This Tiny Hedge Fund Just Made 8,600% On a Vix Bet – from Bloomberg news

I know SVXY, but I forgot about VIX when market kept going up for over a year. What kind of research has they done to find this big bet?! Amazing! I should not leave my eyes outside of the the ball.

Here is the company’s website: https://www.ibexinvestors.com/#welcome1

Justin Borus is another brilliant Israeli investor!

On Jan. 2, the managers put down $200,000 on what looked like a lottery ticket, with each SVXY put costing 34 cents. On Feb. 6, they sold the 6,300 contracts at about $28 each, leaving them with $17.5 million.

Denver traders pocketed $17.5 million on $200,000 VIX wager

People laughed when the firm bought disaster protection in XIV

Nobel Laureate Engle Says Volatility Is Result of Economic Fundamentals

What’d You Miss? Full Show, 2/8/2018

Winklevoss Brothers Aren’t Worried About Bitcoin’s Plunge

Machine Trading Is Driving Market Moves, Says Swanson

Not everyone got crushed when the market collapsed.

For traders at a little-known Denver hedge fund who saw it coming, it was the score of a lifetime — a $17.5 million payday on a $200,000 bet.

Justin Borus

Source: Ibex Investors

“People were laughing at us, saying this could never happen, this should never happen,” Justin Borus, the 41-year-old founder and manager at Denver-based Ibex Investors, said in an interview. “We saw people pricing this as a 1-in-5,000 event, but it was more like a one-in-five-year event.”

Borus’s team bet that an exchange-traded fund linked to a calm stock market would go to zero in the event of suddenly volatile trading. The ETF almost did — it lost 96 percent of its value.

Borus said they always believed in the wager, even when just about no one else did. But the jackpot still caught them by surprise. Two of the group — Ari Rubin and Cooper Stainbrook — were taking a long walk around the Colorado capital when the market started to go haywire on Feb. 5.

As they walked, the two of them — Ibex’s director and chief data scientist — were on the phone with a client and in passing mentioned rare, so-called black-swan events. The client told them to check out the VIX Index. One was happening as they spoke.

Extreme Velocity

“We came back to our screen and we’re watching the VIX and it’s moving with extreme velocity,” said Rubin, a former Israeli Defense Force soldier and ski bum turned money manager. “We’re laughing at every tick up until we realized what was going on. Cooper just looks at me and goes, ‘Oh man. The Vol-pocolypse just happened.’”

What was happening was the biggest plunge for U.S. equities in more than six years. Concern inflation was seeping into the economy triggered a decline in the Dow Jones Industrial Average that reached 6.3 percent at its lowest level. The benchmark index for equity volatility rose to more than twice its level the day before, crushing bettors who’d gotten used to years of very low volatility.

For about a year, Ibex had been buying options on the ProShares Short VIX Short-Term Futures ETF, ticker SVXY. The executives wouldn’t comment publicly on the exact mechanics of the trade or its profit, but they were detailed in a research note published by an adviser to the firm, Pravit Chintawongvanich of Macro Risk Advisors. Owning the contracts fit into the 15-year-old fund’s niche-product strategies. As of January, the 20-person firm managed about $350 million.

Volatility Spasm

Ibex’s plan was to profit when five years of a record-calm stock market burst into a spasm of volatility. Exchange-traded volatility notes that rose when volatility fell looked like a particularly ripe target, given the potential for a feedback loop that might send the Cboe Volatility Index surging in the event of market stress.

Other investors may have been lulled by the years of relative serenity in the stock markets. The average volatility rate for 2017 was lower than every single trading day from Dec. 22, 1995, to June 20, 2005. The VIX finished below a level of 10 — super quiet! — on only nine days before May 2017 and 68 days since.

That’s why so few have dared bet against short-vol, which had been minting money with breathtaking consistency. Even retail traders bought inverse VIX ETPs, hoping to make a quick and easy buck. That’s what intrigued Ibex.

Laughed in Their Faces

They went shopping for the right derivatives to place their bet. Brokers responded with ridicule — options speculating the inverse VIX would go to zero would never pay off.

“Cooper and I go to New York a lot,” Rubin said. “In one instance, someone actually laughed in our faces at the type of options we were looking at.”

On Jan. 2, the managers put down $200,000 on what looked like a lottery ticket, with each SVXY put costing 34 cents. On Feb. 6, they sold the 6,300 contracts at about $28 each, leaving them with $17.5 million.

The firm had been in frequent contact with MRA’s Chintawongvanich, who’d been warning that the VIX notes could blow up for a while. Ibex was one of the few clients who actually heeded his warning, he said.

“Before this happened, I looked like the boy who cried wolf,” Chintawongvanich said. “There’s a risk that was underpriced by the market which we’ve been pointing out for a long time, and one of our clients capitalized on it, and I’m really happy for them.”

Ibex gives partial credit to a view of the Rocky Mountains outside the firm’s window. They’re 2,000 miles from New York and the conventional wisdom that said VIX ETPs could never blow up.

“The traditional mutual fund and hedge fund business is toast,” Borus said. “Most people investing in equities are going to index funds and ETFs. We believe in different strategies with higher risks and higher returns.”

After a sleepless Monday night, Rubin and Stainbrook celebrated by going skiing.

Among the biggest winners from last week’s turmoil is the mysterious buyer of out-of-the-money options tied to the Cboe Volatility Index priced at about 50 cents apiece.

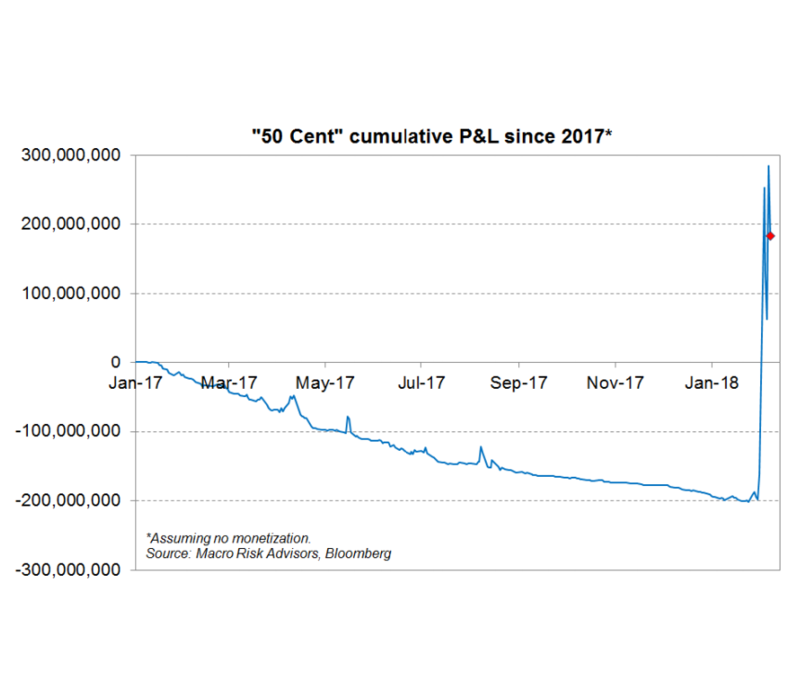

Pravit Chintawongvanich, head of derivatives strategy at Macro Risk Advisors, estimates that the trader dubbed “50 Cent” (a play on the rapper known as “50 Cent,” Curtis Jackson), has made nearly $200 million total on this trade since the start of 2017 — thanks to a swing of $400 million in a single month.“At one point, ‘50 Cent’ became ‘30 Cent,’ scrimping on his usual VIX option purchases, unwilling to pay up for the 50 cent VIX options that were his namesake,” Chintawongvanich wrote. “But in early February, when it seemed like Fiddy’s fortunes could go no lower, it came: redemption.”

But these gains linked to VIX options may be somewhat of a Pyrrhic victory for their owner: The strategist says that these calls were one way a large, income-earning portfolio of risk assets elected to hedge against a downturn.

“We think the reason ‘50 Cent’ was so adamant about paying a fixed price (50 cents) on a fixed number of contracts (50,000) is because they had a fixed hedging budget for the year,” he writes.

Meanwhile, the so-called VIX Elephant has gone the way of its relative, the woolly mammoth: It’s now extinct. This trader, who put on massive VIX call spread trades while selling puts to benefit from a rise in volatility, has closed out all of their positions to earn a net $40 million on the trade, according to Chintawongvanich.

‘VIX Elephant’ Hedges Against Increase in Volatility

‘VIX Elephant’ Hedges Against Increase in Volatility

Trading patterns associated with the new kingpin in volatility options resurfaced on Wednesday, hours before concerns about trade protectionism roiled markets.

The so-called “VIX Elephant” — the moniker bestowed upon the options giant by Macro Risk Advisors head of derivatives strategy Pravit Chintawongvanich — traded more than 2 million contracts, closing out positions in January VIX options and rolling the trade over to same-strike options that mature the following month.

This entailed buying back 262,500 January VIX puts with a strike price of 12, selling 262,500 15 calls, and buying back 525,000 25 calls in order to close out the existing position. Then, the new position was established by selling 262,500 12 February puts, buying 262,500 15 calls, and selling 525,000 25 calls.

This particular trade, which stands to gain should implied equity volatility rise moderately, confirms a definitive shift in the Elephant’s buying and selling patterns.

“While the ‘Elephant’ originally traded three-month options, rolling after two months, they appear to have switched to a one-month cycle,” the strategist writes.

Daily volume in options tied to the Cboe Volatility Index hit their second-highest level on record Wednesday, exceeded only by the last time the Elephant — joined by another mystery volatility buyer known as “50 Cent” — went on the stampede at the start of December.

The timing of that roll proved fortuitous: a spike in implied volatility allowed the Elephant’s previous positions to be closed at a loss of $2 million rather than $20 to $30 million. However, Chintawongvanich estimates that this trader is down roughly $35 million since then as market calm prevailed.

“More generally, the ‘Elephant’ trades reflect a trend towards low premium outlay hedges with minimal convexity,” the strategist concludes. “Clients we talk to have been more interested in VIX call flies or S&P put flies that carry well and have a fairly low initial cost, but may not mark up as much as an outright option in a risk-off scenario.”

In other words, this Elephant might soon be seeing a new animal on safari: copycats.

About Timeless Investor

My name is Samual Lau. I am a long-term value investor and a zealous disciple of Ben Graham. And I am a MBA graduated in May 2010 from Carnegie Mellon University. My concentrations are Finance, Strategy and Marketing.

This Tiny Hedge Fund Just Made 8,600% On a Vix Bet – what a bet, how do they find it?

This Tiny Hedge Fund Just Made 8,600% On a Vix Bet – from Bloomberg news

I know SVXY, but I forgot about VIX when market kept going up for over a year. What kind of research has they done to find this big bet?! Amazing! I should not leave my eyes outside of the the ball.

Here is the company’s website: https://www.ibexinvestors.com/#welcome1

Justin Borus is another brilliant Israeli investor!

On Jan. 2, the managers put down $200,000 on what looked like a lottery ticket, with each SVXY put costing 34 cents. On Feb. 6, they sold the 6,300 contracts at about $28 each, leaving them with $17.5 million.

This Tiny Hedge Fund Just Made 8,600% On a Vix Bet

ByMachine Trading Is Driving Market Moves, Says Swanson

Not everyone got crushed when the market collapsed.

For traders at a little-known Denver hedge fund who saw it coming, it was the score of a lifetime — a $17.5 million payday on a $200,000 bet.

Justin Borus

“People were laughing at us, saying this could never happen, this should never happen,” Justin Borus, the 41-year-old founder and manager at Denver-based Ibex Investors, said in an interview. “We saw people pricing this as a 1-in-5,000 event, but it was more like a one-in-five-year event.”

Borus’s team bet that an exchange-traded fund linked to a calm stock market would go to zero in the event of suddenly volatile trading. The ETF almost did — it lost 96 percent of its value.

Borus said they always believed in the wager, even when just about no one else did. But the jackpot still caught them by surprise. Two of the group — Ari Rubin and Cooper Stainbrook — were taking a long walk around the Colorado capital when the market started to go haywire on Feb. 5.

As they walked, the two of them — Ibex’s director and chief data scientist — were on the phone with a client and in passing mentioned rare, so-called black-swan events. The client told them to check out the VIX Index. One was happening as they spoke.

Extreme Velocity

“We came back to our screen and we’re watching the VIX and it’s moving with extreme velocity,” said Rubin, a former Israeli Defense Force soldier and ski bum turned money manager. “We’re laughing at every tick up until we realized what was going on. Cooper just looks at me and goes, ‘Oh man. The Vol-pocolypse just happened.’”

What was happening was the biggest plunge for U.S. equities in more than six years. Concern inflation was seeping into the economy triggered a decline in the Dow Jones Industrial Average that reached 6.3 percent at its lowest level. The benchmark index for equity volatility rose to more than twice its level the day before, crushing bettors who’d gotten used to years of very low volatility.

For about a year, Ibex had been buying options on the ProShares Short VIX Short-Term Futures ETF, ticker SVXY. The executives wouldn’t comment publicly on the exact mechanics of the trade or its profit, but they were detailed in a research note published by an adviser to the firm, Pravit Chintawongvanich of Macro Risk Advisors. Owning the contracts fit into the 15-year-old fund’s niche-product strategies. As of January, the 20-person firm managed about $350 million.

Volatility Spasm

Ibex’s plan was to profit when five years of a record-calm stock market burst into a spasm of volatility. Exchange-traded volatility notes that rose when volatility fell looked like a particularly ripe target, given the potential for a feedback loop that might send the Cboe Volatility Index surging in the event of market stress.

Other investors may have been lulled by the years of relative serenity in the stock markets. The average volatility rate for 2017 was lower than every single trading day from Dec. 22, 1995, to June 20, 2005. The VIX finished below a level of 10 — super quiet! — on only nine days before May 2017 and 68 days since.

That’s why so few have dared bet against short-vol, which had been minting money with breathtaking consistency. Even retail traders bought inverse VIX ETPs, hoping to make a quick and easy buck. That’s what intrigued Ibex.

Laughed in Their Faces

They went shopping for the right derivatives to place their bet. Brokers responded with ridicule — options speculating the inverse VIX would go to zero would never pay off.

“Cooper and I go to New York a lot,” Rubin said. “In one instance, someone actually laughed in our faces at the type of options we were looking at.”

On Jan. 2, the managers put down $200,000 on what looked like a lottery ticket, with each SVXY put costing 34 cents. On Feb. 6, they sold the 6,300 contracts at about $28 each, leaving them with $17.5 million.

The firm had been in frequent contact with MRA’s Chintawongvanich, who’d been warning that the VIX notes could blow up for a while. Ibex was one of the few clients who actually heeded his warning, he said.

“Before this happened, I looked like the boy who cried wolf,” Chintawongvanich said. “There’s a risk that was underpriced by the market which we’ve been pointing out for a long time, and one of our clients capitalized on it, and I’m really happy for them.”

Ibex gives partial credit to a view of the Rocky Mountains outside the firm’s window. They’re 2,000 miles from New York and the conventional wisdom that said VIX ETPs could never blow up.

“The traditional mutual fund and hedge fund business is toast,” Borus said. “Most people investing in equities are going to index funds and ETFs. We believe in different strategies with higher risks and higher returns.”

After a sleepless Monday night, Rubin and Stainbrook celebrated by going skiing.

— With assistance by Brandon Kochkodin

*****************************************************

Another success trade on VIX

‘50 Cent’ VIX Trade Just Paid Off to the Tune of $200 Million – from Bloomberg

Hate it or love it, the underdog’s on top: patiently waiting for the VIX to explode has finally been rewarded in a big way.

Among the biggest winners from last week’s turmoil is the mysterious buyer of out-of-the-money options tied to the Cboe Volatility Index priced at about 50 cents apiece.

Pravit Chintawongvanich, head of derivatives strategy at Macro Risk Advisors, estimates that the trader dubbed “50 Cent” (a play on the rapper known as “50 Cent,” Curtis Jackson), has made nearly $200 million total on this trade since the start of 2017 — thanks to a swing of $400 million in a single month. “At one point, ‘50 Cent’ became ‘30 Cent,’ scrimping on his usual VIX option purchases, unwilling to pay up for the 50 cent VIX options that were his namesake,” Chintawongvanich wrote. “But in early February, when it seemed like Fiddy’s fortunes could go no lower, it came: redemption.”

“At one point, ‘50 Cent’ became ‘30 Cent,’ scrimping on his usual VIX option purchases, unwilling to pay up for the 50 cent VIX options that were his namesake,” Chintawongvanich wrote. “But in early February, when it seemed like Fiddy’s fortunes could go no lower, it came: redemption.”

But these gains linked to VIX options may be somewhat of a Pyrrhic victory for their owner: The strategist says that these calls were one way a large, income-earning portfolio of risk assets elected to hedge against a downturn.

“We think the reason ‘50 Cent’ was so adamant about paying a fixed price (50 cents) on a fixed number of contracts (50,000) is because they had a fixed hedging budget for the year,” he writes.

Meanwhile, the so-called VIX Elephant has gone the way of its relative, the woolly mammoth: It’s now extinct. This trader, who put on massive VIX call spread trades while selling puts to benefit from a rise in volatility, has closed out all of their positions to earn a net $40 million on the trade, according to Chintawongvanich.

**************************

here is another one

A Huge Player in VIX Options Just Changed Its Buying Behavior

By

Luke Kawa

January 11, 2018, 8:06 AM PST

‘VIX Elephant’ Hedges Against Increase in Volatility

‘VIX Elephant’ Hedges Against Increase in Volatility

Trading patterns associated with the new kingpin in volatility options resurfaced on Wednesday, hours before concerns about trade protectionism roiled markets.

The so-called “VIX Elephant” — the moniker bestowed upon the options giant by Macro Risk Advisors head of derivatives strategy Pravit Chintawongvanich — traded more than 2 million contracts, closing out positions in January VIX options and rolling the trade over to same-strike options that mature the following month.

Read more: Is the VIX Being Gamed? A Sudden Swoon Has Traders Talking Again

This entailed buying back 262,500 January VIX puts with a strike price of 12, selling 262,500 15 calls, and buying back 525,000 25 calls in order to close out the existing position. Then, the new position was established by selling 262,500 12 February puts, buying 262,500 15 calls, and selling 525,000 25 calls.

This particular trade, which stands to gain should implied equity volatility rise moderately, confirms a definitive shift in the Elephant’s buying and selling patterns.

“While the ‘Elephant’ originally traded three-month options, rolling after two months, they appear to have switched to a one-month cycle,” the strategist writes.

Daily volume in options tied to the Cboe Volatility Index hit their second-highest level on record Wednesday, exceeded only by the last time the Elephant — joined by another mystery volatility buyer known as “50 Cent” — went on the stampede at the start of December.

The timing of that roll proved fortuitous: a spike in implied volatility allowed the Elephant’s previous positions to be closed at a loss of $2 million rather than $20 to $30 million. However, Chintawongvanich estimates that this trader is down roughly $35 million since then as market calm prevailed.

“More generally, the ‘Elephant’ trades reflect a trend towards low premium outlay hedges with minimal convexity,” the strategist concludes. “Clients we talk to have been more interested in VIX call flies or S&P put flies that carry well and have a fairly low initial cost, but may not mark up as much as an outright option in a risk-off scenario.”

In other words, this Elephant might soon be seeing a new animal on safari: copycats.

About Timeless Investor

My name is Samual Lau. I am a long-term value investor and a zealous disciple of Ben Graham. And I am a MBA graduated in May 2010 from Carnegie Mellon University. My concentrations are Finance, Strategy and Marketing.