Energy and metals – Part III

- Potential future catalyst

- FDA approval of Moderna vaccine

- FDA approval of child 5 ~12 yrs old vaccine

- FDA approval of child 0~5 yrs old vaccine

- Delta CV-19 cases bottom

- the antiviral pills could come by the end of the year

- Covid’s ‘pandemic phase’ ending when antiviral pills, kids’ vaccines available

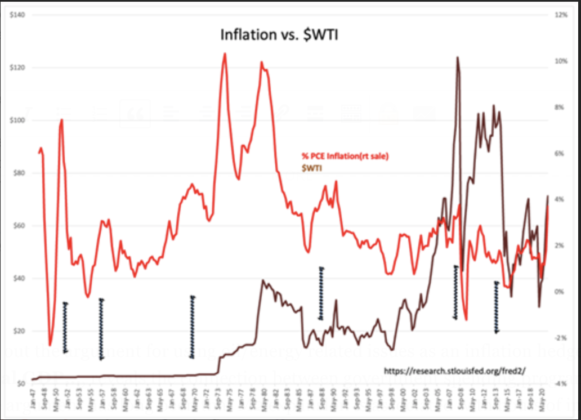

- $3.5 Tril welfare money for huge inflation, US dollar devalued

- oil companies Q3 earning and stock buyback

- US economy fully reopen, US might be back to normal in one year

- stock market rotation due to inflation and interest rate

- record revenue and stock dividend and buybacks

- demand recovery in China, Europe and world wide

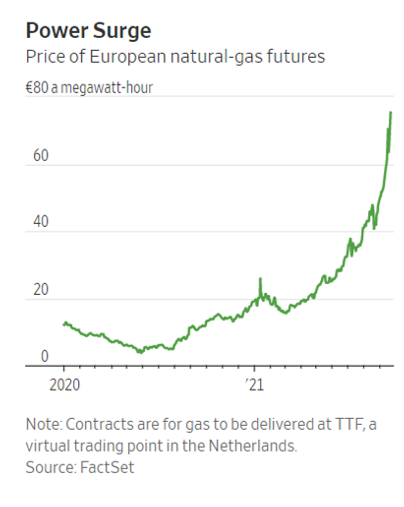

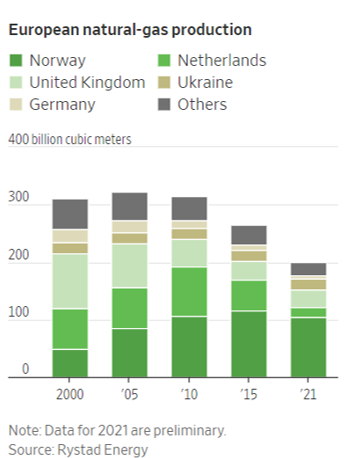

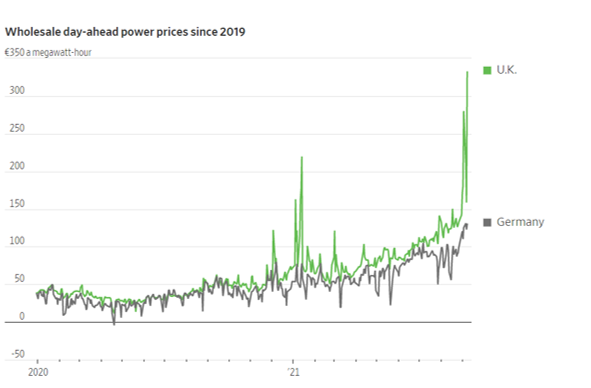

- energy crisis in Winter in China and Europe

- supply crunch

- US infrastructure bill approved by end of Sept What the Infrastructure Bill Would Help Fix First – WSJ

- U.S. crude oil inventories fell more than expected

- middle east war from Taliban

- fall of new energy and EV companies due to China’s RE’s fall and interest rate’s rise

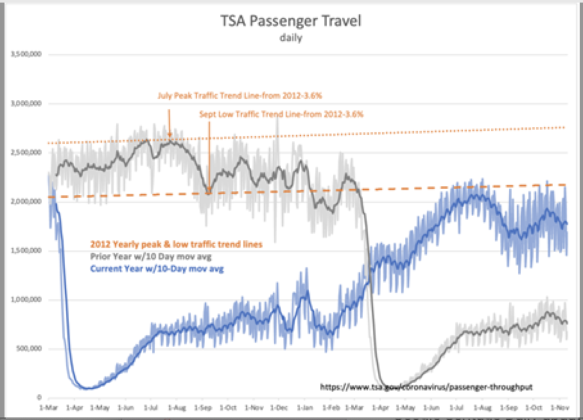

- oil demand is on the rise, as international travel restrictions are starting to be loosened

- Hurricane Ida have continued a month after the hurricane made landfall, with nearly 300,000 daily barrels of oil still offline – short term effect

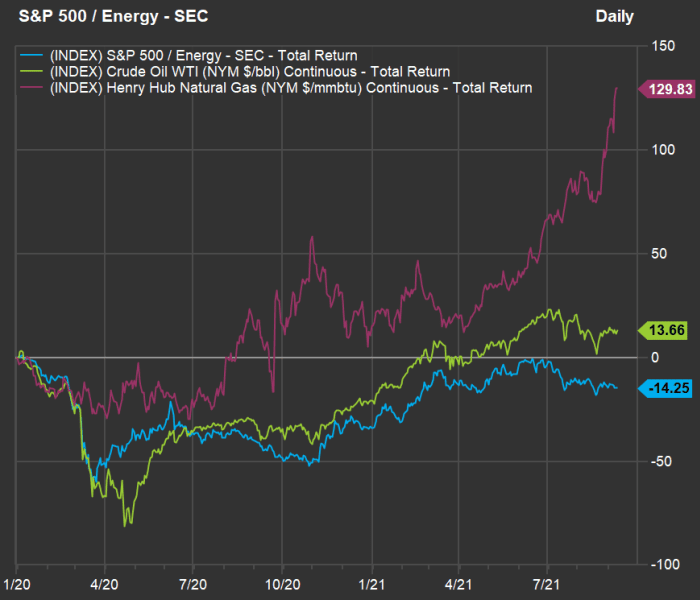

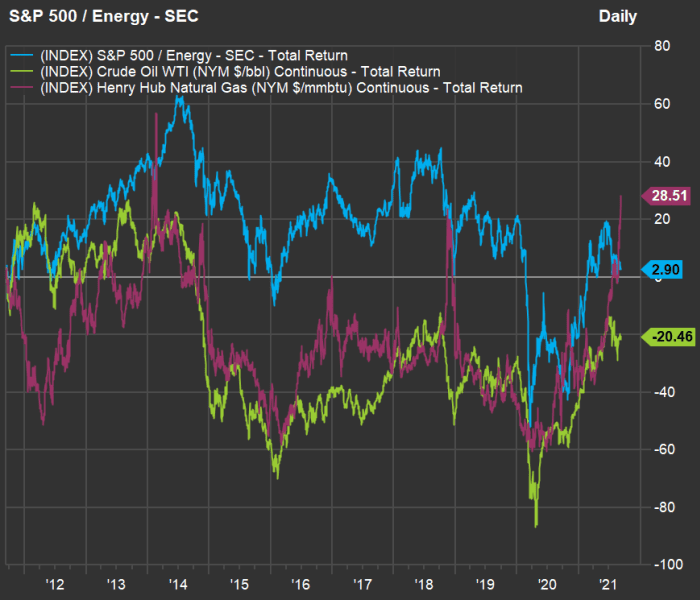

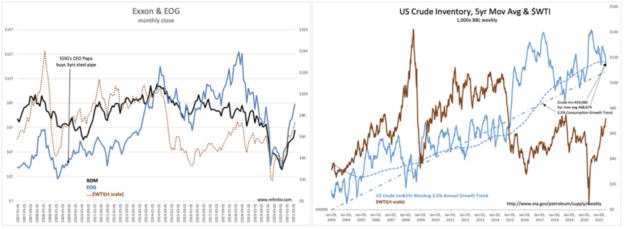

- U.S. oil/gas companies are still in the early part of an “extended” cyclical rebound with echoes of the mid-2000s. And while valuations have recovered from lows of last year, only a few of the companies are higher vs. their pre-COVID-19 levels.

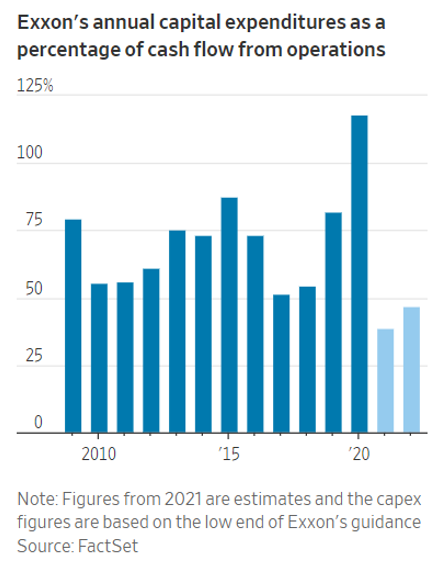

- the real reason that Big Oil won’t raise production is a matter of simple economics. oil explorers in the United States are making more money now than at any other point in the more-than decade-long history of the nation’s shale revolution. “And this may just be the beginning,” Bloomberg Markets reported this week. “Free cash flow, the key metric watched by investors, probably will increase by 38% next year, presuming oil prices remain elevated.”

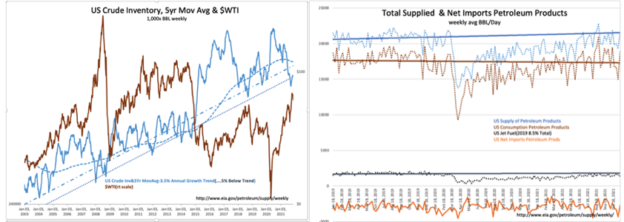

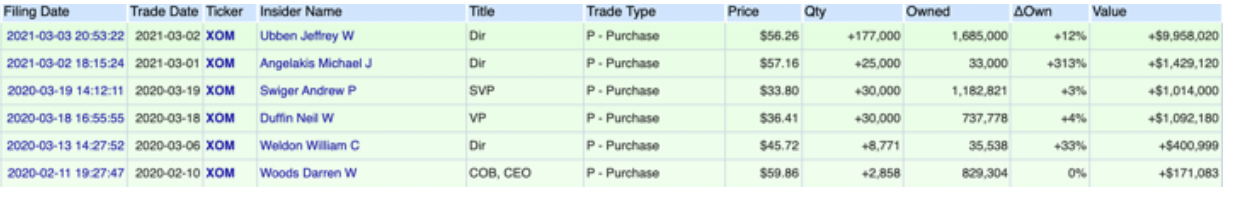

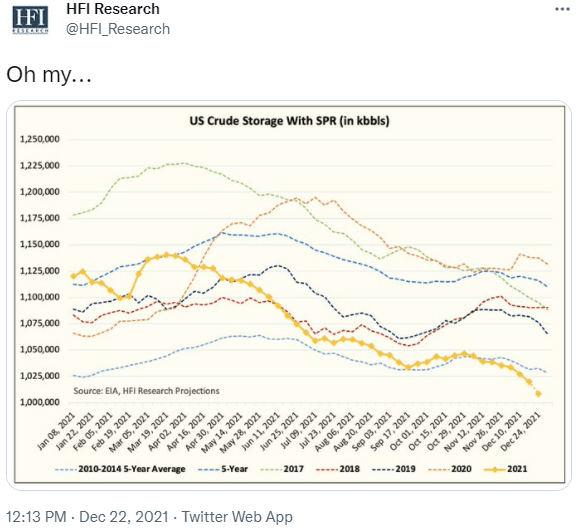

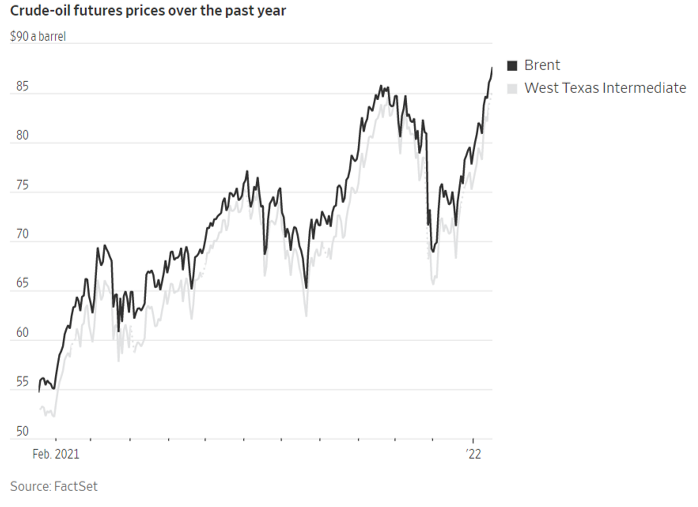

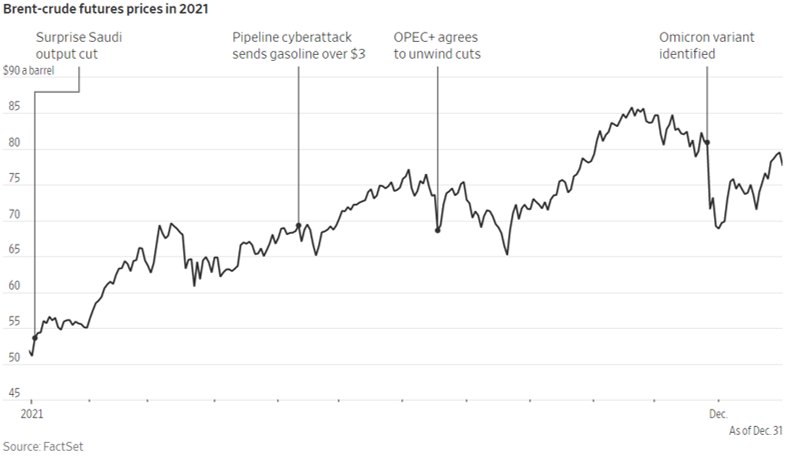

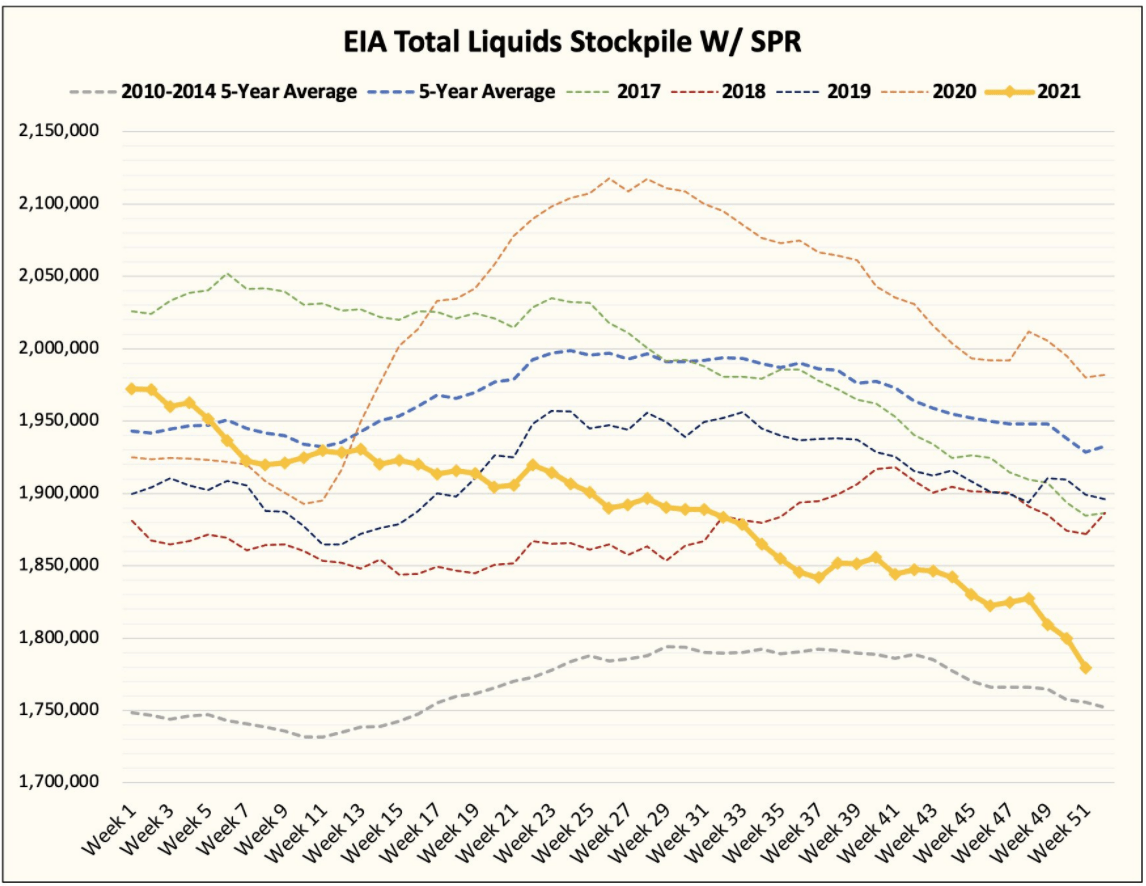

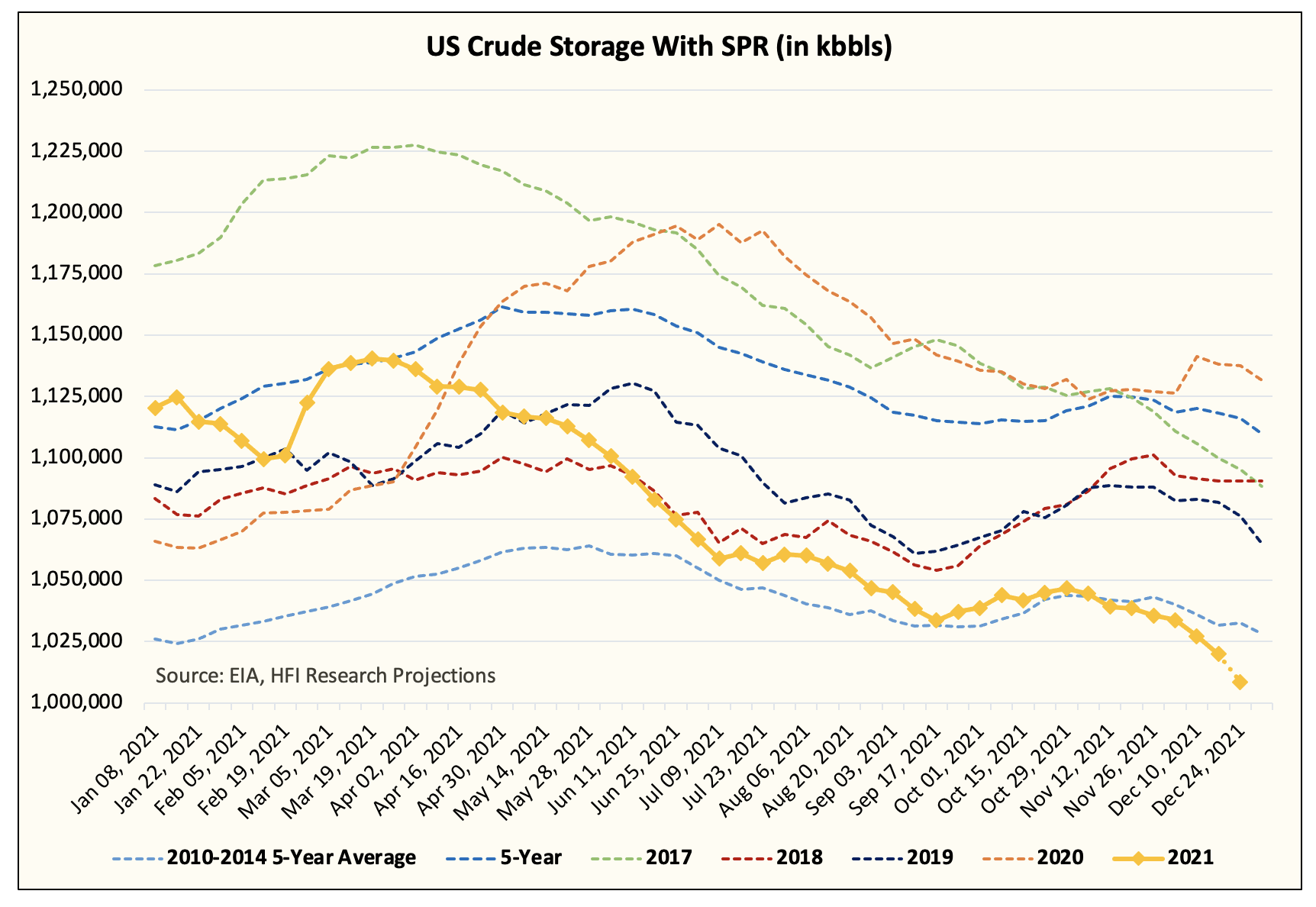

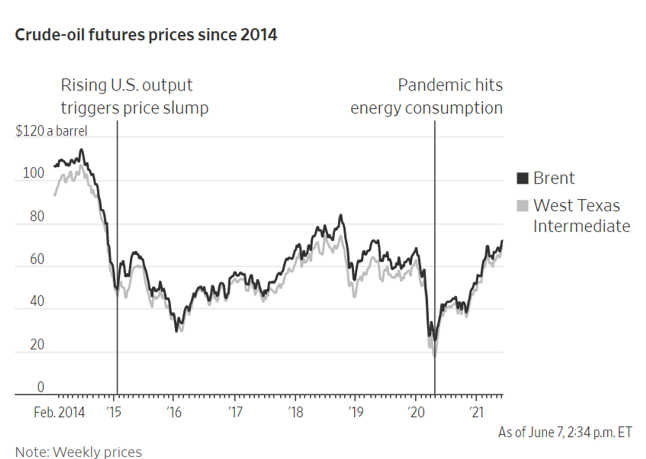

- Dec 23, 2021. This week saw another large oil/oil product inventory draw (NYSEARCA:USO) (CL1:COM) (CO1:COM), bringing the two-week total to ~27mb and resulting in stocks below the 2010 to 2014 average, a period in which Brent oil prices averaged ~$100.

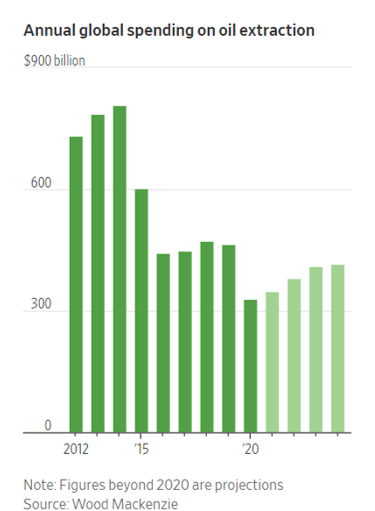

- Rystad reported that oil exploration put up its worst year since the Second World War, as majors like Exxon (NYSE:XOM), Chevron (NYSE:CVX), BP (NYSE:BP), and Total (NYSE:TTE) cut budgets and retrench to short-cycle basins.

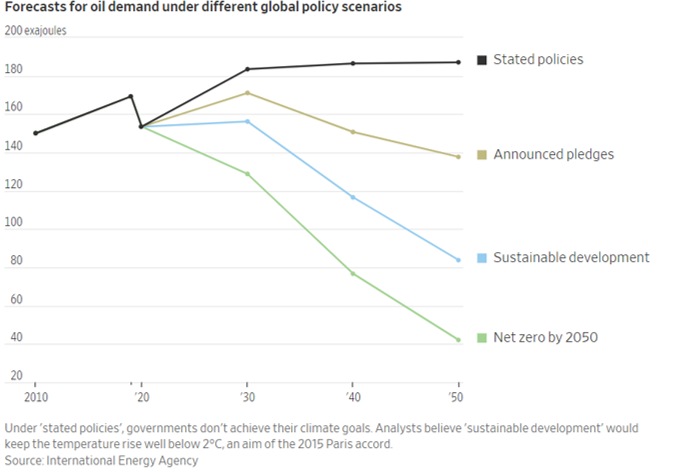

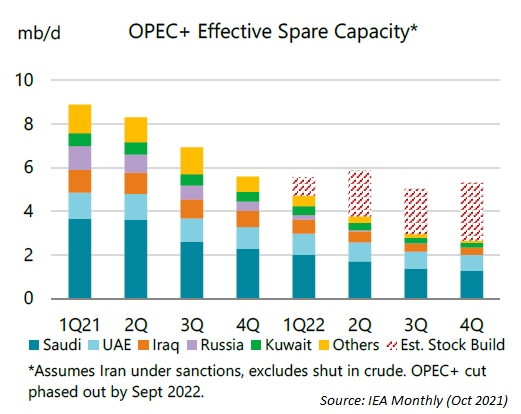

- The IEA said in its monthly oil market report that OPEC+ spare capacity could fall to below 4 million barrels per day (bpd) in the fourth quarter of 2022 from 9 million bpd in the first quarter of 2021. It forecast global demand at 99.6 million bpd in 2022, slightly above pre-pandemic levels. OPEC+ Spare Capacity Is Insufficient Amid Global Energy Crisis; The Myth Of OPEC+ Spare Capacity

- Beijing is cutting interest rate to bolster economy, and expediting the rollout of major infrastructure projects

Potential future risks

- new CV-19 variant coming

- another CV-19 cases wave

- OPEC+ and US to significantly increase oil production

- watch out the possible oversupply in 2022

- Oil price and oil demand will be under pressure due to China housing property crisis (i.e EverGrande)

- US and Iran nuclear deal

- OPEC to increase production

- Iran to increase production

- customers do not use oil once price is too high

- oil price tends to reverse to mean once increases too fast.

- Higher rate will strengthen dollar, and reduce oil price

- Russia to invade Ukraine, to strengthen $ and suppress interest rate, the trading algorithm will reduce oil price. World financial market (swift system, oil transfer, sanction of Russia, Russia’s anti-sanction, world economy slow down, etc.) will be in danger – at least in short term, and oil stocks will be dragged down significantly

- Oil Stocks Are Nearing New Heights. It’s Time to Be Careful. A surging oil price might correct itself, as consumers back away from spending on gasoline to protect their wallets. The higher prices go, the more incentive oil companies have to extract barrels from the ground, and the more wells that were once uneconomical can be pumped at a profit. Plus, central banks around the globe are set to lift interest rates to combat high inflation across the board, which could cause oil prices to decline by slowing economic growth.

In general, oil supply and demand are driven by a number of key factors:

- Changes in the value of the U.S. dollar

- Changes in the policies of the Organization of Petroleum Exporting Countries (OPEC)

- Changes in the levels of oil production and inventory

- The health of the global economy

- The implementation (or collapse) of international agreements

- Russian/Ukraine war

- 03/21/2022 – EU oil embargo?

The White House has announced President Biden will visit Poland as part of his European trip this week for talks with allies about the war in Ukraine. Ahead of the meeting, the European Union is considering whether to impose an oil embargo on Russia. The decision could prompt Moscow to close flows on the Nord Stream 1 pipeline, which help provide the 27-country EU with 40% of its natural gas needs.

- 03/21/2022 – Oil prices jump again on Russia-Ukraine fears, as IEA calls for cut in energy usage. China’s latest Covid impact could be less dire than anticipated amid expectations of easing restrictions. The key hub of Shenzhen partially opened up Friday, as five districts were allowed to restart work and resume public transportation, Reuters reported.

- Crude futures were up as much as 3% on Monday morning during Asia trading, with Brent at $110.81, and U.S. futures at $107.68.

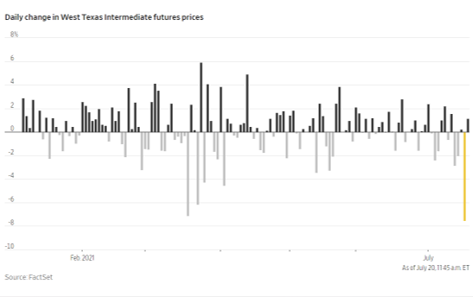

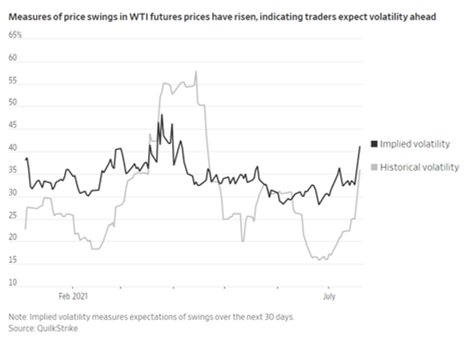

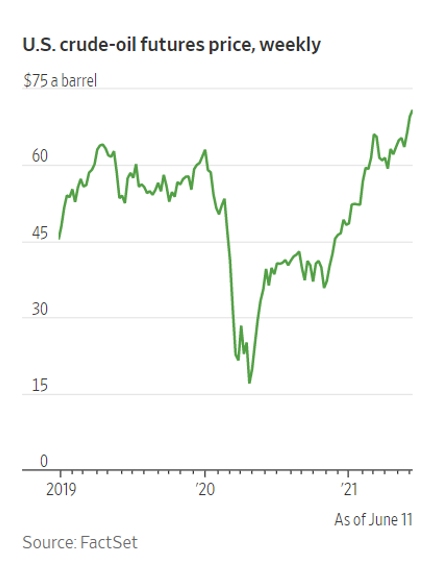

- Oil prices have been volatile in recent weeks – soaring to record highs in March before tumbling more than 20% last week to touch below $100. They jumped again in the latter half of last week.

- Ukrainian and Russian officials have met intermittently for peace talks, which have failed to progress to key concessions.

- Tight supply continued to worry markets, sparking a call by the International Energy Agency (IEA) on Friday for “emergency measures” to reduce oil usage.

Oil prices jumped even higher on Monday after Russia-Ukraine talks appeared to yield no sign of progress, and markets continued to fret over tight supply — sparking a call by the International Energy Agency to reduce oil demand.

In a note on Monday, Mizuho Bank said two factors were pushing oil prices higher: lingering Russia-Ukraine uncertainty as well as hopes that China’s latest Covid impact could be less dire than anticipated amid expectations of easing restrictions. The key hub of Shenzhen partially opened up Friday, as five districts were allowed to restart work and resume public transportation, Reuters reported.

Ukrainian and Russian officials have met intermittently for peace talks, which have so far failed to progress to key concessions. Still, Ukrainian President Volodymyr Zelenksyy has called for another round of talks with Moscow.

“If these attempts fail, that would mean that this is a third world war,” Zelenskyy told CNN’s Fareed Zakaria in an interview that aired Sunday morning.

“The breakdown of peace talks between Russia and Ukraine saw crude oil prices extend their rebound on Friday,” ANZ Research analysts Brian Martin and Daniel Hynes wrote in a Monday note. “However, it failed to offset the losses earlier in the week, with Brent crude ending down more than 4%.”

The Russia-Ukraine war has led to worries over supply disruptions as a result of U.S. sanctions on Russian oil and gas. The U.K. and European Union also said they would phase out Russian fossil fuels. Russia supplied 11% of global oil consumption and 17% of global gas consumption in 2021, and as much as 40% of Western European gas consumption in the same period, according to statistics from Goldman Sachs.

European Union governments are set to meet U.S. President Joe Biden this week as the EU considers an oil embargo on Russia over the unprovoked invasion of Ukraine.

The Commonwealth Bank of Australia warned Monday that oil prices have fallen below recent peaks because markets are still largely pricing oil by “assessing the likelihood of a diplomatic solution to the Ukraine conflict.”

“Physical shortages, linked to current sanctions on Russia, though will eventually play a more dominant role in oil price determination,” said Vivek Dhar, the bank’s director of energy commodities research, in a note.

“The industry’s apparent inability to fill any potential gap has seen calls for consumption to be reduced,” the ANZ Research analysts said.

OPEC+ in its latest report showed some producers are still falling short of their supply quotas, with Reuters citing sources who said that the alliance missed its targets by more than 1 million barrels a day.

In a 10-point plan, the IEA’s suggestions to reduce oil demand included reducing speed limits for vehicles, working from home for up to three days a week, and avoiding air travel for business.

“We estimate that the full implementation of these measures in advanced economies alone can cut oil demand by 2.7 million barrels a day within the next four months, relative to current levels,” the IEA said Friday.

- 03/18/2022 – Iran might can fill some oil supply gap created by Russia

Russia backs down on demands in Iran nuclear deal talks, making revival of 2015 pact imminent

- With the U.S. terminating its imports of Russian oil and the EU looking to reduce its energy dependency on Moscow, Iranian crude is looking more alluring.

- A return to the 2015 deal would see the return of Iranian oil to the market at a time when crude prices have hit their highest levels in more than a decade.

- The release of British-Iranian dual nationals from years of Iranian detention back to the U.K. has improved prospects for an agreement.

Russia has walked back its threat to torpedo the revival of the 2015 Iranian nuclear deal over recent sanctions imposed over its invasion of Ukraine, reopening the way to an agreement after nearly a year of talks.

The parties involved in the pact, formally known as the Joint Comprehensive Plan of Action, or JCPOA, were reportedly close to reaching a deal in Vienna until the U.S. and EU imposed sweeping sanctions on Russia over its invasion of Ukraine. Moscow then demanded that future trade with Iran not be impacted by Western sanctions, prompting the talks to be suspended last week.

The prospect of a return to the deal has not sat well with Washington’s Arab Gulf allies, particularly Saudi Arabia and the United Arab Emirates, two of OPEC’s leading crude producers and longtime adversaries of Iran. The two reportedly did not take President Joe Biden’s calls as he attempted to convince them to increase their oil production to alleviate soaring prices.

OPEC has not indicated any move to upping its production beyond pre-planned increases agreed between OPEC members and their non-OPEC allies, led by Russia, in 2021.

- 03/16/2022 – “It seems like the old adage that the best cure for high prices, is high prices, is as strong as ever,” myriad factors weighed on sentiment, including talks between Russia and Ukraine, a potential slowdown in Chinese demand and unwinding of trades ahead of the Federal Reserve’s expected rate hike on Wednesday.

Oil drops again, now more than 27% below recent high

Oil registered heavy losses Tuesday, building on Monday’s decline, as myriad factors weighed on sentiment, including talks between Russia and Ukraine, a potential slowdown in Chinese demand and unwinding of trades ahead of the Federal Reserve’s expected rate hike on Wednesday.

Both West Texas Intermediate crude, the U.S. oil benchmark, and global benchmark Brent crude settled below $100 per barrel Tuesday, a far cry from the more than $130 they fetched just over a week ago.

WTI ended the day at $96.44, for a loss of 6.38%. During the session it traded as low as $93.53. Brent settled 6.54% lower at $99.91 per barrel, after trading as low as $97.44.

WTI and Brent fell 5.78% and 5.12%, respectively, on Monday.

“Growth concerns from the Ukraine-Russia stagflation wave, and FOMC hike this week, and hopes that progress will be made in Ukraine-Russia negotiations” are weighing on prices, said Jeffrey Halley, senior market analyst at Oanda. “It seems like the old adage that the best cure for high prices, is high prices, is as strong as ever,” he added, noting that he believes the top is in for oil prices.

China’s latest moves to curb the spread of Covid-19 are also having an impact on prices. The nation is the world’s largest oil importer, so any slowdown in demand will hit prices.

A deal with Iran could also add new barrels of oil to the market. Russia’s Foreign Minister Sergey Lavrov is in favor of resuming the deal, according to Reuters.

- 03/16/2022 – China is set to see a sharp slowdown in March, given it is dealing with the worst Covid outbreak since 2020. Oil price drops 8% again to $94.7 today. But Putin reportedly told European Council President Charles Michel that Ukraine is “not showing a serious attitude” toward ending the fighting between the two countries. Finally, OPEC warned in its monthly report that inflation stoked by the Russia-Ukraine war could undercut oil consumption, but it did not change its forecast for strong demand this year.

China’s Covid spike worsens: Dongguan factory center locks down, new cases top 3,500 nationwide

- Recent outbreaks in 28 provinces have infected more than 15,000 people and stem primarily from the highly transmissible omicron variant, China’s National Health Commission said Tuesday, according to state media.

- On Tuesday, Dongguan city in the southern province of Guangdong ordered employees of businesses to work from home and locked down residential areas, permitting only necessary activities such as buying groceries and taking virus tests.

- Yum China, which operates Pizza Hut and KFC in the country, announced Monday that same-store sales for the first two weeks of March have fallen by about 20% year-on-year.

China is set to see a sharp slowdown in March, given it is dealing with the worst Covid outbreak since 2020. Larry Hu, CHIEF CHINA ECONOMIST, MACQUARIE

Major oil stocks extend slide as crude closes below $100

Widespread COVID-related lockdowns in China are spooking the market, “given its resulting impact on energy demand, as well as the uncertainty it brings about further lockdowns,” Kpler analyst Matt Smith told MarketWatch.

“Growth concerns from the Ukraine-Russia stagflation wave, and FOMC hike this week, and hopes that progress will be made in Ukraine-Russia negotiations” are weighing on prices, according to Oanda’s Jeffrey Halley.

But Vladimir Putin reportedly told European Council President Charles Michel that Ukraine is “not showing a serious attitude” toward ending the fighting between the two countries.

Finally, OPEC warned in its monthly report that inflation stoked by the Russia-Ukraine war could undercut oil consumption, but it did not change its forecast for strong demand this year.

- 03/10/2022 – UAE backtracks on output boost statement, oil price will increase again?

Oil Rises As UAE Backtracks On OPEC Output Boost Statement

- Crude prices tanked yesterday after the UAE Ambassador to Washington said that the UAE favors further production increases.

- Today, the Emirati energy minister, Suhail al Mazrouei has reaffirmed that the UAE will stick to the OPEC plan of gradual production increases.

The UAE has taken a step back from assurances it would encourage fellow OPEC members to boost their production above their agreed quotas to help rein in runaway oil prices.

In a tweet quoted by media, the Emirati energy minister, Suhail al Mazrouei, said that “The UAE believes in the value OPEC+ brings to the oil market,” and the country remains committed to the OPEC agreement for the gradual increase of oil production.

The minister’s statement follows another one, made by the UAE’s ambassador to the United States, saying that “We favour production increases and will be encouraging Opec to consider higher production levels.”

Shared with the Financial Times, the statement also said that “The UAE has been a reliable and responsible supplier of energy to global markets for more than 50 years and believes that stability in energy markets is critical to the global economy.”

Yet it seems Ambassador Yousef al-Otaiba’s statement was not coordinated with the energy ministry, which prompted the tweet by al Mazrouei.

Oil prices reacted positively to the Minister’s tweet, with Brent crude trading 5.97% higher at $117.8 per barrel, while WTI crude traded 5.23% higher on the day at $114.4 per barrel.

- 03/09/2022 – this might ease oil price somewhat

U.A.E. Pushes for Increased OPEC Oil Production Amid Russian War on Ukraine – WSJ

The move marks a departure for the Persian Gulf producer after months of standing with Saudi Arabia and Russia

The U.A.E. has about 1 million barrels a day of so-called spare capacity to produce more oil.

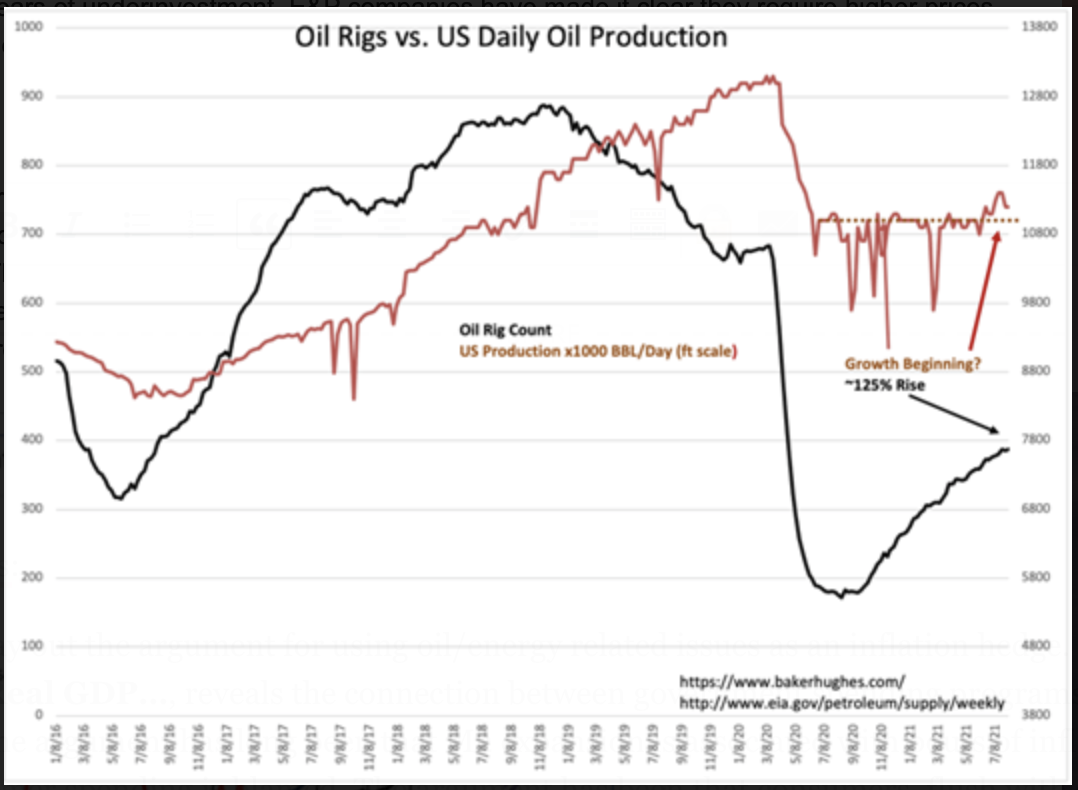

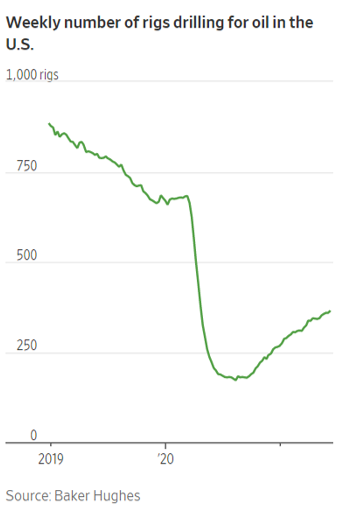

- U.S producers were largely expecting to keep oil production flat this year, and in the face of surging crude prices output can’t just be ramped up, said Oxy CEO Vicki Hollub.

- The oil-rich Permian Basin faces significant challenges in boosting output, according to Hollub. But it’s the only shale basin in the U.S. that can increase production, she said.

- Among the challenges are the age of the wells, labor shortages and securing raw materials.

- 03/08/2022 – should I invest more in oil companies?

USA TODAY US, NATO balk at plan to send MiG-29 jets to Ukraine; defiant Zelenskyy vows ‘fight to the end’: Live updates

Russia warns oil prices could reach $300 per barrel

Russia warned the price of oil could leapfrog to $300 a barrel and threatened the possible closure of gas supplies to Europe amid rising tensions against Western countries considering a ban on Russia oil.

“It is absolutely clear that a rejection of Russian oil would lead to catastrophic consequences for the global market,” Russian Deputy Prime Minister Alexander Novak said in a statement on state television, according to Reuters. “The surge in prices would be unpredictable. It would be $300 per barrel if not more.”

Noting Germany’s decision last month to freeze the certification of the Nord Stream 2 gas pipeline, Novak said Russia could ax the existing Nord Stream 1 pipeline – considered one of Europe’s main sources of natural gas.

“We have every right to take a matching decision and impose an embargo on gas pumping through the Nord Stream 1 gas pipeline,” said Novak, The Guardian reported.

Gas prices are now the most expensive in US history

After days of dramatically rising gas prices in wake of Russia’s invasion of Ukraine, the national average for a gallon of gas is now the highest in U.S. history, breaking the record that stood for nearly 14 years. As of Tuesday morning, the cost of regular gas in the U.S. is $4.17, according to AAA, up from $4.06 on Monday. Last week, the average cost was $3.60.

The previous national average high was $4.11, set on July 17, 2008, according to AAA.

“Americans have never seen gasoline prices this high, nor have we seen the pace of increases so fast and furious,” Patrick De Haan, head of petroleum analysis at fuel-savings app GasBuddy, said in a statement on Monday.

Oil Prices Could Hit $240 This Summer

Oil prices could hit $240 per barrel this summer in the worst-case scenario if Western countries roll out sanctions on Russia’s oil exports en masse.

That’s according to Rystad Energy’s head of oil markets, Bjørnar Tonhaugen, who made the statement in an extraordinary market note sent to Rigzone on Wednesday.

“Market volatility is at an all-time high, with prices surging on the expectation that supply will further tighten due to restrictive sanctions on Russian energy from the West,” Tonhaugen said in the statement.

- The EU imported 45% of its total gas imports from Russia in 2021.

- On Tuesday, it announced its plan, called REPowerEU, to reduce its purchase of Russian gas by two-thirds before the end of the year.

- The plan focuses on ramping up renewables, increasing energy efficiencies and diversifying its energy supply sources. Also, the plan includes options for mitigating the higher energy costs to vulnerable consumers and small businesses.

-

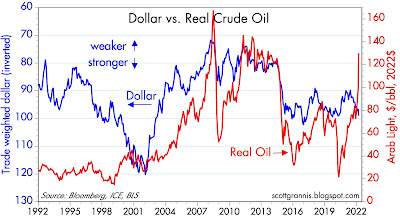

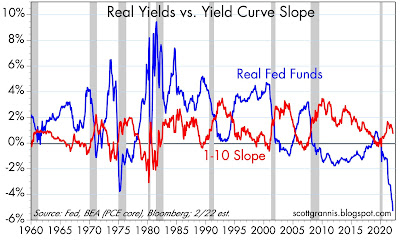

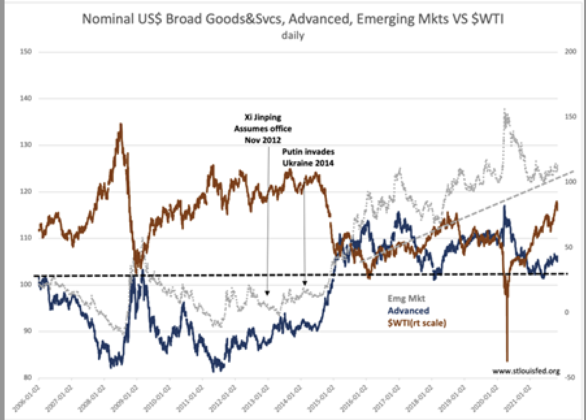

03/07/2022 – great comments from Scott Grannis on currencies and commodities. Chart #3 compares the value of the dollar (blue, inverted) to an index of industrial commodity prices. Note how the two tend to move together (i.e., inversely). But they’ve done just the opposite in the past few years: the dollar has been strong and commodity prices have been soaring. This tells us that the value of the dollar is not driving higher commodity prices. But since commodity prices are rising in terms of nearly all currencies, it’s possible that the world’s central banks are way too accommodative. Recessions are almost always preceded by very high real interest rates, a flat or inverted Treasury yield curve, and a significant increase in 2-yr swap spreads. Currently we have none of these conditions. Real yields are very low, the yield curve is still positively sloped, and swap spreads (in the U.S., but not in the Eurozone) are still within normal ranges. Liquidity is therefore abundant, and abundant liquidity is one of the best ways for an economy to avoid a recession. With liquidity, markets can efficiently shift risk to those willing to bear it; without liquidity, panic can ensue, much as happens when someone yells “Fire!” in a crowded theater. – we have Russian invasion, high inflation and “superbubble” of stock/housing/bond/commodity market, but no burst of these yet might be simply because we have abundant liquidity and us economy continues to grow despite of all these.

Currencies & commodities in perspective

Chart #3 compares the value of the dollar (blue, inverted) to an index of industrial commodity prices. Note how the two tend to move together (i.e., inversely). But they’ve done just the opposite in the past few years: the dollar has been strong and commodity prices have been soaring. This tells us that the value of the dollar is not driving higher commodity prices. But since commodity prices are rising in terms of nearly all currencies, it’s possible that the world’s central banks are way too accommodative. In other words, it’s possible that all currencies are being debased, and that’s why hard assets are rising. In that case, look for inflation to be rising nearly everywhere.

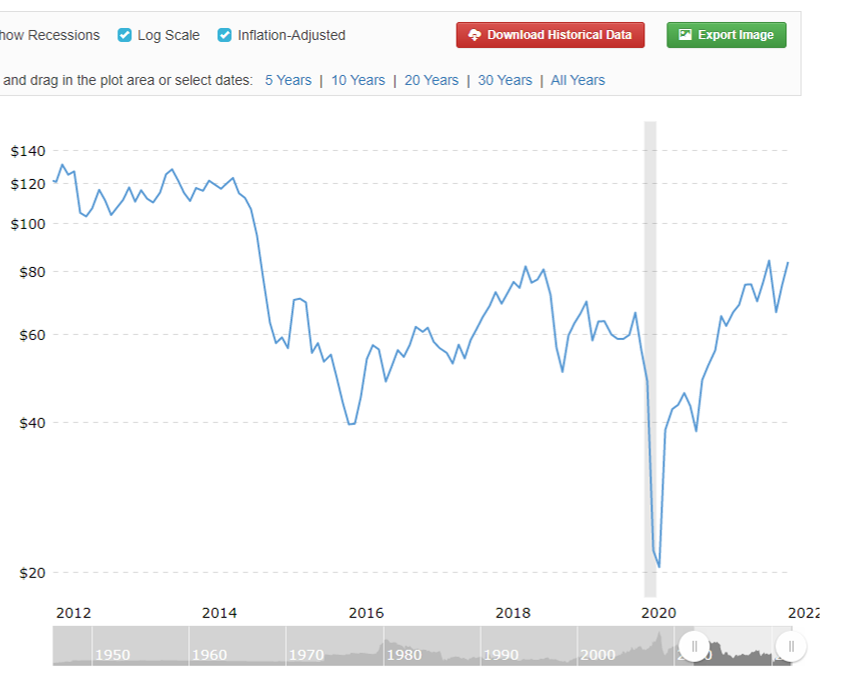

Chart #4 compares the dollar (inverted) to the price of oil. Here we seen the same pattern as with industrial commodity prices.

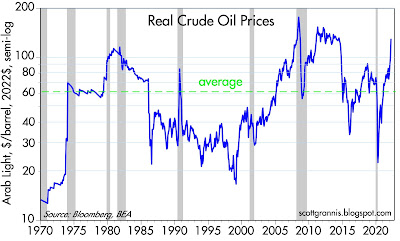

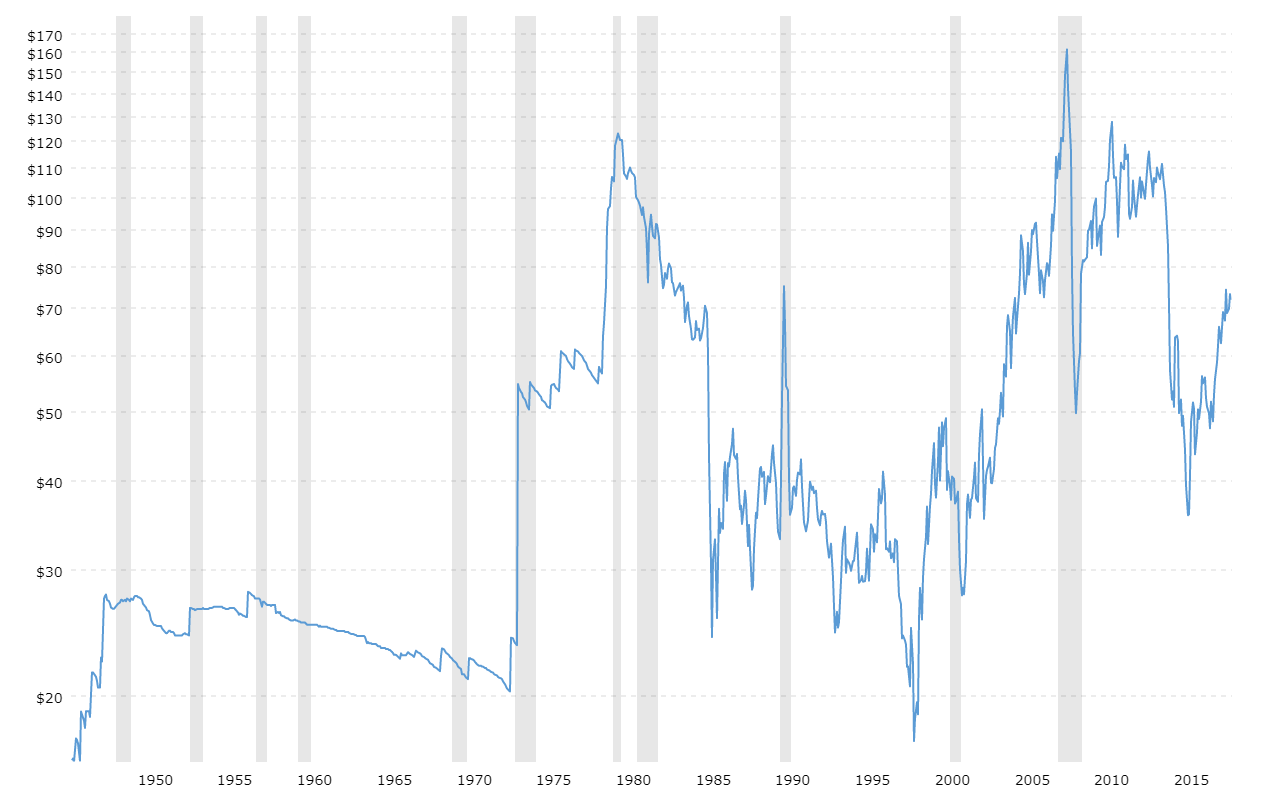

Chart #5 shows the inflation-adjusted price of oil. Note how virtually every recession has been preceded by a a very high real level of oil prices. Energy is so essential to growth that when oil becomes very expensive growth tends to weaken. It would be tempting to say that this chart is good evidence that recession risk is high, both here and in the Eurozone. But I think it takes a few more things to happen before recession becomes imminent. I go back to previous posts in which I point out that recessions are almost always preceded by very high real interest rates, a flat or inverted Treasury yield curve, and a significant increase in 2-yr swap spreads. Currently we have none of these conditions. Real yields are very low, the yield curve is still positively sloped, and swap spreads (in the U.S., but not in the Eurozone) are still within normal ranges. Liquidity is therefore abundant, and abundant liquidity is one of the best ways for an economy to avoid a recession. With liquidity, markets can efficiently shift risk to those willing to bear it; without liquidity, panic can ensue, much as happens when someone yells “Fire!” in a crowded theater.

- 03/08/2022 – Scott’s great viewpoint on how Russia/Ukraine war will the U.S. and Eurozone economies

I don’t pretend to know how the Russia/Ukraine war will play out, but I can shed some light on how it has impacted the U.S. and Eurozone economies. Not surprisingly, the U.S. economy continues to grow, while the Eurozone economy has taken a serious hit. Everyone, however, is suffering from higher-than-expected inflation. Central banks live in fear of the risks of war, and so are reluctant to tighten. As a result, monetary policy is still very accommodative nearly everywhere, and unlikely to pose a serious near-term risk.

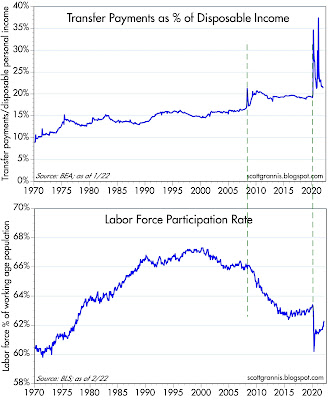

Chart #1

The February jobs report was quite strong, and contained the welcome news that the labor force participation rate (see the bottom chart above) has risen significantly. Chart #1 also suggests the reason for the surge, namely the big decline in transfer payments. Funny how things work: if you pay people who aren’t working, you won’t find very many willing to work, and when you stop paying them they are more inclined to work. (Our economy is not suffering from a lack of jobs, that’s for sure.)

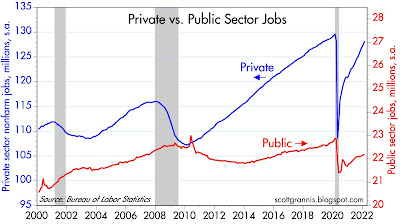

Chart #2

Chart #2 compares the level of private and public sector jobs. Two bright spots: private sector employment has recovered almost all its Covid-related loss, while public sector jobs have recovered less than half. (In my book, private sector jobs are much more productive than public sector jobs.) Government has become less obese, and that’s good news.

On the other hand, the level of private sector jobs today is still at least 5 million short of where it might have been in the absence of the Covid crisis.

Chart #3

Swap spreads, shown in Chart #3, are excellent indicators of a) liquidity conditions and b) the outlook for corporate profits and economic health in general. Swap spreads have risen a bit in the U.S., but not enough to be worrisome (in a normal economy, you’d expect these spreads to be 15-35 bps). Conditions in Europe are not so good, however, with swap spreads having jumped to recession-era levels. Limiting Russia’s ability to use the SWIFT payment system is a big factor reducing liquidity overseas.

Chart #4

Chart #4 is my favorite chart for gauging recession risk. Every recession except the last one was preceded by very high real yields and a flat or inverted yield curve. We’re not even close to either at this point. Real yields on the Fed funds rate are at record-setting (and mind-blowing) lows, which means liquidity conditions are flush and the Fed and the banks are practically begging people to borrow money. Combine this with Chart #3 and you see that all three of the indicators that normally precede recessions are not at all in worrisome territory, at least in the U.S.

Chart #5

|

|

Chart #5 compares the price of gold to the real yield on 5-yr TIPS (inverted, so as to be a proxy for their price). This tells us that both TIPS and gold are highly sought-after for their risk-reducing properties—which in turn means the market is very worried. There is no shortage of things to worry about, and from a contrarian viewpoint, that’s bullish. The last time the markets were this worried was in the 2011-2014 period, when Europe faced the risk of national defaults and the collapse of the Euro.

Chart #6

Chart #6 shows nominal and real yields on 5-yr Treasuries, and the difference between the two (green line), which is the market’s expectation for what the CPI will average over the next 5 years. Inflation expectations are now at new highs (about 3.3%), as the market is slowly coming around to seeing that the burst of inflation that started early last year is not going to be transitory. I would expect these expectations to continue rising over the next year or so, which means that nominal interest rates are almost certain to rise meaningfully.

Chart #7

Chart #7 compares the real yield on 5-yr TIPS to the current real yield on the Fed funds rate. In effect, the red line is what the market thinks the blue line will average over the next 5 years. In short, the market thinks the Fed is going to keep short-term rates negative in real terms for a long time. Borrowing at a floating rate of interest is thus likely to be attractive for awhile.

Unfortunately, as I’ve explained many times in recent posts, the persistence of negative real yields helps weaken the demand for money, and this in turn adds fuel to the current inflation fires. The Fed will need to do a lot of tightening at some point to bring inflation down.

Chart #8

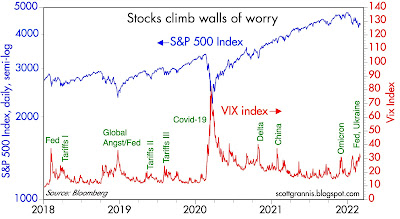

Chart #8 compares the Vix index (the worry index) to the level of the S&P 500. Whenever the market gets very worried, stock prices (unsurprisingly) decline. The level of worry today is not yet at an extreme, however, so things may get worse before they get better. On the other hand, a healthy amount of worry means the market is prepared for bad news, and that acts as a buffer.

- 03/08/2022 – Russia is also a major supplier of grains and metals such as aluminum, nickel and palladium, which it accounts for 40% of the world’s production. A sweeping ban on exports could upend global commodity markets. Nickel hit an all-time high today.

Russia Set to Ban Commodity Exports Following Western Sanctions – WSJ, Putin decree didn’t specify which commodities would be covered by the export ban

Oil prices rose following Mr. Putin’s decree. Brent-crude prices, the international benchmark, extended earlier gains to trade 5.9% higher at $130.50 a barrel, before slipping back. They remained below the high of about $139 a barrel recorded on Monday.

Russia is also a major supplier of grains and metals such as aluminum, nickel and palladium, which it accounts for 40% of the world’s production. A sweeping ban on exports could upend global commodity markets. Nickel hit an all-time high today.

- 03/08/2022 – The U.S. is banning imports of Russian oil now, The U.K. government said Tuesday it will phase out Russian oil imports by the end of 2022. Some Western government officials are pushing for the Group of Seven leading economies to work together to help European nations wean themselves off Russian oil and gas, which officials believe such a shift could take years to play out, given the high level of dependence and the long-term gas contracts that exporters have already signed.

Biden Bans Imports of Russian Oil, Natural Gas – WSJ

Deliberations about imposing a ban ramped up as lawmakers of both parties called for action on the issue

The U.S. is banning imports of Russian oil, President Biden said, targeting the lifeblood of Moscow’s economy as the West ratchets up pressure on Russian President Vladimir Putin over his invasion of Ukraine.

The U.S. will give companies 45 days to wind down existing contracts for Russian energy supplies, a senior Biden administration official said. The order also bars new U.S. investment in Russia’s energy industry and blocks Americans from financing foreign companies that invest in the sector.

Mr. Biden acknowledged that many of the U.S.’s European allies won’t be able to take similar action right away because of their heavy dependence on Russian energy. “We can take this step when others cannot,” he said, adding that the U.S. is working with Europe on a long-term strategy to wean off Russian energy.

The U.K. government said Tuesday it will phase out Russian oil imports by the end of 2022. Russian oil imports currently make up 8% of U.K. demand. The government is also exploring options to end Russian gas imports altogether.

The European Union said Tuesday that it planned to cut its imports of Russian natural gas by two-thirds by the end of this year.

Some Western government officials are pushing for the Group of Seven leading economies to work together to help European nations wean themselves off Russian oil and gas. This would include helping countries build more liquefied natural-gas terminals, rerouting deliveries from other nations and working with countries in the Middle East to increase production. However, officials believe such a shift could take years to play out, given the high level of dependence and the long-term gas contracts that exporters have already signed.

- 02/13/2022 – In my estimation, the greatest investment returns come from evaluating the factors and degree to which a consensus has been formed distant from the economic reality of any business sector. The snap-back can be intense which is what I think we will see with fossil fuels.

News reports the EIA is backing away from an earlier forecast of a crude surplus in 2022. This reinforces a building theme of supply deficit in the near an likely longer term i.e. 1yr and out to 2yrs-3yrs, with current lack of equipment capacity and trained labor.

IEA updates oil supply/demand forecast – demand higher, balances tighter in 2022

The International Energy Agency “IEA”, OPEC, and the US Department of Energy have been aligned inforecasting oil surplusesfor the duration of 2022 and beyond. The market has taken a different view in recent months, withrapid inventory declinesleading prices to multi-year highs. Early Friday, a revised report from the IEA suggests the Agency is coming around to the market’s view.

The report’s forecast revision, just the revision, lifted demand estimates for 2022 by 800kb/d. With the Agency citing higher petrochemical demand from China and increased consumption in Saudi as the primary reasons for the revision. Post revisions, the IEA sees demand growing 3.2mb/d in 2022.

On the supply side, the IEA discussed at length the potential for OPEC+ to increase supplies. Indicating that if quotas were met, the group could add 4.3mb/d to the market this year. As to why the group has been unwilling or unableto meet self-imposed quotas, the IEA provides little insight. Importantly, the Agency sees US supplies growing by 1.2mb/d in 2022; Conoco’s(NYSE:COP)CEOsees 800-900kb/d of growth, while the Citi strategist advising clients to short oil sees 1.0mb/d of supply growth this year.

Just as important as the supply/demand forecast is the IEA inventory update. The Agency is the only source providing a comprehensive view of OECD oil and oil product inventory levels. In December, OECD stocks fell by 60mb. The DOE report showed a 36mb decline in the US over the same period, indicating that record inventory draws are not unique to the US market.

(NYSEARCA:USO)(NYSE:XOM)(

NYSE:SHEL)(NYSE:CVX)(NYSE:BP ) In assessing supply growth, there is a clear divide between those jockeying spreadsheets in Paris and Washington DC, and those buying pipe, hiring crews and producing barrels, like Conoco’s CEO Ryan Lance. Though in assessing real-time inventory reports few disagree that the market is in deficit and in need of additional supplies, and soon.

Higher oil prices, even perhaps a new all-time high are ahead in my opinion accompanied with strong rise in cash flows for energy related cos. It does not stop there as we have seen in the past there are connections throughout the industrial sector spilling over into retail and services that become empowered with rising cash flows in anything as economically vital as oil/gas. This will spark innovation as in past price surges and some entirely new businesses are likely to emerge.

The next 2yrs-3yrs will prove interesting to say the least considering the 7yr drought of CAPEX and a potential 180 degree turn in investor psychology.

In my estimation, the greatest investment returns come from evaluating the factors and degree to which a consensus has been formed distant from the economic reality of any business sector. The snap-back can be intense which is what I think we will see with fossil fuels.

IEA updates oil supply/demand forecast – demand higher, balances tighter in 2022

Official OPEC stats for January are out, results are worse than expected

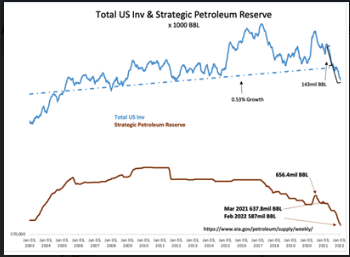

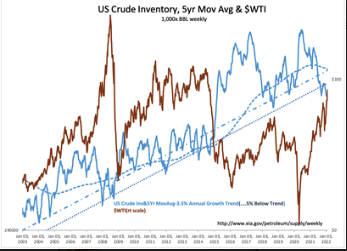

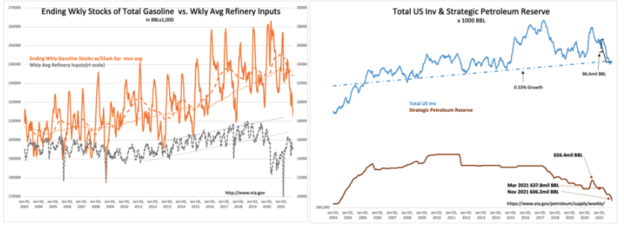

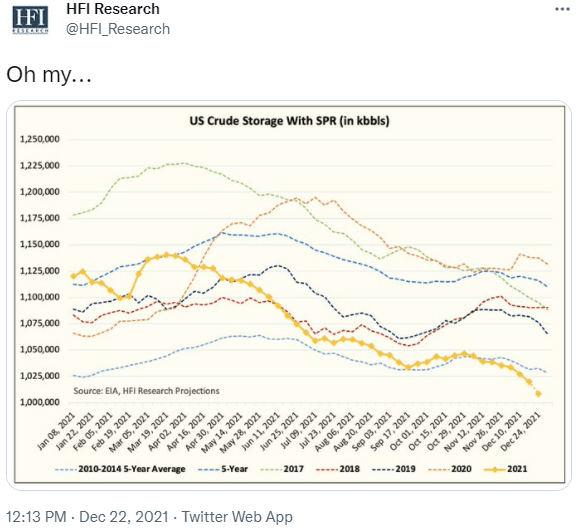

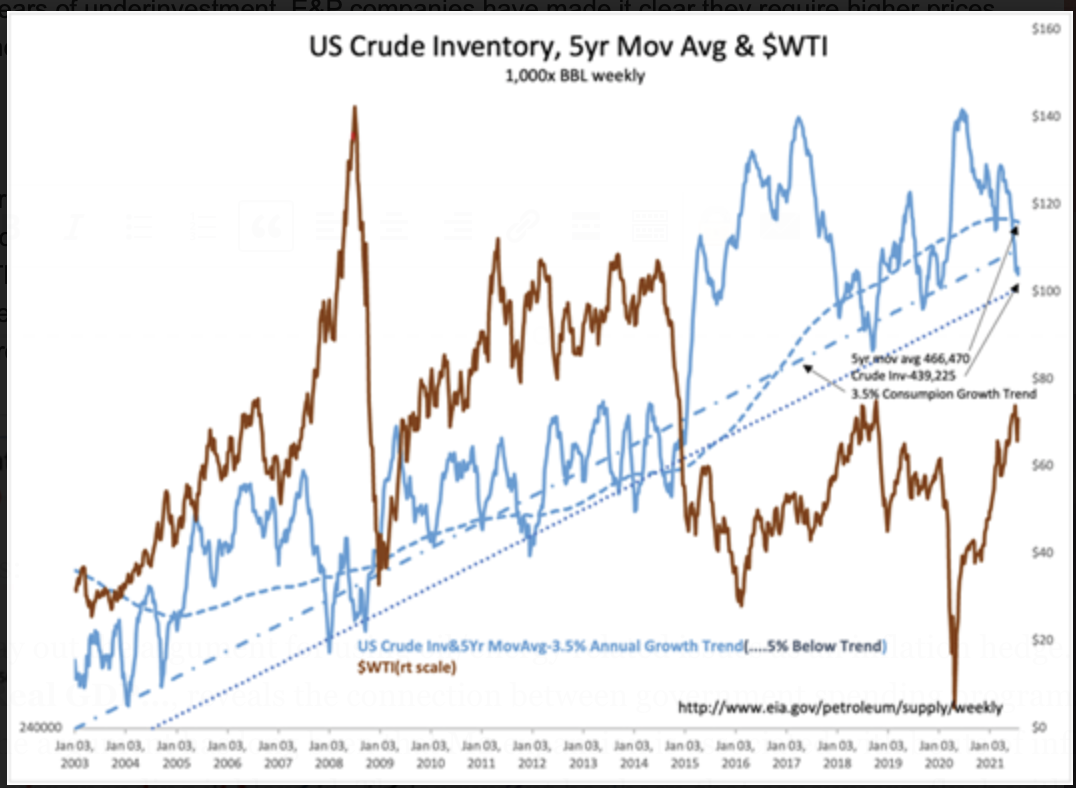

- 02/09/2022 – A few analysts see a crude deficit and forecast much higher prices, yet market activity reflects disbelief. Since March 2021, Total US Crude Inv has fallen 143mil BBL or ~13%. ~70 mil BBL of this decline is in the SPR while the rest comes from the industry working inventory which with this report hit a new low vs trend-line from 2003.

Crude Inventory Down 13% With 1/2 Coming From SPR

I do not think we are at a “peak oil” scenario. What I do think is we have a constantly shifting energy and drilling policy in the US now and that simply does not work for the long-term planning needed for the industry to make significant investments. Until the energy industry feels safe in starting multi-million dollar projects, they need to have some level of confidence those projects are not going to be scrapped on a whim from Washington, thus stranding millions in then lost investment.

Until we get that, we can expect energy prices to continue their upward march. The unfortunate thing about this is the dynamic will be in place for some time. Even if we played “what if” and said the US formulates a long-term plan next month, it takes time for the industry to then decided what to do within those parameters and then implement it. In short, the current state of the energy market will have a decent, long-tail effect into the future that is negative for consumers.

“Davidson” submits:

-

US Crude Prod 11.6mil BBL/Day(0.1mil higher vs last week), US Crude Imports 3.3mil BBL/Day(1.3mil lower vs last week) Total US Crude Inv fall 6.2mil BBL(4.8mil working Inv and 1.4mil SPR)

-

US Gas Inv lower by 1.7mil BBL, Crude Refining Input rise 0.3mil BBL/Day, US Exports Refined Prod remain low, Jet Fuel consumption remains at lower levels, US Consumption appears reaching for higher level

The overall picture in the US Oil Situation is continued production discipline as crude inventories continue in decline. US Gasoline Inventories are lower on during refinery shutdowns for maintenance with available domestic supplies being supplemented by lower exports. US Consumption in recent weeks appears to be reaching higher levels. The volatility in data makes this too early to call.

Since March 2021, Total US Crude Inv has fallen 143mil BBL or ~13%. ~70 mil BBL of this decline is in the SPR while the rest comes from the industry working inventory which with this report hit a new low vs trend-line from 2003.

A few analysts see a crude deficit and forecast much higher prices, yet market activity reflects disbelief.

- 01/31/2019 – What Oil Companies Can Learn From Big Tobacco

- 01/28/2022 – good for the oil companies, stay invest in the long run

Chevron Rakes in $15.6 Billion in Annual Profits as Oil Prices Climb – WSJ

For Big Oil’s Future, Look to Big Tobacco’s Past – WSJ

- 01/27/2022 – developing news on Russia. “Putin is trying to frighten us with a great war, and now we understand that for at least two more weeks there won’t be war. As long as the diplomats talk, the guns remain silent,” – but uncertainty and volatility might increase

- China Calls for Calm From U.S. on Ukraine – WSJ China’s description of Messrs. Blinken and Wang’s phone call didn’t mention Washington’s proposals. During the call, Mr. Wang told Mr. Blinken that “regional security cannot be guaranteed by strengthening or even expanding military blocs,” an apparent reference to NATO. Mr. Wang said Beijing would support a solution in Ukraine that was “in line with the direction and spirit of” internationally-backed cease-fire agreements signed in 2014 and 2015 between Russia, Ukraine and Russia-backed militants in eastern Ukraine that sought to restore order along Ukraine’s eastern frontier with Russia. Mr. Putin is set to attend the opening ceremony on Feb. 4 and hold a summit with Mr. Xi—the Chinese leader’s first face-to-face meeting with a head of state in nearly two years, and one expected to solidify an alliance between the two U.S. rivals. – It seems like China sides with Russia. Will US back down? We will see what will come out from Putin and Xi’s meeting on Feb 4th.

- Russia and Ukraine agree to continue ceasefire talks

-

Russia Says It Sees Little Scope for Optimism in U.S. Proposals on Ukraine – WSJ After massing troops near Ukraine border, Moscow has been pushing for Washington to bar former Soviet states from joining NATO. “There is not much reason for optimism,” Kremlin spokesman Dmitry Peskov told reporters on Thursday. “It cannot be said that our considerations were taken into account or that any willingness to take into account our concerns was demonstrated.” He said, however, that Mr. Putin would nonetheless “take some time to analyze” Washington’s responses and urged against rushing to conclusions. “No matter how diametrically opposed our views sometimes are, dialogue is always needed,” Mr. Peskov added.

- Ukraine’s Bulked-Up Military Is Still Outgunned by Russia – WSJ Facing off against the troops and tanks that Russian President Vladimir Putin has massed around Ukraine in recent months is a force of roughly 260,000, trained by Western advisers and equipped with its own upgraded armored vehicles, U.S. and British antitank missiles and Turkish armed drones. Russia’s air power and its missile forces would give it a big advantage over Ukraine in the event of a broad conflict, allowing it to inflict considerable damage even without a large deployment of ground forces.

- Russia Sends Medical Units to Ukrainian Front – WSJ

- Fresh Russia-Ukraine Talks Point to Possible Off-Ramp in Crisis – WSJ

Two sides are in discussions to revive a dormant agreement that Ukraine fears could represent a ‘Trojan horse’ to give Russia sway in its future

-

What Russia Wants and What the U.S. Is Proposing in the Ukraine Crisis – WSJ

Russia has issued security-related demands about Ukraine while building up forces along border shared by the two countries

- 01/26/2022 – Russia and Ukraine news.

- Will There Be a War Over Ukraine? 13 Putin Watchers Weigh In

Here’s what Biden needs to know about the famously unpredictable Russian president — and Washington’s best - Ukrainian Foreign Minister says current Russian troop numbers insufficient for full invasion this number is insufficient for a full-scale offensive along the entire Ukrainian border. They also lack some important military indicators and systems to conduct such a large full-scale offensive. Russia will not allow ‘endless discussion– Russian Foreign Minister Lavrov addressed the country’s State Duma on Wednesday and repeated his desire for assurances from the US regarding security measures. “We will not allow any attempts to wind up our initiative in endless discussion,” said Lavrov on Wednesday. “If there won’t be any constructive response and the West will continue its aggressive line, then as the President said multiple times, Moscow will take appropriate response measures.”

- Russia and Ukraine agree to continue ceasefire talks

- Russia’s Attempts to Sanction-Proof Its Economy Have Exposed a Weak Spot – WSJ

- U.S. Delivers Response to Russian Demands

- Italian Executives Meet With Putin

- What Does Russia Want With Ukraine?

- Biden Puts More Military Muscle Into NATO’s Russia Response – WSJ

- Waiting for the Last Days of Putin – WSJ Mr. Putin would face a no-win choice, war with NATO or accepting a defeat of his pet fighters that his personalized rule probably couldn’t survive. If Mr. Putin believes this, then he also believes the U.S. is willing to court big risks to end Mr. Putin’s rule. “Putin is trying to frighten us with a great war, and now we understand that for at least two more weeks there won’t be war. As long as the diplomats talk, the guns remain silent,” said Ukrainian lawmaker Oleksiy Goncharenko. He added, however, that he doesn’t expect any breakthrough in Berlin because Moscow’s and Kyiv’s positions are so far apart.

- What Russia Wants and What the U.S. Is Proposing in the Ukraine Crisis – WSJ

– US makes no concessions on Ukraine after Russia threatens retaliation over unmet demands

– Tensions continue to mount on Wednesday as fears of a Russian invasion of Ukraine persist globally. Russia has denied it is planning to invade despite massing an estimated 100,000 troops along the border. Here’s the latest.

– US Secretary of State Antony Blinken said that the US made no concessions — but is open to dialogue — in response to Russia’s demands for the US and its allies to curb preparation for an invasion and for Ukraine and other ex-Soviet nations to be denied entry to NATO, according to The AP

– Russia promised to retaliate if demands were not met and also warned the US against imposing personal sanctions on President Vladimir Putin, Reuters reports – Ukrainian leaders tried to calm those living in their country by reassuring them that, while the threat of Russian invasion is real, it is not imminent, per The AP

- 01/24/2022- Tilson thinks there is bullish sign. I think he might be right, but should after clearing the uncertainty of Russia invasion, which might become clear after mid of February. Now market might not like the uncertainty, which cause the equity pull back. In addition, Nasdaq is too much overvalued. And Margin debt is too high.

Following up on Friday’s thoughts on the market pullback, the negativity out there has reached very high levels, which is usually a bullish sign.

My friend Doug Kass of Seabreeze Partners sent around some interesting charts yesterday, which have him venturing back into the market…

The Nasdaq is off to the worst start to a year in its history – and that includes the dot-com bust and The Great Recession of 2008-09:

2022: -13.1%

2008: -11.5%

2016: -10.7%

2009: -8.6%

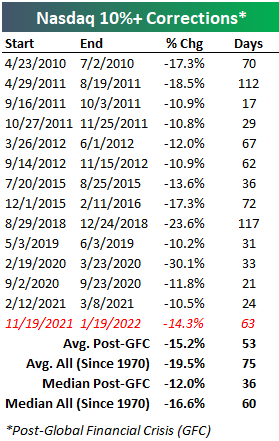

1996: -5.1%The Nasdaq correction is over 17.5%, the fourth-worst correction since The Great Financial Crisis. At 65 days, it’s already longer than the average post-Great Financial Crisis correction of 53 days:

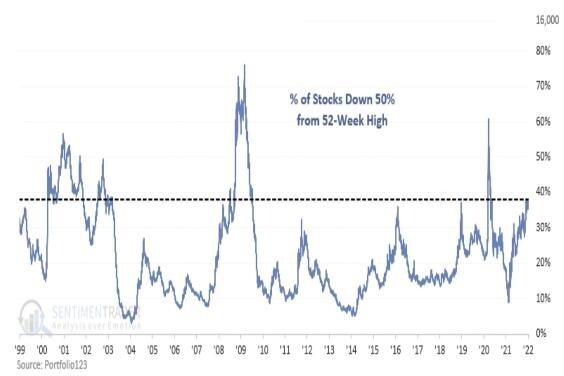

… The number of Nasdaq Index issues down by more than 50% from their 52-week highs has risen to 42%. Since the 2008 financial crisis, only March 12-April 8, 2020 saw more Nasdaq stocks cut in half:

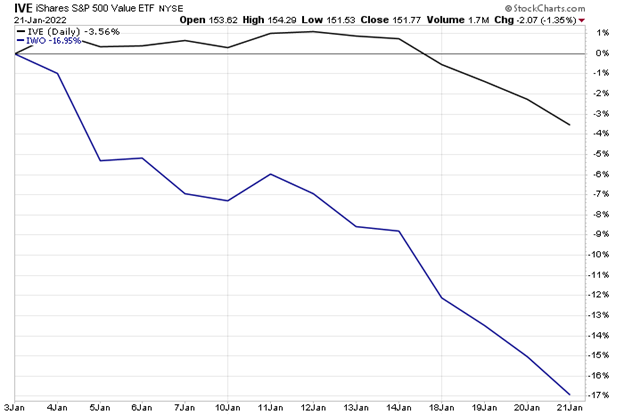

Small growth stocks (measured by the iShares Russell 2000 Growth ETF, IWO) have declined by an astonishing 17% in the last 13 trading days, far more than the iShares S&P 500 Value ETF (IVE):

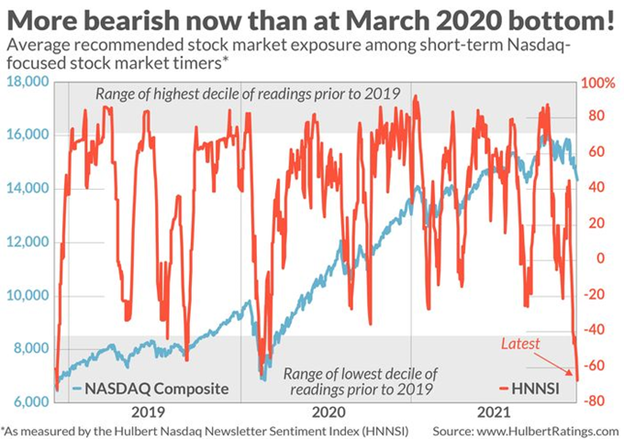

… The Hulbert Sentiment Index is at the most bearish reading since March 2020:

I think Doug is right that we’re approaching a bottom, especially now that the pandemic is receding (see below), so it’s time to start buying your favorite stocks…

- 01/24/2022 – NATO is not unified (see Germany) and seems like only does some peripheral tasks, US is weak (see Afghanistan) and will not send troops, China supports Russia politically and might support economically if western sanction happens because China looks this as a precedence of Taiwan, Russia cannot allow Ukraine to slip away from Russia which will set a precedence for other old Soviet Union countries

-

Pentagon Places Hundreds of Troops on Standby for Deployment to Eastern Europe

- US puts 8,500 troops on heightened alert amid Russia tension

- Russian Duma takes its time over call for east Ukraine ‘independence’. RIA information company quoted one other Communist deputy as saying the draft could be mentioned “in February”. The Duma Council, which decides when votes ought to happen, is subsequent scheduled to fulfill on Feb. 7. A proposal to ask Russian President Vladimir Putin to recognise two breakaway east Ukraine areas as unbiased won’t be prepared for dialogue by the related parliamentary committee till subsequent week, the committee’s head informed Reuters on Monday. The proposal, initiated by the Communist faction within the Duma, is important as a result of – if parliament authorized it and Putin agreed – it will mark a hardening of Russia’s stance within the Ukraine disaster and additional elevate tensions with the West.

- 01/21/2022- Russia/Ukraine introduces lots of uncertainty to oil stocks and general market. Friday’s meeting is fruitless. Intensive talks between Russia and Western allies yielded posturing and threats but concluded with the two sides seemingly no closer to resolving a standoff that could spiral into one of Europe’s worst security crises in decades. Russian Foreign Minister Sergei Lavrov said on Friday in Moscow, “We will not wait forever” for the West to respond to Russia’s demands.

Russia-U.S. Talks Concluded With Posturing and Threats, but No Movement on Either Side – WSJ

Week of diplomacy leaves U.S. officials pessimistic, uncertain about Vladimir Putin’s intent in Ukraine crisis

Russian Foreign Minister Sergei Lavrov warned on Friday that Moscow was running out of patience. Russia had asked the U.S. in December to respond in writing to its demands of the North Atlantic Treaty Organization.

“We will not wait forever,” Mr. Lavrov said. “Our patience has run out…Everyone understands that the situation is not improving. The potential for conflict is growing.”

No further talks have been scheduled, and the U.S. signaled that the ball is in Russia’s court.

“It’s hard to say whether the talks had any effect on Putin‘s thinking because his mind is not readable,” said Evelyn Farkas, a former defense official in the Obama administration. “If he was already firmly intending to undertake a military operation against Ukraine, he may still do that.”

Heading into the talks, U.S. officials had hoped that carrots—the offer of fresh talks on missile deployments and troop exercises—and sticks—in the form of financial sanctions and export controls—would encourage Mr. Putin to engage in diplomacy rather than attack Ukraine.

Yet in direct talks with the U.S. on Monday, in the NATO-Russia Council on Wednesday and at the Organization for Security and Cooperation in Europe on Thursday, Moscow restated key demands that the U.S. and NATO have rejected.

Russia wants NATO to forswear future expansion into Ukraine and other former Soviet countries, curb the alliance’s ties with Ukraine and former Soviet states and restrict military deployments on the territory of the alliance’s Eastern European members.

U.S. and Western officials rejected the demands as “nonstarters,” according to State Department spokesman Ned Price. The U.S. diplomats left the meetings pessimistic about Moscow’s intentions and lack of flexibility, senior U.S. officials said.

Washington described this week’s discussions as a way to air differences and see what might be possible in future talks. But U.S. officials have voiced increasing mistrust of Moscow, and the troop buildup near Ukraine made it hard for NATO and the American side to entertain Russia’s ideas about the future of European security.

Mr. Lavrov on Friday blamed Washington for a lack of progress, saying U.S. officials should have been ready to negotiate on key Moscow demands. “The Americans failed to study our proposals in order to arrive at a specific position,” Mr. Lavrov said. “They limited themselves to questions and verbal explanations. We are past that stage.”

U.S. officials say the threat of a Russian invasion of Ukraine is real. Russia has deployed more than 100,000 troops along the border with Ukraine and has been moving tanks, infantry fighting vehicles, rocket launchers and other military equipment westward from their bases in its Far East, according to U.S. officials and social-media reports.

U.S. officials have pointed to Russia’s 2014 invasion and annexation of the Crimean Peninsula and fomenting of separatist war in eastern Ukraine, warning they are seeing the same signs of imminent conflict.

“That does give you an indication of all the preparations that are under way,” White House spokeswoman Jen Psaki said, adding that a potential invasion could begin by mid-February.

- 01/20/2022 – the historical all time high (about two times of that of year 2000) margin debt can be served as the biggest catalyst for market crash (and might be great for leveraged inversed ETFs)

The Latest Margin Data

FINRA has released new data for margin debt, now available through December. The latest debt level is down 0.93% month-over-month.

- 01/20/2022 – Russia alert !! “Uncertainty, ambiguity—this is part of his strategy,” The relative lack of consequences for previous actions may have emboldened Mr. Putin to keep raising the stakes. After all, he invaded Georgia in 2008, Ukraine in 2014, annexed Crimea the same year, and ordered alleged assassination plots abroad, such as the 2018 Novichok affair in England, with only limited Western sanctions.

Putin Loves to Roll the Dice. Ukraine Is His Biggest Gamble Yet. – WSJ

Former spy chief’s tolerance for risk is tested as he threatens a ground war unseen in Europe since the 1940s

Mr. Putin is clear about wishing to reassert Russia’s influence over its neighbors, particularly Ukraine. But he has cultivated an aura of unpredictability about his next moves. All along, pulling out tactical surprises has been a hallmark of his foreign policy, from annexing Ukraine’s Crimea peninsula to sending troops to Syria.

“Uncertainty, ambiguity—this is part of his strategy,” said Gleb Pavlovsky, a political scientist who advised the Kremlin between 1997 and 2011. “If everything is clear, then, as they say, whoever is forewarned is forearmed. If everything is clear, then immediately his ability to threaten falls.”

While Mr. Putin relies on the country’s military, intelligence and diplomatic establishment, he’s the one determining policy after having mastered details to a level few Western leaders do, according to foreign officials who have interacted with the Russian leader. This concentration of authority, they say, makes it even harder to analyze Russia’s future moves and predict Moscow’s real intentions.

“He is his own foreign minister and his own defense minister,” said former U.S. national security adviser John Bolton, who has met with Mr. Putin several times, including in Moscow in October 2018.

The relative lack of consequences for previous actions may have emboldened Mr. Putin to keep raising the stakes. After all, he invaded Georgia in 2008, Ukraine in 2014, annexed Crimea the same year, and ordered alleged assassination plots abroad, such as the 2018 Novichok affair in England, with only limited Western sanctions.

Ukraine Fears Minor Attacks Are in Russia’s Game Plan – WSJ

Foreign minister says President Biden’s ‘minor incursion’ comment plays down Moscow’s intentions, which Kyiv sees as destabilizing country, not invading

‘We should not give Putin the slightest chance to play with quasi-aggression or small-incursion operations. This aggression was there since 2014. This is the fact.’ — Ukrainian Foreign Minister Dmytro Kuleba

Oleksandr Danylyuk, Mr. Danilov’s predecessor, said that if Russia attacks it would likely pursue a large-scale offensive aimed at bringing Ukraine under Moscow’s control rather than just expanding the territory it already holds.

“Large aggression will scare the West, and they will be willing to talk,” Mr. Danylyuk said in an interview. “Small aggression will get big sanctions. The negative consequences will outweigh the advantages.”

Mr. Putin has two broad options, Mr. Danylyuk said. The first is a large-scale operation aimed at seizing the eastern half of Ukraine, toppling the government or forcing it to negotiate. The second is an attack using missiles and airstrikes to destroy military and transportation infrastructure. Such an approach would be less costly and strike where Kyiv is weak: its outdated air defense. “It was designed in the 1980s,” said Mr. Danylyuk. “It will not stop Russian aviation, which is state of the art, and missiles and even drones. It’s not designed for it.”

Biden Says Russia Likely to Move Against Ukraine, as Blinken Visits the Region – WSJ

Moscow has deployed forces to its ally Belarus, adding to the troops already positioned along Ukraine’s borders

Russia-Ukraine Border Crisis: Will Putin Invade Ukraine?

The U.S. has warned Moscow of sanctions in the event of an invasion

Russia hasn’t revealed much information about the scale of its troop deployment on the Ukrainian border. U.S. officials, however, say Mr. Putin is assembling a force that is expected to total 175,000 troops, giving him the means to order an invasion by early 2022. Citing new intelligence reports that include images from spy satellites, the officials say the Russian military buildup differs from an earlier massing of troops in the spring. When complete, they say, Russia’s deployment in the area will likely be twice as large. Russia has also embarked on a rapid mobilization of reservists and deployed troops and military assets to ally Belarus, which also shares a border with Ukraine.

Russia’s Military Buildup Near Ukraine Is an Open Secret – WSJ

Satellite images, social media posts and flight-tracking data allow private analysts to track details governments once classified

Biden Seeks to Reassure Ukraine, Vowing a Strong Response to Russia and Transferring Weapons – WSJ

President says any Russian troop movement into Ukraine would be considered an invasion, clarifying earlier remarks about a ‘minor incursion’

Biden Issues New Warning to Russia Over Invading Ukraine | World News | US News

U.S. President Joe Biden says any Russian troop movements across Ukraine’s border would constitute an invasion, saying Moscow would “pay a heavy price” for such an action.

- 01/18/2022 – Russia alert!

Putin Is Waging War on Europe – WSJ

His officials and media supporters have started talking openly about ‘military confrontation.’

What Does the Russian Ultimatum to the West Mean? | Desk Russie (desk-russie.eu)

Hence the approach of the Kremlin: “This is not a proposal for discussion, but an ultimatum — a demand for unconditional surrender. The West has no choice but to lose face — unless it stands proudly and goes to war with Russia. Judging by the way the West has begun to show disarray on the other side, they are well aware of this.” By threatening war, stresses RIA Novosti, “Moscow is emphasizing that Russia is ready — morally, technically, and in every other sense of the word — for any development of events. And the reputation it has earned in previous years confirms that the Russians will indeed be ready to use force if they deem it necessary. It is worth recalling the words of Vladimir Putin, who stated bluntly this summer that if Russia sank the British destroyer responsible for a provocation off the coast of Crimea, there would be no major consequences: the outcry of the world press should not be counted as such […] No, this time the West will pay with its own hands.”

White House warns Russian invasion of Ukraine may be imminent

Press secretary Jen Psaki warned that an “extremely dangerous situation” is building along the Ukrainian border where Russia is amassing troops.

The White House believes Russia could launch an invasion of Ukraine at any moment, press secretary Jen Psaki said Tuesday, warning that an “extremely dangerous situation” is building along the Ukrainian border.

“We believe we’re now at a stage where Russia could at any point launch an attack on Ukraine. I would say that’s more stark than we have been,” Psaki said during her daily press briefing.

The assessment comes as Secretary of State Antony Blinken travels to Ukraine this week to meet with Ukrainian President Volodymyr Zelenskyy. Blinken spoke with Russia’s foreign minister on Tuesday morning and the two plan to meet in Geneva, where he will urge Russia to “take immediate steps to de-escalate,” Psaki said.

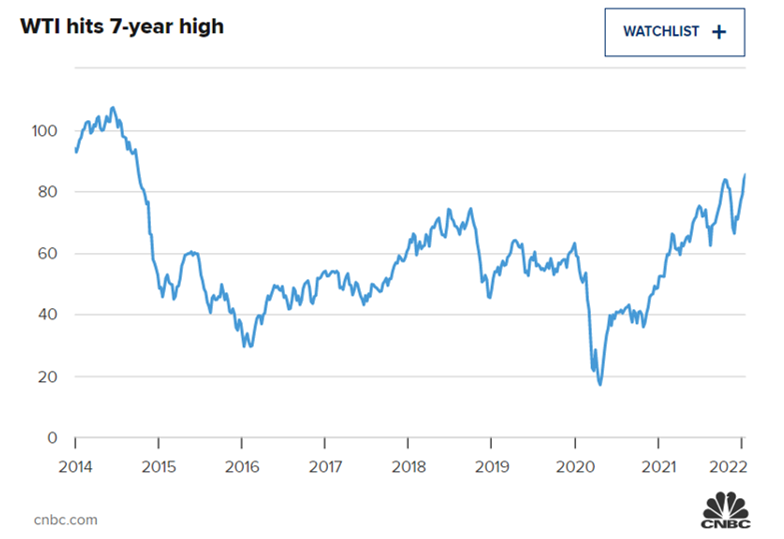

- 01/18/2022 – oil price to seven year high

Oil Prices Hit Seven-Year High on Rising Geopolitical Tensions – WSJ

Concerns over the Omicron variant and tensions in Europe and the Middle East are factors driving the rally

Among the factors driving the rally are concerns that tensions in the Middle East and Europe will spill into energy markets by denting supplies from major crude producers, particularly Russia and the United Arab Emirates. Any outages are likely to goose prices in a market where demand is rising and stockpiles have fallen below recent norms, traders and analysts say.

Adding to oil’s gains, the wave of infection caused by Omicron hasn’t reduced demand as much as traders thought it might when the variant was identified in late November. In a report published Tuesday, the Organization of the Petroleum Exporting Countries forecast that the world would consume 100.8 million barrels of oil a day this year, up 4.2 million barrels a day from 2021. The rise has been driven by rising demand for light distillates used in the petrochemical industry.

Investors are bidding up shares of energy companies, making the sector the best performer on the S&P 500 so far in 2022. Chevron Corp. has gained 9.9% and Exxon Mobil Corp. 17%.

- 01/17/2022 – to understand the history of oil price

World Oil Market and Oil Price Chronologies: 1970 – 2004

Oil Price History—Highs and Lows Since 1970

Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma (DCOILWTICO) – FRED

OPEC vs. the US: Who Controls Oil Prices?

Stocks of Total Crude Oil and Petroleum Products (Including SPR)

- 01/17/2022 – history of Russia’s invasion of Crimea

THE RUSSIAN INVASION OF THE CRIMEAN PENINSULA, 2014–2015

A Post–Cold War Nuclear Crisis Case Study

Annexation of Crimea by the Russian Federation

Everything you need to know about the Ukraine crisis

By Max Fishermax@vox.com Sep 3, 2014, 11:01am EDT

- 01/17/2022 – study of Russia’s invasion of Crimea and oil price

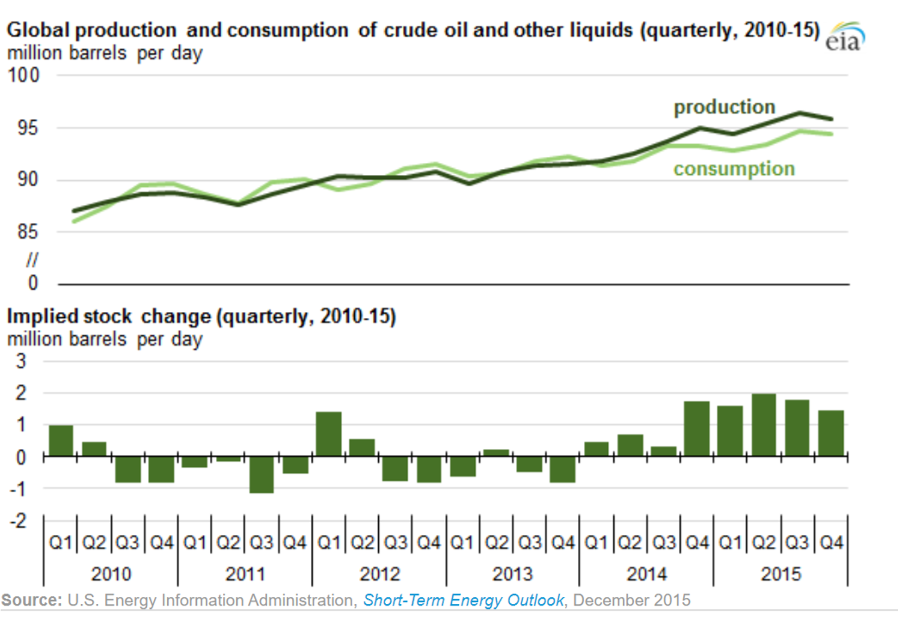

Why the Price of Crude Oil Dropped in 2015

- The year 2015 was a perfect storm for oil prices.

- The dollar was strong. Inventories were huge. The economy was weak. And production was growing.

- All of these factors drove the price of crude oil to less than $40 per barrel.

1. The Dollar Strengthens: In 2015, the dollar was at a 12-year high against the euro. The surge in the dollar in the second half of 2014 caused a rare sharp decline in all of the leading commodity indexes. Russia’s invasion of Crimea contributed the most to the $ strenghening.

2. OPEC Retains Production Levels. Prices of OPEC’s benchmark crude oil fell by a whopping 50% after the organization decided against cutting production at that 2014 meeting in Vienna.

OPEC, the cartel of oil producers that sets production levels, was unwilling to prop up the oil markets by cutting its production levels. The oil ministers said in a statement that they had “concurred that stable oil prices – at a level which did not affect global economic growth but which, at the same time, allowed producers to receive a decent income and to invest to meet future demand – were vital for world economic wellbeing.” Prices of OPEC’s benchmark crude oil fell by a whopping 50% after the organization decided against cutting production at that 2014 meeting in Vienna.

3. Global Inventory Grows: The prices of crude futures declined in late September 2015 when it became clear that oil stockpiles were growing amid increased production. The Energy Information Administration (EIA) reported that global oil inventories increased in every quarter of 2015, with a net inventory build of 1.72 million barrels per day. That was the highest rate since at least 1996. By the end of 2015, oil prices were below $40 per barrel, the lowest level since 2009.5. Total oil production by the end of 2015 was expected to increase to more than 9.35 million barrels per day—higher than previous forecasts of 9.3 million barrels per day.

U.S. highlights for 2015: As a result of lower crude oil prices, U.S. crude oil production began to decline in the second quarter of 2015. The decrease was led by reductions in Lower 48 onshore production, which began to fall in April. Despite the decline, production of crude oil averaged an estimated 9.3 million barrels per day (b/d) in 2015, a 7% increase over 2014 and the highest rate since 1972.

International highlights for 2015: EIA estimates that total Organization of the Petroleum Exporting Countries (OPEC) crude oil and other liquids production increased 3% to 37.4 million b/d in 2015, led by production growth in Iraq. At its December 4 meeting, OPEC members announced they “should continue to closely monitor developments in the coming months,” indicating that OPEC producers, led by Saudi Arabia, are continuing the policy of supporting production and defending market share in a low oil price environment. On July 14, the Joint Comprehensive Plan of Action (JCPOA) between Iran and the five permanent members of the United Nations Security Council and Germany (P5+1) was announced. The agreement could lead to sanctions relief, contingent on verification by the International Atomic Energy Agency (IAEA) that Iran has complied with key nuclear-related steps.

4. The Economy Weakens: While the supply of oil became increasingly abundant in 2015, global demand for oil was decreasing. The economies of Europe and developing countries were weakening. Vehicles were becoming more fuel-efficient. Meanwhile, China’s devaluation of its own currency suggested that its economy might be weakening as well.6 Since China is the world’s largest oil importer, that was a huge hit to global demand and caused a negative reaction in crude oil prices.

5. Iran Makes a Deal: In July 2015, the U.S. and several other world powers signed a deal that lifted economic sanctions against Iran. The Iran nuclear deal, as it became known, freed Iran to start exporting oil again. Investors feared it would add to the world’s oversupply of oil, dragging down prices even more. (Iran withdrew from the agreement in 2019 after then-President Donald Trump ordered the killing of Iranian General Qasem Soleimani. President Joe Biden has indicated a willingness to see it reinstated.)

Some predictions in March 2014 on oil price

How the Situation in Crimea Could Cause Oil Prices to Fall

By Rory Johnston – Mar 04, 2014, 4:03 PM CS

Moscow’s aggression in Crimea has markets in a panic and bulls predicting continued increases in the price of oil should tensions endure. Nonetheless, there is a chance that Russia’s Ukrainian incursion could result in the exact opposite effect—a decline in oil prices. There are two different ways the Crimean crisis could result in decreased prices: a positive supply shock from the American strategic petroleum reserve (SPR) and a negative demand shock from financially crippled emerging markets.

Ukraine War Could Cause Huge Oil Price Spike

The question is how much a war between Russia and Ukraine would move oil prices higher. There is no formula to count it. However, the more violent the conflict, the more likely that the move upward would be sharp

Crude oil in the United States currently trades at about $102 a barrel. It has bounced between that level and $90 for a year. So far, the $100 price has not effected gas, oil, and petrochemical prices enough to dent the economies of the developed nations. If the 2008 oil spike, which pushed crude above $120 a barrel for about three months, is any indication, GDP among these countries could be hurt by much higher prices. The victims would range from drivers to transportation companies and airlines. And the ripple caused by high petrochemical prices, which effect a broad range of industries, is too large to calculate.

Much higher oil prices are on the way if the situation in Ukraine gets much worse. Global GDP, the recovery of which is still fragile, probably faces a new hurdle.

- 01/14/2022 -Watch out Russia’s possible invasion

The Putin Puzzle: Why Ukraine? Why Now? – WSJ

Even dictators have domestic political considerations, and Putin has a long history of using an aggressive foreign policy to bolster his standing in Russia. Putin may hope that provoking a diplomatic crisis will win back the popularity he saw when Russians rallied around the flag in 2014.

Russia Moves More Weaponry Toward Ukraine, Keeps the West Guessing – WSJ

Tanks, missile launchers and other materiel are seen being shifted westward from bases in the Russian Far East

White House Says Russia Planning ‘False Flag’ Operation as Pretext for Invading Ukraine – WSJ

Press secretary Jen Psaki says U.S. sees signs invasion could come in matter of weeks

Here’s what a Russian invasion of Ukraine would mean for markets (msn.com)

“If Russia invades Ukraine, the trade is buy TY,” wrote Brent Donnelly, president of Spectra Markets, in a Friday note, referring to 10-year Treasury-note futures. rally in Treasurys would pull down yields, which move in the opposite direction of prices.

- 01/13/2022 – watch out Russia’s move on Ukraine. If Russia invades, US$ will jump, oil price will crash. Is this a good entry point?

Russia warns it will sever ties with the US if it sanctions Putin over Ukraine crisis (yahoo.com)

A top Russian diplomat on Thursday suggested there was no point in continuing to hold dialogue, as European leaders warned of the potential for war. Some US officials and experts have expressed concerns that Moscow could use the failed diplomatic talks as a pretext for an invasion.

Russia Suggests Military Deployment to Venezuela, Cuba if Tensions With U.S. Remain High – WSJ

Deputy foreign minister says Moscow couldn’t exclude sending military infrastructure to the two countries

Turmoil in Russian markets intensified on Thursday, with the ruble depreciating as much as 2.6% against the dollar and trading at 76.5 rubles to $1. Russian stocks and bonds also came under pressure.

“The market has suddenly gone from ignoring this to taking it very seriously,” said Paul McNamara, an emerging-market debt fund manager at GAM.

- 01/13/2022 – Commodity Prices Surge in 2021

The Periodic Table of Commodity Returns (2012-2021)

Commodity Prices Surge in 2021

After a strong performance from commodities (metals especially) in the year prior, 2021 was all about energy commodities.

The top three performers for 2021 were energy fuels, with coal providing the single best annual return of any commodity over the past 10 years at 160.6%. According to U.S. Global Investors, coal was also the least volatile commodity of 2021, meaning investors had a smooth ride as the fossil fuel surged in price.

| Commodity | 2021 Returns |

|---|---|

| Coal | 160.61% |

| Crude Oil | 55.01% |

| Gas | 46.91% |

| Aluminum | 42.18% |

| Zinc | 31.53% |

| Nickel | 26.14% |

| Copper | 25.70% |

| Corn | 22.57% |

| Wheat | 20.34% |

| Lead | 18.32% |

| Gold | -3.64% |

| Platinum | -9.64% |

| Silver | -11.72% |

| Palladium | -22.21% |

Source: U.S. Global Investors

The only commodities in the red this year were precious metals, which failed to stay positive despite rising inflation across goods and asset prices. Gold and silver had returns of -3.6% and -11.7% respectively, with platinum returning -9.6% and palladium, the worst performing commodity of 2021, at -22.2%.

- 01/10/2022 – Oil Eases as Kazakhstan Unrest Abates

Russian President Vladimir Putin Monday told the governments of former Soviet states they could count on Moscow to protect them against popular uprisings, as the capital of Kazakhstan seemed to be returning to near-normal after a week of unrest.

Kazakhstan is a major oil producer, with output at a current 1.6 million barrels a day. Crude prices were down slightly on Monday after increasing more than 5% in the course of last week.

- 01/10/2022 – Barron’s calling for $100 oil and one great comment from a viewer:

The real long term problem is that western economies have been generously funding oil exploration for nearly a century. This is now fundamentally changing with many western oil companies shifting investment to renewable energy and of course western banks less likely to continue lending for fossil fuel extraction projects. Then you have an industry that is heavily indebted. The western leaders have already told the fossil fuel industry you are going out of business in 30 years! So without the prospects of continued production or even growth, all of that debt is going to have to get paid off over that time period, further, investors who were happy to burn over $300B investing in US shale from 2015-2020 because they were rewarded with higher stock prices will now also want their money back and that is not just the $300B, that is also with interest. These are all major dynamics that are going to result in a massive under investment in oil and gas extraction over the next decades and keep OPEC in charge. OPEC will need even higher prices because they won’t be able to self finance without it if western banks stiff them.

Bets Are Rolling In Again for $100 Oil

There are several reasons for the resurgent bullishness. For one thing, oil prices and stocks have proven resilient over the past year. Unlike in previous years, producers have stayed disciplined, choosing not to ramp up drilling to take advantage of higher prices.

That outperformance, and a general sense that the energy transition will take time, has made “old energy” stocks “relevant again,” Bank of America analyst Doug Leggate wrote on Monday. He expects the stocks to regain their 5% weight in the S&P 500, down from a double-digit weighting more than a decade ago, but up from their 2% weighting at their lows in 2020.

And while the oil market faces both bullish and bearish risks, the bullish ones are more apparent today.

For instance, several geopolitical risks could force prices higher. Russia’s military buildup on the Ukraine border has major implications for oil and gas prices. If Russia invades, oil prices would almost certainly spike as countries around the world impose punitive sanctions on the country. Tran calls it “a buy now, ask questions later type of event risk for the oil market” and expects that an invasion would force average oil prices up $6.40 a barrel in the second quarter.

Production and exports are at risk in other countries also. Libyan production has declined recently after infrastructure was damaged. And it’s not clear if the U.S. and Iran will come to an agreement on a new nuclear deal and lift sanctions for oil exports. Analysts had been optimistic about a deal last year, but hopes have faded as talks stalled.

In general, there is increasing anxiety that supply is growing too slowly, and that OPEC doesn’t have enough spare capacity to send throughout the world if demand starts to exceed prepandemic levels. Tran doesn’t think OPEC and its allies (known as OPEC+) have been adding supply as quickly as the group had projected.

“OPEC+ remain steadfast in adding 400 kb/d back to the market each month, but our data suggests that monthly additions tally closer to 250 kb/d,” Tran wrote. “This amalgamates to 14 million missing barrels last quarter that were penciled into balances that have simply not shown up.”

More evidence of a supply shortfall would be extremely bullish for oil prices. The more that countries have to compete for every barrel of exports, the higher prices could go.

- 01/03/2022 – watch out the possible Iran production increase by the middle of 2023

How Iran Could Trigger The Next 10 Percent Drop In Oil Prices

- Iran announced plans last week to boost oil production from its supergiant South Azadegan oil field to at least 320,000 barrels per day

- The development of the West Karoun fields are instrumental to the 25-year deal between Iran and China

- The impact of additional Iran crude flows on global oil prices could be significant against a background of uncertain demand in the coming months

- Given ongoing high and steady sales of crude oil to China and other Asian countries and the likelihood of a new iteration of the Joint Comprehensive Plan of Action (JCPOA) being agreed with the U.S. at some point this year, Iran announced plans last week to boost oil production from its supergiant South Azadegan oil field to at least 320,000 barrels per day (bpd) by the middle of 2023, from the current 140,000 bpd.

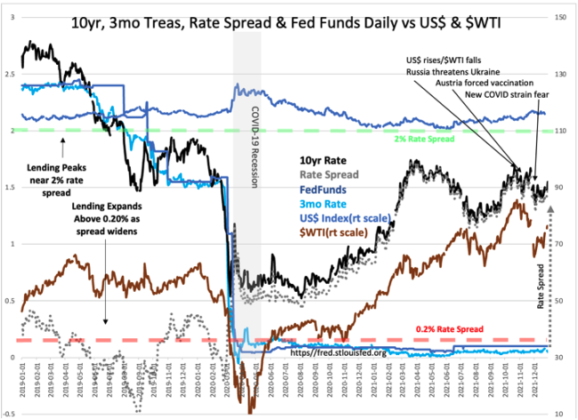

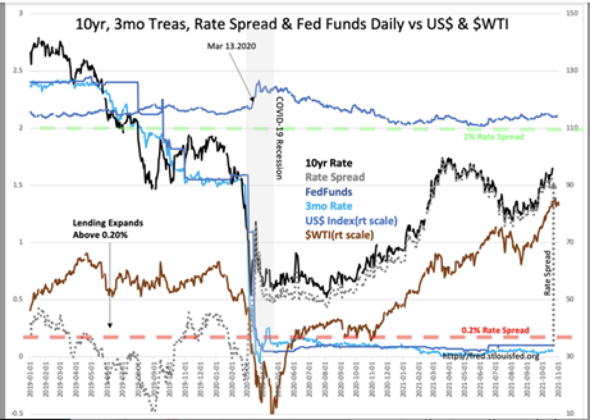

- 01/03/2022 – The rising rate spread of the moment indicates greater liquidity is present than a few weeks ago. Events which turn into ‘Black Swans’ historically have had little long-term impact unless liquidity is low. At the moment liquidity is high and rising. On the horizon remains the likelihood that Russia will invade Ukraine and cause another shock to those not paying attention.

That sloshing sound is the Trillions globally pumped into markets…

“Davidson” submits:

Liquidity reigns! Liquidity as reflected in the T-Bill/10yr Treas rate spread has a long history(from 1953) of indicating the market’s ability(in fact it is investor ability to wait out market shocks) to adjust to major events. Rising rates and rising $WTI, reversing the declines beginning early Nov 2021 in response to multiple threats 1st Russia, followed by Omicron and lockdowns in Austria, Australia and etc., indicate investor psychology has recovered.

On the horizon remains the likelihood that Russia will invade Ukraine and cause another shock to those not paying attention. Russia invading Ukraine to some degree has already been absorbed into market thinking and not likely to be as significant as if it occurred unexpectedly. Nonetheless, it will still have an impact of unpredictable consequence even if expected but adequate liquidity is present to ease markets through it. The rising rate spread of the moment indicates greater liquidity is present than a few weeks ago. Events which turn into ‘Black Swans’ historically have had little long-term impact unless liquidity is low. At the moment liquidity is high and rising.

The S&P 500 Energy Index (NYSEARCA:XLE) finishes as the top sector performer for 2021, surging more than 47% after dragging along the bottom a year earlier with a 37% loss.