Guru watch- Jaime Rogozinski ,Keith Patrick Gill, etc

- 06/10/2021 –

Reddit Legend Keith Gill Boosts Stake in GameStop – WSJ

GameStop Trader ‘Roaring Kitty’ and Former Employer May Face Federal Regulatory Scrutiny – WSJ

- 06/09/2021 – Re-review of Keith Gill’s GME investment

Keith Gill Drove the GameStop Reddit Mania. He Talked to the Journal. – WSJ

Trader known as DeepF—ingValue on the WallStreetBets forum helped turn the investing world upside down. “I didn’t expect this.”

- 06/04/2021 – more news on GMEliked

https://www.cnbc.com/2021/06/04/amc-meme-stocks-could-spark-more-heat-in-the-week-ahead-as-investors-await-inflation-news.html

- 06/04/2021 – I need to really learn how to invest like Mr. Gill

The Big Short SQUEEZE from $5 to $50? Could GameStop stock (GME) explode higher?? Value investing!

- 04/12/2021 –

GameStop Working to Replace CEO George Sherman – WSJ

- 04/05/2021 – GME plans to sell 3.5 mil shares, this might drag down stock price

GameStop to Sell Stock After Social-Media Fueled Trading Frenzy – WSJ

Videogame retailer says it could raise hundreds of millions of dollars from investors to help support its turnaround plan

The company said Monday that it would sell up to 3.5 million shares, adding that the timing and amount of any stock sale would involve various factors.

- 03/23/2021 – GME is considering selling additional equity shares, bad for the price

GameStop shares fall 12% as company says it may sell stock to fund transformation

- GameStop missed on the top and bottom lines of its quarterly results, but e-commerce sales jumped 175% last quarter and accounted for more than a third of its sales in the period.

- The brick-and-mortar video game retailer named former Amazon and Google executive Jenna Owens as its new chief operating officer.

- GameStop also acknowledged in a filing that it was considering selling additional equity shares.

- During a much anticipated earnings conference call that at one point reached maximum capacity, the company declined to answer questions.

- 03/19/2021 –

How GameStop Bull Roaring Kitty Isn’t All That Different From Warren Buffett

- 03/08/2021 –

- 02/28/2021 – GME one-stop-shop

- 02/24/2021 – interesting comments

academic paper on Short Selling ETFs

- 02/24/2021 – Any new action on this?

GameStop’s CFO didn’t resign – he was pushed out after the board ‘lost faith’ in him, sources say

- 02/23/2021 – Gamma squeeze!

The Real Squeeze to Be Worried About Isn’t a Short Squeeze, It’s a Gamma Squeeze

A gamma squeeze is a short squeeze taken to the next level; here’s why they’ve become more common and how to avoid them.

- 02/22/2021 – chronical of GME stody

So many folks (esp. the media) are missing the complete backstory on $GME and how we got here.

This has been simmering for over a year and the story behind it is great. I’ve been tracking this since September and devoured all of the details from the origin through today.

So back in September 2019 (!) some guy named DeepFuckingValue posted this on r/wallstreetbets:

It was just a post about his LEAPS (aka, Long-Term Equity Anticipation Securities — tl;dr long-dated calls) on GME. At the time, nobody understood his position at all. The top comment on that post? “Bid-ask spread on these are ridiculous, good luck getting rid of them” lol.

For the next year, every month about once a month, he posted his “YOLO GME” position. Every month for a year he got made fun of. I caught wind of this trade back in September 2020, a FULL YEAR after this guy was already holding. I also thought it was weird—the dying retailer?

So I dug into the public quarterly reports of GameStop. Every quarter, public companies are required to release what’s called a “10-Q” which is a quarterly report of their financials. You can find them here:

And what did I find? GameStop was actually in a great financial position; they weren’t going broke! In fact, they had a lot of cash-in-hand, enough to pay off all their debts. So why was it trading at like … $2-4/share?

Next, I looked at their short interest. “Shorting”, for those who don’t know, is when you borrow a stock (from someone) and sell it on the market expecting the price to go down. You eventually buy back the stock at a lower price, return the borrowed shares, and pocket the diff.

So, the short interest was over 100% of total shares. In fact, it was 140%. Which makes no sense—how can you sell more shares than there are shares? Keep in mind, not all shares are actively traded. In fact, over 75% of $GME is locked up in passive funds and GME board & C-suite.

So really, short interest was like 300-500% of *float* (float is how many shares are actively traded, basically). Which is insane. Basically, the shorts (which are hedge funds like Melvin) were expecting $GME to go bankrupt and they’d never have to cover (return their shares).

u/DeepFuckingValue had figured this out long before anyone. Even Michael Burry (yes, The Big Short guy) who bought in AFTER u/DeepFuckingValue. And he bought in, with conviction in his trade, ignoring the haters.

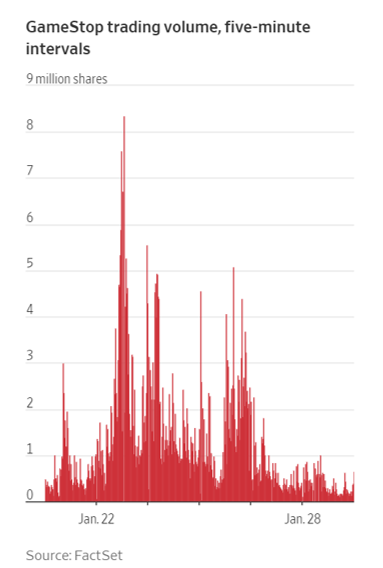

A year later and people start to take notice on reddit. The price has started to inch up, from $4 to $8 to $12 over September and October. And more people on r/WallStreetBets started buying in. And then more people. And then more people.

Which, of course, makes the price go up. So the price keeps going up and more people keep taking notice and so on. Eventually, the shorts are supposed to cover. But how? They need to purchase more shares than there are in the company. Well, that means purchasing at any price.

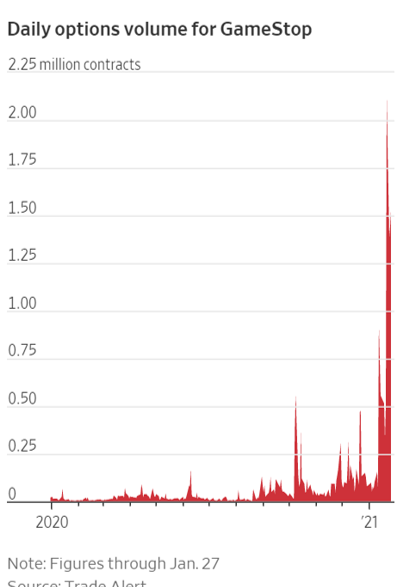

So they start to cover, which means buying hundreds of thousands of shares, which pushes the price up more. And then last Friday, thanks to momentum and growing interest from retail traders, we had what is called a “gamma squeeze.” Which isn’t the short squeeze!

So, quick aside to explain this: Market Makers (the big banks and funds, like GS, Citadel, etc) write options. When they do, they have to remain “market neutral” by law. So there are what’s called “the greeks” on options: theta, gamma, etc. Look ’em up if you’r curious. Anyway…

“Gamma” is a number between 0-1 that changes on a call as the price of a stock gets closer to the call price. Lets say you buy a $300 call and the stock is $290. Gamma would be ~0.98. Meaning for every call purchased (which rep. 100 shares), MMs buy 98 shares to be neutral.

As gamma changes, they have to buy more or sell more shares. On Friday, the price was over every available call strike, which meant that MMs had to buy millions of shares—if a call is “in the money” (stock price > call price) they have to deliver the shares.

So on Friday and Monday, the price ran up very quickly as MMs hustled to cover the calls and settle them. Then the news took notice and everything went wild. More people piled in, larger firms are piling in on the buy side, Elon, Chamath… and the price exploded.

So that’s how we’re where we are now. Supposedly, a number of shorts have covered. That being said, last I checked, the short interest was still ~138% so either: (a) the shorts haven’t covered or, (b) more people are shorting to replace the shorts that covered

When you short, you pay a borrow fee which can change from day to day. Right now that fee on $GME is between 20-80%. That’s like… credit card interest rates! To borrow a stock! So the longer you’re holding your short position, the more it costs.

Eventually it either costs too much and you have to close your position for a loss, or you go bankrupt. Melvin almost went bankrupt (they got a $2.75B bailout from 2 other hedge funds). This is where we are now. Where does it go from here? I’m not sure!

Sorry this was so long, I find it really interesting and have been very invested in the story for months 🙂

@smalter @thinking_slow @kevinroose enjoy? 😅

Also I want to clarify something: all of this talk about regulating retail, investigations, so on? Nothing illegal happened here. It’s legal to discuss stocks and recommend positions. Just a lot of very upset wealthy people crying loudly to the media.

- 02/19/2021 – update of Gill

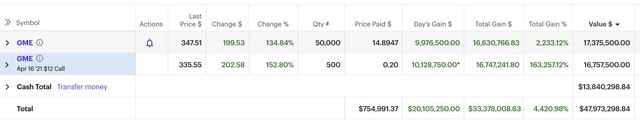

Reddit Legend Keith Gill Boosts Stake in GameStop – WSJ

A screenshot of his brokerage account appears to show that he bought an additional 50,000 shares of the stock

- 02/03/2021 – short interest is not published real time every day, instead: “FINRA member firms are required to report their short positions as of settlement on (1) the 15th of each month, or the preceding business day if the 15th is not a business day, and (2) as of settlement on the last business day of the month.* The reports must be filed by the second business day after the reporting settlement date. FINRA compiles the short interest data and provides it for publication on the 8th business day after the reporting settlement date.” See following Publication Schedule for 2021. I am not sure of GME’s short interest because it is outdated.

one web site to look for short interest:

https://finviz.com/quote.ashx?t=amc&ty=c&ta=1&p=d

Nasdaq Short Interest Publication Schedule

Report Overview

Short selling is the selling of a security that the seller does not own, or any sale that is completed by the delivery of a security borrowed by the seller. Short selling is a legitimate trading strategy. Short sellers assume the risk that they will be able to buy the stock at a more favorable price than the price at which they sold short. Short positions are those resulting from short sales. Each FINRA member firm is required to report its “total” short interest positions in all customer and proprietary accounts in Nasdaq-listed securities twice a month. These reports are used to calculate short interest in Nasdaq stocks.

FINRA member firms are required to report their short positions as of settlement on (1) the 15th of each month, or the preceding business day if the 15th is not a business day, and (2) as of settlement on the last business day of the month.* The reports must be filed by the second business day after the reporting settlement date. FINRA compiles the short interest data and provides it for publication on the 8th business day after the reporting settlement date.

The short interest information includes the adjustment for stock splits. The adjustment to the short interest for stocks that split on or before the reporting settlement date will automatically be reflected in all historical data available on the website to facilitate historical comparisons. For stock splits that occur after the settlement date, however, the adjustment will be reflected in the following reporting period. If a stock split occurs before the settlement date, the Short Interest and Average Daily Share volume will be adjusted based on that stock split. For example: in a given reporting date, if an issue had 10,000 Shares Sold Short, and an Average Daily Share Volume of 20,000 and experienced a 2:1 stock split prior to that reporting date, the Short Interest and Daily Share Volume would be adjusted on a 2:1 basis: Short Interest would be adjusted to 20,000 shares and the Daily Average Share Volume would be adjusted to 40,000 shares. All historically archived values would be adjusted similarly.

The requirement for reporting short interest as of settlement on the last business day of the month became effective September 2007.

Publication Schedule for 2020

| Settlement Date | Due Date- 6 p.m. | Dissemination Date after 4 p.m., ET |

|

|---|---|---|---|

| December | 12/15/2020 | 12/17/2020 | 12/24/2020 |

| 12/31/2020 | 1/5/2021 | 1/12/2021 |

Publication Schedule for 2021

| Settlement Date | Due Date- 6 p.m. | Dissemination Date after 4 p.m., ET |

|

|---|---|---|---|

| January | 1/15/2021 | 1/20/2021 | 1/27/2021 |

| 1/29/2021 | 2/2/2021 | 2/9/2021 | |

| February | 2/12/2021 | 2/17/2021 | 2/24/2021 |

| 2/26/2021 | 3/2/2021 | 3/9/2021 | |

| March | 3/15/2021 | 3/17/2021 | 3/24/2021 |

| 3/31/2021 | 4/5/2021 | 4/12/2021 | |

| April | 4/15/2021 | 4/19/2021 | 4/26/2021 |

| 4/30/2021 | 5/4/2021 | 5/11/2021 | |

| May | 5/14/2021 | 5/18/2021 | 5/25/2021 |

| 5/28/2021 | 6/2/2021 | 6/9/2021 | |

| June | 6/15/2021 | 6/17/2021 | 6/24/2021 |

| 6/30/2021 | 7/2/2021 | 7/12/2021 | |

| July | 7/15/2021 | 7/19/2021 | 7/26/2021 |

| 7/30/2021 | 8/3/2021 | 8/10/2021 | |

| August | 8/13/2021 | 8/17/2021 | 8/24/2021 |

| 8/31/2021 | 9/2/2021 | 9/10/2021 | |

| September | 9/15/2021 | 9/17/2021 | 9/24/2021 |

| 9/30/2021 | 10/4/2021 | 10/11/2021 | |

| October | 10/15/2021 | 10/19/2021 | 10/26/2021 |

| 10/29/2021 | 11/2/2021 | 11/9/2021 | |

| November | 11/15/2021* | 11/17/2021 | 11/24/2021 |

| 11/30/2021 | 12/2/2021 | 12/9/2021 | |

| December | 12/15/2021 | 12/17/2021 | 12/24/2021 |

| 12/31/2021 | 1/4/2022 | 1/11/2022 |

* There are two trade dates that settle on November 15, 2021. Firms that file their short interest positions via an ASCII text file should use the trade date of November 10, 2021 when populating Record Type 2, Field 6 of the file.

Additional Information

- Data Field Definitions

- Subscribe to Secure Download File

- Secure FTP Documentation

- Questions or Technical Assistance: NASDAQ Subscriber Services at +1 212 231 5180

- 02/03/2021 – Both hedge fund managers are value investors, they found the idea from consumer investment conference in January 2020. The firm will pay close attention to whether individual investors are discussing a stock on message boards before they bet on or against it. GME may not be the only one, more might come on message boards, so be aware!!

This Hedge Fund Made $700 Million on GameStop

Individual investors weren’t the only ones to make a lot of money on GameStop’s rally

Richard Mashaal and Brian Gonick started buying GameStop Corp. GME 2.68% shares in September.

They aren’t Reddit day traders or Discord users. They are hedge-fund managers in New York. And when the stock surged from less than $10 a share to above $400 and the dust had settled, they were sitting on a profit of nearly $700 million, one of the great fortunes of the January market mania.

Senvest’s interest in the videogame retailer was piqued by a presentation from the new GameStop chief executive at a consumer investment conference in January 2020.

Despite the rally’s fade this week, Senvest said the GameStop story will change one part of how they do business: The firm will pay close attention to whether individual investors are discussing a stock on message boards before they bet on or against it.

“I wouldn’t expect that impact to be over,” Mr. Gonick said.

- 02/03/2021 – I can find the most accurate short interest rate information from Yahoo finance and Etrade

https://finance.yahoo.com/quote/GME/key-statistics?p=GME

- 02/03/2021 – should I use small money to ride the wave like this guy? I can use OTM LEAPs with relatively small implied volatility

For One GameStop Trader, the Wild Ride Was Almost as Good as the Enormous Payoff

A small-time trader turns $500 into more than $200,000

- 02/03/2021 – Mr. Gill is still holding on GME, should I jump in too?

- Keith Gill, AKA Reddit’s DeepF——Value, apparently lost more than $13 million on Tuesday alone from his GameStop bet as the shares dropped 60%.

- Despite the losses, the investor is holding onto 50,000 shares of GameStop as well as 500 call options in the brick-and-mortar video game retailer.

- At GameStop’s record high last week, Gill’s total return in the name ballooned more than 2,000% to as much as $33 million, according to his Reddit posts.

- 02/02/2021 – these two small firms made a killing on GME, but they did it since 2011 which is a long haul. Small investors like Mr. Gill and I can ride on this horse if I can fin it earlier.

Two Small-Time Investors Were Buying GameStop Stock Before It Was Cool

GameStop’s rally has been credited to Chewy co-founder Ryan Cohen, but two relatively unknown investors were pushing for big changes more than a year prior

Mr. Wolf, 47, started Hestia Capital in 2009 after working at hedge funds and co-founding a health-care startup. He first bought GameStop in 2012. His firm is so small it doesn’t have to file the quarterly disclosures required of those that manage over $100 million in outside money. At its peak, Hestia had spent just under $7 million to buy about 2.1% of GameStop, according to filings.

Mr. Broderick, 51, manages Permit Capital, based in West Conshohocken, Pa., outside Philadelphia. It’s part of a broader financial group started by former Morgan Stanley executive Richard Worley and onetime FAO Schwarz chairman Peter Morse. The fund is named after a particularly hard-to-catch fish.

Permit Capital managed about $287 million as of December. Mr. Broderick first bought GameStop stock in 2011. At its peak, Permit had spent about $35 million on a 5.5% stake, making it one of the biggest holders, according to filings.

- 02/02/2021 – No wonder Mr. Gill is so good, he has accounting major and has conducted so deep and excellent study of GME

Keith Gill Drove the GameStop Reddit Mania. He Talked to the Journal.

Trader known as DeepF—ingValue on the WallStreetBets forum helped turn the investing world upside down. “I didn’t expect this.”

In high school, Mr. Gill was a distance runner, and he earned national honors on the team at nearby Stonehill College, where he graduated in 2009 with an accounting major. He ran a four-minute mile until sidelined by an Achilles injury.

Mr. Gill moved to New Hampshire for a few years and found a mentor, an investor and software developer his aunt introduced him to. He holds a designation as a Chartered Financial Analyst and said he was drawn by the complexity and challenge of stock picking, which became an outlet for the energy he once put into running. He started working at MassMutual in 2019.

- 02/01/2021 – interesting to see the founder of WSB (https://www.reddit.com/r/wallstreetbets/)

WallStreetBets Founder Reckons With Legacy Amid Stock-Market Frenzy

Jaime Rogozinski likens recent surge in GameStop shares to a ‘train wreck happening in real time’

The man who created Reddit’s WallStreetBets isn’t who you think he is.

He is 39 years old. He lives in Mexico City with his wife, a physician, and spends his weeks chasing after their 3-year-old twins and tending to his day job as a consultant—hardly the sort of character one might associate with the roiling investing forum.

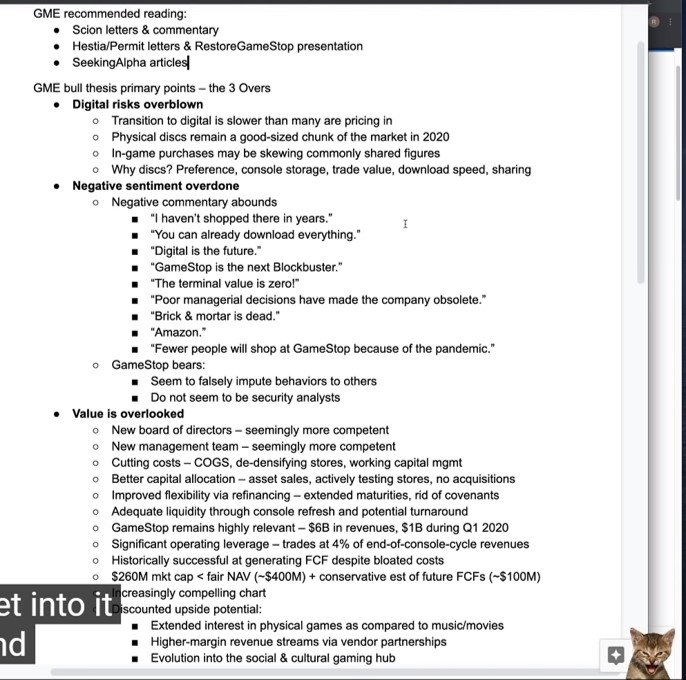

- 01/30/2021 – A great investment presentation and unbelievable profit by Roaring Kitty, I do not know why I totally missed it!!!!

great thesis in one page

100%+ short interest in GameStock stock (GME) – fundamental & technical deep value analysis

In this video I review GameStop (GME, $4.03, $260M market cap). As of July 2020 I’m bullish on the stock – perhaps foolishly so. What are your thoughts on GME? Do you agree or disagree with my take? What did I overlook in my analysis? Which of my assumptions were off?

There’s a lot to cover in a GME thesis. I did my best to review what I consider most of the important items. As time passes I’m sure I’ll realize I forgot to discuss something important. I’ll update this description with such updates.

One item I failed to mention is how management could use GME’s rising cash balance to repurchase the remaining 2021 bonds on the open market at a discount; the bonds currently trade at ~87 as of July 2020. It’s possible the discount would vanish if they attempted to buy back the bonds in size, but it’s still a scenario worth mentioning because such a move would marginally increase its value per share.

Another glaring omission is Scott Preston’s GME piece in Barron’s from February 2020 – I can’t believe I forgot to mention it. It’s one of the best articles written on the company and a must-read for anyone following the story. In particular Scott does a terrific job walking through the different ways GME can reinvent itself. The article is here: https://www.barrons.com/articles/game…

Resources mentioned in the video:

Furey, Edward “Present Value of Cash Flows Calculator”;

CalculatorSoup, https://www.calculatorsoup.com – Online Calculators

Hestia/Permit Restore GameStop presentation May 2020: https://www.sec.gov/Archives/edgar/da… Scion 13D April 2020: https://www.sec.gov/Archives/edgar/da… Scion June 2020: https://www.businesswire.com/news/hom… SeekingAlpha GME Articles: https://seekingalpha.com/symbol/GME/a… Statista: https://www.statista.com/statistics/1… The Verge – Xbox Series X optical drive: https://www.theverge.com/2019/6/10/18… Xbox 2013 blog update: https://news.xbox.com/en-us/2013/06/1… Variety – Death of Physical Video Games Exaggerated: https://variety.com/2019/gaming/featu… GamesIndustry.biz – AAA game downloads: https://www.gamesindustry.biz/article… GamesIndustry.biz – GameStop’s concept stores: https://www.gamesindustry.biz/article…

The Roaring Kitty channel revolves around educational live streams where I share my daily routine of tracking stocks and performing investment research. My investment style involves continually tracking thousands of stocks using a variety of widely available tools. When opportunity strikes – as it occasionally does in markets comprised of biased humans – I’m prepared to pounce and capitalize on the situation. I’m probably best classified as a fundamentals-focused deep value investor, though I find I’m increasingly leaning on technical analysis for screening, timing, and tracking stocks. In the years ahead I look forward to honing my portfolio management approach by acquiring bolt-on skillsets and further developing my approach to risk management.

Some of the tools I use: Google Chrome, Chrome extensions & search engines, Google Sheets / Google Apps Script / StackOverflow, StockCharts, insider buying via OpenInsider, stock ownership via WhaleWisdom, SEC filings via sec.gov, SeekingAlpha, Twitter, Quandl / Sharadar, and bond prices via FINRA.

The Roaring Kitty channel and live streams are for educational purposes only. I share my approach to investing in an effort to set you on the right path to building out your own investment process. I don’t provide personal investment advice or stock recommendations during the stream. Please understand that my style of investing is extremely aggressive and I take on a substantial amount of risk. It’s likely my approach would not be suitable for you. If you’re seeking personalized advice, I encourage you to sit down with a financial professional who can review your personal situation, financial background, risk tolerance, etc. Check out the Roaring Kitty disclaimer video for more information: https://www.youtube.com/watch?v=YM-Us…

from Scion letter

Scion Asset Management Urges GameStop to Buy Back $238 Million of Stock with Cash on Hand GameStop stock at all-time lows this month – Scion seeks full execution of March 2019 $300 million share repurchase authorization

‘Big Short’ investor Michael Burry made a 1,500% gain on GameStop during its Reddit-fueled rally