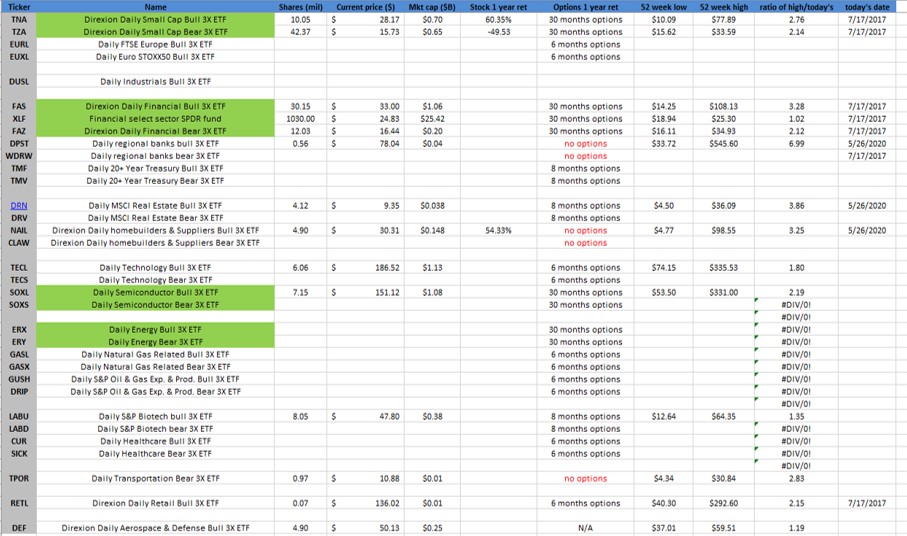

Study of ETFs

- 10/06/2021 – watch out the SEC’s action on leveraged ETFs. ProShares and Direxion are the two only companies that can provide 3X leveraged ETFs

SEC Considers Crackdown on Complex ETFs

The Securities and Exchange Commission will consider tougher rules for “complex” exchange-traded products––such as leveraged and inverse funds––that might pose risks to retail investors and the broader financial market, SEC Chair Gary Gensler said in a statement.

Many exchange-traded notes, commodity pools, and structured notes, for example, are subject to less strict rules than exchange-traded funds, even though they might pursue similar strategies and present many of the same risks. As these products grow in both size and number, the regulators need to consider the magnified impact they may have on the broader financial system, wrote the two commissioners. They also recommend the SEC adopt a “tailored sales practices framework” that helps investors better understand the characteristics and risks of the more complex products.

A Regulatory Crackdown on Certain Risky Funds Leaves Gaps

For over a decade, funds have been able to do an end-run around leverage restrictions by employing swaps and other derivatives—financial contracts that can amplify an investor’s exposure to benchmarks such as the S&P 500 index, with little money down. But regulators have finally caught up with the industry with a new rule it passed in October.

The SEC’s new rule “18f-4” establishes clear derivatives-exposure parameters. It allows the creation of new funds that have two times, or 2X, their underlying benchmark’s exposure via derivatives, but forbids any new funds with three times, or 3X, exposure. It grandfathers in existing 3X funds so they can continue to operate.

The rule was some 10 years in the making. In 2010, after the financial crisis, the SEC issued a moratorium on granting approval to money managers wishing to launch such leveraged funds, pending further review. Like now, it grandfathered in ProShares and Direxion.

Rule 18f-4 under the Investment Company Act

Rule 18f-4 provides certain exemptions from the Act subject to conditions. The conditions and other elements of the rule include the following:

- Derivatives Risk Management Program. The new rule generally requires a fund to implement a written derivatives risk management program. The program will institute a standardized risk management framework for funds, while also permitting principles-based tailoring by each fund to the fund’s particular risks. The program must include risk guidelines as well as stress testing, backtesting, internal reporting and escalation, and program review elements. A derivatives risk manager approved by the fund’s board of directors will administer the program. The fund’s derivatives risk manager will have to report to the fund’s board on the derivatives risk management program’s implementation and effectiveness to facilitate the board’s oversight of the fund’s derivatives risk management.

- Limit on Fund Leverage Risk. A fund relying on the rule generally must comply with an outer limit on fund leverage risk based on value-at-risk, or “VaR.” This outer limit is based on a relative VaR test that compares the fund’s VaR to the VaR of a “designated reference portfolio” for that fund. A fund generally can use either an index that meets certain requirements or the fund’s own securities portfolio (excluding derivatives transactions) as its designated reference portfolio. If the fund’s derivatives risk manager reasonably determines that a designated reference portfolio would not provide an appropriate reference portfolio for purposes of the relative VaR test, the fund would be required to comply with an absolute VaR test. The fund’s VaR generally is not permitted to exceed 200% of the VaR of the fund’s designated reference portfolio under the relative VaR test or 20% of the fund’s net assets under the absolute VaR test.

- 06/05/2021 – need to read

MicroSectors FANG+™ Index -3X Inverse Leveraged ETN

iShares Russell 2000 Growth ETF

- 06/03/2021 – great introductions on Direxion’s leveraged ETF for infrastructure plan

Leveraged ETFs to Unlock Biden’s Infrastructure Plan

DUSL, DEFN, NAIL, EURL, DRN, SOXL/SOXS, CLCD, CURE, TMV, LABU, WEBL, HJEN, TNA, SPXL, TPOR,

- 03/16/2021 – a interesting ETF “MOON” to watch out

ARKK Copycat Is Beating Cathie Wood’s Original by 10-Fold

A tiny ETF tracking innovative companies is quietly outpacing one of the most famous investments on Wall Street.

The Direxion Moonshot Innovators ETF (MOON) has risen 39% this year, compared to ARK Innovation ETF’s 3.5% gain, according to data compiled by Bloomberg.

MOON “has a heavier weight to biotech companies and less on straight technology and internet companies, which are the reason why ARKK has underperformed,” said Mohit Bajaj, director of ETFs for WallachBeth Capital.

Launched in November, MOON has risen roughly 70% since then, yet has attracted only about $220 million in assets. ARKK’s haul of more than $7 billion so far this year has put its total above $24 billion.

- 11/24/2020 – good ETFs to look at

10 Best ETFs for 2020: The Battle At the Top Tightens

With all of that said, let’s take a look at how each of these funds has performed (in ascending order from best to worst) through the end of September:

- Renaissance IPO ETF (NYSEARCA:IPO)

- Global X Cloud Computing ETF (NASDAQ:CLOU)

- SPDR FactSet Innovative Technology ETF (NYSEARCA:XITK)

- Invesco QQQ Trust (NASDAQ:QQQ)

- The Communication Services SPDR ETF (NYSEARCA:XLC)

- AdvisorShares Vice ETF (NASDAQ:ACT)

- iShares Russell 2000 Growth ETF (NYSEARCA:IWO)

- Consumer Staples Select Sector Fund (NYSEARCA:XLP)

- The ETFMG Alternative Harvest ETF (NYSEARCA:MJ)

- U.S. Global Jets ETF (NYSEARCA:JETS)

There’s not much time left in the year, but a few of these ETFs still might manage to run higher.

- 11/24/2020 – solar energy ETF

Job Growth in Solar Energy Will Help Boost “TAN” ETF

Job growth in the solar energy sector ticked higher in 2019—the first time in about three years—showing that the effects of import tariffs are starting to wane for solar energy. Other factors like declining costs and a federal tax credit helped drive the growth, according to a report by The Solar Foundation.

Per a Bloomberg report by Brian Eckhouse, “U.S. jobs in the industry increased 2.3% to almost 250,000 last year, marking the first annual increase since 2016 — the year before the threat of new tariffs emerged. The uptick won’t be a blip: the nonprofit organization projects a 7.8% surge in jobs in 2020.”

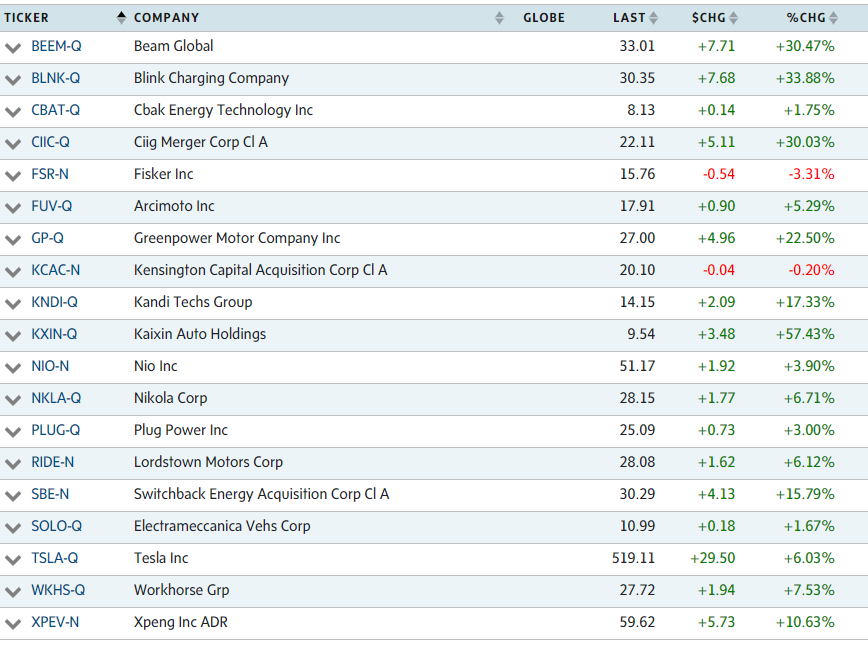

- 11/23/2020 – worth to invest in the future (EV etf, etc.)?

The Global X Autonomous & Electric Vehicles ETF (DRIV) seeks to invest in companies involved in the development of autonomous vehicle technology, electric vehicles (“EVs”), and EV components and materials.

The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index.

I chose the Global X Cloud Computing Fund (NASDAQ:CLOU) to be one of the best ETFs to buy this year. So far, so good. … The top holdings are Twilio (NYSE:TWLO), which is up 119%, Zoom Video (NASDAQ:ZM), up 271%, Zscaler (NASDAQ:ZS), up 137%, Coupa Software (NASDAQ:COUP), up 79%, and Shopify (NYSE:SHOP), up 129%.

Fanniegate Hero@DoNotLose2h

The world is on fire. Met a guy who made $1.8m from $200k yesterday on this bullshit. Said he was waiting to make $100m. I wished him well. This was his first rodeo.

- 11/18/2020 – worth to study leveraged ETFs

Leveraged ETFs are powerful and complex trading instruments that allow traders to magnify the return on investment. While higher returns are an attractive proposition, investors need to realize that losses are magnified too. Thus, these ETFs need to be handled with care.

Leveraged ETFs deliver the desired returns over prespecified periods only (usually one day). A leveraged ETF that offers 2x exposure to the S&P 500 only attempts to do so over one-day holding periods. Investors looking to hold these ETFs for significantly longer time periods can often find themselves losing money even if the underlying benchmark behaved as expected.

With 115 ETFs traded in the U.S. markets, Leveraged ETFs gather total assets under management of $39.42B. The average expense ratio is 1.06%. Leveraged ETFs can be found in the following asset classes:

- Equity

- Asset Allocation

- Fixed Income

- Currency

- Commodities

- Alternatives

The largest Leveraged ETF is the ProShares UltraPro QQQ TQQQ with $9.08B in assets. In the last trailing year, the best performing Leveraged ETF was the FNGU at 334.45%. The most-recent ETF launched in the Leveraged space was the Innovator Double Stacker 9 Buffer ETF – October DBOC in 10/01/20.