intelligence has in store for us – from the risks and Elon Musk’s Neuralink chip to robotics. The video will also go over the fundamentals and basics of artificial intelligence and machine learning. Breaking down ai for beginners into simple terms – showing what is ai, along with neural nets.

Elon Musk’s Book Recommendations (Affiliate Links)

- • Life 3.0: Being Human in the Age of Artificial Intelligence https://amzn.to/3790bU1

- • Our Final Invention: Artificial Intelligence and the End of the Human Era https://amzn.to/351t9Ta

- • Superintelligence: Paths, Dangers, Strategies https://amzn.to/3j28WkP

Other topics covered in this video include: • Elon Musk’s motivation for building Neuralink, testing with pigs first before humans • The risks of artificial intelligence and the ethics behind it • How Tesla cars use artificial intelligence for autopilot (using cameras, sensors, and radar) • Elon Musk’s OpenAi company he started – acting as a research lab for ai • The books Elon recommends for understanding artificial intelligence • Breaking down the basic branches of ai (computer vision, speech recognition, natural language processing, pattern recognition, and machine learning)

- 12/03/2021 – Elon Musk: Strict Rules He Forces His Kids to Follow

Elon Musk is known for many things. From reimagining the Automotive industry to kickstarting the private Space Industry, he truly is one of the most important Engineering titans of our time. But with all this spotlight and millions of people looking up to him, we cannot imagine how difficult it would be for all his children to live up to the Musk Legacy. Thankfully, just as Elon Musk was no ordinary inventor and businessman; he is also no ordinary parent. In fact, Elon has been very much involved in his children’s education. Elon has a very clear idea of how he wants to raise his children and what kind of environment he wants them to grow in. All his planning for his children’s education is accompanied by some strict rules that they must follow. In this video, we will be looking at Elon Musk’s visions for his children’s education and the strict rules he expects them to follow

This mini documentary takes a look at how Elon Musk sees the world through a scientific and engineering mind – and how this fuels the businesses he has started. We will also take a look at how he taught himself about different industries: from banking (Paypal), to rocket engineering (SpaceX). Elon Musk champions the use of physics as a way of thinking. And believes that more people should be innovating in manufacturing – to help build the city of the future. Rather than entering the finance, law, or internet based industries. This video also takes a look at the ‘reasoning from first principles’ framework – which will allow anyone to view their world, personal and business, just like Elon.

Elon Musk’s Book Recommendations + Others (Affiliate Links)

- • The Hitchhikers Guide to the Galaxy: https://amzn.to/3kNFSyW • Ignition: https://amzn.to/3i20BgN

- • Benjamin Franklin: https://amzn.to/2G24eWX

- • Structures: Or Why Things Don’t Fall Down https://amzn.to/36KGCRc

- • The Foundation: https://amzn.to/3i753dU

- • Six Easy Pieces (Thinking Behind Physics): https://amzn.to/3mUvIP2

Other topics covered in this video include: • Elon Musk’s book recommendations • The books he read to help him start SpaceX • How he joined a Mars society when he moved to LA, helping him start his new space venture • Elon Musk’s biography as a child – looking at his schooling, what he read, and how he viewed the world • Elon Musk quotes – showing how he views the world through a scientific mind – showing why he started his own school, and Neuralink • A look at his college days – when he would sell computer parts out of his dorm room, and building his own rocket kits when he was younger • How he surrounds himself with smart people – which fast tracks his learning and education in new industries • And the expectations when hiring people for SpaceX or Tesla

- 11/30/2021 – watch out Starlink to be IPO’d

Elon Musk tells SpaceX employees that Starship engine crisis is creating a ‘risk of bankruptcy’

- Elon Musk described a dire situation with SpaceX’s development of Raptor rocket engines the day after Thanksgiving in a companywide email, a copy of which was obtained by CNBC.

- “The Raptor production crisis is much worse than it seemed a few weeks ago,” Musk wrote.

- Raptor engines power the company’s Starship rocket, with Musk adding that SpaceX faces “genuine risk of bankruptcy if we cannot achieve a Starship flight rate of at least once every two weeks next year.”

Elon Musk Is Quietly Building Up A TRILLION Dollar Weapon – Starlink

- 11/27/2021 – other good movies of Elon Musk

Elon Musk: The Scientist Behind the CEO (and How He Teaches Himself) Documentary

Elon Musk on Religion and God…

MIND BLOWING WORK ETHIC – Elon Musk Motivational Video

Electrified – The Current State of Electric Vehicles Documentary

Elon Musk: Strict Rules He Forces His Kids to Follow

The Rise of SpaceX Elon Musk’s Engineering Masterpiece

- 11/27/2021 – two must watched documentary films on EV history

auto dealership associations and GM fought Tesla’s efforts to sell cars directly to consumers in several states. There’s a long, acrimonious history between the two companies, and anyone who watched the documentary films “Who Killed the Electric Car?” and the sequel “Revenge of the Electric Car” will understand why.

Revenge of the Electric Car Documentary on youtube

Revenge of the Electric Car – 2011 (FULL MOVIE DOCUMENTARY) – (English Subtitles)

- 11/24/2021 – Elon Musk is a real genius and visionary

Elon Musk: The future we’re building — and boring | TED

21,069,673 viewsMay 3, 2017

“I am not trying to be anyone’s saviour, I’m trying to think about the future and not be sad” – Elon Musk One of the best quotes

If You Hate Elon Musk Watch This Video — It Will Change Your Mind | Elon Musk’s Speech

Elon Musk is a business magnate, engineer, inventor, and designer. Elon Musk is the founder of Tesla, SpaceX, and The Boring Company. Elon Musk is also the co-founder of Neuralink and OpenAI. Musk is considered by many to be the greatest entrepreneur of our generation due to his relentless efforts to have a better future for humanity. “Being an entrepreneur is like eating glass and staring into the abyss.” — Elon Musk

This man has my respect from moment the world knew about him, this man is so smart and has such a beautiful future i hope SpaceX will reach mars and beyond!. My Deepest respect for Elon and his teams behind him!

In Their Own Words: Elon Musk, PBS, September 29, 2021

The brightest mind on earth with a sense of humor. Inspiring on an order of magnitude.

Cathie Wood Dropped A BOMBSHELL On Tesla’s Future Market Share

Wood thinks Tesla will become $3 Tril company. Tesla will change to the cheaper battery and increase production to 1.5 million vehicles in 2022!!

- 11/23/2021 – how Elon Musk’s companies are taking on everything

| Industry | How it Could Be Disrupted | |

|---|---|---|

| SpaceX | Space Launches | Offering lower priced transport into space |

| Telecommunications | Offering lower priced service | |

| Satellite Internet | Putting more satellites into space for cheaper | |

| Tesla | Automobiles | Building the best, lowest-cost electric vehicle |

| Personal Transport | Eliminating the need for car ownership entirely | |

| Solar Energy | Increasing access with Powerwall and Solar Roof | |

| Fossil Fuels | Maximizing efficiency of solar panels | |

| Car Sharing | Making idle Tesla cars available via app | |

| The Boring Company | Tunneling | Reducing cost of tunneling through the ground |

| Infrastructure | Building more efficient transportation infrastructure | |

| Real Estate | Increasing range people can live from their place of work | |

| Freight Shipping | Reducing freight costs by a magnitude | |

| OpenAI | AI/Machine Learning | Owning the best AI system in the world |

| Competitive Gaming | Consistently producing better-than-human AIs | |

| Neuralink | Prosthetics | Reducing cost of effective prostheses by magnitude |

| Medicine (Treatment) | Treating serious illness with simple injection | |

| Military | Allowing enhancement of human capabilities | |

| Robotics | Better modeling of brain-machine interaction |

We take a look at the state of his companies and how they are — or aren’t — transforming the industries in which they operate:

- Automotive: Tesla has boomed in 2020. We take a look at the company’s rocky history and how Musk has propelled Tesla to become the most highly-valued carmaker in the world.

- Aerospace: Find out how SpaceX plans to build a “freeway” to Mars by reducing the cost of flying a spaceship to a fraction of what it is today, and to harness rocket technology for earth travel as well.

- Telecommunications: Musk’s work in space could revolutionize how we get online, and provide fast, affordable internet for those without access.

- Energy: According to a utilities lobbying group, Musk’s efforts with Tesla and SolarCity could “lay waste to US power utilities and burn the utility business model.”

- Transportation: We analyze the Hyperloop, Musk’s proposed “fifth mode of transportation” that’s a “cross between a Concorde and an air hockey table,” and the progress that’s been made.

- Infrastructure/Tunneling: We look at how Musk’s business, called The Boring Company, is trying to cut costs in the notoriously expensive tunneling industry, where a mile of tunnel can cost $1B to dig and each additional inch in diameter costs millions more.

- AI: We investigate why Musk, who is certain that the race for AI superiority will be the “most likely cause” of WWIII, is investing so much into building better AI.

- Healthcare: We dig into the high-bandwidth, minimally invasive brain machine interfaces that Neuralink is developing to create futuristic humans.

Elon Musk’s Companies

Elon Musk is the CEO, founder, inventor, or adviser for some of the world’s most-hyped companies, including:

- SpaceX (including Starlink)

- Tesla (including SolarCity)

- The Boring Company

- OpenAI

- Neuralink

Read on for a deep dive into how Elon Musk and his companies are transforming vital industries.

- 11/11/2021 – I love Prof. Aswath Damodaran: Musings on Markets: Tesla’s Trillion Dollar Moment: A Valuation Revisit!

- 11/04/2021 – Tesla is high demand, no question about it. The growth momentum is high

Hertz Will Have to Wait for Teslas, Just Like Other Buyers – WSJ

Companies in talks over timing of deliveries for 100,000 Tesla order

Tesla Inc. TSLA +1.63% and Hertz Global Holdings Inc. HTZZ +6.92% are negotiating over how quickly Hertz will receive deliveries from a bulk order of 100,000 Tesla electric cars for its rental fleet, according to people familiar with the matter.

- 10/28/2021 – Elon Musk’s speeches

Elon Musk’s Speech Will Leave You SPEECHLESS | One of the Most Eye Opening Speeches Ever

Elon Musk: Caltech Commencement Speech (Big English Subtitles & HD)

- 05/17/2021 – Burry owned 8,001 put contracts of TSLA, this is not a small short number. Burry previously mentioned in a tweet, which he later deleted, that Tesla’s reliance on regulatory credits to generate profits is a red flag.

Michael Burry of ‘The Big Short’ reveals a $530 million bet against Tesla

- Michael Burry is long puts against 800,100 shares of Tesla or $534 million by the end of the first quarter, according to a filing with the U.S. Securities and Exchange Commission.

- Burry was one of the first investors to call and profit from the subprime mortgage crisis.

- Burry previously mentioned in a tweet, that Tesla’s reliance on regulatory credits to generate profits is also an impediment to the company’s long-term prospects

As of March 31, Burry owned 8,001 put contracts, with unknown value, strike price, or expiry, according to the filing.

Burry previously mentioned in a tweet, which he later deleted, that Tesla’s reliance on regulatory credits to generate profits is a red flag.

Besides his “Big Short,” Burry made a killing from a long GameStop position recently as the Reddit favorite made Wall Street history with its massive short squeeze.

In the first quarter of 2021, Tesla reported $518 million in sales of regulatory credits, which Elon Musk’s company generally receives from government programs to support renewable energy. It has sold these to other automakers, notably FCA (now Stellantis) when they needed credits to offset their own carbon footprint.

In the fourth quarter of 2020, Tesla’s $270 million in net income was enabled by its sale of $401 million in regulatory credits to other automakers.

Tesla historically racked up around $1.6 billion in regulatory energy credits, primarily zero emission vehicle credits, which helped Tesla report more than four consecutive quarters of profitability, qualifying Elon Musk’s automaker for addition to the S&P 500 index.

Tesla is currently delayed in producing and delivering its updated versions of its high-end sedan and SUV, the Model S and X. And it is delayed in commercial production of its custom-designed “4680” battery cells for use in forthcoming vehicles, including the Cybertruck and Tesla Semi.

Meanwhile, Elon Musk’s electric vehicle venture is facing regulatory scrutiny in China and the U.S. with high profile vehicle crashes leading to negative publicity and investigations by vehicle safety authorities in both nations.

Many believe that CEO Elon Musk’s tweets about bitcoin and dogecoin have also contributed to the volatility in Tesla’s stock. Musk has tens of millions of followers on Twitter.

- 05/04/2021 – need to review this video on FSD of TSLA

- 05/04/2021 – Competition from Mercedes is on for Tsla

Mercedes EQS Electric Sedan: The S Stands for Stunning

The automaker should be able to win back some customers who drifted to Tesla, and hold onto the Tesla-curious.

- 05/04/2021 – Beijing is now targeting Tesla, might be negative for it

- Tesla has limited time to get market share in China before the government takes action, experts say.

- State media is indicating that time could run out sooner than Tesla had bargained.

- Experts say it’s clear Beijing is trying to give Tesla a bad name so domestic rivals can catch up.

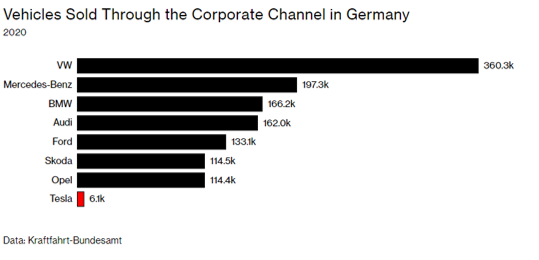

- 03/05/2021 – Tesla’s much smaller servicing network, its refusal to offer bulk discounts, and a lack of long-standing sales relationships with Europe’s biggest companies (About 60% of new-vehicle purchases in Europe are made through the corporate channel) have kept it far behind homegrown brands, which have decades of experience tailoring offerings to the massive corporate demand pool. Although Tesla is gaining popularity with private buyers, it accounted for only 0.3% of vehicles sold through the corporate channel in Germany last year, according to the country’s KBA vehicle authority.

Tesla Needs to Crack Europe’s $360 Billion Corporate Car Market

The EV maker’s smaller servicing network and refusal to offer discounts on bulk purchases make it harder to compete with established brands.

Car buyers are showing increasing interest in Tesla Inc. models, and the employees at German software maker SAP SE are no exception. Europe’s largest tech company, like major corporations across the Continent, provides cars for company and personal use as an employee perk. And SAP lately has been getting dozens of requests for Teslas from its workers each month. But the company won’t buy them, saying Tesla’s lack of servicing centers near its Walldorf headquarters and other SAP facilities has fueled concerns that employees would take time off to deal with repairs if they were given the coveted electric vehicle.

Servicing teams “need to be there at short notice, and Tesla still has some work to do,” says Steffen Krautwasser, who manages SAP’s 17,000 cars in Germany. “The interest in Teslas is extremely high, but we simply can’t offer them at this point.”

About 60% of new-vehicle purchases in Europe are made through the corporate channel, including company cars offered as a perk (for which employees have certain fees deducted from their paycheck). The sheer size of the roughly €300 billion ($360 billion) corporate car market will play a key role in determining how quickly the combustion engine is phased out in favor of batteries across the region. Yet Tesla, which is building its first European factory near Berlin, with plans to begin production later this year, is almost absent from that sales channel. European automakers, including BMW, Renault, and Volkswagen, dominate.

Tesla’s much smaller servicing network, its refusal to offer bulk discounts, and a lack of long-standing sales relationships with Europe’s biggest companies have kept it far behind homegrown brands, which have decades of experience tailoring offerings to the massive corporate demand pool. Although Tesla is gaining popularity with private buyers, it accounted for only 0.3% of vehicles sold through the corporate channel in Germany last year, according to the country’s KBA vehicle authority.

Lackluster sales in the corporate car market could leave Tesla with excess production capacity in Europe,

- 03/05/2021 – VW ID.4 > Tesla Model 3/Y from Edmund

https://www.edmunds.com/roadnoise/#2021-volkswagen-id4-video

- 03/05/2021 – Tesla is a great company, but it is way overpriced. Competition and parts shortage drag TSLA down, out of controlled cost will drag down its profitibility

Tesla closes below $600 for the first time since December — here’s what’s weighing the stock down

- Tesla finished below $600 for the first time since Dec. 4, and has lost 15% on the year.

- The sell-off comes amidst a bigger drawback in tech stocks, which are valued based on the presumption of heavy growth in future cash flows.

- Competition and parts shortages are also playing a part.

- sales of mini car in India might help Tsla just like what it did in China

- Poth Capital gives price of TSLA $150

Controlling costs has been on CEO Elon Musk’s mind on and off for years.

In December 2020, he wrote in e-mail to all Tesla employees: “Investors are giving us a lot of credit for future profitability but if, at any point, they conclude that’s not going to happen, our stock will immediately get crushed like a souffle under a sledgehammer!”

But at the same time, Tesla is on an expansion tear that will cost it handsomely. The EV maker is building factories in Austin, Texas, in Brandenburg, Germany and expanding its footprint in China. It has also embarked on revamping aspects of its Fremont facilities, including the paint shop, the area of the factory where its cars are painted.

Musk also has ambitions for Tesla to mine its own lithium, domestically. And to ramp up production of Tesla’s own battery cells at a pilot plant also in Fremont.

Besides these efforts, the company is in the midst of costly recalls and could face more– whether voluntary or mandatory. Most significantly of these voluntary recalls, in China and in the US, Tesla is recalling Model S and X vehicles experiencing touchscreen display failures.

- 03/05/2021 – some news on TSLA shorts – is TSLA stock starting to be crushed like a soufflé under a sledgehammer? any chance to come back live?

Well Respected Investor Bets Against Tesla For These Reasons

Per CNN, Burry is referencing an email that Musk allegedly sent to his employees saying that Tesla’s actual profit margin is fairly low at only roughly one percent, and that the stock price is due to investor expectations of future profits rather than recent results.

“If, at any point, they conclude that’s not going to happen, our stock will immediately get crushed like a soufflé under a sledgehammer!” he wrote in the email, which was first reported by Electrek.

The email encouraged employees to find even the smallest cost savings in the car manufacturing process.

- 03/03/2021 – Michael Burry on TLSA

Burry initiated short position(s) on Tesla before or around early December 2020, according to a now-deleted tweet[24] [25] and likely added to his short positions [26][27] after the market cap of Tesla surpassed that of Facebook. Burry predicts Tesla stock will collapse like the housing bubble; [27] he boasted that “my last Big Short got bigger and Bigger and BIGGER” and taunted Tesla bulls to ‘enjoy it while it lasts.’[

- 03/03/2021 – Telsa’s market share in Europe drops: 2019 – 109,000 vehicles, 31% market share, No. 1; 2020 – 98000 vehicles, 13% market share, No. 3; First month 2021 – 1,619 vehicles, vs VW – 9,005 vehicles, Hyundai and Kia – 7087 vehicles, Renault-Nissan-Mitsubishi – 6018 vehicles. Is TSLA crumbled?

Tesla’s market share in Europe keeps crumbling, as China reclaims top spot in global EV race

Volkswagen Group sold the most electric vehicles of any company in the key European market in January 2021

Tesla’s TSLA, 0.21% trajectory in Europe is in decline. There were 1,619 registrations of Tesla’s battery-electric vehicles in 18 key European markets in January, representing 3.5% of all battery-electric vehicles registered that month, according to a report based on public data by automotive analyst Matthias Schmidt. In 2020, the U.S. car maker saw 1,977 vehicles registered in January—more than a 5% market share.

Tesla comfortably topped the European EV charts in 2019. It sold more than 109,000 vehicles that year, making up 31% of the region’s battery-electric-vehicle market. But the tide turned in 2020, with Tesla dropping behind both the brands of Volkswagen Group VOW, 4.30% and the alliance between Renault RNO, 5.76%, Nissan 7201, +4.16%, and Mitsubishi 8058, +2.72%.

Last year, Tesla made up just 13% of the European market despite a smaller proportional decline in the number of vehicles it sold—around 10%—from 109,000 in 2019 to nearly 98,000 in 2020.

More broadly in January, China raced past Europe to reclaim its crown as the world’s largest market for electric vehicles. There were 179,000 battery-electric and plug-in hybrid electric vehicles registered in China in January, compared with 110,000 in Europe.

Schmidt’s report shows that Volkswagen Group, which manufactures VW, Audi, Skoda, Seat, and Porsche, remains the most popular battery-electric vehicle group in Europe, with more than 22% of the market share after 10,193 of its vehicles were registered.

It is closely followed by Stellantis STLA, -1.56%, a group formed earlier this year through the merger of PSA—which included Peugeot and Citroën—and Fiat Chrysler. Stellantis sold 9,005 vehicles.

Behind Stellantis is Hyundai and Kia, increasingly popular in Europe, which had 7,087 registrations. That puts the Korean group ahead of the Renault-Nissan-Mitsubishi Alliance, with 6,018 registrations, though Renault’s Zoe remained the most popular battery-electric vehicle in Europe in January.

Then comes Mercedes-owner Daimler DAI, 1.57%, BMW BMW, 3.60%, and Volvo VOLV.B, 1.67%, all with registrations ahead of Tesla in the first month of the year.

- 03/03/2021 – VW is fully cost competitive with Tesla and boast best-in-class energy density and efficiency, VW plans to at least double the share of its sales this year to between 6% and 8%, which might narrow the gap with Tesla by deliveries to roughly 700,000 cars. Tesla expects to hand over at least 750,000 vehicles in 2021. In addition, VW ID.3’s gross margin is around 15%, “already almost on par” with VW’s combustion-era Golf model. _ TSLA in Europe is under pressure. M Burry’s comment: investors, partly due to the ESGFog underestimate the size, scale, brands, staying power and resources of Volkswagen.

Volkswagen’s Electric Car Stacks Up Well Against Tesla in UBS Teardown

The deep dive into the ID.3 by UBS Group AG analysts found the platform underpinning VW’s EV models will be fully cost competitive with Tesla and boast best-in-class energy density and efficiency. Analysts led by Patrick Hummel called the car “the most credible EV effort by any legacy auto company so far.”

“The market has been waiting” for VW’s battery-electric vehicle production to ramp up, and for “proof points,” Diess tweeted Wednesday. “So here we are.”

VW plans to at least double the share of its sales that are fully electric this year to between 6% and 8%, suggesting it might narrow the gap with Tesla by boosting deliveries to roughly 700,000 cars. Tesla expects to hand over at least 750,000 vehicles in 2021.

“VW might not be the Apple, but the Samsung of the EV world, with profitable, high-volume EV brands,” UBS’s Hummel said. He estimates the ID.3’s gross margin is around 15%, “already almost on par” with VW’s combustion-era Golf model.

- 02/11/2021 – will BTC crash? also drag down TSLA? from WSJ: bank will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients

Burry’s comments: 70% of $BTC is mined in sanctioned countries, China, Iran, Russia. Crypto is in a race – add enough reputable agents of commerce to counter and overcome the inevitable coordinated actions of the ECB/BoJ/Fed/IMF/WorldBank-level powers-that-be to crush it.

Bitcoin to Come to America’s Oldest Bank, BNY Mellon

The custody bank plans to eventually treat digital currencies like any other asset

Bank of New York Mellon Corp. BK +0.85% , the nation’s oldest bank, is making the leap into the market for cryptocurrencies.

The custody bank said Thursday it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients. In time, BNY Mellon will allow those digital assets to pass through the same plumbing used by managers’ other, more traditional holdings—from Treasurys to technology stocks—using a platform that is now in prototype. The bank is already discussing plans with clients to bring their digital currencies into the fold.

“Digital assets are becoming part of the mainstream,” said Roman Regelman, chief executive of BNY Mellon’s asset-servicing and digital businesses.

It is a big step for Wall Street’s back-office banks, whose concerns over regulatory, legal and stability risks left them reluctant to come into direct contact with crypto markets. But as prices of bitcoin and other digital assets have continued to rise, they have become more popular with asset managers, hedge funds and other institutional investors.

- 01/08/2021 – what is Burry’s short thesis? debt is still low, cash is high. Cost will be down because of scaling up. No net income, no cash flow, no problem for the time being since TSLA can issue more stocks (more dilution?) and more debt. what will burst the “bubble”? competition?

- Michael Burry, whose lucrative wager on the US housing bubble’s collapse in 2007 was captured in “The Big Short,” expects Tesla stock to implode in a similar fashion.

- “Well, my last Big Short got bigger and bigger and BIGGER too,” the Scion Asset Management boss tweeted. “Enjoy it while it lasts.”

- Burry highlighted that Tesla gained about $60 billion in market capitalization on Thursday, the equivalent of General Motors’ entire market value.

- The Scion chief disclosed in December that he’s shorting Tesla, slamming its stock price as “ridiculous.”

- 01/05/2021 – good comparison

Tesla vs. NIO: Battle for the World’s Largest EV Market

- 01/01/2021 – great documentary movie on Elon Musk. I need to get to know this man, his company, and this industry

Elon Musk: How I Became The Real ‘Iron Man’

- 12/18/2020 – at exactly 3:50pm ET, TSLA started to jump up to since the algos work, BUT I sold my shares at 3:35pm when price dropped quickly (I was not scared, just did not want to lose more since I saw a news one company downgraded TSLA, also, I plan to use the sale proceeding to buy other stocks, bad idea). Therefore, I exactly missed the last jump! I am very stupid!! – Maybe I can never pick the last jump since algos are designed to buy at the last second. But I still can wait until 3:59pm. So stupid I am! A big lesson learned for me!!!!!!!!!

At 3:50 p.m. EST the exchange operator will start disseminating information on market imbalances, or outsize demand to buy or sell Tesla. At that point, traders will step in, likely vaulting an already crazy day to new heights.

“A few minutes before the close, when the imbalance feeds come out, a ton of algos will start pairing off imbalances or positioning their trades,” said Shishir Gupta, global index strategist at RBC Capital Markets.

- 12/17/2020 – can it be a good short term trade? Buy in the morning, set the limit sell and sell before market close

Tesla Joins the S&P 500: Five Things to Watch

Traders are bracing for big swings in stock, options markets ahead of electric-car maker’s addition to index Monday

3. Last 30 Minutes of Trading

Tesla’s addition stands to add to the importance of the closing auction that determines end-of-day prices for thousands of stocks. Nasdaq will accept so-called market-on-close orders throughout the day. At 3:50 p.m. EST the exchange operator will start disseminating information on market imbalances, or outsize demand to buy or sell Tesla. At that point, traders will step in, likely vaulting an already crazy day to new heights.

“A few minutes before the close, when the imbalance feeds come out, a ton of algos will start pairing off imbalances or positioning their trades,” said Shishir Gupta, global index strategist at RBC Capital Markets.

Why Friday Is Big for Tesla Stock, Ahead of Monday’s Epic S&P 500 Inclusion

The trading impact has been significant. Shares are up about 58% since Nov. 16, when the decision was made by the S&P index committee to include Tesla. The S&P and Dow Jones Industrial Average, for comparison, are up only 3% and 1%, respectively, since then.

Barron’s suggested a 60% gain was too much when speculation initially raged about Tesla’s S&P 500 inclusion, after the company reported a second-quarter profit. We were wrong. Shares have soared more than many pundits expected.

Part of the reason for our skepticism was Tesla’s meteoric rise this year. Shares are up 673% year to date, making it the world’s most valuable auto maker by a wide margin. Toyota Motor (TM) is second with a market capitalization of roughly $250 billion.

12/03/2020 – Burry shows a spreadsheet in the tweet detailing Tesla’s financial performance against older automakers. The company touts an industry-high market capitalization but posts total profits and revenue far below those seen by Toyota, Volkswagen, and other major car companies.

- Michael Burry, whose bet against the housing market was made famous by “The Big Short,” revealed in a late-Tuesday tweet that he’s short Tesla.

- The hedge fund manager advised CEO Elon Musk to issue more shares while they sit at their “ridiculous” levels.

- “That’s not dilution. You’d be cementing permanence and untold optionality,” he added.

- Tesla dipped as much as 7.1% on Wednesday before paring losses and trading roughly 3% lower.

The famed investor Michael Burry has revealed that he’s short Tesla and advised CEO Elon Musk to issue more shares while they sit what Burry called their “current ridiculous” levels.

Tesla shares have rallied more than 575% this year, boosted more recently by the company’s coming inclusion in the S&P 500 and fading profitability concerns. Some of Wall Street’s more bearish analysts have turned more optimistic toward the stock, and favor from waves of retail investors has further supported Tesla’s lofty valuation.

Not every bear has been converted, though. Burry reiterated his pessimistic outlook for the company in a late-Tuesday tweet, adding that Musk should take advantage of the sky-high stock price to raise more cash.

“So, @elonmusk, yes, I’m short $TSLA, but some free advice for a good guy … Seriously, issue 25-50% of your shares at the current ridiculous price. That’s not dilution,” Burry tweeted.

The hedge fund manager included a spreadsheet in the tweet detailing Tesla’s financial performance against older automakers. The company touts an industry-high market capitalization but posts total profits and revenue far below those seen by Toyota, Volkswagen, and other major car companies.

Burry has espoused his bearish outlook online in the past. Ahead of Tesla’s Battery Day event, the investor highlighted Tesla’s thin margins and questioned the rationality of its industry-leading market cap. Though the automaker has steadily notched quarterly profits since the late-September event, its valuation has only swung higher.