Find good ways to have tax benefit

- 12/21/2021 – conversion of IRA to Roth IRA

The backdoor Roth IRA may be on the chopping block. Here’s what you can do now

If the Build Back Better bill, passed by the House in November and now under consideration by the Senate, becomes law, it could limit high-income savers’ options to convert their savings into Roth IRAs and Roth 401(k)s, which offer tax-free withdrawals in retirement.

The most immediate restriction, unless lawmakers amend the date, would start in 2022, when you would no longer be allowed to convert after-tax contributions — say from a non-deductible IRA — into a Roth.

To determine how much tax you’ll owe on your after-tax contributions, the IRS uses a pro-rata rule, which calculates what you’re converting as a percentage of all your IRA balances.

What the Pro-Rata Rule Means for Your Backdoor Roth IRA

What is the Backdoor Roth IRA Pro Rata Rule?

When the IRS determines your backdoor Roth IRA conversion taxes, they will regard all of your current IRA accounts as one entity. This is known as the aggregation rule – no IRA stands alone; instead IRAs are regarded in the aggregate.

The pro rata rule states that taxation of IRA accounts when converted partially or fully to Roth accounts will be calculated proportionally to the fraction of after-tax vs. before-tax contributions. The percentage of funds that are yet to be taxed will be taxed at the pro rata rate, regardless of whether you are transferring all or one of your accounts at once.

Suppose that, when combined, 80 percent of the funds across three of your IRAs are pre-taxed while 20 percent have already been taxed. Let’s suppose you are converting 20 percent of your funds into a Roth IRA. You might be tempted to claim that what you are transferring is the 20 percent that’s already been taxed and therefore you do not owe any new taxes. Unfortunately, this is not the case—due to the pro rate rule, 80 percent of all conversions will be subject to new taxes, regardless of which account the money comes from.

If most (or all) of your contributions have already been taxed, the pro rata rule won’t be as big of a deal. But if you have not paid many (or any) taxes on your total savings, which is often the case, you should expect a higher tax bill.

Backdoor Roth IRA: What It Is and How to Set One Up

A backdoor Roth IRA lets you convert a traditional IRA to a Roth, even if your income is too high for a Roth IRA.

Roth IRA Vs. Traditional IRA: What’s the Difference?

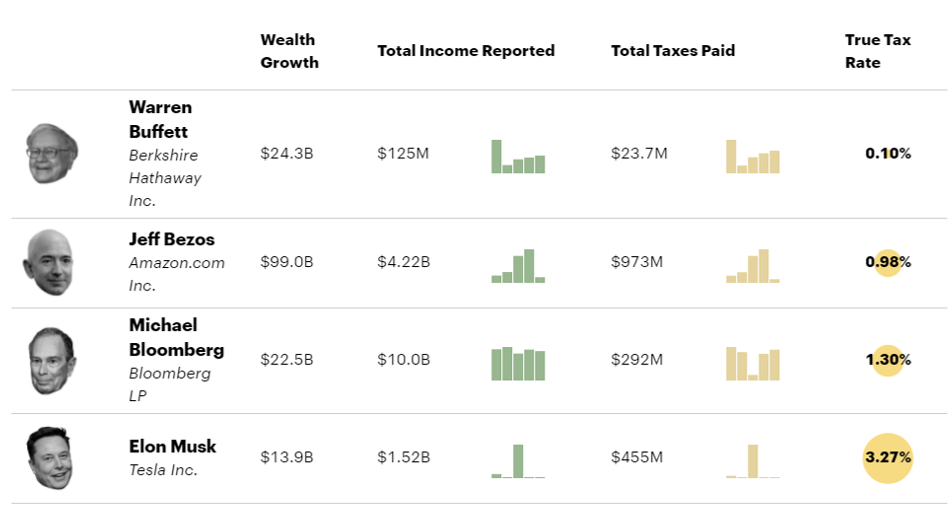

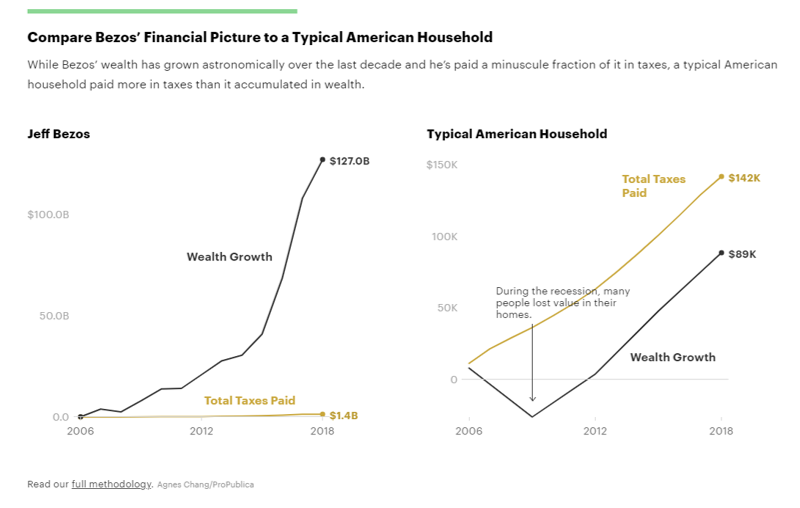

- 06/24/2021 – to figure out how do the super rich pay so low tax rate?

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

How the Wealthiest Avoid Income Tax — ProPublica

The tax data was provided to ProPublica after we published a series of articles scrutinizing the IRS. The articles exposed how years of budget cuts have hobbled the agency’s ability to enforce the law and how the largest corporations and the rich have benefited from the IRS’ weakness. They also showed how people in poor regions are now more likely to be audited than those in affluent areas.

ProPublica is not disclosing how it obtained the data, which was given to us in raw form, with no conditions or conclusions. ProPublica reporters spent months processing and analyzing the material to transform it into a usable database.

We then verified the information by comparing elements of it with dozens of already public tax details (in court documents, politicians’ financial disclosures and news stories) as well as by vetting it with individuals whose tax information is contained in the trove. Every person whose tax information is described in this story was asked to comment. Those who responded, including Buffett, Bloomberg and Icahn, all said they had paid the taxes they owed.