Good recap of GSE story – Part III

- 06/23/2021 – GSE trade is over – from Todd

Supreme Court to GSE Shareholders… “It’s Over”

9 months to the day I announced my GSE stocks sale and was lambasted online for “selling on the eve of a SCOTUS victory”, SCOTUS finally weighs in.

Their answer?

It’s Over.

Some shareholders are hanging their hat on the remand to the 5th Circuit on the constitutionality of the FHFA single head director. Their thought process is that this will then make the actions of FHFA illegal. Justice Thomas commented on that:

I seriously doubt that the shareholders can demonstrate that any relevant action by an FHFA Director violated the Constitution. And, absent an unlawful act, the shareholders are not entitled to a remedy

Yeah…. it should be noted on the remedy (damages) portion of the ruling the justices were completely aligned. So, play this out. Let’s pretend the lowed court does in fact rule for damages for shareholders. The Fed will surely appeal to SCOTUS which has already said they do not believe monetary damages are warranted here unless shareholders can prove the actions of FHFA were illegal or against the wishes of the administration. The justices explicitly said they believe neither to be the case here.

Did FHFA “preserve and protect” the GSE’s? The court says emphatically that since the GSE’s continually operated, are profitable, and are still the cornerstone of the US housing market, YES, they did. The court ruled that there is nothing in the regulations saying that the GSE’s were to be operated for the benefit of shareholders. Since the GSE’s are still performing their essential functions, they were in no doubt “preserved”.

The shareholders’ characterization of the third amendment as a step toward liquidation is inaccurate. Nothing about the amendment precluded the companies from operating at full steam in the marketplace, and all the available evidence suggests that they did so. Between 2012 and 2016 alone, the companies “collectively purchased at least 11 mil- lion mortgages on single-family owner-occupied properties, and Fannie issued over $1.5 trillion in single family mortgage-backed securities.” Perry Capital, 864 F. 3d, at 602

During that time, the companies amassed over $200 billion in net worth and, as of November 2020, Fannie Mae’s mortgage portfolio had grown to $163 billion and Freddie Mac’s to $193 billion.14 This evidence does not suggest that the companies were in the process of winding down their affairs.

It is not necessary for us to decide and we do not decide whether the FHFA made the best, or even a particularly good, business decision when it adopted the third amendment. Instead, we conclude only that under the terms of the Recovery Act, the FHFA did not exceed its authority as a conservator, and therefore the anti-injunction clause bars the shareholders’ statutory claim.

So, there will be no damages….

So then what happens to the GSE’s and shareholders? Flash forward 5 years, my bet would be shareholders are in the exact same position.

The full annotated (PDF) of the decision can be founds here

- 01/19/2021 – Bradford’s great recap of GSE’s release and privatization process – still continued

After this past week, I wanted to finally put together a listing of everything I’ve done here just to try to see what it looks like. In the past seven years, I have written 212 published articles on Seeking Alpha alone. I’ve been wrong an awful lot about what I thought was about to happen in the past 7 years and I have the record to prove it. Even though I have been wrong about timing, the net worth sweep HAS stopped cash payments from going to Treasury now and the US Treasury has a commitment to restructure the equity so that they can raise money and there are a host of other telling preconditions in place. We are so much further along than we ever have been before but if you looked at the price you wouldn’t have any idea. I figure there can be an equity offering in Q4 2021.

- 01/19/2021 – Supreme court might decide the fate of GSE in May. Yellen might not do anything

Shareholders of Fannie Mae, Freddie Mac will be ‘vindicated’ in May: ACG Analytics managing partner

Jan. 19, 2021 – 4:04 – ACG Analytics managing partner David Metzner on the future of Fannie Mae and Freddie Mac during the Biden

- 01/14/2021 – Todd is right again, GSE release is stalled or at least prolonged for uncertain time. NWS is ended, but no agreement on JPS and no write down on SPS. So no foreseen future for JPS.

Fannie Mae, Freddie Mac can keep future earnings, per agreement between Treasury and regulators

The Federal Housing Finance Agency and the Treasury Department have reached an agreement that will allow Fannie Mae FNMA, and Freddie Mac FMCC, -0.51% to keep their earnings for the foreseeable future.

The FHFA and Treasury agreed to amend the preferred stock purchase agreements for the shares in the two enterprises that the federal government continues to hold following the Great Recession. The amendments will let Fannie and Freddie retain all earnings until they have reached the requirements set by FHFA’s new capital rule issued late last year. Under that rule, the two mortgage giants would have been required to hold $283 billion in unadjusted total capital as of June 30, 2020, based on their assets at the time.

from FHFA: FHFA and Treasury Allow Fannie Mae and Freddie Mac to Continue to Retain Earnings FOR IMMEDIATE RELEASE, 1/14/2021

Washington, D.C. – The Federal Housing Finance Agency (FHFA) and the U.S. Department of the Treasury (Treasury) today announced amendments to the Preferred Stock Purchase Agreements (PSPAs). The amendments allow Fannie Mae and Freddie Mac (the Enterprises) to continue to retain earnings until they satisfy the requirements of the 2020 Enterprise capital rule.

“Today’s agreement that allows Fannie Mae and Freddie Mac to continue retaining earnings is a step in the right direction, but more hard work remains,” said FHFA Director Mark Calabria. “Capital at Fannie Mae and Freddie Mac protects the housing finance system and taxpayers. Retained earnings alone are insufficient to adequately capitalize the Enterprises. Until the Enterprises can raise private capital, they are at risk of failing in the next housing crisis.”

Additionally, Treasury has agreed that the Enterprises can raise private capital and exit conservatorship once certain conditions are met. To facilitate Enterprise equity offerings, Treasury has committed to work to restructure its investment in each Enterprise.

from Treasury (BlueprintonNextStepsforGSEReform)

- 01/14/2021 – there might be no big bang or mid bang for prefs. Mnuchin is too weak to make tough decision. GSE’s story will drag another decade?

Trump Team’s Final Act on Fannie-Freddie Leaves Fates to Biden

-

Mnuchin plans to let mortgage giants hold much more capital

- Treasury opposes reducing $220 billion U.S. stake in companies

The Trump administration is poised to unveil last-minute changes to Fannie Mae and Freddie Mac that would allow the mortgage giants to retain significantly more capital, while leaving many of the thorniest issues on releasing the companies from federal control to President-elect Joe Biden, said four people familiar with the matter.

The revisions — expected to be announced as soon as Thursday — would modify the contracts that govern taxpayers’ backstopping of Fannie and Freddie. They fall far short of freeing the companies from their government conservatorships, something Treasury Secretary Steven Mnuchin vowed to accomplish after President Donald Trump’s 2016 election win.

Treasury Department officials have already started briefing lawmakers on the tweaks, which are the result of an agreement between Mnuchin’s agency and the Federal Housing Finance Agency — Fannie and Freddie’s regulator. While the revisions have been presented as if a deal has been finalized, they could still change before they are publicly released.

The actions will lock-in several policies the companies are already subject to under FHFA Director Mark Calabria, said the people who asked not to be named to discuss the matter before the changes are announced. They include ensuring big lenders don’t get advantages unavailable to smaller ones when doing business with Fannie and Freddie and limiting the amount of higher-risk mortgages that the companies can guarantee.

Most significant, Fannie and Freddie won’t have to pay their profits to the government until they have much bigger capital buffers to protect the companies against losses. Right now, Fannie and Freddie combined can’t hold more than $45 billion in capital, after which they must pay their entire net worths to the U.S. Treasury.

Controversial Policy

People briefed on the plans said it wasn’t clear how much capital the companies will be permitted to keep but said the changes were framed as an end to the so-called net-worth sweep, a controversial policy implemented during the Obama administration that requires they send their earnings to the Treasury.

However, Treasury opposes reducing the government’s ownership stake in Fannie and Freddie, a longtime goal of the companies’ private shareholders. Whether to modify the Treasury’s senior preferred stake is under consideration at the White House, said one person familiar with the matter. If Treasury’s position holds, Biden will be guaranteed a strong say in the companies’ futures. Unlike the current White House, the incoming administration is seen to be in no hurry to re-privatize the companies, the people said.

A Treasury spokeswoman declined to comment, while an FHFA spokesman had no immediate comment.

Fannie and Freddie don’t make mortgages. They buy them from lenders, wrap them into securities and guarantee to investors the repayment of principal and interest. The government took them over in 2008, as billions in loans soured during the financial crisis, eventually injecting them with $187.5 billion in bailout money.

Since then, two presidential administrations and Congress have tried and failed to replace Fannie and Freddie with a new housing-finance system. Most recently, Calabria has vowed to lead the companies out of conservatorship, rapidly publishing new rules for the companies on products, capital and liquidity, while setting prerequisites for leaving government control.

Calabria’s Push

In recent months, Calabria tried to garner support for releasing Fannie and Freddie before they have built up large capital cushions, an effort meant to lock-in their eventual release before Biden took the reins. That push ended up being a bridge too far for Mnuchin.

Calabria won’t have to leave after Biden is sworn in because he is serving out a term that extends into 2024. That said, Biden would likely seek to replace the FHFA chief if he tries to quickly release the companies or put them into receivership, people familiar with the matter have said.

With the agreement, the Treasury and FHFA plan to set out recommendations for what needs to happen before Fannie and Freddie are freed. But the suggestions won’t be binding for Biden’s Treasury, the people said. That means the changes effectively amount to a blueprint for eventually making Fannie and Freddie fully privatized companies.

One of the thorniest issues that Treasury intends to leave unresolved will be the government’s stake in Fannie and Freddie, a position that now exceeds $220 billion in senior preferred shares as well as warrants to acquire nearly 80% of the companies’ common stock.

Private shareholders of Fannie and Freddie, including hedge funds, have desperately hoped that the Trump administration would at least reduce its stake. That would allow investors to again receive dividends or mitigate how much they would be diluted if the companies raise capital in the private market.

Pending Case

Shareholders have also sought redress in the courts, claiming the 2012 decision by the Obama administration to sweep nearly all of Fannie and Freddie’s profits was illegal. The Supreme Court heard that case in December and legal analysts expect them to issue a ruling this year.

The same case could determine what happens to Calabria, who is an independent regulator insulated from the White House. The Supreme Court could decide that Biden should be allowed to fire Calabria at any time for any reason, further jeopardizing efforts to release the companies.

- 01/11/2021 – “PSPA amendment light” might come

from Charles Gasparino

SCOOP (1 of 3): With

@stevenmnuchin1

back home people close to him say he will take up the thorny issue of GSE reform this week. His plan is fluid but if announced it will lay out guidelines to recap $FNMA $FMCC. Bankers w knowledge of his efforts tell me don’t expect too much

(2 of 3) from this effort beyond broad strokes of recap and release. The issues that are being followed closely by preferred shareholders wont be completely dealt with, I am told. As reported, holders of preferred want a negotiated settlement as part of their lawsuit.

(3 of 3) A spokesman for Treasury had no immediate comment. As always, the situation is fluid given the likely impeachment of Trump

- 01/08/2021 – Mnuchin might not have enough time to finish this, too bad

Are Treasury, FHFA running out of time to approve GSE capital boost?

GSE reform

Are Treasury, FHFA running out of time to approve GSE capital boost?

By Hannah Lang January 08, 2021, 1:57 p.m. EST 6 Min Read

WASHINGTON — With less than two weeks remaining in the Trump administration, the Federal Housing Finance Agency and Treasury Department are nearing the deadline to allow Fannie Mae and Freddie Mac to retain more or all of their earnings.

FHFA Director Mark Calabria has identified removing the cap on Fannie and Freddie’s capital as a major step toward re-privatizing the mortgage giants. Officials estimate the companies need a capital cushion of roughly $275 billion — much higher than they are allowed to hold — in order to exit conservatorship.

Raising or removing the cap on retained earnings would require amending the stock agreements governing the FHFA and Treasury’s oversight of the government-sponsored enterprises. But with Calabria’s job security on shaky ground and Treasury Secretary Steven Mnuchin set to depart when President-elect Joe Biden is sworn in, the window may be closing.

It’s also not clear that Calabria and Mnuchin entirely agree on how to revise the agreements.

“Director Calabria is in kind of a tough situation because he can’t do anything unilaterally,” said Ted Tozer, senior fellow at the Milken Institute and former president of Ginnie Mae.

Treasury Secretary Steven Mnuchin has said that he supports changing the terms of the government’s ownership of the companies to allow them to hold more capital. But it remains to be seen if he will ultimately sign off on the change in the last few days of the Trump administration.

Treasury Secretary Steven Mnuchin has said that he supports changing the terms of the government’s ownership of the companies to allow them to hold more capital. But it remains to be seen if he will ultimately sign off on the change in the last few days of the Trump administration. Bloomberg News

The preferred stock purchase agreements, or PSPAs, lay out the government’s ownership of the two GSEs. They were last amended in 2019 to allow the mortgage giants to hold onto a combined $45 billion in capital, but that is a far cry from the amount the companies will need to hold when privatized.

Mnuchin has said that he supports changing the terms of the government’s ownership of the companies to allow them to hold more capital. But it remains to be seen if he will ultimately sign off on the change in the last few days of the Trump administration. It’s also unclear if Biden’s pick for Treasury secretary — former Federal Reserve Chair Janet Yellen — would be willing to sign onto an agreement allowing the GSEs to retain their earnings.

“The PSPA has got to be amended by both sides,” Tozer said. “I would think if something didn’t come out in the next few days, it’s going to go to the Biden administration on what to do.”

After the FHFA issued a final rule in November imposing higher capital requirements for Fannie and Freddie to take effect once the companies exit their federal conservatorships, senior officials at the agency said the next step would be to amend the PSPAs to allow the GSEs to work toward building the capital that would be needed to meet those requirements.

Many still believe that Treasury and FHFA are likely to come to an agreement before Jan. 20 that would allow Fannie and Freddie to hold more capital, but doubt that it will be as sweeping as some originally thought.

“Something remains likely to happen. No one really knows what that is, and the expectation that it was going to be something monumental was probably overblown,” said Ed Mills, a policy analyst with Raymond James. “It is likely to be less impactful than initially hoped for by those who wanted a big action.”

The Trump administration’s housing finance reform blueprint released last year made recommendations for amending the PSPAs. For example, the plan calls for preserving a periodic commitment fee that Fannie and Freddie pay the government for its backing.

Calabria also at one point expressed support for amending the PSPAs to codify some of the regulatory and supervisory changes made to the GSEs during conservatorship.

But there may not be enough time to negotiate significant revisions to the agreements before the change in administration, experts say.

“The problem with Treasury right now is that they’re doing 800 things with only a handful of people. I don’t know how you’re going to get these guys to prioritize this given that any amendment will impact the secondary market in some way — and it could be received negatively,” said Tim Rood, the head of industry relations at SitusAMC. “That’s why I think it’s going to be the broader strokes.”

Mills agreed. He said that although Mnuchin and Calabria are likely to come to some agreement, he is skeptical that any agreement would address the payments that Fannie and Freddie have been making to the Treasury for years in an effort to repay the government for the 2008 bailout.

“The most likely change is to recognize the fact that there is a capital rule that’s been finalized, and harmonize the PSPA with the updated capital rule, which would allow them to retain more capital and set a path toward meeting those capital requirements,” Mills said.

A revision of the PSPAs could also be held up over determining the amount of dividends Fannie and Freddie pay Treasury as a primary investor, said Tozer.

“Now that they’re profitable, I think those are all things we’ve got to talk about: stopping the sweep so they can build capital, but then also highly compensate the U.S. taxpayer for their investment, and I’m hoping that’s what’s going on now,” he said.

Tozer added that he didn’t think Treasury and the FHFA could allow the GSEs to retain wider capital cushions without answering the dividend question.

“It gets tricky, because at that point, I would think there could be some legal challenges,” he said. “I would think that that could open up a lot of court challenges of saying the taxpayer has been basically shortchanged.”

Some speculate that a holdup on changing the PSPAs could be due to Mnuchin’s busy schedule. He traveled to the Middle East this week and was the Trump administration’s point man in negotiating the most recent congressional stimulus package.

“Mnuchin’s portfolio is the largest, most diverse portfolio of any Treasury secretary in the modern era, maybe ever, and so, he is pulled in many different directions,” said Mills. “Because of how diverse his portfolio is, he has limited bandwidth to do much beyond what is the immediate most pressing item.”

The Treasury Department did not respond to a request for comment.

Though the administration has made clear its goal of accomplishing comprehensive housing finance reform, overhauling the GSEs has been less pressing than other agenda items on Mnuchin’s plate the last four years.

Mnuchin even told reporters in December that he felt as though GSE reform was “the one area I feel like we didn’t make enough progress.”

“My concern right now is that Secretary Mnuchin has been completely overwhelmed with this COVID package and is dealing with all these issues, so I wonder if because of that” a PSPA agreement “is on the back burner,” said Tozer.

But with the incoming Biden administration likely to bring different priorities for Fannie and Freddie, Calabria and Mnuchin now face urgency to come to an agreement in the next two weeks, said Rood.

“I don’t think Calabria or Mnuchin want to chance leaving the PSPAs to the new administration, but it comes down to what are they willing to risk for that insurance,” he said.

While Yellen is likely to focus on more domestic issues than Mnuchin has and could lead “significant policy discussions related to housing,” said Mills, her focus will probably lean more toward mortgage credit availability than privatizing the GSES.

“What I would view from a Yellen perspective is that I think she would certainly be very open to continuing a process, but would not be viewed as someone who would be aggressively moving to recap and release,” he said. “I would view her as … first, do no harm to the larger housing market.”

Hannah Lang

Reporter, American Banker

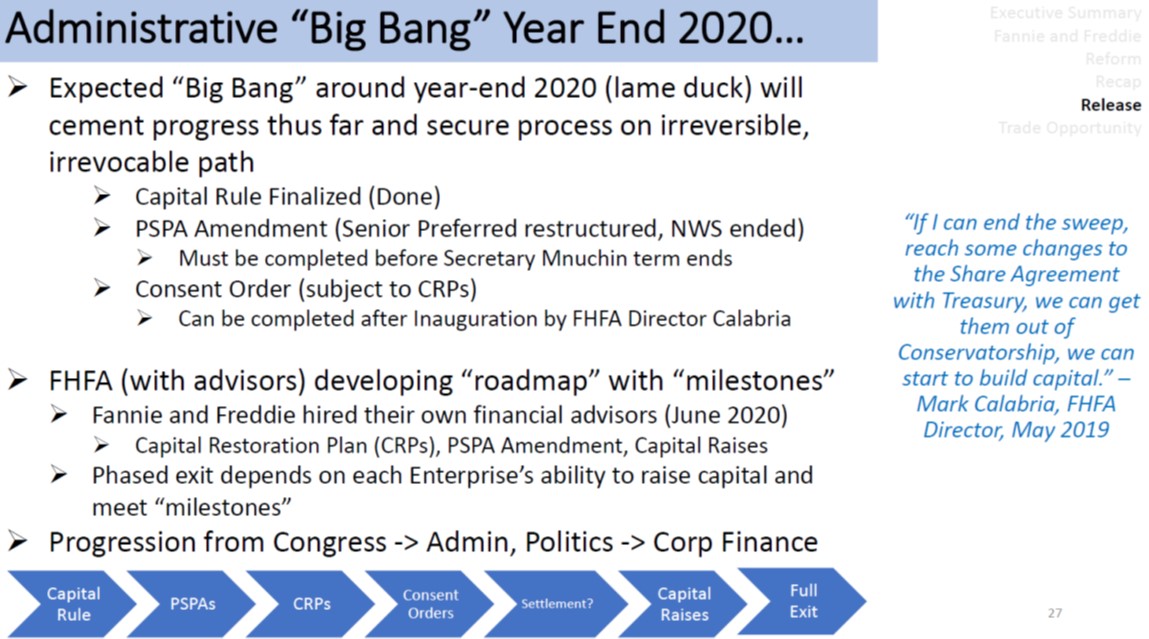

- 12/29/2020 – good argument on reform framework and “Big Bang”, not certain though

This last unfinished business of the Financial Crisis will likely begin with a significant amendment to their original bailout agreements with the US Treasury, followed by years of capital retention and raising to become well-capitalized once again.

James Jacobs GSE Slides – This Time is Different

- 12/27/2020 – crying wolf for so long, cannot believe it will become true

Fannie Mae And Freddie Mac SPSPA Prime Time

- Fannie Mae and Freddie Mac are unable to raise third-party capital without a SPSPA Amendment and are rapidly reaching their capital buffers.

- If not all the preconditions for the SPSPA modification have been met, the vast majority have been. It appears that everything is set for imminent SPSPA modification.

- Tim Pagliara says the largest cash dividend in the history of the world was paid by Fannie Mae to Treasury and recapitalization and release is the right thing to do.

- 12/22/2020 – is it related to release?

FHFA announces proposed rule on living wills for GSEs

Agency wants GSEs to develop a plan to safely unwind from conservatorship

The Federal Housing Finance Agency (FHFA) took another step in its quest to remove Fannie Mae and Freddie Mac from conservatorship on Tuesday, seeking public comment on a rule that would require Fannie Mae and Freddie Mac to develop plans to unwind without negatively affecting the broader financial system.

Should the FHFA be appointed receiver for the government-sponsored entities, the so-called “living wills” would facilitate a rapid and orderly resolution from conservatorship, the agency said Tuesday.

“The rule proposed today is an important step toward a stronger housing finance system,” said Mark Calabria, FHFA director. “Requiring [Fannie Mae and Freddie Mac] to develop living wills helps FHFA fulfill its responsibility to ensure that the failure of either would harm neither taxpayers nor the mortgage market.”

The proposed rule gives the FHFA a tool that supplements its existing statutory authorities, Calabria said, to restructure either Fannie Mae or Freddie Mac if either fail so that the government does not have to put them back into conservatorship.

The rule is similar to the one issued by the Federal Reserve Board and the Federal Deposit Insurance Corporation under the Dodd–Frank Wall Street Reform and Consumer Protection Act, which requires many large financial institutions to submit living wills.

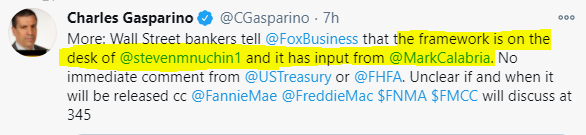

- 12/16/2020 – is 4th PSPA coming very soon?

Wall Street bankers and US Treasury talk reform of Fannie Mae, Freddie Mac: Gasparino

Dec. 16, 2020 – 3:44 – Sources tell FOX Business’ Charlie Gasparino that bankers discussed framework for eventual recap and release of Fannie Mae and Freddie Mac with the Treasury department.

- 12/15/2020 – one hit piece for GSE. If it is true, these two companies will never get released, or at least take forever to be released.

Fannie, Freddie Privatization Decisions Likely to Be Left to Biden Administration

Mnuchin says Treasury is not focused on legal move to privatize Fannie Mae and Freddie Mac before President Trump leaves office

Treasury Secretary Steven Mnuchin suggested in an interview with The Wall Street Journal that he is unlikely to support a legal move—called a consent order—to end the government conservatorships of the mortgage-finance companies before President Trump leaves office. His signoff would be required for any change in their legal status.

“We’re going to not do anything that jeopardizes taxpayers and puts them at additional risk,” Mr. Mnuchin said. “We also want to be careful that we don’t do anything that overnight would limit access to mortgage finance.”

Mark Calabria, the Trump-appointed regulator of the companies, was pushing as recently as last month to speed up the mortgage giants’ exit from government control before Mr. Biden’s inauguration next month. Mr. Calabria wanted the government to take legal steps that the next administration would find difficult to reverse—such as a consent order—but he cannot do so without Mr. Mnuchin’s approval.

- 12/14/2020 – Does this hint that HSE will be released soon? speculation

Fannie Mae is asking key employees to be prepared to work through the holidays as the mortgage giant plots a potential 11th-hour release from government control

By Sean Czarnecki, Alex Morrell, and Rebecca Ungarino

December 14, 2020, Business Insider

Ho-ho-hold off on unplugging for the holidays.

That’s what top Fannie Mae execs are telling key employees as the mortgage giant braces for an update in the coming weeks regarding its bid to exit government conservatorship, according to sources familiar with the matter and internal communications viewed by Business Insider.

- 12/09/2020 – interesting to learn what Supreme Court thinks about this case. Ready to invest back?

Supreme Court to hear Fannie, Freddie case on profit sweep

- The U.S. Supreme Court will consider today whether investors can challenge the 2012 agreements that let the government collect more than $300B in profits from mortgage giants Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC).

- A ruling that favors investors would give them an opportunity to reap a huge settlement.

- “This is an incredibly important case, not just for GSE shareholders but for the broader economy, given its potential to alter the mortgage policy landscape,” said Isaac Boltansky, director of policy research for Compass Point Research & Trading.

- The 90-minute hearing at the court takes place today, but a ruling in the case is scheduled by late June.

- 12/04/2020 – to listen to this on 12/09

Federal Housing Finance Agency Consolidated Oral Arguments

The U.S. Supreme Court hears the consolidated oral arguments in Collins v. Mnuchin, Docket number 19-422 and Mnuchin v. Collins, Docket number 19-563.

- 12/04/2020 – still not clear when it will be released

‘It is just a road that could take several years.’ Prospects for a quick privatization of Fannie Mae and Freddie Mac dim following Mnuchin comments

Published: Dec. 4, 2020 at 11:38 a.m. ET

In an appearance on Capitol Hill this week, Treasury Secretary Steven Mnuchin emphasized that Fannie and Freddie should have ‘appropriate capital’ before ending government control.

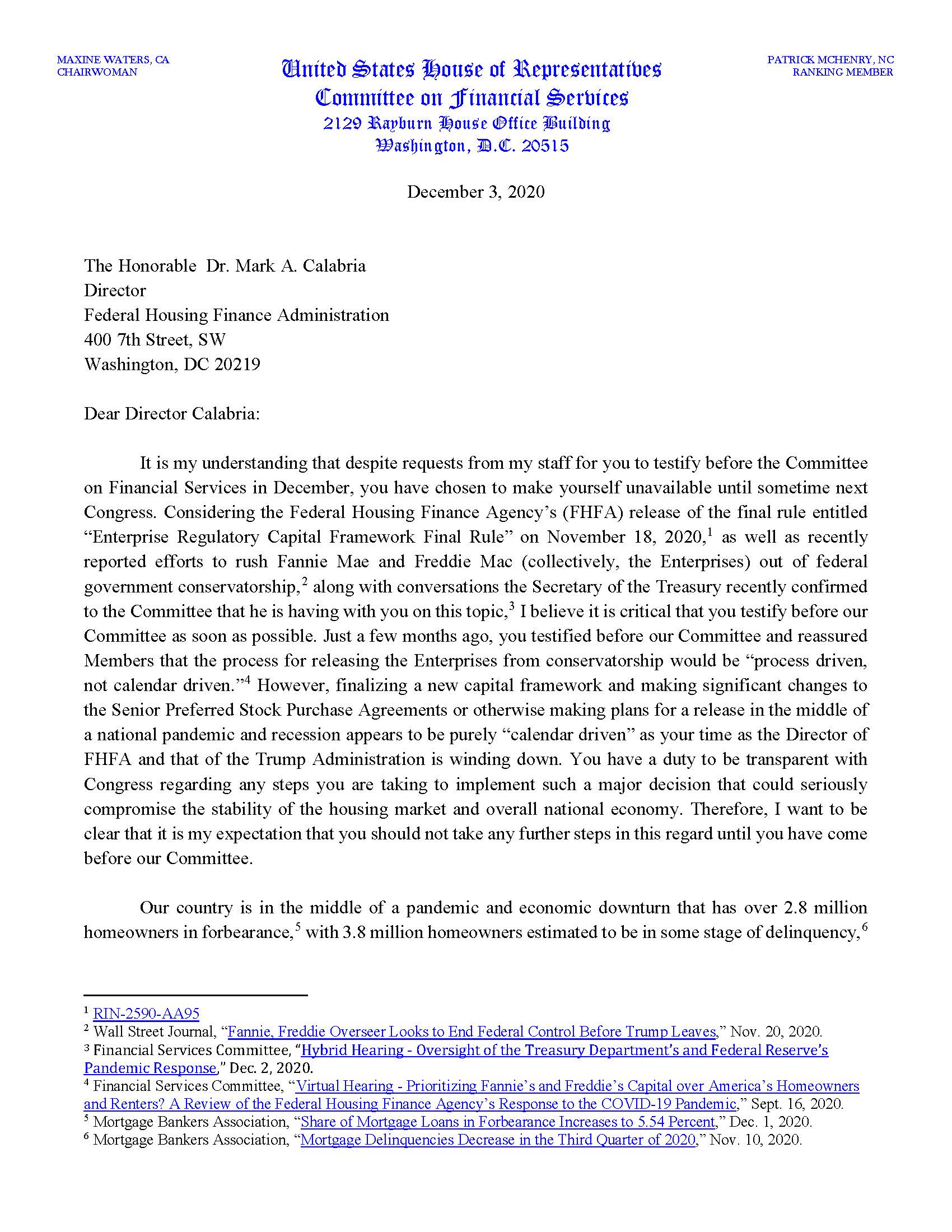

- 12/04/2020 – congress woman wants to pause the release

- 12/03/2020 – Tim Howard does not think an imminent settlement, is he right? how about speculation to drive price up? then it becomes a mostly speculation

to Fannie and Freddie Preferreds and Commons Message Board

“I don’t know where we go from here, but one thing I do know is that we should not expect to hear of a last minute settlement of the Collins case prior to oral argument at SCOTUS next week. That show will go on.”

Tim Howard December 2, 2020

https://howardonmortgagefinance.com/2020/10/07/the-director-digs-in/comment-page-1/#comment-19762

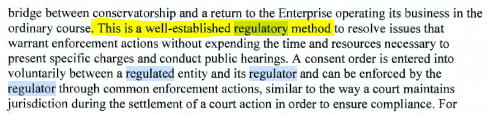

- 12/02/2020 – Mnuchin is still vague on this. Is consent decree coming soon?

Mnuchin in Talks With Fannie-Freddie Overseer on Rushed Redo

-

Treasury Secretary says he hasn’t decided to take action

- Companies need ‘significant’ capital to be released, he says

Treasury Secretary Steven Mnuchin said he’s made no decision on actions that might be taken at the end of the Trump administration to free Fannie Mae and Freddie Mac from U.S. control, while raising the possibility that the companies could be released before they are fully capitalized.

Mnuchin, speaking at a Wednesday House hearing, said he has had discussions about possible moves with Federal Housing Finance Agency Director Mark Calabria, the companies’ regulator. But Mnuchin said he hasn’t made up his mind on whether to do anything, while reiterating that he opposes ending Fannie and Freddie’s federal conservatorships until they have “significant” capital buffers to protect against losses.

During the House hearing, Mnuchin said the companies could be released from U.S. control before reaching the capital requirement under a consent decree. In such a scenario, the companies would technically exit conservatorship but still have restrictions on some business activities.

“There could be a scenario where at some point between basically the zero capital they have and the full capital requirement, there would be a consent order,” Mnuchin said. “They would be released subject to a consent order.”

Crapo: Legislation dead. Finish the job

Warner (who never misses an opportunity to bash the GSEs): white flag

Waters: Don’t rush exit from c-ship

- 12/01/2020 – Supreme Court decision is short term catalyst for prefs. But it is a 50/50 chance tp go either way

Trump’s Time Is Short to Overhaul Fannie-Freddie as Hedge Funds Want

President Donald Trump is running out of time to do what hedge funds and other investment firms with big ownership stakes in Fannie Mae and Freddie Mac have wanted since he took office: put the mortgage giants on a path to exiting government control.

While Trump has long vowed an overhaul of the companies, he’s made little progress in four years and now has less than two months to act. Fannie and Freddie’s regulator, Federal Housing Finance Agency Director Mark Calabria, wants to make sweeping changes before President-elect Joe Biden is sworn in — but Calabria can’t pull the trigger without the blessing of Treasury Secretary Steven Mnuchin.

Biden could undo many of Mnuchin and Calabria’s changes to Fannie and Freddie’s bailout accords if he gained authority to remove the FHFA chief before the companies have been released from conservatorship.

The Supreme Court is also scheduled to hear arguments that an earlier amendment to the bailout agreements robbed Fannie and Freddie of tens of billions of dollars in earnings that they should have been permitted to retain. If the court sides with shareholders, that could give the government more impetus to release the companies.

Calabria could try to free Fannie and Freddie under a consent agreement before Biden terminates him if a bailout amendment lets him. Such an arrangement would likely limit Fannie and Freddie’s executive compensation, dividends and other business activities until they raised more capital.

However, if the bailout amendment leaves Treasury in control of the fates of Fannie and Freddie, there’s a good chance the Biden administration keeps them in limbo for the foreseeable future.

Julia Coronado @jc_econ Comments from Mnuchin and Powell cast doubt on @MarkCalabria‘s push to rush a GSE privatization through before late January. Mnuchin says it takes time, should be done carefully w/ appropriate capital. Powell concurs.

- 11/29/2020 – another (old) voice to against the release

Why rushing to privatize housing finance is a bad idea

We have some sympathy for Mr. Calabria’s desire to end the amorphous status quo. But a privatization rushed to beat President-elect Joe Biden’s inauguration is a bad idea. It might be a bad idea, period: Given the 2008 bailout, selling the two entities off would amount to a taxpayer-enabled windfall for hedge funds and other investors who bought the beaten-down stock speculating on just such a policy change. Of course, new investor interest may not materialize given the government’s own residual ownership stake. Congress would have to decide whether to give Fannie and Freddie explicit government backing.

Another law of politics: If it ain’t broke, don’t fix it. Fannie and Freddie are broken in one sense — they collapsed — but quite sound in another: The government propped them up so comprehensively that mortgage markets now function normally. The housing-industry “stakeholders” with political juice to demand fundamental change feel no urgency to do so. Meanwhile, the FHFA since 2008 has quietly taken administrative steps to improve the companies’ financial stability. The Biden administration’s most realistic duty is to press ahead with incremental improvements that do not require legislation so that Fannie and Freddie may be better positioned for a permanent legislative fix or, at least, to cope with the next crisis, when it inevitably comes.

- 12/01/2020 – hearing from banking committee. Crapo said to go ahead with admin action. supreme court hearing is coming on 12/09. Should I come back to this position again?

https://www.banking.senate.gov/hearings/11/20/2020/the-quarterly-cares-act-report-to-congress

HoldenWalker99 @HoldenWalker99·

.@MikeCrapo opening statement comments to @USTreasury @stevenmnuchin1 are very significant in the face of recent lobbying efforts to undermine GSE reform. Chances of PSPA amendment increasing.

Every GSE reform naysayer wants @FHFA and @USTreasury to stall administrative action and wait for Congress to pass legislation. Well, Congress (via Senate majority party chair of Senate Banking) just said to go ahead with administrative action.

I doubt that either Director Calabria or Secretary Mnuchin will pay much attention to Chair Waters’ request to “immediately halt your efforts to raise the Enterprises’ capital requirements and to release them from conservatorship” during the remaining days of the Trump administration. Calabria has already issued his final capital rule, and Mnuchin will not feel constrained by the objections of Ms. Waters in whatever he decides to do before he leaves office with respect to the Senior Preferred Stock Agreement or Treasury’s statutory “final say” on how and when Fannie and Freddie may be released from conservatorship by FHFA (although is not at all clear to me what Mnuchin might be considering in either area).