Energy and metals – Part IV(about GUSH, OXY, etc)

- Potential future catalyst

- FDA approval of Moderna vaccine

- FDA approval of child 5 ~12 yrs old vaccine

- FDA approval of child 0~5 yrs old vaccine

- Delta CV-19 cases bottom

- the antiviral pills could come by the end of the year

- Covid’s ‘pandemic phase’ ending when antiviral pills, kids’ vaccines available

- $3.5 Tril welfare money for huge inflation, US dollar devalued

- oil companies Q3 earning and stock buyback

- US economy fully reopen, US might be back to normal in one year

- stock market rotation due to inflation and interest rate

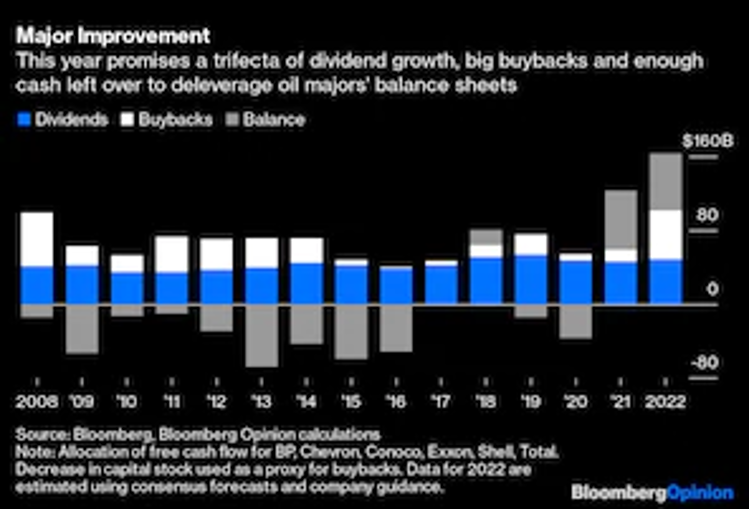

- record revenue and stock dividend and buybacks

- demand recovery in China, Europe and world wide

- energy crisis in Winter in China and Europe

- supply crunch

- US infrastructure bill approved by end of Sept What the Infrastructure Bill Would Help Fix First – WSJ

- U.S. crude oil inventories fell more than expected

- middle east war from Taliban

- fall of new energy and EV companies due to China’s RE’s fall and interest rate’s rise

- oil demand is on the rise, as international travel restrictions are starting to be loosened

- Hurricane Ida have continued a month after the hurricane made landfall, with nearly 300,000 daily barrels of oil still offline – short term effect

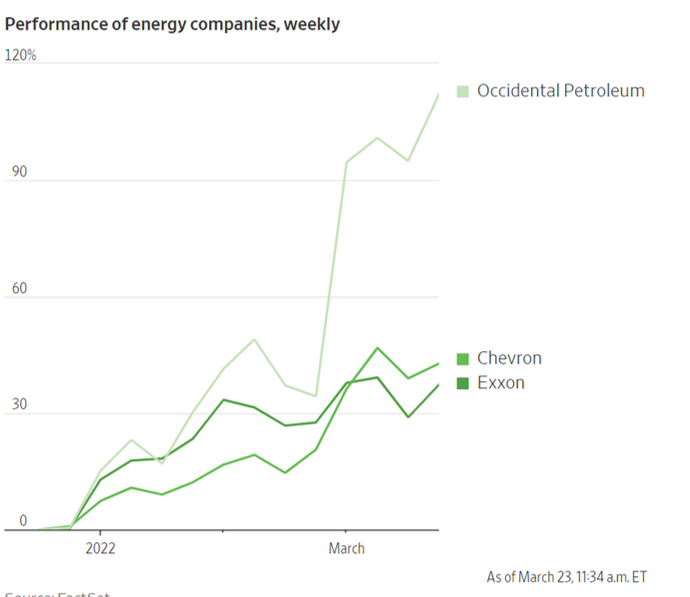

- U.S. oil/gas companies are still in the early part of an “extended” cyclical rebound with echoes of the mid-2000s. And while valuations have recovered from lows of last year, only a few of the companies are higher vs. their pre-COVID-19 levels.

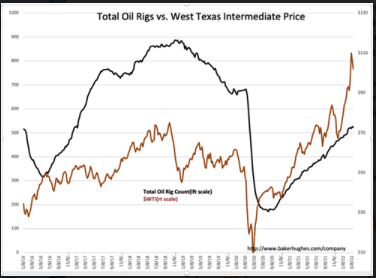

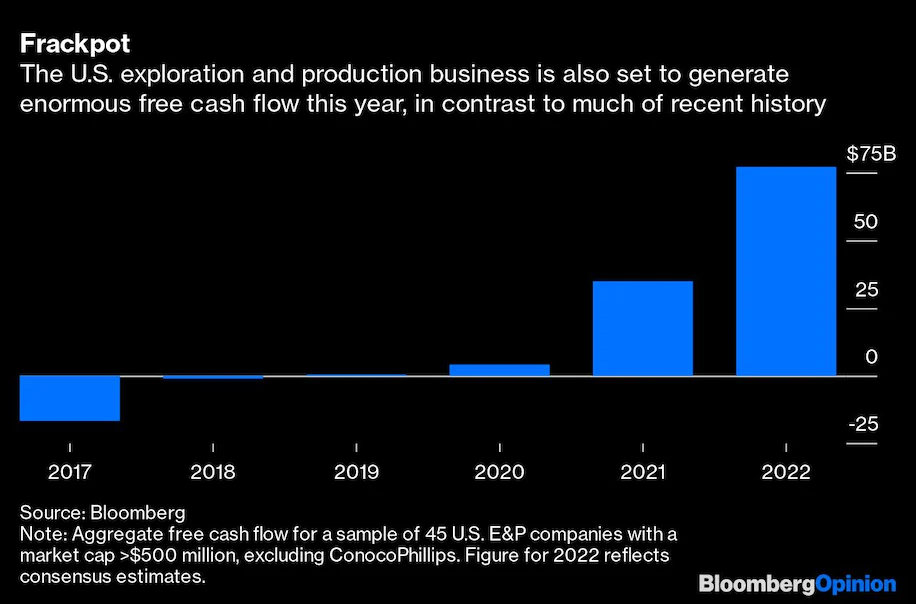

- the real reason that Big Oil won’t raise production is a matter of simple economics. oil explorers in the United States are making more money now than at any other point in the more-than decade-long history of the nation’s shale revolution. “And this may just be the beginning,” Bloomberg Markets reported this week. “Free cash flow, the key metric watched by investors, probably will increase by 38% next year, presuming oil prices remain elevated.”

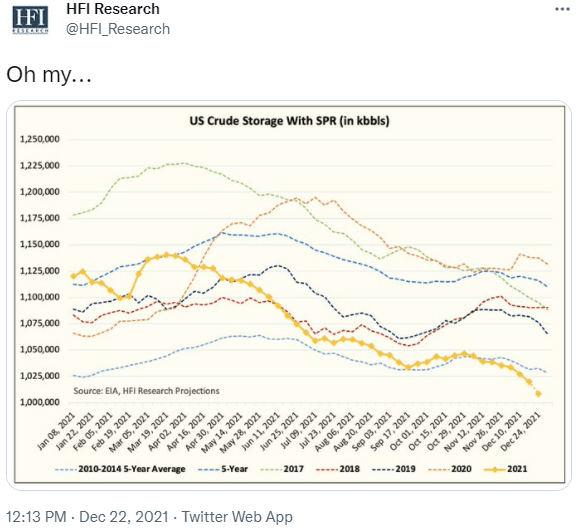

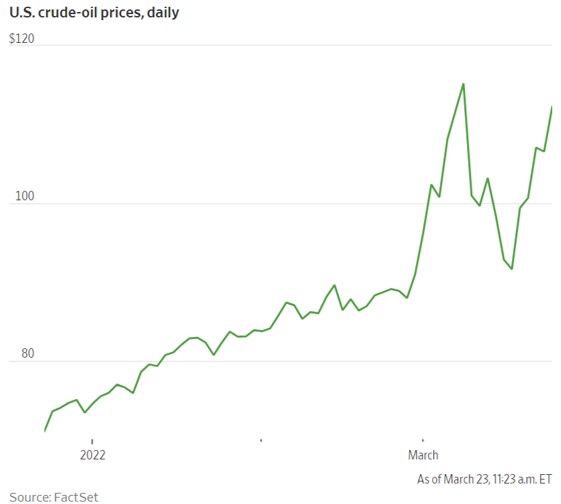

- Dec 23, 2021. This week saw another large oil/oil product inventory draw (NYSEARCA:USO) (CL1:COM) (CO1:COM), bringing the two-week total to ~27mb and resulting in stocks below the 2010 to 2014 average, a period in which Brent oil prices averaged ~$100.

- Rystad reported that oil exploration put up its worst year since the Second World War, as majors like Exxon (NYSE:XOM), Chevron (NYSE:CVX), BP (NYSE:BP), and Total (NYSE:TTE) cut budgets and retrench to short-cycle basins.

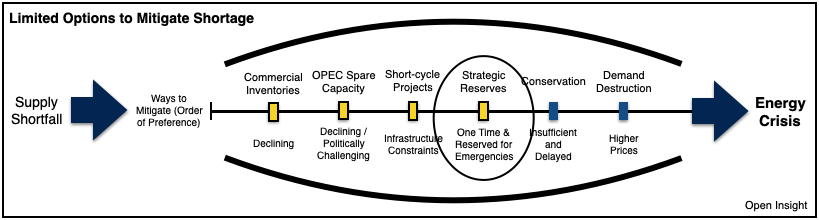

- The IEA said in its monthly oil market report that OPEC+ spare capacity could fall to below 4 million barrels per day (bpd) in the fourth quarter of 2022 from 9 million bpd in the first quarter of 2021. It forecast global demand at 99.6 million bpd in 2022, slightly above pre-pandemic levels. OPEC+ Spare Capacity Is Insufficient Amid Global Energy Crisis; The Myth Of OPEC+ Spare Capacity

- Beijing is cutting interest rate to bolster economy, and expediting the rollout of major infrastructure projects

- Because US froze Russia’s Central bank reserves, many other countries are thinking about reducing reserves in US dollar, this might reduce the strength of US dollar. In addition, all currencies are inflated due to worldwide monetary easing, US dollar wil not strengthen too much

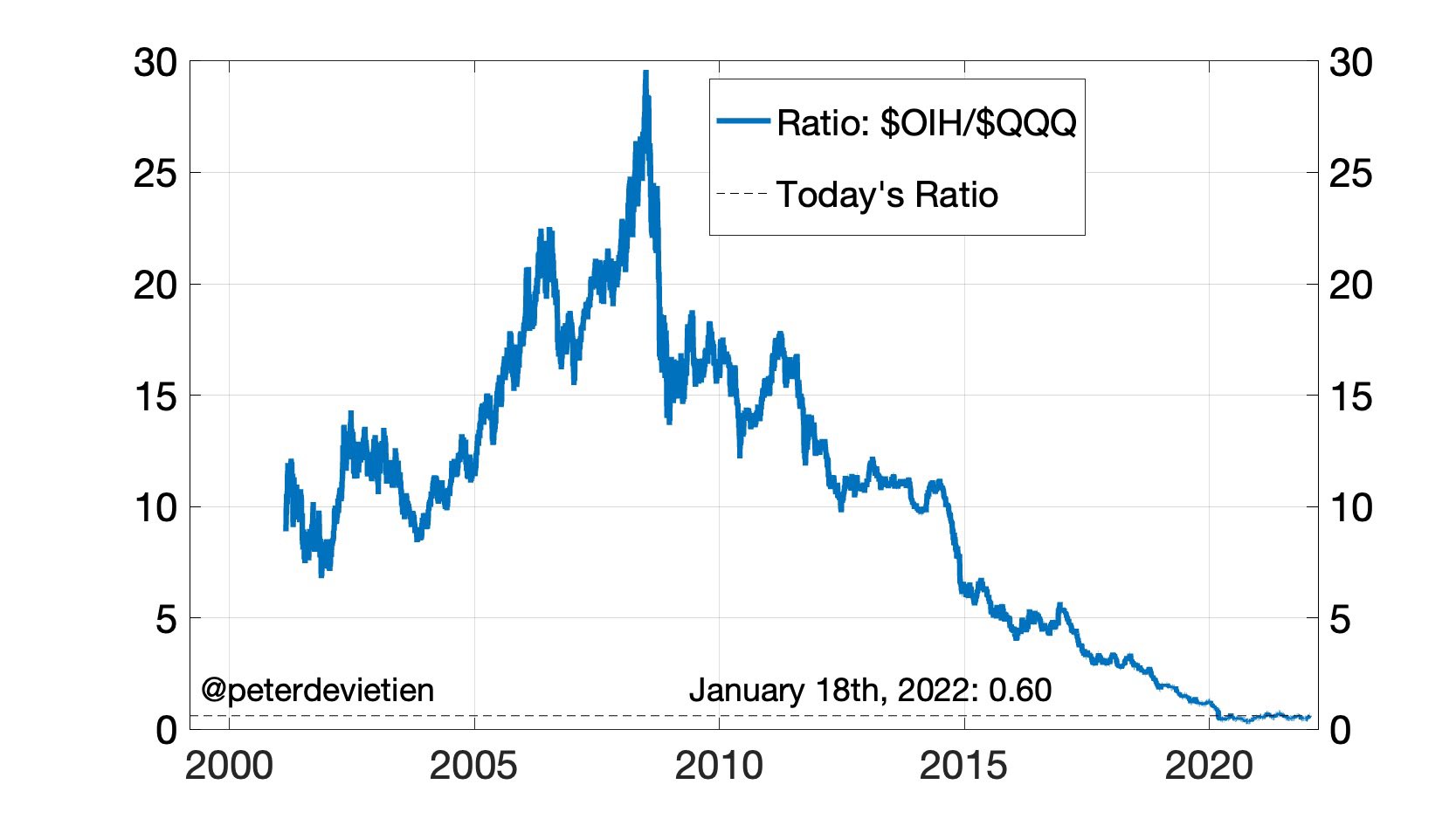

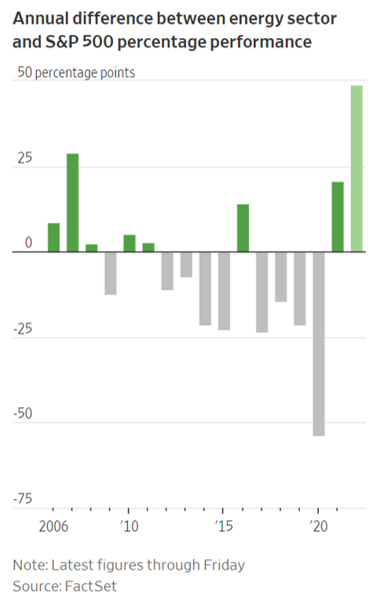

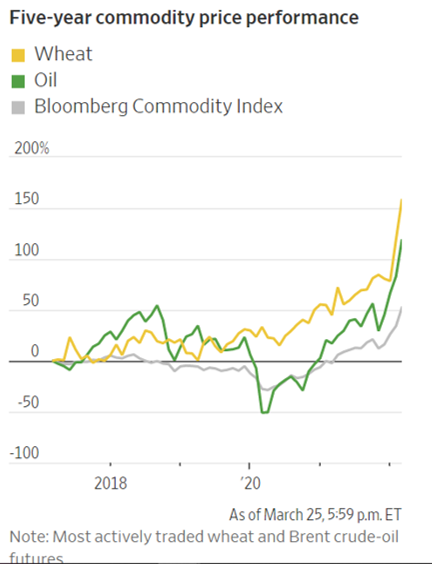

- Huge upside to energy stocks as mean reversion vs the broader market kicks in.

- Simple chart of oil & gas stocks $xop vs #oil futures vs the s&p 500 $spy since September 2014. There is lots of room for oil & gas stocks to recover just to “catch up” with the price of oil and even more to broader market performance

- Perhaps energy is in fact a structural long? I was thinking of it as a multi-year cyclical play.

Perhaps energy is in fact a structural long? I was thinking of it as a multi-year cyclical play. Perhaps it depends on how much capital floods into the space as previous "structural long" sectors like tech and alternative energy roll over after their 18 year bull markets https://t.co/rw5pizKLXd

— Josh Young 🦬🛢️ (@Josh_Young_1) January 23, 2022

Or in chart form: pic.twitter.com/ZsaewEO9IV

— Josh Young 🦬🛢️ (@Josh_Young_1) January 23, 2022

Another good chart illustrating why "growth investors" may be shocked by the recent market shift and disappointed by it potentially continuing for years. H/t @johnmaher0 https://t.co/2JhIiwkeKR

— Josh Young 🦬🛢️ (@Josh_Young_1) January 23, 2022

33. Josh’s advice: I try to discount short term stuff that’s biased and that’s somewhat unreliable and heavily weight aggregations of that sort of short term information where it starts to become more meaningful signal as well as focusing on sort of medium and longer term effects that. In aggregate, can end up having a real impact even on the short term

Potential future risks

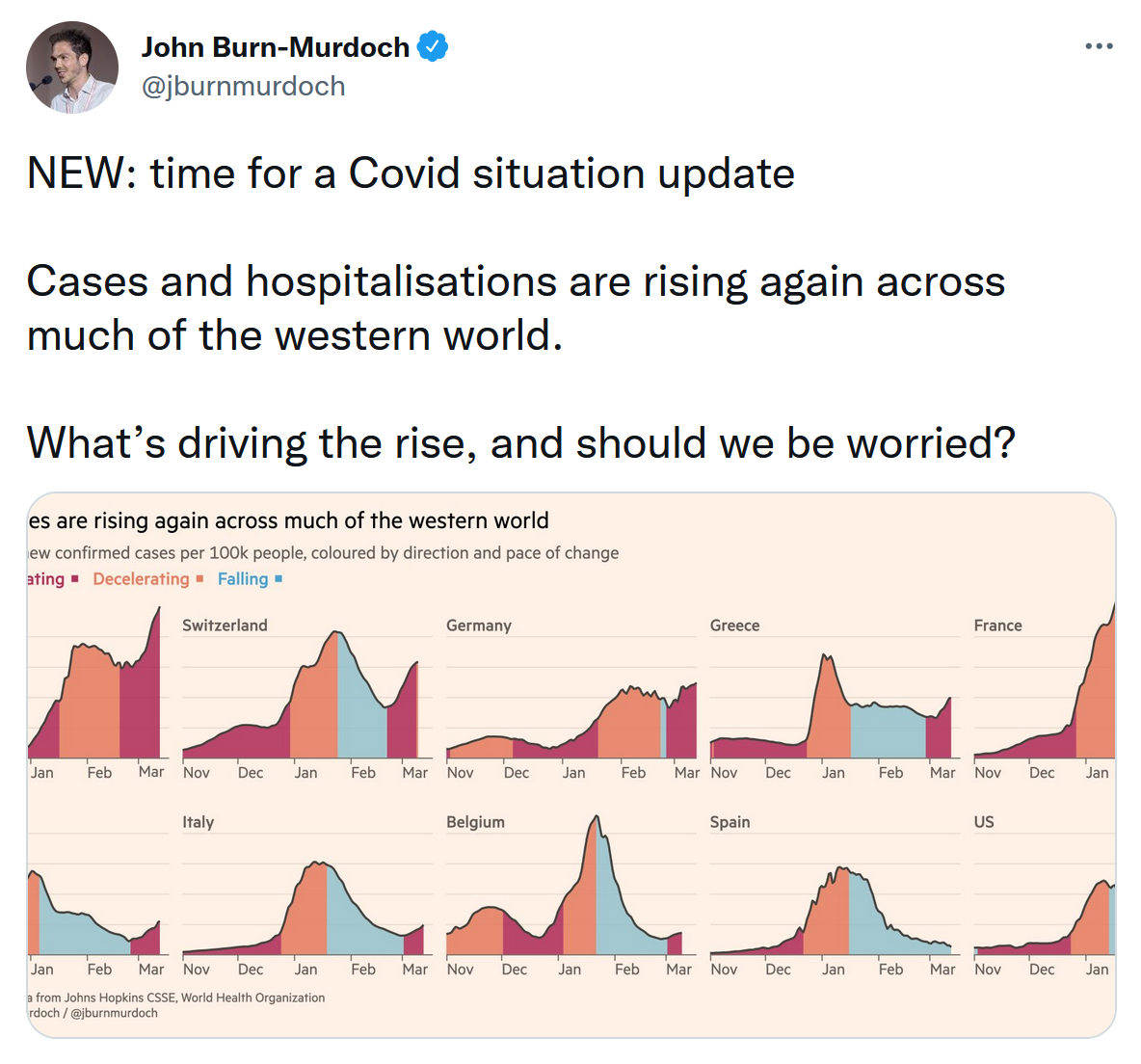

- new CV-19 variant coming

- another CV-19 cases wave

- OPEC+ and US to significantly increase oil production

- watch out the possible oversupply in 2022

- Oil price and oil demand will be under pressure due to China housing property crisis (i.e EverGrande)

- US and Iran nuclear deal

- OPEC to increase production

- Iran to increase production

- customers do not use oil once price is too high

- oil price tends to reverse to mean once increases too fast.

- Higher rate will strengthen dollar, and reduce oil price

- Russia to invade Ukraine, to strengthen $ and suppress interest rate, the trading algorithm will reduce oil price. World financial market (swift system, oil transfer, sanction of Russia, Russia’s anti-sanction, world economy slow down, etc.) will be in danger – at least in short term, and oil stocks will be dragged down significantly

- Oil Stocks Are Nearing New Heights. It’s Time to Be Careful. A surging oil price might correct itself, as consumers back away from spending on gasoline to protect their wallets. The higher prices go, the more incentive oil companies have to extract barrels from the ground, and the more wells that were once uneconomical can be pumped at a profit. Plus, central banks around the globe are set to lift interest rates to combat high inflation across the board, which could cause oil prices to decline by slowing economic growth.

In general, oil supply and demand are driven by a number of key factors:

- Changes in the value of the U.S. dollar

- Changes in the policies of the Organization of Petroleum Exporting Countries (OPEC)

- Changes in the levels of oil production and inventory

- The health of the global economy

- The implementation (or collapse) of international agreements

- Russian/Ukraine war

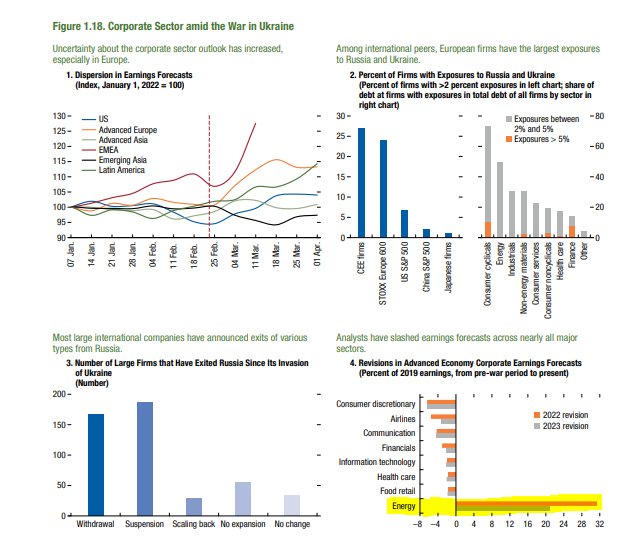

- The ongoing energy crisis is the culmination of years of underinvestment across the oil and gas value chain, combined with bad energy policy, ESG activism and divestment. While energy prices have undeniably been lifted by the ongoing crisis in Eastern Europe, underinvestment in energy supply security were bound to lead to shortages and soaring prices eventually. The current conflict is an unexpected, short-term tailwind; oil and gas prices could correct sharply in the event of a negotiated peace, but will likely rise further over time due to longer term factors. While higher energy prices are a major tailwind for oil and gas equities, they are a bad spell for the broader economy: they disproportionately hurt the poor and middle-class, and they stoke already white-hot broader price inflation. However, soaring energy prices are an early manifestation of a larger under-supply issues and are likely to persist. This may drive additional energy market dislocations, along the lines of those that we previously identified and addressed. from Bisoninterests (Important Off-The-Run Metrics Indicate More Oil Opportunity Ahead)

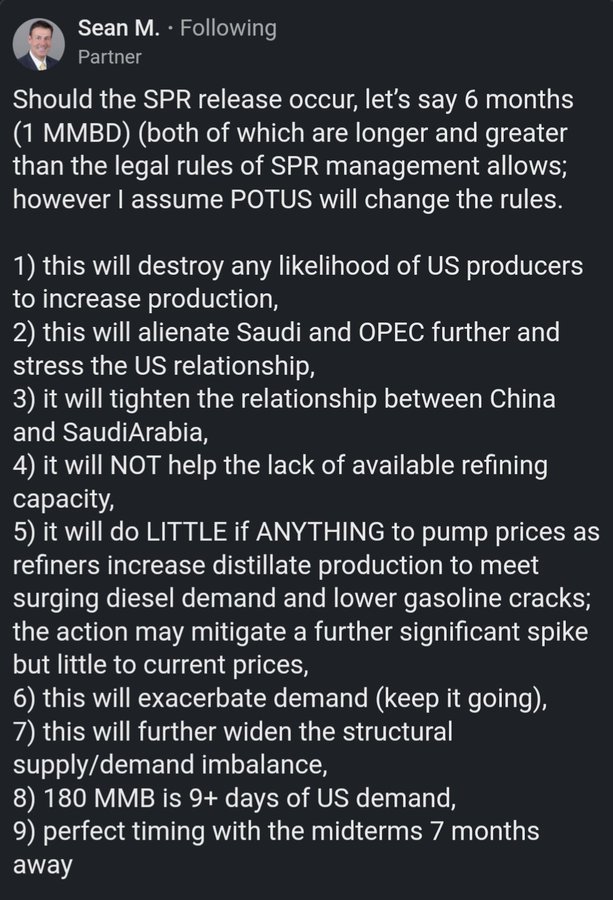

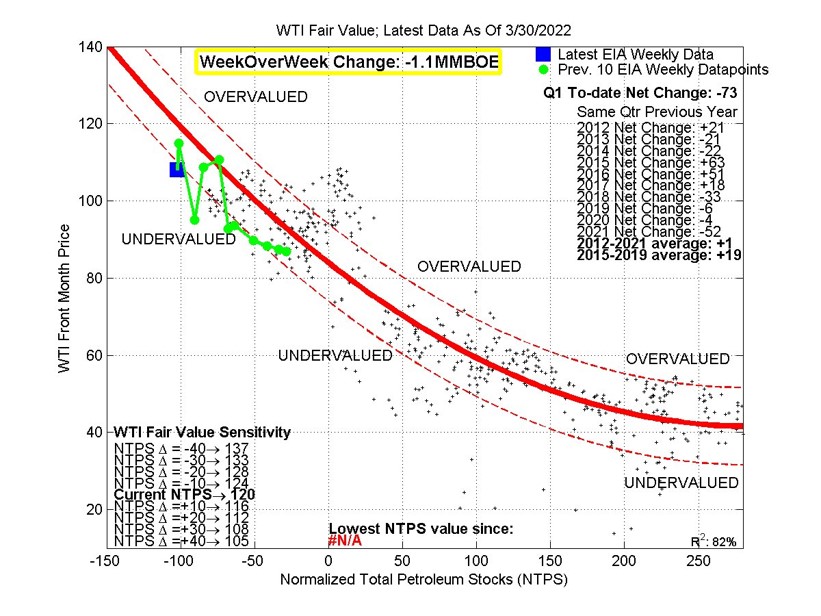

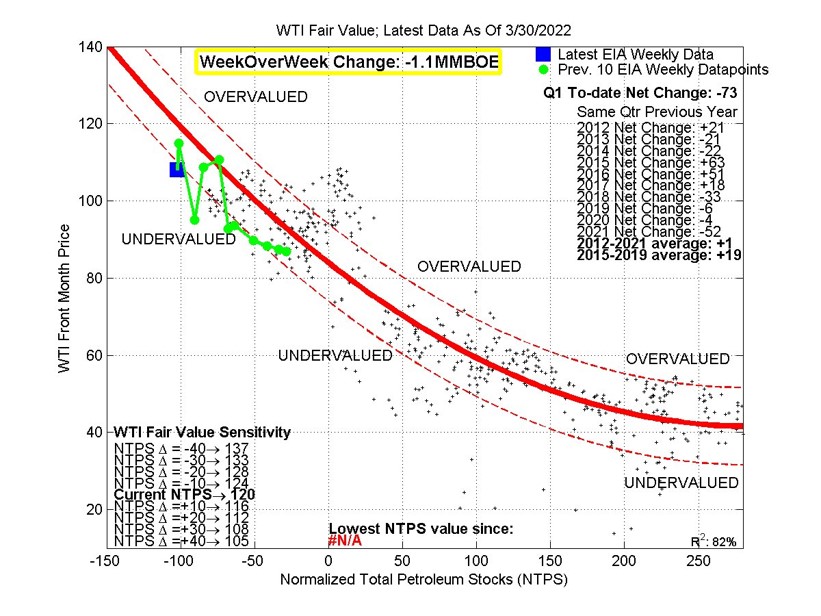

- Interesting analytical approach to implied oil price based on inventory declines. Theoretically SPR releases don’t affect this, and the calculated “fundamental” price for WTI oil is $120. 1Q22 eia data shows largest Q1 total stocks draw since at least ‘12 at -73mmboe or -0.81M b/d. WTI fair value price sits at 120 or $16 undervalued from current levels. SPR release is accounted for in this analysis and shift in strategy will have no impact on this calculation.

-

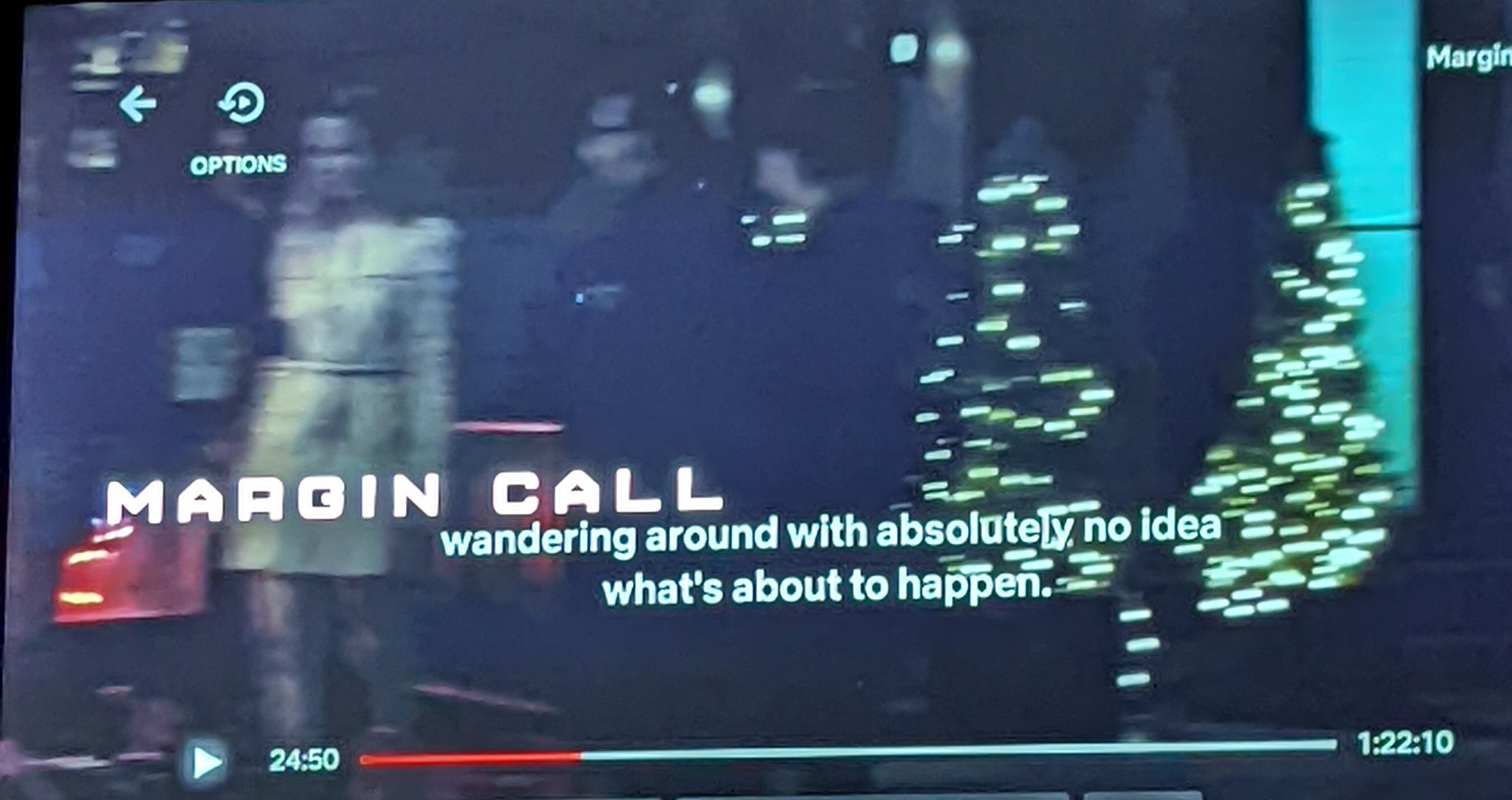

“look at these people, wandering around with no idea what’s about to happen” – Margin Call – This is a little how it felt with oil in November 2020. Vaccine roll out, Covid reopening, years of under investment in oil exploration and development. Oil was about to go nuts and almost no one knew

Go-to website for oil stock investment

From Josh Young: I find that the best way to get good returns is by really focusing on the best opportunities to compound money and be able to earn multiple times return and so over time. And by doing that I am better on my long investments and I just give up the sort of downside protection associated or the whatever people think they are getting from shorting stocks and sometimes that can be really painful because you get squeezed or whatever and it is a big distraction so I am not doing any direct arbitrage, it is more of a if Canadian oil and gas stocks are generally trading at a big premium to US then I will get sell some of my Canadian stocks and redeploy cheaper in the us and vice versa.

“To achieve exceptional returns you have to accept the kind of volatility that’s considered impolite in the hedge fund industry.” – @Josh_Young_1

Josh Young’s twitter: https://twitter.com/Josh_Young_1

Josh Young’s youtube videos https://www.google.com/search?q=josh+young+oil+youtube&oq=josh+young+oil+youtube&aqs=chrome..69i57.9992j0j7&sourceid=chrome&ie=UTF-8

https://www.youtube.com/results?search_query=josh+young

Bison Interests twitter: https://twitter.com/BisonInterests

Josh Young’s seekingalpha articles: https://seekingalpha.com/author/josh-young

2. study of macro conditions

Scott Grannis’s macro analysis: http://scottgrannis.blogspot.com/

- 05/04/2022 – Tracy thinks it is almost a bigger deal than an oil embargo – target insurers for oil transportation

This is almost a bigger deal than an oil embargo from the EU >>

EU Targets Russia’s Global Oil Trade With #Shipping Sanctions https://t.co/8xJ31hpDEo pic.twitter.com/QeporUplKq

— Tracy (𝕮𝖍𝖎) (@chigrl) May 4, 2022

- 05/04/2022 – EU member states started discussing the package of sanctions in Brussels on Wednesday. All 27 countries will need to sign off on it. – we will see what is the outcome on Wednesday

EU Proposes Ban on Russian Oil Imports, Sending Prices Higher – WSJ

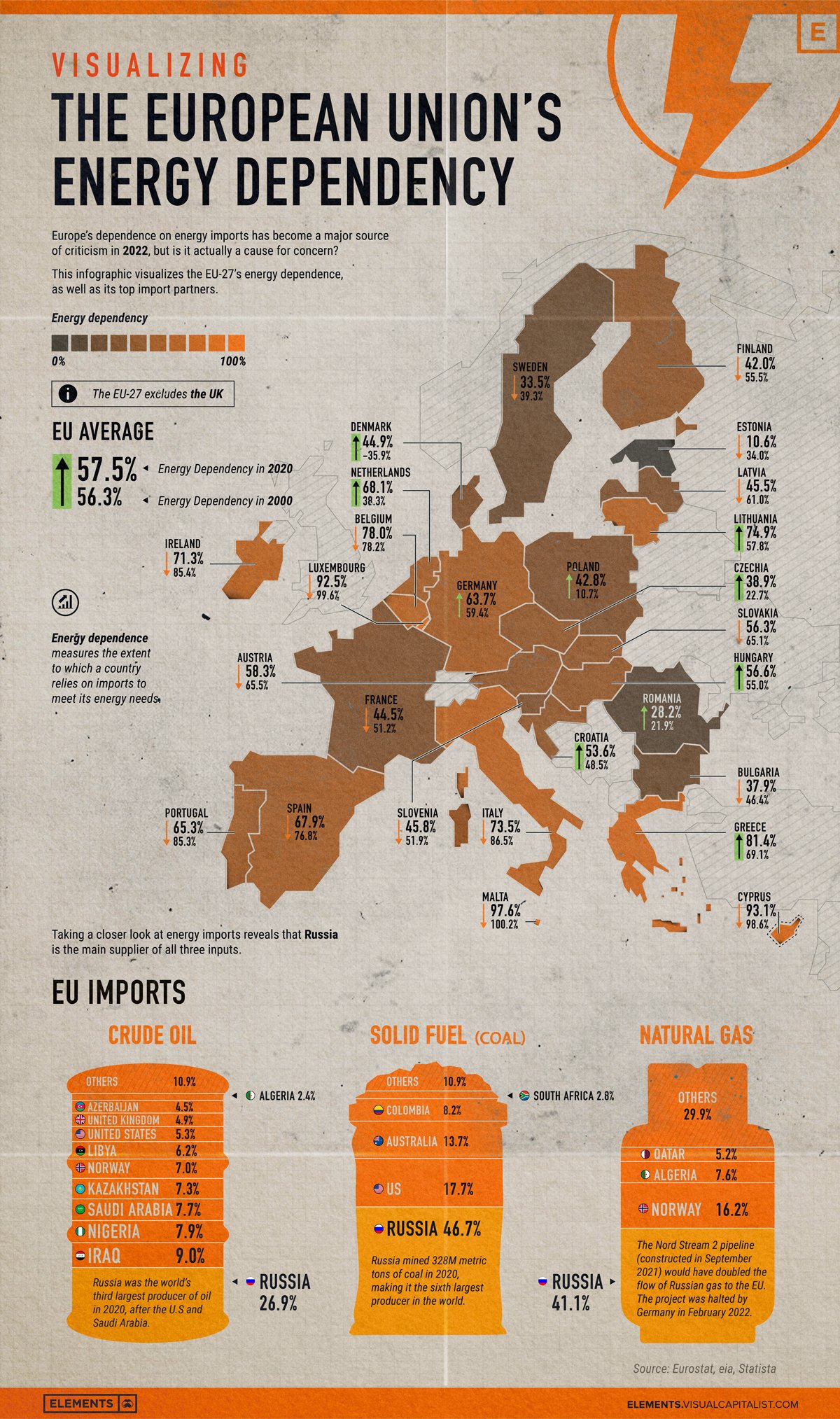

The European Union proposed a ban on imports of Russian crude within six months and on refined oil products from the country by year-end, prompting a jump in oil prices, while the bloc is set to impose sanctions on high-ranking Russian military officials involved in alleged war crimes and the siege of Mariupol.

European Commission President Ursula von der Leyen outlined the proposal in a speech to the European Parliament, and said the EU’s executive body is also proposing to take Russia’s biggest bank, Sberbank, and two other Russian banks off the Swift financial-messaging system. The commission is also planning to ban three major Russian state-owned broadcasters from the EU.

EU member states started discussing the package of sanctions in Brussels on Wednesday. All 27 countries will need to sign off on it. EU officials are pushing for a decision this week, although differences remain among member states about some of the proposals.

Diplomats said there could be some tough discussions on a number of points in the package although a broad consensus has emerged in favor of an oil embargo.

Hungary has repeatedly warned it could veto an oil package that doesn’t give it enough time and financial assistance to set up the infrastructure needed to wean itself off Russian oil pipeline deliveries. Diplomats said at least two more member states, the Czech Republic and Bulgaria, have argued that if Hungary and Slovakia are given more time to stop buying Russian oil exports, they should be given the same leeway.

Hungary received around 60% of its oil imports from Russia in 2020, according to the International Energy Agency. Slovakia imports almost all its oil consumption from Russia.

A short exemption for the two countries wouldn’t significantly reduce the scope of the ban. Combined, Hungary and Slovakia imported fewer than 200,000 barrels a day of Russian oil in 2021, said Giovanni Staunovo, commodities analyst at UBS Global Wealth Management.

- 05/03/2022 – it seems like even without the oil/gas embargo from EU, Russia will sanction west and EU anyway. In addition, The European Union hopes to pass the sixth round of sanctions against Russia at the next meeting of the EU Foreign Affairs Council, the bloc’s chief diplomat said on Monday…. Bullish for oil?

Putin Signs Decree on New Retaliatory Sanctions against Westhttps://t.co/8lSlkXm8dJ pic.twitter.com/RRb4AVKMok

— Tracy (𝕮𝖍𝖎) (@chigrl) May 3, 2022

Putin Signs Decree on New Retaliatory Sanctions against West

Russian President Vladimir Putin has signed a decree on retaliatory economic sanctions in response to the “unfriendly actions of certain foreign states and international organizations”, the Kremlin said on Tuesday.

According to the decree, Russia will forbid the export of products and raw materials to people and entities that it has sanctioned.

The decree also prohibits transactions with foreign individuals and companies hit by Russia’s retaliatory sanctions and permits Russian counterparties not to fulfill obligations towards them.

The European Union hopes to pass the sixth round of sanctions against Russia at the next meeting of the EU Foreign Affairs Council, the bloc’s chief diplomat said on Monday.

Josep Borrell told a news conference in Panama City, where he is on an official visit, the bloc hopes to curb Russia’s energy exports as part of its efforts to sanction Moscow over its invasion of Ukraine.

The European Commission, the executive branch of the union, is expected to propose the package of EU sanctions this week, including a potential embargo on buying Russian oil – a measure that would deprive Moscow of a large revenue stream, but that has so far divided EU countries.

Borrell, who chairs the Foreign Affairs Council meetings, said he hopes the EU will be able to take “measures to significantly limit these imports” but conceded so far there is no agreement from all the members.

- 05/03/2022 – Good reminder to be careful out there. Oil and gas prices are very volatile, very hard to predict the short term move.

Good reminder to be careful out therehttps://t.co/XTBZ5rVRx7

— Josh Young 🦬🛢️ (@Josh_Young_1) May 3, 2022

- 05/01/2022 – Buffett and Munger on Oil stocks

🛢️Buffett & Munger on #Oil!

Buffett: It's hard to say which of us knows less about oil

Munger: we should hold much larger oil reserves in the SPR and elsewhere because it will be worth a lot more in the future

Buffett: rapid energy transition odds are extremely low. #oott pic.twitter.com/juQVV1RTZB

— Josh Young 🦬🛢️ (@Josh_Young_1) April 30, 2022

Buffett: the best guard against inflation is being the best at what you do.

Also Buffett: buying o&g stocks hand over fist.

I guess if you can't be the best at what you do, and even if you are the best, buy oil and gas stocks? "Do what I do, not what I say"? #inflation #oil pic.twitter.com/gMD2plAin7

— Josh Young 🦬🛢️ (@Josh_Young_1) April 30, 2022

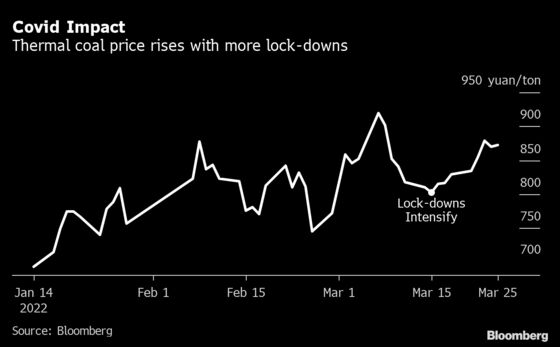

- 04/29/2022 – watch out the potential Beijing lockdown. On the other hand, Shanghai lockdown starts to ease. In Shanghai, authorities said more people have been gradually allowed in principle to leave their homes recently. More than 12 million, nearly half the population, are now in that category.

ICYMI Beijing down….

"Beijing on Friday sealed off apartment blocks and closed movie theaters, gyms and shopping malls" https://t.co/NNA3VqJFfg

— Tracy (𝕮𝖍𝖎) (@chigrl) April 29, 2022

BREAKING | Beijing seals off homes, shuts venues over COVID-19 outbreakhttps://t.co/4CjcD7CeMW

— Nikkei Asia (@NikkeiAsia) April 29, 2022

Beijing closes more venues as anger at Shanghai’s COVID-19 lockdown grows

China’s capital Beijing closed more businesses and residential compounds on Friday, with authorities ramping up contact tracing to contain a COVID-19 outbreak, while resentment at the month-long lockdown in Shanghai grew.

In the finance hub, fenced-in people have been protesting against the lockdown and difficulties in obtaining provisions by banging on pots and pans in the evenings, according to a Reuters witness and residents.

Nomura estimates 46 cities are currently in full or partial lockdowns, affecting 343 million people. Societe Generale estimates that provinces experiencing significant mobility restrictions account for 80% of China’s economic output.

In response to COVID-19 and other headwinds, China will step up policy support for the economy, a top decision-making body of the Communist Party said on Friday, lifting stocks from recent two-year lows.

In Shanghai, authorities said more people have been gradually allowed in principle to leave their homes recently. More than 12 million, nearly half the population, are now in that category.

Still, many cannot leave their compounds, while those who can have few places to go as shops and other venues are closed. Often one of the 52,000 police mobilized for the lockdown asks them to return home.

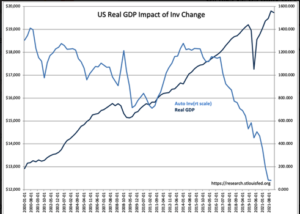

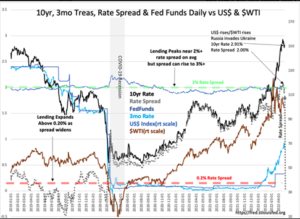

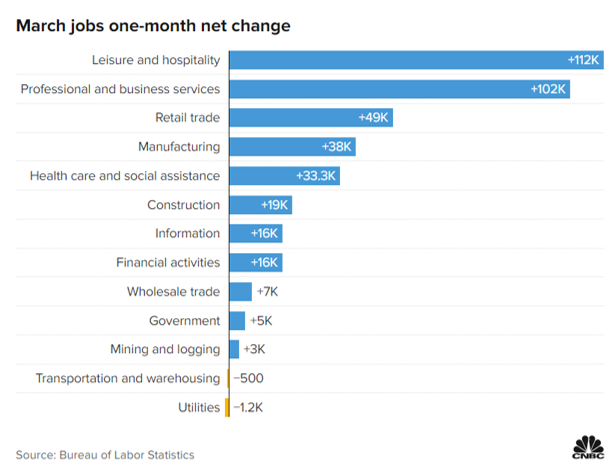

- 04/29/2022 – according to Davidson, negative GDP growth comes from supply constraints, not indicate recession. The decline reported in Real GDP is a signal of demand requiring more supply. It is not a signal that economic growth is slowing.. Plus, oil E&P is growing very strong. The T-Bill/10yr Treas Rate Spread continues to hover near or over 2.00%. This remains a very strong indicator of economic expansion as capital continues to move from Fixed Income into equity. bullish for both oil/gas and financial (DPST?)

GDP and E&P Give Mixed Signals

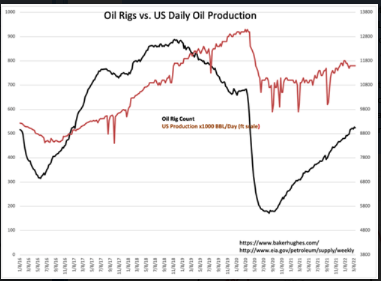

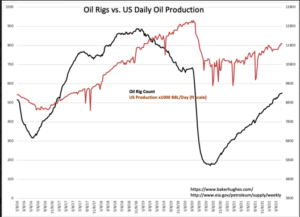

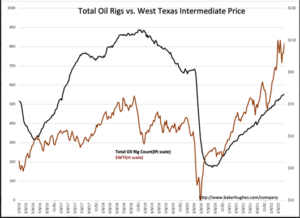

The Baker Hughes Rig Count rises by 3 oil rigs leaving the level of gas rigs unchanged. With crude and refined inventories continuing to decline and $WTI holding above $100/BBL providing strong cash flows to the E&P industry one might expect higher pace of production increases and equipment deployment but this is not what we see. There is a clash of perspectives in the market which is defined by the recent release of McKinsey&Co’s report “Energy Perspective 2022”. This report calls for EV(Electric Vehicles) to dominate transport and reduce oil consumption dramatically in 2yrs-5yrs. Counter to this is Exxon Mobil(XOM)’s announcement of 3x increase in their share buyback program yesterday reflecting high confidence in their industry’s future prospects.

Market perception of XOM being pulled higher by every financial release. While some will proclaim the co missed recently elevated eps expectations, the whole picture presented by management and their outlook continues to display a deep discount to management’s actions. Management’s commentary provides support for a very positive outlook.

Mixed signals in Real GDP:

GDP was reported as declining and some have jumped to adding their voices forecasting recession. Falling inventories due to issues in air craft and vehicle manufacturing i.e, w/production less than sales, is a negative input for GDP. This link provides a good explanation: https://aneconomicsense.org/2012/01/08/contribution-to-gdp-growth-of-the-change-in-inventories-econ-101/. US Real GDP vs Inv Change uses the auto industry to illustrate this point. In the past this has been one of signs of recession. In today’s supply chain disruptions, a decline in inventory w/o replacement production is a negative for Real GDP and misrepresents the current economic trend. The lack of vehicle and air craft production to offset inventory declines in a period when demand is high misrepresents economic expansion.

The T-Bill/10yr Treas Rate Spread continues to hover near or over 2.00%. This remains a very strong indicator of economic expansion as capital continues to move from Fixed Income into equity. The term equity includes stocks and business ventures. The earnings reports strongly favor investment in core economic businesses and disfavor the COVID-favored stay-at-home issues. The correction occurring today is sharply focused on issues heavily favored 2yrs ago. Amazon, Teledoc, Netflix have corrected sharply with lower share prices likely as investors warm-up to earnings trends emerging as headline stories in companies such as Exxon, Federal Express and issues like Thor Inds and Camping World with solid but ignored business trends.

The decline reported in Real GDP is a signal of demand requiring more supply. It is not a signal that economic growth is slowing.

As everyone knows from their first Econ 101 class in Macroeconomics, GDP is equal to Consumption + Investment + Government Spending + Net Exports (Exports minus Imports), where total Investment is equal to Fixed Investment plus the Change in Inventories. The change in GDP will therefore equal the change in Consumption + the change in Investment + the change in Government Spending + the change in Net Exports, where the change in Investment will equal the change in Fixed Investment plus the change in the Change in Inventories. – therefore, when inventory drops, GDP might drop.

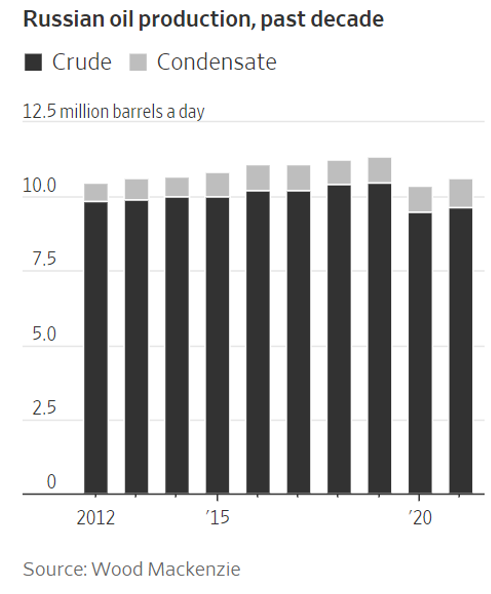

- 04/27/2022 – over 1 million barrels per day of lost production in Russia so far, and expects exports to decline significantly going into the summer. The International Energy Agency has said the impact of sanctions and buyers’ aversion to Russian oil would take full effect from May onwards. That would be the lowest since 2003, when Russian oil output stood at 421 million tonnes.- should I position my portfolio for May?

Andurand sees over 1 million barrels per day of lost production in Russia so far, and expects exports to decline significantly going into the summer. @AndurandPierre #russia #oil #oott https://t.co/NsWhauX6e3

— Josh Young 🦬🛢️ (@Josh_Young_1) April 27, 2022

Exclusive-Russia sees its oil output falling by up to 17% in 2022 -document

Russia may see its oil production fall by as much as 17% in 2022, an economy ministry’s document seen by Reuters showed on Wednesday, as the country struggles with Western sanctions.

The United States has banned Russian oil imports, while Western sanctions against Russian banks and vessels had crippled the oil trade, one of Moscow’s key sources of revenue. The European Union is also considering fully banning Russian oil.

The scale of the production decline would be the most significant since the 1990s when the oil industry suffered from underinvestment.

Russian oil output started to decline in March and had fallen by around 7.5% by mid-April.

According to the document, Russian oil output may decline to between 433.8 million and 475.3 million tonnes (between 8.68 million and 9.5 million barrels per day) in 2022 from 524 million tonnes in 2021.

That would be the lowest since 2003, when Russian oil output stood at 421 million tonnes.

- 04/27/2022 – more stimulus and more demand for oil in China? Chinese government agencies are discussing plans to accelerate big construction projects, especially in the manufacturing, technology, energy and food sectors, as well as to issue coupons to individuals to spur consumer spending, the people said.

China’s Xi Pushing to Beat the U.S. in GDP Growth Despite Covid Lockdowns – WSJ

Topping U.S. economy required to demonstrate superiority of China’s one-party system, Chinese leader tells officials

In meetings over the past few weeks, Mr. Xi told senior economic and financial officials that ensuring that the economy is stable and growing is important because it is critical to show that China’s one-party system is a superior alternative to Western liberal democracy, and that the U.S. is declining both politically and economically.

In response to Mr. Xi’s call to rev up growth, Chinese government agencies are discussing plans to accelerate big construction projects, especially in the manufacturing, technology, energy and food sectors, as well as to issue coupons to individuals to spur consumer spending, the people said.

Beijing is also reversing its policies in other sectors, such as real estate, to prop up the economy. Some local governments have in recent weeks eased their restrictions on home purchases, while China has also put off plans to expand a trial of a property tax, part of a push to restore confidence in the sector.

- 04/26/2022 -Russia’s crude exports hit a snag when Rosneft struggled to find buyers

Russia Tried to Sell a Huge Slug of Oil. Nobody Wanted It. – WSJ

Russia’s crude exports hit a snag when Rosneft struggled to find buyers

Russia failed to sell a huge batch of oil, a sign that soon-to-be imposed sanctions against its state oil giant are playing havoc with the energy industry that undergirds its bruised economy.

Moscow maintained a brisk pace of energy exports in the two months after the invasion, bringing in revenue that Kyiv says funds the Kremlin war machine. Many U.S. allies left oil and gas shipments out of their harshest sanctions on Russia. Importers in India and elsewhere swooped in to buy cheap Russian barrels at a time of rocketing energy prices.

But exports hit a snag in recent days when Rosneft ROSN 2.86% Oil Co. struggled to find buyers for enough oil to fill a fleet of tankers, traders familiar with the sale said. The producer, in which the government owns a large minority stake, had invited companies to bid for the oil last week, according to traders and a document seen by The Wall Street Journal.

A Rosneft spokesman had no immediate comment.

The problems with the sale give an early indication that European sanctions targeting Rosneft, and due to kick in on May 15, are starting to disrupt Russia’s ability to move crude from oil fields to overseas buyers.

- 04/26/2022 – good picture to show the investment in energy. Be aware of the risk in financial sector

possibly one of the best investments for this 2022 pic.twitter.com/QOpb0trlwq

— Oliva (@door_public) April 26, 2022

- 04/26/2022 – if there is nuclear war, then even oil stocks will be crushed? do I need hedge?

Russia’s Lavrov Says NATO Is Using Ukraine as a Proxy, Warns Against World War III – WSJ

- 04/25/2022 – Biden admin’s policy is still hostile to oil/gas industry. Bullish for oil price?

U.S. drops Trump’s Alaska oil exploration policy, restricts North Slope drilling

The Biden administration on Monday overturned a Trump-era policy that would have opened new areas in Alaska to oil development, Reuters reports.

The move resurrects Obama-era policies in the National Petroleum Reserve on the western side of Alaska’s North Slope which allow oil leasing in about half of the 23M-acre reserve while increasing protections for areas considered important to the Arctic ecosystem and to indigenous populations, while the Trump plan announced in 2020 sought to allow oil development on more than 80% of the reserve.

- 04/25/2022 – Dem starts to realize the need for oil and gas? – how much would it cost to reduce global warming? $131 tril is one answer

Sen. Joe Manchin Pushes for Democratic Compromise on Climate Agenda – WSJ

High energy prices and Russia’s invasion of Ukraine give coal-state lawmaker leverage on measures to promote fossil fuels

Voter unrest over high energy prices and concern over dependence on Russian energy have given Sen. Joe Manchin (D., W.Va.) leverage to press for measures promoting more domestic fossil-fuel production in the Democrats’ new climate legislation and potential executive actions.

Mr. Manchin’s interests include getting financial and permitting help for natural-gas exports and oil and gas pipelines, as well as policies to make it easier for companies to drill more on federal territory, according to lobbyists and congressional aides familiar with the situation.

Some of Mr. Manchin’s efforts are expected to face opposition from some Democrats who say the Biden administration has already retreated too far from its goal of weaning the U.S. off fossil fuels.

Asked for comment, the White House responded with a series of recent statements from administration officials, including comments from principal deputy press secretary Karine Jean-Pierre saying the administration is seeking to increase short-term supplies of gasoline while still pressing forward with the transition to clean energy.

“Addressing the emergency supply crunch while accelerating clean energy efforts is fully consistent with the theory of the case and what we’re trying to do,” she said.

Climate activists are expecting to compromise, said Justin Guay, director for global climate strategy at the Sunrise Project, an environmental group. But they will likely draw the line at gas-export terminals and other big infrastructure that could encourage years of additional fossil-fuel consumption.

“A climate bill can’t be a cover for cynical opportunism and handouts for fossil fuels,” he said.

Democrats could strike a deal that fulfills some of Mr. Manchin’s demands, even help for pipelines, and still make the progress they need if the clean-energy provisions are strong enough, according to Rhodium Group, an independent research firm.

- 04/24/2022 – CV-19 in China

New Details of Shanghai Nursing Home Covid Deaths Suggest City Is Overwhelmed – WSJ

China’s policy of lockdowns, coupled with low vaccination rates among older people, hasn’t been effective during the highly contagious Omicron wave

- 04/23/2022 – EU is still going Green?

As Europe Seeks to Move Away From Russian Gas, Which Renewables Will Benefit? – WSJ

As Europe Seeks to Move Away From Russian Gas, Which Renewables Will Benefit?

Policy makers are counting on faster expansion of solar, wind and other technologies

- 04/23/2022 – here is the story how Shanghai’s covid condition developed like what is at present. But how can Xi end this lockdown? when is the end of the tunnel? or wil it be ever end?

Shanghai’s Omicron Outbreak Corners Chinese Leader – WSJ

Xi Jinping looked to ease China’s zero-Covid strategy until the highly contagious variant forced a return to strict lockdowns

“Fighting all the previous variants was like putting out a forest fire, it can be done,” said Michael Osterholm, director of the Center for Infectious Disease Research and Policy at the University of Minnesota. “But Omicron is like the wind. How do you stop the wind?”

- 04/23/2022 – Italy believes natural gas supplies from Russia to EU may be cut off in May: Report

Italy believes natural gas supplies from Russia to EU may be cut off in May: Reporthttps://t.co/fyqDGYZ0Fo

— E. Justin, Randomer (@ejustin46) April 23, 2022

Italy Believes Natural Gas Supplies From Russia To EU May Be Cut Off In May: Report

Italy believes that natural gas supplies from Russia to the EU could be cut off in May as paying for Russian energy in rubles violates European sanctions.

Amid the relentless war in Eastern Europe, Italy believes that natural gas supplies from Russia to the European Union could be cut off in May as paying for Russian energy in rubles violates European sanctions. In an interview with Italian daily, Corriere della Sera, Stefano Bessegini, head of Italy’s Regulatory Service for Energy, Grids and the Environment, stated that this can really happen in May and there could also be a risk of not filling the storage facilities completely, RIA Novosti reported.

In response to Western sanctions on Russia, Italian Prime Minister Mario Draghi has emphasised the importance of taking steps to reduce reliance on the Russian Federation in the energy sector. He also advocated for an increase in natural gas imports from other nations, specifically from Azerbaijan, Algeria, Tunisia, and Libya. During Draghi’s visit to Algeria earlier this month, the two nations’ leading oil and gas corporations signed a deal to boost the supply of blue fuel to the Apennines, which will eventually grow by 9 billion cubic metres per year.

EU vows to completely phase out Russian fuel imports

It is pertinent to mention here that the European Union has pledged to completely phase out Russian fuel imports in the coming years. Earlier this month, the 27-member bloc announced its fifth package of sanctions on the Russian Federation. Notably, the package includes a full-fledged ban on Russian coal imports. While the new sanctions came into force on April 8, a total ban on Russian coal imports is expected by mid-August. Meanwhile, Russian Deputy Prime Minister Alexander Novak has claimed that the EU will not be able to fully replace Russian oil and gas in the next five to 10 years.

- 04/23/2022 – This energy crisis is just the tip of the iceberg for EU countries?

"tip of the iceberg" energy crisis 😬 pic.twitter.com/JhsTYaWYLx

— Josh Young 🦬🛢️ (@Josh_Young_1) April 23, 2022

- 04/23/2022 – “What the Netherlands would actually like to achieve is being independent of Russian gas and Russian oil before the end of the year,” Dutch Prime Minister Mark Rutte said Friday.

More details here, including % Russian origin of hydrocarbons https://t.co/LU1TmXQwP6

— Josh Young 🦬🛢️ (@Josh_Young_1) April 23, 2022

The full details here. The Netherlands is less dependent on Russian gas than most European countries (15% supply vs. 40% EU average)https://t.co/PULpNoB5rY

— Samuel Ramani (@SamRamani2) April 23, 2022

But it’s the biggest eu importer of Russian oil so this is big

— Louis 🇺🇦 (@LJA___) April 23, 2022

Dutch to cut Russian oil, gas imports by year-end: PM

The Netherlands aims to cut Russian oil and gas imports by the end of the year, Dutch Prime Minister Mark Rutte said Friday, but he admitted Europe remained dependent on Moscow’s supply.

The European Union is scrambling to find alternatives to Russian energy after Moscow’s invasion of Ukraine since Russia currently supplies 40 percent of the EU’s gas needs and some 15 percent to the Dutch.

“What the Netherlands would actually like to achieve is being independent of Russian gas and Russian oil before the end of the year,” Rutte said.

“We can achieve this by working hard on a mix of energy savings and sustainability, but it will also have to lead to the import of energy from other countries, including liquid natural gas,” the Dutch leader told journalists at his weekly press conference.

The Netherlands imported some 11 billion euros ($11.8 billion) in oil from Russia in the first 11 months of last year, the Volkskrant daily newspaper said.

Around 3.7 billion euros were also spent on importing gas and coal from Russia, the paper said.

The Netherlands aimed to halt coal imports by 11 August.

But Rutte admitted that even the Netherlands, which imported far less Russian gas than neighbouring Germany and eastern EU countries, remained dependent on Russian supplies.

“It really is a challenge. We are very dependent on Russian gas in Europe and there are not many alternatives to LNG,” Rutte said.

It is estimated that Dutch gas consumption can be reduced by around 9 billion cubic metres by 2025 through sustainable measures, a government statement said Friday.

“That is more than the import from Russia (about 6 billion cubic metres),” the statement added.

Europe’s largest port Rotterdam was expanding its liquid natural gas terminal and a floating terminal was being built in the northern port of Eemshaven.

“Approximately 8 billion cubic metres of extra liquefied gas can be imported before the end of the year,” the government said.

In addition, the Dutch government will try “in the coming weeks” to conclude agreements with other countries to become independent of Russian oil “as quickly as possible,” it said.

- 04/22/2022 – EU continues to go green? policy makers banking on a faster expansion of solar, wind and other clean technologies to reduce demand for Russian gas while contributing to progress on the bloc’s existing climate goals

As Europe Seeks to Move Away From Russian Gas, Which Clean-Energy Technologies Will Benefit? – WSJ

Policy makers are counting on faster expansion of solar, wind and other technologies

As Europe tries to hasten a push toward more renewable energy sources, and away from Russian gas, which clean technologies are likely to fare the best?

Europe is seeking to swiftly curtail its reliance on Russian natural gas, which last year accounted for about 40% of the bloc’s gas consumption, amid outrage over Russia’s invasion of Ukraine and worries that supplies could be suddenly cut off by Moscow. The European Union says it wants to reduce imports of Russian gas by two-thirds this year and end its dependence on them entirely by 2027.

In the short term, much of the savings is expected to come from a switch to other gas suppliers, along with a greater reliance on coal-fired power plants. But renewables could soon play a bigger role, with policy makers banking on a faster expansion of solar, wind and other clean technologies to reduce demand for Russian gas while contributing to progress on the bloc’s existing climate goals.

“We had a fear for a few days that the crisis would kind of put everything on pause in terms of climate policy,” says Jules Besnainou, executive director of Cleantech for Europe, which advocates for clean tech and tracks venture-capital investment in the sector. “We’ve seen kind of the reverse, which is a real emphasis on the rollout of clean technology.”

- 04/22/2022 – when can China reopen?

COVID cases in China may have peaked. An extended lockdown would be bearish for oil, and reopening could be bullish. WTI oil is down slightly in the overnight market at $103/bbl. https://t.co/6gUeBHSnWy

— Josh Young 🦬🛢️ (@Josh_Young_1) April 22, 2022

- 04/22/2022 – the war might drag on

Russian military official says Kremlin plans to take full control of southern Ukraine, state news agency reports

The deputy commander of Russia’s central military district, Rustam Minnekayev, was cited saying that the Kremlin is planning to take full control of Donbas and southern Ukraine as part of the second phase of its operations, according to state-owned news agencies and as reported by Reuters. Mariupol’s city council released satellite images claiming they show mass graves where Russian forces are burying Ukrainians, per the BBC and the New York Times.

- 04/21/2022 – OilX, a consultancy that uses imaging data from NASA satellites to measure flaring, estimates that Russian output fell to a low of 9.76mbpd. April represents a big drop from the 11.1 million of February, before the impact of the invasion of Ukraine, and the 11 million of March.

OilX, a consultancy that uses imaging data from NASA satellites to measure flaring, estimates that Russian output fell to a low of 9.76mbpd. April represents a big drop from the 11.1 million of February, before the impact of the invasion of Ukraine, and the 11 million of March. pic.twitter.com/MJc3g9Q2UH

— Alexander Stahel 🇺🇦 (@BurggrabenH) April 21, 2022

COLUMN: After 8 weeks of war, Russian oil production is finally succumbing to the impact of Western sanctions and self-sanctions. Production is down ~10% from pre-war levels, with output in recent days just below 10 million b/d | #OOTT via @bopinion https://t.co/5UzDSJJEqw pic.twitter.com/GwN2Z5VRwS

— Javier Blas (@JavierBlas) April 21, 2022

- 04/20/2022 – the momentum of negative narrative on oil industry is still popular

👀🤔 "go woke, go broke?" https://t.co/kHFetdVRVh

— Josh Young 🦬🛢️ (@Josh_Young_1) April 20, 2022

also this one

Mastercard to link all employee bonuses to ESG goals

- 04/20/2022 – “the US is acting as an oil supplier of last resort” – it’s going to get interesting as DUCs run out and service capacity remains limited. See HAL comments on preference for short cycle development versus long term exploration. More appetite for the former, not so much for the latter. Will further increase the energy resource have vs have nots divide. that is very bullish medium-term as short cycle inventory is developed without longer-term inventory replacement. Kind of burning the furniture.

"the US is acting as an oil supplier of last resort" – it's going to get interesting as DUCs run out and service capacity remains limited.https://t.co/fvJXAWvgbN

— Josh Young 🦬🛢️ (@Josh_Young_1) April 20, 2022

- 04/20/2022 – Germany confirms it will stop buying Russian oil by the end of 2022. “We will halve oil by the summer and will be at 0 by the end of the year, and then gas will follow, in a joint European roadmap, because our joint exit, the complete exit of the European Union, is our common strength.” – the longer the war lasts, the more chance Germany will stop buying Russia oil and gas

BREAKING: Germany confirms it will stop buying Russian oil by the end of 2022

What about Russian gas? 🤔

— Josh Young 🦬🛢️ (@Josh_Young_1) April 20, 2022

Germany will end oil imports from Russia by year end, says minister

BERLIN – Germany will stop importing oil from Russia by the end of the year, said German Foreign Minister Annalena Baerbock after a meeting with her Baltic counterparts on Wednesday.

“I therefore say here clearly and unequivocally yes, Germany is also completely phasing out Russian energy imports,” said Baerbock.

“We will halve oil by the summer and will be at 0 by the end of the year, and then gas will follow, in a joint European roadmap, because our joint exit, the complete exit of the European Union, is our common strength.”

I agree, that is very bullish medium-term as short cycle inventory is developed without longer-term inventory replacement. Kind of burning the furniture.

— Josh Young 🦬🛢️ (@Josh_Young_1) April 20, 2022

- 04/19/2022 – The relationship between the U.S. and Saudi Arabia has hit its lowest point in decades, with Mr. Biden saying in 2019 that the kingdom should be treated like a pariah over human-rights issues such as Mr. Khashoggi’s murder. The U.S.-Saudi relationship has faltered before. The 1973 Arab oil embargo, led by Saudi Arabia in response to U.S. support for Israel during the Yom Kippur War, sparked the worst U.S. recession in 40 years.

How U.S.-Saudi Relations Reached the Breaking Point – WSJ

The decadeslong alliance is at risk over disagreements regarding oil production levels, security concerns and the invasion of Ukraine

The relationship between the U.S. and Saudi Arabia has hit its lowest point in decades, with Mr. Biden saying in 2019 that the kingdom should be treated like a pariah over human-rights issues such as Mr. Khashoggi’s murder.

The political fissures have deepened since Russia’s invasion of Ukraine, senior Saudi and U.S. officials said. The White House wanted the Saudis to pump more crude, both to tame oil prices and undercut Moscow’s war finances. The kingdom hasn’t budged, keeping in line with Russian interests.

The U.S.-Saudi relationship has faltered before. The 1973 Arab oil embargo, led by Saudi Arabia in response to U.S. support for Israel during the Yom Kippur War, sparked the worst U.S. recession in 40 years.

- 04/19/2022 – Potential additional oil related sanctions are worth watching closely. Von der Leyen : “The primary goal is to shrink Putin’s income. But oil is traded globally. What shouldn’t happen is that Putin charges even higher prices on other markets for supplies that otherwise go to the EU. That is why we are currently developing clever mechanisms so that oil can also be included in the next sanctions step.”

Potential additional oil related sanctions are worth watching closely. #eu #russia #oil https://t.co/qKiZLBYXZK

— Josh Young 🦬🛢️ (@Josh_Young_1) April 19, 2022

“Russia’s bankruptcy is only a matter of time” full article is here

EU Commission President Ursula von der Leyen wants to see rapid arms deliveries to Ukraine and wants to tighten sanctions against Russia

Von der Leyen : “No. The sanctions eat their way deeper into the Russian economy every week: exports to Russia have collapsed by 70 percent. 700 Russian aircraft have lost their license due to a lack of spare parts and software updates. Hundreds of large companies and thousands of experts are turning their backs on the country. According to current forecasts, gross domestic product in Russia will collapse by 11 percent. Russia’s national bankruptcy is only a matter of time. With this war, Putin is also destroying his own country and the future of its people.”

They are preparing a sixth package of sanctions. What are the key points?

Von der Leyen : “We continue to look at the banking sector, particularly Sberbank, which alone accounts for 37 percent of the Russian banking sector. And of course there are energy issues.”

Every day the EU states pay Russia 450 million euros just for oil supplies. How long is this supposed to go on?

Von der Leyen : “The primary goal is to shrink Putin’s income. But oil is traded globally. What shouldn’t happen is that Putin charges even higher prices on other markets for supplies that otherwise go to the EU. That is why we are currently developing clever mechanisms so that oil can also be included in the next sanctions step.”

So the federal government isn’t slowing down?

Von der Leyen : “Germany has supported Ukraine for many years and approved all five sanctions packages that we proposed within 48 hours. The EU has never acted as united, determined and energetic as it is now. Germany has its part in that.”

Headline: OIL MAY HIT $185 IF EU BANS ALL RUSSIAN OIL IMMEDIATELY: JPM

Unlikely but noteworthy. @jpmorgan #oil @EU_Commission #russia

— Josh Young 🦬🛢️ (@Josh_Young_1) April 19, 2022

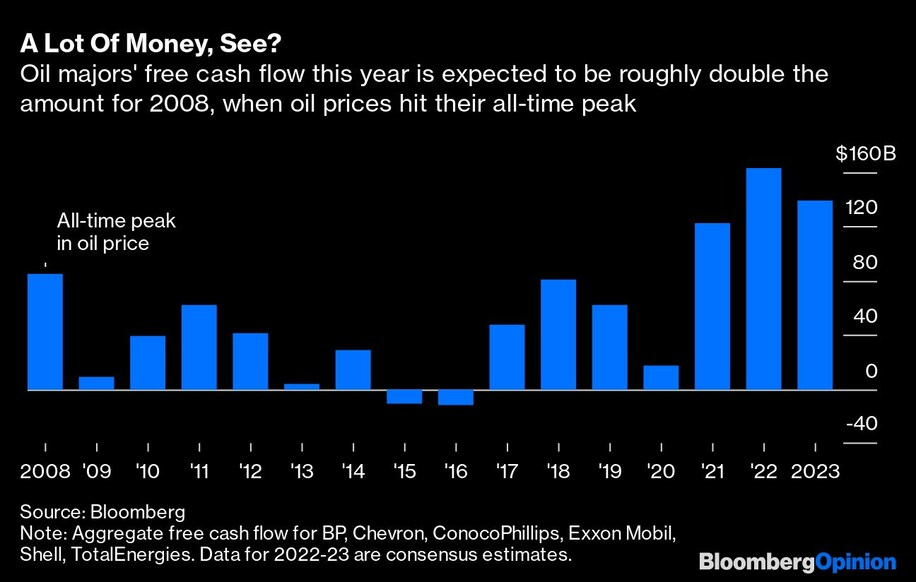

- 04/19/2022 – And the quote that really stands out. Although they used 2008 and not 2014. We think 2014 is a better comp year for a lot of reasons, including more similar commodity prices, wasn’t the year of a global financial crisis with weird distortions, etc. I hope you’re sitting down for this news: Oil co’s look set to make a lot of money. I know. But trust me, this year, it’s really a lot of money. Their smaller competitors in the U.S. exploration and production business are also in for a big year.

Wow that was fast. @BisonInterests white paper out Thursday on oil and gas producers swimming in cash, #Bloomberg article out Tuesday…https://t.co/S8PUpXRoKy

— Josh Young 🦬🛢️ (@Josh_Young_1) April 19, 2022

Big Oil’s Windfall Creates a Quandary for the Industry full article is here (oil_cash_flow_blom)

This leaves the industry with an unfamiliar conundrum: What to do with all the cash? First-world problem, perhaps, but at this moment a potential problem nonetheless.

- 04/18/2022 – Golden Age of Oil and Gas Producers?

Business has never been better for oil and gas producers.

Here's why share prices can move even higher from here, in this Golden Age of Oil and Gas Producers 🧵

— Bison Interests (@BisonInterests) April 18, 2022

- 04/17/2022 – ESG is failing, like before again?

It seems like @barronsonline is coming around to what was covered in my interview with themhttps://t.co/6mVkATEjt4

— Josh Young 🦬🛢️ (@Josh_Young_1) April 17, 2022

Sustainable Investing Failed Its First Big Test. A Reckoning Is Coming.

- 04/17/2022 – Energy markets were facing the biggest supply crisis in decades, which could result in lasting changes, the Paris-based agency said Wednesday in its monthly report. The impact could mean 3 million barrels a day of Russian supply effectively cut off from global markets starting next month, the IEA said. The issue has been compounded by OPEC+’s own inability to meet its supply targets, due in part to ailing oil infrastructure in some member countries. The group’s output lags behind its targets by 1.1 million barrels, the IEA said.

Headline: Oil Market Faces Biggest Supply Crisis in Decades Unless OPEC Boosts Output, IEA Says – WSJ https://t.co/7G2QTo1UGl

— Josh Young 🦬🛢️ (@Josh_Young_1) April 18, 2022

Oil Market Faces Biggest Supply Crisis in Decades Unless OPEC Boosts Output, IEA Says – WSJ

Three million barrels a day of Russian oil output could be lost from April because of sanctions, agency says

Russia’s invasion of Ukraine and Western sanctions on its oil exports threaten a supply shock that will weigh on the global economy and tighten energy markets even further unless major producers increase output, according to the International Energy Agency.

Energy markets were facing the biggest supply crisis in decades, which could result in lasting changes, the Paris-based agency said Wednesday in its monthly report.

Russia’s invasion of its neighbor has prompted Western nations to levy harsh sanctions on Moscow and the Russian economy. While only some nations, including the U.S., have banned Russian oil imports outright, traders, energy companies and shipping firms are shunning Russian crude, fearful of the reputational risk, the IEA said.

The impact could mean 3 million barrels a day of Russian supply effectively cut off from global markets starting next month, the IEA said. The agency slashed its forecast for global oil supply this year by 2 million barrels a day to 99.5 million barrels a day, based on what major producers of the Organization of the Petroleum Exporting Countries have currently agreed to pump.

There were signs, however, that a Western diplomatic effort to urge Gulf oil producers to pump more was working. The United Arab Emirates last week said it would push other OPEC members to pump more oil.

U.K. Prime Minister Boris Johnson traveled to the Gulf on Wednesday to meet with Saudi and Emirati leaders in a bid to convince them to increase oil output.

The issue has been compounded by OPEC+’s own inability to meet its supply targets, due in part to ailing oil infrastructure in some member countries. The group’s output lags behind its targets by 1.1 million barrels, the IEA said.

The IEA has taken its own steps to ease oil-market tightness. Its members agreed earlier this month to release around 60 million barrels of oil from emergency stockpiles, but the amount was seen as too little to have a meaningful impact. The IEA said that its members were ready to release more crude from inventories.

- 04/17/2022 – Bullish oil – Libyan oil field shut down and production suspended until a political disagreement is resolved

Bullish oil – Libyan oil field shut down and production suspended until a political disagreement is resolved https://t.co/mDQEkmykDM

— Josh Young 🦬🛢️ (@Josh_Young_1) April 17, 2022

- 04/17/2022 – This chart from the interview shows $xle performance vs $spy, with under-performance for almost 15 years, from 2008-2021. It shows lots of room for oil and gas and related equities to run.

This chart from the interview shows $xle performance vs $spy, with under-performance for almost 15 years, from 2008-2021. It shows lots of room for oil and gas and related equities to run. pic.twitter.com/v3D2YLFzH4

— Josh Young 🦬🛢️ (@Josh_Young_1) April 17, 2022

- 04/15/2022 – Davidson’s viewpoint – Investors should have equities that respond well during inflationary periods i.e., energy and energy related, infrastructure related, transport and suppliers of other vital goods and services where inflation adjustments are passed through.

Oil, DUC’s, Retail Sales and Inflation

The current rise in M2 2020-2022 from government issuance of debt is guaranteed to be inflationary for several years at best. Those who speak of “peak inflation is behind us” have little sense of history. Investors should have equities that respond well during inflationary periods i.e., energy and energy related, infrastructure related, transport and suppliers of other vital goods and services where inflation adjustments are passed through.

- 04/15/2022 – IF speaks to the ethos of Bison: we face into the storm. A copy is hanging on a wall of our CIO ‘s home.

What it took to make it through a multi-year bear market in oil and gas, courtesy of Kipling:

"If you can force your heart and nerve and sinew

To serve your turn long after they are gone

And so hold on when there is nothing in you

Except the will which says to them "Hold on"" pic.twitter.com/w1BLm71qeB— Josh Young 🦬🛢️ (@Josh_Young_1) April 15, 2022

- 04/15/2022 – the sentiment on oil is still hate even the current great run of oil and oil stocks. Does this mean that we have long runway of oil stocks?

Sentiment check: "fossil fuels still hated" ✅ pic.twitter.com/7AeL2d722j

— Josh Young 🦬🛢️ (@Josh_Young_1) April 15, 2022

Have fun staying cold? https://t.co/IM1s0zKpTL

— Josh Young 🦬🛢️ (@Josh_Young_1) April 15, 2022

- 04/15/2022 – Josh’s quick take on what makes a good oil stock

what to look for in a good oil stock? three primary things and a couple of secondary things

- good management team, strong track record, good skills to apply to this particular scenario

- strong balance sheet, paid off lots of debt and survive long down term

- high quality asset, not measured conventionally in terms of super high rate of return on drilling, but some combined ability to generate free cash flow along with ability to generate growth that maybe access to consensus to expect

- when I am looking for beyond that great set up and of course of discounted valuation, is either some combination of hid assets, or some sort of catalysts that can help to unlock value that help me realize access return relatively just owning an index or some other oil stocks

Minute or less on what makes a good oil stock https://t.co/RpGkf1OEON

— Josh Young 🦬🛢️ (@Josh_Young_1) April 14, 2022

- 04/13/2022 – It is too early to tell whether Russia’s energy industry will suffer lasting damage, analysts say. There are signs the country is adapting fast to lost demand in the West, sending more shipments of crude to Turkey and India among other countries. Oil producers in Russia have recovered from setbacks in the past. Output almost halved between 1987 and 1996 during the disintegration of the Soviet Union, according to a book on Russian oil by Thane Gustafson. Russia returned to the top table of oil-market players when Mikhail Khodorkovsky’s Yukos and Roman Abramovich’s Sibneft applied Western production and management techniques in the 2000s.

Russia’s Oil Industry, Linchpin of Economy, Feels Sting of Ukraine War Disruptions – WSJ

Storage facilities are filling up, refineries are cutting output and crude-oil wells are throttling back production

Oil is backing up through Russia’s energy supply chain and leading to a drop in crude-oil production, a blow to Moscow’s main economic engine as the war in Ukraine rages.

Refiners are trimming output and in some cases closing down because of falling demand at home and abroad. Storage space is running low in pipelines and tanks. Wells, which pump from some of the world’s biggest crude reserves, are dialing down production.

The losses so far are modest, and overall the industry continues to generate massive amounts of revenue for Moscow. But the problems of getting crude from the ground to end users are likely to mount in the coming months, traders and analysts say.

In the latest indication of problems ahead, the International Energy Agency forecast Wednesday that starting in May, almost 3 million barrels a day in Russian production will be turned off. That would reduce output to fewer than 9 million barrels a day, a larger pullback than other analysts have predicted.

The space to store oil appears to be dwindling in the state-owned Transneft PJSC pipeline network as less crude flows into refiners, traders and analysts say. Measuring how much crude is housed in the network is difficult. Many storage tanks in Russia have fixed or covered roofs, or are underground, so satellites can’t calculate the oil inside them by tracking the height of the roof, Mr. Joswick said.

It is too early to tell whether Russia’s energy industry will suffer lasting damage, analysts say. There are signs the country is adapting fast to lost demand in the West, sending more shipments of crude to Turkey and India among other countries.

Oil producers in Russia have recovered from setbacks in the past.

Output almost halved between 1987 and 1996 during the disintegration of the Soviet Union, according to a book on Russian oil by Thane Gustafson. Russia returned to the top table of oil-market players when Mikhail Khodorkovsky’s Yukos and Roman Abramovich’s Sibneft applied Western production and management techniques in the 2000s.

- 04/13/2022 – WSJ’s take on supply chain problem, worth watching

Why Global Supply Chains May Never Be the Same – A WSJ Documentary

- 04/12/2022 – Remember the adage: there is always a bull market somewhere. But I need to spend time to find it!

Remember the adage: there is always a bull market somewherehttps://t.co/EqxsTRD2Sk

— Josh Young 🦬🛢️ (@Josh_Young_1) April 12, 2022

- 04/10/2022 –

https://www.reuters.com/world/europe/chechen-chief-kadyrov-says-russian-forces-will-take-kyiv-2022-04-11/?taid=62538bb18999870001e56a1e&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

- 04/12/2022 – from Todd Subs: EIA: Stopping Pipeline Growth Negative for Consumers, Little If Any Environmental Benefit

People are treating this as though it is some type of momentous determination. For me, it is really just Econ 100. Demand continues to grow, transportation of nat gas is essentially stagnant meaning we will not be able to ship what we need so costs MUST rise. We then MUST use coal or oil generation to supplement our electric generation as renewables will not even come close to bridging the gap. This then determines environmental benefits of restricting nat gas transport are minimal if any.

I’m shocked this is “news”

- 04/10/2022 – Josh Young: Huge upside to energy stocks as mean reversion vs the broader market kicks in.

Huge upside to energy stocks as mean reversion vs the broader market kicks in. https://t.co/akqZuYkyx2

— Josh Young 🦬🛢️ (@Josh_Young_1) April 10, 2022

Similar concept to a chart I've been sharing intermittently showing upside in oil and gas stocks vs oil prices and the broader market https://t.co/AyE0ZpswnQ

— Josh Young 🦬🛢️ (@Josh_Young_1) April 10, 2022

- 04/10/2022 – “Higher for longer” geopolitical case for oil, the Russia edition. the interview from Russian top think tank implies that the war will last as long as either side wins (Russia or Ukraine). If afterwards you still harbor any illusions about sustainable negotiated settlement with Putin’s Kremlin on European security order read it again. And again. Russian believe “We will be victorious because Russians always are in the end.” Russians support Putin at 81% now, people are ready for a rough period».

"Higher for longer" geopolitical case for oil, the Russia edition https://t.co/0fXWLqoxy7

— Josh Young 🦬🛢️ (@Josh_Young_1) April 10, 2022

Sergey Karaganov: «We are at war with the West. The European security order is illegitimate»

Sergey Karaganov has served as a presidential advisor in the Kremlin both under Boris Yeltsin and Vladimir Putin. He is still considered close to Russia’s president and foreign minister Sergey Lavrov. His recent proposals on Russian-speaking minorities in the “near abroad” are known as “Putin doctrine” and Professor Karaganov, who is honorary chair of the Moscow think tank the Council for Foreign and Defense Policy, was first to come out publicly about an all-out invasion of Ukraine in 2019. President Putin has mentioned on Feb. 24 that Ukraine’s accession to NATO warrants Russia’s military intervention to prevent it.

The EU seems to be moving towards cutting dependence from Russian energy – first coal, then oil and finally natural gas. Did you expect that?

«I hope you are not suicidal. Of course that would damage Russia, too, but Europe would undermine its economy and its social situation. I hope it will not happen, because you can calculate your own interests. If you don’t want our coal, we will sell it somewhere else. If you don’t want our oil, after a time and some losses, we will sell it elsewhere. And if you don’t want gas, well, well, we can also eventually redirect it after some suffering. Russians support Putin at 81% now, people are ready for a rough period».

Amping up the war crimes rhetoric slows & reduces the odds of cease fire efforts. War is a humanitarian crisis. The longer it goes, the more people are killed & mistreated. And the higher the risk of a prolonged energy crisis that kills poor people. https://t.co/el36l117ta

— Josh Young 🦬🛢️ (@Josh_Young_1) April 10, 2022

- 04/09/2022 – EU is still dragging their feet on sanction of Russian oil/gas, more to come?

European Countries Debate How to Cut Purchases of Russian Oil – WSJ

Disagreements among European governments make an early decision unlikely, and any exit from Russian oil is expected to be gradual

- 04/09/2022 – Japan is banning oil/gas from Russia, more strains to the global supply chain, and more tightening on oil

TOKYO — Japan announced Friday it is expelling eight Russian diplomats and trade officials and will phase out imports of Russian coal and oil, with Prime Minister Fumio Kishida saying Moscow must be held accountable for “war crimes” in Ukraine.

Kishida said Japan will also ban imports of Russian lumber, vodka and other goods, and will prohibit new Japanese investment in Russia.

Reduction of fossil fuel imports from Russia is a difficult choice for resource-poor Japan, whose hydrocarbon needs account for about half of its total energy mix. The decision could mean a shift for Japan’s energy policy toward more renewables and nuclear power.

Russia accounts for about 11% of Japanese coal imports and also ranks among the top exporters of liquefied natural gas and oil, according to government data.

Kishida said Russian coal is used industry-wide, from utility companies to cement and steel manufacturers. “We will have to assess the impact first, and will take steps toward Russian coal ban by securing alternatives,” Kishida said, declining to set a timeline for a total ban.

- 04/09/2022 – the Russia-Ukraine war might become bloodier with this new assignment. NATO must seriously do something to stop this. Unfortunately, it seems like China is still on Russia’s side.

The BBC, citing its sources, reports that #Russia is forced to change its military leadership due to the failure of the offensive. Now they are led by General Alexander Dvornikov, who has war experience in #Syria.https://t.co/dqhUY0UBTE pic.twitter.com/02vOR5OH4B via @nexta_tv

— AlexandruC4 (@AlexandruC4) April 8, 2022

Putin taps ‘Butcher of Syria’ for escalation in Donbas

Russian President Vladimir Putin is reportedly tapping the so-called “Butcher of Syria” to rejuvenate the Kremlin’s offensive amid a string of military setbacks in Ukraine.

Gen. Alexander Dvornikov, who was given command of Russia’s southern military district after achieving infamy for his brutal campaigns in Syria, has now been tasked with conquering Ukraine’s eastern Donbas region as Putin desperately tries to eke out some kind of victory, the BBC reported.

Chinese state media are promoting allegations that the Ukrainians staged the mass graves in Bucha, the latest in the Asian nation's furtherance of Russian propaganda about the Ukrainian invasion.

— Washington Examiner (@dcexaminer) April 9, 2022

- 04/09/2022 – another potential geopolitical risk (which is ignoring by the market) might come soon

Potential Libyan oil blockade. 1.2 million bopd. Exports had already fallen ahead of this. Worth watching. Oil geopolitical risk is still under-appreciated. H/t @garquake @reportingLibya https://t.co/S5CWe3pKWB

— Josh Young 🦬🛢️ (@Josh_Young_1) April 9, 2022

Libya’s 5+5 JMC wants to stop oil exports and halt domestic flights

Members of the 5+5 of the Joint Military Committee has called on Khalifa Haftar, leader of the Libyan National Army (LNA), to take drastic measures with the goal of enforcing a blockade on the government of Abdul Hamid Dbeibeh.

The LNA representatives accused the Libyan prime minister of corruption, violations of the political agreement and obstructing the committee’w work.

They also denounced his decision not to hand over power to his political rival, Fathi Bashagha, who was designated as the country’s prime minister by the House of Representatives months ago.

In response to “this dangerous slope”, the LNA representatives called on Haftar to shut down oil exports, close coastal road linking the western and eastern regions of Libya, halt domestic flights between the two regions and cease all cooperation with Dbeibeh’s government.

- 04/08/2022 – this does confirm Josh’s prediction – OPEC does not have capacity to boost production

Headline: OPEC does not have capacity to boost production: Nigerian ministerhttps://t.co/pQKKrT9Jl9

— Josh Young 🦬🛢️ (@Josh_Young_1) April 8, 2022

- 04/08/2022 – new podcast from Josh Young

Ep. 107: Josh Young on $200 Oil and the Structural Energy Supply Problem

This podcast is sponsored by Masterworks, the first platform for buying and selling shares representing an investment in iconic artworks. They are making it possible to invest in multimillion-dollar works from artists like Banksy, Kaws, Basquiat, and many more.

Josh Young is the Chief Investment Officer and Founder of Bison Interests – an investment firm that focuses on the publicly traded oil and gas sector. He has over 15 years of experience in investment management, 10 of which were focused on publicly-traded oil and gas securities. Josh became Chairman of the Board of RMP Energy in 2017. After refreshing the board and management team and rebranding the company (Iron Bridge Resources), it was bought out at a 78% premium in 2018. Before this, Josh was a management consultant to Fortune 500 companies and private equity firms, and then an investment analyst at a private equity fund. Josh worked as an energy investment analyst for a multi-billion-dollar, single family office. In this podcast we discuss:

- Understanding the energy sector: upstream/midstream/downstream

- focus on upstream – producing companies

- occasionally on midstream and downstream

- The cost of drilling

- The impact of ESG on the energy sector

- Why oil isn’t output higher

- The structural supply issues for energy sector

- The investment needs to maintain supply

- The regulatory pressures on supply

- Whether the Middle East step up supply

- Whether the oil bull market is still early

- The best to get exposure to energy

- Books that influenced Josh: The First Billion Is the Hardest (Pickens) and Fooling Some of the People All of the Time (Einhorn)

- 04/07/2022 – first step on Russian energy embargo?

Europe Agrees to Ban Russian Coal, but Struggles on Oil, Gas

The European Union nations have agreed to ban Russian coal in the first sanctions on the vital energy industry over the war in Ukraine, but it has underlined the 27 countries’ inability to agree so far on a much more sweeping embargo on oil and natural gas that would hit Russia harder but risk recession at home.

The move is significant because it breaks the taboo on severing Europe’s energy ties with Russia. It’s also certain to fuel already record-high inflation. But compared with natural gas and oil, coal is by far the easiest to cut off quickly and inflicts far less damage on Russian President Vladimir Putin’s war chest and the European economy. The EU pays Russia $20 million a day for coal — but $850 million a day for oil and gas.

- 04/08/2022 – Germany is still the main block of sanction on Russia. “The problem with Germany is that everything is reactive only, and the first answer to any daring question is always: ‘no, that’s impossible,’”. If Germany starts to embargo Russian oil, imagine what will happen to the oil market

Germany Faces Pressure to Bolster Response to Russian Aggression in Ukraine – WSJ

Complaints rise that Germany is blocking stronger sanctions and refusing to send substantial military aid to Ukraine

Germany is coming under pressure from Western allies to beef up its response to Russia’s aggression, accept stronger sanctions against Moscow and send more weapons to Ukraine.

“It’s Germany that is the main roadblock on sanctions,” Poland’s Prime Minister Mateusz Morawiecki told reporters on Monday. “It is not the voices of German businesses that should be heard aloud in Berlin today. It is the voice of these innocent women and children.”

A German government spokesman said that Germany was working with partners to strengthen the sanctions against Russia and that it would continue sending military aid to Ukraine.

“The problem with Germany is that everything is reactive only, and the first answer to any daring question is always: ‘no, that’s impossible,’” Mr. Gressel said.

- 04/07/2022 – BUllish for oil – OPEC+ oil production declined in March and substantially missed quota levels

This is the March OPEC+ oil production quota scorecard on a country by country level pic.twitter.com/DjlIe4PCEB

— Bison Interests (@BisonInterests) April 8, 2022

2/ OPEC 13 production decreased by 0.08, this is the first month in which production declined since our white papers last year.

12/19 OPEC+ countries (excluding the exempt) missed their production quotas, down from February.

— Bison Interests (@BisonInterests) April 8, 2022

3/ Saudi Arabia has hit their quota again for the second month, and Russia just missed their quota by a lot (unsurprisingly).

Link to first white paper: https://t.co/QcUfMoLZpK— Bison Interests (@BisonInterests) April 8, 2022

4/ Link to our more comprehensive OPEC+ Spare Capacity Analysis: https://t.co/Q73VVkusTu

— Bison Interests (@BisonInterests) April 8, 2022

- 04/06/2022 – the sentiments from US government on oil industry are still very negative

Oil Executives Testify on High Gas Prices

Oil executives from six companies testify on high gas prices before a House Energy & Commerce subcommittee.

Gouged at the Gas Station: Big Oil and America’s Pain at the Pump

- 04/07/2022 – Josh’s comment: Kind of funny seeing shots fired by analysts and teams who missed the large run-up in oil and gas prices and related equities over the past 18 months. Reminiscent of the pullback in November last year. Lots of victory laps on comparatively small % moves. More to come?

The market is definitely not pricing in these predictions of up to 5 million barrels per day of oil production disruptions, but noteworthy https://t.co/9U1ujkImBF

— Josh Young 🦬🛢️ (@Josh_Young_1) April 7, 2022

Factbox: Global oil supply disruptions could reach 5 mln bpd

Global oil supply disruptions could reach around 5 million barrels per day (bpd) as Western sanctions in response to Moscow’s invasion of Ukraine cut Russian output and other producers also grapple with production or export challenges.

That is on top of some 2.2 barrels bpd of crude that OPEC+, which groups members of the Organization of the Petroleum Exporting Countries and allied producers, including Russia, have yet to return to the market following record output curbs imposed after the pandemic reduced demand

Kind of funny seeing shots fired by analysts and teams who missed the large run-up in oil and gas prices and related equities over the past 18 months. Reminiscent of the pullback in November last year. Lots of victory laps on comparatively small % moves. More to come? https://t.co/dhHkeICiXi

— Josh Young 🦬🛢️ (@Josh_Young_1) April 7, 2022

- 04/06/2022 – another Podcast from Josh Young

Takeaways from this podcast

- there are still lots of bad sentiments on oil industry

- current investors are mostly retail investors, institutional investors have not joined yet

- still very depressed sector even with the stock rising

- oil industry is deleveraging a lot currently, and one day they will back to grow

- backwardation will continue to drain the tighr inventory

- prefer to focus invest in conventional oil industry than shale companies because the formers can and have lowered debt a lot, while the latter have very difficulty to lower significant debt

- Journey energy company has great CEO who multipled the previous stock price >10X. I like good companies with great CEO

- Government policies do matter. Alberta in Canada had very tight regulation to deter the oil and gas industry since 2012, therefore, I invested more in Canada than US. US government sets the tone for oil industry including bank lending, environmental, production, etc. Oil industry is therefore not a free market.

- US’s windfall tax proposal, SEC’s requirement of ESG disclosure, all these increasing negative regulatory process – maybe the Russia and Ukraine war changes this, US wants more energy and energy security?

- how to get the positive narrative back on oil industry? environmental and anti-hydrocarbon – look at what people do and what they spend their money (where their money come from matter a lot too), not what they say. their behavior (they bought a lot on beach front house) show they do not believe climate change. They probably want control more. the news of USSR funded Greenpeace is heavily suppresed in all media, this is amazing for me.

- three ways to change people’s minds – ask sequence of questions, make people laugh, scare people.

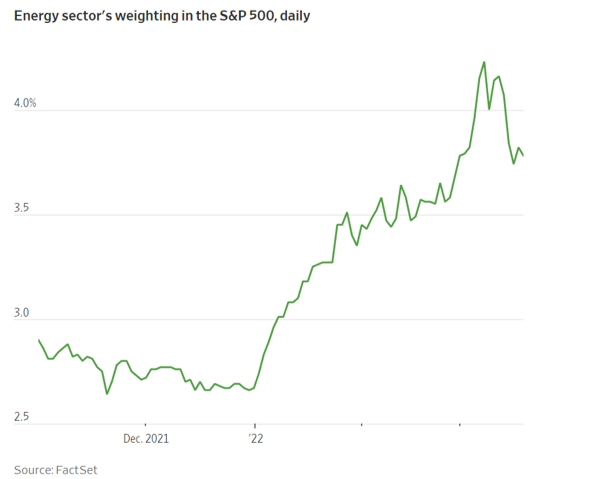

- when the bubbles of alternative energy and tech companies burst, people will look into oil/gas companies and commodities as the percentage of S&P allocated to energy goes to 2% to 4% to 22% as historically high. Policies change will come

- We emphasize too much in environmental effects of US and Canadian oil/gas industries, but Russia (oil companies are won by states) and Venatual should polute more

- From Josh Young: I find that the best way to get good returns is by really focusing on the best opportunities to compound money and be able to earn multiple times return or so over time. And by doing that I am better on my long investments and I just give up the sort of downside protection associated or the whatever people think they are getting from shorting stocks and sometimes that can be really painful because you get squeezed or whatever and it is a big distraction so I am not doing any direct arbitrage, it is more of a if Canadian oil and gas stocks are generally trading at a big premium to US then I will get sell some of my Canadian stocks and redeploy cheaper in the us and vice versa.

- the oil industry can do better by being honest about the why they choose to return cash to investors than reinvest and produce more oil, they need to talk about supply chain constraints, need more people, inventory constraint. More honest, more better equity valuation

- try to have constructive conversation and debate than just argument

https://podcasts.apple.com/us/podcast/chuck-yates-needs-a-job/id1536448009?i=1000556434243

this podcast is also on youtube as follow

paused at 42:00, need to finish the rest 36:15 minutes

I was on @nimblephatty's podcast. Feels like an oil and gas industry rite of passage. Chuck thanks for having me on! https://t.co/9HBz6eDuwZ

— Josh Young 🦬🛢️ (@Josh_Young_1) April 6, 2022

- 04/06/2022 – EU still cannot make the first step to ban Russian coal

Europe Keeps Russian Oil, Gas Flowing Despite Tightening Sanctions – WSJ

Germany resists far-reaching energy boycott as allegations of civilian killings in Ukraine add pressure to increase penalties on Moscow

German officials have privately signaled they might agree to an oil embargo phased in over several months. That could give EU countries that import large amounts of Russian oil time to adjust their supplies and make changes to refineries built to receive Russian crude.

Several studies by economists have found that an immediate embargo on Russian oil and gas could shave 3% to 6% off Germany’s gross domestic product, roughly the same contraction Germany’s economy suffered during the Covid-19 pandemic and associated lockdowns.

German Chancellor Olaf Scholz has dismissed such findings as based on uncertain theoretical models, instead citing warnings by German industry that boycotting Russian gas in particular could cause an economic disaster.

EU diplomats fail to agree on coal ban, new Russia sanctions: sources

European Union diplomats failed to approve on Wednesday new sanctions against Russia proposed by the European Commission, as technical issues needed to be addressed, including on whether a ban on coal would affect existing contracts, sources said.

On Tuesday, the EU executive proposed to ban the import of all types of coal from Russia, as part of a wider package of measures that would further restrict trade with Moscow.

Sanctions need to be approved by EU governments, but concerns were raised in a meeting of EU envoys on Wednesday, three sources familiar with the talks told Reuters.

One key issue was raised by Germany, the EU’s largest importer of Russian coal. Berlin wanted clarification on whether the coal ban would affect existing contracts or only future contracts, sources said.

- 04/05/2022 – Oil sector on whole market

If energy is going to 10%+ of the S&P 500, what is it reducing? Tech? What else? Thought provoking chart of past bubbles. https://t.co/NSdMrwx0vk pic.twitter.com/jqsZQtu2Yo

— Josh Young 🦬🛢️ (@Josh_Young_1) April 5, 2022

- 04/05/2022 – EU TO BAN ALL COAL IMPORTS FROM RUSSIA – EU SOURCE Could be a first step towards sanctions on Russian oil and gas?

EU to work on additional sanctions including oil imports from #Russia -Von der Leyen #oott h/t @staunovo

That didn't take long!

— Josh Young 🦬🛢️ (@Josh_Young_1) April 5, 2022

EU Proposes Ban on Russian Coal Imports, Ships After Atrocities

1. Sanctions package to include ban on most Russian trucks, ships