Study of TMV (TMF), TTT and TBT (TLT)

Catalysts

Risks

- it might take very long term to have rate increase. The growth rate is very low.

************************************************************************************

- 06/02/2022 – a flattening of the yield curve will affect the DPST and TBT negatively even though rate increases. In addition, Economic and political uncertainty, as well as stock market volatility, persist. Some investors are turning to U.S. Treasuries, the yields of which are up significantly, for income and a measure of asset preservation. investors buying treasury will drop yield down – be aware

Stock Market Today: June 2, 2022

U.S. Treasury bond yields were a mixed bag, though many of the yields were lower after the day of trading. A few short-term yields rose, suggesting a flattening of the yield curve, which usually is a negative for financial companies’ earnings. Still, traders are pricing in a 50-basis-point hike of the federal funds rate at the June 15th Federal open Market Committee (FOMC) meeting.

Economic and political uncertainty, as well as stock market volatility, persist. Some investors are turning to U.S. Treasuries, the yields of which are up significantly, for income and a measure of asset preservation.

- 05/26/2022 – national wide, housing market starts to cool down

Home listings suddenly jump as sellers worry they may miss out on the red-hot housing market

- The supply of homes for sale jumped 9% last week compared with the same week one year ago, according to Realtor.com.

- Real estate brokerage Redfin also reported that new listings rose nearly twice as fast in the four weeks ended May 15 as they did during the same period a year ago.

- Pending home sales, a measure of signed contracts on existing homes, dropped nearly 4% in April, month to month and were down just over 9% from April 2021, according to the National Association of Realtors.

- 05/25/2022 – short term inversion on yield spread can still happen even with rate hike. So think about finding a way to unload TBT (or portion of it) for oil

Stock Market Today: May 25, 2022

U.S. Treasury bond yields were lower across the board, as traders looked for safe-haven instruments. Still, medium-term yields fell more than others, and some inversions across the yield curve continue to exist, suggesting traders were strategic with what bonds they allocated money to.

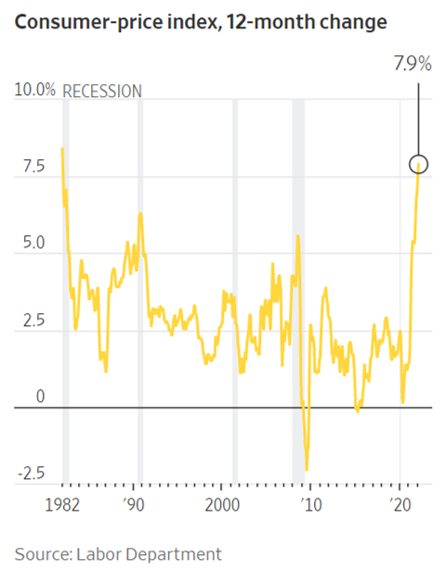

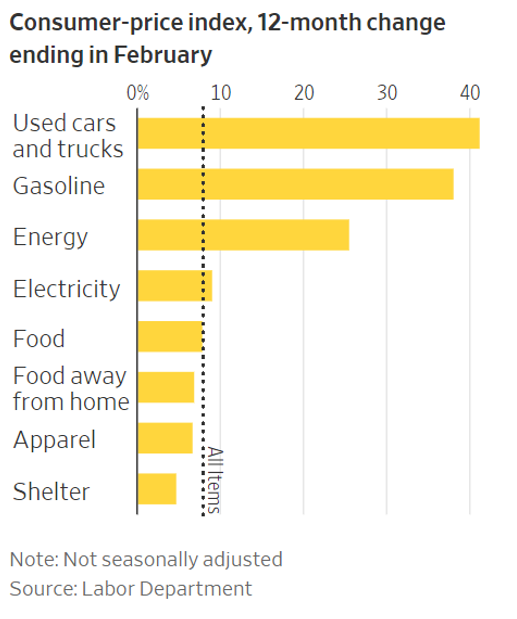

- 03/10/2022 – Inflation in US reaches record high, should Fed be more aggressive on interest rate hike. and Inflation Was Broader Than Gas Prices

Inflation Reached 7.9% in February; Consumer Prices Are the Highest in 40 Years – WSJ

Surging energy costs related to Russian invasion of Ukraine are pushing prices higher

Rising energy, food and services prices pushed already elevated U.S. inflation to a 7.9% annual rate last month—another four-decade high—with oil and commodity market disruptions from the Ukraine crisis expected to add more cost pressures.

The consumer-price index, which measures the cost of goods and services across the economy, hasn’t been this high since it was 8.4% in January 1982, when the nation was in recession and trying to tame what had been double-digit inflation.

Higher energy prices, including gasoline price increases, helped push up the inflation reading, along with cost gains for groceries, restaurant food, transportation services and apparel, the Labor Department said on Thursday.

Strong demand for goods from consumers and supply-chain constraints related to the Covid-19 pandemic have elevated inflation over the past year, with persistent shipping bottlenecks and shortages of supplies like semiconductors rippling across the economy. A historically tight labor market also has pushed wages higher and led to more open jobs than there are workers looking for work, leaving businesses struggling to keep up with demand.

Economists expect additional price increases related to the Ukraine crisis after crude-oil prices in March hit their highest levels since 2008, and U.S. gasoline prices reached record highs.

February Inflation Was Broader Than Gas Prices – WSJ

Higher prices across a range of goods and services will be a concern for the Fed

- 03/10/2022 – ECB plans to increase interest rate before year end to fight inflation

ECB Plans to Phase Out Stimulus Sooner Than Expected – WSJ

European Central Bank keeps rates on hold, paves way for increases before year’s end

FRANKFURT—The European Central Bank said it would aim to phase out its large bond-buying program by September, sooner than expected, taking a key step toward raising interest rates to contain surging inflation despite the shock of war in Ukraine.

The ECB said in a statement that it would keep its key interest rates on hold but paved the way for increases before the end of the year. Any rate rises will take place “some time” after the end of the bank’s bond-buying program and will be gradual, the ECB said.

Taken together, Thursday’s actions signal a determined move away from the ultra-easy monetary policies that the ECB introduced in recent years. They reflect mounting concerns about inflation, which is close to 6% in the eurozone.

- 03/07/2022 – Central banks are delaying or softening rate increases after relying on easy money to get through the Covid-19 pandemic. At the heart of the latest bout of uncertainty is Russia, the world’s 11th-largest economy and a crucial energy supplier to much of Europe. Western nations have in recent days imposed the most sweeping economic sanctions against a major country in recent decades. Christopher Smart, former U.S. Treasury/National Security Council special assistant to President Barack Obama, said the uncertainty among global businesses was reminiscent of that which accompanied the collapse of Lehman Brothers in September 2008.

Global Economy Braces for Impact of Russia’s War on Ukraine – WSJ

Central banks are delaying or softening rate increases after relying on easy money to get through the Covid-19 pandemic

Soaring commodity prices, sweeping financial sanctions and the potential for a ban on energy imports from Russia after it invaded Ukraine are threatening to hobble a global economy still weakened by the Covid-19 pandemic. They are also complicating the task of central banks that had been preparing to phase out easy money.

On both sides of the Atlantic, inflation is at levels that haven’t been seen for decades, and still rising. Global stock markets are wilting and the dollar is surging against other currencies as investors rush for the safety of U.S. assets.

Economists are increasingly warning of a possible bout of stagflation, particularly in Europe, a situation of high inflation and low growth that afflicted major economies during the 1970s. Back then, central banks responded to a surge in oil prices with easy-money policies that caused a wage-price spiral. Now, some central banks might give up on their plans to increase interest rates after keeping them down during the pandemic.

“It’s going to be increasingly hard to ignore the comparisons to the 1970s as the commodity price action is increasingly resembling this,” said Jim Reid, a strategist at Deutsche Bank.

At the heart of the latest bout of uncertainty is Russia, the world’s 11th-largest economy and a crucial energy supplier to much of Europe. Western nations have in recent days imposed the most sweeping economic sanctions against a major country in recent decades.

Christopher Smart, former U.S. Treasury/National Security Council special assistant to President Barack Obama, said the uncertainty among global businesses was reminiscent of that which accompanied the collapse of Lehman Brothers in September 2008.

“We’ve never seen anything this comprehensive, this powerful and this sudden imposed on an economy this size and important to the global economy,” said Mr. Smart.

It is similar to the Lehman crisis “in the sense that there’s going to be a lot of uncertainty about who has exposure to Russia, the indirect exposure,” he said. “I may know that I’m not exposed, but I’m not really sure who among my clients may be exposed, who has investments that they’re…going to have to write down.”

Europe, with its geographical proximity to the conflict and heavy dependence on Russian energy, is potentially facing its third recession in two years. The U.S. economy is likely to fare better given its role as the world’s top oil producer and still-sizable household savings, but even in the U.S., surging inflation is likely to weigh on consumer spending and growth.

- 03/03/2022 – Powell said he would propose a quarter-percentage-point interest-rate increase at the central bank’s meeting in two weeks amid high inflation, strong economic demand and a tight labor market. he laid the groundwork for the possibility of half-point increases this summer, pushing back against the idea that more traditional quarter-point increases represent a speed limit for the Fed. Going forward, Sen. Richard Shelby (R., Ala.) pushed Mr. Powell to say whether he would follow the example set by former Fed Chairman Paul Volcker in the 1980s to push down inflation at all costs. “I would hope history will record that the answer to your question is yes,” said Mr. Powell. Mr. Shelby responded curtly: “That would be a departure from what you’ve done.”

Fed’s Powell Says Ukraine War Creates Risks of Higher Inflation – WSJ

Central bank wants to avoid adding to uncertainty after Ukraine invasion, Fed chairman says

Before a House panel on Wednesday, Mr. Powell offered an unusually explicit preview of anticipated policy action when he said he would propose a quarter-percentage-point interest-rate increase at the central bank’s meeting in two weeks amid high inflation, strong economic demand and a tight labor market.

Federal Reserve Chairman Jerome Powell said Russia’s invasion of Ukraine was likely to push up inflation, a setback to the central bank’s expectations that price pressures would diminish in the coming months.

On Wednesday, Mr. Powell effectively ended a debate in markets and among other Fed officials over whether they would lift rates from near zero this month with a larger half-percentage-point increase. At the same time, he laid the groundwork for the possibility of half-point increases this summer, pushing back against the idea that more traditional quarter-point increases represent a speed limit for the Fed.

Fed officials last spring and summer attributed most of the rise in inflation to supply-chain bottlenecks, which wouldn’t necessarily demand a policy response if those kinks were expected to resolve themselves in a few months. Fed officials began taking steps to withdraw stimulus last fall, and accelerated that process in December, as inflation pressures remained strong and labor markets healed rapidly. “Hindsight says we should have moved earlier…but there really is no precedent for this,” Mr. Powell said.

Going forward, Sen. Richard Shelby (R., Ala.) pushed Mr. Powell to say whether he would follow the example set by former Fed Chairman Paul Volcker in the 1980s to push down inflation at all costs. “I would hope history will record that the answer to your question is yes,” said Mr. Powell.

Mr. Shelby responded curtly: “That would be a departure from what you’ve done.”

- 02/22/2022 – Stock Market Today: February 22, 2022

The biggest fear for the markets is that a full-on invasion will trigger a steep selloff for stocks and propel oil prices even higher. The latter would only further fan the flames of inflation, which, in turn, could prompt the Federal Reserve to take more strident steps in raising interest rates, thereby increasing the risk of a potential recession.

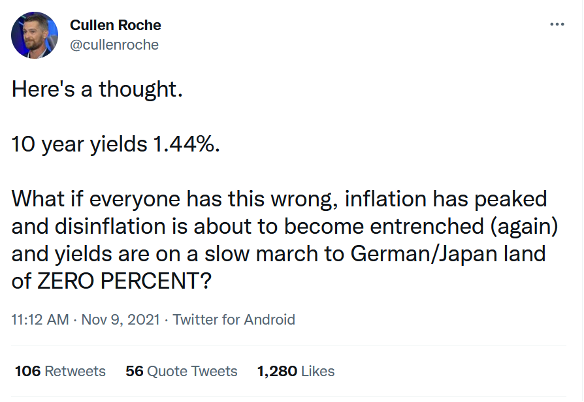

- 11/11/2021 – Tilson thinks bet on inflation might be bad. Because inflation can last very long, and stock price will be elevated at inflation. Either way, bet on int rate might not be a very clean-cut good idea. In addition, we cannot rule out a deflation scenario like German and Japan. Therefore, it might be better to focus on stocks than on interest rate, or I need to trim down my position in TMV and TBT.

The Labor Department announced yesterday that U.S. Inflation Hit 31-Year High in October as Consumer Prices Jump 6.2%. Excerpt:

U.S. inflation hit a three-decade high in October, delivering widespread and sizable price increases to households for everything from groceries to cars due to persistent supply shortages and strong consumer demand.

The Labor Department said the consumer-price index – which measures what consumers pay for goods and services – increased in October by 6.2% from a year ago. That was the fastest 12-month pace since 1990 and the fifth straight month of inflation above 5%.

The core price index, which excludes the often-volatile categories of food and energy, climbed 4.6% in October from a year earlier, higher than September’s 4% rise and the largest increase since 1991.

Based on many articles I’m reading and e-mails I’m receiving, many folks are freaking out about this.

I’m not…

I think it’s a combination of short-term supply chain issues (which will get sorted out), a white-hot economy (which is good for stocks), and U.S. workers demanding and getting higher pay (which is good for America).

Other investors are shrugging this off as well, which is why the S&P 500 Index closed yesterday only 1.2% lower than the all-time closing high it reached on Monday.

If you want to worry about some macro factor, here’s a contrarian view (which I wouldn’t rule out):

|

In summary, I spend zero time worrying about inflation (or deflation). If I own good stocks, I’m going to be fine no matter what…

- 09/24/2021 – TBT’s approach is like CDS for housing market. Note that there is always “erosion” to consider when buying inverse or leveraged ETFs or open- or closed-end mutual funds. The “erosion” might can be seen as regular interest payment for CDs.

TBT: My Best Inflation Play Ever

TBT’s approach is the pinnacle of simplicity. Instead of holding 20-year US Treasury bonds, this ETF enters into Treasury Index Swaps with investment banks like Societe Generale, Citibank, Morgan Stanley and Goldman Sachs. These swaps give the ETF the opportunity to sell back positions to these investment banks at a profit if the bonds fall.

I have chosen this ETF because it is leveraged 2x to the underlying investment. That is how confident I am that inflation will once again rear its ugly head. If, in the interim, all the jawboning by Fed and Treasury talking heads makes this ETF cheaper, good for me. I will buy more.

What is in it for the investment banks engaging in this swap? They receive all the interest on the bonds and a fee from the counterparty to the swap – that would be, in this case, TBT. The big investment banks are betting that rates will not rise too far or too fast.

This arrangement allows the holders of this ETF to benefit if rates rise (or suffer if rates fall.) As new debt is created at higher rates, these older Treasury bonds, to remain relevant, must pay the same effective yield as the new ones. By being “short” the 20-year Treasury bonds, this ETF makes money if rates rise, meaning prices of these bonds must fall.

One other thing to remember. There is always “erosion” to consider when buying inverse or leveraged ETFs or open- or closed-end mutual funds. As a result of daily marking to market and the small fees involved when entering a swap, such funds will decline minutely day by day.

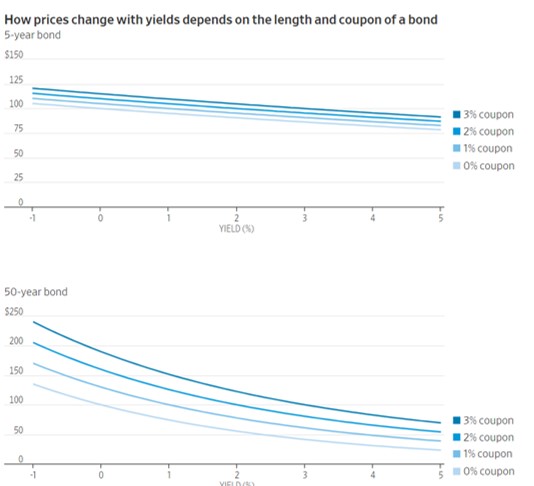

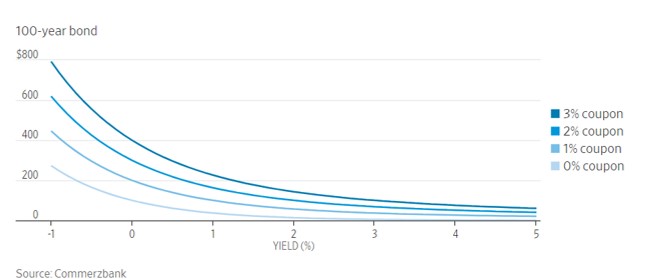

- 02/26/2021 – given the current super low interest rate, the longer the bond maturity, the risker the bond value will lose once interest rate goes up. Maybe that is the reason in US there is no 50~100 year bonds since nobody will buy them?

As Yields Rise, Beware the Hidden Risks in Ultralong Bonds – WSJ

Slim coupons make much of the recently issued debt with maturities of between 50 and 100 years riskier than traditional bond math suggests

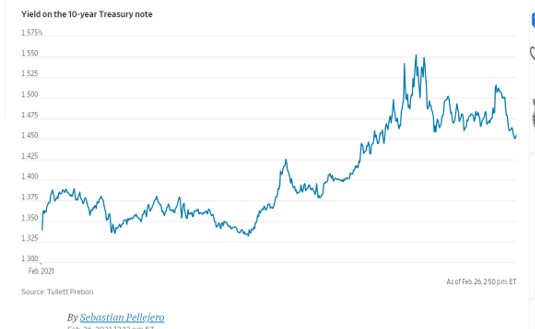

- 02/26/2021 – yield on t10-year Treasury note down to 1.501% from yesterday 1.513% maybe because higher yields attracted buyers. However, when there is faster economy growth and maybe high inflation, rate might eventually increase again.

U.S. Treasury Yields Steady – WSJ

The yield on the benchmark 10-year Treasury note recently traded around 1.501%, down from 1.513%

The yield on the benchmark 10-year Treasury note recently traded around 1.501%, according to Tradeweb, down from 1.513% at Thursday’s close.

Yields, which rise when bond prices fall, soared on Thursday as a weekslong selloff intensified—fueled by bets that the Federal Reserve will start raising interest rates earlier than previously expected in response to what investors widely expect to be a burst of economic growth and inflation later this year.

The 10-year yield logged its largest one-day gain since Nov. 9 during Thursday’s session to finish at its highest closing level in a year. The five-year yield, which is more sensitive to the near-term outlook for interest rates, experienced its largest one-day gain in more than 10 years.

Selling, though, abated Friday, as the higher yields attracted buyers.

While many investors expected the 10-year yield to move higher in 2021, the jump to 1.5% from around 1% in a matter of weeks is raising some concerns. While Fed officials have said that the yield’s climb toward pre-pandemic levels marks a return to normalcy, some investors worry their lack of concern could spur more selling.

Investors tend to sell Treasurys when they expect faster growth and inflation, which lowers the value of bonds’ fixed payments and can prompt the Fed to raise interest rates. Their optimism has been lifted recently by improving economic data, the promise of more government spending and the expanding distribution of coronavirus vaccines.

- 02/25/2021 – try to fully understand this

Key Short-Term Bond Spread Hits Lowest Level in Nearly a Year – WSJ

Treasury prices rally, but traders worry about a reversal if inflation picks up

- 02/25/2021 – the current 10 year treasury yield is at historical low. Imagine it probably can only go up, the stock market will probably go down

https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

- 02/25/2021 – try to understand this

How far can Treasury yields climb before spoiling the stock party?

- 02/25/2021 – The 10-year yield is up 8 basis points to 1.47%, having hit an earlier high of more than 1.49%. TBT, TLT

As 10-year Treasury yield nears 1.5%, watch out for an ‘equities riot’

- Long-term rates are rising sharply again, with the 10-year Treasury yield approaching 1.5% for the first time in more than a year.

- The 10-year yield is up 8 basis points to 1.47%, having hit an earlier high of more than 1.49%.

- The 30-year is rising 5 basis points to 2.29%.

- The spread between the 10-year and 2-year is at 1.34 and has doubled in four months to the widest gap since 2016.

- The bond selloff is weighing on equities as valuations come under the microscope with yields rising, and there’s concern the TINA trade is evaporating.

- Albert Edwards, global strategist at Societe Generale, had said that a move to 1.5% in the 10-year would prove too bearish for stocks. But in a note today, he says equities are currently just “squishy.”

- Right now, “the long bond bull market remains intact, even if 10y yields rise to 2% – or a bit beyond,” Edwards writes. “But with bubbles everywhere waiting to burst, a Japanese-style equity riot may be close.”

- “To be sure, if bond yields continue to rise and there is a smooth rotation out of growth and defensive stocks into value and cyclical stocks, the Fed will remain sanguine,” he adds. “But the risk is growing that with so many bubbles blown by the Fed something will burst soon. And despite the widespread certainty that the Fed can micro-manage the equity market, and levitate it at will, the real shocker would be if the Fed lost control in any impending equity riot.”

- A Rubicon was crossed in monetary early in the pandemic and now the “revolutionaries” have “hoisted there own MMT policy ensign” and captured the levers of policy, Edwards writes.

- Among bond ETFs (NYSEARCA:TBT) +2.7%, (NASDAQ:TLT) -1.4%, (NYSEARCA:TIP) -0.7%, (NASDAQ:IEF) -0.8%, (NASDAQ:BND) -0.6%, (NASDAQ:VGLT) -1.3%

- The S&P (NYSEARCA:SPY) -0.9% and Nasdaq 100 (NASDAQ:QQQ) -1.6 are down.

- Yesterday, Wall Street veteran Adam Crisafulli said that a 1.75% print on the 10-year would see pronounced compression of P/E valuations.

- 02/25/2021 – interest rate continues to rise, 10-year Treasury yield topped 1.46% Thursday, hitting its highest level since February 2020. “rates will continue to rise due to increasing growth and inflation expectations and, eventually, Federal Reserve normalization”

S&P 500 falls after 10-year rate hits one-year high, tech stocks lead decline

U.S. stocks fell on Thursday as higher bond yields continued to put pressure on high-growth technology stocks.

The S&P 500 lost 0.6%, while the tech-heavy Nasdaq Composite slid 0.9% as Tesla, Alphabet and Microsoft all traded in the red. The Dow Jones Industrial Average falls 100 points after closing at a record high in the previous session.

The 10-year Treasury yield topped 1.46% Thursday, hitting its highest level since February 2020. The benchmark rate has risen 35 basis points this month, inching close to the S&P 500′s dividend yield of 1.47%. Higher rates could make equities less attractive, while hitting the growth-oriented technology sector especially hard.

“Our base case is that rates will continue to rise due to increasing growth and inflation expectations and, eventually, Federal Reserve normalization,” said Ryan Detrick, chief market strategist at LPL Financial. “We also believe if rates move too high too fast, the Fed will intervene to make sure rising rates don’t become too restrictive and disrupt equity markets or the real economy.”

- 02/24/2021 – If bond is now “the elephant in the room”, should I buy TMV?

Some investors face ‘colossal’ losses on U.S. Treasury bonds as yields surge

Capital losses on 30-year T-bond so far this year comparable only to 1980, 2009: analyst

The multidecade-long bull market in Treasurys has delivered rich gains to patient investors, but a 2021 bond-market selloff is likely inflicting significant pain on some market participants.

Though many were expecting yields to rise this year as the reflation narrative gained ground, few were prepared for the rapid rise in long-term bond yields since the start of this year. Yields move in the opposite direction of bond prices.

Read: Bond markets have ‘never been so sensitive’ to a Treasury yield surge

Stronger price pressures are one of the biggest concerns of fixed-income investors as they can wipe out the value of a bond’s interest payments.

The iShares 20+ Year Treasury Bond exchange-traded fund TLT, -0.79%, which focuses on bond maturities of over 20 years, is down 11.6% year-to-date.

- 02/24/2021 – background knowledge of TMV and TMF

TMV Direxion Daily 20+ Year Treasury Bear 3x Shares ETF from Gurufocus.com

from Direxion: The Direxion Daily 20+ Year Treasury Bull (TMF) & Bear (TMV) 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the ICE U.S. Treasury 20+ Year Bond Index. There is no guarantee the funds will meet their stated investment objectives.

02/24/2021 – ideas on rising interest rates