Study of Burry

-

- 08/23/2021 – Burry bets more on interest rate hike

‘Big Short’ investor Michael Burry is betting that interest rates are about to go up

Burry’s Scion Asset Management has upped its holdings of put options on the iShares 20+ Year Treasury Bond ETF, an index fund that tracks long-dated US government bonds, to $280 million from $172 million three months prior, according to the SEC disclosures.

-

- 06/26/2021 – recap of Burry’s view on financial crisis

Michael Burry on the financial crisis

Watch video of Michael Burry speaking April 5, 2011 on “Missteps to Mayhem: Inside the Doomsday Machine with the Outsider who Predicted and Profited from America’s Financial Armageddon,” as part of the 2010-2011 Chancellor’s Lecture Series at Vanderbilt University.

-

- 06/26/2021 – another great video on Burry’s bio

Michael Burry: How I Made My First $1,000,000

-

- 06/22/2021 – Burry deleted his tweet again

Michael Burry deleted his Twitter account on Monday after sounding the alarm on a colossal bubble in asset prices and predicting the worst crash in history.

The investor of “The Big Short” fame had rejoined Twitter only last week after deleting his account in early April. During his brief return to the platform, his tweets ranged from investing advice to song lyrics; he also commented on cryptocurrencies, stocks, inflation, and government bailouts.

“Greatest Speculative Bubble of All Time in All Things” was his description of markets last week. “All hype/speculation is doing is drawing in retail before the mother of all crashes,” he tweeted a couple of days later.

The Scion Asset Management boss cautioned that bitcoin was overpriced and that a dangerous borrowing binge had fueled the crypto boom. He described the Federal Reserve as a “misguided monster” for focusing so much on preventing market declines. And he highlighted news reports of supply shortages and hoarding as evidence of a mounting inflation threat.

Burry offered some tips for investors, too. “Analyze, think independently, be informed, find the data, and you’ll know a lot that no one else does,” he tweeted.

The fund manager highlighted the opportunity to pinpoint stocks that institutions can’t own because of their size, client base, or federal regulations but where there’s a path to future ownership.

Burry revealed that he wasn’t a fan of the US government stepping in to save banks and insurers during the financial crisis. “I hated the bailouts too!” he tweeted, adding that AIG and Goldman Sachs should have been allowed to collapse.

Notably, the value investor isn’t as bearish on “big tech” stocks as might be assumed. He tweeted that recent stock-price gains for Facebook and Alphabet, Google’s parent, were “for very good reasons that completely #trump my own personal distaste.”

When one of Burry’s followers asked whether he’d been approached about making a new movie, presumably on the meme-stock boom this year, he responded, “Believe it or not, yes.”

Burry is best known for his starring role in “The Big Short,” a book by Michael Lewis that chronicled his billion-dollar bet against the US housing bubble in the mid-2000s. Christian Bale played the fund manager in the movie adaptation.

The Scion chief laid the groundwork for the GameStop short squeeze in January by investing in the video-game retailer back in 2019 and underscoring the company’s untapped potential in several letters to its bosses.

-

- 06/21/2021 – be aware of the market crash and get ready for it. – prepare for the seven years draught and famine!

Michael Burry Just DESTROYED Cathie Wood (And Warned Of Great Depression 2.0)

Burry said the market crash will be the biggest in history.

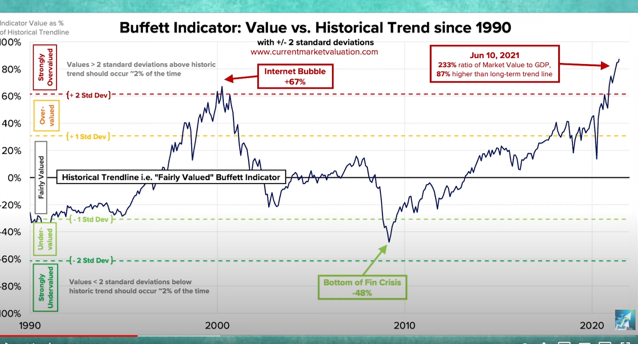

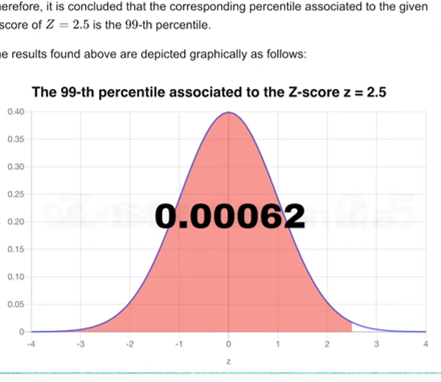

- Buffett indicator is at historical high, and 99th percentile

2. Burry’s phrase: retail investors are like pigs, eat a lot and trying to timing the market, but eventually get killed

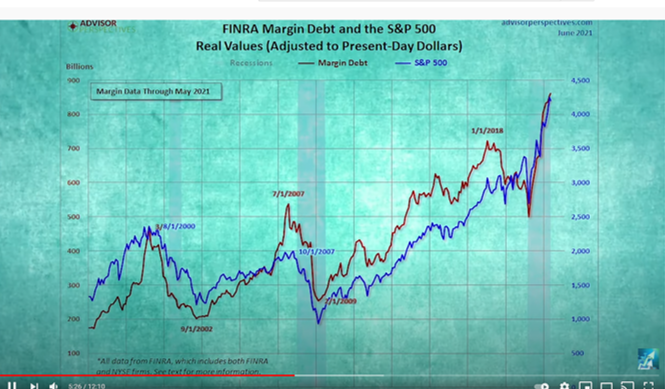

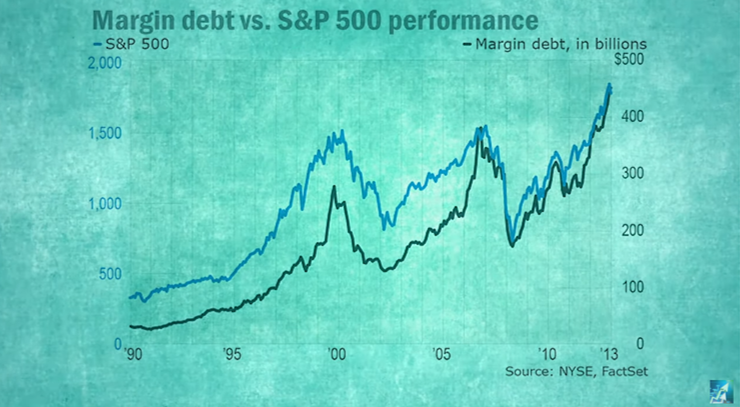

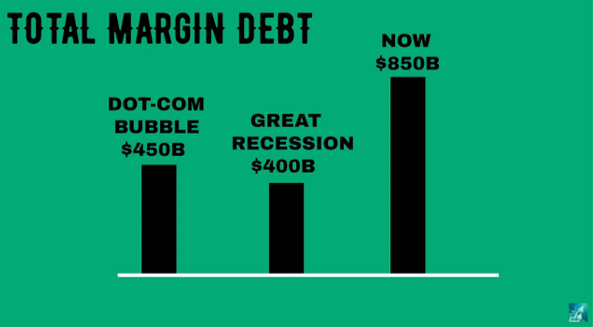

3. we have historical high margin debt – more than two times of that of 2008, once margin call happens, the crash will be unprecedent. Margin debt correlates very well with SP500.

-

- 06/21/2021 – FB and GOOG continue to rise due to revenue of ad from economy reopening, exactly like Murry predicted

Facebook, Alphabet Keep Rising; Apple, Netflix Fade – WSJ

After a synchronized surge last year, so-called FAANG stocks peel away as investors look beyond pandemic

Among big tech stocks, Alphabet and Facebook have served as a kind of reopening play, reporting a surge in advertising. Facebook’s profit in its latest quarter nearly doubled from a year earlier, while Alphabet’s earnings more than doubled.

“They’ve had this huge resurgence in online advertising and that’s really been driving the stocks,” said Daniel Morgan, senior portfolio manager at Synovus Trust Co. “All these businesses are reopening, coming back on, the economy’s accelerating. Where do they go to promote themselves? A lot of them go to Facebook.”

Netflix, by contrast, disappointed investors when it reported that its subscriber growth had slowed as the economy reopened. The streaming giant got a boost from the pandemic as many consumers were forced or chose to stay home, and it ended 2020 with more than 200 million subscribers.

-

- 05/28/2021 – The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increase while retail sales, PMI stage V recovery. Trillion more stimulus & reopening to boost demand as employee and supply chain costs skyrocket. #ParadigmShift. – Burry’s huge bet on inflation

Michael Burry’s BIG Bet On Inflation (The Big Short 2.0?)

Burry’s huge bet on interest rate – be aware the long term downward trend of leveraged bear ETFs, they are not good for long term investment. Burry might have already sold them

- TLT – 1,266,400 shares, $171.534 million, put

- TBT – 2X bear, 2,536,000 shares, $55.133 million, call

- TBT – 2X bear, 300,000 shares, $6.522 million, ETF

- TTT – 3x bear, 100,000 shares, $4.577 million, call

- TMV – 3x bear, 38,400 shares, $3.138 million, call

- IWO – 140,900 shares, $42.374 million, put

Michael Burry Warns Of An Upcoming Frightening Market Crash & Bets Big On It

- Burry bullish on FB (550,000 shares, $161.992 million, call) and GOOG (80,000 shares, $165.490 million, call) because the higher the inflation, the more advertisement payment they will receive from customers

- Burry bullish on consumer staples such as Hence Kraft and CVS because they are inflation defenders

- the speculated stock market will ultimately make investors borrow a lot of loans for margin, once market dip, the chain reaction will cost the crash

- Burry might bet on short term, not long term

- Burry’s huge bet on interest rate and inflation is impressive

- the definition of hyperinflation is currency loses value by 50% daily!

- Remember Burry’s famous quote: “The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increase while retail sales, PMI stage V recovery. Trillion more stimulus & reopening to boost demand as employee and supply chain costs skyrocket. #ParadigmShift.”

-

- 05/18/2021 – Need to study Burry’s updated portfolio

Michael Burry’s Scion goes bearish on Tesla, bullish on Facebook and Alphabet

- Scion Asset Management, run by investor Michael Burry of “The Big Short” fame, discloses a bet that Tesla (TSLA -3.9%) stock will fall in its latest 13F filing.

- The firm holds put options on 800,100 Tesla shares, as of March 31, 2021.

- At the same time, Scion doubled down on its bullish bet on Kraft Heinz (KHC +0.7%), with call options on 1.17M KHC shares, up from 589.7K shares as of Dec. 31, 2020.

- Also holds call options on 550K shares of Facebook (FB -0.9%) and call options on 80K class C shares of Alphabet (GOOG -0.3%), both new positions.

- Scion takes a new 225K-share position in Occidental Petroleum (OXY +3.7%).

- Cuts stake in ServiceNow (NOW -1.8%) to 700K shares from 1.5M shares previously.

| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13FFORM 13F INFORMATION TABLE |

|

||||||||||||||||||

| COLUMN 1 | COLUMN 2 | COLUMN 3 | COLUMN 4 | COLUMN 5 | COLUMN 6 | COLUMN 7 | COLUMN 8 | ||||

| VALUE | SHRS OR | SH/ | PUT/ | INVESTMENT | OTHER | VOTING AUTHORITY | |||||

| NAME OF ISSUER | TITLE OF CLASS | CUSIP | (x$1000) | PRN AMT | PRN | CALL | DISCRETION | MANAGER | SOLE | SHARED | NONE |

| AERPIO PHARMACEUTICALS INC | COM | 00810B105 | 1,290 | 1,000,000 | SH | DFND | 1,2 | 1,000,000 | 0 | 0 | |

| ALPHABET INC | CAP STK CL C | 02079K107 | 165,490 | 80,000 | SH | Call | DFND | 1,2 | 80,000 | 0 | 0 |

| CORECIVIC INC | COM | 21871N101 | 9,955 | 1,100,000 | SH | DFND | 1,2 | 1,100,000 | 0 | 0 | |

| CVS HEALTH CORP | COM | 126650100 | 30,092 | 400,000 | SH | Call | DFND | 1,2 | 400,000 | 0 | 0 |

| CVS HEALTH CORP | COM | 126650100 | 8,275 | 110,000 | SH | DFND | 1,2 | 110,000 | 0 | 0 | |

| DIREXION SHS ETF TR | 20YR TRES BEAR | 25460G849 | 3,128 | 38,400 | SH | Call | DFND | 1,2 | 38,400 | 0 | 0 |

| FACEBOOK INC | CL A | 30303M102 | 161,992 | 550,000 | SH | Call | DFND | 1,2 | 550,000 | 0 | 0 |

| GENCO SHIPPING & TRADING LTD | SHS | Y2685T131 | 3,575 | 354,711 | SH | DFND | 1,2 | 354,711 | 0 | 0 | |

| GOLDEN OCEAN GROUP LTD | SHS NEW | G39637205 | 3,554 | 530,000 | SH | DFND | 1,2 | 530,000 | 0 | 0 | |

| HELMERICH & PAYNE INC | COM | 423452101 | 5,392 | 200,000 | SH | DFND | 1,2 | 200,000 | 0 | 0 | |

| INGLES MKTS INC | CL A | 457030104 | 9,248 | 150,000 | SH | DFND | 1,2 | 150,000 | 0 | 0 | |

| ISHARES TR | 20 YR TR BD ETF | 464287432 | 171,534 | 1,266,400 | SH | Put | DFND | 1,2 | 1,266,400 | 0 | 0 |

| ISHARES TR | RUS 2000 GRW ETF | 464287648 | 42,374 | 140,900 | SH | Put | DFND | 1,2 | 140,900 | 0 | 0 |

| KRAFT HEINZ CO | COM | 500754106 | 46,992 | 1,174,800 | SH | Call | DFND | 1,2 | 1,174,800 | 0 | 0 |

| LUMEN TECHNOLOGIES INC | COM | 550241103 | 8,678 | 650,000 | SH | DFND | 1,2 | 650,000 | 0 | 0 | |

| MARINUS PHARMACEUTICALS INC | COM NEW | 56854Q200 | 4,602 | 297,272 | SH | DFND | 1,2 | 297,272 | 0 | 0 | |

| MEREDITH CORP | COM | 589433101 | 4,169 | 140,000 | SH | DFND | 1,2 | 140,000 | 0 | 0 | |

| NETAPP INC | COM | 64110D104 | 21,801 | 300,000 | SH | Call | DFND | 1,2 | 300,000 | 0 | 0 |

| NOW INC | COM | 67011P100 | 7,063 | 700,000 | SH | DFND | 1,2 | 700,000 | 0 | 0 | |

| OCCIDENTAL PETE CORP | COM | 674599105 | 5,990 | 225,000 | SH | DFND | 1,2 | 225,000 | 0 | 0 | |

| PRECISION DRILLING CORP | COM NEW | 74022D407 | 4,813 | 222,706 | SH | DFND | 1,2 | 222,706 | 0 | 0 | |

| PROSHARES TR | PSHS ULTSH 20YRS | 74347B201 | 6,522 | 300,000 | SH | DFND | 1,2 | 300,000 | 0 | 0 | |

| PROSHARES TR | PSHS ULTSH 20YRS | 74347B201 | 55,133 | 2,536,000 | SH | Call | DFND | 1,2 | 2,536,000 | 0 | 0 |

| PROSHARES TR | ULSH 20YRTRE NEW | 74347G887 | 4,577 | 100,000 | SH | Call | DFND | 1,2 | 100,000 | 0 | 0 |

| RPT REALTY | SH BEN INT | 74971D101 | 6,846 | 600,000 | SH | DFND | 1,2 | 600,000 | 0 | 0 | |

| SCORPIO TANKERS INC | SHS | Y7542C130 | 3,509 | 190,100 | SH | DFND | 1,2 | 190,100 | 0 | 0 | |

| SUNCOKE ENERGY INC | COM | 86722A103 | 7,711 | 1,100,000 | SH | DFND | 1,2 | 1,100,000 | 0 | 0 | |

| TESLA INC | COM | 88160R101 | 534,411 | 800,100 | SH | Put | DFND | 1,2 | 800,100 | 0 | 0 |

| URSTADT BIDDLE PPTYS INC | CL A | 917286205 | 874 | 52,512 | SH | DFND | 1,2 | 52,512 | 0 | 0 | |

| VECTOR ACQUISITION CORP | COM CL A | G9442R126 | 5,465 | 461,591 | SH | DFND | 1,2 | 461,591 | 0 | 0 | |

| ZYMEWORKS INC | COM | 98985W102 | 8,875 | 281,018 | SH | DFND | 1,2 | 281,018 | 0 | 0 | |

Michael Burry’s SHOCKING Position REVEALED | Hyper-Inflation Prep

very bearish on TSLA

very bullish on FB and GOOG

Very bearing on bond price, using

-

- 04/08/2021 – website to track Burry’s portfolio

https://twitter.com/intent/follow?ref_src=twsrc%5Etfw&screen_name=cheaperthanguru&tw_p=followbutton

- 04/03/2021 – Burry’s books

-

- 03/20/2021 – detailed study of MB’s stocks

Michael Burry’s New Stock Picks

-

- 03/16/2021 – Burry slams NFTs

- Michael Burry subtly criticized non-fungible tokens (NFTs) this week.

- “The Big Short” investor shared a quote comparing NFTs to “magic beans.”

- Burry has blasted Tesla, bitcoin, Dogecoin, GameStop, and other popular bets this year.

- 03/13/2021 – video in MB

-

- 03/04/2021 – Burry invests in POAHF

‘Big Short’ investor Michael Burry is betting Volkswagen will beat Tesla in electric vehicles

Michael Burry owns a stake in Volkswagen’s largest shareholder, Porsche SE.

“The Big Short” investor is betting Volkswagen can beat Tesla in electric vehicles.

Burry said he was short Elon Musk’s car company in December.

- 03/03/2021 – another archive and study of MB

https://acquirersmultiple.com/tag/michael-burry/

- 03/02/2021 – MB background

Michael James Burry (/ˈbɜːri/; born June 19, 1971) is an American investor, hedge fund manager, and physician. He founded the hedge fund Scion Capital, which he ran from 2000 until 2008, before closing the firm to focus on his own personal investments. Burry is best known for being the first investor to foresee and profit from the subprime mortgage crisis that occurred between 2007 and 2010

In an April 3, 2010 op-ed for The New York Times, Burry argued that anyone who studied the financial markets carefully in 2003, 2004, and 2005 could have recognized the growing risk in the subprime markets.[18] He faulted federal regulators for failing to listen to warnings from outside a closed circle of advisors.[18][16]

- 03/02/2021 – Burry is buying physical lands with water on site, housing (in special situations) and gold to bet against hyperinflation?

Sept 7, 2010: Burry Discusses Investing in Farmland, Real Estate, Gold: Video

“I don’t think the recovery will be that robust” – It’s 2018 and we’re already back up to 2007 bubble housing prices in many markets all over the U.S….Here we go again!

Lmao this guy is buying real estate with all the money he got from the banks predicting the real estate market to crash

- 02/23/2021 – Burry on learning inflation effect from Buffet

‘Big Short’ investor Michael Burry turns to Warren Buffett to underscore the dangers of inflation

Michael Burry of “The Big Short” fame turned to Warren Buffett to hammer home the dangers of inflation in a Twitter thread on Tuesday.

“Warren Buffett’s #BerkshireHathaway annual letters guided me tremendously earlier on,” the Scion Asset Management boss said.

“During the last great inflation, #WarrenBuffett wrote about the topic at hand, and for those eyeing the future, this is worth revisiting, the 1980 chairman’s letter.”

Burry shared several screenshots from Buffett’s 1980 letter to Berkshire Hathaway shareholders. In the letter, Buffett explained that high rates of inflation act as a tax on capital, discouraging companies from investing by reducing their real returns.

Inflation can also result in investors earning negative returns, Buffett said, because it serves as an implicit tax on their purchasing power, on top of the explicit taxes they pay on dividends and investment gains.

“The average tax-paying investor is now running up a down escalator whose pace has accelerated to the point where his upward progress is nil,” the Berkshire chief wrote.

Burry dredged up the letter to emphasize that if inflation ramps up, corporate profits today will be far more valuable then profits in the future.

“Taking #Buffett’s lessons from 1980, and porting them to 2021 doesn’t take much translation,” he tweeted.

02/23/2021 – Burry on learning from Buffett

- Michael Burry analyzed Warren Buffett as a young investor but decided not to model himself on the Berkshire Hathaway chief.

- Burry, whose massive bet against the US housing market was immortalized in “The Big Short,” realized Buffett’s willingness to depart from the teachings of his mentor, Benjamin Graham, was key to his phenomenal success.

- “I recognized that Warren Buffett, though he had every advantage in learning from Ben Graham, did not copy Ben Graham, but rather set out on his own path, and ran money his way, by his own rules,” Burry said.

- “Buffett was too popular for me,” Burry said. “I won’t ever be a kindly grandfather figure.”

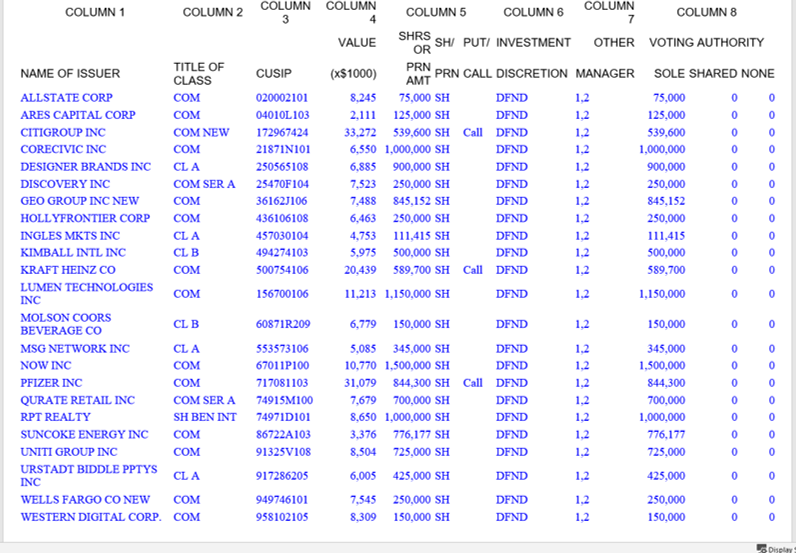

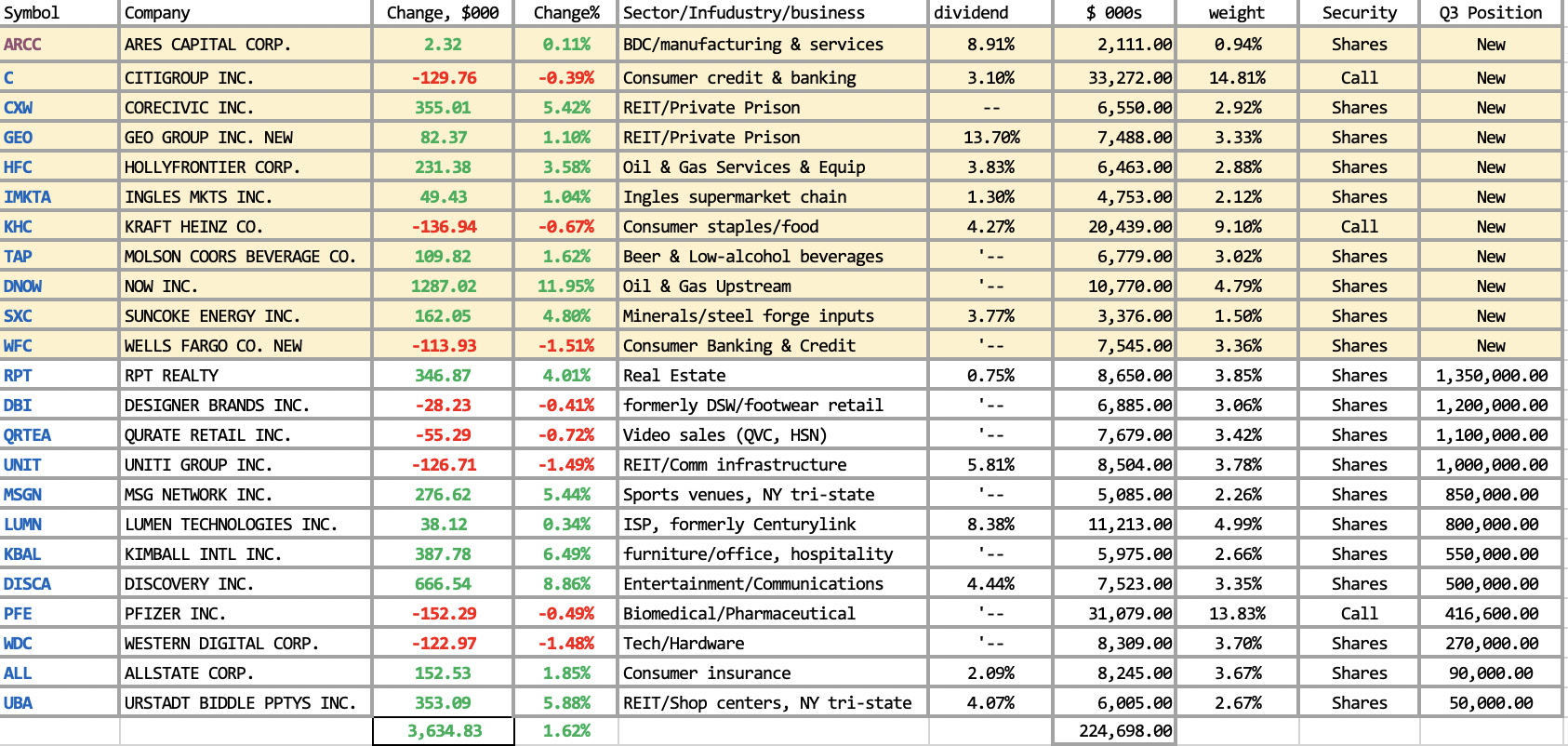

- 02/22/2021 – study of Burry’s 4Q20 portfolio: DNOW, WFC, GEO

Michael Burry Goes on a Buying Spree in 4th Quarter

Michael Burry’s Scion Asset Management appeared to be incredibly active in the fourth quarter of 2020, according to its latest 13F.

According to the report, which covers the three months to the end of December 2020, Burry acquired nine new positions during the period and added to two existing holdings. He also divested nine holdings throughout the period and reduced a further nine.

The most significant portfolio addition last quarter was NOW Inc. (NYSE:DNOW). Scion acquired 1.5 million shares in the business, giving it a 7.7% portfolio weight. This global distributor to the oil and gas and industrial markets has seen revenues fall by more than half over the past five years.

However, despite this decline, the firm’s balance sheet is full of cash. At the end of the last fiscal period, its net cash balance was $376 million. It is currently changing hands at a price to tangible book value of 1.5, although Wall Street analysts do not expect the business to return to profit until at least 2023.

The second-largest addition to the portfolio was Wells Fargo (NYSE:WFC), and the third-largest was GEO Group (NYSE:GEO). Both of these additions now account for around 5% of the overall portfolio.

GEO is an interesting buy for Burry’s portfolio. The firm is a real estate investment trust, which specializes in the ownership, leasing and management of correctional, detention and re-entry facilities across the U.S. (i.e. it’s basically a for-profit prison company). Political factors have seen the stock come under significant selling pressure in recent weeks and months. After these falls, shares in the business at changing hands at just under book value.

This seems like a classic Burry trade. He likely sees significant value in this company’s assets when looking beyond the political headwinds currently driving buyers away.

Three other stocks Burry was buying in the third quarter were Molson Coors Beverage Co. (NYSE:TAP), CoreCivic Inc. (NYSE:CXW) and HollyFrontier Corp. (NYSE:HFC). It seems that to make space for these holdings and free up capital, Burry divested his GameStop (NYSE:GME) holding, which previously made up around 11% of assets in Scion’s equity portfolio.

- 02/19/2021 – what should I do with upcoming inflation?

- Michael Burry expects the economy’s reopening and more stimulus to fuel inflation.

- “The Big Short” investor warned governments might ‘squash’ bitcoin and gold to protect their currencies.

- Burry highlighted Germany’s hyperflation in the 1920s as a cautionary tale for the US.

- 02/17/2021 – more needed to be read

https://fintel.io/i/scion-asset-management-llc

https://www.gurufocus.com/news/1289435/%5C

- 02/17/2021 – 4Q20 portfolio

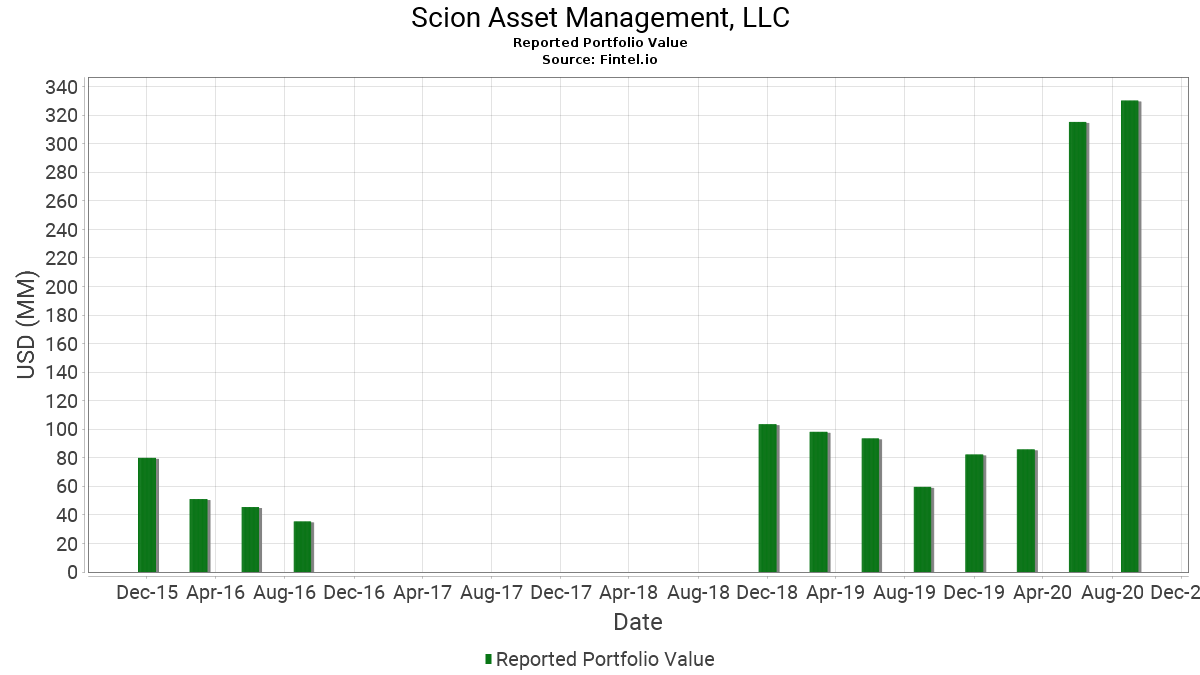

- 02/17/2021 – Michael Burry portfolio performance: 4x jump in value, stunning!

resource: https://fintel.io/i/scion-asset-management-llc

- 10/21/2019 – study on CAH

Four Drug Companies Reach Last-Minute Settlement in Opioid Litigation

McKesson, Cardinal Health, AmerisourceBergen and Teva agree to $260 million settlement

- 10/20/2019 – What Michael Burry (Of The Big Short) Is Investing In Now

- 10/20/2019 – SEC portfolio Aug 2019

| 60,000 | 9,851 | 10.53 | |||||||||||

| 2019-06-30 | 13F | GOOG / Alphabet Inc. Class C | 9,000 | 9,728 | 10.40 | ||||||||

| 2019-06-30 | 13F | CAH / Cardinal Health, Inc. | 200,000 | 9,420 | 10.07 | ||||||||

| 2019-06-30 | 13F | BABA / Alibaba Group Holding Limited | 50,000 | 8,473 | 9.06 | ||||||||

| 2019-06-30 | 13F | DIS / The Walt Disney Co. | 60,000 | -14.29 | 8,378 | 7.80 | 8.95 | ||||||

| 2019-06-30 | 13F | GSKY / GreenSky, Inc. | 600,000 | 120.57 | 7,374 | 109.49 | 7.88 | ||||||

| 2019-06-30 | 13F | SPWH / Sportsman’s Warehouse Holdings, Inc. | 1,597,011 | 27.75 | 6,037 | 0.60 | 6.45 | ||||||

| 2019-06-30 | 13F | AABA / Altaba Inc | 0 | -100.00 | 0 | -100.00 | 0.00 | ||||||

| 2019-06-30 | 13F | CPLG / CorePoint Lodging Inc. | 0 | -100.00 | 0 | -100.00 | 0.00 | ||||||

| 2019-06-30 | 13F | FB / Facebook, Inc. | 0 | -100.00 | 0 | -100.00 | 0.00 | ||||||

| 2019-06-30 | 13F | FPH / Five Point Holdings, LLC | 0 | -100.00 | 0 | -100.00 | 0.00 | ||||||

| 2019-06-30 | 13F | GME / GameStop Corp. | 0 | -100.00 | 0 | -100.00 | 0.00 | ||||||

| 2019-06-30 | 13F | GOOGL / Alphabet Inc. | 0 | -100.00 | 0 | -100.00 | 0.00 | ||||||

| 2019-06-30 | 13F | JD / JD.com, Inc. | 0 | -100.00 | 0 | -100.00 | 0.00 | ||||||

| 2019-06-30 | 13F | PETQ / PetIQ, Inc. | 0 | -100.00 | 0 | -100.00 | 0.00 |

- 10/15/2019 – Scion asset management – What are they investing in Right Now?

- 10/14/2019 – Scion Asset Management LLC information

AndyB3 years ago