Study of Bison’s research

- 03/08/2023 – recommended by Josh Young

Kuppy (Hedge Fund Mgr): Oil & Energy Will Outperform Gold Next Few Yrs? CPI Back Over 10% in 2024?

- 03/03/3023 – Podcast of Josh Young

Josh Young: Energy Value Chain Analysis (Offshore & Onshore)

[0:00] Introduction and book recommendations.

[8:00] The onshore space

[18:00] How to approach the onshore value chain ($VTLE, $DVN)

[33:00] Common Mistakes naive investors make.

[36:00] Drilled but Uncompleted (DUC) Wells

[44:00] The Offshore Space

[1:02:00] Portfolio Management: Position Sizing

[1:07:00] Hurdle Rates

[1:17:00] A day in the life with Josh Young

[1:21:00] Closing Question and More From Josh Young

This episode is brought to you by MIT Investment Management Company, also known as MITIMCo, the investment office of MIT. Each year, MITIMCo invests in a handful of new emerging managers who it believes can earn exceptional long-term returns to support MIT’s mission. To help the emerging manager community more broadly, they created emergingmanagers.org, a website for emerging manager stockpickers.

- 02/26/2023 – Podcast of Josh Young

100% Returns, Value Traps & Why Profits Are Made on the Buy

We discussed starting an energy fund, outperforming benchmarks, dividends vs. buybacks, value traps, how to value an energy company, good prices vs. good assets, the dangers of diversification, the outlook for natural gas & the relevance of OPEC.

- when buy individual oil company, be careful not to buy the one which can go bankrupt

- natural gas is oversupplied this year

- how to value an energy company – not constraint in only free cash flow yield since it can be changed very fast given the volatility of oil price. look at valuation matrix and growth prospective

- final advice on energy stock investment – be fearful when others are greedy, by greedy when others are fearful

- 02/25/2023 – Ep 01 – The Journey of $JOY a Conversation w/ Alex Verge

- 01/26/2023 – Bison’s thesis on VTLE

https://yetanothervalueblog.substack.com/p/josh-young-from-bison-investments?sd=pf

- 10/06/2022 –

Oil Controls Fed Policy Now With Josh Young https://t.co/lUvwXEhrKi

Timely podcast release of a live interview with @leadlagreport, done prior to the recent OPEC+ meeting. https://t.co/M1zGcfMm3p

— Josh Young (@Josh_Young_1) October 6, 2022

- 09/15/2022 –

- 09/10/2022 – great comments from Josh

Josh Young: Oil & Natural Gas Drilling Costs Still Rising, Higher Supply Costs Going Forward

- OPEC+ will cut production mainly due to no more spare capacity, nothing else

- global economic recession might drag down oil stocks and oil price significantly, might have no more $140

- Russian oil will not be out of the world market significantly, do not account for it

- China reopen is one of the biggest factors for oil price

- the cost is about 20% higher for oil industry

- 09/07/2022 – retweeted by Josh

Is Europe doomed for energy?

Yes or no?

Find out below in the space with experts:https://t.co/COy4oX6FzN

— unusual_whales (@unusual_whales) September 7, 2022

- volatility as opportunity, portfolio management not looking for risk management, but best return, and valuation matters most

- my company Bison lives with volatility. make decision on data driven, and mid- long term goals. Not for the short term. Avoid FOMO thoughts

- Josh is the biggest investor in Bison, try to look for opponent to prevent confirmation bias. Always invert

- focus on small o/g companies so far. Prefer larger companies if same cheap valuation as that of small companies

- Canadian oil stocks better than us stocks so far due to currency devaluation

- xop (mid-cap o/g stocks) for benchmark

- biggest risk is China, reopen or not, when to reopen. 1 ~3 millions b/d difference

- 08/27/2022 – Josh on crude oil supply and Powell speech

Crude Oil Supply: The Week Ahead – 29 Aug 2022

- crude oil supply: Saudi/UAE cuts vs spr

- UAE’s cut is very critical since only UAE and Saudi have spare capacity

- they cannot run at max capacity for months, otherwise, they will kill the wells

- however, given the relationship of US and Saudi, they have to wait for a few catalysts, such as recession on oil demand destruction, and Iran deal, in order to justify their production cut

- Iran deal cannot provide more oil

- spr cannot last too long, there will be an end

- be aware of the big divergency between cruid oil price and oil equity price for the last one a a half month – Oil downed significantly, oil equity price slowly comes back

- oil price might trip by the end of the year, coincident with China stimulus and reopen?

- Jackson Hole Drama

- China Stimulus (finally?)

- early next year?

- What’s ahead for next week?

- look for more oil demand data

- market upticks again?

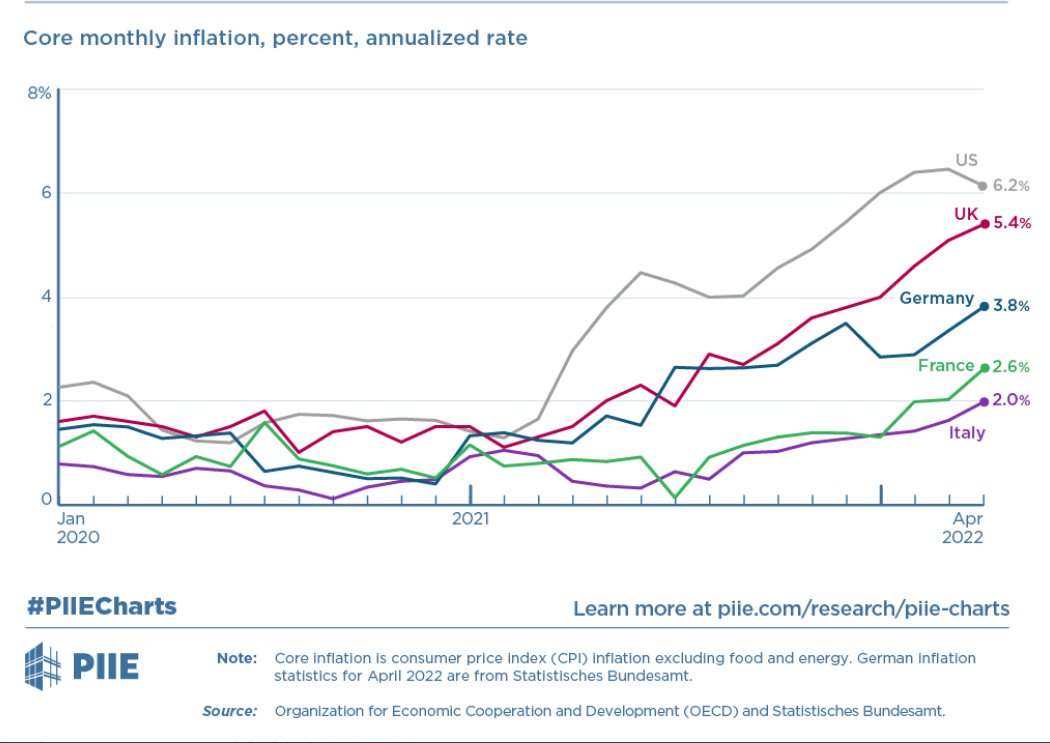

- 08/25/2022 – on inflation

24Aug2022-Inflation-student-loan-ong-Josh-Young – Twitter space meeting

- inflation will become long term issue

- EU will burn oil for gas in the winter time, bullish oil. Bison is writing a white paper on this

- China bought commodities at all cost in Oct 2021, caused the price spike in the end of 2021, this single hands the bullish oil. We think it might happen again near the end of this year

- 08/12/2022 –

Why Buffett is Buying Oil Companies w/ Josh Young (TIP468)

My guest today is oil and gas expert Josh Young. Josh is the Chief Investment Officer and Founder of Bison Interests, which focuses on investing strictly in oil and gas, which has become very contrarian over the last few years. We had Josh on the show in Q1 and were blown away with the extent of his knowledge, which is very useful at the moment as oil swings from decade highs to average lows. A lot has been happening in the oil and gas markets so we spend the first half of the discussion catching up on Q2 headlines and spend the back half of the show discussing Buffett’s recent massive investments in both Chevron and Occidental. IN THIS EPISODE, YOU’LL LEARN:

books recommended by Josh – Crude Volatility

- 00:00:00 – Intro

- 00:01:44 – Why the price of oil has been experiencing 30% swings in Q2

- 00:06:44 – How the war between Russia and Ukraine has been affecting the oil and gas markets

- 00:23:32 – How interest rates continuing to climb could affect the supply and demand of oil

- 00:28:04 – Recession risks for oil and why some smaller producers are experiencing very low valuation multiples

- 00:48:36 – Why Buffett’s Berkshire Hathaway has now invested $26B into Chevron and $13B into Occidental and shows no sign of slowing down

- 00:51:55 – How retail investors can think about investing like Buffett with a much smaller portfolio

- 01:04:47 – A forecast for airline stocks

Oil Prices Explained: What makes them volatile?

- 07/31/2022 –

Josh Young – Founder & CIO @ Bison Interests – A Bull Case for Oil & Gas 40:21

First Half 2022 MicroCap Bloodbath with Jason Hirschman, Yaron Naymark and Josh Young

- 06/17/2022 – Josh on Radio

Chase Taylor and John Young

Know Your Risk Radio with Zach Abraham, Chief Investment Officer, Bulwark Capital Management

- oil market is much tighter than the nat gas

- windfall tax will hurt the production of oil

- less regulation, more investment into oil industry will be better to recommend to Biden admin

- the increase of numbers of rigs just to make up the depletion of wells

- Josh stays on his long term view of OnG

- 06/15/2022 – Josh on Bloomberg BI

- 06/02/2022 – Josh on OPEC+ announced it will increase production. In addition, Josh recommends Baytec, JOY and BSM (Blackstone Minerals) for good portfolio

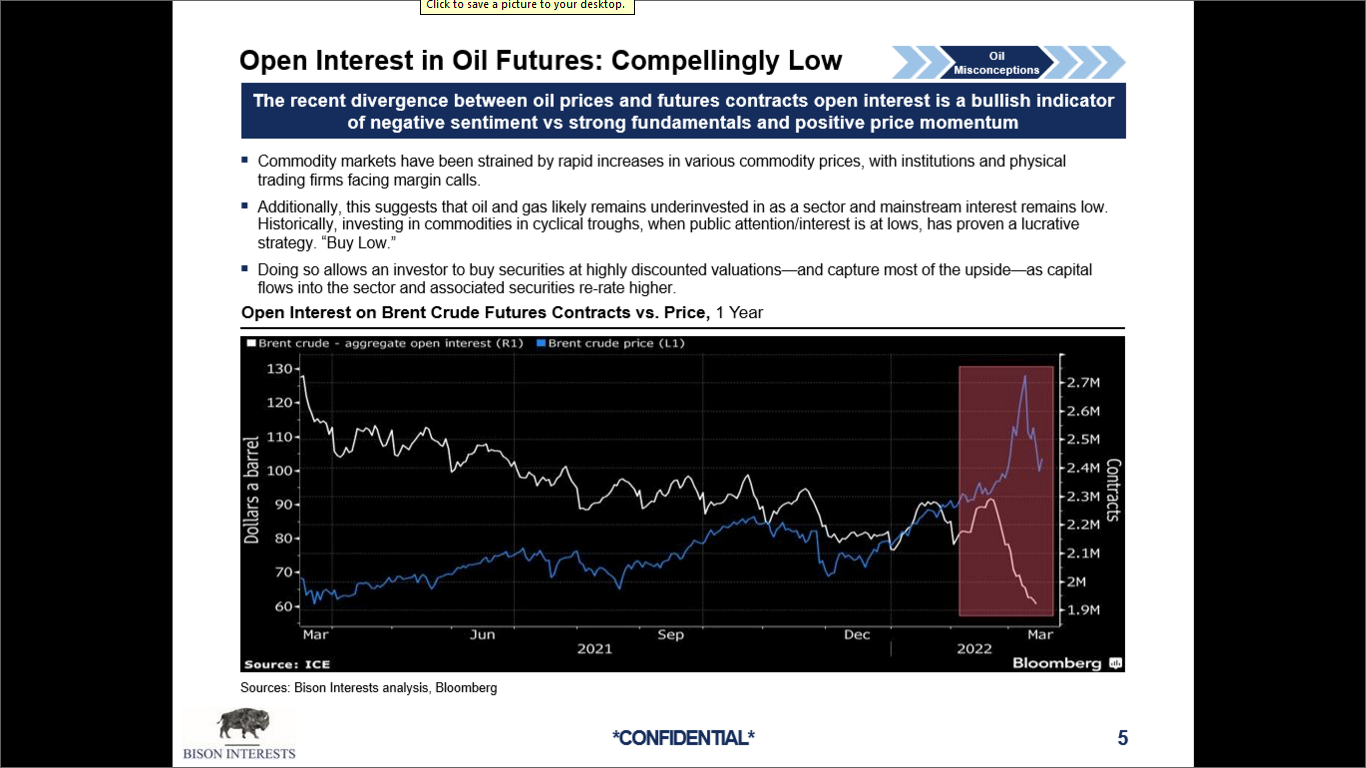

OPEC+ doesn’t have much spare capacity left: Bison Interests on youtube

OPEC+ announced it will increase production by 648,000 barrels per day in both July and August. Josh Young, CIO, Bison Interests, joins BNN Bloomberg to discuss why he is skeptical of the cartel meeting its quota and why he sees more upside in energy stocks going forward. His top picks are Baytex, Journey and Black Stone Minerals.

- we noticed early on was that these countries weren’t producing as much as they said they would we did some analysis and realize that they were unlikely to they were unlikely to be able to actually meet their quotas fully and subsequently

- I think they still remember how painful it was to get into a price war in early 2020 where the results of that was actually a oil going negative and so I think they’d want to have a good framework and the reality is that these countries are all running out of spare capacity including Saudi Arabia and UAE and as they as they come to the end of this agreement by the end of this year it seems likely Adele have the full amount of production

- US President Joe Biden potentially visiting Saudi Arabia this month at you know if that happens what do you think would come out of that I think I think Biden and other world leaders have been operating under a set of misconceptions around the energy industry and how these things actually work versus kind of what they hope and expect and so I think there’s this understanding that’s incorrect that Saudi Arabia has been holding a lot of oil they could be producing and exporting and the reality is that they actually don’t have that much capacity left and to the extent that they did accelerate their production today that might come at the cost of a reduced ability to produce as much as they’re hoping to tomorrow so far

- Josh recommends Baytec, JOY and BSM (Blackstone Minerals)

- 06/02/2022 – Josh on OPEC, oil, minerals and royalties (Twitter space) -esp talk about small investment in offshore companies – this is my question too, e.g. RIG

at 25:00 talk about small investment in offshore companies. this is about sequence and timing. Cons – still not that profitable, lots of debt; pros- debt will be reduced significantly, more torque on oil price, better to be ahead of the game before the equity price increases too much

- 05/24/2022 – Josh on Stagflation, SPR release, oil and gas

- agree with Brigewater’s long term view of stagflation

- market might be bottomed since everyone is negative on it: I think it’s interesting we’re seeing kind of people get extremely bearish on the market and you know I have some puts on which I think I’ve talked about repeatedly before and haven’t got insurance almost feel like I’m over in shirt and I’ve just been seeing extreme negative sentiment across a number of friends that is not to say that the market will crash. To say that things won’t get worse but generally when almost everyone has faced -11 in the short run that’s a pretty good indicator that things make it better

- lots of people and funds are still bearish on oil and gas. Henry hub

- gas price is very volatile in the short term, cannot predict it in the short term

- I like equities when most people hate without any economic reasons

- I like Oklahoma drillers because there was a sort of very painful boom bust sizeStaying strong and then the stupid stock didn’t end up working as well and I guess that plus like previous blow ups and I should say that it feels like there is there’s been kind of more booms and busts. In addition, they already have infrastructure ready. the cost is significant high if somebody starts from scrach

- real Capital discipline or is it or is it supply chain constraint for ong companies

- the supply chain problem might be solved in 2023 or 2024, not sure. However, it cause the difficulty for oil production to increase. Rig counts increase very slow.

Headline: The US is on the cusp of stagflation and markets are yet to fully realize, hedge fund giant Bridgewater sayshttps://t.co/YdR7fZKVpQ

— Josh Young (@Josh_Young_1) May 24, 2022

the best ways against inflation is oil and REITs in 1971 ~1981

As a reminder of what did best in the last stagflation environment in the US … pic.twitter.com/bodRS2nuOy

— Josh Young (@Josh_Young_1) January 24, 2022

— Greg Germon (@jackgermon) May 11, 2022

- 05/03/2022 – Josh’s talk on Baytex

Josh Young – Baytex Energy: The Business of Oil & Gas

Josh Young is the CIO of Bison Interests. We cover the mechanics behind the production of a barrel of shale, how producers like Baytex fit into the broader energy ecosystem, and how management approaches issues like hedging, debt reduction and returning capital to shareholders.

- 04/22/2022 – Risk Radio talk from Josh

I was on Know Your Risk Radio today with @KYRRadio. We discussed the oil market macro outlook and why I think an oil export ban from the US is unlikely. Let me know what you think! https://t.co/va6Y3xrkgv

— Josh Young (@Josh_Young_1) April 22, 2022

podcast website (Josh Young with Zach Abraham on Know your risk radio)

April 23, 2022Know Your Risk Radio with Zach Abraham, Chief Investment Officer, Bulwark Capital Management

- 04/21/2022 – Oil, gas and Telsa (Josh’s Twitter Space)

- 0:00 Tesla, very impressive on lower cost with current commodity price increase, notice increase car price. great car, impressive AI, hard to value the AI. Could be overvalued, the true value might be $100

- 27:00 inflation – rapid inflation, if not hyper-inflation. in 1970’s, inflation was last for a decade, not sure about now. People can tolerate inflation at present because of asset growth?

- 30:00 oil consumption – increase consumption, might last for a decade. The current ESG movement will enhance this need. Even Elon Musk advocate to increase oil production. alternative energy cannot replace oil. While it reduce the supply side of oil, so it is bullish for oil?

- 04/20/2022 – Oil services market tightness (Josh’s Twitter Space)

- the price of gas is very hard to predict

- small oi production companies are easier to ramp their production and revenue than the larger companies because one extra rig can increase their output in larger proportion

- lots of EIA reports are short sighted and are wrong, I need to discount them

- I try to discount short term stuff that’s biased and that’s somewhat unreliable and heavily weight aggregations of that sort of short term information where it starts to become more meaningful signal as well as focusing on sort of medium and longer term effects that. In aggregate, can end up having a real impact even on the short term.

- there’s a lot of bad information about what’s happening in Russia and Ukraine, and it’s been very politicized. And so I’ve mostly just other than headlines, which I’ll share if I think they’re relevant for oil. I’m generally deemphasized. A lot of that in my analysis and I’ve just assumed that Russian oil production will continue more or less uninterrupted. But I think there’s a good chance that overtime Russian production will be lower even if the export is uninterrupted. Just given what’s happening from a services perspective and conversations last night as well as many conversations over the last month plus. Are indicative that that there are real issues with Russia’s current oilfield services situation and ability to develop out fields that people are expecting, and so I think I heard someone talking about this yesterday somewhere where they were basically saying instead of Russia growing 2,000,000 barrels a day over the next few years. Maybe they shrink by 2,000,000 barrels a day and again excluding all the political stuff just purely based on the service intensity today and the service capability

And their decline rate. It does look fairly likely that Russia produces a couple million barrels a day, less over the next two or three years.

- 04/08/2022 – discussion on $200 Oil and the Structural Energy Supply Problem

Ep. 107: Josh Young on $200 Oil and the Structural Energy Supply Problem

This podcast is sponsored by Masterworks, the first platform for buying and selling shares representing an investment in iconic artworks. They are making it possible to invest in multimillion-dollar works from artists like Banksy, Kaws, Basquiat, and many more.

Josh Young is the Chief Investment Officer and Founder of Bison Interests – an investment firm that focuses on the publicly traded oil and gas sector. He has over 15 years of experience in investment management, 10 of which were focused on publicly-traded oil and gas securities. Josh became Chairman of the Board of RMP Energy in 2017. After refreshing the board and management team and rebranding the company (Iron Bridge Resources), it was bought out at a 78% premium in 2018. Before this, Josh was a management consultant to Fortune 500 companies and private equity firms, and then an investment analyst at a private equity fund. Josh worked as an energy investment analyst for a multi-billion-dollar, single family office. In this podcast we discuss:

- 7:00 Understanding the energy sector: upstream/midstream/downstream

- focus on upstream – producing companies

- occasionally on midstream (infrastructure or services companies, very poorly understood currently, more opportunities) and downstream (refineries, Josh does not do much here)

- there are many professional oil/gas investment businesses are not in business any more. General investors face a lot of challenge in this sector since there are lots of dynamics going on

- 14:00 The cost of drilling

- many expert companies are gone, people do not understand which parts are short on supply – pressure pump or drilling rig

- You can be so early that it seems like your research on fundamental is wrong, and you need time months for your thesis to play out

- 16:00 The impact of ESG on the energy sector – the sentiment is still not good even with oil and oil stocks run up a lot in 2021 and 2022

- lots of inertial for institutional investors to get in oil/gas industry

- afraid of investor hate and public sentiment

- lots of sunk cost in ESG already

- still some companies are out of oil industry such as Dutch ING issuance

- 17:30 Why oil isn’t output higher

- why US and Saudi, which have capacity, to produce more?

- CNBC shows politicians have lots of ignorance or intentional disinformation

- bad policies. the trajectory and policies are going worse and worse for the oil/gas industry, so it will more profitable for oil industry

- anti fracking and anti-oil policies. regulation it is a huge problem for oil industry

- all people (CEO, executives) are all worried about the policies. Currently the policies are way worse

- the negative rhetoric in the media makes recruiting of young people from college is extremely difficult. Once they were told this industry is going away, why will they enter this industry?

- people, capital and equipment are key elements of this industry, they cause money. but there are so many hurdles for them

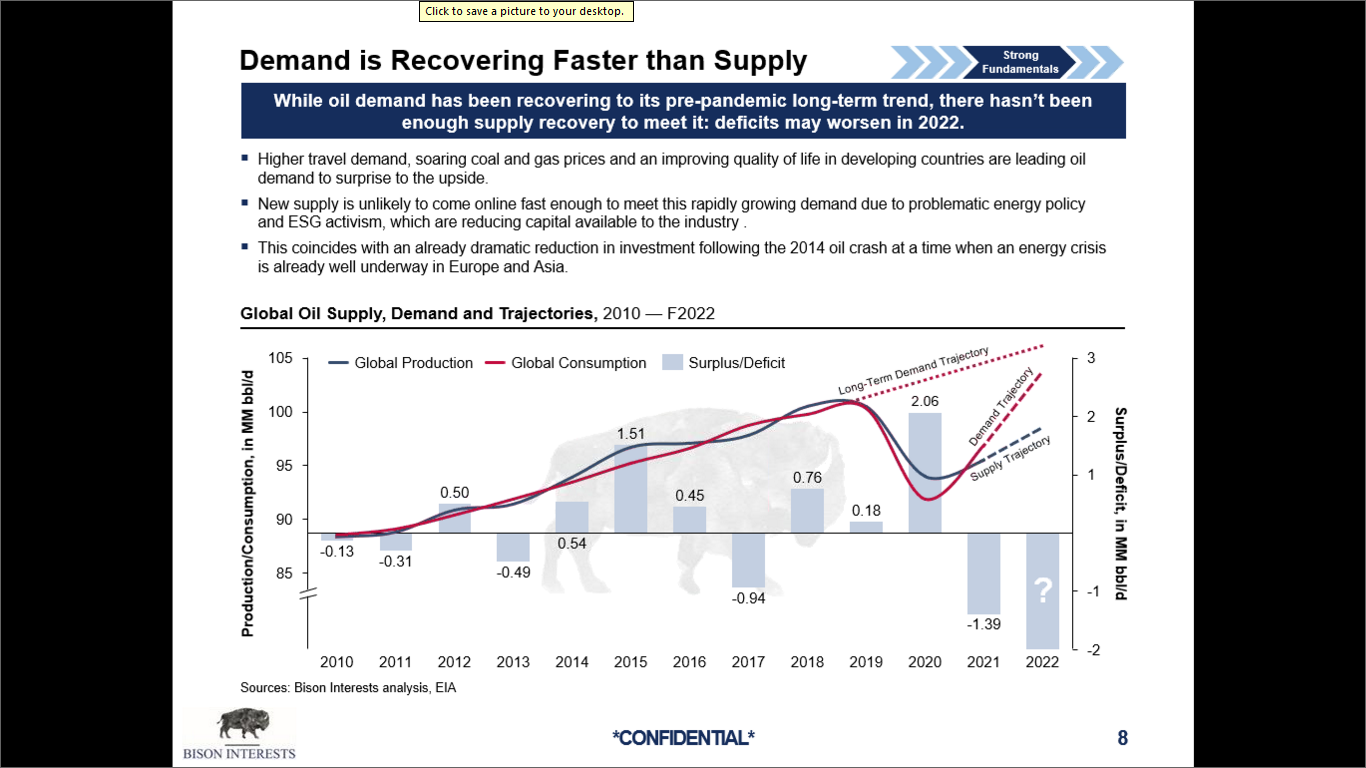

- 26:00 The structural supply issues for energy sector

- less related to general supply chain associated pandemic, more related to the oil industry whole value chain got damaged in the last eight years. so less of not enough trucks, or boats to for shipping, more to the companies that produced more drill bits, now they cannot because they repurpose to other stuff, and they do not have the capacity. they rationalized over the last eight years down cycle. So there is long up cycle after long down cycle because you need time to build new factories, retool your old ones, and upsize your talents which is very difficult, and you need lot of capital which you do not have for any of this. Therefore, in order for that to happen, you need much higher price and high price not temporary but for a long time. This is what Josh think will happen.

- Lots of people say oil price is high and it is going to crash, and I say wait a second, if you look at the history of oil, there is no long down cycle with a short time period of going up and then immediately going down, almost so often, the long down cycle goes with a long up cycle, almost like the biblical story. It is not just a phycological thing, it is lot of physical and sentiment, it is kind of like the phycological fallacy of fighting the last war. It is so hard for people to overcome. you saw this with general market with financial crisis, there are people still bearish since 2009. Most of them are out of business. Similar to investment in oil industry. of course, there might be economy crisis to trade down the oil price, but in the long run, the oil equity price will have long trend up. It is lot caused by the supply chain, not the covid supply chain, but the value chain has been deteriorated for a long time. You need investment, then we need multiple years to increase capacity. We have not seen that started.

- The investment needs to maintain supply

- The regulatory pressures on supply

- what is the pandemic effect on oil industry

- we got into energy shortage in Jan 2020, and it made the pandemic physiologically more challenging for Josh and other oil and gas investors and oil industry executives.

- Oil industry has been down since 2014, and by early 2020, it seems like the industry was going to rebound due to the oil shortage. But because of the pandemic, the oil price dropped to negative, oil industry was crushed, many companies bankrupted, investment companies got out of this industry, many oil/gas funds closed or became energy transition funds or new energy funds.

- You cannot rock that back, it is hard to raise money after all these

- there was huge shift during the pandemic in the period when there is already under supply. Demand shot down when there were multi years of under investment kicking in. Investment People thinking they are contrarian thinks you are really crazy.

- 34:00 Whether the Middle East step up supply

- the are out of capacity

- Saudi Arab also has plenty of gas, but the water is very expensive to drill out of gas

- their current capacity can only supply today’s demand, it needs more and more investment for future demand

- there is not much construction yet. lots of oil fields are expiring, we drill more oil than its capacity, and needs more exploration. They are now burning the furniture.

- Whether the oil bull market is still early

- 34:30 The best to get exposure to energy

- the popular sentiment is that the current supercycle of commodity is short, but Josh thinks it is very very unlikely

- Do you think we can reach $200 oil? Josh thinks we have to reach that level for the current a few months of $100 oil, it is not enough for the base level of oil industry activities to rebuild the industry and supply chain. We need much higher price. It is classic economic cycle. When you see manufacturing starts to make rig, pressure pump, etc. you maybe getting closer to oil price to make sense. Even that, you need fabrication and manufacturing to be built, and more of the built, and to run for a while to replace all the stuff that broke and you need more stuff, and wedge to make wedge, we are not making the first one, not fix the factor to make the first wedge, even the second. then we might be the second innings.

- look at the oil price just the first thing to do, but you need to look at the fundamental, whether there is investment for the supply. it is not about price, but activities.

- what is your take on Russia? Josh underwriting Russia’s inputs to be conservative since the war is so uncertain and unpredictable. Russia is not the core of oil bull thesis, so is not Iran, and Vanasvala. Josh does not see them as threat to the oil industry but benefit, at least in the first few years. Russia has a bit oil reserve capacity, maybe that will gone due to the war. OPEC has not much oil reserve capacity.

- Can China provide the tools to help with supply chain. Chinese regime has a lot of demand in oil in order to maintain control. Chinese corporate culture is not good at innovation.

- 45:00 why not just play oil price then buying equity? Equity is very levered to oil price. Option on oil price has critical timing issue. Equity return is about 5X or 10X than that on oil price, especially for the ones paying off debt, buy back stocks. Every dollar paid on debt, get two dollar on capital valuation. Buyback can compound money much faster.

- 49:00 do you neutralize S&P beta when you make these holdings? long short managements turn to do quite poorly on their long investments relatively to the only long investments even though they might be slow. To achieve exceptional returns you have to accept the kind of volatility that’s considered impolite in the hedge fund industry. Volaticity is always happen. I embrace the volatility. If I know that I can make 5X or 10X over five years, I will not care too much about the volatility whether there are months or year of pain, instead of guessing when the road bump will happen, I just stay in the course and pay extra capital when there is bump.

- 52:35 what is your biggest focus? Canadian oil producers. most of them are on natural gas, and NGL. the market most people do not understand. Currency effect is good for the stock. US oil stocks are like the handle of wipe, and Canadian stocks are like the tail of wipe.

- 54:15 what is the best investment advice you ever receive? figure out what you are going to do, and do it and not let the noise to distract you. Took that to heart. once you figure out what is gonna happen, have that exposure to win from it and have longevity to express that, and to be able to economically benefit from that.

- 55:00 how do you handle the large flow of information? Constantly gather positive and negative indicators. simplest thing is to notice who does well in the multiple years. who does well in the last numbers of years, what are they finding interests in and what are they focus on. Take notice of that and priority that over the headline and other analyst’s information, like Napoleon’s finding lucky generals. many people pay too much attention to the headline and ideas with people have very bad track record, people talk on TV or have a good degree do not mean that we need to spend meaningful time on their stuff.

- Books that influenced Josh: The First Billion Is the Hardest (Pickens) and Fooling Some of the People All of the Time (Einhorn)

Background knowledge: Upstream vs. Downstream Oil and Gas Operations: What’s the Difference?

KEY TAKEAWAYS

- Upstream and downstream oil and gas production refer to an oil or gas company’s location in the supply chain.

- Upstream oil and gas production is conducted by companies who identify, extract, or produce raw materials. Many of the largest upstream operators are the major diversified oil and gas firms, such as Exxon-Mobil (XOM), Occidental Petroleum (OXY)

- Downstream oil and gas production engages in anything related to the post-production of crude oil and natural gas activities. Examples of downstream companies include leading U.S. refiners Marathon Petroleum (MPC) and Phillips 66 (PSX).

- Midstream links upstream and downstream and includes transportation and storage services. examples: Kinder Morgan and William companies

- Integrated oil and gas companies function in two or three of these streams. such as Shell, Chevron, ExxonMobil, and BP.

What Is an Integrated Oil and Gas Company?

Integrated oil and gas companies operate in multiple streams. They may, for example, have drilling operations as well as own refineries and license gas stations to franchisees. Some of the largest and most influential energy companies in the world are integrated companies, such as Shell, Chevron, ExxonMobil, and BP.

- 04/06/2022 – another Podcast from Josh Young and Chuck Yate

https://podcasts.apple.com/us/podcast/chuck-yates-needs-a-job/id1536448009?i=1000556434243

this podcast is also on youtube as follow

Takeaways from this podcast

- there are still lots of bad sentiments on oil industry

- current investors are mostly retail investors, institutional investors have not joined yet

- still very depressed sector even with the stock rising

- oil industry is deleveraging a lot currently, and one day they will back to grow

- backwardation will continue to drain the tighr inventory

- prefer to focus invest in conventional oil industry than shale companies because the formers can and have lowered debt a lot, while the latter have very difficulty to lower significant debt

- Journey energy company has great CEO who multiplied the previous stock price >10X. I like good companies with great CEO

- Government policies do matter. Alberta in Canada had very tight regulation to deter the oil and gas industry since 2012, therefore, I invested more in Canada than US. US government sets the tone for oil industry including bank lending, environmental, production, etc. Oil industry is therefore not a free market.

- US’s windfall tax proposal, SEC’s requirement of ESG disclosure, all these increasing negative regulatory process – maybe the Russia and Ukraine war changes this, US wants more energy and energy security?

- how to get the positive narrative back on oil industry? environmental and anti-hydrocarbon – look at what people do and what they spend their money (where their money come from matter a lot too), not what they say. their behavior (they bought a lot on beach front house) show they do not believe climate change. They probably want control more. the news of USSR funded Greenpeace is heavily suppresed in all media, this is amazing for me.

- three ways to change people’s minds – ask sequence of questions, make people laugh, scare people.

- when the bubbles of alternative energy and tech companies burst, people will look into oil/gas companies and commodities as the percentage of S&P allocated to energy goes to 2% to 4% to 22% as historically high. Policies change will come

- We emphasize too much in environmental effects of US and Canadian oil/gas industries, but Russia (oil companies are won by states) and Venatual should polute more

- From Josh Young: I find that the best way to get good returns is by really focusing on the best opportunities to compound money and be able to earn multiple times return or so over time. And by doing that I am better on my long investments and I just give up the sort of downside protection associated or the whatever people think they are getting from shorting stocks and sometimes that can be really painful because you get squeezed or whatever and it is a big distraction so I am not doing any direct arbitrage, it is more of a if Canadian oil and gas stocks are generally trading at a big premium to US then I will get sell some of my Canadian stocks and redeploy cheaper in the us and vice versa.

- the oil industry can do better by being honest about the why they choose to return cash to investors than reinvest and produce more oil, they need to talk about supply chain constraints, need more people, inventory constraint. More honest, more better equity valuation

- try to have constructive conversation and debate than just argument

- 03/31/2022 – Bison Interests & Kiefaber and Oliva – Oil Market Update

65 views Mar 31, 2022

details of Josh’s presentation Josh_Young and Kiefaber n Oliva oil market update

Q/A

1.Effect of China’s lockdown for zero-covid – only short term, would not affect long term. Fewer lock down over time

2.Risk of economic recession on oil industry – so many calls on recessions were wrong, hard to say, recession is not a sure thing. We might have stagflation, than deflation. The more people say it, the more unlikely

3.Effects of Iran and Venisvala for oil bearish view – needs long time come out of sanction to ramp up production, initially, their own consumption might offset their production

4.When can E&P market to be balanced – need to be in the level of 2012 and 2014, needs muti-years, a lot of money, and a long time. Where the money comes from? Oil industry profit, less regulation, much and much much higher oil price, less tax. Institutional to change their view and direction and start to invest in oil. The current oil price is much higher than two years ago, but it can still be much much higher

5.Effects of shut-in oil from Russia – lots of conflicting reports here, current thesis does not base on this scenario. If to some extent there is interruption on Russian supply, just like US, we need long time for them to come back

6.Will US ban oil export? – no oil export ban. US policy is always pushing down gas price for political reasons, not pushing down oil. Gas and oil are different. US energy policy – gap price (gas price negative) down for the short term

7.OPEC had 600,000 per day in Q12022, but we see oil inventory down – OPEC is wrong on report, we saw them revise it many times. Not like years ago when OPEC had much more reserve capacity, they can drive down the oil price, now they do not have that capacity

8.Capital is still leaving the industry. Aggregate investment is still down. Endowment, pension funds, insurance companies are leaving

9.Transportation issue for gas and oil from Permian? Gas is almost full capacity. Infrustructure issue. Permission issue- there is big dislocation here, federal anti-oil policy

10.Oil price without covid? – 1% increase yearly

11.Proposed Windfall tax on oil companies? Risk in oil investment? – mostly tax the major oil producers. If to all producers. You will punish more for oil companies. these will be reflected on oil price, and drive up the oil price

12.US tech companies are almost like monopolies, they can raise price easily. Even though oil/gas companies contribute a lot for the US infrastructure, they cannot easily raise price

13.Is it good opportunity for private capital investment in oil companies? – yes, but very risky. Need lots of due diligent. High probability of being scammed, such as MKGP “permanent basement”. Very risky for individual, very difficult

14.How much relieve of Keystone pipeline? – policy restriction everywhere, hard to predict

- 03/09/2022 – Oil Prices with Josh Young

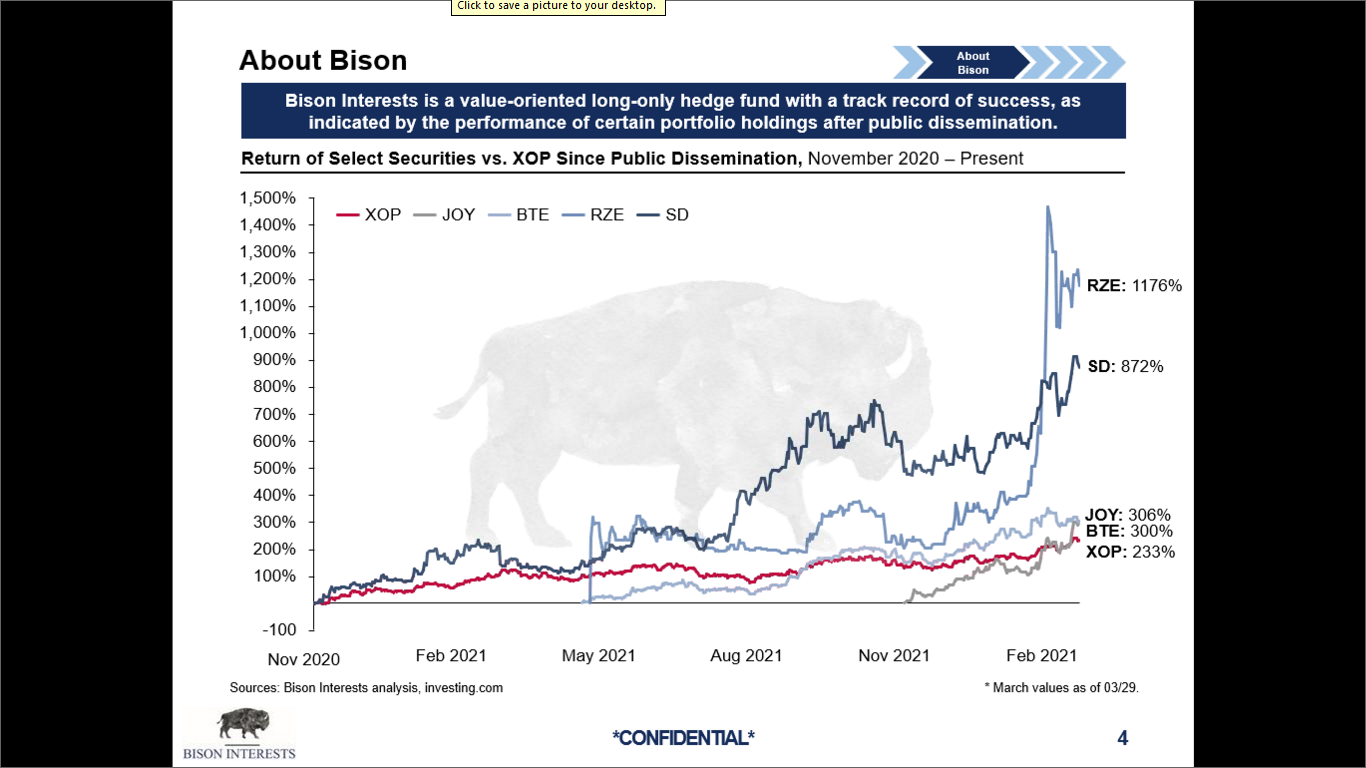

A deep dive on OIL with expert Josh Young from Bison Interests. Bison returned 350% in 2021 compared to the S&P 500’s 29% and we cover a lot of reasons why they may just be getting started. Prior to Bison, Josh was the chairman of RMP Energy.

IN THIS EPISODE, YOU’LL LEARN:

- 0:00:00 – Intro

- 0:57:00 – Why oil has been the most hated commodity as of late

- 0:06:41 – Debunking myths about oil

- 0:11:08 – Methane release

- 0:14:28 – Bitcoin mining

- 0:17:01 – Why supply levels could lag demand for the foreseeable future

- 0:19:25 – The key drivers of Oils spike in price

- 0:22:55 – Marginal cost to produce oil

- 0:25:29 – Uncompleted and completed wells (DUCs)

- 0:28:36 – U.A.E missing their quota

- 0:33:10 – Onshore vs offshore oil development

- 0:40:49 – Oil producers that Josh is invested in

- 0:51:45 – The Russia/Ukraine conflict and how it could potentially disrupt supply

- 0:59:46 – How Europe’s decline of Natural Gas will affect the price

All news from Bison Interests: Interviewed and quoted by Forbes, The Wall Street Journal, Bloomberg, Reuters and more

March 31, 2022: U.S. and allies may find tapping stockpiles inadequate to plug Russian oil gap

March 30, 2022: Bison Interests & Kiefaber and Oliva – Oil Market Update

March 23, 2022: (Barron’s) Oil Investor Who Made 390% Last Year Explains 3 Stock Picks

March 13, 2022: (The Wall Street Journal) Hedge Funds’ Commodity Bets Soar After Russia’s Invasion of Ukraine

March 9, 2022: (The Investor’s Podcast Network) Oil Prices with Josh Young

March 6, 2022: (Al Jazeera) Josh Young Featured on Al Jazeera to Discuss the War in Ukraine and Rising Oil Prices

March 3, 2022: Oil Stocks haven’t Kept Up with Oil Prices, but it’s Only a Matter of Time

March 1, 2022: (MicroCap Review Magazine): Oil & Gas Outlook for 2022

February 15, 2022: (Reuters GMF) Oil equities disconnected from high crude oil prices due to negative sentiment, ESG-driven divestment

February 14, 2022: (KEDM) Josh Young and Kuppy Dive Into the Oil Market

February 8, 2022: (Die Zeit) The Return of Oil Multinationals (German)

January 27, 2022: (Yet Another Value Podcast) Josh Young Journeys through the Energy Space (Podcast 92)

January 21, 2022: (Breitbart) Climate Change Backlash — Hedge Fund Cashing in on Oil and Gas Equities as Fossil Fuel Sector Flourishes

January 11, 2022: (Structured Products Daily) Josh Young on capital expenditure contraction

December 26, 2021: (Ideabrunch) Josh Young shares his approach to oil and gas investing, experience from the boardroom, and his three top ideas

December 2, 2021: (BNN) The best is yet to come for Canadian Oil and Gas Stocks

November 23, 2021: (Al Jazeera) Bison CIO Josh Young featured on Al Jazeera to Discuss SPR Releases

November 14, 2021: (The Crux Investor) Ferg’s Undesirables: Oil & Gas, Energy Return on Investment

November 4, 2021: (BNN) A strategic petroleum reserve release would just put more upside pressure on oil prices long-term

November 3 , 2021: (Reuters) US shale producers signal more oil incoming, as OPEC counts on restraint

October 26, 2021: (Reuters) Third-quarter profits for shale producers without hedges

October 19, 2021: (Kuppy’s Event Driven Monitor) Where’s the oil and gas supply?

October 12, 2021: (CNBC) We are seeing a “revaluation up” of oil and gas as commodities

October 9, 2021: (The Wandering Investor Podcast) Deep Dive on Saudi Arabia, Russia, Aramco, US Shale with Josh Young

October 7, 2021: (The Financial Times) Hedge funds cash in as green investors dump energy stocks

October 6, 2021: (Planet Microcap Podcast) Running Out of Gas? Thoughts on the Energy Crisis and Oil and Gas Markets with Josh Young, CIO of Bison Interests

October 4, 2021: (BNN) OPEC+ does not have as much spare capacity as they say they do

August 20, 2021: (10-K Club) Ethane bull market!

August 19, 2021: (BNN) Delta variant and China’s economy are ‘short-term concerns’ for oil

July 30, 2021: (The Market Huddle) Kuppy takes the wheel (guests: Kuppy & Josh Young)

July 20, 2021: (BNN) We’re seeing an undersupplied oil market going forward: Josh Young

July 14, 2021: (Bison Investor Presentation) Inflationary trends in the oil and gas industry

June 25, 2021: (BNN) Lumber and oil prices will remain elevated: Bison Interests’ Young

June 18, 2021: (The Globe and Mail) North American oil service firms’ pricing and hiring on the upswing

June 17, 2021: (Reuters) North American oil service firms’ pricing and hiring on the upswing

June 1, 2021: (BNN) Oil prices can go a lot higher before affecting economy and consumption: Bison Interests’ Josh Young

May 5, 2021: (BNN) Baytex and Razor Energy have a lot more upside to go: Josh Young

March 28, 2021: (YAHOO FINANCE) No timeline given for freeing huge ship blocking Suez Canal

March 27, 2021: (AL JAZEERA) Interview on Al Jazeera live broadcast

March 24, 2021: (BNN) Houston-based energy firm sees value in Canadian Oil

March 9, 2021: (BLOOMBERG) Oil Bulls Who Stayed Course Through Free-Fall Reap Rewards

January 29, 2021: (AL JAZEERA NEWS) Bison’s CIO Josh Young featured on a panel discussing the GameStop price surge and its stock market implications

January 28, 2021: (BLOOMBERG) Our CIO was quoted discussing our recently disclosed position in Senvest and it’s recent likely GameStop windfall

January 27, 2021: (AL JAZEERA NEWS) Bison CIO Josh Young joins Al-Jazeera to discuss the frenzy around GameStop and Reddit forum Wallstreetbets

December 9, 2020: Josh Young joins the Flowline Podcast for episode 86 , where they dive into what’s happening in the business side of the oil & gas industry

November 23, 2020: Josh Young is invited back to the #hottakeoftheday podcast to discuss what’s going on in the world of energy investing and his long positions in Canada and the US

August 3, 2020: (WSJ) Energy Journal: Josh Young speaks with David Hodari on the future of oil investment and upstream exploration

May 22, 2020: (BLOOMBERG) Tiny Shale Stocks Lose Love as Energy Analysts Ditch Coverage

May 11, 2020: (WSJ) Wanted: Somewhere, Anywhere, to Store Lots of Cheap Oil

May 5, 2020: #hottakeoftheday Podcast with Josh Young shortly after the Spring 2020 Oil Market Collapse

April 8, 2020: (REUTERS) Oil sinks as market doubts OPEC supply cuts will be enough

April 5, 2020: (AL JAZEERA NEWS) Bison Interests’ CIO interviewed prior to the announced OPEC plus cuts, giving his thoughts

April 5, 2020: (AL JAZEERA NEWS) Bison Interests’ CIO interviewed about what will happen in the next few days with the Saudi/ Russian Oil Price War

April 2, 2020: (REUTERS) Oil surges more than 13% on hopes of output deal

March 3, 2020: (REUTERS) Coronavirus puts shaky condition of debt-laden shale firms in spotlight

January 3, 2020: (REUTERS) U.S. shale producer shares spike with oil prices but rise seen as fleeting

September 16, 2019: John Daugherty Realtors sits down with Bison Interests for their Market Data Monday segment.

September 15, 2019: (AL JAZEERA NEWS): How will Saudi Arabia Respond to Attacks on its Oil Plants?

September 14, 2019: (REUTERS) Instant View: Reactions to attack on Saudi oil facilities

September 12, 2019: (REUTERS) Low-cost fracking offers boon to oil producers, headaches for suppliers

May 14, 2019: (SEEKING ALPHA) Interview with Bison CIO on who the next O&G takeover target might be

April 25, 2019: (BUSINESS INSIDER): Inside the hedge fund money-raising environment

April 22, 2019: (SUMZERO) Bison Interests Lands Another Large Investment via Cap Intro

April 18, 2019: (BLOOMBERG): Canada Stocks Reach Record as Energy, Tech Add to Pot Rally

April 15, 2019: (BLOOMBERG): Houston Energy Fund Looks North of 49th Parallel for Fat Return

September 10, 2018: (PRESS RELEASE): Iron Bridge Resources Announces Agreement with Velvet Energy

February 13, 2018: (FOX NEWS): Oil Rising

October 12, 2017: (HART ENERGY): Is Energy Poised To Win Back Investors?

August 2, 2016: (BLOOMBERG): Hedge Fund Brief (pg. 4 of 15)

February 16, 2016: (BLOOMBERG): Bison Raises $20 millon from university endowment