Study of TQQQ

- 01/08/2019 – Observations of TQQQ/options and investment strategy (TQQQ_strategy)

- Q: what is the intrinsic value of TQQQ and Nasdaq-100?

- 11/01/2018 – The Big Tech Selloff, Why the fall from super-high values shouldn’t hurt the larger economy.

Google reported advertising revenues increasing by 20% year-over-year during the third quarter. Amazon’s subscription service revenues were up 52% during the quarter after raising prices for its Prime membership. Margins for Amazon’s cloud business rose a spectacular 77%. Microsoft ’s cloud-computing revenues soared 76%, and even its Windows software sales ticked up.

Investors are no doubt reacting in part to signs of slowing revenue growth and increasing costs. Amazon is raising its minimum wage to $15 per hour and has projected weaker sales in the fourth quarter. Google’s share of digital advertising sales are starting to dip while the traffic acquisition costs it pays to partners to direct customers to its search engine are increasing. Facebook reported soft revenue growth as it struggles to squeeze more advertising revenue from its news feed. It has also hired thousands of new employees to remove violent content and fake news. Netflix has gone on a spending-and-debt binge.

The bigger systemic worry among investors is softening global growth. The fastest growing markets for many U.S. tech companies including Netflix and Facebook are overseas. Amazon is making a major play for India. As demand for $1,000 iPhones plateaus in the U.S., Apple will need to increase sales of handsets and other devices overseas.

- TQQQ FUND DESCRIPTION

The ProShares UltraPro QQQ provides 3x leveraged exposure to a modified market-cap-weighted index tracking 100 of the largest nonfinancial firms listed on NASDAQ.

- TQQQ FACTSET ANALYTICS INSIGHT

As a levered product, TQQQ is not a buy-and-hold ETF; it’s a very short-term tactical instrument. Like many levered funds, it delivers 3x exposure only over a one-day holding period. Technology companies dominate TQQQ’s underlying index—the Nasdaq-100—so TQQQ’s future performance is tied closely to the performance of the tech industry. Management fees are relatively less important here than trading costs, as TQQQ is a short-term vehicle, designed to provide its exposure for 1 day. TQQQ clears that hurdle easily with tight spreads and strong daily volume.

- TQQQ factsheet (ProSharesFactSheetTQQQ)

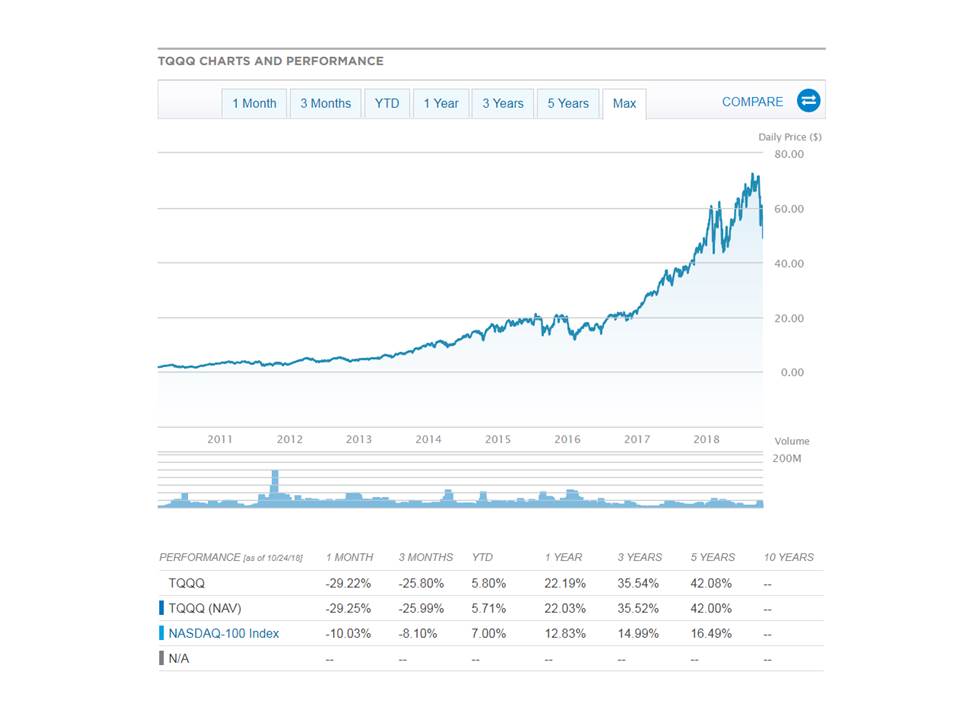

- TQQQ price history

- Comparison – study of QQQ from seeking alpha

- 08/31/2018 – Do All Leveraged ETFs Go To Zero?