Study of clean energy stocks

- 11/25/2020 – demand is increasing, cost is dropping, Green energy is booming

Big Oil’s Lessons for the New Green Supermajors

Once humble utility companies, Enel and Iberdrola have emerged as global clean-energy giants

The decline of oil-and-gas supermajors over the past two years has been matched by the rise of previously obscure utility companies. In Europe, Enel ENEL 0.82% and Iberdrola IBDRY 0.75% have emerged as green-energy giants, in part by taking leaves out of the big-oil playbook.

Why Investors Have Learned to Love Wind and Solar Power

Renewable energy has become cheap and now offers investors utility-like returns

After a stormy, dependent youth, the wind-and-solar-energy industries have matured into boring, profitable middle age. This year’s plunging interest rates make that a more appealing proposition than ever for investors.

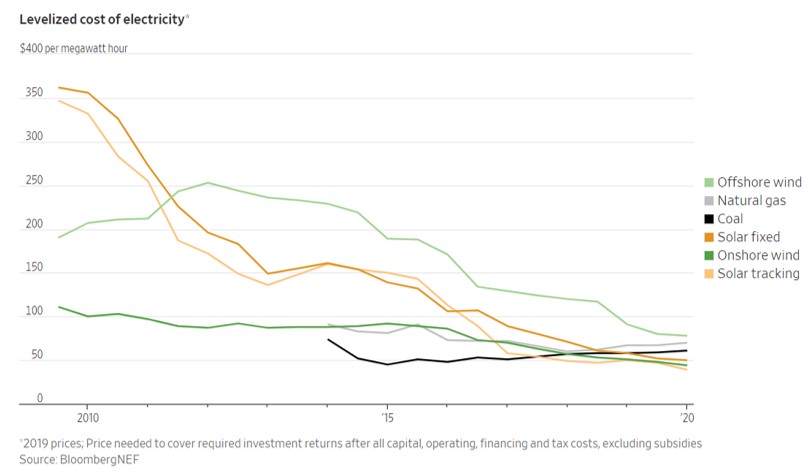

Wind turbines and solar panels, which once proliferated thanks to government handouts, now produce energy more cheaply than coal and natural gas. Chinese manufacturers sell solar panels at a fifth of the price a decade ago. Bigger wind turbines and better installation methods have halved their cost. These developments tripped up a previous generation of green-minded investors, but look to have run their course.

Subsidies now mostly focus on upgrading the distribution infrastructure. Wind and solar are intermittent, but can provide a constant flow of electricity in combination with storage—batteries or hydro—or gas.

Governments run auctions to gather electricity prices from potential suppliers. The winner has the right to build and signs a long-term contract to sell power at the bid price. Unsubsidized renewables are routinely at least as cheap as fossil fuels. Google, Walmart, Amazon and other big corporations also have been signing power-purchase agreements directly with clean-energy producers.

After contracts end, producers sell the power into the local market. The risk that open-market prices drop seems slight given the inexorable rise of energy usage. Demand for power and projects has been relatively resilient during the Covid-19 crisis, though some installations have been delayed. Long-term, economic growth in the developing world is expected to buoy demand.

- 11/25/2020 – is it really the future or just day dreams

Elon Musk, Fuel Tech (FTEK) stock, FuelCell, Plug Power, CLNE and more: Green energy roundup

The “Green” energy trade is once again top of mind, with trading volumes and volatility capturing the market’s attention.

But it’s not just the Fuel Tech (NASDAQ:FTEK) type names, which doubled yesterday and are on track again to double today — more than week after it nearly doubled following earnings results that beat expectations. There’s more ‘mainstream’ news drawing attention to the space.

- Elon Musk, the Tesla (NASDAQ:TSLA) CEO, became the second-richest person in the world, passing Bill Gates for the honor, and now sits only behind Amazon CEO Jeff Bezos in his net worth, even though he must still exercise his options. The development occurred after Tesla added to last week’s S&P 500 inclusion-related gains, rising to a new all-time high Monday. The electric vehicle’s market cap is now above $500 billion.

- In other alternative energy related moves, Clean Energy (NASDAQ:CLNE) is up another 15% after Monday’s 25% gains.

- Other standouts include FuelCell Energy (NASDAQ:FCEL), up 16% in Tuesday trading, bringing the month’s gains to over 280% and the year to well over 1000%. Check out the performance here.

- Plug Power (NASDAQ:PLUG) earlier announced that it had raised $1 billion in capital in efforts to expand its hydrogen facilities in the U.S.

- It’s unclear to what extent the move in these names is related to short sellers unwinding their positions. Plug Power’s most recent short interest figure sits at 15%, while FuelCell remains a touch higher, at 17%. Tesla had long been among the most shorted names in megacaps, though the percent short has declined in recent months. Nevertheless, 6.3% of the stock is still sold short.

- Read more: Electric vehicle names head higher led by Kandi (NASDAQ:KNDI) stock, Ayro, and Li Auto