Bank of America includes three major business divisions: Consumers, Corporate and Investment Management. The first division, Global Consumer and Small Business Banking (GC&SBB) is the largest one in the company, and deals primarily with consumer banking and credit card issuance. The second division operates under the Merrill Lynch subsidiary and provided mergers and acquisitions advisory, underwriting, capital markets, as well as sales & trading in fixed income and equities markets. It also has one of the largest research teams on Wall Street. The third division, Global Wealth and Investment Management manages assets of institutions and individuals. It is among the 10 largest U.S. wealth managers. These three divisions are the core businesses of BAC.

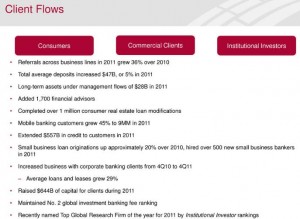

In year 2011, the client flow – the source of business – experienced strong growth,

Here is the negative side of the story,

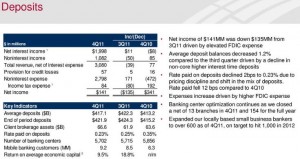

• Deposits were down in Q4 2011

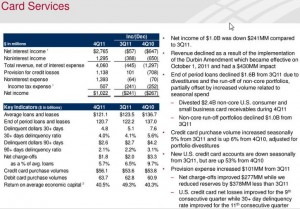

• Card services were down in Q4 2011

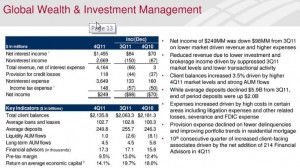

• Wealth and Investment management was done in Q4 2011

• Global banks and markets were down in Q4 2011

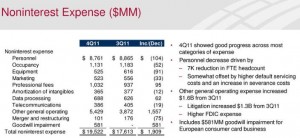

• Noninterest expense increases mainly due to litigation cost, higher FDIC expense and large sum of goodwill impairment in Europe

Here is the so-so side of the story,

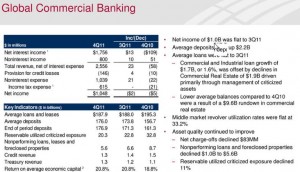

• Net income of global commercial banking was flat in Q4 2011

• 4Q2011 revenue and net income reduced compared with 3Q2011, however, it increased compared with 4Q2010

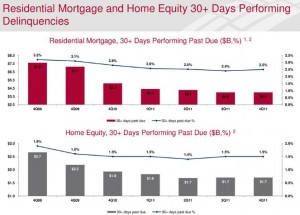

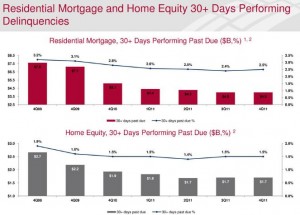

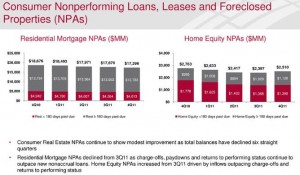

• Residential mortgage and home loan delinquencies were flat – seems to bottom out

So what about the positive side of the story?

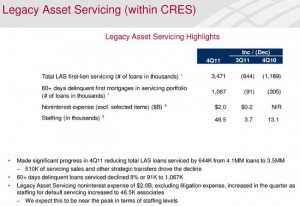

• Significant progress in reducing total LAS loans in Q4 2011 – there are tons of stories on Countrywide and BAC, so LAS is the short term key issue for BAC and it seems

like BAC is tackling it OK.

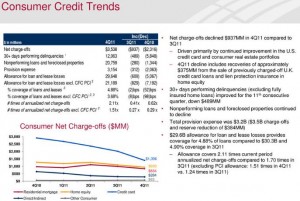

• Consumer credit charge-off reduced significantly – good sign to get the profit back down the road.

• Consumer NPAs improved modestly

• Tier 1 common equity ratio improved from 8.60% to 9.86 in 2011. This ratio is very

impressive. According to BasalIII requirement, that is the ratio required ratio in 2017 and 2018. This simply means that BAC has met the requirement 5 years ahead of schedule!!

Let us look at the overall picture,

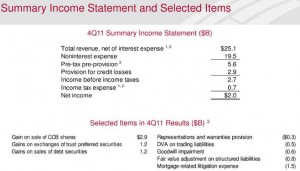

If we assume BAC is in “normal business scenario”, we should take out the significant mortgage-related costs, and the one time sales gains: $5.6B+2.9B+2.9B-1.2B-1.2B = 3.2B (to be conservative, I do not include the litigation fees in noninterest expense item). So the net income can be easily more than doubled! – remember that we are long term investor, in the long run, if BAC gets rid of the nightmare of mortgage issue, we can be confident that the net income of BAC will increase significantly.

If we assume BAC is in “normal business scenario”, we should take out the significant mortgage-related costs, and the one time sales gains: $5.6B+2.9B+2.9B-1.2B-1.2B = 3.2B (to be conservative, I do not include the litigation fees in noninterest expense item). So the net income can be easily more than doubled! – remember that we are long term investor, in the long run, if BAC gets rid of the nightmare of mortgage issue, we can be confident that the net income of BAC will increase significantly.

In sum, BAC’s fourth-quarter earnings in all three business divisions are either down than Q3 or flat. The significant mortgage related cost dragged down it profit, on the other hand, the sale of non-core assets and accounting gains made it possible for the company to remain profitable during the quarter. Excluding nonrecurring items, the company would have incurred a loss. However, excluding the provision and litigation loss, the company would have profit significantly. Higher non-interest expense was the primary headwind

in the quarterly numbers.

The company is moving in the right direction: Capital and liquidity are very strong; credit charge-offs, LAS, NPAs reduced consistently. It seems like in 2011 BAC were focusing on tackling the capital and mortgage problems, so will it tackle the earnings in 2012?

Moynihan said the top priority in 2012 for BAC is earnings,