Study of PLL

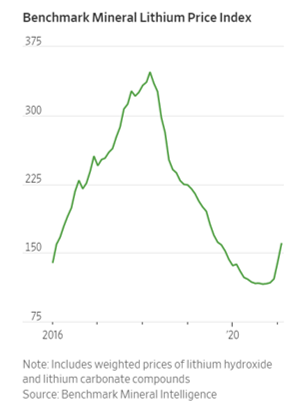

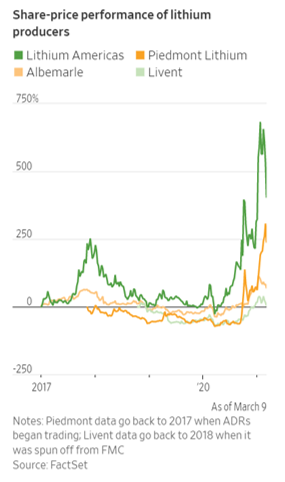

03/11/2021 – Lithium is highly demand (domestically) for EV. Piedmont Lithium Ltd. PLL starts to explore the mine region. Piedmont is still about two years away from pulling lithium out of the ground in North Carolina. Last September, it announced a deal to supply lithium to Tesla Inc. once its mine comes into operation. And Although lithium deposits can be found all over the world, it’s difficult to turn them into the chemicals that power batteries. Refining the metal involves large amounts of equipment and intricate chemical processes that can cause water and soil pollution without proper controls. It can take five or more years for a new lithium-mining operation to produce battery-grade materials, experts say. – so total it might take 7 years or more to have battery-grade materials!! Is there too much speculation or potential growth?

America’s Battery-Powered Car Hopes Ride on Lithium. One Producer Paves the Way. – WSJ

The U.S. is racing to catch up to China in mining and refining the metal, and Piedmont Lithium is at the leading edge

Lamont Leatherman, a 55-year-old geologist who grew up here, is its unlikely instigator. A decade ago, he combed the woods near his childhood home in search of lithium, a soft, white metal he believed would be crucial to the burgeoning industry of electric vehicles.

Now, the company he helped found five years ago to explore the region, Piedmont Lithium Ltd. PLL 6.50% , has deployed drilling rigs throughout the 2,300 acres it owns or controls to map out deposits. The company is preparing to launch one of the first big new lithium mines in the U.S. in decades.

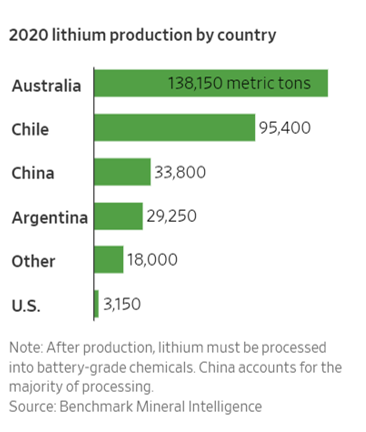

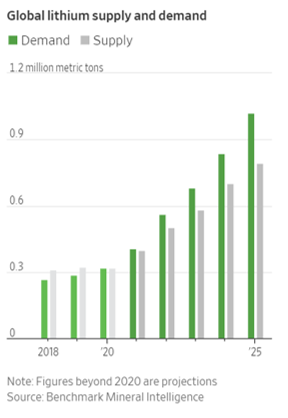

Lithium is an increasingly crucial material, central to the rechargeable batteries that power cellphones and electric cars. These batteries are becoming a disruptive force in the energy sector as well. Demand, especially from vehicles, is expected to surge, and controlling the resources that power them is the 21st-century version of oil security.

Piedmont is still about two years away from pulling lithium out of the ground in North Carolina. Last September, it announced a deal to supply lithium to Tesla Inc. once its mine comes into operation. The company plans to spend more than $500 million to build a pair of plants to extract lithium.

“We’re going to build a big business here,” said Chief Executive Keith Phillips, a former mining banker for firms such as JPMorgan Chase & Co.

Piedmont’s U.S.-listed shares recently hit $80, up from $11 before the company unveiled the Tesla deal. The surge briefly gave the company a market value above $1 billion.

Exploration is well under way. In January, a small team of workers bored tubes hundreds of feet into the earth to map the deposits of lithium several miles north of the original mine that produced lithium for bombs. Spodumene, the mineral that contains lithium, is abundant in what’s known as the Carolina Tin-Spodumene Belt.

Although lithium deposits can be found all over the world, it’s difficult to turn them into the chemicals that power batteries. Refining the metal involves large amounts of equipment and intricate chemical processes that can cause water and soil pollution without proper controls. It can take five or more years for a new lithium-mining operation to produce battery-grade materials, experts say.