Study of GUSH, ERX, XOP, PSCE and XLE (and OIH?)

- Warren Buffett’s Berkshire Hathaway added to its already large Occidental Petroleum stake over the past trading sessions, a regulatory filing revealed Tuesday evening.

- The conglomerate bought nearly 5.8 million shares of the oil company in a few separate trades on Friday, Monday and Tuesday.

- Berkshire paid prices in a range from $59.85 to $61.90, the filing showed.

- 03/07/2023 – Powell to congress

https://www.banking.senate.gov/

LIVE: Fed Chair Powell testifies before the House committee on monetary policy — 3/8/23

https://ceraweek.com/promo/cw23-live.html?utm_campaign=Oktopost-2022-Q3-Global-CERAWeek-CW23+&utm_content=Oktopost-twitter&utm_medium=social&utm_source=twitter

- 03/06/2023

Plunging Gas Prices Could Kill Off $40 Billion In Deals

- 03/02/2023 – China’s reopening is the key factor

Goldman Sees Oil Price Spike In 2024 As Spare Capacity Runs Thin

Events in China, not Russia, drove oil prices this past year, and now that Chinese manufacturing activity is on the upswing, the next 12-18 months are likely to see another spike in oil prices, says Goldman Sachs.

That could mean crude oil targeting prices above $100 per barrel in the fourth quarter of this year.

“Global oil demand contracted 2% in the fourth quarter of last year, and that’s a recession in my book,” Currie said. That contraction, said Currie, created the spare capacity in oil and other commodities, but manufacturing data coming out of China this morning shows that is now reversing.

“We created new supply, not through investment, but through China contracting, through lockdowns. Now, as China comes back, we’re gonna lose that spare capacity and we’re gonna be back to the same problems we had before,” Currie warns. The real focus, according to Goldman, is supply scarcity.

“At this point, the ability to get from one year to the next given how scarce supply is, is really the focus. And the markets have been trading that way,” Currie said, noting that a commodities supercycle is not an “upward trend”; rather, it is a “sequence of spikes”.

- 02/25/2023

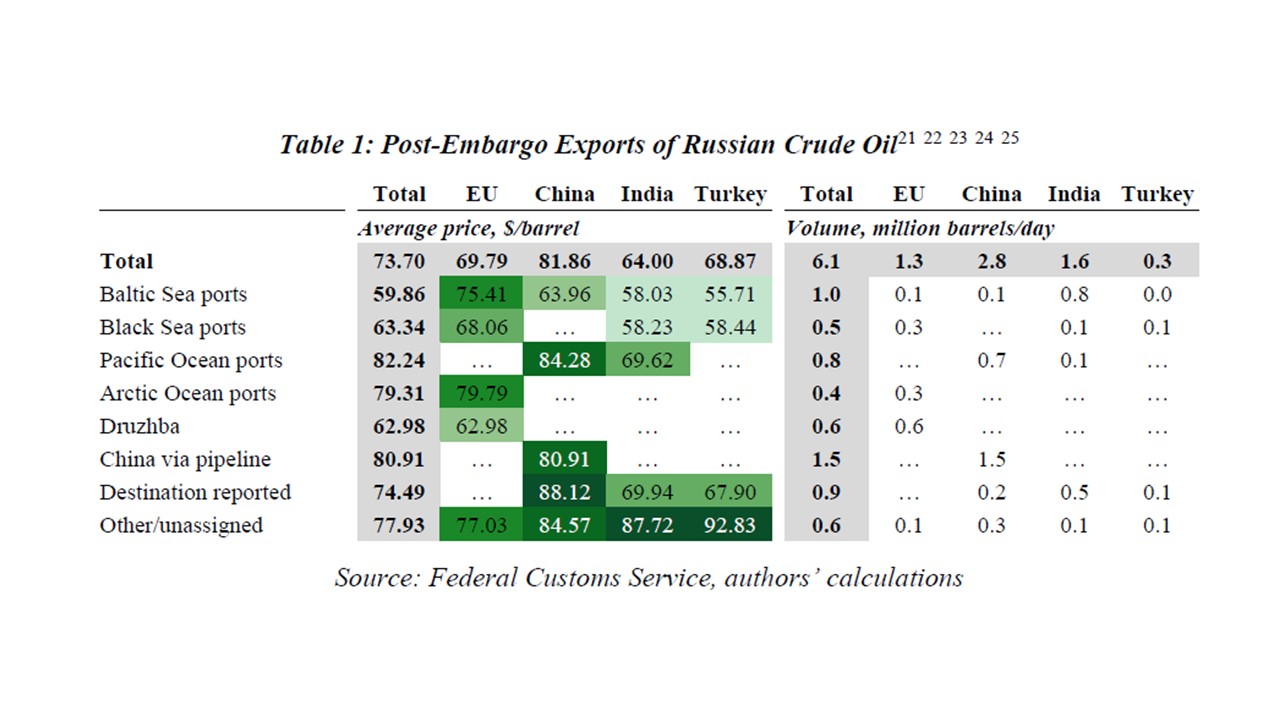

We use a unique high-frequency Russian customs dataset to evaluate the impact of international sanctions on Russia – focusing on Russian crude oil and oil products exports, as they are the key sources of export earnings and government revenues. We study the effects of two focal sanctions measures – the EU embargo and G7 price cap on Russian seaborne crude oil, which both took effect on December 5, 2022. We find that Russia was able to redirect crude oil exports from Europe to alternative markets such as India, China, and Turkey but that export earnings were curbed substantially by the sizable discounts that Russian exporters had to accept in market segments where the impeding EU embargo lowered demand, e.g., exports from Baltic Sea ports – a dynamic that only became more pronounced after the embargo and price cap’s taking effect. However, we do not find crude oil discounts as large as those reflected in Urals prices towards the end of 2022. In particular, prices in market segments that are unaffected by lower European

demand, e.g., exports from Russia’s Pacific Ocean ports, have not dropped in a meaningful way and shipments do not appear to comply with the price cap. What the EU embargo and G7 price cap have, thus, triggered is a fundamental fragmentation of the market for Russian crude oil. Based on our analysis, we conclude that a central focus of policy

going forward should be the enforcement of existing sanctions on Russian oil – along with the lowering of the oil price cap. As far as oil products are concerned, we show that it is significantly less feasible to redirect exports away from the European market. This suggests that the EU embargo on oil products, which took effect on February 5, 2023, will

prove to be a powerful additional tool to further curb Russian export earnings and fiscal revenues.

Table 1 also reinforces our earlier point that those segments of the Russian oil

market that are not much affected by the EU embargo, such as crude oil shipped from Pacific Ocean ports, do not display similar dynamics. Despite popular beliefs that China is getting large discounts on its purchases of Russian crude oil, this appears to be incorrect. In fact, we calculate an average price of $84/barrel based on transactions reported to Russia’s customs service—with pipeline oil slightly cheaper at $81/barrel vs. seaborne crude from Kozmino at $84/barrel. While India receives a discount for Pacific Ocean shipments—as Russia is trying to gain alternative customers through all available export channels—it is significantly smaller (by $10-11/barrel) than the one we documented above for Baltic Sea shipments.

- 02/25/2023 –

Red Bull and Vodka Economy (guest: Harris Kupperman ‘Kuppy’) – Market Huddle Ep.207

- 02/24/2023 – EIA report

https://ir.eia.gov/wpsr/overview.pdf

- 02/18/2023 – check out the IV history of GUSH

https://marketchameleon.com/Overview/GUSH/Summary/

https://www.investopedia.com/terms/i/iv.asp#:~:text=Volatility%20(IV)%20Works-,Implied%20volatility%20is%20the%20market’s%20forecast%20of%20a%20likely%20movement,the%20symbol%20%CF%83%20(sigma).

https://www.investopedia.com/terms/o/optionpricingtheory.asp

https://www.investopedia.com/terms/l/leaps.asp

https://www.investopedia.com/terms/b/blackscholes.asp

https://www.investopedia.com/ask/answers/060115/how-implied-volatility-used-blackscholes-formula.asp

- 02/16/2023 – another great buy from Buffett, real patience and big one time buy, great timing

Warren Buffett Just Bought 4 Stocks. Here’s the Best of the Bunch.

Buffett’s biggest purchase in Q4 was adding to Berkshire’s stake in Occidental Petroleum (OXY -0.67%). At the end of the third quarter, Berkshire owned 21.4% of the oil company. By the end of the year, that stake was up to 28%.

- 04/20/2022 – holdings of XEG.TO. Can I find a few ones to invest using LEAPs?

iShares S&P/TSX Capped Energy Index ETF (XEG.TO)

Top 10 Holdings (94.20% of Total Assets)

| Name | Symbol | % Assets |

|---|---|---|

| Canadian Natural Resources Ltd | CNQ.TO | 25.17% |

| Suncor Energy Inc | SU.TO | 24.63% |

| Cenovus Energy Inc | CVE.TO | 12.80% |

| Tourmaline Oil Corp | TOU.TO | 8.35% |

| Imperial Oil Ltd | IMO.TO | 7.18% |

| ARC Resources Ltd | ARX.TO | 6.00% |

| Whitecap Resources Inc | WCP.TO | 2.65% |

| PrairieSky Royalty Ltd | PSK.TO | 2.57% |

| Crescent Point Energy Corp | CPG.TO | 2.56% |

| Parex Resources Inc | PXT.TO | 2.29% |

-

-

- Three oil stocks should deliver outsized gains in 2022, as crude prices continue to rebound. 3 Oil Stocks to Buy in Canada Today, https://www.fool.ca/2021/12/25/3-oil-stocks-to-buy-in-canada-today/

-

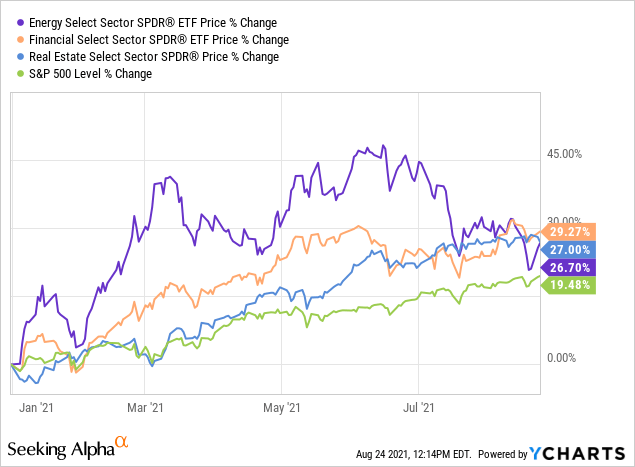

- 04/17/2022 – XOP and PSCE have a lot catch up with S&P500

The implications for small cap high-performing producer equities are particularly exciting. With $xop still down 50% and $psce down 80% from the last $100 oil time period in 2014, in a multi-year bull market this could be just the start. I own these, no recommendation. pic.twitter.com/x7eQ7ZP40K

— Josh Young (@Josh_Young_1) April 17, 2022

- 04/15/2022 – Josh prefers XOP and PSCE than XLE because$xle is mostly mega cap integrated companies with cash flows from different factors. Oil and gas producers in $xop and $psce are generally more direct beneficiaries of higher commodity prices. In addition, Josh thinks there is more room for XOP, PSCE and XLE to grow. Josh said hs is Definitely not pitching PSCE, just showing how poorly small cap has performed and how much room theoretically the right small cap o&g pubcos could have to “catch up”. But should I study and invest in PSCE? and how about OIH?

Plenty of upside left. I'm focused on $xop vs $spy pic.twitter.com/dJHpv3v8O6

— Josh Young (@Josh_Young_1) April 15, 2022

$xle is mostly mega cap integrated companies with cash flows from different factors. Oil and gas producers in $xop and $psce are generally more direct beneficiaries of higher commodity prices

— Josh Young (@Josh_Young_1) April 15, 2022

My sector is intrinsically a meme. I've been comping vs $xop because it's actually been investable, but look at the small cap e&p ETF $psce since 2014! Brutal… (And lots of room to catch up?) pic.twitter.com/QCpQLxwn16

— Josh Young (@Josh_Young_1) April 15, 2022

Small cap got brutalized in the o&g bear mkt

— Josh Young (@Josh_Young_1) April 15, 2022

Interesting find. There are only 30 energy stocks in the underlying S&P sub sector. Might be due to rerate I suppose, even if only on the principle of a rising tide lifting all boats.

— Andrew Perkin (@perks99) April 15, 2022

Thanks. Definitely not pitching PSCE, just showing how poorly small cap has performed and how much room theoretically the right small cap o&g pubcos could have to "catch up"

— Josh Young (@Josh_Young_1) April 15, 2022

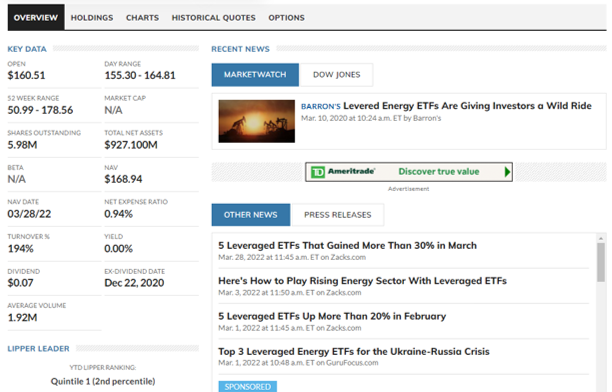

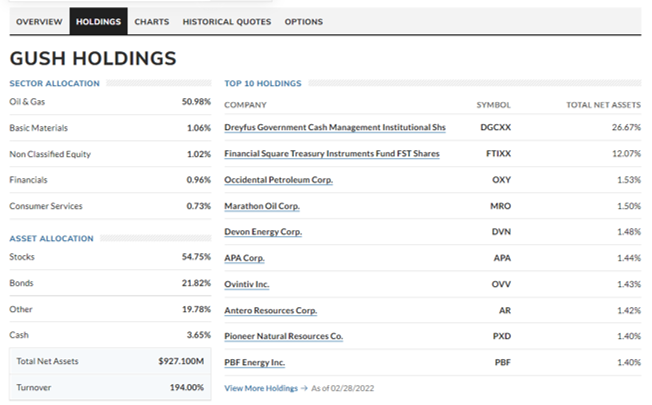

- 03/29/2022 – overview and holdings of GUSH

Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares

- 08/25/2021 – will energy stocks come back?

Inflation-Proof Your Portfolio: These 3 Energy Stocks Are Very Bullish Now

With July’s Job Openings and Labor Turnover (JOLTS) survey showing record levels of job openings – 10.1 million – this could be just the beginning of higher wages. Especially once we’ve got the delta variant of COVID under control, allowing the recovery to hopefully complete.

The bottom line is, we could see a rush back to inflation stocks.

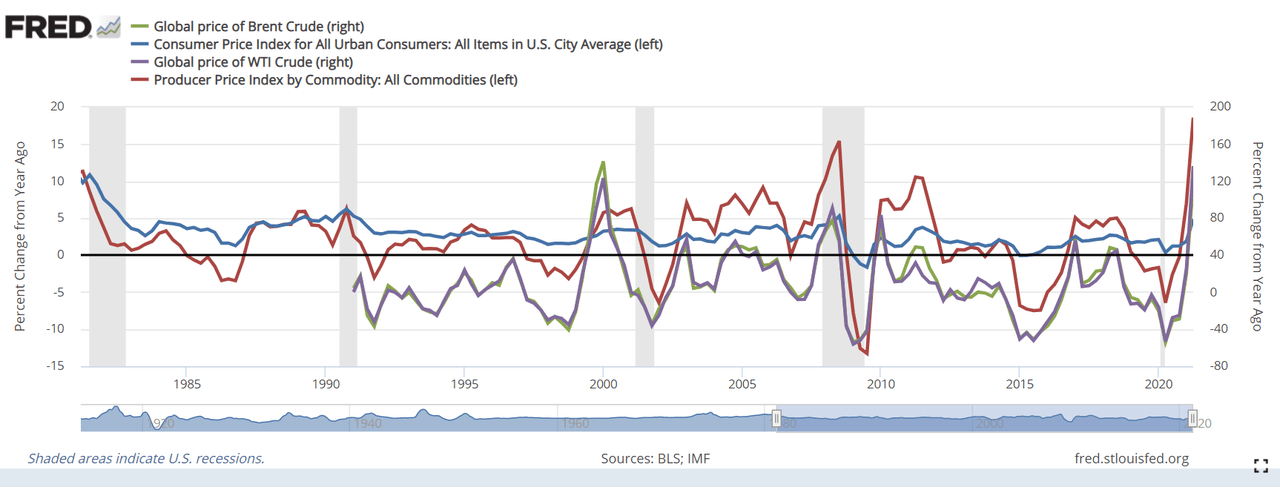

oil prices (gray and green lines) are even more closely correlated with producer prices (red line) than with consumer prices (blue line):

Source: Federal Reserve Bank of St. Louis

- 08/25/2021 – here are the catalysts and risk of investment in GUSH

Catalysts

- FDA approval of Moderna. Approval of vaccines for 12~15 years and 5~12 years old

- Infrastructure plan

- economy reopening of US, and other countries, more jobs

- get Delta variant under control

- bad news from EV companies

- Middle East local wars

- inflation goes up. commodity price will go up (in addition, Oil companies like to pay high dividend)

- investors will rush back to inflation stocks

- Taliban terror attack on oil field to beef up oil price to make profit

Risks

- Cv-19 cases re-surge

- China and US manipulate oil market to get cheap oil

- US oil industry has increase more and more production

- interest rate goes up, dollar will become stronger, oil price will drop

- 04/08/2021 – To Eliminate $35 Billion Fossil Fuel Subsidies will hurt profit but may not oil/gas price. This is significant headwind for GUSH and oil industry

Biden’s Plan Looks To Eliminate $35 Billion Fossil Fuel Subsidies

The $2-trillion infrastructure and tax plan of U.S. President Joe Biden proposes to eliminate tax preferences and implicit subsidies for fossil fuels that would boost government receipts by more than $35 billion over the next decade, the U.S. Treasury said in the Made in America Tax Plan Report this week.

President Biden’s plan on fixing the nation’s infrastructure unveiled last week proposes to “eliminate tax preferences for fossil fuels and make sure polluting industries pay for environmental clean up.”

In the report on the tax plan, the Treasury said its estimates “suggest that eliminating the subsidies for fossil fuel companies would increase government tax receipts by over $35 billion in the coming decade. The main impact would be on oil and gas company profits. Research suggests little impact on gasoline or energy prices for U.S. consumers and little impact on our energy security.”

- 03/23/2021 – Oil prices resumed their slide on Tuesday after Covid-related restrictions in Europe multiplied

Tuesday, March 23, 2021

Oil prices appeared to find their footing at the start of the week, after a huge selloff last week. “Oil (had) its worst week this year as concerns grow over a flaring up in COVID-19 cases across Europe,” Dutch bank ING said in a note. “This comes at a time when there are clear signs of weakness in the physical oil market.”

Oil prices resumed their slide on Tuesday after Covid-related restrictions in Europe multiplied. The price plunge was likely magnified by the rush by net-long investors to exit their positions. Long bets on futures had begun to look overstretched. WTI crashed as low as $58.60 on Tuesday morning.

- 03/23/2021 – warning: Robinhood heavily traded GUSH back in June 09, 2020 in potential economy reopening (and failed). They might do it again

Robinhood and Its Merry Traders Lean In Updated Jun 9, 2020

New retail investors have been trading heavily in some risky stocks.

Here are the top 10 stocks that saw the biggest increases in popularity over the last one day on the platform, according to Robintrack:

- Hertz (HTZ) – car rental company, filed for bankruptcy on May 22

- Nikola (NKLA) – electric truck maker, expects zero revenue in 2020

- TOP Ships (TOPS) – Greek oil tanker company, penny stock

- Oasis Petroleum (OAS) – oil and gas producer

- American Airlines Group (AAL) – expects to cut management and administrative staff by 30%, domestic schedule down 55% yoy during July 2020

- Invesco Mortgage Capital (IVR) – real estate investment trust

- Direxion Daily S&P Oil & Gas Exp. & Prod. Bull (GUSH) – oil and gas ETF

- Valaris (VAL) – offshore oil driller exploring bankruptcy

- Delta Air Lines (DAL) – massive layoffs soon

- Carnival (CCL) – cruise operator

- 03/23/2021 – GUSH and ERX are quite volatile, even though Neither GUSH nor GASL is an ETN, and therefore they aren’t in danger of automatic acceleration “termination”, as UWT is. GUSH and GASL’s advisor, Rafferty Asset Management, has the management discretion to take steps to ensure the fund’s portfolio won’t respond to rises or falls in its underlying index beyond 30% on any one day.

Best Of 2020: Why These Leveraged Energy ETPs Tanked December 20, 2020

Leveraged and inverse funds are common in commodities, particularly in energy ETPs, where more than one-fourth of all available exchange-traded products (ETPs) use some leverage or inverse factor.

Most ETNs have automatic termination, or “acceleration,” clauses baked into their prospectuses. “Accelerating” an ETN means closure: Its due date is moved up, such that investors receive the note’s closing indicative value in cash immediately (or almost immediately), rather than whenever the note was originally scheduled to close.

The most notable example of automatic acceleration occurred back in 2018, when the VelocityShares Daily Inverse VIX Short Term ETN (XIV) was shuttered after losing 96.3% of its value in a single trading day. At the time, the ETN held $1.9 billion in assets (Read: “Inverse VIX ETN Shuts Down“).

Steep Declines in GUSH, GASL

Several other leveraged energy ETFs saw extreme declines on Monday, including the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3X Shares (GUSH) and the Direxion Daily Natural Gas Related Bull 3x Shares (GASL). Both are ETNs offering exposure to their relevant commodity equities.

At its lowest point, GUSH had shaved 78.8% off its previous day’s iNAV, while GASL had dropped 80.1%.

Those steep declines were still a few percentage points shy of the 90% drop allowed by GUSH and GASL’s prospectus, however.

Neither GUSH nor GASL is an ETN, and therefore they aren’t in danger of automatic acceleration, as UWT is. However, the funds’ prospectus does acknowledge that if their underlying indexes were to fall more than 30% on a given trading day, then their triple leverage factor would mean that investors would lose all their money (Read: “How An ETF Can Drop 100% In A Day“).

As such, GUSH and GASL’s advisor, Rafferty Asset Management, has the management discretion to take steps to ensure the fund’s portfolio won’t respond to rises or falls in its underlying index beyond 30% on any one day.

In the case of GUSH, that appears to be exactly what happened on Monday, as the S&P Oil & Gas Exploration & Production Select Industry Index, the underlying benchmark upon which GUSH applies its 3x leverage factor, had dropped 34%.

Massive Reverse Splits Announced

On Tuesday, Direxion announced a 1-for-40 reverse split for GUSH, as well as a 1-for-10 split for the more broadly based Direxion Daily Energy Bull 3x Shares (ERX), and a whopping 1-for-100 split for GASL.

Reverse splits remove outstanding shares from the market while raising the price of the remaining shares an equivalent amount. For example, after the split goes into effect on March 23, one share of GUSH will be worth what 40 GUSH shares had been worth prior to the split.

This can help issuers and investors alike grapple with steep price declines, such as what happened during Monday’s sell-off.

They’re also a tactic used to avoid delisting from an exchange, which usually requires securities to meet minimum size and liquidity standards in order to trade.

History Not Repeating Itself … Yet

As of the time of this writing on Wednesday morning, Monday’s bloodbath in leveraged energy products does not seem to be repeating itself. UWT was down 12%, GUSH was down 18% and GASL was down 20%.

Of course, those securities had already seen such steep price declines that it’s unclear how much further they had left to fall.

In any case, we’ll be keeping an eye on them for any additional surprises.

- 02/01/2021 – balanced viewpoints on GUSH. Also good comments on promising vaccine roll out: both U.S. and China have laid out ambitious vaccination plans, with the Biden administration targeting to vaccinate 150 million people within 100 days and Chinese authorities aiming to administer 50 million doses within the next few days ahead of the Lunar Year celebrations. Subsequently, China will undertake a much larger vaccine drive to inoculate 60% to 70% of people against the coronavirus. It won’t be long before these and other countries vaccinate most of their populations, get closer to achieving herd immunity, and contain the pandemic. That’s going to play a big role in improving the oil demand outlook.

GUSH: Global Energy’s Rebound Likely To Produce Returns In 2021

- Direxion Daily S&P Oil & Gas Exploration & Production Bull 2x shares (GUSH) is the fund manager’s leveraged play on the global energy industry.

- The continued run in WTI prices as the world progressively returns to work has bode well for global energy.

- From worst in class last year, with losses of around 30%, the oil and gas sector may possibly deliver strong returns in 2021.

- A weaker USD, a progressive opening-up of global economies, and considerable lost ground to make up position oil and gas assets for a 2021 revival.

- While I remain bearish on the structural makeup of leveraged assets such as GUSH, oil seems prepped for a lasting return.

The Bullish Case for Oil

As previously highlighted, the US oil and gas industry is coming off a tumultuous year which saw plunging commodity prices, a breakdown in futures pricing mechanisms, a raft of bankruptcies throughout the shale patch, a spate of deep-cutting economic lock downs and a U-turn in energy policy spurned by a change in administration.

Notwithstanding a range of factors look to contribute to oil’s meaningful continuation to the upside during 2021.

- A durable weakening of the $US dollar. A multitude of factors will likely contribute to the dollar’s continued weakening. Notably, a relentless current account deficit will continue to pressure the Greenback. A change in administration will likely see a more pronounced range of fiscal stimulus activities generating further currency weakness. The Federal Reserve plays a central role to monetary policy and has persistently telegraphed its reluctance to raise interest rates until 2022-2023. This, along with an increasing use of currencies Ex-dollar for global trade operations – particularly promoted by both China and Russia – may provide further impetus for a shunning of the US dollar. In all, numerous different actions will continue to push US currency lower and dollar denominated assets to the upside.

- A global return to work. Economies have been shuttered for the most part of 2020. With a wave of vaccines coming online, it is likely that we see renewed economic activity, an increase in international trade and a loosening of cross border movements to stimulate GDP growth.

- A less volatile backdrop to OPEC strategy. The SARS-COV2 outbreak has wreaked havoc across global economies. And in doing so, it has significantly changed the focus of sovereign governments often from growth strategies to recovery ones. This change in the economic landscape is likely to drive a degree of restraint in OPECs global energy strategy which we have not seen for some time. Oppositely, any denuclearization deal rolled out between the new US administration and Iran could see additional barrels flood global energy markets. Having said that, given the economic strife inflicted upon the world, the impact of additional barrels may not be as pronounced with a global economy in recovery mode.

2021 is likely to be one of significant economic renewal. With this comes a range of interesting investment opportunities – front and centre to which will be crude oil and a range of securities, ETFs, and financial instruments well positioned to deliver positive risk adjusted returns.

While I do not recommend long-term holding of (GUSH), it will most likely provide a range of trading opportunities during the year which, when coupled with light crude oil futures, could be the single biggest asset class rebound of the year.

GUSH: A Leveraged ETF For Oil Bulls

- The Direxion Daily S&P Oil & Gas E&P Bull 2x Shares ETF has surged by 130% in the last three months after the increase in oil prices pushed E&P stocks.

- Continued strength in oil prices and a financial recovery from oil producers might continue pushing GUSH higher.

- GUSH, like all leveraged ETFs, is not suitable for those looking for a buy-and-hold investment and comes with its fair.

both U.S. and China have laid out ambitious vaccination plans, with the Biden administration targeting to vaccinate 150 million people within 100 days and Chinese authorities aiming to administer 50 million doses within the next few days ahead of the Lunar Year celebrations. Subsequently, China will undertake a much larger vaccine drive to inoculate 60% to 70% of people against the coronavirus. It won’t be long before these and other countries vaccinate most of their populations, get closer to achieving herd immunity, and contain the pandemic. That’s going to play a big role in improving the oil demand outlook.

The supply side of the picture is already looking good, with declining production in the US and OPEC+ reining in exports. The US oil production fell from more than 13 million bpd in Q1-2020 to 10.9 million bpd at the end of last week, according to the US Energy Information Administration’s estimates. With the oil prices climbing to more than $50 a barrel, I believe the shale drillers are focusing on improving shareholder returns and will likely concentrate on maintain production instead of chasing growth. OPEC kingpin Saudi Arabia meanwhile seems determined to support oil prices by announcing a unilateral cut in production by a million bpd in the next two months. Iraq has already slashed output to comply with the production cut agreement while turmoil in Libya has hampered the country’s supplies. Russia will also reduce seaborne oil shipments to shore up its domestic stockpiles.

I think these supply-side factors will continue to lend support to oil prices, even if infections rise. But if the US, China, and other countries successfully vaccinate hundreds of millions of people in the coming months and we start getting some clarity of achieving herd immunity down the road, then that might improve demand outlook and help push oil prices higher.

Further Gains In GUSH

With oil now at $50 a barrel and facing a positive outlook, the oil producers look well-placed to post an increase in earnings. The oil producers sold their crude at low prices in 2020. For instance, Pioneer Natural Resources, which is one of the biggest holdings of GUSH’s index, realized an average oil price of just $36 per barrel for the first nine months of 2020 and earned an adjusted net profit of $1 per share. But the company will likely realize much higher prices in 2021 which will give a boost to its profits. The company might also increase shareholder payouts. That’s also true for other oil producers. The earnings growth might help push their shares higher. On top of this, an increase in oil prices will further improve their outlook and likely lift shares. In my view, this will have a positive impact on GUSH’s performance and the leveraged ETF might move twice as high.

For these reasons, I think GUSH can be a great option for investors to consider in a supportive oil price environment. I’d recommend investors closely follow this ETF and use technical indicators, in conjunction with those of crude oil, for short-term trading opportunities.

- 11/11/2020 – negative view on GUSH: it is very volatile, mechanics of the ETF imply a tendency to move slowly to the downside, so it is ONLY best for short term trading. – not quite understand it

Drilling Down Oil-Focused Trading Strategies With GUSH

- Direxion Daily S&P Oil & Gas Exploration & Production Bull 2x shares present opportunities to design short-term trading strategies relating to crude oil price action.

- The fund seeks, before fees & expenses, 200% performance of the S&P Oil & Gas Global Exploration & Production select industry index.

- Leveraged ETF products must be treated with extreme care.

- Consequently, they are best for tactical directional derivative plays.

- GUSH is a 2x levered product which is only appropriate for short-term exposure to fluctuations in oil prices. It fits perfectly in your derivatives toolbox but not as a long-term security holding of your portfolio.

- The mechanics of the ETF imply a tendency to move slowly to the downside which makes it a perfect candidate for fading on upside price spikes.

- 30 to 60-day defined risk positions are ideal – the duration allows for the price mechanics to kick in while benefiting from the positive Theta on the short leg.

Global Macro Outlook

Global energy will most likely face a mixed run towards the end of this year. The freshly elected Biden administration will have an unequivocal impact on the global energy outlook, expressly given that his policies remain so unlike those of the Trump administration. Key highlights on my thesis for global energy include:

- A Biden government will continue to promote a Green New Deal as the cornerstone of his policies. The Paris Climate Accord will be re-joined immediately by executive order.

- A policy push towards a Federal drilling ban may eventuate.

- It remains unclear whether Biden will ban fracking.

- Biden’s stance towards Iran will be more muted – a compromise to the more aggressive positioning taken by the Trump administration could mean additional Iranian barrels on the global market which would strain crude prices.

With these key macro points in mind, let’s review actionable strategies on the following premises:

-

- A Biden government may not be as damaging as originally mooted by the previous administration.

- Changes in people’s attitudes towards energy will have a bearish impact on global oil.

- A more alternative energy administration means likely flat to negative crude oil prices into the end of the year.