A lot of great information on BABA, score 3.7/5

Potential upcoming catalysts

- holiday season for e-commerce companies

- end of release of regulatory laws. Chinese government’s crack down on big tech might come to end by the end of the year

- reconfiguring growth and household properties will be shift to equities. cash flows will be substantially higher.

- IPO of Ant’s financial (one news here)

- 中金:北京证券交易所宣布设立,中国资本市场迎来新格局

- upcoming Biden-Xi summit by end of the year

- One Upside to Economic Woes May Be China-U.S. Thaw

Strong exports and weak domestic demand in China, paired with scarce goods and inflation in the U.S., underline the two economies’ mutual dependency - Jack Ma reappears in Hong Kong

- The Biden administration has continued the tough public façade of confronting China on trade.

- China to relief and abandon CV-zero Policies

- relief of Chinese real estate market crisis

- The pursuit of COVID-zero and the consequential lockdowns sparked panic-buying, boosting online sales

- With Xi Jinping’s third-term re-election largely assured, investors could also be relieved by a likely continuation of an administration they are familiar with.

Risks

- delisting of China stocks from us market

- downfall of China economy

- bad outcome from upcoming Biden-Xi summit

- fraud is uncovered in Chinese stocks and crash the stock price. Possibly in specific stocks, hard on all stocks

- VIE cancellation – biggest risk

- Real estate property market will drag down the whole economy (Property accounts for about 70% to 80% of household wealth in China, and drives about 10% of household income, according to Moody’s.)

- In China, War and Stagflation Jitters May Permanently Damage the Market

- a new draft of China’s overseas listing rules that may be finalized as soon as this month

- SEC might delist VIE stock, SEC warns of investment risks. Aug 17, 2021, SEC Chairman Gary Gensler issued his most direct warning yet about investing in Chinese companies, reiterating a call for more disclosures of risks. “When American investors think we’re investing in a Chinese company, it’s much more likely that we’re actually investing in a company in the Cayman Islands,” he said in a video message. “In certain sectors like technology and the internet, the government of China actually doesn’t allow ownership and investment from people outside of China. To get around this, China-based. operating companies establish contracts with shell companies in other countries.” Outlook: Gensler is asking SEC staff to take “a pause, for now” in approving IPOs of shell companies that Chinese firms use to list shares in the U.S. He also wants investors to have more information about how those firms are structured and what money is flowing between the Cayman Islands and China. “That means disclosing the political and regulatory risk that the government of China could, as they’ve done a number of times recently, significantly change the rules in the middle of the game.”

-

*********************************************************************************

- 02/24/2023 –

Spy Balloon Fallout Highlights Fragility Of U.S.-China Relations

Xi has promoted an economic strategy of “dual circulation,” emphasizing self-reliance and leveraging the country’s massive market to generate GDP growth.

US-China relations are heading towards an irreversible downward spiral, with Washington sanctioning more Chinese firms with alleged ties to military intelligence.

President Biden has been criticized by Republican members of Congress for being too soft on China and may be inclined to further strengthen the U.S.’s “anti-China” containment policy.

- 01/30/2023 – China’s PMI comes bakc?

China’s factory activity likely contracted more slowly in January: Reuters poll

China’s factory activity in January is expected to have contracted more slowly than in December, a Reuters poll showed on Monday, with production hampered as workers continued to fall sick after the government dismantled its “zero-COVID” regime.”

“Early signs suggest that conditions improved in January,” according to a note from Capital Economics, “and any lingering supply-side issues will matter less at a time of year when factories wind down production in any case,” they added while forecasting a PMI reading of 50.0.

The world’s second-largest economy continues to face major external headwinds on the demand-side, however, with China’s export-orientated manufacturers continuing to report shrinking order books as fears of a global recession linger.

China’s cabinet pledged on Saturday to boost consumption as to help drive the economy’s recovery. Over the Lunar New Year holiday, consumption increased 12.2% on the same period last year despite concerns that the services sector might be hobbled by staff shortages resulting from COVID.

China aims to boost consumption and imports as global demand cools

China’s cabinet said on Saturday it would promote a consumption recovery as the major driver of the economy and boost imports, state broadcaster CCTV reported, at a time of cooling global demand as major economies teeter on the brink of recession.

At a meeting chaired by Premier Li Keqiang, China’s state council – which functions as the cabinet – also vowed to speed up the rollout of foreign investment projects, maintain a stable yuan, ease cross-border travel and help companies to participate in domestic and overseas trade shows.

- Many of the largest Chinese e-commerce companies found themselves in the sights of the U.S. Trade Representative, Thursday, due to their alleged roles in the buying and selling of counterfeit goods online.

- Affiliates of Alibaba (NYSE:BABA) and Baidu (NASDAQ:BIDU), as well as PinDuoDuo (NASDAQ:PDD) were among those companies on the latest “notorious markets” list by the Office of the United States Trade Representative [USTR], Ambassador Katherine Tai. The list includes 42 online sites, and 35 traditional outlets that Tai said are involved in “substantial trademark counterfeiting” and copyright piracy.

- 02/16/2022 – Appaloosa sold all 525,000 shares of Alibaba (BABA, Financial), trimming 1.85% of its equity portfolio.

David Tepper Drives Into General Motors, Boots Alibaba

- 01/19/2022 – China cuts benchmark rates twice on Monday and Thursday, and more to come in the coming months, in order to bolster its economy. Enshrined stability as the “top priority” for China’s economy in 2022, in a meeting chaired by Mr. Xi. In face of downward economic pressure, China’s top economic planning agency, the National Development and Reform Commission, said Tuesday that Beijing is expediting the rollout of major infrastructure projects to counter uncertainties early in the year. – all these will be good tailwinds for CWEB and global energy market

China Cuts Benchmark Rates to Bolster Flagging Economy – WSJ

Move follows raft of economic data released by China that showed slowing growth in final months of 2021

China’s central bank lowered its benchmark lending rates, stepping in to support a slowing economy that has been weighed down by a slump in the property market during a politically important year for leader Xi Jinping.

The People’s Bank of China said Thursday that it cut its five-year loan prime rate, a benchmark for medium- and longer-term loans including mortgages, to 4.60% from 4.65%—the first such cut since April 2020. The Chinese central bank also lowered the one-year loan prime rate by 10 basis points to 3.70%, the second cut to that rate in as many months.

The moves were widely expected by analysts and traders after the central bank on Monday lowered rates on its one-year medium-term lending facility by 10 basis points, to 2.85%, underscoring Beijing’s shift to a looser policy stance as economic clouds gather.

“China’s easing cycle is in full swing now,” Sheana Yue, a Singapore-based economist at Capital Economics, told clients in a note Thursday. Ms. Yue predicted that the central bank would continue to slash rates in the coming months, which in turn would help to shore up housing demand.

On Sunday, China’s top law-enforcement body issued a rare warning about the political implications of domestic economic weakness, warning that, “with the economic downturn, some deep-seated problems may surface.”

“Once economic and financial risks are mishandled, they can easily be transmitted into the social and political sphere,” read the commentary, which was published by the Communist Party’s Central Political and Legal Affairs Commission, which oversees the country’s police, prosecutors and courts.

Last month, the Communist Party’s top decision-making body, the Politburo, enshrined stability as the “top priority” for China’s economy in 2022, in a meeting chaired by Mr. Xi.

In face of downward economic pressure, China’s top economic planning agency, the National Development and Reform Commission, said Tuesday that Beijing is expediting the rollout of major infrastructure projects to counter uncertainties early in the year.

Economists at investment bank Nomura are worried about the rising economic and social costs of China’s zero-tolerance Covid containment strategy, as well as the weak property market and slowing export growth. They say that a much more aggressive easing policy is needed to keep the economic recovery on track.

As it is, the easing bias of China’s central bank contrasts with the policy direction of the Federal Reserve and other developed-world central banks, which are preparing to wind down pandemic-era stimulus to curb high inflation.

Alibaba, JD.com rally as China’s central bank cuts key interest rate

- Chinese Internet stocks surged Thursday, as an interest rate cut by China’s central bank spurred a rally among the likes of Alibaba, JD.com and Weibo.

- Prior to U.S. stock market opening, the People’s Bank of China cut its one-year loan prime rate for the second time this month, to 3.7%, in an effort to relax the country’s economic policies. The move had an immediate effect on China’s leading Internet and tech companies, which often react to new Beijing economic measures.

- Evidence of that was seen in Alibaba (NYSE:BABA), as its shares climbed more than 5%; JD.com (NASDAQ:JD), up by 10.4%; Baidu (NASDAQ:BIDU), which rose almost 6%; DiDi Global (NYSE:DIDI), up almost 7%, and Tencent Holdings (OTCPK:TCEHY) and Weibo (NASDAQ:WB), both of which climbed more than 6%.

- The KraneShares CSI China Internet ETF (NYSEARCA:KWEB) was also on the rise and up by more than 7%.

- On Wednesday, the Cyberspace Administration of China denied a report that it would require the country’s Internet companies to get regulatory approval before making investments or raising new funding.

The Communist Party of China (CPC) will convene the 20th National Congress of the CPC in Beijing in the second half of 2022, according to a communique released on Thursday.

- 01/17/2022 – Xi’s new policies

From 6G to big data, China is looking to boost tech’s share of its economy

- China is aiming for 10% of its gross domestic product to come from the digital economy by 2025, up from 7.8% in 2020.

- As part of its 14th Five Year Plan, Beijing says that this will come from technologies like big data and 6G mobile internet, even though that is some years away.

- The ambition highlights China’s push to get ahead in new technology as it continues a rivalry with the U.S. in areas from semiconductors to artificial intelligence.

China’s Xi says countries must abandon ‘Cold War mentality,’ warns against confrontation

- Speaking via videoconference at The Davos Agenda virtual event, Xi said: “We need to discard Cold War mentality and seek peaceful co-existence and win-win outcomes.”

- Beijing and Washington’s tense relationship over Taiwan has been identified as a top risk for Asia this year, while one of the region’s top experts has previously warned China’s “disturbing” crackdown on U.S.-listed China stocks could be interpreted as the early stages of a Cold War.

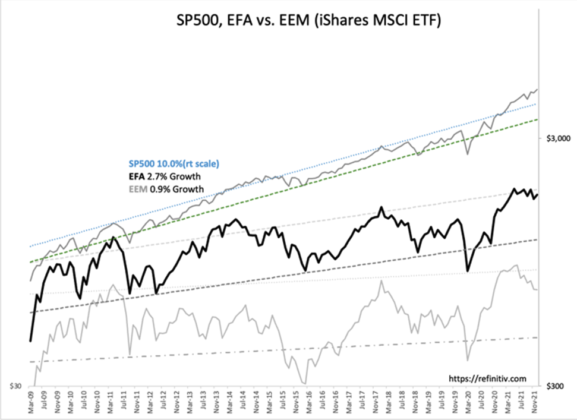

- 01/03/2022 – Davidson is right, I should not be tempted to invest in emergent stocks (such as Chinese stocks) because what is not considered is the risk to private property which is considerably higher in countries like China, Venezuela, Turkey, Russia and etc. Investors take this into consideration and have favored the US over EFA(developed but leaning socialistic) and EMM(often non-democratic authoritarian) at risk of unexpected government confiscation. I should have sticked to the US.

Stick to the US – “Davidson” submits:

In 2014 the data emerged which supported the recommendation that investors focus solely on US based companies. The basis for this was the monthly chart SP500, EFA vs EEM. With the SP500 performance vastly better than EFA and EMM since then, the same recommendation is renewed today.

Consensus opinion today recommends 40% of portfolios should be placed in EEM(Emerging Markets). It is worth examining why the asset class is viewed as undervalued and offering higher than average growth when the historical data does not support this perception. One needs to do some digging and have enough experience to puzzle-out this bit of cognitive dissonance. It is a similar narrative that has been repeated multiple times by the many pundits in the media. They accepted an earlier view that seemed reasonable at the time and developed products to take advantage of new-found opportunity, it seems no one applied hindsight to reassess the initial point of view as the data emerged to reveal that the outcome has failed to meet expectation. It is worth asking the question, “Why continue to recommend International investing when the US has such outperformance?”

The financial industry (it is an industry) like any industry seeks to maximize returns and minimize risks. The emergence of Modern Portfolio Theory(MPT) in 1952, a purely mathematical approach based on statistical analysis of prices, sought to eliminate faulty human judgement in the investment process. With the growth of employee retirement plans emerging post-WWII, the corporate responsibility to produce acceptable results grew significantly as did the risk of failure and subsequent liabilities. The business, social and political risks were rising sharply as faulty investment judgement paved the path towards financial self-immolation. MPT coming out of academia with Harry Markowitz and others eventually receiving the 1990 Nobel Prize in Economics gradually became the basis for all business education programs. As a mathematical construct, it could be defined and taught in graduate programs and became a significant offering for universities. Applying MPT to investment management mostly eliminated human judgement which in turn lowered liability exposure. When markets corrected, the ensuing investor lawsuits experienced lower success rates with MPT’s academic and Nobel Prize backing. As investment fees became more competitive, firms lower overall cost of business implementing MPT. Financial Planning now a ubiquitous product is based on MPT with many firms assuring investors they will have successful outcomes, something they would have never contemplated advertising 20yrs ago. Human judgement has been replaced by computer analysis.

So…“Why continue to recommend International investing when the US has such outperformance?” The basis for this recommendation lays in a simple belief long held and embedded in MPT’s mathematical model: Smaller = Higher Growth It is the consensus view that smaller companies grow faster than larger companies. That view, based on experience in the US, has been translated globally without any other consideration. In general smaller companies do grow faster than significantly larger companies. It is easier to double revenue when a company is very small just beginning to offer its products vs a long-established company with an existing and successful market position. The issue occurs when making broad top-down assumptions and not reassessing one’s position after one has expanded into unfamiliar markets believing the rules are universal. MPT basically recommends EMG on market capitalization. EMG companies are proportionately smaller and should have higher growth. The recommendation is further supported by EEM companies having lower P/Es and lower Pr/Cash Flow ratios vs US companies. What is not considered is the risk to private property which is considerably higher in countries like China, Venezuela, Turkey, Russia and etc. Investors take this into consideration and have favored the US over EFA(developed but leaning socialistic) and EMM(often non-democratic authoritarian) at risk of unexpected government confiscation. The belief that mathematics and computer analysis reveal investment opportunities better than human judgement is one of those perceptions that fails the test of reality.

When investing one must always, always review initial assumptions and expectations. New data emerges daily that either supports one’s original thought process or looks very different in light of hindsight. The perception behind the consensus recommendation of 40% portfolio exposure to EEM is not supported by the data. The SP500 has a growth rate of 10x+ that of EEM and ~4x that the EFA. The recommendation has been and continues to be, avoid International investing as the risk/return is unfavorable relative to the US.

- 12/26/2021 – seems like positive news from official CSRC – 1. If complying with domestic laws and regulations, companies with VIE structure are eligible to list overseas after filing with the CSRC. 2. We will adhere to the “Grandfathering principle”, prioritize stability while pursing progress, and ensure the smooth and steady implementation of the filing system. The institutional design is as follows: First, we will start applying the filing requirements to new offerings and listings. Only new initial public offerings and refinancing by existent overseas listed Chinese companies will be required to go through the filing process; other existent overseas listed companies will be allowed sufficient transition period to complete their filing procedures. Second, we will differentiate between initial public offering and refinancing. We have fully taken into account the efficiency of refinancing in overseas markets. 3. The highly globalized capital markets in today’s world call for closer cooperation and policy communication among regulators in different jurisdictions. Going ahead, the CSRC will further promote cross-border securities regulatory cooperation with our international counterparts. Firstly, we will enhance information sharing by establishing a filing information relaying mechanism. Secondly, we will step up cross-border enforcement cooperation and form synergies in cracking down on violations of laws and regulations such as financial fraud, so as to safeguard fairness, maintain market order, and protect the legitimate rights of global investors. Thirdly, we will proactively promote cross-border cooperation in audit supervision, so as to create a sound regulatory environment for overseas listings.

Relevant Officials of the CSRC Answered Reporter Questions

Dec.23.2021

On December 24, 2021, the CSRC issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments, hereinafter referred to as the “Administration Provisions”) and the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments, hereinafter referred to as the “Measures”), which are now open for public comments. The reporter interviewed relevant officials of the CSRC regarding the consultation.

1. Reporter: What is the background for improving the regulatory system for overseas offering and listing of Chinese companies?

Official: Opening-up is the basic state policy of China. In recent years, the opening-up of China’s capital markets has been steady and fast, with an increasing number of Chinese companies listed in overseas markets such as Hong Kong SAR, New York, London in direct or indirect forms. Overseas listings have played a positive role in supporting Chinese companies to utilize foreign capital, enhance corporate governance, and deeply integrate into the global economy. While Chinese companies listed overseas have greatly contributed to the economic development and social prosperity of China, both domestic and overseas investors have shared the dividends of China’s sustained and steady economic growth by investing in Chinese companies listed overseas.

As the opening-up of China’s capital markets continues to deepen, the initiative to improve the regulatory system for overseas listings has been proposed with the purpose of promoting the sound, sustainable and long-term development of Chinese companies listed overseas. The current legal basis for the regulation of overseas listings is the Special Provisions of the State Council Concerning the Overseas Securities Offering and Listing by Limited Stock Companies (No. 160 Order of the State Council, hereinafter referred to as the “Special Provisions”), which was formulated at the early stage of China’s capital markets and has lagged behind the demand of market development and high-level opening-up. The revised Securities Law of the People’s Republic of China (hereinafter referred to as the “Securities Law”) amended in December 2019 stipulates that direct or indirect overseas listings should comply with relevant provisions of the State Council. Companies, intermediaries and other relevant parties are also paying close attention to how the regulatory system for overseas listings will be improved and reformed, and are expecting the rules specifying relevant procedures and requirements to be released timely by the government in order to enhance overseas listings compliance with laws and regulations.

Against such backdrop, after reviewing and assessing the implementation of the Special Provisions, the CSRC, in coordination with other relevant government authorities, have extended proposals to comprehensively revise the Special Provisions and formulate new regulations of direct or indirect overseas listings, hence drafted the Administration Provisions and the supporting Measures, aiming at addressing the existing weaknesses of the system and meeting the demand of market development.

Moving forward, after the two rules are implemented upon completion of public consultation and due legislative procedures, the CSRC will formulate and issue guidance for filing procedures to further specify the details of filing administration and ensure that market entities could refer to clear guidelines for filing.

2. Reporter: What are the purposes for improving the regulatory system for overseas listings?

Official: Improving the regulatory system for overseas listings is not only a pragmatic measure to expand the opening-up of the capital markets and bolster the “dual circulation” development paradigm, but also a demonstration of China’s determination to deepen the reforms to streamline administration, delegate powers and improve regulation and services.

First, it can meet the demand of supporting Chinese companies to raise capital in overseas markets in compliance with laws and regulations. The CSRC and relevant government authorities in China fully respect companies’ own choices for listing venues, and such attitude is consistent, clear, and unswerving. Looking ahead, neither the trend of expanding opening-up nor the attitude of supporting companies to utilize both domestic and international resources will be altered. Improving the regulatory system for overseas listings is not to tighten up regulatory policies for overseas listings. We stay committed to seeking development through opening-up, and promoting development through improving regulation. We will strive to maintain effective channels for overseas capital-raising , and provide companies with clear, transparent and operable rules for overseas listings, and a more stable and predictable institutional environment.

Second, it can meet the demand of promoting an institution-based high-level opening-up. Overseas listings is an important part of the two-way opening-up of China’s capital markets, and thus overseas-listed companies should meet the requirements of high-quality development. Complying with the laws and regulations of China is the basic requirement for Chinese companies, no matter in which market they choose to be listed. In recent years, some specific overseas-listed Chinese companies have committed serious violations of laws and regulations such as accounting frauds, which have damaged the international reputation of Chinese companies and negatively impacted their overseas financing activities. Through improving the regulatory system for overseas listings, security can be better ensured while achieving development and opening-up, and the overall regulatory compliance of overseas-listed Chinese companies can be enhanced, which is conducive to allowing overseas listings to enable technological advancements and bolster the growth and international competitiveness of Chinese companies, promoting legitimate rights of global investors, and ensuring a regulated, sound and orderly development of overseas listings.

Third, this is in line with the reforms to streamline administration, delegate powers and improve regulation and services. Over the recent years, CSRC has been pushing forward reforms to better regulate overseas listings of Chinese companies, by streamlining application procedures and requirements, as well as substantially shortening the approval cycle. Such reforms have yielded positive results. Under the newly established filing system, CSRC will not examine whether companies meet the listing requirements and conditions of the host overseas market; nor will the CSRC conduct any such examination or investigation in disguised forms. Rather, we will strive to strengthen domestic and cross-border regulatory cooperation and hold market entities accountable for compliance with laws and regulations. We will continue to open up and invigorate the market while standardizing our regulations, in order to better regulate overseas listings of Chinese companies.

3. Reporter: Please introduce the implementation steps of overseas listing filings and relevant arrangements for smooth and orderly implementation, such as transition period.

Official: We will adhere to the “Grandfathering principle”, prioritize stability while pursing progress, and ensure the smooth and steady implementation of the filing system.

The institutional design is as follows: First, we will start applying the filing requirements to new offerings and listings. Only new initial public offerings and refinancing by existent overseas listed Chinese companies will be required to go through the filing process; other existent overseas listed companies will be allowed sufficient transition period to complete their filing procedures. Second, we will differentiate between initial public offering and refinancing. We have fully taken into account the efficiency of refinancing in overseas markets. Hence, different institutional arrangements have been made for refinancing in terms of filing time and filing material requirements, which will match with the normal practices of overseas markets and reduce the impact on financing activities of overseas listed companies.

4. Reporter: Please introduce the main filing process for overseas listings.

Official: The CSRC’s filing system will focus on compliance issues of domestic companies, while the filing procedures and material requirements will be based on necessity and rationality. The filing process is expected to be more efficient than the current administrative approval process, so as to reduce excessive burden on companies. According to the filing requirements, companies are obliged to submit compliance reports, while their intermediaries must issue necessary verification materials. The CSRC will issue filing notice within 20 working days upon receiving complete and compliant filing materials. If relevant information in the filing materials are deemed incomplete or insufficient, companies will be requested to submit supplementary materials or explanation. According to the information reflected in the materials, the CSRC may solicit opinions from relevant authorities where necessary. The solicitation time will be excluded from the filing period. Feedback of relevant authorities will be conveyed to the applicant timely.

5. Reporter: Please introduce considerations with respect to domestic cross-departmental regulatory coordination under the filing system.

Official: In order to successfully implement the filing system, the CSRC will work closely with other domestic regulatory authorities responsible for relevant industries and sectors in creating a regulatory coordination mechanism in order to strengthen policy coherence, information sharing and regulatory collaboration. To alleviate regulatory burdens on companies, companies will not be requested to obtain permits or approvals from various authorities.

First, where the authority of a specific industry clearly requests in its rules and regulations that a company undergo certain regulatory procedures prior to overseas listing, the company shall obtain such regulatory opinions, filing records, or approval from the authority before submitting the filing application with the CSRC. For instance, according to the “Measures for the Implementation of Administrative Licensing Matters for Chinese Commercial Banks”, Chinese commercial banks are obliged to seek approval from the banking regulatory authorities prior to overseas listings.

Second, in accordance with the Administration Provisions, the CSRC will take the lead in establishing a cross-departmental supervisory coordination mechanism for overseas listings. Upon receiving filing applications, the CSRC will proactively communicate with relevant regulatory authorities or solicit opinions to improve filing efficiency. In addition, the CSRC will support and cooperate with relevant authorities to jointly clarify the rules and regulations of certain sectors, in order to enhance policy predictability.

Last but not least, companies that fall within the scope of security reviews in accordance with relevant laws and regulations, such as foreign investment security and cyber security reviews, shall declare and undergo security review procedures before submitting filing applications.

6. Reporter: What are the considerations around improving cross-border cooperation in securities regulation?

Official: The highly globalized capital markets in today’s world call for closer cooperation and policy communication among regulators in different jurisdictions. Going ahead, the CSRC will further promote cross-border securities regulatory cooperation with our international counterparts. Firstly, we will enhance information sharing by establishing a filing information relaying mechanism. Secondly, we will step up cross-border enforcement cooperation and form synergies in cracking down on violations of laws and regulations such as financial fraud, so as to safeguard fairness, maintain market order, and protect the legitimate rights of global investors. Thirdly, we will proactively promote cross-border cooperation in audit supervision, so as to create a sound regulatory environment for overseas listings.

7. Reporter: What’s CSRC’s attitude toward overseas listings of companies with VIE structure?

Official: If complying with domestic laws and regulations, companies with VIE structure are eligible to list overseas after filing with the CSRC.

- 12/26/2021 – also positive news reported from WSJ. The China Securities Regulatory Commission said the draft rules aren’t meant to tighten policies for overseas listings, though it also stressed that companies listed overseas can’t leak state secrets and that they must follow domestic regulations such as foreign-investment, cybersecurity and data-security laws. It is seeking public consultation until Jan. 23. The rules also blessed the structure known as variable-interest entity, or VIE,

China’s Securities Regulator Lays Out Overseas Listing Rules – WSJ

The draft framework aims for clarity following Beijing’s crackdown on overseas listings by Chinese companies

China’s securities regulator said domestic companies seeking to sell shares abroad would have to follow domestic rules and file for local registration, in a draft framework meant to clarify proceedings in a market rocked by the state’s crackdown on overseas listings.

The draft rules, released on Friday, follow a nearly six-month pause in Chinese listings in the U.S., since the ill-fated New York initial public offering for ride-hailing giant Didi Global Inc. DIDI -0.53% In July, the Chinese government punished Didi for front-running domestic regulations and subsequently said it would install guidelines for Chinese companies selling shares overseas. Companies have put on hold their listing plans pending more regulatory clarity from Beijing.

The China Securities Regulatory Commission said the draft rules aren’t meant to tighten policies for overseas listings, though it also stressed that companies listed overseas can’t leak state secrets and that they must follow domestic regulations such as foreign-investment, cybersecurity and data-security laws. It is seeking public consultation until Jan. 23.

The rules also blessed the structure known as variable-interest entity, or VIE, which has been used since the early 2000s by virtually every Chinese internet company to get around China’s restrictions on foreign investments in domestic businesses. The regulator said on Friday that companies can sell shares abroad using the VIE structure provided they abide by domestic laws and register with the CSRC first.

The regulator seems to be trying to create a more efficient domestic system for Chinese companies that are trying to raise capital overseas, said Jason Elder, a capital-markets lawyer at Mayer Brown LLP who has worked on deals involving Chinese companies. He added that the framework will ultimately depend on the CSRC’s final guidance.

“What they’re not pushing toward is a further delinking or decoupling with the global financial system, but they’re rather recognizing that their regulatory environment could be improved to provide more certainty that companies listing overseas are complying with domestic laws,” Mr. Elder said.

The rules will first apply to those companies that are seeking to sell shares abroad and will be also applied to those seeking secondary listings, backdoor listings or listings via special-purpose acquisition companies. For those that are already listed overseas, there will be a grace period of unspecified duration, the CSRC said.

A company would need to file for a registration with the CSRC within three working days after filing for an overseas IPO. International banks that act as sponsors or lead underwriters of Chinese companies’ overseas listings are also required to register with the CSRC.

The development of the draft rules aims to provide a clearer framework for overseas listing and promote a stable and predictable policy environment, the CSRC said. It added that it has always supported Chinese companies choosing listing destinations of their own.

The language used to describe the process of getting the nod from the CSRC for overseas listing is “registration,” which in the domestic market hints at a friendly tone and typically indicates that the regulator will check only the completeness of the companies’ disclosure and if there are major compliance or legal issues.

In the U.S., securities regulators have started a countdown that will force many Chinese companies to leave American stock exchanges. In late 2020, then-President Donald Trump signed a law that bans the trading of securities in foreign companies whose audit working papers can’t be inspected by U.S. regulators for three years in a row. That year, Luckin Coffee Inc., an upstart rival to Starbucks Corp. in China, admitted to fabricating revenue and expenses.

“In recent years, some overseas listed companies have committed serious violations of laws and regulations such as financial fraud, which has damaged the overall international image of Chinese companies and has adversely affected the overseas financing of Chinese companies,” the CSRC said.

In light of heightened scrutiny from Washington, some Chinese companies have rerouted to Hong Kong for IPOs.

Companies would need to get the CSRC’s approval before cooperating with investigations by overseas regulators, the CSRC said. The regulator reiterated that it would keep collaborating with overseas peers on cross-border securities regulations, including strengthening information-sharing and audit-inspections cooperation.

Under the draft rules, Chinese authorities would be able to require companies seeking to list outside the country to dispose of domestic assets or operations as a way to mitigate national-security concerns, the CSRC said.

- 12/26/2021 – Chinese companies set up as variable interest entities (VIEs) are allowed to list in offshore markets if they register with regulators and meet compliance rules, according to a draft of a new regulation released on Christmas Eve by the China Securities Regulatory Commission (CSRC). The regulation also allows mainland-incorporated firms to directly list overseas without the need for a VIE if they meet the requirements. The draft was published online to solicit public opinion through January 23. The CSRC said that the rule is not retroactive, so companies already listed as VIEs overseas are exempt from the stricter rules. The new rules “don’t demand companies that seek offshore listing get regulatory approval, instead they need only file relevant documents with the CSRC for records. So it is essentially paving the way for overseas listings,” said Luo Zhiyu, a partner at DeHeng Law Offices who specialises in cross-border IPOs, mergers and acquisition – is this good news?

- China’s securities watchdog published a new draft regulation stating companies can list overseas as variable interest entities if they meet compliance rules

- A requirement for security reviews of certain companies seeking overseas listings after Didi Global’s New York IPO led to uncertainty about the VIE structure

China’s securities watchdog has given tacit approval to a corporate structure that lets technology companies raise funds offshore, closing a two-decades-long regulatory loophole that has become a lightning rod in rising US-China tensions in capital markets.

Chinese companies set up as variable interest entities (VIEs) are allowed to list in offshore markets if they register with regulators and meet compliance rules, according to a draft of a new regulation released on Christmas Eve by the China Securities Regulatory Commission (CSRC). The regulation also allows mainland-incorporated firms to directly list overseas without the need for a VIE if they meet the requirements. The draft was published online to solicit public opinion through January 23.

The regulator said it would only assess the truthfulness, accuracy and completeness of submitted documents before giving applicants a green light for offshore listings, indicating that the registration-based system is not a stricter approval process.

“The draft rule ends months of speculation about China’s stance on VIEs, and it turns out to be friendly to those cash-starved tech companies and foreign funds,” said Cao Hua, a partner at private-equity firm Unity Asset Management. “At least companies that previously looked to list shares abroad via the VIE structure can stick to their fundraising plans and focus on business growth.”

The draft rule contradicts a December 1 report from Bloomberg that said China planned to ban initial public offerings on foreign exchanges through VIEs to address concerns about data security. It added that fundraising through VIEs would still be allowed in Hong Kong.

VIEs have been used for decades in capital markets, coming to prominence after the collapse of Enron. They are often used by Chinese companies that list on overseas stock markets, primarily the United States, to get around China’s ban on offshore investments in industries deemed to be strategically sensitive, such as the internet, fintech and telecommunications.

As of mid-September, a total of 545 mainland companies, most of which are tech start-ups, raised funds offshore through the system, according to a research report by Guotai Junan Securities.

“Now CSRC may effectively level the playing field between the US and Hong Kong with respect to this issue by itself not permitting companies that are not fully compliant with regulations in China to list overseas, full stop,” said Marcia Ellis, a partner at Morrison & Foerster and global chair of the firm’s private equity group in Hong Kong. “Some companies that are not fully compliant with all regulations in China may no longer be able to list anywhere.”

The CSRC said that the rule is not retroactive, so companies already listed as VIEs overseas are exempt from the stricter rules.

Beijing revamped its rules for overseas listings after ride-hailing behemoth Didi Global launched its US$4.4 billion IPO in New York in late June despite warnings from regulators. That triggered a data security investigation led by the powerful Cyberspace Administration of China (CAC), which recently culminated with the firm announcing plans to delist in the US in favour of Hong Kong.

Under new rules drafted by the CAC in July, Chinese companies handling the data of more than 1 million users must seek approval before listing overseas. Such reviews were later clarified to also apply to Hong Kong listings.

The new rules “don’t demand companies that seek offshore listing get regulatory approval, instead they need only file relevant documents with the CSRC for records. So it is essentially paving the way for overseas listings,” said Luo Zhiyu, a partner at DeHeng Law Offices who specialises in cross-border IPOs, mergers and acquisitions.

Didi’s case sparked concern about the fate of the VIE structure, which was first used by a Chinese enterprise in 2000, when Weibo owner Sina Corp listed on the Nasdaq. CSRC officials held discussions with the Securities and Futures Commission in Hong Kong, as well as investment bankers, accountants and lawyers over the past few months on the VIE structure, the South China Morning Post reported earlier this month.

“The filing system essentially creates a new policy tool to manage the overseas listings in terms of both quantity and quality, and the practical impact will largely depend on how CSRC will administer and adjust the implementation,” said Chen Weiheng, partner and head of China practice at US law firm Wilson Sonsini.

The lawyer added that the new rule also sheds light on a mechanism allowing for cross-border cooperation between the CSRC and overseas counterparts such as the US Securities and Exchange Commission.

Under this mechanism, the CSRC may inform an overseas regulatory counterpart of a company’s violations of China’s overseas listing rules. The overseas regulator may also request the CSRC’s assistance in regulatory investigations in connection with a Chinese company’s overseas share offering.

International underwriters of a Chinese firm’s offshore listing will also be required to register with the CSRC, according to the new regulation.