There might be something that I can learn from the History of AIG’s recapitalization and stock price to the prediction of future actions of GSE.

Summary

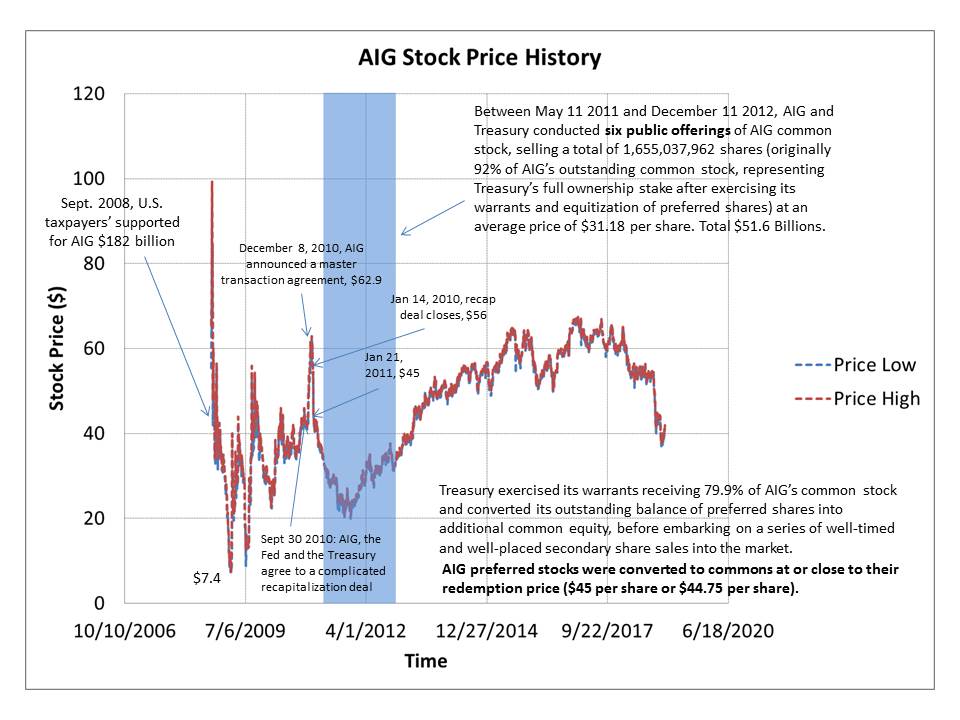

- It can be seen that after the capitalization plan, AIG stock price jumps in the beginning from ~$32 (09/30/2010) to $50 (01/03/2011), then dropped to $20.5 (11/21/2011), and then gradually increased to $66.5 (01/03/2017). It is possible that FNMA/FMCC’s common stock price may also jump significantly in the beginning of recap, then drops significantly within one year due to dilution, then after one year, stock is back to recap price. Therefore, given the current depressed common stock price, should I buy commons and wait for the jump in recap date?

- The Treasury will convert $49.1 billion of preferred shares held with the government to about 1.7 billion shares of AIG’s common stock, at a discounted price. – it might be great if GSE will do the same thing.

- We can see that AIG preferred stocks were converted to commons at or close to their redemption price ($45 per share or $.4475 per share).

- the Treasury is still expected to hold about 92% of AIG’s common stock, the complete offload of which is not expected before the first quarter of 2011, after converting its preferred interests. This holding will be sold over time depending on the performance of AIG’s shares in the market. In reality US sold last AIG shares on Dec 11 2012. Totally it took 2 years and three months for this process.

AIG stock price history – 09/30/2010, start of capitalization plan

Timeline: U.S. government’s rescue and sale of AIG

(Reuters) – The U.S. Treasury said on Monday it would sell the last of its remaining AIG shares, rounding off a $182 billion bailout that began during the financial crisis.

Following is a timeline of key events in AIG’s recent history:

2008

September 16: The government rescues AIG with an $85 billion bailout, as the company was minutes from bankruptcy.

September 17: The government removes Robert Willumstad as AIG’s chief executive and names former Allstate CEO Edward Liddy to replace him.

October 8: AIG and the Fed reach a deal for another $37.8 billion in liquidity.

November 10: AIG bailout is restructured to include the Troubled Asset Relief Program (TARP) and the creation of the Maiden Lane facilities.

2009

March 2: Bailout is restructured again to give the Fed preferred interests in life insurers ALICO and AIA.

AIG posts a fourth-quarter loss of $61 billion.

May 21: Liddy says he will resign.

August 10: Robert Benmosche, the former CEO of MetLife, takes over as AIG’s chief executive. He will ultimately get the lion’s share of the credit for turning the company around and preventing a fire sale of its assets.

2010

March 1: AIG reaches deal to sell AIA to Prudential for $35.5 billion; the sale later falls apart.

March 8: AIG reaches deal to sell ALICO to MetLife for $15.5 billion; the deal closes later in the year.

September 30: AIG, the Fed and the Treasury agree to a complicated recapitalization deal to repay the Fed and centralize the government’s investment with the Treasury.

October 22: AIG prices the public offering of a two-thirds stake in AIA in Hong Kong, in one of the largest IPOs ever.

2011

January 12: AIG strikes a deal to sell its Taiwanese insurance unit Nan Shan.

January 14: The recapitalization deal closes.

May 11: Treasury launches its first sale of AIG stock, reducing its stake in the company from 92 percent to 77 percent.

August 5: The company says it will hold on to United Guaranty, its mortgage insurance unit whose fate had been undecided.

Shares fall to a 17-month low, having lost half their value over the course of the year on uncertainty about the company’s future.

August 8: AIG sues Bank of America for $10 billion, alleging mortgage fraud, in one of the clearest indications yet AIG intends to fight back against the banks it believes contributed to its decline.

September 2: ILFC, AIG’s aircraft leasing business, files for an initial public offering.

2012

February 23: After making a determination it has returned to consistent profitability, AIG recognizes nearly $20 billion in tax-related benefits.

February 28: The New York Fed sells the last of the assets in Maiden Lane II, one of the two vehicles it set up to help rescue the company.

June 14: The New York Fed says the last of its bailout-related loans has been repaid with interest.

June 28: AIG says it will rebrand some units that dropped the AIG name during the depths of the crisis, restoring the company’s mark to prominence.

September 9: The Treasury launches its fifth sale of AIG stock, this time for $18 billion, in an offering that will take its stake in the company to around 20 percent.

November 2: AIG says it plans to shift its focus from stock buybacks to debt management, and adds it would like to pay a dividend in 2013 if possible.

December 7: AIG confirms it is in talks to sell 90 percent of its aircraft leasing unit ILFC to a Chinese consortium.

December 9: AIG strikes deal to sell up to 90 percent of ILFC for a valuation of $5.28 billion.

Dec 10: The U.S. Treasury says it will sell its last 234.2 million shares of AIG stock, worth some $7.8 billion at market prices. The government will retain warrants to buy AIG stock.

Sources: Federal Reserve, A.M. Best, company reports

Reporting by Ben Berkowitz; Editing by Diane Craft, Phil Berlowitz

AIG Implements Recapitalization Plan

After much mulling over the past several weeks, yesterday American International Group Inc. (AIG – Free Report) gave its thumbs up to execute the recapitalization plan for exiting the US taxpayers loan curriculum, as per the regulatory filing agreed and signed by the two parties. The US federal government has planned to sell about 20% of its stake or about 15 billion shares in AIG by the first quarter of 2011 under the recapitalization program.

Finally, AIG agreed to execute the recapitalization program, charted out by the US Federal Reserve in late September, since the company has yet to pay a huge chunk of the $182.5 billion government bailout loan taken in September 2008. Evaluation on this exorbitant debt also came from the credit rating agency, A.M. Best, who affirmed its issuer credit rating of “bbb” on AIG, reflecting a negative outlook.

According to the proposed plan, the U.S. Federal Reserve Bank New York (FRBNY) has agreed to divert AIG’s TARP loan obligations towards the U.S. Treasury. In turn, the Treasury will convert $49.1 billion of preferred shares held with the government to about 1.7 billion shares of AIG’s common stock, at a discounted price.

However, the Treasury is still expected to hold about 92% of AIG’s common stock, the complete offload of which is not expected before the first quarter of 2011, after converting its preferred interests. This holding will be sold over time depending on the performance of AIG’s shares in the market.

Accordingly, on October 8, AIG offered 74.48 million of its equity units, wherein every equity unit consists of a corporate unit worth 0.09867 shares of AIG common stock and $3.27 in cash, representing about 95% of the outstanding corporate units.

However, the company had been able to tender only about 49.5 million of the corporate units for $161.8 million until November 23, even after extending the deadline twice. Last week, AIG also vended off $500 million in three-year notes and $1.5 billion in 10-year paper amid strong demand in the market.

Besides, the proceeds from the AIG’s ALICO sale to MetLife Inc. (MET – Free Report) and AIA IPO will be utilized to repay the line of credit extended to AIG by the FRBNY credit facility before the end of the first quarter of 2011. The company is also expected to use the proceeds from the culmination of its Nan Shan deal in Taiwan for repayment of the credit line with FRBNY.

Moreover, the recapitalization program will now liberate AIG from the restrictions including raising debts and issuing stock, which is worth $2-3 billion in the open market. As per the freshly laid terms, AIG will be able to execute up to two common stock offerings annually until the government stake fizzles down to below one-third.

As of September 30, 2010, AIG owed the US government an outstanding debt and equity balance of $95.6 billion. Of this, the company had outstanding net borrowings under the FRBNY credit facility of $14.3 billion, and accrued interest and fees of $6.2 billion, while $14.9 billion remained available. Besides, the remaining available amount with the Treasury Department related to Series F Preferred Stock was $22.3 billion, at the end of September 2010.

On one hand, the government authorities were also mulling over the profitability of the agreement. It is believed that if the shares of AIG continue to trade equal or higher than the current levels, only then there’s scope of a gain since the warrants of AIG carry a strike price of $30 per share. However, on completion of the recapitalization program, AIG will also receive warrants to purchase up to 75 million shares of AIG stock in 10 years at a price of $45 per share.

On the other side, it is a crucial, faster but riskier step for AIG since the company has already used most of the other sources such as asset disposals to accumulate funds. While it is expected that the Treasury may earn about $22 billion from the sale of AIG’s securities, we believe the projection is too good to be credible currently, given the government’s time frame of 5-8 years before it can completely sell off its stock and exit AIG’s board.

Overall, the decision to convert the various ownership interests of the U.S. government to common stock, which will ultimately be sold to public investors, appears to be an essential step to be taken for the stabilization of AIG. The company is the only insurer left to repay its TARP loan, whereas Hartford Financial Services Group Inc. (HIG – Free Report) and Lincoln National Corp. (LNC – Free Report) have already repaid their bailouts and the Treasury raised more than $900 million by selling warrants in the companies.

Although these actions will result in streamlining AIG’s operations and the debt reduction will strengthen its balance sheet, the company’s ratings lay exposed to the risk of being heavily dependent on the U.S. government’s support, which also includes the availability of significant liquidity. Moreover, the company is vulnerable to be marred by several one-time charges associated with the business restructuring, in the upcoming quarters.

Going forward, we believe that AIG will now have to stand on its own feet once again, while maintaining ample liquidity and re-establish itself in the industry. This is also important to restore shareholder confidence.

“At the Closing, (i) the shares of AIG’s Series C Perpetual, Convertible, Participating Preferred Stock (the “Series C Preferred Stock”) held by the Trust will be exchanged for approximately 562.9 million shares of AIG common stock, which will ultimately be held by the Treasury Department; (ii) the shares of AIG’s Series E Fixed Rate Non-Cumulative Preferred Stock (the “Series E Preferred Stock”) held by the Treasury Department will be exchanged for approximately 924.5 million shares of AIG common stock; and (iii) the shares of the Series F Preferred Stock held by the Treasury Department will be exchanged for (a) the Transferred SPV Preferred Interests (as described above), (b) newly issued shares of Series G Preferred Stock (reflecting an initial liquidation preference if and to the extent that AIG has drawn down available funds under the SPA between the date hereof and the Closing) and (c) approximately 167.6 million shares of AIG common stock. The Treasury Department will then hold approximately 1.655 billion shares of AIG common stock, representing pro forma ownership of approximately 92.1 percent of the AIG common stock that will be outstanding as of the Closing.”