good to study the EVs industry

- 11/21/2021 – Chip makers (NVDA, QCOM, GFS, INTC) are good for EV stocks

- Reports that Apple (NASDAQ:AAPL) has set a goal of producing a fully autonomous electric car by 2025 would have been enough to set the tech sector and Wall Street on fire with speculation about what an “iCar” might look like. But, when those reports from last week said the key to Apple’s car plans is a breakthrough semiconductor platform, that fire of speculation turned into an almost uncontrollable blaze.

- Apple (AAPL) as it historically does, is keeping its mouth shut about anything it might be doing on the car front. However, the potential for a new chip technology unlike any other in the auto sector illustrates the role that chip developers are playing in advancing changes in the auto industry. And recent comments from many bellwether chip company executives show how much automobiles are playing a role in their plans for new areas of diversification and growth.

- Nvidia (NASDAQ:NVDA) reported strong quarterly results on Nov. 17, and not surprisingly, the company’s performance was largely driven by its gaming and data-center businesses. Revenue from automotive products was only $135 million, but that was an increase of 8% from a year ago. Nvidia (NVDA) also said that during the quarter, it lined up self-driving truck start-up Kodiak Robotics, British automaker Lotus, autonomous bus manufacturer QCraft, and EV startup WM Motor as customers to use Nvidia’s Drive Orin platform for their next-generation vehicles.

- In talking about Nvidia’s (NVDA) results, Chief Executive Jensen Huang said that the automotive industry also provides an outlet for use of the company’s Omniverse virtual technology platform.

- “There are 100 million cars. We’ve heard that the new cars will all have — will all be — have the capability to have something like an Omniverse Avatar. And so there’s 100 million cars to be $1,000 per car per year,” Huang said.

- Of course, Nvidia (NVDA) isn’t alone among chip companies with plans of building big automotive businesses.

- Qualcomm (NASDAQ:QCOM) has made autos one its primary areas of focus, and on Nov. 3, it reported $270 million in fourth-quarter revenue from automotive sales, a 44% increase from a year ago. At that time, Chief Executive Cristiano Amon said Qualcomm (QCOM) was working with automakers to create “a joint roadmap to build multi-tier, multi-generation, scalable and upgradable platforms for a long-term sustainable business.”

- Qualcomm (QCOM) wasted little time putting some meat on those auto-plan bones when, on Nov. 17, the company announced a deal to provide its Snapdragon system-on-a-chip technology to BMW for the German automaker’s next generation of autonomously driven cars. At its investor day meeting that same day, Qualcomm said such deals should help it boost its automotive-chip revenue from $1 billion this year, to $3.5 billion in 2026.

- “This is just the beginning,” Amon said of the BMW deal. “It’s an incredible opportunity to scale very fast in our auto pipeline.”

- Other automakers are building closer ties with many large chipmakers. Last week, General Motors (NYSE:GM) said it will work with Qualcomm and other chip companies on semiconductors for its cars, and Ford (NYSE:F) announced a new partnership with GlobalFoundries (NASDAQ:GFS) centered around jointly developing chip technologies for Ford (F) vehicles.

- Tom Caulfied, GlobalFoundries CEO, called the deal with Ford “a key step forward in strengthening our cooperation and partnership with automakers to spur innovation, bring new features to market faster, and ensure long-term, supply-demand balance.”

- At Intel (NASDAQ:INTC), the semiconductor giant’s Mobileye self-driving car business reported its best-ever quarter in October, with sales of $326 million, or 39% higher than in the same period a year ago. On Intel’s (INTC) earnings call, Chief Executive Pat Gelsinger said that with Mobileye, Intel will soon deliver driverless robo-taxi service in conjunction with rental car company Sixt SE. Gelsinger added that Intel (INTC) expects the market for “automotive silicon” will reach $115 billion by the end of the decade “as AVs [autonomous vehicles] begin to move from the garage to the streets.”

- At the IAA Mobility Conference in September, Gelsinger said that the advancements in chip technology are turning the automobile into “a computer with tires,” and left no doubt about how close chip companies and carmakers will work together in the coming years.

- 11/19/2021 – Apple is aiming for FSD car by 2025, can they achieve it?

- Apple shares hit a record on Friday following a Bloomberg report that the company is accelerating efforts to launch a vehicle.

- As of early afternoon Friday, its stock was up more than 1% and trading at over $160.

- Apple’s track record in new markets could foreshadow success, wrote Morgan Stanley analyst Katy Huberty, in a report following Bloomberg’s story.

Apple shares hit a record on Friday following a report that the company is accelerating efforts to launch a self-driving vehicle. As of early afternoon on Friday, Apple’s stock was up more than 1% to above $160.

According to the full report from Bloomberg News, the company is pushing internally for a 2025 deadline for an autonomous vehicle.

Apple Accelerates Work on Car Project, Aiming for Fully Autonomous Vehicle

Apple Inc. is pushing to accelerate development of its electric car and is refocusing the project around full self-driving capabilities, according to people familiar with the matter, aiming to solve a technical challenge that has bedeviled the auto industry.

For the past several years, Apple’s car team had explored two simultaneous paths: creating a model with limited self-driving capabilities focused on steering and acceleration — similar to many current cars — or a version with full self-driving ability that doesn’t require human intervention.

Under the effort’s new leader — Apple Watch software executive Kevin Lynch — engineers are now concentrating on the second option. Lynch is pushing for a car with a full self-driving system in the first version, said the people, who asked not to be identified because the deliberations are private.

Apple is internally targeting a launch of its self-driving car in four years, faster than the five- to seven-year timeline that some engineers had been planning for earlier this year.

- 11/16/2021 – Tilson’s great commentary on TaaS (Transportation as a Service)

How “TaaS” will change your life

The technology I want to tell you about today is known in Silicon Valley and Manhattan as “TaaS,” and if you’ve never heard of it, you soon will!

TaaS stands for “Transportation as a Service.”

And while it might not sound like a very high-tech name, it’s possible only because of the convergence of dozens of new incredible technologies, including two big new technologies in particular. I believe it could completely transform our daily lives.

Just for starters…

- It will dramatically change the value of homes and real estate all over the country.

- It will eventually put an estimated $5,600 back into the hands of 93% of U.S. families every year.

- It will dramatically change the value of your car. For most people, this is a big deal because cars are most people’s second-biggest purchase (after housing).

- TaaS will also likely result in the collapse of oil prices.

- It will radically change the tax structure of almost every city and small town in America. That’s because estimates show that Chicago, for example, will lose at least $250 million in revenue because of TaaS. Los Angeles will lose more than $140 million. New York will lose a half-billion dollars… every single year!

- TaaS will also radically change the insurance industry and the health care industry, saving millions of lives. In fact, at the end of the day, TaaS might be the biggest medical innovation in decades, even though it has nothing to do with pills or new equipment.

Two technologies – EV and Autonomous driving

Tilson identified a massive investing megatrend beginning to emerge in the markets. Less than a year later, his five “TaaS”-related recommendations were up an average of 66%, including two 100%-plus winners.

the new technologies are all about great advantage on economics, not on environmental green

“Things will go slow, until they go fast” – the early stage of new disruptive technologies

Investment #1: Buy Waymo

Investment #2: Own the Most Important Technology in the Electric Car Space

Electric car maker NIO soared 1,519% over the past year. Blink Charging, a leading provider of EV charging stations, soared 2,492% in the past year. CBAK Energy Technology, which produces batteries for electric cars and busses, soared 727% in the past year.

Also, one thing you have to realize is that the key to the possibility of making substantial gains in this space in the coming years is NOT to try to guess which company will win. Remember, in addition to Tesla, GM, Ford, and other U.S. manufacturers… there are some 400 electric car makers in China!

Plus, remember that by next year, there will be 500 different EV models available worldwide.

That’s why, the absolute best thing you can do is to simply take a stake in the best technology and the critical components EVERY electric car uses.

Investment #3: Own the Two Key Technologies for Autonomous Vehicles

Driverless vehicles are becoming a reality today because of a dramatic confluence of many technologies: computing power, cameras, sensors, laser range finders (called LiDAR), GPS, and artificial intelligence software, just to name a few.

But my team and I believe there are two companies responsible for by far the most “critical components” for the best self-driving cars.

The first company makes the most technologically advanced “brain” and “nervous system” for autonomous vehicles. This firm has already partnered with many of the leading companies in this space, including BMW, Hyundai, Audi, Intel, and Lyft, just to name a few.

The other key technology you want to own in the driverless technology space is the company that provides the computing power for many of today’s driverless vehicles.

This is critical for EVERY autonomous vehicle.

Already, this company has partnered with many of the world’s leading vehicle manufacturers, like Toyota, Volkswagen, Mercedes, and Volvo…

Investment #4: The Small Speculation

There’s one more TaaS investment my team uncovered recently, which we strongly recommend you make right away…

It’s a small company you’ve almost certainly never heard of.

You’ll have to take an extra step or two to buy it, but we think it will be well worth it.

In short: This company’s technology is needed in ALL self-driving and autonomous cars… and right now this small company’s materials are used in 20% of the entire global market.

If we’re right about our projections, this company’s revenue could quadruple over the next five years… and if that plays out as we expect, you will likely see a great return on your investment.

In recent months, the stock is up as high as 50%, but we think it has much higher to go.

- 10/29/2021 –

https://www.barrons.com/articles/tesla-ford-gm-betting-big-ev-batteries-stocks-51635472423?mod=hp_HERO

- 10/20/2021 – great documentary movie about Tesla, very inspirational. Musk is genus. It is not wise to short Musk, instead, I need to find chance to long his companies

In Their Own Words Elon Musk, PBS

- 08/29/2021 – Technical and huge cost challenge for EVs

GM’s Chevy Bolt Recall Casts Shadow Over EV Push – WSJ

The $1.8 billion recall, among GM’s costliest ever, underscores the difficulty, expense of fixing defective electric-vehicle batteries

GM this month expanded the Bolt safety recall for the second time, calling back the roughly 142,000 models built since it went on sale five years ago. The Detroit auto maker also paused production of all new Bolts. The safety action on its lone U.S. electric car will cost GM an estimated $1.8 billion, or around $12,700 per car, among its costliest recalls.

The safety problems underscore the risks for traditional auto makers as many take a sharp turn toward electric vehicles. The high cost of energy-dense lithium-ion battery cells means replacement expenses can spiral when defects occur. Ford Motor Co. , Hyundai Motor Co. and other car companies have been hit with huge costs to fix relatively small numbers of electric cars.

- 06/07/2021 – real in-depth discussion on the technologies of EVs and AVs. especially Tesla. Watch out two real competitors of Tesla: Mobileeye, comma.ai

from Tilson, “Tesla’s FSD Software: Revolutionary or Vaporware?”

My analyst Kevin DeCamp has been very bullish – and very right – on Tesla since he bought the stock in 2012 and a Model S in 2014 (both of which he still owns, along with a new Model Y – hence my nickname for him: “100-bagger”)!

He’s done a lot of research on autonomous vehicles and Tesla’s full self-driving, which he’s summarized in his report below. Here’s his conclusion:

Tesla has clearly taken a hard path for achieving autonomy, but it’s a scalable one that lends itself to intermediate products along the way. Critics say that Musk had no choice but to only use cheap sensors because he needs to sell affordable cars, but what if this approach gets to Level 5 autonomy first? How many lives will be saved? Already, crash data from Tesla’s Autopilot – which is standard on all of its cars – show that it’s already saving lives, and it will only get better over time. Although controversial because of its non-camera based driver monitoring system, I can say with confidence that my own experience with Autopilot makes me a safer driver and the founder of Waymo, Sebastian Thrun, feels the same way about his Tesla.

Tesla’s camera vision approach aligns perfectly with its first principles DNA in that it is the simplest solution possible – if it works. As Musk has said many times, “the best part is no part” – if we can train computers through deep learning to see and perceive “as plain as day” with 360-degree superhuman vision, then the massive costs of Lidar and HD maps could be unnecessary.

Either way, AVs are guaranteed to be an enormous market – with estimates as high as $7-10 trillion annually. Apple has the largest market capitalization of any company in the world, yet the total global smartphone market is less than $1 trillion. There will be hundreds of billions invested in this sector over the coming years, and many ways to make money. Don’t miss Whitney Tilson’s TaaS (Transportation as a Service) video to learn how to take advantage of this massive trend.

Lastly, if you can gain enough conviction on Tesla’s camera vision approach – as I have – I think there is still substantial upside for the stock, even at a ~$570 billion market cap, because the world – for the reasons I laid out – is doubting Tesla and Musk once again. Stay tuned…

If you have questions or comments for him, please email him directly at kdecamp@empirefinancialresearch.com

——————————

Tesla’s FSD Software: Revolutionary or Vaporware?

As I wrote in my last essay a few months ago on Tesla’s future, 2021 is an extremely important year for the company’s autonomy goals and its full self-driving (FSD) software rollout. As usual, there is a lot of controversy surrounding Tesla in general – and the debate about FSD is particularly heated. Scrolling through Twitter, opinions range from CEO Elon Musk is a god and Tesla’s lead in autonomous vehicles (AVs) is unassailable, to Musk is a fraud and the $10,000 FSD option is vaporware. To add to the confusion, the technology of self-driving cars is incredibly complex and can’t be easily understood by watching a quick YouTube video (isn’t that how we all learn these days?)

I’d like to address this difficult subject by doing a deep dive into Tesla’s approach to AVs compared to the rest of the industry. Given that the market for AVs will be worth many trillions of dollars, I think the effort is worth it. In addition, in the process we will build a basic understanding of artificial intelligence (AI) – which will affect almost every industry and by one estimate will add as much as $13 trillion to global output by 2030.

Overview of Lidar/HD maps vs. Tesla’s computer vision approach

Lidar (“light detection and ranging”) determines distances by targeting an object with lasers and measuring the time for the reflected light to return to the receiver. Lidar generates photons in the infrared range of the electromagnetic spectrum, which is why it’s not visible to the human eye. Lidar sensors are extremely useful for AVs because they allow the car to construct a live high-resolution 3D map of its surrounding environment.

HD (high-definition) maps are highly accurate 3D maps used specifically for AVs that contain details not normally present in traditional maps – lane markings, street signs, traffic signals, etc. – and have precision down to the centimeter level. AVs using this technology such as Alphabet’s (GOOGL) Waymo use very powerful onboard computers to cross-check these HD maps with Lidar data to enable extremely accurate spatial localization.

Lidar also enhances object recognition by increasing a camera’s ability to recognize objects because of the context that Lidar’s high-resolution 3D map provides. Although most autonomy companies use other sensors such as radar and cameras, the Lidar/HD map combination form the technological backbone of most AV companies such as Waymo, Cruise, and Argo AI.

Tesla, however, has chosen to go a different route, avoiding both Lidar and HD maps. Its system, instead, focuses primarily on computer vision (CV) using cameras and AI. Tesla contends that extremely good computer vision is necessary for autonomy because of the way our roads are designed and, once it achieves this incredibly difficult objective, Lidar will be unnecessary and a waste of resources. Tesla also claims to have the ability – through a “pseudo-lidar” approach – to create sufficient 3D depth maps using only cameras and deep learning (a form of AI), which provides spatial localization and object recognition at a much lower cost than Lidar and HD maps. To quote Musk:

Lidar is a fool’s errand…..anyone relying on Lidar is doomed……doomed. Expensive sensors that are unnecessary. It’s like having a whole bunch of expensive appendices – like one appendix is bad, but now you want a whole bunch of them? That’s ridiculous……you’ll see.

This is music to most Tesla bulls’ ears, but what do AV industry experts think of his statements?

Industry experts on Tesla’s approach

To put it mildly, most of the industry is highly skeptical of Musk’s claims. Chris Urmson, co-founder and CEO of Aurora, a self-driving technology company, recently commented on Tesla’s technology, “It’s just not going to happen. It’s technically very impressive what they’ve done, but we were doing better in 2010.” (when he worked at Waymo).

Austin Russell, CEO of Luminar (LAZR) – a Lidar startup – comments:

Our 50 other commercial partners and seven of the top 10 largest auto makers in the world would probably disagree with Elon along with pretty much every expert in the industry….What Tesla has today, what they call full self-driving you don’t need lidar for. The problem is that it’s not full self-driving (laughs), it’s actually not self-driving at all. That’s where I think they have drawn huge criticism in the industry with this rogue branding approach to what is being delivered. Lidar gives you a true 3D understanding, not a 2D understanding. Instead of keeping your hands on the wheel and eyes on the road at all times, take your hands and eyes off, use your phone, read a book, watch a movie. Actually autonomous.

I could continue quoting others in the industry, but that sums up the general consensus from experts – or at least competitors with a completely different approach. But, what about Tesla’s actual progress on solving full self-driving?

Elon Musk’s promises

Musk has undoubtedly disappointed many investors and customers with his autonomy claims and missed timelines – giving plenty of ammo to Tesla bears and skeptics.

Here are a few:

- In 2016, Musk claimed that all Tesla’s being produced had all the hardware for Level 5 autonomy – a system capable of performing all driving tasks in all conditions – with only a software update needed and promised a coast-to-coast self-driving demo in 2017.

- In February 2019, Musk claimed in a podcast that by the end of 2020, Tesla’s autonomy would be so capable that drivers would be able to snooze in the car while it took them to their destination.

- In April 2019, during Tesla “Autonomy Day” Musk said, “fast forward a year, maybe a year and three months – but next year for sure – we will have over a million robotaxis on the road.” He added that in “probably” two years (2021) Tesla will make a car with no steering wheels and pedals and projected that the net present value of each of the company’s cars, used as a robotaxi, would be worth $200,000 “conservatively” because the car could potentially earn its owner $30,000 a year.

Fast forward to today and Tesla is obviously way behind Musk’s 2019 timeline – the last I checked, all Teslas still have steering wheels and pedals and my Model Y isn’t worth $200,000!

That said, Tesla has released an “FSD beta” to a relatively small number of Tesla customers (perhaps 1,000-2,000) that the company claims is “feature complete,” meaning that it can execute most routine drives with few or no interventions.

Are we collectively so jaded by Musk’s grandiose claims that we are ignoring a major step forward in AVs?

Current state of the industry

Musk certainly deserves criticism for the way he has handled expectations on autonomy, but let’s not forget about the rest of the industry’s missed timelines. Most notably, Google’s Co-founder Sergey Brin promised self-driving cars “for all” within five years… in 2012.

Waymo – formerly Google’s self-driving car project – is widely viewed to be the leader in the space and is the first company in the U.S. with a truly commercialized driverless service without safety backup drivers, which has operated since October 2020 (though it is limited to a small geofenced area (Level 4) of approximately 50 square miles in Chandler, Arizona). This is impressive, but a far cry from Brin’s promise.

Waymo hasn’t announced when it will expand to other cities and the CTO Dmitri Dolgov was very tight-lipped about the strategy and speed of the rollout in a recent interview. Dolgov recently became co-CEO (with Tekedra Mawakana) when the former CEO, John Krafcik, stepped down unexpectedly. In addition, Waymo’s long-time chief financial officer and its head of automotive partnerships and corporate development are departing this month. Does this sound like a company on the verge of dominating a multi trillion-dollar industry?

This recent podcast with a few leaders in the AV industry also leads me to believe that large-scale AV deployments using Lidar/HD maps will not happen in the near future. This would explain why there has been a consolidation in the industry to absorb the massive costs associated with getting to the starting line and beginning to generate revenues.

When you take into consideration Musk’s missed timelines and the AV industry’s glacial progress, it’s not a stretch to conclude that self-driving cars are one of the greatest technical challenges of all time. One of the biggest difficulties is that Lidar and HD mapping are both very expensive, which makes this approach difficult to scale. Waymo ordered “up to” 80,000 vehicles in 2018, but has only taken delivery of around 600. Tesla has over one million vehicles – adding the equivalent of more than three Waymo fleets every single day (~2,000 cars) – with eight cameras collecting and processing data with its in-house-designed FSD chip – whether the customer purchases the FSD option or not. In addition, Tesla makes money on every single one of these vehicles, with a gross margin currently around 22%, among the best in the auto industry. If Tesla is right that computer vision and AI can eventually solve AVs, then it is not difficult to make the case that it could easily catch up and overtake its competitors.

In a series of interviews on Dave Lee’s YouTube channel, AI/machine learning expert James Douma breaks down all of the components of Tesla’s autonomy technology stack in great detail and at one point makes an analogy between Tesla’s AV efforts and the invention of human flight over a 100 years ago. Interestingly, when the Wright brothers conquered flight, the world barely noticed. Flight was considered so impossible that people didn’t believe it even when it happened. Given all of these empty promises and failed timelines, could we collectively be experiencing something similar?

Tesla Vision

When Andrej Karpathy, Tesla’s director of AI and Autopilot Vision, started his PhD at Stanford in 2011, computer vision was primitive by today’s standards. When he would run state-of-the-art visual recognition detectors, it wasn’t uncommon to get bizarre outcomes in which the computer, for example, would detect with 99% confidence cars in trees, as you can see in this screenshot:

“And you would kind of just shrug your shoulders and say, ‘that just happens sometimes…’” Karpathy said to a laughing audience during a presentation at OpenAI in 2016.

When you begin to understand how a computer “sees,” it becomes clear how this might happen.

An image to a computer is just a matrix of pixels like a chess board, with each pixel assigned a number that determines the brightness value at that point. In a grayscale image, the number is 0 if the pixel is black and 255 if the pixel is white. The numbers from 0-255 represent different shades of gray. In a color image, each pixel has 3 different numbers representing different intensities of red, green, and blue. So a one-megapixel color image is a grid of 1,000 X 1,000 pixels with each pixel having a red, green, and blue value.

As a result, the core challenge of computer vision is going from a grid of pixels and brightness values to high-level concepts like recognizing cars, dogs, pedestrians, lane lines, drivable space, etc. This is an enormous challenge even just for static images, let alone moving objects and the safety concerns involved with navigating a two-ton vehicle. When you consider the state of computer vision in 2011, the spatial localization and safety provided by Lidar and HD maps was an obvious choice when early work on Waymo started in 2009.

However, everything changed in computer vision in 2012 when a neural network that was trained through deep learning won the ImageNet Challenge, beating the runner up by over 10 percentage points. ImageNet is a database of over 14 million hand-annotated images designed for visual image recognition software research. Although deep learning has been around since at least the 1980s, this decisive win essentially put it on the map for computer vision and today experts wouldn’t even consider doing any serious image recognition task without deep learning.

Deep learning and neural networks

Computer vision was difficult with older techniques because of the challenge of writing software with instructions for identifying different objects given all the variables – background, lighting, viewpoint, etc. When you consider that an image is just a grid of numbers for a computer, writing a program even just to reliably tell the difference between a dog and a cat is extremely difficult.

Neural networks, also known as artificial neural networks, are a subset of machine learning, which in turn is a type of AI. Deep neural networks help solve computer vision because they can learn by example through a process called deep learning. Using a training process with a large dataset of labeled images, a neural network can learn the difference between a dog and a cat without the need for human written code – largely writing the code itself. The key requirement is a very large and varied dataset. Although a child can learn what a fire hydrant is with just a few examples, a neural network requires thousands of different examples.

One of the limiting factors is computing power. In fact, one of the reasons that deep learning aced the ImageNet challenge in 2012 is because the team that won leveraged the growing computing power of GPUs (graphics processing units) over CPUs (central processing units), which greatly improved the processing speeds for its neural networks. Tesla’s FSD chip includes two neural processing units, each capable of peak performance of 37 trillion operations per second (TOPS) while running at only 100 watts. Version two of this FSD chip with improved specifications will likely be ready in a year or two.

Another limiting factor is the human labeling needed for such a massive dataset. Tesla is currently in the process of designing and developing a “dojo” supercomputer which will assist in the labeling and training process. One of the bottlenecks Tesla has encountered is the massive time and resources needed to label individual images. By having Tesla’s data team label video data instead of individual frames, dojo will then parse out these video labels into individual frames speeding the labeling and training process up significantly.

There are also other ways to label data where the process is more automated. For example, “imitation learning” involves sourcing trajectories that human drivers take through intersections and training the neural network on those paths. In this case, the data is “labeled” automatically by the driver. Comma.ai – an AV startup – has taken this approach to the extreme and has vowed to eventually achieve Level 5 autonomy using this “end-to-end” deep learning technique in which all of the “labeling” is done by the human drivers and the neural network essentially learns all driving tasks through imitation learning.

Just as Tesla is moving into battery manufacturing to address the biggest constraint for its goal of producing 20 million EVs a year by 2030, it is addressing the constraints for a truly advanced computer vision system that is necessary for Level 5 autonomy. Keep an eye out for more details on these strategic moves on Tesla’s AI day, tentatively scheduled later this year.

Tesla’s fleet advantage: Large, varied, and real dataset

When you consider the large datasets needed to train neural networks even for the simplest image-recognition tasks combined with the enormous visual variability on our roads, it becomes obvious why most AV companies believe that Lidar and HD maps are necessary.

However, the challenge of this approach is the enormous cost of scaling – how do you break out of the geofenced box given the cost of the fleet, the Lidar sensors, the safety drivers, and the cost and difficulty of maintaining HD maps? Again, Tesla gets paid to add more than three Waymo fleets to the road each day. Waymo’s cars are essentially line-following robots on virtual rails that are confined to a safe space. They will never learn to drive everywhere in any condition (Level 5) if their experience remains so limited. As of April 2020, Teslas on Autopilot had logged 3 billion miles, while Waymo last reported 20 million, more than 99% fewer. Sure, both companies also use simulation, but this can never mirror the real world in all its complexity. Admittedly, Waymo’s 20 million miles are truly autonomous, but what’s important here is the amount and variety of data that Tesla has access to across 150 times more miles.

As Andrej Karpathy said in Tesla’s Autonomy Day presentation, “Lidar is really a shortcut – it sidesteps the fundamental problems, the important problem of vision recognition that is necessary for autonomy. And so it gives a false sense of progress, and is ultimately a crutch. It does give really fast demos though…”

To be clear, Waymo also uses AI and deep learning for its vehicles, but it’s not the foundation of its approach. As AI expert Lex Fridman put it, “For Waymo, deep learning is the icing on the cake; for Tesla, deep learning is the cake.”

Tesla’s cars are everywhere gathering data, but not all the data coming from its fleet is useful. Tesla has mechanisms to source and curate the most useful data through a trigger infrastructure that flags examples when the neural net is uncertain, or a driver intervenes and takes over. Also, it can gather from the dataset a large collection of images of a particular object that is confusing the neural network – a bike on the back of a car, for example. Then, it can correctly label these images, incorporate them into the dataset, retrain the network, redeploy, and iterate repeatedly – a process it calls the “data engine.”

Ironically, just as Google gained an early lead with its search engine by having that first-mover advantage and the positive flywheel of data that helped train its own AI – every time you do a Google search, you are helping train it – the same logic applies to Tesla’s approach to autonomy – if it’s right about computer vision.

A true Level 5 autonomous car will need to handle every situation safely 99.9999% of the time. Attaining those last 9s of reliability is going to be incredibly difficult, but I predict that the first company to do it will be one with an enormous, real world dataset – namely, Tesla.

Another reason to think that Tesla is likely to emerge as the winner is that it’s consistently rated among the most attractive firms for engineering students. Where do you think the top data scientists and machine learning engineers want to work? The company with a hundred times the amount of real-world data than the rest of the industry combined, or one that confines itself to a geofenced area in the name of safety while 3,700 people die globally in traffic accidents per day?

Pseudo-Lidar

A fair criticism of a camera vision-only approach is that it doesn’t produce the depth perception and real-time precise 3D maps that Lidar does. This criticism is becoming less and less valid over time, however, as neural nets can determine depth with increasing accuracy through a process called “self-supervised learning.” Basically, you feed raw videos into the neural network and it can teach itself – without any human input – depth through known geometric functions like Structure from Motion (SfM) and Simultaneous Localization and Mapping (SLAM).

Thus, Lidar’s main advantage of accurate localization/3D mapping is diminishing – and deep learning is accelerating this trend. In addition, Lidar often fails in heavy rain and with very bright objects. It even has difficulty seeing black cars due to low reflectivity or knowing the difference between a plastic bag and a tire. Supposedly, one of the major benefits of Lidar is its ability to see in the dark, but in the real world we use headlights so I’m not sure this is much of an advantage. Not only is Lidar expensive, but it’s also complex and very difficult to mass produce – especially at automotive grade levels. Lastly, there are remaining issues with Lidar that may get worse as more AVs are on the road – interference between Lidars from different vehicles and eye safety issues that are related to the tradeoffs of using near-infrared wavelength Lidar vs. short-wave infrared Lidar.

If cameras and AI can eventually generate depth maps with pseudo-Lidar that are accurate enough for safe autonomy, then Lidar won’t be necessary and Tesla is likely to achieve Level 4 and then Level 5 autonomy way before anyone else.

Of course, there is the chance that once Waymo and/or other AV companies conquer the complex city environments where they are currently testing, they will expand much more rapidly than I anticipate. Will Tesla’s neural networks close this depth perception gap faster than these Lidar/HD maps AV companies break out of these geofenced areas? This is the trillion-dollar question…

Mobileye

One company that has a very good chance of rivaling Tesla in data is Mobileye, which was acquired by Intel (INTC) in 2017. Over 60 million vehicles are equipped with some form of its ADAS (advanced driver assistance systems). The company has acknowledged the non-scalability of HD maps and developed its own type of map called “AV maps” that assist in navigation and perception. I am impressed with Mobileye’s ambition and technology offerings, but because of the company’s lack of vertical integration and rapid OTA (over-the-air) update iteration cycles that Tesla employs, I think Mobileye will have a hard time catching up to Tesla using its deep learning approach. I believe this is the reason Mobileye has chosen to use Lidar for robotaxis, even though it demonstrated the technological viability of a camera-only system in a video demo last year.

Comma.ai

An approach that I would not count out is the “end-to-end,” imitation deep learning employed by Comma.ai. The founder, George Hotz, was allegedly approached by Musk to rewrite Tesla’s Autopilot software in 2015. After a contract dispute, Hotz bailed and went on a mission to solve autonomy himself and used his unfinished work for Tesla to build the foundation of his company. He now claims that its OpenPilot software is the “Android” to Tesla’s “iOS” because it’s available for 100 different car models and currently has over 2,000 daily active users. Already, this scrappy startup has doubled Waymo’s last reported fleet miles with 40 million logged. I consider it the only true competitor to Tesla’s Autopilot. If Apple acquired Comma.ai, I would definitely need to reconsider my prediction of Tesla achieving Level 5 autonomy first.

Might both approaches be viable paths?

There are many different possible outcomes, but it’s conceivable that these geofenced Level 4 solutions continue to expand slowly for ride-hailing services and Tesla eventually achieves Level 5 autonomy as the first self-driving vehicle available to consumers. I think the market is large enough for both approaches to be successful, and that this is the most likely outcome.

However, there is a chance that the Lidar/HD map approaches are still a decade or more away from achieving scale and Tesla’s data flywheel accelerates its progress to the point where it is clear to the industry (and the stock market) that it is the only viable medium-term solution to Level 5 autonomy. In this scenario, Comma.ai would definitely be an acquisition candidate or Hotz may choose to stay independent and sell access to its data – an option he seems open to.

Deep dive on deep learning

Although this report covers a lot of material, we have barely scratched the surface. To learn more, I highly recommend watching the entire playlist of Dave Lee’s interviews with machine learning expert James Douma, as well as Andrej Karpathy’s many presentations on YouTube.

Conclusion

Tesla has clearly taken a hard path for achieving autonomy, but it’s a scalable one that lends itself to intermediate products along the way. Critics say that Musk had no choice but to only use cheap sensors because he needs to sell affordable cars, but what if this approach gets to Level 5 autonomy first? How many lives will be saved? Already, crash data from Tesla’s Autopilot – which is standard on all of its cars – show that it’s already saving lives, and it will only get better over time. Although controversial because of its non-camera based driver monitoring system, I can say with confidence that my own experience with Autopilot makes me a safer driver and the founder of Waymo, Sebastian Thrun, feels the same way about his Tesla.

Tesla’s camera vision approach aligns perfectly with its first principles DNA in that it is the simplest solution possible – if it works. As Musk has said many times, “the best part is no part” – if we can train computers through deep learning to see and perceive “as plain as day” with 360-degree superhuman vision, then the massive costs of Lidar and HD maps could be unnecessary.

Either way, AVs are guaranteed to be an enormous market – with estimates as high as $7-10 trillion annually. Apple has the largest market capitalization of any company in the world, yet the total global smartphone market is less than $1 trillion. There will be hundreds of billions invested in this sector over the coming years, and many ways to make money. Don’t miss Whitney Tilson’s TaaS (Transportation as a Service) video to learn how to take advantage of this massive trend.

Lastly, if you can gain enough conviction on Tesla’s camera vision approach – as I have – I think there is still substantial upside for the stock, even at a ~$570 billion market cap, because the world – for the reasons I laid out – is doubting Tesla and Musk once again. Stay tuned…

- 06/01/2021 – The car subscription EV market is set to top $12 billion by 2027, and many of the big car makers are making moves on it, from Porsche to Volvo… and even to Hertz itself, since there is a big opportunity here. – good stocks: Facedrive’s Steer (TSX.V:FD; OTCMKTS:FDVRF) , TSLA, AAPL, TM, BLNK, Celestica (TSX:CLS) , Teck Resources Limited (TSX:TECK.B), Lithium Americas Corp. (TSX:LAC), Maxar Technologies (TSX:MAXR) , Westport Fuel Systems (TSX:WRPT).

Is This One Of The Best Ways To Play The Electric Vehicle Boom?

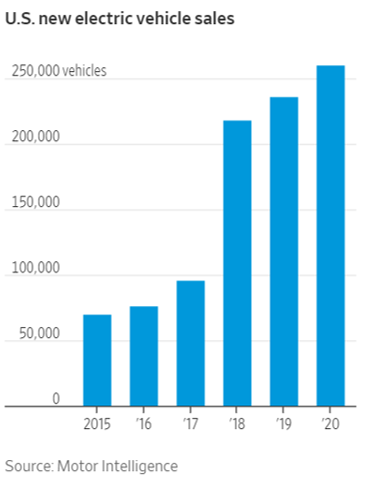

Electric vehicle sales jumped 43% in 2020 while overall car sales decreased by 20%, and there’s still plenty of room to run on the electric playing field, according to some of the biggest wealth managers, but there’s a potential big industry disruptor here …

One of the next big shake-ups in the auto industry – and one that will help, not hinder the adoption of EVs – is the burgeoning car subscription business.

The car subscription market is set to top $12 billion by 2027, and many of the big car makers are making moves on it, from Porsche to Volvo… and even to Hertz itself, since there is a big opportunity here.

But Washington, D.C.-based Steer combines two big trends: subscriptions and EVs, making it one to watch in this sector.

Acquired by Canadian Facedrive in Q3 2020, Steer – like Facedrive itself – is all about getting out in front of the newest trends, first…

And turning carbon-offset offerings into profitable tech-driven verticals.

There’s an important shift happening in consumer behavior, and Facedrive (TSX.V:FD; OTCMKTS:FDVRF) intends to be out in front of it all the way. In our view, this is definitely one stock to watch closely.

- 06/01/2021 – EV is all about software, not hardware any more like that of gasoline car. Need to pay attention to this. and also need to pay attention to Aptiv and Lear called auto supplier stocks

Tesla Is Turning Cars Into Phones. Other Car Makers Better Catch On.

Cars are slowly becoming less about hardware and more about software. That shift has the power to change the automotive industry as much as any other trend, including vehicle electrification and autonomous driving. Automotive investors should start paying more attention to software.

Cars are still in the rotary phone stage—or perhaps the flip phone stage. But that is changing. Tesla (TSLA) pioneered over-the-air updates, and now more auto makers are doing the same, connecting their vehicles to the web. Ford Motor (F) announced this past week a plan to set up a new business around connecting its commercial vehicles.

“Tesla has never really focused on model years,” Tesla power electronics supplier Aptiv (APTV) CEO Kevin Clark tells Barron’s. Tesla can improve power output with software. EV range enhancements can be made with software. In-car entertainment enhancements? Yes, software.

That approach has yielded real benefits. Tesla’s gross profit margins are better than BMW ‘s ( BMW. Germany), despite being about 30% of BMW’s size. Tesla also saves on tooling. Tesla spends less on capital, adjusted for size, than does BMW.

The software-defined vehicle trend is still in the early innings, Clark says. It has a long way to run, but the end of the game for cars might not look exactly like the phone business.

There are a couple of key differences between the industries. Manufacturing cars so teenagers can use them without injuring pedestrians isn’t a trivial matter. Also, the regulatory complex, including crash testing and emissions regulations for automobiles, isn’t comparable to phones either. And a new car costs, on average, $40,000 and is expected to last a decade or more. A phone costs $1,000 and lasts until it is dropped one too many times.

Still, attention needs to be paid. At minimum, investors can start tracking how many software engineers auto makers and suppliers have. (Clark says Aptiv has thousands). The winning automotive maker of the future won’t be those with the coolest looking car. It will be the ones with the best software for entertainment, safety, and reliability.

- 05/28/2021 – EV bubble in China: China Evergrande New Energy Vehicle Group Ltd., or Evergrande Auto

What a crock! Embattled Chinese Property Tycoon Turns to Electric Cars. Cue $87 Billion Valuation. Excerpt:

Guests at a private August dinner hosted by billionaire entrepreneur Jack Ma were intrigued by a fellow diner who introduced himself as a humble car salesman.

It was Xu Jiayin, better known as the chairman of China Evergrande Group, the country’s biggest real-estate developer and one of China’s most indebted companies. At the time of the dinner Evergrande was just weeks away from a potentially devastating showdown with its creditors.

If he was feeling desperate, Mr. Xu didn’t show it, according to one of the people present at the meal at one of Mr. Ma’s houses in Hangzhou, where Mr. Ma’s Alibaba Group Holding Ltd. is based. He was pitching his most audacious venture to date: a new electric-vehicle company that aims, according to its own public statements, to surpass Tesla Inc. and others in becoming the world’s “largest and most powerful” EV maker by 2025.

The Chinese government’s drive to make the country a world leader in electric vehicles has spawned dozens of startups jockeying for position in its small but fast-growing market. Mr. Xu’s unlikely fusion of car-making and property development, which he’s building from scratch, is the wildest of them all.

Evergrande’s Hong Kong-listed EV unit, China Evergrande New Energy Vehicle Group Ltd., or Evergrande Auto, saw its market capitalization soar last month to roughly $87 billion, more than most global auto makers, including Ford Motor Co. and General Motors Co., and four times the value of its own parent company—all without having sold a single vehicle.

Other electric-car makers burn billions of dollars developing one production model. Evergrande says it is developing 14 at once. It is also building multiple factories even though the company has no industrial or technical background.

Evergrande’s debut at the Auto Shanghai expo in April raised more questions than it answered about the company’s progress. Its huge stand was roughly as large as the nearby BMW AG booth. It showcased nine of Evergrande’s first production EVs, all eye-catching cars designed by internationally renowned figures including Anders Warming, formerly of BMW and Mini. The cars were mock-ups with foggy plastic windows, not working vehicles.

- 05/28/2021 – F150 Lighting is an impressive EV truck. original F150 is the best selling vehicle in US for the past 40 years!

Ford F150 Lightning Impressions: Better Than I Thought!

- 05/21/2021 – the car is evolving into essentially a smartphone on wheels

Apple and the End of the Car as We Know It – WSJ

As cars become computers with wheels, Apple is joining other tech companies in eyeing the $5 trillion auto market

Driverless Hype Collides With Merciless Reality – WSJ

Artificial UnIntelligence | Kevin Grems | TEDxOkoboji – Bing video

- algorithm is just computer programming, not magic. And human programmers are biased

- computer might never solve the real world problem which computing can be exponential and the answer can be philosophical (e.g. decide which people can be crashed if the car has to crash on one person). Human do not have the absolute answer yet. How do you expect computer to have

- self-driving real world problem might never get resolved even media says otherwise

- human is prone to make error in programming, a little error inside can easily crash the program

- our collective enthusiasm for applying computer technology to every aspect of life has resulted in a tremendous amount of poorly designed systems. We are so eager to do everything digitally—hiring, driving, paying bills, even choosing romantic partners—that we have stopped demanding that our technology actually work.

- it’s just not true that social problems would inevitably retreat before a digitally enabled Utopia.

- 04/30/2021 – the biggest hurdle of EVs is lack if charge station and charge too slow in public charging

- Roughly 20% of electric vehicle owners in California replaced their cars with gas ones, a new study shows.

- The main reason drivers made the switch was the inconvenience of charging.

- The findings suggest new challenges facing the growth of the nascent electric vehicle market.

Standard home outlets generally put out about 120 volts of power at what electric vehicle aficionados call “Level 1” charging, while the high-powered specialty connections offer 240 volts of power and are known as “Level 2.” By comparison, Tesla’s “Superchargers,” which can fully charge its cars in a little over an hour, offer 480 volts of direct current.

Of those who switched, over 70% lacked access to Level 2 charging at home, and slightly fewer than that lacked Level 2 connections at their workplace.

“If you don’t have a Level 2, it’s almost impossible,” said Tynan, who has tested a wide range of makes and models of PEVs over the years for his research.

Even with the faster charging, a Chevy Volt he tested still needed nearly six hours to top its range back up to 300 miles from nearly empty — something that takes him just minutes at the pump with his family SUV.

Public charging stations may look like the electric version of the gas station, but nearly two-thirds of PEV drivers in the survey said they didn’t use them. Exactly why they didn’t use the public stalls was not specified.

EVs have come a long way in recent years in terms of range, safety, comfort, and tech features, but Hardman and Tal note that very little has changed in terms of how they are recharged.

- 03/28/2021 – I’m super bullish on electric vehicles (“EVs”) and autonomous vehicles (“AVs”), for reasons I lay out in this video. This future is coming sooner than almost anyone expects… and is already minting many new millionaires in the process. According to Bank of America (BAC), TaaS could attract $2.5 trillion in investments over the next decade. Ford, GM, and Volkswagen Shares Are Hot. Thank EV Mania. Electric-Vehicle Fever Spreads to Europe. However, the major EV companies, as a group, can’t possibly grow into their enormous combined valuation, so investors will need to be smart and selective: Rob Arnott Warns of ‘Big Market Delusion’ in Electric Vehicles

In it, I share our biggest idea here at Empire Financial Research: The rapid development of EVs and AVs will lead to an entirely new industry called “TaaS” – “Transportation as a Service.”

I think TaaS will transform life as we know it – from the way we eat to the way we shop, work, and travel. This future is coming sooner than almost anyone expects… and is already minting many new millionaires in the process. According to Bank of America (BAC), TaaS could attract $2.5 trillion in investments over the next decade.

- 03/22/2021 – consumers are unsure about the availability of public charging stations, dealers are skeptical about the consumers’ willingness to purchase, so they have bit of ‘boy who cried wolf’ syndrome. In addition, dealers will lose big profit from mechanical services with EVs

Dealer electric-vehicle inventory will remain light because he is uncertain about longer-term demand. “It’s still very early days,” Mr. Sowers said.

- 03/22/2021 – EV is more environmental friendly in the long run. But need more energy and has more CO2 emission when building EVs.

Are Electric Cars Really Better for the Environment? (wsj.com)

Building both a Tesla Model 3 and a Toyota RAV4 generates several tons of greenhouse gas emissions to smelt the aluminum, manufacture the components and assemble the vehicle. But building a Tesla actually generates more emissions because of the metals needed for its lithium-ion battery. Before it rolls off the assembly line, the Tesla has generated 65% more emissions than the RAV4.

building an EV has more CO2 emissions than building a ICE car, however, the longer timethe car is used, the less emission in EV. Overall, the lifetime emissions of the RAV4 are 77% more than the Model 3. So it is significant.

if states push aggressive mandates similar to California, which said last fall that it wanted all new cars sold in the state to be EVs by 2035. Emissions would drop to 35.4 gigatons—below the two-degree threshold. Electricity use would grow astronomically, as would demand for minerals, but gasoline would shrink to 8% of 2020 levels.

- 03/14/2021 – the new tax bill could include technology-neutral incentives rather than wind- and solar-specific credits, and would aim to move beyond the current cycle of short-term incentive extensions to a more permanent approach – good to have technology-neutral incentives?

Senate Democrats plan to reintroduce energy tax reform bill, focus on long-term incentives

- Senate Democrats are retooling energy tax reform legislation that was first proposed two years ago but which failed to advance in a Republican-led Congress.

- The Clean Energy for America Act could include technology-neutral incentives rather than wind- and solar-specific credits, and would aim to move beyond the current cycle of short-term incentive extensions to a more permanent approach, according to Bobby Andres, senior policy adviser to Democrats on the U.S. Senate Finance Committee.

- “We’re actively working on updating that bill for reintroduction and very much view it as a cornerstone of the efforts on energy tax this Congress,” Andres said Wednesday at the virtual American Council on Renewable Energy (ACORE) Policy Forum.

- 03/14/2021 – DOJ plans to invest billions of dollars over the next few years in the technologies that are going to make the EV future a reality

DOE will spend billions on electric vehicle R&D in jobs fight with China, Granholm says

- President Joe Biden’s administration is aggressively pursuing transportation electrification not just because of its potential to curb greenhouse gas emissions and address climate change, but also to prevent China from cornering a bourgeoning $23 trillion market in carbon-reducing technologies, Secretary of Energy Jennifer Granholm said Tuesday.

- The U.S. Department of Energy plans to “double down” on research and development through its loan programs office, in order to make electric vehicles (EVs) easier to produce and deploy, Granholm said at a virtual event hosted by Securing America’s Future Energy (SAFE).

- “DOE is going to invest billions of dollars over the next few years in the technologies that are going to make the EV future a reality,” Granholm said. “To reduce costs, and reliance on China.”

SAFE has estimated China controls nearly 70% of global EV battery manufacturing capacity, and North America has less than 10%. The group advocates for emissions-free transportation policies, and has published research showing the United States could create 647,000 jobs within the next five years by aggressively growing the EV market and securing the electric transportation supply chain.

According to SAFE, 142 lithium-ion battery megafactories were under construction worldwide as of 2020; 107 were located in China — with just nine in the United States.

“This could be a big problem. Because the auto and truck manufacturing sectors in the United States have been the key to our industrial base,” SAFE CEO Robbie Diamond said during the webinar.

- 03/12/2021 – great documentary on EV history

It ran on electricity, produced no emissions, and was among the fastest, most efficient production cars ever built. So why did General Motors crush its fleet of EV1 electric vehicles in the Arizona desert? Launched by GM in 1996 in response to California’s pollution crisis and resulting Zero Emission Vehicle mandate, the EV1 electric vehicle was a revolutionary modern car, requiring no gas, no oil changes and no muffler. But the fanfare surrounding the EV1’s launch disappeared and the cars followed. Was it lack of consumer demand, as carmakers claimed, or were other forces at work? Those questions and more are answered in this compelling documentary that shines a light into the dark corners of the U.S. economy and government. 2006 EV Confidential LLC.

- the US consumers who, apart from a few zealous fans, was either unaware or uninterest. most of them only care whether the car drives well or not, affordable or not, they do not care much about environmental effects.

- the batteries, with their very limited range and lack of recharging infrastructure. In addition, automotive and oil industries bought innovative battery companies and buried them.- conspiracy story

- the oil companies, whose very business was threatened and who tried to obstruct the building of public battery-charging stations. OPEC flooded the market with lots of oil to suppress oil price and make EV relatively costly

- the car companies who did not want to disturb their existing business models. e.g. internal combustion engine business is very profitable, even though it is very dirty compared with those of EV services. e.g. GM killed EV1

- the us government, with the powerful influence of the oil and automotive industries at work inside Bush admin

- CARB (California Air Resources Board)- the chairman of CARB gave car industry lots of time to present, while little time for environmentalists. In addition, this chairman if the head of hydrogen fuel cell association who promotes hydrogen fuel cell which is a very costly and far far futurist technology

- hydrogen fuel cell – Bush admin promotes hydrogen fuel cell, rather than EV, as a bait and switch to kill EV and hydrogen fuel cars

- 02/14/2021 – $TSLA below $100/share by later this year will not crash the system. There is no reflexivity in such a fall. But it would trigger the end of an era for a certain type of investing. – Michael Burry

If Tesla Bubble Bursts, Catastrophe Won’t Follow

Not all bubbles are equal. Britain’s bicycle-stock bubble of the 1890s holds lessons for today’s electric-vehicle mania.

None of this is an issue for the obvious bubbles under way in the fashionable stocks of the moment. Tesla TSLA 0.55% is valued so highly it is now the U.S.’s fifth-biggest company by market capitalization. Even if the electric-car maker vanished tomorrow, it would have an insignificant effect on the economy, as Tesla’s operations are tiny. It is mostly equity-financed, so its failure wouldn’t start a domino line of bank failures. And while shareholders would be hurt, there’s no reason to think that would lead to a collapse in spending across the country.

- 02/14/2021 – Electric cars might once again be mainstream, but it’s been a long road to get here.

Before Tesla: Why everyone wanted an electric car in 1905

What’s old is new again

An electric car buzzes along the road of a downtown street, with pedestrians and fellow drivers alike stopping to stare at the wealthy owners inside. The car costs roughly 7 times more than a normal Ford, and its reputation and design has helped to fuel long wait lists and pent-up demand.

The scene could be straight out of Silicon Valley in 2013, but it’s not. For a brief period in the early 20th century in the United States, the electric car was high society’s hottest commodity, sought after by socialites and businessmen alike.

By 1900, electric cars were so popular that New York City had a fleet of electric taxis, and electric cars accounted for a third of all vehicles on the road.

- 01/15/2021 – The critical breakthrough or innovation that you need is the solid-state separator that prevents lithium-metal dendrites from forming. QS has a raft of well-funded competitors racing to produce a commercially viable solid-state battery

The Leaders in the Race to Build a Better EV Battery

Investors are swarming around one of the few publicly traded competitors working on a new technology that promises faster charges and a longer lifespan

The two biggest drawbacks of electric cars—limited range and slow charging—will likely persist until battery makers can solve the dendrite problem.

In the human body, dendrites are extensions of nerves that transmit signals among cells. In lithium-ion batteries, they are tiny, needlelike deposits of lithium resembling microscopic tree branches. They can grow within the batteries, leading to short circuits or even fires.

Batteries that are in use in cars today require a slower charge, in part because of the risk of dendrite formation. A too-fast charge can cause dendrites to build up. Because QuantumScape’s batteries appear to have solved the dendrite problem, they can be charged faster.

“The critical breakthrough or innovation that you need is the solid-state separator that prevents lithium-metal dendrites from forming,” Mr. Singh said in an interview. He said test data on QuantumScape’s batteries show no dendrites have formed.

Another risk: A raft of well-funded competitors racing to produce a commercially viable solid-state battery.

French company Bolloré SA BOL -0.73% uses a polymer electrolyte in its commercially-available solid-state batteries, which are now being produced for some large buses made by Daimler AG DMLRY -3.41% and others. Those batteries require being kept at brutally hot temperatures of 50 to 80 degrees Celsius, or 122 to 175 degrees Fahrenheit, limiting their utility for personal vehicles. Bolloré’s researchers are working on lowering that threshold and hope to have batteries for autos by 2026, said Fabricio Protti, the company’s deputy chief executive.

- 01/06/2021 –

Warren Buffett-backed Chinese electric car company outsells its start-up rivals

- Automaker BYD, backed by billionaire Warren Buffett, said its new electric luxury sedan “Han” has seen sales increase every month to surpass 10,000 units in November.

- At these levels, the “Han” model alone is selling just as well, or better, than vehicles from China’s electric car start-ups Nio, Li Auto and Xpeng.

- BYD’s overall sales of battery-powered electric passenger cars fell 11% in 2020.

- 01/06/2021 – NIO’s battery swap technology platform is very competitive than TSLA’s supercharge, great idea too! NIO also standardize battery for all its vehicles, great idea. NIO also allow customers to buy vehicle without buying battery. In addition, Chinese government is using subsidiary to promote NIO’s technology. Tesla has to cut sale price significantly in order to get Chinese government’s subsidiary.

Tesla vs. NIO: Battle for the World’s Largest EV Market

Gone are the long waits at charging stations: Chinese electric-vehicle startup NIO is pioneering battery-swap systems, challenging Tesla and other rival car makers.

- 12/27/2020 – good ideas on “Apple car investment”

Apple Car developments could kickstart big auto-tech partnerships in 2021

- What will Apple’s (NASDAQ:AAPL) car development program look like if the company moves forward with a dramatic move into the automobile industry?

- “Initially, the most likely rollout would involve several hundred Apple Cars driving in US cities for a year or two before becoming more widely available. Apple could either sell cars directly to consumers or offer a subscription-like transportation service similar to Zoox or Tesla robotaxi. It’s highly unlikely Apple will build cars, and more likely they outsource manufacturing to an OEM partner,” predict Loup Ventures’ Gene Munster and team.

- As for manufacturing partners, Wedbush Securities pointed to Tesla (NASDAQ:TSLA), Volkswagen (OTCPK:VWAGY), Nio (NYSE:NIO) and XPeng (NYSE:XPEV) as potential strategic partners for Apple. If it looks to find an OEM partner, Apple could be competing with Baidu (NASDAQ:BIDU), Zoox (NASDAQ:AMZN) and Waymo (NASDAQ:GOOG) on the expectation that those companies and others will be hunting around for expanded auto partnerships.

- A major investing theme in 2021 may be how tech-auto partnerships shake out for commercial and retail vehicles, and the implications for upstarts like Fisker (NYSE:FSR), Lordstown Motors (NASDAQ:RIDE), GreenPower Motors (NASDAQ:GP), Ayro (NASDAQ:AYRO), Workhorse Group (NASDAQ:WKHS) and others.

- With Apple several years away from having a car on the roads, Seeking Alpha author D.M. Martins Research warns to be careful with irrational exuberance on the Apple Car, grounding its bullish Apple thesis instead on the 5G cycle and AAPL’s expanded services portfolio. For investors, the most juicy Apple Car trades so far have been in Lidar names.

- 12/17/2020 – finish read this tomorrow

Tesla’s 1,000% Stock Price Explosion Isn’t About Electric Cars

The list of things that are gearing up because of the EV boom is a long and lucrative one. It’s not just about EVs anymore. EVs are simply one delivery mechanism in a massive worldwide energy transition.

Sure, September saw record EV sales up 91% year-on-year, with UBS forecasting that EV market share will reach 40% by 2030, and Tesla planning to rapidly accelerate production with 3 new factories in 3 countries and 20 million EVs coming off the line by 2030, for a 40x increase over this year.

But there are major money-making opportunities in the tie-ins to this sector.

The list of things that are gearing up because of the EV boom is a long and lucrative one. It’s not just about EVs anymore. EVs are simply one delivery mechanism in a massive worldwide energy transition.

Sure, September saw record EV sales up 91% year-on-year, with UBS forecasting that EV market share will reach 40% by 2030, and Tesla planning to rapidly accelerate production with 3 new factories in 3 countries and 20 million EVs coming off the line by 2030, for a 40x increase over this year.

But there are major money-making opportunities in the tie-ins to this sector.

It’s about charging stations … and powerhouse speculative plays like Blink Charging.

It’s even about hydrogen fuel cells … and stocks like Plug Power and Fuel Cell.

It’s about the energy transition and high-tech software fueling this boom.

Chipmakers like Nvidia are setting the foundation of the future…

While innovative tech platforms like Facedrive (TSXV:FD,OTC:FDVRF), with its Electric Car ‘on demand’ service and exploding food delivery business are bringing that future to life.

And the timing has never been more perfect…

Tesla has paved the way…but investors are only beginning to see the bigger picture.

And the opportunity to cash in on the “electrification of all things” is practically limitless.

Especially for an ambitious young company like Facedrive which is rethinking entire industries, from ridesharing and food delivery to the very concept of car ownership as we know it.

Because the industry is still in its infancy, there are countless ways to profit…from battery metals to full-scale tech platforms, early investors will be the biggest winners.

Lithium: The One Thing Standing Between Tesla and Global EV Domination

For pure-play lithium producers who have been waiting a while to reap the rewards from the EV boom … that time has arrived.

That supply crunch we’ve all been anticipating for years is now upon us.

On September 22nd, on Tesla’s (NASDAQ:TSLA) battery day, Elon Musk–who also just leapfrogged past Bill Gates in his massive, fast-track accumulation of wealth–revealed his plans to build enough battery capacity to make 30 million EVs by the end of this decade. That’s from 500,000 to 30 million …. That’s a lot of lithium.

It’s been a long, painful road. But the bottom of lithium prices appears to have been reached, and the timing to get in on pure plays seems ideal, with analysts forecasting an increase in lithium demand this decade of over 6x.

That’s coupled with a reduction in supply for various reasons, from bankruptcies that have taken some players out of the game to scale backs and delays in expansion plans when everyone jumped the gun on this earlier.

Hotter-Than-Hot: EV Charging and Hydrogen

These are speculative story stocks, but this is definitely storytime.

Remember the Tesla story? Anyone who opened that book early on is probably a millionaire now–at worst.

Every single tie-in to the EV industry is a speculative stock, but speculative in this case means smart.

Blink (NASDAQ:BLNK) is building an EV charging network that may be small right now, but it’s got explosive growth potential that is as big as the EV market itself.

This stock is on a major tear and all that cash flowing into it right now gives Blink the superpower to acquire and expand.

A wave of new deals, including a collaboration with EnerSys and another with Envoy Technologies to deploy electric vehicles and charging stations adds further support to the bullish case for Blink.

Michael D. Farkas, Founder, CEO and Executive Chairman of Blink noted, “This is an exciting collaboration with EnerSys because it combines the industry-leading technologies of our two companies to provide user-friendly, high powered, next-generation charging alternatives. We are continuously innovating our product offerings to provide more efficient and convenient charging options to the growing community of EV drivers.”

And then there’s hydrogen, and other speculative arena bursting at the seams.

Investors are piling in, and governments, too. (So is big oil).

And last week, “green” hydrogen development got a further nudge towards commercialization when a pilot project for heating homes was approved.

Billionaires couldn’t keep their hands off of Plug Power (NASDAQ:PLUG) this year, with giant BlackRock’s Larry Fink piling in heavily, among other heavy hitters. Why? Partly because Plug Power is already providing its hydrogen-powered tech solutions to big-name retailers, but overall, because the green revolution is clearly happening and unfolding as we speak. It helps that Plug’s full-year guidance implies year-on-year sales growth of around 35%, even if profit won’t come for a while.

Morgan Stanley’s Stephen Byrd believes green hydrogen will become economically viable quicker than investors appreciate saying Plug Power’s deal with Apex Clean Energy to develop a green hydrogen network using wind power offers a chance to tap into “very low cost” renewable power and helps accelerate the shift to clean energy. Plug has a goal for over 50% of its hydrogen supplies to be generated from renewable resources by 2024.

The company has also just announced a partnership with Universal Hydrogen to build a commercially-viable hydrogen fuel cell-based propulsion system designed to power commercial regional aircraft. The initiative will help bring Plug’s proven hydrogen ProGen fuel cell technology to new markets.

FuelCell Energy (NASDAQ:FCEL) is another alternative fuel stock that has turned heads on Wall Street. Up over 219% year to date, FuelCell has been one of the biggest winners over the election season, with President-elect Joe Biden campaigning for a carbon-free America. In fact, analysts even estimate the U.S. could spend as much as $1.7 trillion on clean energy initiatives over the next 10 years. And that’s great news for companies like Blink, Plug and FuelCell.

Though many expect FuelCell to return to earth in the short-term, its long-term trajectory is solid. It has spent years building a patent moat and developing solutions that will tie into the energy transition perfectly.

FuelCell may be expected to see a hit due to its looming Q4 earnings report, which is expected to go poorly, but the company has managed to take advantage in its earlier rally, raising net proceeds of over $150 million in a public offering of 25 million shares.

If you want to make money, you first bet on growth, not profit.

Software and Services: The Real EV Cash Cow

When Morgan Stanley recently raised its rating on Tesla (for the first time in 3 years)–to $540–it only took two weeks to blow the roof off of that. Tesla is now trading at over $643, just when you thought it had no further space to soar.

Why?

Because this isn’t just about EVs anymore. We’ve gone way beyond that.

As Morgan Stanley put it when it raised Tesla’s rating: “Tesla is on the verge of a profound model shift from selling cars to generating high margin, recurring software, and services revenue … To only value Tesla on car sales alone ignores the multiple businesses embedded within the company.”

And on the services and software scene — the latest investor buzzword is “tech ecosystem”. That’s the buzzword that brings in all the money now because of the potential for unlimited revenue-generating verticals.

With that in mind, another one to look at is Canadian Facedrive (TSXV:FD,OTC:FDVRF), which has by now made major inroads into the U.S.

It’s already got tie-ins to household names like utility giant Exelon, and more … aiming at a series of multi-billion-dollar industries.

It’s competitor Doordash may have soared to a valuation of $50 billion lately, but Facedrive’s 25% growth in a single month is also very impressive and helps show the growth opportunity the food delivery sector offers investors.

Just like Apple (NASDAQ:APPL) isn’t just about the iPhone anymore, and its big revenue will come from services, the EV industry isn’t just about cars, either–it’s about platforms.

Facedrive’s flagship EV-focused ride-hailing platform was only the pioneering beginning of the carbon-offset ride. Next game food delivery, pharma deliveries, and even COVID and social distancing tie-ins, with TraceScan contact-tracing and eSports revenue.

The biggest coup, though–and the one that got Facedrive solidly in the U.S. market–was its September acquisition of Steer–the platform of platforms in the EV revolution. Steer plans to challenge the entire private car industry by changing the way an entire continent views car ownership.

And by offering customers an entire virtual garage of EVs … from the Tesla line-up to the Audi e-Tron and everything on your EV luxury list, as well as more mainstream offerings.

Chinese Automakers Should Not Be Ignored

Though Tesla has taken the title of de facto king of electric vehicles, Chinese automakers are picking up the pace, as well. And while Nio Inc. (NYSE:NIO) has taken much of this spotlight due to its breakout this year, a newcomer on the scene is beginning to make big moves, as well.

Li Auto (NASDAQ:LI) was founded in 2015 by its namesake, Chairman and CEO Li Xiang. And while it may not be a veteran in the market like Tesla or even NIO, it’s quickly making waves on Wall Street.

Backed by Chinese giants Meituan and Bytedance, Li has taken a different approach to the electric vehicle market. Instead of opting for pure-electric cars, it is giving consumers a choice with its stylish crossover hybrid SUV. This popular vehicle can be powered with gasoline or electricity, taking the edge off drivers who may not have a charging station or a gas station nearby.

Though Li just hit the NASDAQ in July, the company has already seen its stock price more than double. Especially in the past month during the massive EV runup that netted investors triple digit returns.

It’s already worth more than $30 billion but it’s just getting started. And as the EV boom accelerates into high-gear, the sky is the limit for Li and its competitors.

Canada Is Also Jumping On Board

NFI Group (TSX:NFI) is one of Canada’s leaders in the electric vehicle space. It produces transit busses and motorcycles. NFI had a difficult start to the year, but it since cut its debt and begun to address its cash flow struggles in a meaningful way. Though it remains down from January highs, NFI still offers investors a promising opportunity to capitalize on the electric vehicle boom.

Recently, NFI has seen an uptick in insider stock purchases which is often a sign that the board and management strongly believe in the future of the company. In addition to its increasingly positive financial reports, it is also one of the few in the business that actually pay dividends out to its investors.

Not to be outdone, GreenPower Motor (TSX.V:GPV) a thriving electric bus manufacturer based out of Vancouver, is making mvoes on the market, as well. Although for the moment, its focus is primarily on the North American market, but its ambitions are much larger. Founded over a decade ago, GreenPower has been on the frontlines of the electric transportation movement, with a focus on building affordable battery-electric busses and trucks.

Year-to-date, GreenPower has seen its share price soar from $2.03 to $36.88. That means investors have seen 1700% gains this year alone. And with this red-hot sector only going up, GreenPower will likely continue to impress.

Boralex Inc. (TSX:BLX) is an upcoming renewable firm based in Kingsey Falls, Canada. The company’s primary energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people globally. Not only has it has had a great influence in the adoption of renewable electricity domestically, it’s even branching out into the United States, France and the United Kingdom. In fact, just recently, Boralex took control of a massive 209MW solar farm in California.