study of PG&E (PCG)

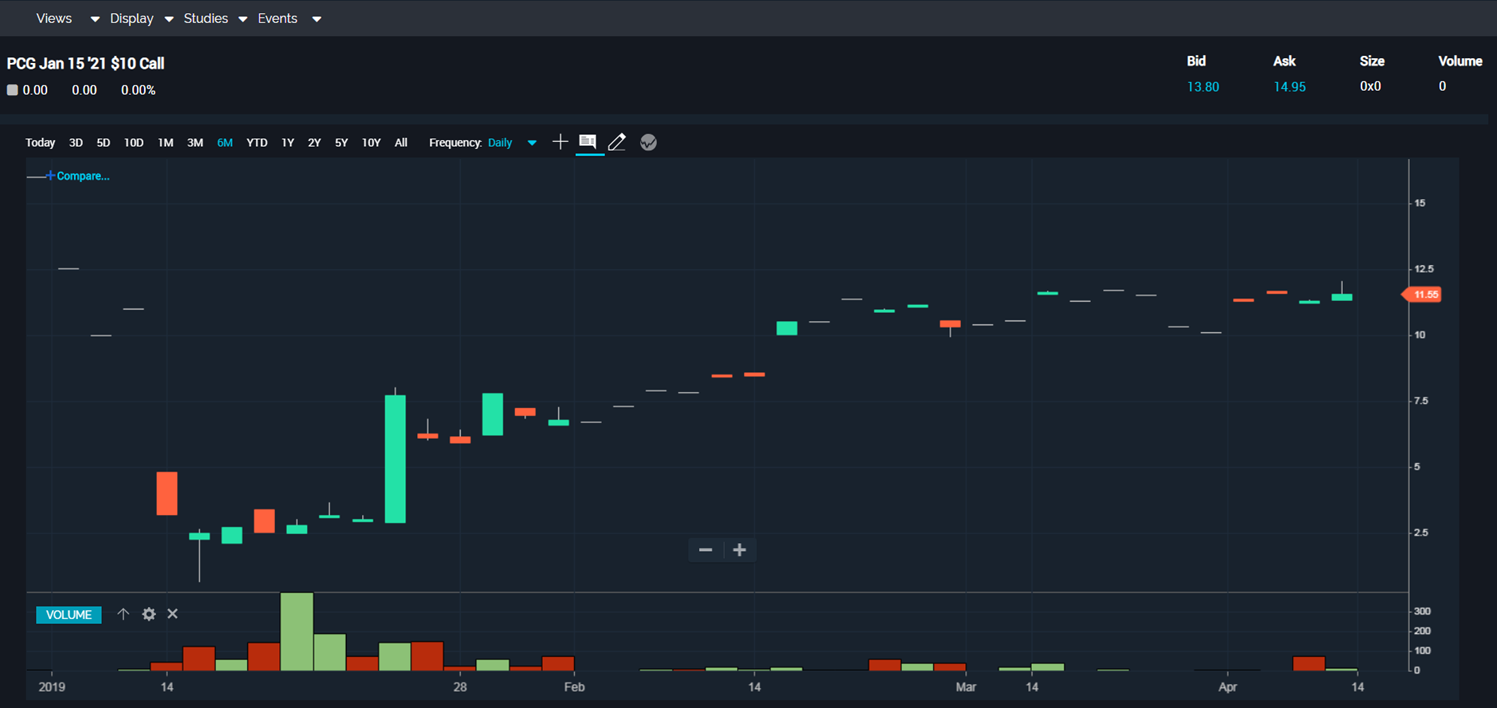

- 12/30/2020 – Tepper and Loeb hold the largest position in their portfolio on PCG. I agree that it is deep undervalued stock. However, given the current stock market, it seems like no imminent catalyst yet. I need to look for catalyst and time to get in

Why Are David Tepper and Daniel Loeb Buying PG&E?

A look at what could have interested the gurus about this troubled utility

In early 2020, PG&E finalized a deal to restructure its “bad capital structure,” and Loeb observed:

“The bankruptcy addressed the company‘s outstanding legacy liabilities and repositioned the balance sheet for investment and growth. PG&E’s fundamentals position it at the high end of the utility industry, with equity rate base growth of approximately 8% and EPS growth of 8‐12% driven by strong investments in infrastructure to serve customers safely and reliably while also reducing the company’s carbon footprint and providing customers with energy choice.”

Given those metrics, Loeb felt the share price was too low:

“PG&E’s valuation is a fraction of its peers: it trades at under 8x 2022 earnings versus the regulated utility peer set at 18x. The shares have traded poorly (down ~5%) since exiting bankruptcy due primarily to technical factors that are extremely common in these situations.”

Further, he expected the price discount to shrink as PG&E finds a new institutional shareholder base, hires a permanent CEO and takes care of its prior operational deficiencies.”

At the end of the third quarter, Daniel Loeb (Trades, Portfolio) held the largest position among the gurus, with 84,935,257 shares. That represented 4.28% of PG&E’s shares outstanding and 8.01% of Third Point’s total assets.

Tepper held the second-largest position, with 80,775,057 shares, representing 13.41% of his firm’s assets.

Ten other gurus also held shares of PG&E, including Seth Klarman (Trades, Portfolio) of The Baupost Group, David Abrams (Trades, Portfolio) of Abrams Capital Management and Howard Marks (Trades, Portfolio) of Oaktree Capital Management.

- 11/18/2020 – PG&E is the largest position in Tepper’s and Loeb’s portfolio, it really worth a look

David Tepper Plunges Into PG&E in the 3rd Quarter

Distressed-debt guru significantly increases holding in embattled utility company

Tepper purchased 71,831,398 shares of PG&E, increasing the stake 803.15%. The shares, which received an 11.93% equity portfolio weight, propelled PG&E into the firm’s top holding with a total weight of 13.41%.

Loeb established a new largest holding during the quarter with his purchase of PG&E for the first time since 2017. The guru purchased 84.93 million shares, which traded for an average price of $9.27 during the quarter. Overall, the purchase had an 8.01% impact on the equity portfolio and GuruFocus estimates the total gain of the holding at 23.87%.

PG&E is a holding company whose main subsidiary is Pacific Gas and Electric, a regulated utility operating in Central and Northern California that serves 5.3 million electricity customers and 4.4 million gas customers in 47 of the state’s 58 counties. PG&E operated under bankruptcy court supervision between January 2019 and June 2020.

- 11/18/2020 – new CEO new chapter of the company?

PG&E Taps Michigan Utility Leader to Become Next CEO

Patti Poppe, who heads CMS Energy, will become the permanent replacement for the man who oversaw PG&E’s exit from bankruptcy

PG&E Corp. PCG 8.22% has chosen the head of a Michigan utility as its next chief executive as it works to improve the safety of its electric system and strengthen its business after sparking a series of deadly wildfires that pushed the company into bankruptcy.

Patti Poppe, who is now chief executive officer of CMS Energy Corp. CMS -2.33% , a utility company in Michigan that serves 6.7 million customers, will become CEO of PG&E on Jan. 4.

“Patti is an exceptional leader with the experience, drive, and character to lead PG&E through its next chapter,” said Robert Flexon, PG&E’s board chairman. “She knows the utility industry top to bottom and has a deep understanding of what it takes to provide safe, reliable, affordable, and clean energy to millions of customers.”

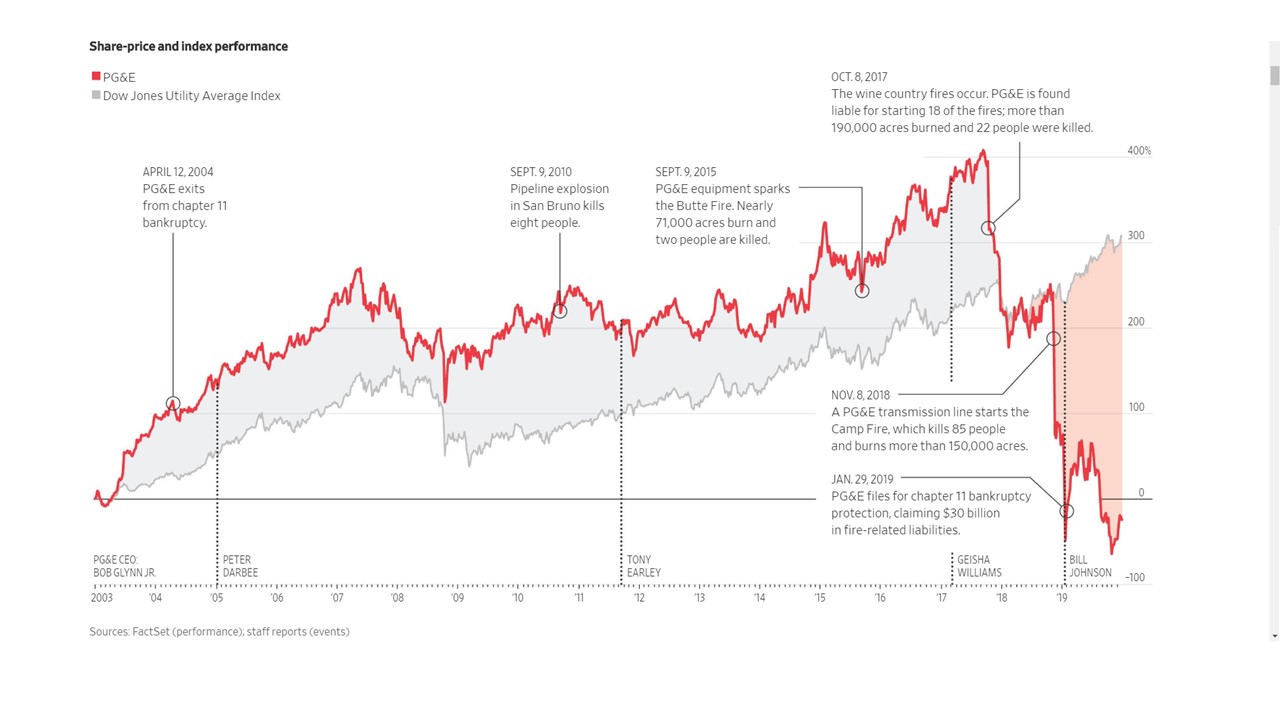

PG&E lost the goodwill of California politicians and regulators after its equipment sparked more than a dozen deadly wildfires in 2017 and 2018 that collectively killed more than 100 people. The company faced billions of dollars in liability costs and sought chapter 11 bankruptcy protection in January 2019.

The company emerged this summer after 18 months of negotiations with financiers, California regulators and lawmakers. PG&E ultimately arrived at a $59 billion reorganization plan, which involved issuing large amounts of new debt and equity to settle $25.5 billion in liability claims brought by fire victims, insurers and others.

- 08/10/2020 – compelling investment thesis PCG, I need to understand the details

Why PG&E Corporation (PCG) Stock is a Compelling Investment Case

Third Point recently released its Q2 2020 Investor Letter, a copy of which you can download here. The fund posted a return of 10.8% for the quarter, underperforming its benchmark, the S&P 500 Index which returned 20.5% in the same quarter. You should check out Third Point’s top 5 stock picks for investors to buy right now, which could be the biggest winners of the stock market crash.

In the said letter, Third Point highlighted a few stocks and PG&E Corp (NYSE:PCG) is one of them. PG&E Corp (NYSE:PCG) is a natural gas company. Year-to-date, PG&E Corp (NYSE:PCG) stock lost 16.3% and on August 7th it had a closing price of $9.10. Here is what Third Point said:

“Third Point’s involvement in PG&E began in late 2018, when the Company’s bonds traded to distressed levels following the tragic Camp Fire. The Company’s bankruptcy filing was prompted by the need to access liquidity and settle outstanding wildfire claims in an organized manner. We believed PG&E’s core business remained in a strong position reflecting a classic “good business/bad capital structure” restructuring and made it the firm’s largest distressed position. By early 2020, the company reached an agreement to restructure the business and as part of that exit plan, the company needed to raise approximately $26 billion in new capital including $9 billion in new common equity. The exit financing was used to settle insurance and victims’ claims relating to the 2017 and 2018 wildfires, repay some pre‐and post‐petition creditors, and contribute to the new Wildfire Fund.

Third Point participated in the common equity offering as a cornerstone PIPE investor. PG&E is the 6th largest U.S. utility by rate‐base and has no unregulated exposure. The bankruptcy addressed the company’s outstanding legacy liabilities and repositioned the balance sheet for investment and growth. PG&E’s fundamentals position it at the high end of the utility industry, with equity rate base growth of approximately 8% and EPS growth of 8‐12% driven by strong investments in infrastructure to serve customers safely and reliably while also reducing the company’s carbon footprint and providing customers with energy choice. Yet PG&E’s valuation is a fraction of its peers: it trades at under 8x 2022 earnings versus the regulated utility peer set at 18x. The shares have traded poorly (down ~5%) since exiting bankruptcy due primarily to technical factors that are extremely common in these situations. We expect this sharp discount to diminish as the company goes through the normal process of finding an institutional shareholder base, as well as hires a permanent CEO and continues to address prior operational deficiencies.

Alternatively, some attribute the extreme discount to peers to potential wildfire risk but the regulatory regime has substantially changed since PG&E filed for bankruptcy. In addition to restructuring the balance sheet and addressing past liabilities, emergence from bankruptcy allows PG&E to fully access the elements of the enhanced wildfire‐related regulatory framework under AB1054. The largest component of this is the new Wildfire Fund, which provides all investor‐owned utilities in California an insurance policy to address future catastrophic wildfire claims in a timely fashion. Funded to withstand 10+ years of potential wildfire liabilities, the Wildfire Fund provides a three‐year rolling cap on shareholder liability estimated by PG&E at around $2.4 billion, which only applies if the utility fails to act prudently.

Most important, however, is PG&E’s focused commitment to an investment in wildfire safety. The company is spending approximately $3 billion per year to reduce wildfire risk through system hardening, vegetation management, and enhanced inspections. The company has also invested in weather stations and cameras to spot potential fires early and sectionalized the grid to reduce customer disruptions caused by the Public Safety Power Shutoff process. In addition, the company has started to adopt state‐of‐the‐art technology such as drones provided by Third Point Ventures’ portfolio company PrecisionHawk and is partnering with Palantir to use AI for further risk mitigation and network efficiency. On a positive green note, the company also recently announced a partnership with Tesla to build a lithium‐ion battery storage system. These investments and PG&E’s commitment to ESG best practices should reduce environmental risk over time, while the Wildfire Fund should protect the state’s investor‐owned utilities who act responsibly on climate change.”

chungking/Shutterstock.com

Last month we published an article revealing that PG&E Corp (NYSE:PCG) exits bankruptcy.

In Q1 2020, the number of bullish hedge fund positions on PG&E Corp (NYSE:PCG) stock decreased by about 4% from the previous quarter (see the chart here), so a number of other hedge fund managers don’t seem to agree with PG&E’s growth potential. Our calculations showed that PG&E Corp (NYSE:PCG) isn’t ranked among the 30 most popular stocks among hedge funds.

The top 10 stocks among hedge funds returned 185% since the end of 2014 and outperformed the S&P 500 Index ETFs by more than 109 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Below you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

- 07/30/2020 – PG&E on energy storage system

Tesla, embattled California utility PG&E team up for high-tech energy storage system

Move will lower costs for customers, PG&E said

Embattled California utility PG&E and Tesla broke ground in Monterey County, California, last week to begin constructing one of the biggest utility-owned, lithium-ion battery energy storage systems on the planet.

“Battery energy storage plays an integral role in enhancing overall electric grid efficiency and reliability, integrating renewable resources while reducing reliance on fossil fuel generation,” Fong Wan, PG&E’s senior vice president of Energy Policy and Procurement, said in a statement. “It can serve as an alternative to more expensive, traditional wires solutions, resulting in lower overall costs for our customers.”

ELON MUSK TWEET ABOUT BILL GATES GOES VIRAL PG&E is aiming for the Moss Landing battery energy storage system to be fully operational by the second quarter of 2021. The two companies are collaborating on design, construction and maintenance, but it will be owned and operated by PG&E.

The energy storage system will be able to store and dispatch up to 730 megawatt-hours of energy to the electrical grid for up to four hours during peak demand, PG&E said. One megawatt is enough electricity to power 750 homes at once, according to the California Independent System Operator.

This isn’t PG&E and Tesla’s first time working together. PG&E’s first lithium-ion battery energy storage system, which uses Tesla Powerpacks, was installed in the Sacramento area in 2017.

- 07/30/2020 – new lawsuit for PG&E

Elliott Hits PG&E With New $250 Million Claim Tied to Bankruptcy

(Bloomberg) — Elliott Management Corp. is claiming PG&E Corp. cost the activist investor $250 million by breaking a promise to help the hedge fund get rights to buy equity in the utility giant during its massive bankruptcy case.

PG&E was supposed to help Elliott gain access to as much as $2 billion in equity commitments, as part of a settlement struck in January to resolve competing and sometimes contentious restructuring plans, according to a court filing by Elliott.

PG&E emerged from Chapter 11 earlier this month after settling wildfire claims tied to its equipment for $25.5 billion. The company raised more than $5 billion in common shares and equity units in a public offering to finance its bankruptcy exit.

“We’re aware of the lawsuit and are currently reviewing,” according to a PG&E representative. Representatives for Elliott — founded by billionaire investor Paul Singer — weren’t immediately available to comment. A hearing on the matter is scheduled for Aug. 25.

- 07/23/2020 – PG&E now exits BK, good time for me to think about reenterying

Risks Remain, but PG&E Looks Undervalued After Exiting Bankruptcy. Here’s Why

It’s not every day that a company fresh from bankruptcy looks like an undervalued investment. But that seems to be the case with PG&E.

The utility holding company exited bankruptcy protection last month after a roughly 18-month restructuring process that came on the heels of two of the worst wildfire seasons in California history. Those wildfires led the company to plead guilty to 84 charges of involuntary manslaughter and pay more than $25 billion to cover the cost of the destruction.

What remains after the bankruptcy process is a company that has monopoly power, a newly relaxed regulatory regime, reliable future revenue growth, and about $10 billion of potential future costs prepaid by its customers. Yet while PG&E (ticker: PCG) is cheap relative to its peers, it’s difficult to assess how much of its discount is warranted in light of a yearslong dividend suspension, among other lingering issues.

- 02/19/2020 – it is not a profitable utility company

PG&E Corp reports $7.7B loss in 2019 amid continuing wildfire risk

Pacific Gas & Electric (PG&E) parent company PG&E Corp recorded a net loss of $7.7 billion in 2019, the company announced on Tuesday, reflecting a $5 billion pre-tax charge for settling claims associated with the 2015, 2017 and 2018 Northern California wildfires.

- 01/15/2020 – This could be the end of story of PCG’s crisis. I should have learned to hold a bit longer of my position in PCG call. For this size of utility company, settlement is always the best solution.

PG&E nears deal with Pimco, Elliott on restructuring plan – Bloomberg

PG&E (PCG +8.1%) pushes to its highest levels of the day following a Bloomberg report that it is near a deal with creditors that would entitle them to a mix of equity and new debt if they scrap their rival restructuring plan.

PG&E held talks with the creditors led by Pacific Investment Management and Elliott Management ahead of a bankruptcy court hearing today, according to the report.

Under the deal being negotiated, the creditors’ investment in the company reportedly would replace some of the exit financing that PG&E is proposing as part of its restructuring.

A deal with bondholders would leave California’s Gov. Newsom as the last major obstacle to PG&E’s restructuring plan.

- 12/28/2019 – long history of struggle

PG&E: Wired to Fail

The utility has sparked deadly fires and pipeline explosions, left millions of Californians in the dark and gone bankrupt twice in less than 15 years. Here’s what went wrong.

- 12/27/2019 – how to fix PCG

Five Ways to Fix PG&E

Suggestions from industry executive, regulators and experts for ways the giant utility can safely keep the lights on

- Stop running equipment until it breaks

- Use predictive tools to assess risk

- Regulate utility safety separately from electricity rates

- Manage forests more aggressively

- Threaten PG&E’s monopoly franchise

- 12/16/2019 – it is hard to estimate the liability of PCG

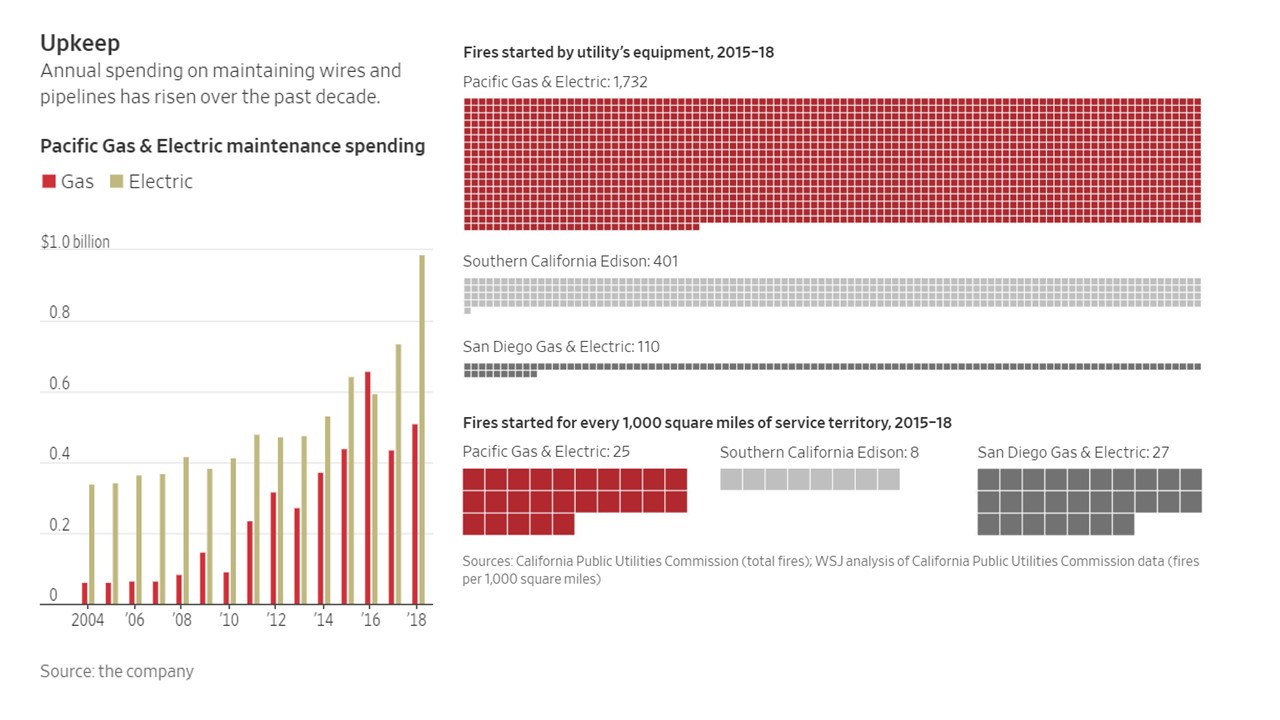

PG&E Had Systemic Problems With Power Line Maintenance, California Probe Finds

Investigation by state utilities commission concludes company failed to properly inspect and maintain transmission lines for years

- 12/14/2019 – I think PG&E’s plan will finally pass, and if this drags the stock price down, I might can buy some on Monday. The current response from Newsom is probably political show. – before Tuesday’s decision

California Governor Threatens to Block PG&E Bankruptcy Exit

Democrat Gavin Newsom says changes needed before he will sign off on embattled utility’s proposed plan to exit chapter 11

- 12/11/2019 – regulators are too cozy with PG&E. government employees always behave like this.

‘Safety Is Not a Glamorous Thing’: How PG&E Regulators Failed to Stop Wildfire Crisis

California’s public utilities commission prioritized rates, green power; wildfires exposed shortcomings

- 11/15/2019 – PG&E — Shares of PG&E surged more than 9% after U.S. activist investor ValueAct revealed a 1.4 million stake in the California utility company. PG&E is embroiled in controversy amid accusations that its equipment is responsible for some of the most destructive wildfires in California’s history. ValueAct, led by founder-CEO Jeffrey Ubben, is known for advocating for changes at the companies in which it’s invested by working with management.

- 11/12/2019 – it seems like the accusation is just for political show. PG&E owes Gavin Newsom, who always sides with PG&E – PG&E helped fund the careers of Calif. governor and his wife. Now he accuses the utility of ‘corporate greed.’

Gavin Newsom accused PG&E of ‘corporate greed.’ The utility spent $700,000 fundi

The utility continued to support Newsom as he clashed with the more liberal

wing of California’s Democratic Party. When some called for San Francisco to

take over its own electrical power grid — a ballot measure supported by eight of

11 district supervisors — Newsom sided with PG&E’s campaign to oppose it.

Newsom told the Chronicle at the time that there was “no groundswell” of city

residents calling for a takeover of the power grid.

The company spent more than $10 million to defeat the proposition and hired a

consultant, Eric Jaye, who was also Newsom’s longtime friend and political

adviser. The measure failed. Jaye declined to comment for this report.

Gavin Newsom’s gubernatorial campaign raised more money from PG&E —

$270,000 — than any of his previous campaigns. But becoming governor forced

him to confront the company’s problems, which were beginning to grow into a

statewide crisis.

Just two days after the November 2018 election, a PG&E transmission line fell

and sparked the Camp Fire, the deadliest and most destructive blaze in

California’s history. Two months later, PG&E filed for bankruptcy.

The governor shepherded a bill through California’s legislature that created a

$21 billion state fund from which PG&E and other utility companies could pay

claims to victims of future wildfires. The law required companies to meet

spending targets on safety initiatives and gave PG&E a deadline for exiting

bankruptcy if it wanted to access the funds: June 30, 2020.

Newsom escalated his public criticism of PG&E last month, when the company

shut off power to millions of residents in an attempt to prevent more fires. In a

terse news conference on Nov. 1, Newsom threatened a public takeover of the

company if it does not find a way out of its bankruptcy.

- 11/12/2019 – It seems like PG&E’s investors’ modified plan might get approved. Therefore, today’s PCG price jumped by +10%. I need to keep eyes in it. And I need to know regarding PG&E’ new proposal, where is the new money come from, and how will that affect common price.

PG&E Is Offering $13.5 Billion in Compensation to Wildfire Victims

Bankrupt utility giant PG&E Corp. is trying to offer $13.5 billion in compensation to the victims of wildfires sparked by its power lines as part of a restructuring plan, according to people with knowledge of the situation. The company’s shares surged as much as 19%.

(Bloomberg) — Bankrupt utility giant PG&E Corp. is offering $13.5 billion in compensation to the victims of wildfires sparked by its power lines as part of a restructuring plan, according to people with knowledge of the situation.

In doing so, the San Francisco-based power company is trying to provide the same amount that a group of its creditors — led by Pacific Investment Management Co. and Elliott Management Corp. — has agreed to pay victims in a rival reorganization proposal, said the people, who asked not to be identified because the negotiations are private. The two sides are at odds, however, over how to structure the payout and how much should come in the form of cash and stock, they said.

PG&E has spent months trying to come up with a restructuring plan that would get it out of the biggest utility bankruptcy in U.S. history by the middle of next year. The utility went bankrupt in January after its equipment was found to have started a series of catastrophic wildfires in 2017 and 2018, burying it in an estimated $30 billion worth of liabilities.

PG&E raises wildfire compensation offer to $13.5B as California turns up pressure

- Pacific Gas & Electric has raised its offer to compensate wildfire victims to $13.5 billion, according to Bloomberg News, after California Gov. Gavin Newsom, D, asked a bankruptcy court to block approval of a smaller settlement and noted the possibility that the state “will need to pursue its own plan.”

- It is the second time Newsom has raised the idea of a state-led takeover of PG&E, which filed for bankruptcy in January facing billions in wildfire liabilities. The utility is also under growing scrutiny related to Public Safety Power Shutoffs (PSPS) it says are necessary to the reduce risk of sparking more fires.

- There is increasing interest in transitioning PG&E from an investor-owned utility to a public entity. Last week more than a dozen California mayors asked the state’s Public Utilities Commission (CPUC) to consider the idea, arguing that the utility must be “reimagined” in order to serve the public. The utility has previously said it is not for sale.

- 11/11/2019 – Cal Governor disputes bondholder’s proposal on insurance settlement, which might be good for investors. California Governor Questions $11 Billion PG&E Insurance Deal

Gavin Newsom blasted financial creditors for “unacceptable” investment tactics in PG&E’s bankruptcy proceedings

California Gov. Gavin Newsom questioned PG&E Corp. ’s $11 billion settlement proposal for insurance losses tied to wildfires and said it could derail the utility’s bankruptcy exit strategy.

In a court filing on Saturday, the Democratic governor raised several objections to the proposed deal with insurance creditors after it emerged as a sticking point in negotiations to resolve PG&E’s massive debts and wildfire liabilities.

- 11/11/2019 – California majors proposed to take over PG&E and make is a customer-owned utility company, here is the full proposal. I need to keep eyes on this.

- 11/09/2019 – Analyst Provides PG&E Bankruptcy Update After Meeting With Company Management – “mgmt. remains assured in its equity backstop commitments, although it did acknowledge risks that if admin claims from the Kincade fire exceeded $250mn, the agreement could be terminated” – so $250 mil is the threshhold

PG&E Corporation (NYSE: PCG) shares jumped 5.6% on Friday morning after Bank of America analyst Julien Dumoulin-Smith reported on a new meeting with senior PG&E management.

The latest news from PG&E is that the company is willing to negotiate with California wildfire victims after the governor appointed a mediator to aid in the process.

Creditor Plan

In September, PG&E bondholders proposed a plan for the company to fund two liability trusts with $25.5 billion split evenly between cash and equity.

“Mgmt. stressed that the $25.5bn offer from Creditors should be viewed with a closer lens, as the $12.5bn deal with victims (all equity) should be adjusted for the multiple at which the bondholders are investing, implying ~$11-11.5bn on an economic value that could be further adjusted downward assuming an illiquidity discount,” Dumoulin-Smith said Friday.

He said it’s unclear at this point whether or not a settlement deal is imminent, but management seems to be highly motivated to move the process forward.

Government Liability

Management was reportedly confident the company’s $900 million charge for government fire costs would hold, despite $8.6 billion in government fire claims. Dumoulin-Smith said Cal Fire, which has $2.8 billion in claims, can only recover claims in which they can prove negligence on behalf of PG&E. At the same time, FEMA, which has $3.9 billion in claims, has no precedent for recovering claims against a public company.

Dumoulin-Smith said this potentially limited government liability is good news for investors and victims.

“Lastly, mgmt. remains assured in its equity backstop commitments, although it did acknowledge risks that if admin claims from the Kincade fire exceeded $250mn, the agreement could be terminated,” Doumolin-Smith said.

He said management sticking to those backstop commitments will be a critical part of maintaining confidence in PG&E’s reorganization plan.

Benzinga’s Take

While some analysts have argued that a best-case scenario outcome for PG&E could take the stock to as high as $40 per share, others have argued that the stock will ultimately be left worthless following its reorganization. At this point, investors almost need a law degree to follow along in the PG&E drama, and even Bank of America has removed its coverage of the stock given the high degree of uncertainty.

- 11/08/2019 – greedy bond holder,

PG&E acknowledged that settlement talks may result in a revised plan that offers fire victims an amount closer to the $13.5 billion bondholders are offering. PG&E Plan to Pay Insurance Claims in Cash Hurts Bankruptcy Talks

An $11 billion cash payout would push victims to take stock deal

PG&E’s opening offer to fire victims is $8.4 billion, an amount that includes $7.5 billion for individual wildfire claimants, and $900 million for emergency services providers. A rival chapter 11 exit strategy put forth by bondholders and wildfire victims themselves, provides for fire damage payments of $13.5 billion, with payment in stock and cash.

In a regulatory filing on Thursday, PG&E acknowledged that settlement talks may result in a revised plan that offers fire victims an amount closer to the $13.5 billion bondholders are offering.

The sticking point in negotiations is the form of payment, according to people with knowledge of the talks.

The company has said the insurance settlement represents a recovery of about 55% on insurance claims. Critics of the deal disagree, and are pointing to payout figures that indicate insurers, and investors that bought insurance claims at a discount, are in for a relative windfall if the settlement is approved.

With holdings of more than $6 billion, Seth Klarman’s Baupost Group is the largest holder of insurance claims. The Boston hedge fund is also one of PG&E’s largest shareholders, owning 24.5 million shares.

It’s not known how much Baupost paid, but the data available indicate the hedge fund could make hundreds of millions of dollars in profit from its PG&E insurance claims, more than enough to offset the losses it has taken on the utility’s flagging stock.

In March, when Baupost reported its holdings in court filings, its stake in PG&E’s stock was worth nearly $467 million. At Thursday’s closing price, Baupost’s stock in PG&E was worth less than $147.5 million.

Baupost declined to comment on the insurance settlement. Judge Dennis Montali is scheduled to hold a hearing on it next week in the U.S. Bankruptcy Court in San Francisco.

The insurance settlement has been controversial from the start. Wildfire claimants argued it is unwise for PG&E to bind itself to an $11 billion cash payout without knowing what the full amount of damages stemming from the blazes will be.

- 11/07/2019 – a great article of in-depth discussion: Unplugging PG&E Is Easier Said Than Done

Who can—or even wants—to take over this burning hellscape? - 11/07/2019 – PG&E swings to $1.6B Q3 loss after fire-related writedowns

- PG&E (PCG -5.6%) opens lower after swinging to a Q3 net loss of $1.62B, or $3.06/share, after reporting a net profit of $564M, or $1.09/share, in the year-ago period.

- Q3 adjusted EPS fell to $1.11 from $1.13 but exceeded Wall Street expectations, after excluding “items impacting comparability,” including a $2.5B charge for claims related to the 2017 northern California wildfires and the 2018 Camp fire, which reflects a previously announced deal with insurance companies over fire claims.

- “Obviously it’s a big writedown but the key remains how the bankruptcy will get resolved,” says Bloomberg analyst Kit Konolige.

- PG&E says adjusted EPS fell mostly because of vegetation management costs, resolution of 2018 regulatory items and an increase in shares outstanding.

- PG&E says it is not providing full-year earnings guidance, citing continuing uncertainty related to the 2017 Northern California wildfires, the 2018 Camp fire, the 2019 Kincade fire and Chapter 11 proceedings.

summary – all warnings, therefore I have sold all today and yesterday. It would be better if I sold them the day before yesterday. I tried to sell, but set limit price too high and the sale did not go through on 11/05. I am too greedy. Should use middle price given very large spread of LEAP premium.

- it’s facing as much as $6.3 billion in after-tax costs in this year alone from the blazes

- The biggest of those blazes, the Kincade fire in Sonoma County, began Oct. 23 shortly after PG&E equipment malfunctioned in the area. It took two weeks to fully contain. While the cause has yet to be determined, it’s “reasonably possible” the company will incur a loss related to the blaze, PG&E said in a filing Thursday. “The utility could be subject to significant liability in excess of insurance coverage,” the PG&E said.

- Newsom has said the state won’t hesitate to take over the company if it doesn’t act soon. Meanwhile, PG&E warned in its filing Thursday that it may not meet a state-imposed deadline of June 30, 2020, to exit from bankruptcy, saying that its reorganization could instead “take a number of years to resolve.”

(Bloomberg) — PG&E Corp., the California utility that went bankrupt in January after its equipment sparked deadly wildfires, said it’s facing as much as $6.3 billion in after-tax costs in this year alone from the blazes, its Chapter 11 case and the recent blackouts.

The troubled power giant reported a $1.6 billion loss for the third quarter. It was driven by $2.5 billion pre-tax charge for claims related to the 2017 Northern California wildfires and the 2018 Camp fire, the company said in a statement Thursday. PG&E is not providing 2019 earnings guidance.

The shares were down 13% at $6.01 at 2:45 p.m. They’ve fallen 75% this year.

“Obviously it’s a big write down,” Bloomberg Intelligence analyst Kit Konolige said in an interview. “The key remains how the bankruptcy will get resolved.”

The earnings are the first PG&E has reported since its mass blackouts last month intended to keep power lines from sparking wildfires during windstorms, which drew outrage from state lawmakers and raised the specter of a government takeover. Despite the shutoffs, blazes continued to erupt. PG&E’s equipment has been identified as a possible cause of at least three.

The biggest of those blazes, the Kincade fire in Sonoma County, began Oct. 23 shortly after PG&E equipment malfunctioned in the area. It took two weeks to fully contain. While the cause has yet to be determined, it’s “reasonably possible” the company will incur a loss related to the blaze, PG&E said in a filing Thursday. “The utility could be subject to significant liability in excess of insurance coverage,” the PG&E said.

The prospect of more wildfire liabilities is critical for PG&E. Since filing for Chapter 11 in January, the judge overseeing its case has warned another big blaze blamed on its equipment would upend the bankruptcy and potentially wipe out shareholders.

During October, PG&E enacted four massive blackouts to keep power lines from toppling in high winds and igniting more fires. The after-tax costs the company is estimating this year include $65 million for customer credits related to shutoffs on Oct. 9. PG&E said it doesn’t plan to issue rebates for future blackouts.

Face to Face

The company’s earnings come days after California Governor Gavin Newsom met face to face with PG&E Chief Executive Officer Bill Johnson and pressed him to quickly strike a deal with investors. Newsom has said the state won’t hesitate to take over the company if it doesn’t act soon. Meanwhile, PG&E warned in its filing Thursday that it may not meet a state-imposed deadline of June 30, 2020, to exit from bankruptcy, saying that its reorganization could instead “take a number of years to resolve.”

PG&E’s reorganization has drawn some of biggest names on Wall Street, including a group of bondholders led by billionaire Paul Singer’s Elliott Management Corp. and Pacific Investment Management Co. The bondholders have aligned themselves with wildfire victims to pitch a restructuring plan that would all but wipe out existing PG&E shareholders, including Seth Klarman’s Baupost Group LLC. U.S. Bankruptcy Judge Dennis Montali have ordered the parties into mediation to speed along a resolution.

PG&E stock has plunged 40% since the start of October, when the company lost its exclusive right to pitch a reorganization plan and became the subject of attacks over its blackouts and wildfires.

Speaking to Yahoo Finance’s The Ticker this week, Citi’s Praful Mehta said that plan backed by wildfire victims has a 75% chance of succeeding, pushing the “stock price to zero” and transforming California’s largest utility company as we know it.

“I don’t think there is a credible plan for the state to step in right now, because that is an extremely complicated next step,” said Mehta, lead analyst for utilities and renewables at Citi. “But even if they can’t step in, if they apply enough pressure here to get these two parties to agree to something, it might help get them to exit by June 2020.”

PG&E is under pressure to meet a state-mandated deadline to exit Chapter 11 bankruptcy by June 30 of next year.

But the utility company suffered a legal setback last month, when a federal bankruptcy judge ruled that it no longer had the exclusive right to shape the terms of its reorganization.

That opened the door for a competing proposal, drawn up by PG&E bondholders, including activist hedge fund Elliott Management Corp. and Pacific Investment Management Co. Their plan sets aside $14.5 billion for them and leaves current shareholders with a tiny stake in PG&E.

The utility has argued the bondholder proposal is an attempt to “pay themselves more than they are entitled to.” It has instead offered up reorganization plan that would cap individual victims claims at $8.4 billion, while insurers or insurance claim holders would get $11 billion under a settlement.

“We have a 75% probability that the bondholder plan succeeds in which case the current shareholders get diluted to zero, the stock price will zero,” Mehta said. “We have 25% scenario that the PG&E stock, a PG&E plan succeeds in which case the stock is worth about $20 to $22 a share.”

background knowledge of these two competitive proposals

PG&E bondholders and fire victims offer plan that would hit stockholders hard (bondholders plan)

It’s unusual for a company in bankruptcy to lose that priority, and Judge Dennis Montali rejected an earlier effort to supplant PG&E. But this time the coalition “likely has a good shot at ending the utility’s control,” said Negisa Balluku, a litigation analyst at Bloomberg Intelligence. “The competing plan may more efficiently solve the case’s key objective of compensating wildfire victims,” she wrote in a new report.

The group’s proposal “represents a path forward that recognizes the victims’ losses and puts their interests ahead of shareholders,” Robert Julian, an attorney for the official committee representing fire victims, said in a statement.

PG&E filed for Chapter 11 bankruptcy protection in January in the face of an estimated $30 billion or more in liabilities from wildfires. Under PG&E’s reorganization plan, claims from individual wildfire victims would be capped at $8.4 billion, while insurers or insurance claim holders would get $11 billion under a settlement announced last week.

The new bondholder proposal offers $28.4 billion in new money in exchange for 58.8% of the equity in the reorganized PG&E. Under an earlier proposal, creditors had offered financing in exchange for an 85% to 95% stake in the new company.

A $24-billion wildfire trust fund would be set up and financed through $12 billion in cash and $12 billion in stock, according to the filing. The trust would have a 39.5% stake in PG&E. Overall, the creditor group and the trust would end up with a combined 98.3% of the equity in PG&E. – this is why shareholders value might be wiped out totally!

- 11/05/2019 – California Mayors Join Campaign to Buy Out PG&E

Leaders of more than a dozen cities, including Oakland and Sacramento, back the idea of making the utility customer-owned

The mayors of Oakland, Sacramento and more than a dozen other California municipalities are joining San Jose in a campaign to buy out the investor-owned PG&E Corp. and turn it into a giant customer-owned cooperative.

Last week, Mr. Newsom named Ana Matosantos, his cabinet secretary, as the state’s new “energy czar.” He instructed her to try to broker a deal between PG&E’s shareholders and bondholders—who are fighting for control of the company—to enable the company to exit bankruptcy by the middle of next year. If the sides cannot find agreement, California may intervene and pursue other options, including a state takeover of PG&E, Mr. Newsom said.

- 11/04/2019 – PG&E Unveils Revised Bankruptcy Insurance Settlement

Insurers can back out of their deal with PG&E if new wildfires push the utility into insolvency. Here is the risk!

Insurance companies and investors with billions of dollars riding on the outcome of PG&E Corp. ’s bankruptcy have reworked provisions of an $11 billion settlement, spelling out the consequences if California’s largest utility becomes insolvent.

Baupost, a Boston-based hedge fund, bought up more than $6 billion of PG&E insurance debt—claims from insurance companies that contend PG&E should have to cover what they paid out victims of wildfires.

If all goes smoothly in one of the largest bankruptcy cases on record, the hedge fund stands to make a profit on the investment.

But all isn’t going smoothly for PG&E, with the Kincade Fire burning and a jury trial looming in San Francisco that could add as much as $18 billion to the PG&E fire damage estimate. Add to that a series of power blackouts that aroused a public outcry and a threat of a government takeover from California Gov. Gavin Newsom, and PG&E is at a tipping point.

Court documents filed over the weekend specify that Baupost and other insurance creditors can retreat from supporting PG&E’s chapter 11 plan, if fire damages hit a number that renders PG&E insolvent.

The court filings also allow PG&E and the insurance creditors to talk to other creditors and to participate in mediation to try to bring the bankruptcy to a peaceful resolution.

- 11/04/2019 – Why Shares of PG&E Spiked Today

The bankrupt utility stock continues to be up and down.

The stock crashed in late October after the judge overseeing the bankruptcy allowed alternative plans filed by creditors to be considered, a potential blow to equity holders. But shares have rallied in recent days after a mediator was appointed to work through competing reorganization plans and come up with a compromise. Traders have hoped that creditors, and in particular fire victims, are hoping to see the case resolved sooner rather than later and would be open to a compromise that would preserve at least some equity value.

PG&E’s initial rally on Monday appears tied to market gossip that a compromise was likely, which in turn likely led to some short covering. But the shares lost some of those gains following a report in the San Francisco Chronicle that the bankruptcy court has ordered PG&E to answer questions about blackouts the utility imposed in October, as well as about the potential cause of the recent Kincade fire.

The judge’s questions relate to issues that could lead to more PG&E creditors, and potentially less recovery for equity holders.

- 11/01/2019 – Governor Newsom Outlines State Efforts to Fight Wildfires, Protect Vulnerable Californians and Ensure That Going Forward, All Californians Have Safe, Affordable, Reliable and Clean Power – official website information

In a Medium post and in taking questions at the Capitol from media, the Governor laid out the steps the parties in the PG&E bankruptcy must take to ensure safety investments and fundamental transformations can be made before the next fire season. His office also released a roadmap (11.1.19-Roadmap) of how a transformed PG&E should operate.

The major wildfire safety bill that I signed into law earlier this year – AB 1054 – requires PG&E to make these fundamental changes. It forces PG&E to make massive investments in safety, ties executive compensation to the utility’s safety record and demands that every year the utility earn a safety certification from the state. And earlier this week, a newly energized California Public Utilities Commission took strong action by opening a major investigation into PG&E’s use of Public Safety Power Shutoffs (PSPS), and vowing a total reform of the rules and regulations governing power shutoffs.

But achieving a permanently transformed utility requires PG&E to exit bankruptcy as quickly as possible. The State of California is developing the blueprint for a transformed utility. Consistent with AB 1054, PG&E must incorporate that blueprint into its bankruptcy plan. To expedite the exit from bankruptcy and facilitate implementation of this transformation, I am convening current executives and shareholders of PG&E, wildfire victims, and PG&E’s other creditors in Sacramento next week in an effort to accelerate a consensual resolution to the bankruptcy cases that creates a new entity – one that better reflects our California values and will advance massive safety transformations beginning before next fire season.

the three major items in the roadmap (11.1.19-Roadmap) are,

- What happened this year will not happen again: PG&E must invest in solutions to maintain service to as many customers as possible during PSPS events. This includes implementing processes and technical solutions before next fire season, such as increasing grid segmentation and distribution loops, distributed generation and backup generation for critical services, and hardening critical transmission and distribution lines. While PSPS events may be required, their implementation cannot take absolute priority over the obligation to provide safe, affordable, and reliable power.

- Safe, affordable, and reliable service must be PG&E’s number one priority.

- California will realize its clean energy future.

California Gov. Gavin Newsom said Friday that he wants to speed up Pacific Gas & Electric’s bankruptcy case, calling on the beleaguered utility’s executives, creditors and shareholders, as well as wildfire victims, to reach “a consensual resolution” to the negotiations before next year’s wildfire season.

“We want to broker that mediation and are calling on all the parties to come in early next week to jumpstart those negotiations,” Newsom said in a Sacramento news conference.

Newsom left little doubt that he is looking beyond the PG&E bankruptcy case and that he envisions a future in which the state takes an active role in restructuring the California’s largest utility.

“It is my hope that the stakeholders in PG&E will put parochial interests aside and reach a negotiated resolution so that we can create this new company and forever put the old PG&E behind us,” Newsom said in statement. “If the parties fail to reach an agreement quickly to begin this process of transformation, the state will not hesitate to step in and restructure the utility.”

- 11/01/2019 – California Governor Threatens State Takeover of PG&E

Gavin Newsom says state may intervene if shareholders, bondholders cannot quickly reach a deal to exit bankruptcy – so the restructure might happen way earlier than June 30 2020.

The governor on Friday said he has demanded that PG&E executives, investors and representatives for wildfire victims appear in Sacramento next week to discuss how to expedite the company’s emergence from chapter 11 by a state-imposed deadline of June 30. He said the state may intervene if the company’s shareholders and bondholders don’t quickly agree on a reorganization plan.

“This process needs to take shape with a deep sense of urgency,” Mr. Newsom said. He added that the state cannot wait until June 30 for PG&E to restructure.

- 10/31/2019 – Northern California fires blamed on utility PG&E amid power cutoffs, fire officials say – investigation is still unergoing.

The company admitted last week that it may be to blame for the widespread Kincade Fire in Sonoma County, north of San Francisco, after a broken wire belonging to the company was found near where the fire sparked. The fire has burned more than 76,000 acres and prompted thousands of evacuations.

- 10/30/2019 – PG&E Trade Punishes Hedge Funds as California Burns

Investors in utility’s stocks and bonds lose $4.1 billion in four trading days – I also need to look for opportunity in PGE bonds

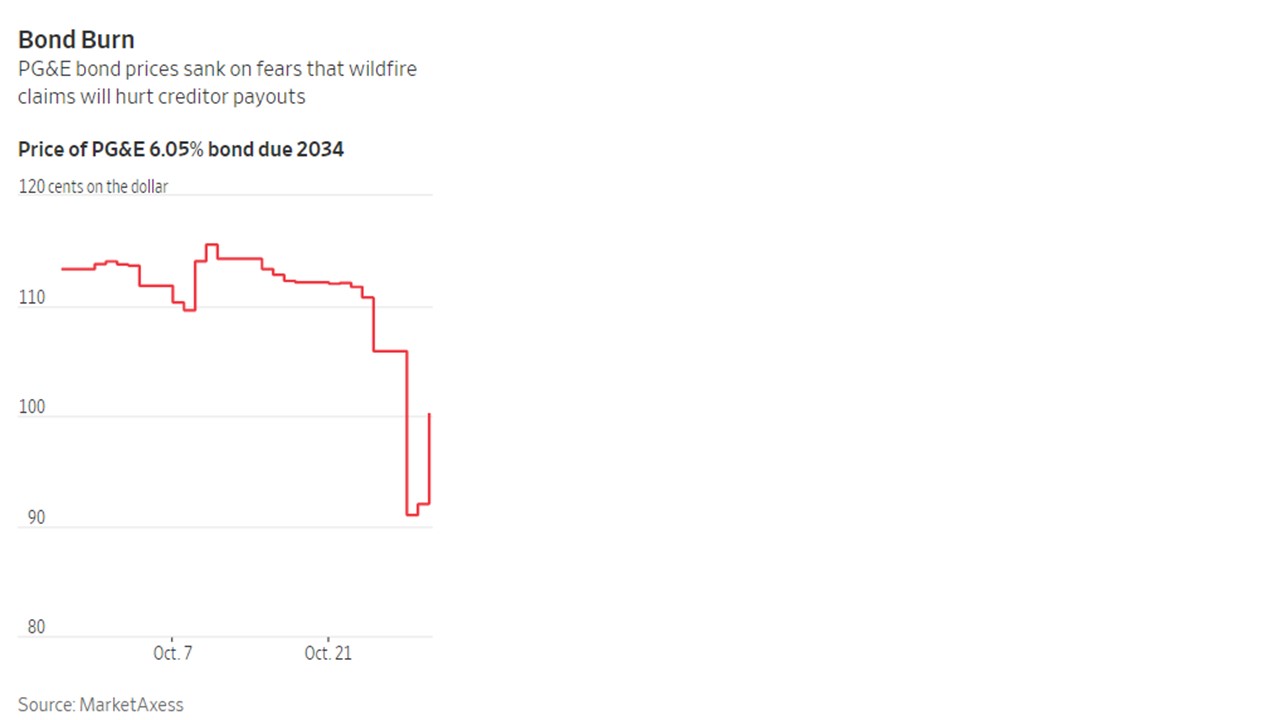

Investors in PG&E Corp. stocks and bonds lost about $4.1 billion in the four trading days after the blaze in Sonoma County, Calif., started late Oct. 23, according to an analysis by The Wall Street Journal. Those who sold the securities missed out on a rebound Wednesday after the fire abated and the value of the shares and debt jumped by about $1.6 billion.

Investors say the selloff has been driven by concern over the Kincade Fire’s spread. An increase in the amount of wildfire claims against the bankrupt electric utility could wipe out its stock and leave too little for the company to repay bondholders in full.

“The number one question for investors is are they on the hook for the Kincade Fire and, if so, how much will that cost,” said Andrew DeVries, a bond analyst at the research firm CreditSights. “The answer is nobody knows.”

The uncertainty is threatening negotiations between PG&E’s investors, insurers and existing wildfire victims, which could stymie plans to bring the company out of bankruptcy, Mr. DeVries said.

Bondholders pledged to invest billions of dollars in the company to pay out wildfire claims but made their commitments contingent on a provision that damage this fall from fires where PG&E operates not exceed 500 buildings, according to a version of their restructuring proposal filed in bankruptcy court in September. The Kincade blaze destroyed or damaged 246 structures as of Wednesday afternoon, according to the California Department of Forestry and Fire Protection.

An increase in wildfire claims could jeopardize what had so far looked like a profitable strategy that Baupost and a handful of other investors have bet on: buying up insurers’ claims against PG&E at a discount. Under a settlement proposed in September by PG&E, Baupost would have stood to gain hundreds of millions of dollars.

- 10/30/2019 – PG&E shares jump 32% amid power shutoffs as judge appoints bankruptcy mediator – the assignment of a bankruptcy mediator may be good sign for PG&E plan

- PG&E shares spiked more than 30% Tuesday on news that U.S. Bankruptcy Judge Dennis Montali had appointed a mediator to parse competing bankruptcy reorganization plans.

- Due to “favorable weather conditions” the utility was able to reduce the scope of an ongoing Public Safety Power Shutoff (PSPS) by 30,000 customers, but more than a half million accounts in 22 counties were still impacted, according to a Wednesday morning tweet.

- PG&E will also provide refunds to customers impacted by a PSPS Oct. 9 through Oct. 13, with the utility criticized for failures of communication and response.

PG&E shares plunged last week on fears its system could be linked to the Kincade fire, but rebounded Tuesday. The utility said it “looks forward to working with the mediator and the other parties to resolve the remaining wildfire claims,” in a statement.

Montali on Monday appointed retired judge Randall Newsome to mediate between rival factions looking to control the utility.

PG&E said it has made significant progress in its Chapter 11 cases, including reaching settlements with two of three major groups of wildfire claimants, potentially extending the date a claim must be made from Oct. 21 into January.

“We are confident our court-approved claims notification process was broad and thorough — above and beyond what is typical in a Chapter 11 process,” PG&E told Utility Dive. “Nevertheless, we have informed the district court that we are willing to extend the bar date for wildfire claims. We will inform the bankruptcy court in advance of the hearing to extend the bar date, which is scheduled for next month.”

- 10/30/2019 – PG&E Trade Punishes Hedge Funds as California Burns

Investors in utility’s stocks and bonds lose $4.1 billion in four trading days

- 10/30/2019 – Why Shares of PG&E Are Rallying Today

Mediation likely raises the probability that equity holders will see some recovery from the bankrupt utility’s reorganization.

shares got a boost on word that the bankruptcy judge has appointed a mediator to work through competing plans and come up with a compromise that would allow PG&E’s reorganization to proceed. The hope is that creditors, and in particular fire victims, need a settlement sooner rather than later and will be open to a compromise that would incorporate at least some of PG&E’s plan and preserve some equity value.

- 10/30/2019 – find a way to find all legal documents of PCG and design strategy accordingly

- 10/29/2019 – Can PG&E Survive the California Wildfires?

- The shares jumped 30% on Tuesday (today) after the bankruptcy judge ordered lawyers for the wildfire victims to enter into mediation with PG&E, and appointed a mediator, a move that may help move the proceedings along.

- The competing plans for reorganizing PG&E — each put forward by groups dominated by hedge funds — envision putting new money into the company, much of it to pay off liabilities related to fires before the bankruptcy. But the funds may end up rethinking their commitments. The plans include language allowing the investment offers to be changed or withdrawn if new fires attributed to PG&E have caused the destruction of 500 structures or more before the end of the year.

- Gov. Gavin Newsom has declared that his office would “love” to see Warren E. Buffett’s holding company, Berkshire Hathaway, make a bid for PG&E. Berkshire would need to get approval by the Federal Energy Regulatory Commission, which has stringent standards for market power.

- And Sam Liccardo, mayor of San Jose, favors a sweeping plan that would put PG&E in its customers’ hands. The plan envisions the entity gaining access to the wildfire fund, but that might require legislative action. Cooperatives in California get to set their own rates. As a result, critics of the plan say the entity would have more leeway to raise rates than PG&E, which must gain the approval of the California Public Utilities Commission to do so.

- In theory, the multibillion-dollar state wildfire fund — being set up to help utilities bear the cost of this year’s fires and those in the future — should be an effective backstop. But there are snags. To gain access, PG&E must emerge from bankruptcy by the middle of next year and, even if it does that, it stands to recoup only 40 percent of eligible damage claims for fires that take place while it is in bankruptcy. (Once it is out of bankruptcy and has satisfied other conditions, it will qualify for full coverage from the fund, which would be financed by bonds and company contributions.) Because PG&E’s equipment is suspected of having caused some of the recent fires, the company may end up facing another large bill for damages.

- 10/29/2019 – website to watch out Kincade fire – numbers of structures destroyed are adding up and approaching 500 threshold. Watch out!!!

as of 11/07/2019 night – 100% contained

60 Structures Damaged Residential, Commercial and Other

374 Structures Destroyed Residential, Commercial and Other

4 Injuries Confirmed Fire Personnel and Civilian Injuries

as of 11/05/2019 night – 86% contained

60 Structures Damaged Residential, Commercial and Other

374 Structures Destroyed Residential, Commercial and Other

4 Injuries Confirmed Fire Personnel and Civilian Injuries

as of 11/04/2019 night – 82% contained

60 Structures Damaged Residential, Commercial and Other

374 Structures Destroyed Residential, Commercial and Other

4 Injuries Confirmed Fire Personnel and Civilian Injuries

as of 11/02/2019 night – 74% contained

59 Structures Damaged Residential, Commercial and Other

372 Structures Destroyed Residential, Commercial and Other

4 Injuries Confirmed Fire Personnel and Civilian Injuries

as of 10/31/2019 night – 65% contained

55 Structures Damaged Residential, Commercial and Other

349 Structures Destroyed Residential, Commercial and Other

4 Injuries Confirmed Fire Personnel and Civilian Injuries

as of 10/30/2019 night – 45% contained

47 Structures Damaged Residential, Commercial and Other

266 Structures Destroyed Residential, Commercial and Other

4 Injuries Confirmed Fire Personnel and Civilian Injuries

as of 10/30/2019 morning – 30% contained

40 Structures Damaged Residential, Commercial and Other

206 Structures Destroyed Residential, Commercial and Other

2 Injuries Confirmed Fire Personnel and Civilian Injuries

as of 10/29/2019, 15% contained

39 Structures Damaged Residential, Commercial and Other

189 Structures Destroyed Residential, Commercial and Other

2 Injuries Confirmed Fire Personnel and Civilian Injuries

- 10/28/2019 – California Fire Damage Estimated at $25.4 Billion – this is estimation one week before Kincade fire was put off. Therefore, the real cost can be way off. I will keep eyes on this.

Damages from the fires ripping across California could run as high as $25.4 billion, and the risks are bound to keep rising.

The Kincade fire cost could be $10.6 billion, while the tally in Southern California could reach $14.8 billion mainly from the Tick, Getty and Saddle Ridge blazes, according to Chuck Watson, disaster modeler at Enki Research in Savannah, Georgia.

PG&E diverted safety money for profit, bonuses

Reports: Utility diverted safety funds into profit

It’s still unknown if this week’s fire in Kincade was caused by PG&E equipment. But the prospect raises the risk of draining PG&E’s equity value. This would undermine the recovery plan favored by PG&E and its shareholders, and make it more likely that a rival plan from bondholders will win approval, Citi analyst Praful Mehta said.

Backers of the PG&E plan could terminate their financial commitment of over $14 billion if a destructive wildfire is linked to PG&E and its service territory before 2020. With wildfires continuing to spread, participants wonder whether PG&E will be able to reach a bankruptcy settlement. Another bad fire season could push them into bankruptcy again.

Earlier this month, Mehta set a Street-low price target at $5 on shares, predicting there was a 75% probability the California power company’s stock would fall to zero. He reiterated the call Friday, saying “shareholders are worried — and should be.”

If the fire is linked to PG&E during the bankruptcy process, meeting California Public Utilities Commission’s standards on whether the disaster was handled prudently will be key, Evercore ISI analyst Greg Gordon said. State legislation limits PG&E’s access to wildfire funds to cover damages at 40%.

“PCG has modest insurance and can access the state wildfire insurance fund (with limits), but this is a setback,” he wrote in a note to clients, using the company’s ticker symbol. “A big fire could increase overall liabilities for shareholders and threaten the viability of their equity backstop.”

If the company were found to have acted imprudently in a $10 billion fire and were able to negotiate claims down to $6 billion, PG&E may still be on the hook for $4.3 billion, Gordon said.

Bloomberg Intelligence analyst Negisa Balluku said that a fire caused by PG&E equipment could also affect PG&E’s ability to abide by California’s wildfire liability law. Such a fire would “likely lead to claims with precedence over those from the 2017-18 California wildfires as well as over unsecured debt,” she said.

PG&E is on track to close at a record low. Energy peers Edison International and Sempra Energy, which may also need to tap California’s wildfire fund, fell as much as 13% and 3.1%, respectively. Mehta said the idea that a single $21 billion fund would be enough “seems wrong,” as the state is “facing significant wildfires that could eat into a significant portion of the fund in the first year.”

Mehta sees a statewide problem that Governor Gavin Newsom should take the lead on by creating a mechanism to replenish state coffers after every wildfire season for the next decade, potentially with tax dollars.

- 10/26/2019 – California’s Governor Wants Berkshire to Bid for Bankrupt PG&E

- 10/26/2019 – background knowledge of Electric Utility companies from Valueline

F10140_electric_utility_west_2019

The California government passed a law that will help address the problems that the state’s electric utilities face from huge liabilities stemming from wildfires. However, this did not ameliorate problems electric companies are facing from past wildfires. Several companies in this Issue are filing rate cases in order to recover capital spending, increased expenses, and earn an adequate return on equity. Most electric utility stocks have performed extremely well in 2019. These equities continue to have a high valuation.

Wildfire Problems In California: In recent years, the two largest electric utilities in California have faced huge liabilities stemming from wildfires in their service area. The largest one, Pacific Gas and Electric (a subsidiary of PG&E Corporation), faced liabilities so large that in early 2019 the utility and its parent filed for protection under Chapter 11 of the Federal Bankruptcy Code. (As a result of this filing, we no longer cover the stock in The Value Line Investment Survey.) The problems faced by Southern California Edison (a subsidiary of Edison International) aren’t nearly as severe, but are still significant. The company took a substantial charge in the fourth quarter of 2018 to establish a reserve for its estimate of the minimum wildfire liabilities it is facing. The third major utility in the Golden State, San Diego Gas & Electric (a subsidiary of Sempra Energy) hasn’t had a major wildfire in its service area in recent years, but in the second quarter of 2016 wrote off costs associated with a 2007 wildfire after the company was unable to recover these costs in rates. The utilities’ problems were exacerbated by California’s inverse condemnation law. Under this law, a company may be found liable for damage caused by its equipment, even if the company is not found negligent.

In July, the California government enacted a law that is expected to lessen the financial problems that utilities would face from future wildfires. (The law does not affect

past wildfires.) A $21 billion fund was formed, half of which has been paid for by the utilities based on their relative size. Edison International issued debt and common

equity in order to finance its $2.4 billion share of this fund. (How the companies will account for these payments in their financial statements is yet to be determined.) Utilities will also benefit from a cost cap and a revised standard of prudence that is less burdensome, although the new law did not abolish inverse condemnation. Electric utilities have increased their capital and operating budgets as they attempt to reduce the risks of

wildfires and respond to them more quickly and effectively. Pacific Gas and Electric even shut down some power lines earlier this month in response to the risks, and received criticism for doing so. Some of the capital spending is recoverable in rates, but the companies will not earn an equity return on these expenditures. The cost of wildfire insurance has soared, which is hardly surprising, but the utilities are recovering these costs from customers.

In 2017, wildfires caused extensive damage in the service areas of Pacific Gas and Electric (a subsidiary of PG&E Corporation) and Southern California Edison (a subsidiary of Edison International). Investigations about the causes of some of the fires are ongoing, but the state agency conducting the investigations has already blamed Pacific G&E for some of them. Lawsuits have been filed against the utilities, as well. At this point, neither company knows what its liability will be. What makes the liability potentially huge is California’s inverse condemnation law. Under this law, if a utility’s equipment contributed to the fire, the utility is liable even if established inspection and safety rules were followed. PG&E, whose board suspended the dividend last December, has already taken a $2.5 billion charge for potential liability. There will undoubtedly be additional charges, but the amount and timing of these are impossible to predict. The utilities have insurance coverage,

but this probably won’t be enough to cover the entire liability.

Utilities in California are trying to address this problem through a regulatory, legal, and legislative strategy.The state legislative session ended with a new law that will be helpful to utilities. The regulatory commission will have to consider a utility’s financial health when determining who ultimately pays for the costs. Companies will be able to issue bonds that will be securitized by payments from customers over time. And the commission may split the costs between the utility and its customers, instead of disallowing recovery of the entire cost even if a utility was only partially responsible. (This is what happened to San Diego Gas & Electric, a subsidiary of Sempra Energy, which had to write off the entire cost related to wildfires that occurred in 2007.) Although the new law was welcome (and was even derided in some circles as a bailout for utilities), this fell far short of fixing the inverse condemnation problem. Accordingly, Pacific G&E and Southern California Edison

are trying to get some relief from the courts.

- 10/26/2019 – PG&E connection to Kincade Fire could deepen utility’s jeopardy (Kincade Fire)

In addition, under the company-backed plan of reorganization, investors can pull the

financing required for PG&E to exit bankruptcy if a fire linked to its equipment

destroys more than 500 structures this year. If PG&E does not resolve its bankruptcy as planned by June, it could lose access to a state-backed fund meant to offer utilities swift financing for wildfire claims.

- 10/25/2019 – PG&E detailed chapter 11 plan from its official website

- 10/25/2019 – As Kincade fire rages, Northern California faces biggest blackouts ever this weekend

The cause of the fire was still under investigation, but some suspicion was already turning to transmission lines owned by embattled Pacific Gas & Electric.

- 10/25/2019 – PG&E Shares Tumble as Wildfire Complicates Bankruptcy Case

Also, the utility company’s $3 billion bond due 2034 fell about 3.5%

PG&E shares dropped 24%, tumbling $1.70 to $5.50 each in early New York Stock Exchange trading, after the Kincade fire spread through Sonoma County in northern California. The company’s $3 billion bond due 2034 fell about 3.5% to 106.63 cents on the dollar and was the third most actively traded bond Friday with $130 million changing hands, according to data from MarketAxess.

The action reflects expectations that the firm may face some liability for starting the blaze, traders said—an outcome that would likely reduce any potential recoveries by investors in PG&E’s Chapter 11 bankruptcy proceeding.

Officials haven’t determined the cause of the blaze, but PG&E filed a public report Thursday stating it became aware of a broken wire on one of its transmission lines in the area seven minutes before the fire began.

- 10/25/2019 – This generator maker’s stock just soared to a record as PG&E power cuts cause business to boom – I need to find companies similar to Generac Holdings. GNRC’s stock ($90) jumps 82% YTD, intrinsic value by FCF is $53, might overvalued, I might need to wait for it dips.

- Generac Holdings hit a new all-time high on Friday, bringing its 2019 gain to 85%.

- Power cuts in California are leading to a surge in demand for the company’s backup generators.

- “This caught us totally off guard. We didn’t see the largest utility in the US coming out and saying ‘look our only solution is to turn the power off,’” Generac Holdings CEO Aaron Jagdfeld said.

- He said that the company has seen “three, four hundred percent increases in volumes out in California.”

Generac Power Systems

Analysis

Generac Power Systems is mainly a generator company – both residential and commercial. They claim to “own” 70% of the US market. They also make water pumps and pressure washers. And the pumps and engines that go along with them.

Their 2013 numbers looked like this: $1.46 billion total made up of $722 million from residential power products, $652 million from commercial and industrial power products and $87 million from other.

Engines used in these brands: Generac.

Engines used in these products: Generators, power washers, water pumps.

Key Competitors: Kohler, Briggs and Stratton, Honda, TTI, FNA Group, Karcher.

- 10/25/2019 – Pomerantz Law Firm Announces the Filing of a Class Action against PG&E Corporation and Certain Officers – PCG – do shareholder use this class lawsuit to compete with bondholder’s plan (fire victims’s claims)?

NEW YORK, Oct. 25, 2019 (GLOBE NEWSWIRE) — Pomerantz LLP announces that a class action lawsuit has been filed on behalf of shareholders of PG&E Corporation (“PG&E” or the “Company”) (: PCG) against certain of the Company’s officers. The class action, filed in United States District Court, for the Northern District of California, and indexed under 19-cv-06996, is on behalf of a class consisting of all persons and entities other than Defendants who purchased or otherwise, acquired PG&E securities between December 11, 2018, and October 11, 2019, both dates inclusive (the “Class Period”), seeking to recover damages caused by Defendants’ violations of the federal securities laws and to pursue remedies under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 promulgated thereunder, against the Company and certain of its top officials.

- 10/25/2019 – New California Wildfire Unsettles PG&E Bankruptcy

If linked to PG&E, the Kincade Wildfire could hurt shareholders’ attempt to protect their investments in the company

The Kincade fire is still burning, but if it is linked to PG&E’s equipment, the resulting damage claims could vault to the top of the repayment line in the company’s chapter 11 proceedings, leapfrogging other claimants.

Fear that another wildfire during PG&E’s bankruptcy could upset the proceedings has haunted the case from the start. Judge Dennis Montali called the prospect of a fire during bankruptcy “the elephant in the room” at hearing in March. He said such a claim could be “astronomical” and suggested it likely would be afforded top priority in a restructuring, meaning PG&E would have to satisfy those claimants in full and in cash ahead of other debts.

At the heart of each bankruptcy plan is the full payment of damages linked to wildfires in 2017 and 2018 that were linked to PG&E equipment, creating the massive liabilities that pushed the company into its second bankruptcy since 2001.

Both plans have built-in escape hatches in the event another catastrophic fire upsets the economics. Under the bondholder plan, it would take a fire that destroyed more than 500 dwellings or commercial structures to allow backers to walk away.

A person familiar with the bondholders’ thinking said Friday they remain committed to the chapter 11 plan they proposed, including an improved safety culture.

- 10/24/2019 – Sonoma County Fire Spreads Quickly, Forcing Evacuations

Kincade Fire, fueled by strong winds and dry conditions, threatens wineries and ranches - 10/24/2019 – California Blackouts Force Businesses to Tally Their Losses

PG&E’s second power shutdown this month raises stakes for stores; utility reports incident on power line near start of Sonoma County fire - 10/24/2019 – background knowledge of SDG&E: Video: SDG&E Releases Documentary on Wildfire Safety Mitigation Efforts | Sempra Energy – PG&E might also need to implement the same technologies in its system

- 10/21/2019 – San Jose to Propose Turning PG&E Into Giant Customer-Owned Utility

Largest city served by PG&E seeks to line up others behind plan to make it the nation’s biggest electric and gas cooperative - 10/16/2019 – Analysts Talk Utility Stocks In The Aftermath Of PG&E Bankruptcy News

- 10/15/2019 – PG&E says it got $34 billion in debt financing to help exit bankruptcy

- 10/15/2019 – Interim Update (1): Damage and Hazards Found After Safety Shutoff Confirm That Turning Off Power was the Right Decision

- 10/14/2019 – https://gordiangroup.com/tag/distressed-investing-conference/; http://www.bankrupt.com/DI2017/

- 10/10/2019 – California Power Outage Rolls Into Second Day, Millions Without Electricity

Next phase of mass blackouts begins, with 234,000 new customers affected - 10/10/2019 – PG&E Plunges on Unfavorable Bankruptcy Court Ruling

PG&E plunges after a U.S. bankruptcy court judge pulls the plug on the company’s exclusive control over its reorganization process. - 10/10/2019 – PG&E power outage could cost the California economy more than $2 billion

- 10/10/2019 – PG&E Plunges on Fear of Total Wipeout by New Bankruptcy Plan

Whether shareholders will actually suffer a total wipeout is open to question, because Montali’s ruling doesn’t shut down PG&E’s effort or necessarily favor its rivals.

“One plan emerging as confirmable is a very acceptable outcome,” Montali wrote. “And if both plans pass muster, the voters will make their choice or leave the court with the task of picking one of them.” He directed the noteholders to file their plan by Oct. 17.

It’s not the first time the company faced such a dilemma. PG&E’s utility unit filed for bankruptcy in 2001, and in that case, creditors were paid in full and shareholders kept considerable value.

Stock Answers

Regulators and creditors might want to maintain a capital structure of at least 50% equity that’s typical for a utility, which would help PG&E sell new shares and debt. Political and public relations considerations could also emerge if pension funds, workers and individual shareholders with sympathetic stories weigh in.

“This would be devastating for my retirement,” shareholder Andreas Krebs of San Francisco wrote to the judge a day before the ruling. “Please consider the average person that has invested their hard-earned retirement money into PG&E. I don’t even know how to address the greed and gall of these creditors that would want to wipe out average people’s savings in order to profit by taking over PG&E.”

The utility previously said it has already lined up $34 billion in debt financing for its own reorganization plan. The company has also received more than $14 billion in equity commitments. It has blasted the plan by Elliott and Pimco, saying it would lead to an “unjustified windfall” of billions of dollars for creditors at the expense of shareholders and utility customers.

Noteholders, meanwhile, said their efforts wouldn’t delay the bankruptcy case. They’ve joined forces with wildfire victims to pitch a plan that would pay out $25.5 billion to victims and their insurers. Their campaign to end PG&E’s exclusive control was supported by the official committee of unsecured creditors, labor unions and fire victims.

- 10/09/2019 – Two Big Tests For PG&E Shareholders

- 10/09/2019 – PG&E’s Bankruptcy Judge Opens the Door to Rival Chapter 11 Exit Plan

Decision clears way for plan from Elliott Management and other bondholders - 10/09/2019 – PG&E bankruptcy judge lets fire victims move forward with restructuring plan

- 10/07/2019 – A PG&E bankruptcy timeline: The road to Chapter 11 and beyond (PGE timeline)

- 10/04/2019 – Why PG&E Stock Popped 12% This Morning

A lawsuit raises hopes that there may be more money left over for stockholders. - 09/13/2019 – PG&E Shares Jump as $11 Billion Settlement Reached on Wildfire Claims

The settlement is subject to conditions including approval by the court overseeing the company’s Chapter 11 reorganization. - 09/05/2019 – PG&E’s Long Record of Run-Ins With Regulators: A ‘Cat and Mouse Game’

Over more than two decades, the California utility has at times misled regulators, withheld data and hindered investigations—accumulating fines and judgments of $2.6 billion - 04/16/2019 – Three Hedge Funds Win Big in PG&E’s Complex Restructuring

Firms that bought shares during January panic have since made $700 million, but gains remain unrealize. Abrams Capital Management LP, Knighthead Capital Management LLC and Redwood Capital Management LLC bought about 45 million PG&E shares in mid-January when the utility announced its plans to file for bankruptcy and its stock dropped to around $6 from $24. The stock has since recovered to around $23 as estimates of the company’s wildfire-related liabilities dropped and California’s government proposed new policies to address future wildfire risk.

If I bought LEAP at Jan lowest point, I can gain 11.5/0.65 = 1769.00%!! Too bad I missed this golden opportunity twice!!! I forgot about this opportunity and did not consistently follow this stock. BIG LESSON LEARNED for me!!!

- 02/10/2019 – PG&E’s Bankruptcy Filing Triggers Complex Reorganization Case

PG&E filed for bankruptcy protection as expected as it struggles with billions in potential liabilities from its role in sparking California wildfires, triggering one of the most complex corporate reorganization cases in years. - 01/29/2019 – PG&E Chapter 11 Bankruptcy: Here’s how it’ll affect customers, employees, shareholders

Shareholders could end up getting completely wiped out

Shareholders will be hurt. How badly depends on what the courts decide.

However it’s not unthinkable that stockholders could lose half or even all of their worth.

The price PG&E’s stock went up more than 2 percent the day the filing was announced. The stock price plummeted to a little more than $5 in early January. It traded at more than $47 in November, before details emerged about the utility’s potential role in the latest wildfires.

Shareholders will keep losing out on dividends

During the 2001 bankruptcy, investors lost out on about $1.7 billion in dividends.

PG&E already suspended dividends in 2017 in response to the North Bay wildfires.

There are a few reasons that the investors in PG&E’s stock aren’t cutting and running now. First, there is a chance the company’s bankruptcy won’t be accepted by the court. That’s because, as Morgan Stanley analyst Stephen Byrd and his team explain in a note today, the company is still essentially solvent. PG&E’s bankruptcy filing says it had $880 million of cash on its books as of Jan. 28. And the judge doesn’t necessarily have to accept its petition for bankruptcy, as the analysts write:

We believe there is a meaningful probability that a court would reject a PG&E Chapter 11 filing on the ground that the company is solvent and that PG&E is filing Chapter 11 to achieve tactical litigation advantages. Bankruptcy law includes a ‘good faith’ Chapter 11 filing requirement, in which the debtor (PG&E) must not be filing for reasons inconsistent with the reasons Chapter 11 was created. For example, if the debtor is solvent but is choosing to file Chapter 11 for tactical litigation advantages, such a filing is prohibited.

Even so, if the court rejects PG&E’s bankruptcy, that ignores the “fundamental risk of potentially open-ended fire liability” that comes with the state’s “inverse condemnation” rule, the analysts write. As a reminder, that rule means the state can hold investor-owned utilities liable for fires that their equipment helped start, even if the company wasn’t negligent.