Study of Meta and TWTR

- Potential future catalyst

- Potential future risks

- In general, TWTR is driven by a number of key factors:

- Go-to website for TWTR stocks investment

- Quote from the epilogue of the book “Elon Musk – Tesla, SpaceX, and the Quest for e Fantastic Future” – ”

He’s not really wired to fail“.

- Elon Musk says Twitter is a war Zone!

- 04/18/2022 – More potential buyers for TWTR? There is no guarantee any private-equity firm will end up making a firm bid, whether for the entire company or just a portion, and there may well be no deal in the end—with Mr. Musk or anyone else. Taking Twitter private would rank as one of the largest leveraged buyouts of all time, and the company doesn’t have the attributes of a typical LBO target like strong, stable cash flow.

Apollo Global Considers Participating in a Bid for Twitter – WSJ

Elon Musk’s $43 billion pitch has put the social-media company in play

Apollo Global Management Inc. is considering participating in a bid for Twitter Inc., TWTR 0.64% ▲ according to people familiar with the matter, after Elon Musk’s $43 billion bid put the social-media company in play.

Apollo, one of the world’s largest buyout firms, has held discussions about backing a possible deal for Twitter and could provide Mr. Musk or another bidder like private-equity firm Thoma Bravo LP with equity or debt to support an offer, the people said.

Apollo, which owns Yahoo, has also been evaluating potential cooperation between the online-media company and Twitter, the people said. There is no guarantee Twitter would be receptive to that, or any other deal.

Private-equity firms including Thoma Bravo are circling Twitter, people familiar with the matter said last week after Mr. Musk launched his surprise bid.

There is no guarantee any private-equity firm will end up making a firm bid, whether for the entire company or just a portion, and there may well be no deal in the end—with Mr. Musk or anyone else.

Taking Twitter private would rank as one of the largest leveraged buyouts of all time, and the company doesn’t have the attributes of a typical LBO target like strong, stable cash flow.

- 04/13/2022 – SEC might rein in Musk?

‘Make an example’: SEC weighs options in latest Elon Musk tussle

While acquiring a sizable share of Twitter’s stock, Tesla’s billionaire CEO appears to have filed notice of his ownership stake later than required, according to experts.

Among the options available to the SEC and its hard-charging new head, Gary Gensler: force Musk to forfeit gains he made between when he was supposed to inform the public of his moves and when he actually did. Still, the money in question — about $150 million — is chump change for a man worth $274 billion.

- 04/14/2022 – youtube about Musk and TWTR

1:54:44

https://www.youtube.com/watch?v=lcIy1FKFUjA

- 04/13/2022 – Tilson’s thoughts on TWTR I agree with Levine that Musk is highly unlikely to make a bid or even to go above a 10% stake. I think the most likely scenario is that Twitter is purchased by a private equity firm with Musk’s participation. As for price, even with today’s big move, I think the takeout price will be much higher, so the stock remains a strong buy.

Bloomberg columnist Matt Levine had some funny musings in his column yesterday about whether Elon Musk might make a bid to buy Twitter (TWTR) outright: Will Elon Musk Buy More Twitter? Excerpt:

The fact that it makes no sense for Elon Musk to do a hostile takeover of Twitter is not absolute proof that he won’t do a hostile takeover of Twitter! The threat remains alarming; they have to take it seriously.

Musk could also just buy more stock in the open market, but what does that accomplish? It gives him more of a toehold for a proxy fight or a hostile takeover, but if he’s not going to do those things, then owning more stock doesn’t matter. Also, he’s at 9.1% now, and if he goes over 10%, he would be subject to stricter limits under U.S. securities laws. In particular, his ability to actively trade the stock, buying and selling whenever the mood strikes him, would be limited. So why bother?

Mostly my guess is that Musk enjoys being able to tell Twitter what to do and does not care very much about it actually getting done. I could be wrong here but tweeting about accepting Dogecoin for Twitter’s paid subscription tier seems like more fun than supervising its implementation. If he buys Twitter, he has to make decisions; Twitter is his problem. If he owns 9% of Twitter, he can just troll; he is Twitter’s problem.

My take: I agree with Levine that Musk is highly unlikely to make a bid or even to go above a 10% stake. Rather, as I wrote in my April 4 e-mail:

Musk has now put Twitter into play, meaning that someone is going to buy this company. The questions are who and at what price?

Regarding the former, the most obvious buyers, Meta (FB), Alphabet (GOOGL), or Microsoft (MSFT), are likely blocked for antitrust reasons, and there’s no way the U.S. government will allow a foreign company to buy Twitter. But I wouldn’t rule out Salesforce (CRM), PayPal (PYPL) – which bid for Pinterest (PINS) recently – or Oracle (ORCL).

But I think the most likely scenario is that Twitter is purchased by a private equity firm with Musk’s participation.

As for price, even with today’s big move, I think the takeout price will be much higher, so the stock remains a strong buy.

- 04/12/2022 – thoughts on Tech companies in general

«There Is No Playbook»

Gavin Baker, founder of Atreides Management, thinks the market operates in uncharted territory. In his view, the earnings power of modern tech companies is underestimated in today’s inflationary environment. Also, he believes that the competitive dynamics among the industry’s giants will change significantly.

- 04/11/2022 – drama continues

Elon Musk Says in Filing He May Engage in Twitter Strategy – WSJ

Elon Musk Deletes Tweets Criticizing Twitter After Deciding Against Joining Board – WSJ

Elon Musk, Again an Outsider at Twitter, Emerges as Unshackled Wild Card for Company – WSJ

- 04/10/2022 – A drama on TWTR and Musk starts

Elon Musk Reverses Decision to Join Twitter’s Board, CEO Says – WSJ

Elon Musk Suggests Changes to Twitter, Takes Barbs at Company – WSJ

- 04/09/2022 – it seems like Elon starts to figure out the biggest problems of TWTR now

Most of these “top” accounts tweet rarely and post very little content.

Is Twitter dying? https://t.co/lj9rRXfDHE

— Elon Musk (@elonmusk) April 9, 2022

- 04/07/2022 – a grand plan for TWTR by Elon Musk? Mr. Musk received a two-year term on Twitter’s board of directors, and as long as he remains in that post, he can’t own more than 14.9% of the company’s stock, Twitter said in a securities filing. That effectively means he wouldn’t be able to take over the company while he remains on its board.

— Elon Musk (@elonmusk) April 7, 2022

another interesting piece on hwat can Musk do to TWTR

10 Things for Elon Musk to Do at Twitter – WSJ

it a positive force for democracy—in Mr. Musk’s words, a true “public town square.”

Elon Musk Joins Twitter’s Board: What It Could Mean for the Social Platform – WSJ

Tesla CEO, who is Twitter’s largest shareholder, has criticized the service and recently said he was considering creating a new social-media platform

Can Elon Musk control Twitter?

Mr. Musk received a two-year term on Twitter’s board of directors, and as long as he remains in that post, he can’t own more than 14.9% of the company’s stock, Twitter said in a securities filing. That effectively means he wouldn’t be able to take over the company while he remains on its board.

- 04/07/2022 – great podcast from Tilson

We got so much out of our chat with Empire Financial Research’s Whitney Tilson on Decoded last week that we asked if he’d sit down with us again to talk about what’s going on in the world right now. The former hedge fund manager and current investment newsletter publisher delivered, just as he does to 140,000 avid readers of his daily takes on market movers and shakers.

In our stimulating chat, Whitney tells us why he’s confident about a ceasefire in Ukraine and a resulting rally in beaten-down growth stocks, skeptical that a viable alternative to the US dollar’s reserve currency status exists, optimistic about Twitter’s potential to become a 10-bagger in the next decade, and so much more.

notes of podcast,

- be able to sit on your hands and let the winners run. mistakes on Netflix and Apple, sold too early

- best invest time is at the market trough turmoil

- TWTR just got new full time CEO. Former CEO spent 70% on Square, only 20% on TWTR. New CEO has full interest, plus Elon Musk

$31 bil market cap, vs FB $600 bil

twtr great for breaking news

Twitter’s potential to become a 10-bagger in the next decade. Braken business turn around - Ukraine is kicking Russian’s ass, better than news. Tilson talked with Retired US special forces and got informed that US is training Ukraine soldiers and Ukraine is kicking Russian’s ass

cease fire in Ukraine can have a relieve relly for the whole market

he’s confident about a ceasefire in Ukraine and a resulting rally in beaten-down growth stocks - skeptical that a viable alternative to the US dollar’s reserve currency status exists, people will flea to US dollar

there is no rising power of country so far, do not think China will be there in 10 years, not trustworthy

the 2nd most likely held currency is Euro, but this joint currency is hard to manage, not like US dollar, managed by one center federal bank - inflation might be long term or soft landing, hard to predict

- invest more in value stocks than growth stocks in the inflation environment. So Tilson only invest in bottom fishing growth companies. also, hedged with Bershire stocks

Tilson’s protfolio is mostly value stocks, mixed with handful growth stocks

still interest in Netflix (40% of quarterly revenue growth, great CEO, 5X market cap of TWTR, use their cash flow in content and international growth, chose not to be profitable), Zoom, penlecon, etc, bottom fishing - there might be normal growth next year

- Apple did not have revenue growth in 5 years before pademic, then they had stock repurchase and shunk the share accounts by 50%, same thing fo FB and GOOG which are massively profitable

- Netflex and Amazon need to find out when they buyback if they find no much growth opportunities. investors’ love of buy-back stories

- Tilson has very regular work out every week, work along with professional guys

Headline: KREMLIN SPOKESMAN SAYS WE HAVE HAD SIGNIFICANT LOSSES OF TROOPS

Perhaps a reason for substantial reduction in oil geopolitical risk premium?

— Josh Young 🦬🛢️ (@Josh_Young_1) April 7, 2022

Headline: KREMLIN SPOKESMAN SAYS WE HAVE HAD SIGNIFICANT LOSSES OF TROOPS

- 04/06/2022 – TWTR is making changes gradually, can Elon Musk be the master mind behind all these?

Social-media platform will begin testing the new function in the coming months

- 04/06/2022- Tilson’s counter argument on investment on FB and TWTR

If I end up being wrong about two of my favorite stock ideas, Twitter (TWTR) and Meta Platforms (FB) – which I discussed in Monday’s and yesterday’s e-mails, respectively – there are two general reasons why…

First is if the businesses’ fundamentals deteriorate – as in Facebook and Instagram continue to lose users to alternatives like TikTok, Meta’s huge investment in the metaverse is a bust, Twitter continues to do a dismal job monetizing its users, etc.

A second reason is a regulatory crackdown that impairs the big tech companies’ business models and profitability. There has been a lot of talk about this for many years, but little action… which I expect will continue to be the case. But this latest development bears watching: EU Takes Aim at Big Tech’s Power With Landmark Digital Act. Excerpt:

The European Union agreed on Thursday to one of the world’s most far-reaching laws to address the power of the biggest tech companies, potentially reshaping app stores, online advertising, e-commerce, messaging services and other everyday digital tools.

The law, called the Digital Markets Act, is the most sweeping piece of digital policy since the bloc put the world’s toughest rules to protect people’s online data into effect in 2018. The legislation is aimed at stopping the largest tech platforms from using their interlocking services and considerable resources to box in users and squash emerging rivals, creating room for new entrants and fostering more competition.

What that means practically is that companies like Google will no longer be able to collect data from different services to offer targeted ads without users’ consent and that Apple (AAPL) may have to allow alternatives to its App Store on iPhones and iPads. Violators of the law, which will take effect as early as later this year, could face penalties of up to 20 percent of their global revenue – which could reach into the tens of billions of dollars – for repeat offenses.

The Digital Markets Act is part of a one-two punch by European regulators. As early as next month, the European Union is expected to reach an agreement on a law that would force social media companies such as Meta, the owner of Facebook and Instagram, to police their platforms more aggressively.

With these actions, Europe is cementing its leadership as the most assertive regulator of tech companies such as Apple, Google, Amazon (AMZN), Meta and Microsoft (MSFT). European standards are often adopted worldwide, and the latest legislation further raises the bar by potentially bringing the companies under a new era of oversight – just like health care, transportation and banking industries.

“Faced with big online platforms behaving like they were ‘too big to care,’ Europe has put its foot down,” said Thierry Breton, one of the top digital officials in the European Commission. “We are putting an end to the so-called Wild West dominating our information space. A new framework that can become a reference for democracies worldwide.”

Taking off my investing hat, I’m glad the EU is doing this. As I’ve written in dozens of e-mails, I think the big tech companies have abused their power and behaved very badly in numerous instances.

I’m most troubled by the idea of a totally untrustworthy, amoral, and weird guy like Meta CEO Mark Zuckerberg being the most powerful person on earth – and I truly think he is…

That said, I think you should hold your nose and buy his stock!

- 04/05/2022 – Tilson’s thesis on FB and TWTR

on FB: https://assets.empirefinancialresearch.com/uploads/2022/04/FB-presentation-Tilson-4-1-22.pdf

on TWTR: https://assets.empirefinancialresearch.com/uploads/2022/04/TWTR-presentation-Tilson-4-1-22.pdf

- 04/04/2022 – overview of Tilson’s take on TWTR

Here are the 12 slides I presented on Friday about Twitter, and here’s an overview…

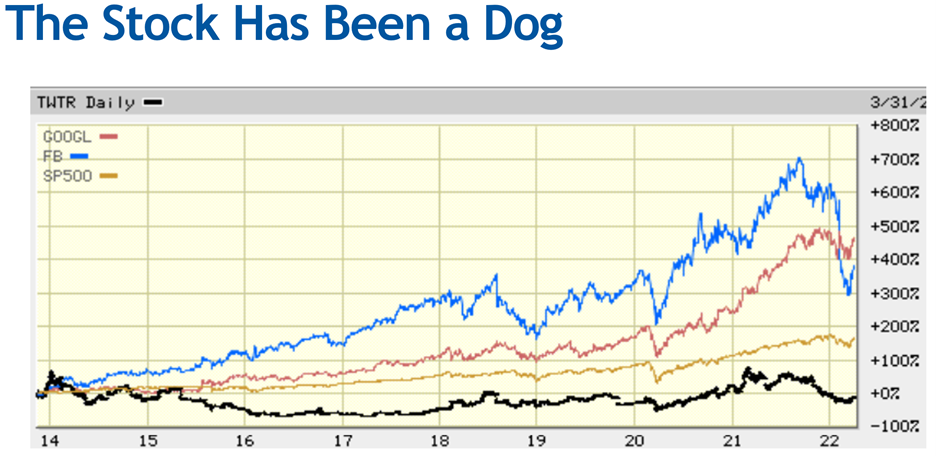

Twitter’s stock (until today) was actually down since its IPO in late 2013, badly trailing Meta, Alphabet (GOOGL), and the S&P 500 Index:

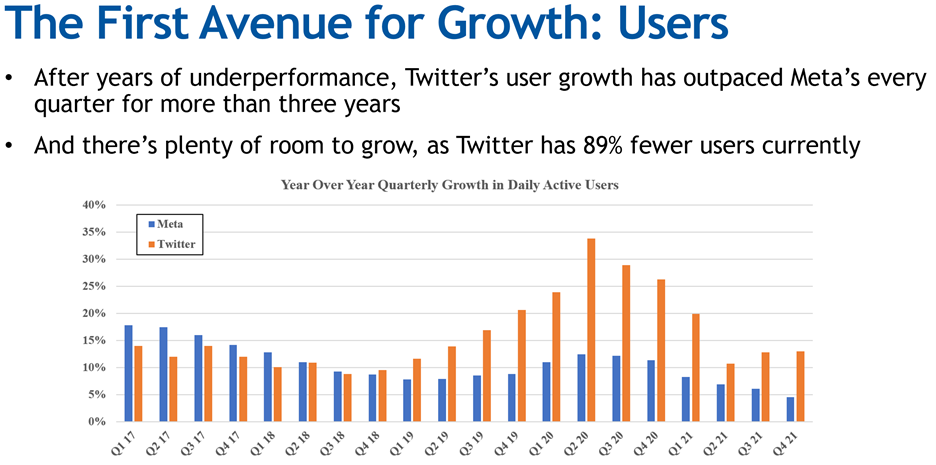

The business has been terribly managed, but there are signs of improvement, most notably that user growth has been strong in the last three years, far surpassing Meta’s:

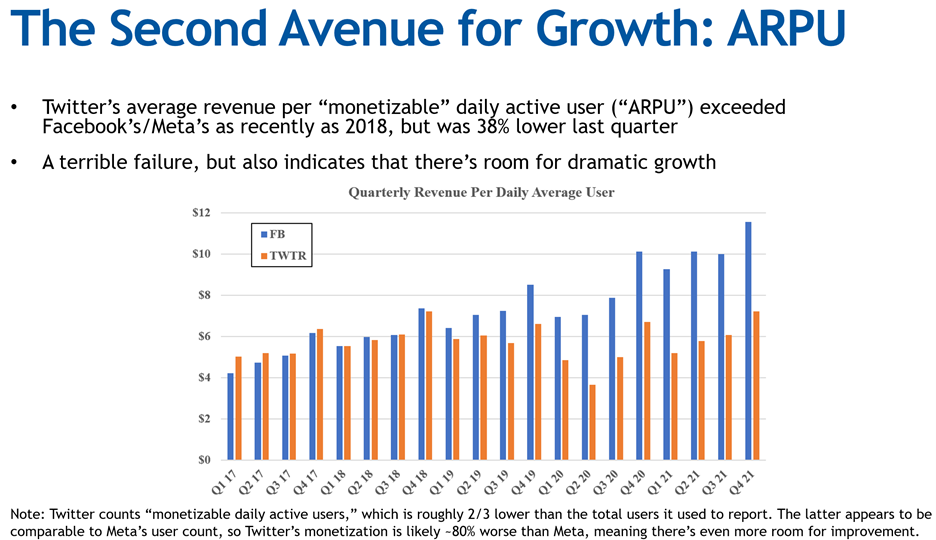

However, Twitter does an exceptionally poor job monetizing its users. Even using its preferred measure of “monetizable” daily average users (which is only roughly one-third of its total users), its average revenue per user (“ARPU”) trails Meta’s – and the gap is steadily widening:

The silver lining here, however, is that there’s lots of room for improvement.

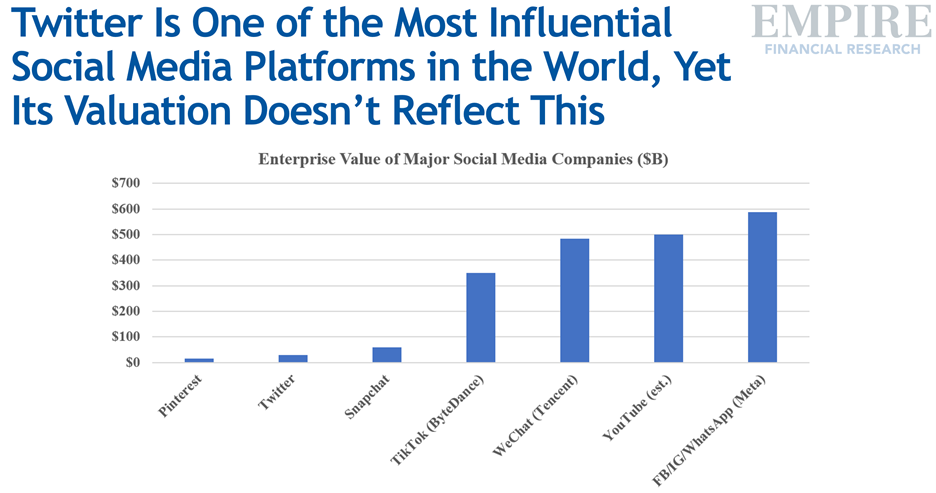

As for valuation, the stock appears expensive at 43 times trailing EBITDA (before today’s jump), but I believe earnings are depressed. Even with Meta’s stock down so much, the market values each Twitter user at less than half of each Meta user: $146 versus $307 per daily average user (again, before today’s jump).

I can’t argue that Twitter is cheap based on traditional valuation metrics, but my “spidey sense” sees a huge disconnect between one of the biggest, most influential social media networks in the world versus its tiny enterprise value:

Here was my summary:

- Buy Twitter (TWTR)

- $31 billion for the greatest platform for idea sharing is cheap

- Continued user growth combined with better monetization via improved ad targeting could cause Twitter’s stock to double

- Hold for the long term… Twitter will either start to execute or get acquired

2) During the Q&A after my presentation, I said it would be madness for Tesla (TSLA) CEO Elon Musk to try to start his own social media network, as he had hinted, but would be brilliant for him to acquire Twitter, which he could easily afford given that his nearly $300 billion net worth dwarfs Twitter’s nearly $40 billion market cap.

Sure enough, the news broke this morning that Musk recently bought 9.2% of Twitter’s shares. Here’s commentary by Andrew Ross Sorkin of the New York Times: Elon Musk’s latest Twitter adventure:

What’s the plan?

Shares of Twitter soared 25% in premarket trading on news that Elon Musk had personally bought a 9.2% stake in the social media company, making him its largest shareholder. The stake, revealed in a regulatory filing, was amassed before Musk criticized Twitter in – yes – a series of tweets, questioning the company’s commitment to “free speech” and wondering whether a new social media platform was needed. With more sway over the company, will he try to reinvent Twitter to be more to his liking?

Musk’s relationship with Twitter is long and complicated, involving most notably his legal wranglings with the SEC over his tweets about Tesla’s finances. Will Musk now agitate for Twitter to alter its policy on moderating content in the name of freer speech? What is Elon Musk doing now? Will he push for Twitter to open up its algorithm, which the company’s co-founder and former CEO Jack Dorsey appeared to support last week? (Musk and Dorsey are friendly.)

We have many more questions:

- Musk built the stake through passive investments — will he keep buying or even try to acquire the company outright? (It would put a relatively small dent in his $270 billion-plus net worth.)

- Will Musk ask to join Twitter’s board? Will Twitter invite him to join?

- What do Tesla and SpaceX shareholders think of this? Will they see it as a distraction for Musk? And if Musk steers Twitter in a direction that irks policymakers, who have been trying to rein in social media platforms, could that create complications for Tesla or SpaceX? Recall that President Trump took a dim view of Amazon (AMZN) because he disagreed with coverage in the Washington Post, which Jeff Bezos owned separately.

- Given Musk’s history with PayPal (PYPL) and interest in cryptocurrency, might he push Twitter to do more in payments?

- How much money did Musk make off this morning’s news? Musk’s disclosure came out today, but the document detailing the stake, worth about $3 billion at Friday’s closing price, is dated March 14. Twitter’s shares are up about 50 percent since then.

My take: Musk has now put Twitter into play, meaning that someone is going to buy this company. The questions are who and at what price?

Regarding the former, the most obvious buyers, Meta, Alphabet, or Microsoft (MSFT), are likely blocked for antitrust reasons, and there’s no way the U.S. government will allow a foreign company to buy Twitter. But I wouldn’t rule out Salesforce (CRM), PayPal – which bid for Pinterest (PINS) recently – or Oracle (ORCL).

But I think the most likely scenario is that Twitter is purchased by a private equity firm, with Musk’s participation.

As for price, even with today’s big move, I think the takeout price will be much higher, so the stock remains a strong buy.

- 10/27/2019 – How Bugs Sapped Twitter’s Ad Capabilities and Drove Prices Lower

Social-media company had to shut down some targeting and measurement functions – it seems like this might be one time bad event, once the bug is fixed, profit probably starts to come back. In addition, election year is coming, could we see a rebound of Twitter? - 10/24/2019- Twitter Shares Plunge as Ad-Business Troubles Weigh on Growth

Tepid outlook shaves off a fifth of the social-media company’s stock market value, prompts questions

Technical glitches in Twitter Inc. ’s advertising software roiled the social-media company in the third quarter, as a pullback in spending from some buyers and weaker pricing for ads also cut into revenue and profit even though it added millions of new users.

The disclosures and a tepid outlook for the current quarter surprised Wall Street, shaving off a fifth of Twitter’s stock-market value Thursday, and prompted questions about the engine that has helped sustain the company’s growth.

- 10/27/2019 – Citron Research on TWTR

Twitter-has-become-the-Harvey-Weinstein

TWTR-Just-Made-the-Turn-and-Is-Hitting-Stride