Here are some news on VIX

- 12/19/2019 – there is a big VIX call options to bet on jump of VIX. What instrument that I should use to bet, UVXY? or buy put on SVXY? One SA article said it is a bad idea to bet on UVXY, especially in the long run. Can I buy a one month UVXY?

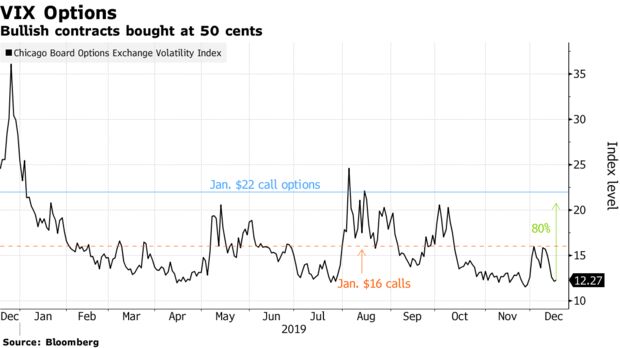

Big VIX Call Options Trade Suggests Re-Emergence of ‘50 Cent’

Someone snapped up roughly 130,000 January $22 calls on the index for about 50 cents each Tuesday, contracts that would pay off if the volatility gauge almost doubles from its current level. The trade came as the S&P 500 Index climbed toward a record for the fourth session in a row and the VIX, which tracks the 30-day implied volatility for stocks in the benchmark gauge, hovered near its lowest level of the year.

The familiar price point for buying VIX calls “will certainly lead to investors believing ‘50 Cent’ is back,” Chris Murphy, the co-head of derivatives strategy at Susquehanna Susquehanna Financial Group, said in a research note.

there are potential catalysts on the horizon, including the partial U.S.-China trade deal falling apart or negative headlines coming out of the World Economic Forum at Davos (Jan 21 ~24, 2020), according to Murphy. The options set to expire on Jan. 22 could also be used to protect around some headlines heading into Brexit or simply be taking advantage of the recent pullback in volatility, he said.

SA article: UVXY: It’s Still A Bad Buy

- UVXY is following an index which has a proven track record of destroying wealth.

- The methodology which UVXY leverages has fallen by a rate of about 50% per year for the last decade.

- The forward curve would suggest that we will likely see UVXY drop by about 5-9% per month simply due to roll yield – before any volatility in the VIX itself.

- 10/26/2019 – today’s VIX is 12.65, probably good time (before year end) to buy

Big VIX Options Trade Braces for 2008-Like Volatility Surge – Bloomberg

Trading in call options on the Cboe Volatility Index, known as the VIX, outweighed puts

by more than 2-to-1 on Friday with the index at its lowest level since July as stocks

rallied. The standout trade was one block of 50,000 April $65 calls that were bought for

10 cents. Those contracts would imply a surge in the VIX of almost 500% from its

current level.

While the magnitude of the strike price is remarkable, Macro Risk Advisors derivatives

strategist Maxwell Grinacoff said the April expiration date is even more interesting. That

time frame could capture the impact of a potential recession, a breakdown in U.S.-

China trade talks and a variety of political risks linked to the Democratic presidential

primary and impeachment proceedings against Donald Trump, he said in an interview

- 12/02/2018 – 15 Most Volatile ETFs

All of these products are designed for quick trades. Holding them too long can result in poor performance due to the performance drag of daily rebalancing.

Stalled negotiations threaten to undermine meeting between Trump and Xi next month

- 10/24/2018- This might affect VIX in March 2019

A Hard Brexit Is Looking More and More Like a Big Mess

- Sept.20, 2018

- Be aware that UVYX and SVXY reversed split on Sept. 18, 2018.

- Sept. 14, 2018

- VIX Options Volume Soars as Someone Bets Big on Volatility SpikeThe VIX fell to 12.37 on Thursday. It’s down more than 66 percent from its Feb. 5 peak. One options investor seems to be positioning for a 62 percent surge into November.

Total VIX options volume spiked to more than double the 20-day average as one investor bought approximately 76,000 November $20 calls while simultaneously selling the same amount of November $26 calls and approximately 95,000 October $13 puts.

Comment: it seems like this investor is betting on volatility jumps in Nov. mid-election. I have also placed another UVXY bet on Jan 2020 $7 call options.

- this is a great company to help research VIX: MACRO RISK ADVISORS

- VIX Options Volume Soars as Someone Bets Big on Volatility SpikeThe VIX fell to 12.37 on Thursday. It’s down more than 66 percent from its Feb. 5 peak. One options investor seems to be positioning for a 62 percent surge into November.

- Feb 09, 2018 – Inverse Volatility Products Almost Worked

And people like them so much they keep coming back for more. Here is the detailed study of how it worked. (Inverse Vol Products Worked)