News on GE

- 10/07/2019 – Larry Culp’s GE Plan: a Fix, Not a Reinvention

CEO reassures executives of the struggling behemoth that he’ll leave intact its traditional structure - 10/07/2019 – GE to Freeze Pensions for 20,000 Workers

Conglomerate says moves will reduce pension deficit by up to $8 billion; it will add $5 billion to pension fund next year

General Electric Co. said it was freezing its pension plan for about 20,000 U.S. workers and offering pension buyouts to 100,000 former employees, as the conglomerate joins the ranks of U.S. companies phasing out a guaranteed retirement

- 08/31/2019 – General Electric Gets Most of Shareholder Lawsuit Dismissed

Suit alleged yearslong fraud that inflated results in GE’s insurance and power division; plaintiffs can amend claims

A federal judge dismissed much of a major shareholder lawsuit against General Electric Co. , knocking down several securities fraud allegations related to accounting at its insurance and power businesses.

While the majority of claims were dismissed, the judge is permitting the plaintiffs to amend those claims to address their shortcomings. The ruling preserved the shareholder claims that GE misled investors by not disclosing its use of factoring—selling future revenue for cash now—to mask the gap between revenue and cash flow in its power division. The suit is several legal complaints consolidated into a single case under Judge Jesse Furman in the U.S. District Court for the Southern District of New York.

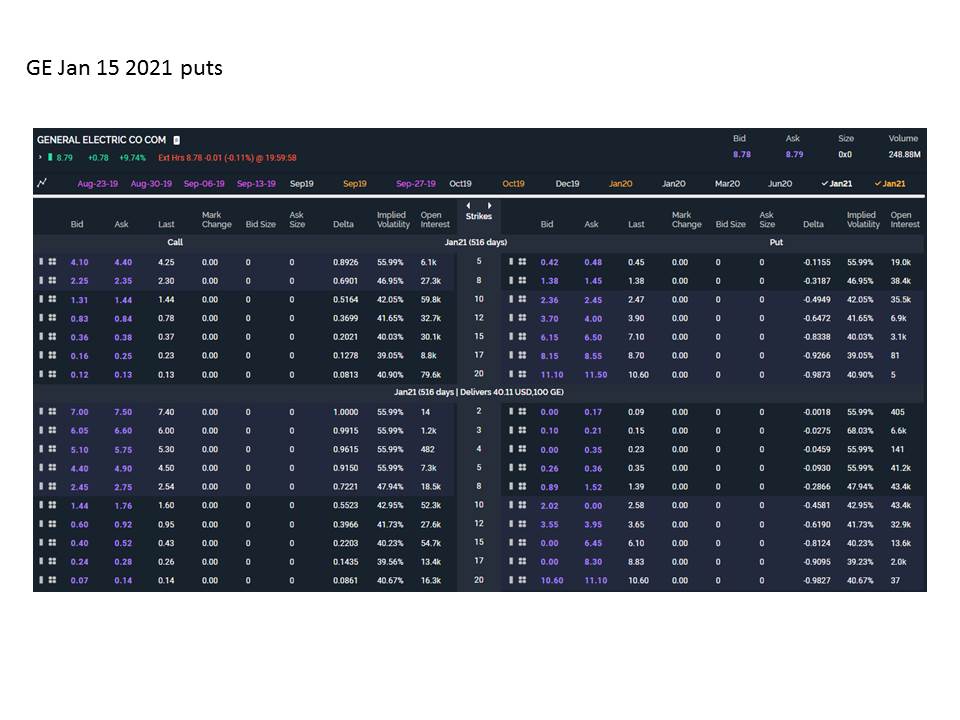

- 08/18/2019 – GE’s 15Jan2021 put price – I might can buy out of money put of $10. If GE goes bk, the return can be 4x.

- 08/15/2019 – CNBC: Read the full report from the Madoff whistleblower on GE – to sell GE call and buy put

full report (2019_08_15_GE_Whistleblower_Report)

gefraud website: https://www.gefraud.com/

Here’s one company that may be benefitting from the GE meltdown

Yahoo Finance, This company is cleaning up on the great dismantling of General Electric. Read the full story

- 08/15/2019 – General Electric Has a Credibility Problem

The former icon’s investor relations are less than ideal, and it keeps hurting the stock. - 08/15/2019 – GE Left Itself Open to Short-Seller’s CritiqueThe company calls the dire analysis “meritless,” but it hasn’t earned the benefit of the doubt with investors. By Brooke Sutherland, August 15, 2019, 11:23 AM PDT

- 08/15/2019 – GE Is New Target of Madoff Whistleblower

Harry Markopolos releases report on GE’s accounting, claiming its cash situation is far worse than disclosed and GE needs to boost insurance reserves. Company says claims are false, misleading. - 08/01/2019 – GE’s New Billion-Dollar Problem? Boeing’s 737 MAX

General Electric helps make the jet’s engines, and the grounding could drain as much as $1.4 billion from its cash flow this year - 06/07/2019 – GE’s Nemesis: An Eerily Prescient Bear

JPMorgan analyst Stephen Tusa warned about the conglomerate’s problems before they were public and ‘broke the mold in analyst optimism’ – Tusa researches very thorough (100 pages research report) in company reports and also interview insider/employees to unearth the inside information. I should learn from him.

Studies have found analysts to be more positive when they are issuing opinions on larger companies, when they cover many companies, and when the companies generate high-investment banking fees. Mr. Tusa has managed to buck all those trends, said Mark A. Chen, a finance professor at Georgia State University who has studied the investment-research industry.

Mr. Tusa covers 21 industrial companies and JPMorgan has collected an estimated $370 million in banking fees from GE since 2010, according to Dealogic, the most the conglomerate has paid to any investment bank over that period.

Prof. Chen found those biases are so prevalent that investors have baked them into their reactions: A negative call, like Mr. Tusa’s, by an analyst under those circumstances tends to move the stock more. “Clearly this analyst broke the mold in analyst optimism,” Prof. Chen said.

That hope was short-lived. Before U.S. markets opened April 8, JPMorgan issued an alert that Mr. Tusa was downgrading GE again. The report—over 100 pages—highlighted GE’s challenges and risks but the thrust was that the stock price had gotten ahead of reality. GE’s stock slid 5% as the broader market rose.

People close to GE say they now believe Mr. Tusa got the information on the turbine defects by talking to utility customers who were getting briefings from GE on the emerging problem.

Mr. Tusa also has a reputation for tough questions, something that many research analysts will often avoid. Analysts at many investment banks depend on gaining access to executives to set up meetings for clients.

- 05/28/2019 – GE Stock Might Have a China Problem, JPMorgan Says

Tusa worries that gas turbines built by the company’s GE Power division could be shut out of the Chinese market because China wants to build its own turbines in the future.

What’s new: Siemens CEO Joe Kaeser said at the EPG conference on May 20 that a Chinese national champion could be formed by the government to sell power turbines like the ones Siemens and GE produce, inside and outside of China.

That was new to most investors at the conference.

Culp brushed off concerns. “I think our view is that China is important,” Culp said, “but China isn’t what we are banking the turnaround in Power on and particularly in gas power.”

“Emerging competition from China is coming,” Tusa said in a Tuesday research report. “Not just within the country, which looks to be largely shutting out GE at this stage, but also set to emerge globally.”

Still, the Chinese gas-powered electricity generation market will develop over decades. That means investors probably won’t focus on this risk for a while. That buys GE, and Culp, some time to restructure power before other issues, like new Chinese competition, emerge.

- 05/15/2019 – GE is not ‘telling the whole story’ about its struggling power business, says JP Morgan’s Tusa – be aware of GE’s financial numbers

General Electric’s power business is still struggling, but the company is sugar coating this in communications with investors, according to a top analyst at J.P. Morgan.

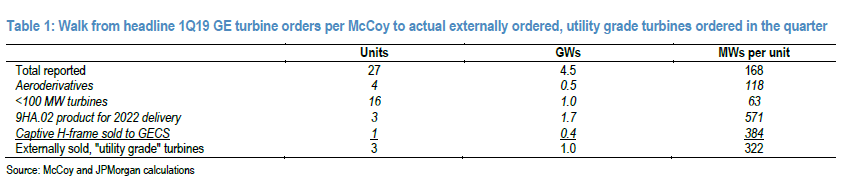

Here is how Tusa broke down the total reported units sold versus the “actual externally ordered” turbines last quarter.

“Beyond this cut of the data, however, the dynamics here raise concern around communications from a company that continues to get material benefit of the doubt around credibility, though appears to us to be stopping short of telling the whole story,” Tusa said.

J.P. Morgan’s analysis comes even after CEO Larry Culp told investors in March that GE’s power business “is in a serious turnaround mode.” Culp also told CNBC that GE has “a number of problems we need to work through this year,” adding that “this is the year that we share with the world what those issues are.”

- 02/25/2019 – GE to Sell Its Biotech Business to Danaher for $21 Billion

Deal allows GE to pay down debt and marks a strategic shift by CEO Larry Culp - 02/08/2019 – General Electric Stock Has Rallied Too Far, Too Fast

- 02/08/2019 – More General Electric Credit-Rating Cuts May Be a ’Foregone Conclusion,’ Analyst Says

- 02/07/2019 – GE: Undervalued By About $68 Billion

- 01/31/2019 – GE +13% as Culp’s candor sparks relief rally

- 01/31/2019 – GE Cites Progress Toward Turnaround After Tough Year

Power unit weighed on fourth-quarter results; conglomerate to pay $1.5 billion to settle subprime probe

“I’m not going to put the company’s reputation at further risk by satisfying an artificial calendar in that regard,” Mr. Culp said. “We are going to come out with guidance when we can walk people through it, where the math adds up, and we can be very clear on how we are going to go about delivering on those numbers.”

Mr. Culp said the company aims to reduce its leverage by $50 billion from selling off its transportation division, selling down its stake in oil-services firm Baker Hughes and the initial public offering of the health-care business. He said GE doesn’t plan to sell its Gecas plane-leasing business, which several private-equity firms have expressed interest in buying.

wo of the foundation’s fourth-quarter stock purchases, General Electric (ticker: GE) and Amazon.com (AMZN), with respective gains of 14% and 8.6%, are outpacing the S&P 500 index’s advance of 5.0% in January.

- 01/30/2019 – GE’s Capital Dilemma: Keep or Sell Jet-Leasing Business?

Sale of business could pay down $40 billion of debt, but would remove steady stream of cash - 01/30/2019 – GE Expands Renewable Energy Business Portfolio to Accelerate Growth, Improve Performance, and Lead the Energy Transition for GE

A common sense move to combine renewal grid assets into a single entity will reduce corp overhead costs as well as streamline operations hopefully improving them.

- 01/30/2019 -Rather than all being negative, analysts are now split on the stock:The company is still winning record orders in various units proving the underlying strength of the franchise

- 01/23/2019 – Former GE Vice Chair Beth Comstock: Culp’s outside perspective a plus

- 01/21/2019 – General Electric’s Airline-Leasing Unit May Not Be on the Chopping Block

- 01/17/2019 – GE Stock Could Drop to 5 Bucks, Analyst Says

Thursday morning, Gordon Haskett analyst John Inch questioned the value of GE Capital Aviation Services, or Gecas, and argued that GE shares could hit $5 in a worst-case scenario. The aircraft-leasing business was said to have a $40 billion book value when reports surfaced private-equity firm Apollo Global Management (APO) was preparing to make a bid for the asset. Inch doubts it is worth much as he says that the Gecas fleet is older and may be less desirable than others hope.

“We believe there is a rising likelihood GE may accelerate the timing and size of its original plans for the IPO of GE Healthcare, that prospects for GE Commercial Aviation Service (GECAS) to be sold at or above book value are now rising, and that the noncore 20% of GE Digital recently recast into a separate business could lead to it being monetized,” Hyemann writes. If GE is able to monetize these three assets ahead of schedule, it could boost the company’s liquidity by as much as $55 billion, he estimates—a figure that includes around $32 billion of incremental debt reduction and about $18 billion-$25 billion of incremental cash generation beyond GE’s June 2018 transformation plan.

If GE were to find itself with so much more cash on hand, it could then fund the roughly $10 billion of remaining underfunded loss reserves at GE Capital’s long-term health-care reinsurance, as well as right-size GE Power’s global large steam- and gas-turbine production capacity ahead of expectations, and shore up reserves for the litigation and government investigation liabilities it may face—all while still paying down debt, he writes.

- 01/07/2019 – 3 Reasons Why I Just Tripled My GE Position

- 01/04/2019 – GE shares rise on report Apollo discussing bid for jet-leasing business

- 12/31/2018 – General Electric: My Best Stock Pick For 2019

- 12/31/2018 – GE’s New CEO Turns the Page on a Horrible 2018

- 12/28/2018 – General Electric Is A Very Strong Buy

- 12/27/2018 – General Electric Healthcare IPO Is Too Risky In This Environment

- 12/26/2018 – General Electric: Expect A Big 2019

- 12/24/2019 – GE Bags 300 Megawatt Wind EPC Order In India

- 12/19/2018 – The Tide May Finally Be Turning for General Electric

Another longtime General Electric (GE) bear has upgraded the long-battered stock this morning—and shares are trading up 8.3%, to $7.87. Last week, JPMorgan analyst Steve Tusaupgraded GE shares from Sell to Hold. Today, Vertical Research Partners analyst Jeffery Sprague upgraded them from Hold to Buy. Sprague noted that he hasn’t had a Buy rating on the company since 2008.

Fears about high debt and liquidity have plagued GE lately, but Sprague pointed out in his report that GE has “near term liquidity.” Adding that while problems like liabilities related to long-term-care insurance are a black box for the company, “may not have to pay on these legacy liabilities soon, diminishing the risk that they cause a life threatening liquidity crisis.”

There is more good debt-related news for GE in the offing. Navistar International (NAV) reported Tuesday that higher discount rates and cash contributions helped shrink its pension-funding gap. GE should report a similar dynamic when the company reports its fourth-quarter earnings early next year. The company’s pension-funding gap was reported at $28 billion in GE’s 2017 annual report. This year, GE made $6 billion in contributions to the plan.

Bloomberg also reported Wednesday that GE “confidentially” filed for an initial public offering of its health-care unit. Barron’s has estimated that the health-care division could be worth up to $60 billion on a stand-alone basis.

Not everyone agrees, though. Gordon Haskett analyst John Inch wrote recently that some bankruptcies in the airline industry could pressure aircraft lessors. That would be new bad news for the company’s GE Capital unit.

GE may not be out of the woods completely, but a lot of bad news is already reflected in the share price, which fell 45% in 2017 and is down another 58% in 2018.

- 12/18/2019 – GE Files Confidentially for Health IPO, Buoying Stock

- 12/14/2018 – GE Powered the American Century—Then It Burned Out

How the company that was once America’s biggest, the maker of power turbines, the seller of insurance, the broadcaster of ‘Seinfeld,’ became a shadow of its former self – a great article (GE-history-WSJ) and video on GE’s long history! - 12/13/2018 – General Electric is soaring after JPMorgan upgrades it for the first time in 2.5 years (GE)

The JPMorgan analyst Stephen Tusa, a long-term bear on General Electric, gave a rare upgrade on the stock’s rating Thursday.Tusa said the iconic industrial giant had a more “balanced risk reward at current levels.” On Thursday, GE said its digital unit would sell a majority stake in ServiceMax, a software provider, to the technology-focused private-equity firm Silver Lake. Tusa raised his rating to “neutral” from “underweight,” a view he had held since May 2016 when the stock was above $30. He maintained his price target of $6, however — 10% below where shares were trading Wednesday. With these efforts, the company’s bottom could be near, according to Tusa. “On the flip side, we are increasingly assuming a material equity raise could be necessary, and, in this instance, while we think there would be near-term downside, we also think there could be support at a lower level, and likely a benefit of the doubt for new management with a higher multiple on lower earnings and free cash flow,” he said.

CNBC: GE spins off digital assets to form internet of things company

WSJ: GE to Sell Part of Digital Business

The conglomerate is selling a majority stake in ServiceMax; JP Morgan removes its ‘sell’ rating on GE

- 12/04/2018 – I Just Doubled My Position In GE, Here’s Why

General Electric’s shares are undervalued and oversold.

The dividend has been cut, and the company is in the midst of a major reorganization.

Investor sentiment is overly bearish.

GE deserves the benefit of the doubt to pull this restructuring off.

- 11/30/2018 – How New CEO Larry Culp Can Turn GE Around

1. Be bold at GE Capital: The first step in fixing GE Capital is getting rid of the LTC problem. There are two possible solutions: purchase a reinsurance policy or pay someone to take the contracts off GE’s hands. The latter possibility, known as the “Warren Buffett solution,” would be to find a respected insurer like Berkshire Hathaway (BRK.A) to handle the LTC payouts until they run off. It would be expensive, possibly costing $5 billion on top of the $15 billion already reserved for losses. But a deal would probably win Wall Street support, given GE’s poor stock performance.

2. Sell part of GE Healthcare

3. Infuse new life into the culture

4. Switch deal-making priorities

- 11/23/2018 – General Electric Debt Fears Are Overblown, Says Analyst

- 11/23/2018 – A smart way to play GE trade is via its preferreds (full article GE_preferreds_FT)

- 11/20/2018 – If GE Debt Gets Junked, Markets Have Reason to Shudder

Hopefully GE will end up merely as a case study in financial mismanagement, rather than the trigger for messy markets - 11/20/2018 – If The PBGC Pressures GE The Stock Could Crater

- 11/18/2018 – GOLDMAN SACHS: GE Capital has a $20 billion funding gap that needs to filled by 2020

- 11/17/2018 – GE, once America’s most valuable company, flirts with a junk rating—and is ‘running out of time’GE’s stock is a sliver of its former self, and its bonds are now trading as if they are already junk-rated, putting pressure on new CEO Larry Culp to quickly raise cash and cut debt.

- 11/17/2018 – How Jeff Immelt’s Courtship Of An Activist Investor Backfired For GE Shareholders

- 11/16/2018 – more insider buyings for GE

| Insider | Position | Date | Buy/Sell | Shares | Shares Owned Following This (Direct & Indirect) | Trade Price ($) | Cost ($1000) | Price Change Since Trade (%) |

Share Ownership Details |

|---|---|---|---|---|---|---|---|---|---|

| DSOUZA FRANCISCO | Director | 2018-11-14 | Buy | 60,000 | 151,500 | $8.32 | 499.2 | -3.61 | 151,500 (Direct) |

| DIMITRIEF ALEXANDER | Senior Vice President | 2018-11-06 | Buy | 10,000 | 180,833 | $9.48 | 94.8 | -15.4 | 103,075 (Direct) 77,758 (401(k)) |

| CULP H LAWRENCE JR | Chairman and CEO (Click for the stocks that their CEOs have bought) |

2018-11-01 | Buy | 225,000 | 598,392 | $9.73 | 2189.25 | -17.57 | 585,800 (By holding company) 12,592 (By family trusts) |

General Electric’s Major Lunge Forward Is A Hint At The Future

General Electric pulls out of Nigeria rail concession

3 Reasons to Stay Away From General Electric (GE) Stock

General Electric: Big Opportunities In Biotech

Several high-profile funds raised stakes in GE before selloff: filings

GE Credit Crunch Ripples Across Wall Street

- 11/13/2018 – GE to Sell Roughly $4 Billion Stake in Baker Hughes

Agreement lets conglomerate raise some much needed cash from oil-services investment. GE had been prevented from selling its stake in Baker Hughes until July 2019 as part of the agreement that formed the company, when GE combined its oil and gas business with Baker Hughes. GE said it plans to maintain a stake above 50% in Baker Hughes after the transactions. - 11/13/2018 – G.E.’s New C.E.O. Risks Repeating History

GE’s Preferred Stock Looms Large for Vanguard and Pimco

GE turns to Wall Street to reorganize as Blackstone eyes assets

General Electric’s Downfall Was Easy to See

GE Power 2019 Losses Caused By Lack Of Orders

GE Will Split Up: Here Is A Sum Of The Parts

GE CEO Culp’s quick comments about health spinoff could mean an ‘outright sale’

Woe Is GE: The Industrial Giant’s Decline Is Not Slowing

A Look At How General Electric Is Positioned, Financially

General Electric powers downwards – Culp’s ability

- 11/12/2018 – GE CEO Culp on whether troubled power business has bottomed: ‘We’re getting close’

GE’s Larry Culp says the industrial conglomerate’s troubled power business is getting close to a bottom. GE’s performance has been heavily hit by its power business.

It seems like Culp is quite serious and a bit nervous on talking about GE’s issues. Also, it seems like he is quite conservative on talking in the earning conference call about his plan of attack.

General Electric’s Culp: No higher priority than bringing down leverage levels from CNBC.

GE chief Culp says need to cut debt urgently, shares fall

General Electric Capitulates To $8.15 On JP Morgan Downgrade. Time To BUY?

- 11/11/2018 – GE: What Is It This Time?

- 11/11/2018 – Larry Culp’s long to-do list to fix GE

- 11/11/2018 – General Electric powers downwards – Culp’s ability

- 11/11/2018 – 4 Reasons General Electric Retirees Should Sell Their Stock

- 11/10/2018 – GE Scares Off Investors Not Named Pollyanna

- 11/08/2018 – General Electric: A True Play On The Global Economy

- 11/08/2018 – Why General Electric Stock Fell 10% in October

- 11/07/2018 – GE and Rolls Royce finalists for Chinese-Russian CR929 jet engine: designer

- 11/06/2018 – GE: The Point Of Maximum Pessimism And Capitulation

- 11/06/2018 – General Electric to Sell LED Business to American Industrial Partners

- 11/06/2018 – humble Larry Culp and Danial Zhang (BABA)

- 11/06/2018 – GE: Q3 Postmortem – Price Target $5 To $8

Summary

– In my recent article, GE: Q3 Earnings Expectations, and in my previous articles, I set the bar very high, so no big surprise all expectations were not met.

-But the dividend was savagely cut, and that is something I have called for repeatedly.

-Another of my calls, the separation of the gas turbine business from the grid and the power businesses, will provide added transparency on performance.

-Revised guidance for FY 2018 was not provided on the earnings call – I provide my own best estimates, with necessary qualifications.

Good discussion on GE’s price

- 11/06/2018 – General Electric to Sell LED Business to American Industrial Partners

General Electric Co. GE +2.05% said it agreed to sell its Current lighting division to private-equity firm American Industrial Partners for an undisclosed amount, as the conglomerate continues to separate from a business that is central to its historical roots. The Current business, which sells LED lighting for commercial use, had about $1 billion in sales in 2017.

General Electric is still trying to sell the rest of its consumer-lighting business, which includes lightbulbs, according to people familiar with the matter.

- 11/06/2018 – GE Rises as UBS Says Liquidity Isn’t an Issue

- 11/06/2018 – How Low Can General Electric Fall?

- 11/05/2018 – GE: Every Cloud Has Its Silver Lining – I have the similar feelings as this author after I listened to the 3Q18 earnings call

Summary

– GE’s zero expectations 3Q18 earnings call, with hindsight, is a perfect set-up by Culp for positive surprises.

-Negative market sentiment is now high and likely overshooting reality.

-No fresh equity capital required and liquidity can be sourced from untapped credit lines.

-Asset sales, restructuring and dividend relief to generate cash to accelerate debt reduction.

-Taking a position in an option combination with downside protection and capturing upside potential from expected medium term re-rating of the GE stock.

- 11/05/2018 – GE shares rise after new CEO Culp buys $2.2 million in stock

Culp bought 225,000 shares at an average price of $9.73 a share, according to an SEC filing disclosed Monday. – this somewhat shows Culp’s confidence in GE - 11/02/2018 – GE’s stock tumbles toward 8th-straight loss after credit downgrade at Fitch makes it unanimous

- 11/01/2018 – Is today GE’s 5.15% drop (to $9.58) due to lots of institutions dumped GE due to it has almost no dividend? So it is drop out of dividend portfolio? or something else from the fundamentals? I need to figure it out today and think about what I should do next.

- 10/30/2018 – GE 3Q2018 earnings presentation (ge_presentation_3Q2018) , transcript (ge_webcast_transcript_10302018)and conference call

- 10/30/2018 – GE plunges 10% to below $10 a share after analysts say dividend cut to a penny may not be enough

GE was on pace for its worst single day of trading since March 2009.

Below is recap of what major Wall Street analysts had to say following GE’s earnings report.

Along with a dividend cut, the company:

- took a $22 billion charge in the third quarter related to acquisitions in its power business

- said the SEC and the DOJ were widening their probes into the company’s accounting practices because of that charge

- reported adjusted earnings and revenue for the third quarter that missed Wall Street expectations and a GAAP loss of $2.63 a share in the period

- said it was splitting its power business into two separate units

reported that 7 percent increase in profits from last year for the aviation unit - said it expects to retain about $3.9 billion in cash a year as a result of the dividend cut

GE shares were last below $10 in April 2009.

J.P. Morgan’s Stephen Tusa – $10 price target

Fundamentally this is worse than expected on profits, with the same dynamics as prior quarters including results at Power and Renewables well below expectations and upside from Aviation. With a lack of guidance, it’s hard to judge the sustainability of each – Power is bad and certainly nowhere near as salvageable as Bulls think, and we also don’t believe Aviation can sustain these types of results … The dividend cut to close to zero will help on this front, but we also don’t think the cut is a silver bullet, and the severity highlights the challenged capital position here … Bottom line, there is still much information to come and wood chop for the new CEO, and color from the call will determine today’s trade. So far, fundamentally there is plenty here to support our negative view.

RBC’s Deane Dray – $15 price target

In new-CEO Larry Culp’s debut earnings, GE is taking the as-expected step of paring down its annual dividend from 48c to 4c, which would save roughly $3.9 billion of cash annually. We expect this action to be well-received. GE also announced a realignment of the Power business, grouping Gas products & services businesses into one unit and Other Power businesses into a second unit. This realignment will raise questions over whether it might lead to further divestitures.

Gordon Haskett’s John Inch – $11 price target

The company announced the elimination of all but a token dividend of 1 cent a quarter – suggesting that GE faces a significant cash constraint, particularly as we expect that new management would still be early in thoroughly reviewing the operations.

Overall, we believe GE’s 3Q18 results are disappointing despite very low expectations. GE’s Power and Renewables results were significantly worse than expected (2 of 3 core businesses to remain in the portfolio) while O&G profit improvement underwhelmed. Cash flow remains negative YTD. A key question is how long Aviation strength can last at what appears close to a cycle peak.

- 10/30/2018 – GE Slashes Payout, Discloses Inquiry; Shares Plummet

Embattled conglomerate books $22.8 billion quarterly loss on accounting charge now subject of DOJ probe

- 10/30/2018 – Q&A With GE CEO Larry Culp on His Fix-It Plan

First outsider to run GE talks about why he took the job and his first moves

WSJ: What is the situation with GE Power? Are you walling off the bad or low-growth businesses? What is the strategy around that?

CULP: In many respects, it is more operational than strategic. What we clearly have to do is improve our day-to-day management of that business.

- Oct 18, 2018 – The Black Hole Inside General Electric – GE Capital might be this black hole, I need to watch out on this!

In a note released on Tuesday, UBS analyst Steven Winoker laid out some scenarios for GE Capital’s issues and came away with a scary conclusion: “Our base case implies negative value for GECC [GE Capital].” GE had not responded to a request for comment by Wednesday evening.

Comparing the Industrial Finance Subsidiaries

Sources: company filings; Barron’s calculations; Bloomberg

Not everyone is that negative, but whether an investor feels comfortable with GE, the stock, could come down to two questions. First, do you believe the worst is over at GE Capital? If the answer is yes, then you can ask yourself the second question: What should you pay for the industrial business?

GE has said it would earn $1 in 2018 guidance, which is about how much GE expects to make from its industrial business. Industrials trade at 16 or 17 times 2019 earnings, which would make GE worth $17 per share. Discount that by 20%, or whatever you feel is appropriate, for financial complexity or GE Capital risk, and you arrive at, perhaps, $14 per share as an interim target.

- Oct 22, 2018 – GE-Iraq Deal May Not Be What It Seems Despite Trump Pressure – I need to watch out this deal as more things will be unfolded, if it turns out as GE said, then it will be a good boost for GE’s share

GE announced Sunday it had signed “principles of co-operation” to add up to 14 gigawatts of power generation capacity, with 1.5 GW set to come online as soon as next year. Siemens said Monday it had entered into a “memorandum of understanding” to add 11 gigawatts of power generation capacity in four years.

But analysts at JPMorgan called the GE Iraq deal a “vague collection” of conversions, services and upgrades, mainly of low-margin steam turbines, with projects involving the advanced H-frame gas turbines yet to be decided.

In addition to the deal’s terms, the language of GE’s statement was “vague” while that of Siemens was “more firm,” JPMorgan analyst Steven Tusa said in a note Monday, noting both involved “unrelated throw-ins” like water treatment units.

“It appears GE does not have entitlement to the large frame turbines, despite a rich legacy of installed base in Iraq, and despite the well-publicized intervention of the U.S. government,” he wrote.

“GE signed an agreement with the Government of Iraq on a comprehensive action plan that is expected to create up to 65,000 jobs, realize annual savings of up to $3 billion, and provide up to 14 GW of power to the Iraqi people by deploying GE’s proven fast power technologies, establishing new power plants, upgrading existing sites, and developing substations and overhead lines across the country,” a GE spokesperson said, responding to the JPMorgan note.

GE Power and its Siemens counterpart will share the deal, worth an estimated $15 billion. The news comes as a big blow to Germany’s Siemens, which appeared poised to secure the contract until the U.S. reportedly pressured Iraqi officials of behalf of GE’s power unit, reminding them of thousands of American war deaths since 2003.

“We received key offers from Siemens and then General Electric to revamp Iraq’s power sector … the pressure by the Americans was heavy,” an Iraqi official told Reuters on Sunday.

- Oct 15, 2018

Barclays Analyst Defends His Optimism on GE Stock

Barclays Analyst Defends His Optimism on GE Stock

General Electric ’s (GE) new CEO, Larry Culp, has plenty of fans on the Street, and Barclays argues that other bearish concerns about the stock look overblown.

Where we’re headed: The firm argues that other complaints about GE shares won’t be enough to sink the stock.

Just over a week after GE named its new CEO, Barclays’ Julian Mitchell upgraded the stock, writing that new leadership was just one of the factors making him more bullish on the shares (and he was hardly the only one brimming with enthusiasm).

Yet GE is a stock that inspires a lot of strong opinions among investors and analysts, so it isn’t surprising that he got some pushback from his call. On Monday, he tried to address these points, while maintaining an Overweight rating and $16 price target on GE.

Mitchell writes that the concerns he heard about his upgrade largely fell into two camps. First, the fact that many of GE’s assets are actually liabilities, and liabilities are much larger than the company and some investors think. He admits that that’s an understandable position to take, given GE’s complex balance sheet and the “shocking magnitude” of the company’s miscalculations. Nonetheless, he writes that there are plenty of examples where companies have seen their net-debt-to-EBIDTA (earnings before interest, taxes, depreciation and amortization) become “’swollen’ by unwanted guests when the share price is under pressure, and these visitors somehow disappear from calculations once conditions improve.”

The second major concern is the seemingly bleak future for GE Power. He writes that Power certainly “is not thriving” but doesn’t see a whole lot of downside left after $7 billion of EBIT has “evaporated,” free cash flow is very negative, GE has announced a write-down of more than $20 billion, and as much as one-third of its head count could be cut.

In addition, a dividend cut and equity raise could trigger selling, but Mitchell sees this pressure as short lived, and other stock resets in his coverage—like Dover (DOV) and Fortive (FTV)—didn’t play out as badly as bears predicted. As for the deferral of third-quarter earnings, he believes that this increases the likelihood that Culp will be able to provide more insight into GE’s future, rather than just retreading what’s happened before him, although he admits that the news created some selling pressure on the shares).

- Oct.12, 2018 – GE Delays Release of Quarterly Results Until Oct. 30

New CEO Larry Culp needs more time to ‘complete initial business reviews and site visits’. Analysts were surprised by Friday’s delay and left open the possibility that there could be an unknown issue or a pending asset sale. The company is telling investors that the delay is related to Mr. Culp’s travel schedule as he is reviewing GE businesses.

GE’s share dropped by 3& due to this delay.

- Oct. 11, 2018

Why GE Shareholders May Be in for an Even Wilder Ride

Larry Culp Has a Long Road Ahead to Fix GE

- Oct 10, 2018 – great technology innovation

GE reveals new inspection technology for wind turbines

GE Renewable Energy has announced details of a high-speed blade inspection system for wind turbines. In a statement Tuesday, the firm said that over 1,500 turbines had already been inspected using the technology, with inspection time per unit taking under 15 minutes, on average. The new system uses thermal imaging technology and wide band acoustic spectral analysis to look for anomalies on blades. It works on both GE and non-GE turbines and can provide real time data analytics.

- Oct 09, 2018 – GE Stock Has Room to Rise, Analyst Says

Where we were: GE named former Danaher (DHR) CEO Larry Culp to the top job, a move that brought plenty of accolades.

Where we’re headed: New leadership and a goodwill write-down are positive steps in GE’s turnaround, one that could change how investors value the stock.

GE’s turnaround consists of three phases, which it’s largely already plodded through: restoring liquidity (via $20 billion in planned asset sales), reducing risk (via debt reduction, litigation resolution, and improving pension funding), and returning to growth (on track for 2019 and beyond). Heymann argues that Culp’s leadership—along with the write-down of $23 billion of goodwill at GE Power—is “likely to be the final of three chapters in GE’s transformation announcements,” following the company’s dividend cut and portfolio “reshaping.”

He writes that Culp’s “exceptional reputation,” along with a contract that motivates him to improve GE’s stock performance, will help shift investors’ focus and lead them to value GE on a sum-of-the-parts (SOTP) basis, rather than on near-term adjusted earnings per share, free-cash-flow generation, and/or dividend yield and sustainability, as has been the case recently.

Heymann’s SOTP analysis assumes no value for GE Power, but still puts the stock between 7% and 23% above recent levels, from $14.60 to $16.78 a share. “While GE may write down potentially all of the $23 billion in goodwill at the Power business, this would suggest Power’s estimated book value at year-end 2017 was approximately $48 billion, or approximately $5.52 a share,” he writes.

Assuming GE were worth $48 billion in book value, that could put GE’s SOTP valuation around $20.10 to $22.30 a share. In addition, if GE were to sell a large minority stake in GE Digital for $10 billion, Heymann writes, that would get the stock to $21.25 to $23.45, while “assigning no value to GE’s second half 2018 or 2019 adjusted EPS or free cash flow.”

- Oct 06, 2018 – Can Larry Culp Fix GE?

The company’s first outsider CEO ever brings with him a management philosophy from the little-known, highly successful conglomerate Danaher. He’s got big problems to solve.

The new boss didn’t have an ID badge or a work computer, but he wasted little time in addressing GE’s top 150 executives from the Boston headquarters. A few days later, he jumped on a flight to visit the Atlanta offices of GE’s power business, whose troubles forced the company to slash its dividend and financial targets, erasing more than $100 billion in market value.

The arrival of Mr. Culp didn’t just install the first outsider in GE’s 126-year history—it also ushered in a new management philosophy that has guided his every move since he became CEO of Danaher Corp. at age 37. The strategy has developed a cult-like following, largely because Danaher used it to buy a string of companies, boost profits and richly reward shareholders.

The structure of Danaher is almost an upside-down version of GE. While it is a conglomerate, it doesn’t use the GE-style corporate umbrella to derive value from those businesses. Danaher has about 200 of its 67,000 workers in corporate functions.

One of the core principles of GE under former CEO Jeff Immelt was that different business units like power, aviation and healthcare benefited from access to the “GE Store” for shared research and technology. There was management training at the Crotonville, N.Y., leadership academy, research centers employing thousands of scientists and engineers in Germany and China, and global finance and sales teams.

Danaher’s top executives are skeptical that conducting research across different divisions has any real value, according to people familiar with their thinking. Increased efficiency—by cutting inventory and improving manufacturing process—reduces the amount of working capital tied up in the company, allowing that cash to be used for growing the business.

The company is so committed to eliminating waste that it wouldn’t be surprising for hour-long meetings to be stopped halfway through to discuss whether the next 30 minutes were necessary, said Paul Leinwand, a principal at PwC’s global strategy business and co-author of “Strategy That Works: How Winning Companies Close the Strategy-to-Execution Gap,” which focused in part on Danaher.

- Oct 4, 2018 – Big incentive for this new CEO.

GE Is Making a $300 Million Bet on Its New CEO. Larry Culp’s compensation could soar, if stock price reaches certain thresholds.

Those awards will consist of “performance share units,” which typically vary based on corporate financial and operational measures over time.

The big payoff, however, will come if GE’s shares rise at least 50% and stay there on average over 30 trading days between now and 2022, the filing shows. GE confirmed that the increase will be calculated from a 30-day average price ending just before Mr. Culp’s Oct. 1 start date.

A 50% rise would push GE’s share price to $18.60 and bring Mr. Culp 2.5 million shares, which—at those prices—would be worth about $46.5 million. If the share price rises at least 150% for 30 trading days—to about $31 a share—Mr. Culp would receive 7.5 million shares, or $232.5 million at that price.

Reaching that threshold would bring Mr. Culp 2.5 million shares, which—at those prices—would be worth just over $45 million.

If the share price rises at least 150% and holds that level —at about $30 a share—for 30 trading days, Mr. Culp would receive 7.5 million shares, or $227 million at that price.

As for Culp’s next moves, Dray hypothesizes that, as GE’s first outside CEO, he will want to assemble his own team. (Flannery was handpicked by longtime GE head Jeff Immelt, whom many blame for the company’s long fall from grace.) That may include Danaher’s long-serving Chief Financial Officer Dan Comas, as it’s “unlikely a coincidence” that he recently stepped down from his position. “We would also anticipate seeing some senior-level departures at GE as part of this management shake-up,” Dray adds.

Melius Research’s Scott Davis agrees, writing that Culp “needs to clean house, and fast,” considering all the legacy executives still at the company.

The most important change, in his opinion, is improving communication, given how poorly GE has executed on this front, including with the recent CEO news and its goodwill impairment warning. “We can’t remember a time where a CEO change did not come with a public conference call and we can’t recall a time where an impairment didn’t come with granularity,” Davis notes.

Culp’s next orders of business, he argues, include fixing GE Power and GE’s balance sheet, raising the company’s cash flow, cutting complexity, slashing corporate costs to Danaher levels, and creating “a culture of honesty.” That’s a long list, but at least it comes from a friendly source: Davis reiterated an Accumulate rating and $27 price target on GE stock.

- GE Will Spin Off Health-Care Business in Latest Revamp: General Electric Co. GE +7.02% will spin off its health-care business and shed its ownership in oil-services company Baker Hughes , BHGE +1.17% betting that the once-sprawling conglomerate can reverse a painful slump by further shrinking.GE said it plans to reduce the net debt of its core industrial business by about $25 billion by 2020. GE also said Tuesday it had entered a $20 billion credit facility with several banks, extending through 2020 an arrangement established earlier this year. The company said it would maintain its quarterly dividend until the health-care business is separated.Credit analysts at S&P warned Tuesday they may downgrade GE, which had more than $100 billion in net debt last quarter. S&P applauded GE’s restructuring plans and decision to reduce its debt, but it said the loss of health care “reduced diversity and cash flow.” A one-notch downgrade to A- is possible, S&P said.

- What GE’s Latest Moves Mean for Investors

- July 26, 2018 – GE’s Profit Falls as Power Division Remains a Drag

Chief executive says the company saw continued strength across segments including aviation and health care - April 20, 2018 – JP Morgan Tusa’s bearish view on GE, all detailed fundamentals – I should have reviewed more carefully before I invest

Analyst maintains ‘sell’ on GE despite earnings beat. Here’s why from CNBC.

why not banrkrupt?