Given the volatility of market and long term perspective of long term financial industry, I plan to buy call options of TNA (or use call options of TZA to hedge my portfolio).

- 07/22/2020 – small businesses are struggling, stimulus plan is only temporary help, vaccine is the only solution

Small Businesses Brace for Prolonged Crisis, Short on Cash and Customers

Hopes for a quick economic recovery from the coronavirus pandemic have been dashed, and companies are exhausting rescue funds. Many are shutting down or slashing jobs again.

Chris Mittelstaedt successfully navigated his San Francisco Bay Area fruit and snack delivery business through the dot-com bust, the 2008 financial crisis and the first few months of the economic ravages of the coronavirus pandemic.

But, along with many of America’s small-business owners, his hopes for a quick economic recovery have been dashed. Surging Covid-19 cases in many parts of the country and fears of additional outbreaks are forcing him to face a longer-term financial crisis.

Congress sought to allay those strains with PPP funds. The program provided a quick influx of cash to struggling businesses, allowing many of them to retain employees or bring back workers. The loans are generally forgivable if businesses spend a certain share of the funds on payrolls and meet certain other requirements.

The federal government as of July 21 had approved about five million PPP loans, worth a total of $518 billion, according to the Small Business Administration, the agency overseeing the program.

But lawmakers designed the PPP to help owners manage through a V-shaped recovery—a steep but brief collapse in demand, followed by a swift rebound. Many firms have now burned through the loans, but sales have only barely picked up—leaving them without funds to keep paying their full pre-pandemic workforce.

On Friday, Treasury Secretary Steven Mnuchin said Congress should consider automatically forgiving PPP loans taken out by the smallest U.S. businesses and offer a second helping of aid to some firms.

- 06/03/2020 – this is very good for TNA and FAS and economy in general

POLITICS: Senate passes bill to give businesses flexibility in spending coronavirus aid, sends it to Trump

- The Senate passed a bill to ease rules about how small businesses can use Paycheck Protection Program loans and still get them forgiven.

- Sen. Ron Johnson earlier blocked an attempt to unanimously approve the legislation, seeking assurances about later changes.

- The measure now heads to President Donald Trump for his signature.

- 05/17/2020 – Lawmakers and government officials are preparing to make significant changes to the Paycheck Protection Program, amid cooling demand for government-backed loans and criticism from business owners who say they can’t tap the funds. Good for TNA

U.S. Expected to Revise Small-Business Aid Program

Changes likely to give firms more flexibility and time to spend funds from the Paycheck Protection Program

- 05/16/2020 – The main reason that Russell2000 is lagging way behind mid- and large sector (SP500) is it has tech sector shortage (only 15.11%). But given its large percentage of health care sector, R2000 might out perform in the second half of this year. In addition, Russell 2000 are a forward indicator of the economy, it might breakout.

Why Small-Caps Are Lagging in This Economic Downturn

Prior to Covid-19, lower rates from the Fed should have created an optimal opportunity for the Russell 2000 to outpace large-cap indices.

if small-cap stocks and specifically the Russell 2000 are a forward indicator of the economy, we may be approaching a breakout zone if the Russell 2000 gains begin outpacing those of the S&P 500 and large caps. According to Stephen Mathai-Davis, CEO of Quantalytics AI, “during the rally at the start of Donald Trump’s presidency, for every one unit gain in the S&P 500, the Russell 2000 was going up nearly one-and-a-half times.”

Although this recovery will be much different because of Covid-19 and the effect that it is having on small business, the Russell 2000 could again be an indicator once the economic tide begins to turn.

Too bad I forgot to sell RUT2000 in my 401k plan back in Sept, I reminded myself once but forgot to execute!!!!!!!!

In the recent slide, small-cap stocks have particularly taken it on the chin—with the Russell 2000 down 2.4% in September and 13.9% in October. That underperformance should continue, warns RBC Capital Markets’ head of equity strategy, Lori Calvasina. Small-caps were so popular earlier in 2018 that the trade became crowded, she wrote last week, with the Russell 2000 futures’ positioning in September matching its December 2016 highs, and still only halfway back to previous lows.

Calvasina recommends hugging the sidelines. She notes that so far in the second half, 44% of Russell 2000 companies have trimmed their 2018 and 2019 margin estimates, compared with 38% of the S&P 500. The reason: higher labor and materials costs.

- 08/15/2017 – Summary

- The Direxion Small Cap Bull 3X (TNA) exchange-traded fund (ETF) is a leveraged, high expense-ratio fund from Direxion Investments that aims to produce 300% of the daily investment results of the Russell 2000 Index. In the period between 2010 and 2015, TNA performed well, with a rate over return exceeding 35%. Introduction of TNA is here or TNA_ Investopedia.

- TNA a small-cap focused and U.S.-centric ETF. While TNA’s management only binds itself to being 80% invested in the Russell 2000, the performance between the two mirrors very closely.

- The sector composition of the Russell 2000 changes depending on changing market caps for listed U.S. companies. However, it’s usual for nearly 25% to be financial services companies, with other significant exposure to health care, technology and consumer discretionary sectors. No single company’s stock comprises more than 1% of the index.

- The fund facts of TNA/TZA are listed in this TNA_TZA_Factsheet

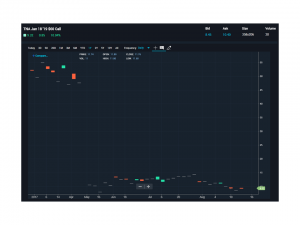

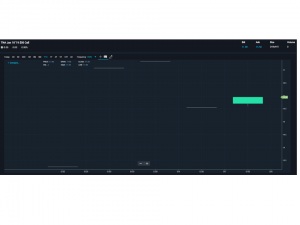

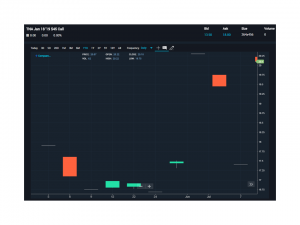

- There are 2 years options of TNA/TZA which I can trade (see following figures of Jan 19″ calls, strike prices $50, $45, $60, respectively).

- Due to the upcoming tax reform, the current historical low interest rate and the deregulation of financial industry, I think I can long on TNA Calls.

Jan18 2019 $50 call, min $13.2 max $17.80

Jan18 2019 $40 call, min $16.5 max $20.10

Jan18 2019 $60 call, min $9.6 max $14.90