I MUST use conservative Kelly criterion to do trade and portfolio allocation

Set up my portfolio allocation for my every account.

05/29/2019 – Articles on details of Kelly criterion – start to use Kelly criterion to allocate my portion of sell and buy

- Using the Kelly Criterion for Asset Allocation and Money Management

- Ed Thorp, Jack Schwager, and the Kelly criterion

Excerpt from Jack Schwager’s interview with Ed Thorp in the book Hedge Fund Market Wizards: - How to use Kelly Criterion for betting – Ultimately the Kelly Criterion offers a distinct advantage over other staking methods such as Fibonacci and Arbitrage methods as there is a lower risk. However, it does require precise calculation of the likelihood of an event outcome, and discipline of this method will not provide explosive growth of your bankroll.

- pictures on Kelly criterio

- 05/01/2019 – The Dhandho Investor: ‘Investing Is Just Like Gambling’

From playing blackjack to knowing how much to invest in a temporarily distressed stock, it’s all about the odds

This new “casino” was the New York Stock Exchange and the “fledgling” options market. According to Pabrai:

“The Black-Scholes formula is, effectively, Basic Strategy for the options market. It dictates what a specific option ought to be priced at. Because he was one of the only players armed with this knowledge, Thorp could buy underpriced options and sell overpriced ones—making a killing in the process.”

Thorp founded a hedge fund called Princeton-Newport Partners, which went on to produce 20% annual returns for 20 years. Actor Paul Newman reportedly asked Thorp how much he could make playing blackjack full time; Thorp responded that it could be $300,000 a year. When Newman asked Thorp why he wouldn’t do it full time, Thorp responded he could make $6 million a year in the options market—with very little risk.

Pabrai recommended that investors approach equity markets with the same mindset. Find a publicly traded company with a simple business model and a durable moat—and in temporary distress. If the current stock price is less than half of its expected intrinsic value in two or three years, then bet on it.

Then it is a matter of waiting for the stock price to increase or, as we might say, revert to the mean. How stock prices return to their intrinsic value is not fully understood. When Benjamin Graham was asked in 1955 why cheap stocks would recover, he said, “That is one of the mysteries of our business and it is a mystery to me as well as to everybody else. But we know from experience that eventually the market catches up with value.”

What Pabrai called “dislocating events” offer investors opportunities to find temporarily distressed companies. He provided a list of nine events (prior to 2007, when the book was published) where there had been immediate double-digit drops in the Dow Jones Industrial Average, and recoveries within a few months:

The fall of Free France in 1940.

The start of the Korean War in 1950

U.S. bombing of Cambodia in 1970.

Arab oil embargo in 1973.

Nixon resignation in 1974.

Hunt silver crisis in 1980.

Financial panic of 1987.

Asian stock market crisis in 1997.

Russian-LTCM crisis in 1998.

Pabrai wound up the chapter with these words:

“Investing is just like gambling. It’s all about the odds. Looking out for mispriced betting opportunities and betting heavily when the odds are overwhelmingly in your favor is the ticket to wealth. It’s all about letting the Kelly Formula dictate the upper bounds of these large bets. Further, because of multiple favorable betting opportunities available in equity markets, the volatility surrounding the Kelly Formula can be naturally tamed while still running a very concentrated portfolio.”

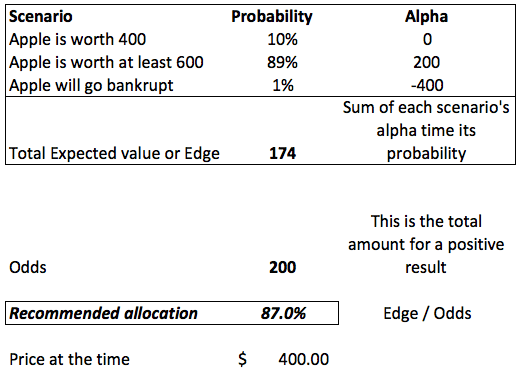

- 06/16/2016 The Kelly criterion is the fraction of capital to wager to maximize compounded growth of capital. Even when there is an edge, beyond some threshold, larger bets will result in lower compounded return because of the adverse impact of volatility. The Kelly criterion defines this threshold. The Kelly criterion indicates that the fraction that should be wagered to maximize compounded return over the long run equals:

F = PW – (PL/W)

where

F = Kelly criterion fraction of capital to bet

W = Dollars won per dollar wagered (i.e., win size divided by loss size)

PW = Probability of winning

PL = Probability of losing

Limitations,

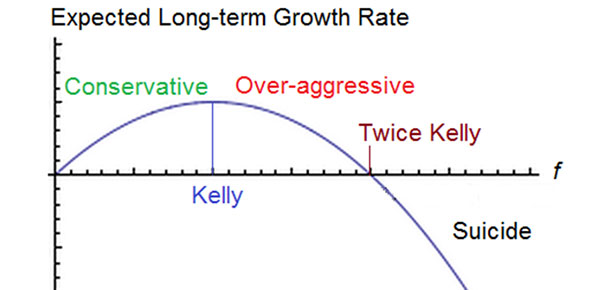

- The Kelly criterion of what fraction of your capital to bet seemed like the best strategy over the long run. The Kelly criterion will give you a long-term growth trend. The percentage deviations around that trend will decline as the number of bets increases. It’s like the law of large numbers.

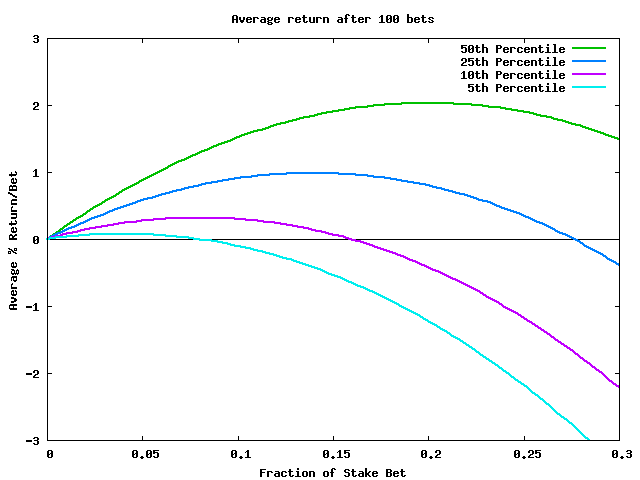

- Bet half the Kelly amount, you get about three-quarters of the return with half the volatility. So it is much more comfortable to trade. I believe that betting half Kelly is psychologically much better.

- We are not able to calculate exact probabilities in the first place. In addition, there are things that are going on that are not part of one’s knowledge at the time that affect the probabilities. So you need to scale back to a certain extent because overbetting is really punishing—you get both a lower growth rate and much higher variability. Therefore, something like half Kelly is probably a prudent starting point. Then you might increase from there if you are more certain about the probabilities and decrease if you are less sure about the probabilities.

- build in an extra margin of safety by only focusing on situations where your diligence leads you to believe that PW > PL AND $W > $L.

- betting double the Kelly criterion will eliminate 100% of the gain

- betting more thab double the Kelly criterion will result in an expected negative compunded return, regardless of the edge on any individual bet.

Resource: http://www.valueinvestingworld.com/2013/05/ed-thorp-jack-schwager-and-kelly.html