Study of DRM, RPT, UBA, SPG, BAM, ESRT, FRT and MAC

- 01/12/2021 – increasing rate will draw down REITs even though renters are back. Before renters back, forbearing might need to be resolved first. Therefore, it might be a while for REITs to be back.

With additional stimulus likely high on the political docket for the incoming Biden administration, rising inflation expectations sent Treasury yields surging to post-pandemic highs, pressuring the yield-sensitive REIT sector.

- 12/09/2020 – renters are back, good for REIT companies

Renters return to Manhattan, driving 30% gain in new leases in November

- The number of new apartment leases signed in Manhattan in November jumped 30% compared with a year ago, according to a report from Miller Samuel and Douglas Elliman.

- The median rent price is now $2,743, with most landlords offering more than two months free rent.

- A real estate recovery in Manhattan will likely take years, given the huge supply of empty apartments and condos and co-ops for sale, brokers say.

- The vacancy rate is at a record 6%, but may be even higher due to unlisted apartments.

- 12/01/2020 – a setback of office come back, good chance to buy more?

A New Setback for Big Cities as Return to the Office Fades

The low level of employees back at their workplaces is intensifying pain for cities geared toward office life

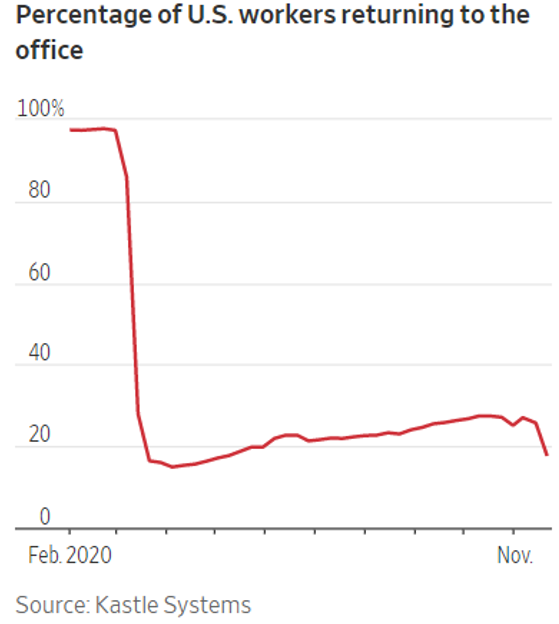

About a quarter of employees had returned to work as of Nov. 18, according to Kastle Systems, a security firm that monitors access-card swipes in more than 2,500 office buildings in 10 of the largest U.S. cities.

That rate is up sharply from an April low of less than 15%, which largely consisted of building-maintenance and essential workers. The office return rate climbed steadily during the summer and early fall, but it has flattened out after reaching a high point of 27% in mid-October, Kastle said. The rate for last week was down even more sharply than in previous weeks but likely reflected the Thanksgiving Day holiday.

“There’s a huge headwind against company executives to strongly push their employee bases to come back to work,” said Douglas Linde, president of big office owner Boston Properties Inc.

- 11/29/2020 – worth to look at it

Vanguard Real Estate Index Fund ETF Shares (VNQ)

- 11/28/2020 – Why buy REITs

Billionaire Investor Says ‘Buy REITs’ – Part 2

- Billionaire investor Bruce Flatt is heavily investing in the recovery of real estate and REITs investments.

- Many investors view this as reckless. They claim that malls and office buildings are dead, and that cap rates are too low.

- We disagree and believe that now is the best time in 10 years to invest discounted REITs ahead of further cap rate compression.

“You Shouldn’t Invest in Real Estate Because Tech is Killing Malls and Office Buildings”

The first issue with this statement is that malls and office buildings are only a small fraction of the real estate market. Only ~10% of REITs invest in them, and the remaining ~90% in much more defensive properties:

- Warehouses

- Distribution centers

- Apartment communities

- Manufactured housing

- Timberland

- Grocery-store anchored strip centers

- Net lease properties

- Data centers

- Cell towers

- Farmland

- Etc…

Most of these properties are doing just fine, and your fears of office buildings and malls shouldn’t keep you away from other real estate investments. Today, nearly all REITs get a bad rep and are discounted because of a few struggling property sectors.

Why Do Real Interest Rates Matter For Real Estate?

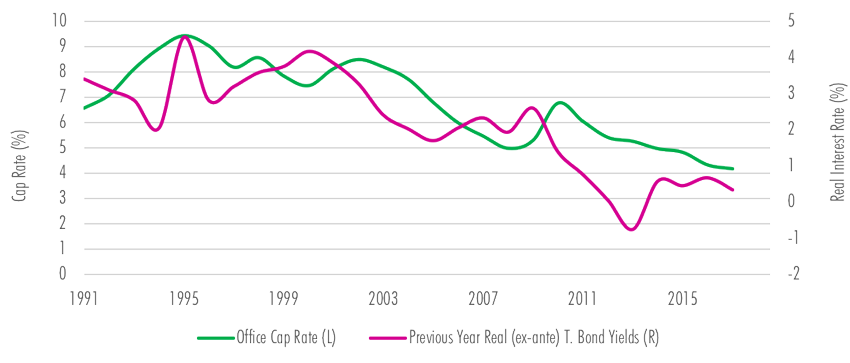

First and foremost, there is a very close statistical relationship between real interest rates and cap rates or yields1 (Figure 1 shows this for the U.S.). The long downward trend in cap rates dates from the mid-1990s and is not just a product of QE and the post-GFC world, but is also heavily linked to the fall in real interest rates.

CAP RATE = REAL INTEREST RATE + SPREAD

Spread = f (expected rent growth, debt availability, performance of other assets)

Real long-term interest rates are the key driver of cap rates. In effect, cap rates move 1-for-1 with real interest rates in the long run.

Billionaire Investor Says ‘Buy REITs’

- Billionaire investor Bruce Flatt is betting big on real estate and expects property prices to surge in the aftermath of this crisis.

- He believes that REITs are the best bargains in today’s market.

- We present why this is a generational opportunity. We keep buying more shares of REITs week after week.