Study of RUT

Catalyst

- economy continue to reopen, benefits most to small businesses

- stock rotation from big high tech (too high price of stock) to small businesses

- higher interest rate makes banks lending to small business easier

risk

- inflation – Higher prices for materials and rising borrowing costs make it more difficult for small businesses to operate. It is harder for the smaller entities than their larger peers to push higher operating costs onto the consumer.

***************************************************************

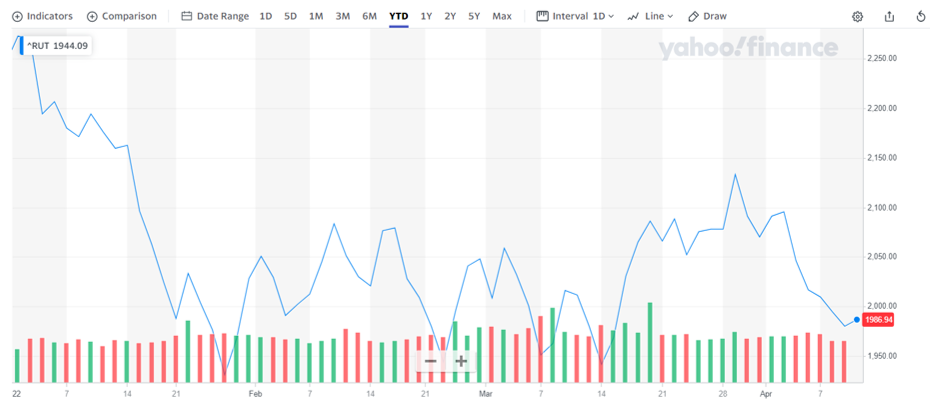

- 04/12/2022 – RUT history price, YTD down by -12.57% (from $2272.56 to $1986.94)

- 11/07/2021 – RUT is going to break out

This Group of Stocks Is About to Break Out

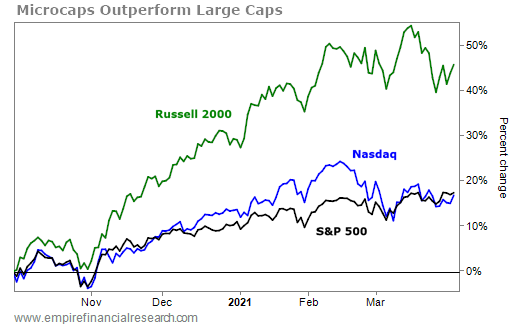

The past few weeks have been choppy for large-cap stocks. Investors have been set up for disappointment this earnings season, leading to short-term volatility.

The large-cap S&P 500 Index and the tech-heavy Nasdaq are up 6% and 10%, respectively, since late August. Still, it hasn’t been a smooth ride up… And investors are beginning to clue into what we have been saying: the slowing of earnings growth for the near future, fears over inflation, and concerns with Washington’s threatening deadlock.

While this doesn’t mean a crash is imminent, it does mean for the moment that large-cap names like Apple (AAPL) and Facebook (FB) may not be the best place to park your money.

Instead, another group of stocks has weathered this recent volatility even better than most: The Russell 2000 – the index of small and microcap names – is up 13% over the same period.

Part of the reason for this is that the Russell 2000 has been relatively stagnant since March, while the other indexes have continued to rally. The S&P 500 was up more than 15% from March through August. The Nasdaq was up more than 13% in the same period, while the Russell was flat.

From October 2020 to March 2021, the S&P 500 and the Nasdaq were up less than 20% each. However, the Russell 2000 was up almost 50% during the same period…

As some technical analysts at Real Money and other outlets have highlighted, the Russell 2000 shows that the market is beginning to recognize the potential for another small-cap and microcap run. And it’s not based just on hype, but on fundamentals.