Here is my preliminary study of JD, checklist score 3.25/5

- 01/25/2019 – It Looks Like the Worst Is over, and JD Stock Could Rally Big

- 01/24/2019 – Are the Bulls Right About JD.com’s Upside Potential?

- 12/28/2018 – JD plans Mall restructuring

- 12/21/2018 – JD.com Shares Rise as Authorities Decline to Charge CEO in Sex Case

Authorities in Minneapolis declined to move forward with charges against JD.com (JD – Get Report) CEO Richard Liu, removing a cloud that was hanging over one of China’s largest e-commerce platforms.

- 11/20/2018 – JD.com chief Richard Liu to shift focus after arrest

- 11/20/2018 – JD.com founder reduces responsibilities amid rape allegation

- 11/19/2018 – China’s JD.com Suffers Share Drop on Customer Decline, CEO Worries

- 11/14/2018 – Can New Technology Initiatives Aid JD.com (JD) Q3 Earnings?

- 11/12/2018 – JD.com, Alibaba’s biggest rival in China, just announced that it sold RMB 159.8 billion ($23 billion) in goods for its Singles’ Day campaign.

- 11/10/2018 – JD.com: Irrational Price

- 11/08/2018 – Blood In China: JD.com Is A Strong Buy With 73% Upside

- 11/08/2018 – Where is Richard Liu? JD.com founder not seen at China events

- 11/06/2018 – College student accusing Chinese billionaire of rape: I told him ‘no’

- 11/05/2018 – A Chinese tech billionaire has been accused of plying a student with drink and then forcing himself on her during a trip to the US

- 10/23/2018 – JD.com, Inc. (JD) Dips More Than Broader Markets: What You Should Know

U.S. starts process to withdraw from a 144-year-old international postal body

How will this affect JD, BABA’s business? or no effects?

- September 05, 2018 – 京东公关发布假消息遭三家美律所起诉?这事估计还没完 (JD_PR_fake_news) The fake news from JD official website has ignited a series of lawsuits for JD. This will drag down the stock price just like BABA did in Jan 2015 (downed to $89/share in four days). However, I think in the long run, Richard Liu will pass this test since it is (1) too big to fail; (2) justice can be bought in China.

I have bought LEAPS of Jan’20 $20 strike price with premium price of $8.70. I will prepare to buy more by following the news down the road.

- June 18, 2018

JD.com Soars on Google Investment, JD.com (JD) is up 5.6% to $46.05 on news that Google (GOOGL) will invest $550 million in the Chinese firm, at $40.58 a share.

- May 08, 2018 from barron’s – JD.com (JD) is down 2.9% to $37.60 after reporting first-quarter earnings. The tech giant earned 0.71 yuan a share, on revenue of 100.13 yuan, while analysts were looking for .82 yuan a share on revenue of 98.92 yuan. For the second quarter, it expects sales of 120 billion yuan to 124 billion yuan, compared with the 122.4 billion yuan consensus.

- May 01, 2018 – Alibaba, JD.com to Dominate Offline Realms, Too He notes that both Alibaba and JD.com have already invested tens of billions of dollars in recent years in online-to-offline solutions, including state-of-the-art omnichannel supermarkets “that double as fulfillment centers.” Certainly, the new retail ecosystem in China is still in the early innings, and it’s an extremely fragmented market. No one player commands more than 1% of the offline market, but Devitt sees Alibaba and JD.com in leadership positions, given their “unrivaled online-to-offline technology and growing list of strategic partners.”

- April 25, 2018 from Barron’s – Alibaba Group Holding‘s (BABA) Luxury Pavilion and JD.com’s (JD) TopLife multibrand luxury sites are both less than a year old, but are already extremely popular, however. Rambourg writes that he expects these multibrand ecommerce sites will certainly continue to gain steam, as the luxury consumer in China is becoming more skewed toward digital natives that spend hours online.

- Dec. 17, 2017 – Tencent, JD.com Acquire $863 Million Stake in Vipshop

Chinese social media firm Tencent (700.HK) and e-commerce giant JD.com (JD) will team up to jointly invest a combined $863 million in Chinese discount online retailer Vipshop (VIPS).

Tencent will acquire a 7% stake via the acquisition of new issued shares for USD604 million. JD.com will acquire a 5.5% stake for $259 million.

Under the agreement, Tencent said it will grant Vipshop access to Weixin Wallet, while JD.com will grant Vipshop access to its mobile application and the main page of its Weixin Discovery shopping entry.

- Nov. 13, 2017 – Wait, Can JD.com Outsell Alibaba?!?!

JD.com reported profit Monday that surprised analysts: net earnings of 1 billion yuan ($151 million), its highest ever quarterly figure, for the period ended Sept. 30. Analysts expected 213 million yuan loss, Reuters reports. JD.com may be the largest beneficiary of piggybacking on the Alibaba Group Holdings (BABA) one-day shopping extravaganza held Saturday, during which Alibaba settled $25.3 billion (RMB168.2 billion) of gross merchandise volume (GMV) through Alipay. That was an increase of 39% compared to 2016. Mobile accounted for 90% of total GMV, Alibaba said.

JD.com saw a 50% rise in gross merchandise value during its Nov. 1 to 11 shopping promotion, to 127 billion renminbi, or $19.4 billion. UPDATED: Whether market participants compared the dissimilar promotions’ growth or not, they liked what they saw. JD shares rose 3.4% in U.S. trading Monday, while Alibaba shares fell 1%.

- Nov. 10, 2017 – JD.com: Second Fiddle to Alibaba Still Gets Play Sanderson has a $51 target on JD.com, which is trading near $40. That implies 28% upside. The analyst sees Alibaba shares moving ahead 18% to $220. He has a buy on each stock.

- Oct. 14, 2017 – JD.com Shares a Better Deal Than Alibaba’s

Beijing-based JD.com controls 18% of the online retail market in China, and 30% of the market for companies selling wares directly to consumers. There, it competes with Alibaba’s Tmall unit. (Another Alibaba business, Taobao, is a selling platform for entrepreneurs.) A key distinction for JD.com is that, under founder and CEO Richard Qiangdong Liu, it has built logistics operations that can manage the sales process from start to finish, including warehousing, shipping to delivery stations, and even the “last mile” delivery to customers’ doors. In this respect, it’s ahead of even Amazon.com (AMZN), which is only now reportedly testing a delivery service to rival some last-mile functions of FedEx (FDX) and United Parcel Service (UPS).

Building that infrastructure has been expensive for JD.com, which is why the company is—like Amazon until recently—only thinly profitable. But JD’s greater control over its sales process gives it some advantages. It beats Alibaba in certain “high trust” categories, like goods for babies, according to Wells Fargo Securities analyst Ken Sena. It also scores higher in customer satisfaction for logistics. Some 91% of JD.com’s first-party orders, where it acts as the merchant, are delivered within two days, including 58% within one day. Like Amazon, it also has a third-party business, where merchants can sign on for JD.com to handle the sales and some or all of the logistics. This year, Wall Street expects JD.com’s first-party gross merchandise volume (the total volume of what is sold) to rise 47%, to $79.3 billion, and third-party GMV to rise 49%, to $61.6 billion. That’s faster than either Alibaba or Amazon, which are both seen growing GMV by 30%, to $708 billion and $346 billion, respectively.

“We do a lot of survey work in China,” says Rob Sanderson, an analyst at MKM Partners. “There’s a strong cohort, about 20% of consumers, that prefers a direct seller, as opposed to a reseller marketplace, which can be kind of a free-for-all.”

Eventually, JD.com hopes to persuade its third-party partners to sign up for a longer menu of logistics services, in exchange for larger fees. It is also dabbling in businesses where Alibaba has led. For example, last month, JD.com poached a top cloud-computing executive from Microsoft (MSFT) in China, the latest evidence of a push to build a cloud business to rival Alibaba’s. JD.com is well positioned to continue going after market share. It is 18%-owned by Tencent Holdings (700.Hong Kong), China’s largest social platform and a key traffic source. Wal-Mart Stores (WMT), which hasn’t distinguished itself in China but has 400 outlets there, owns 10%. Baidu (BIDU), China’s search leader, is a partner; under a recently announced venture, shoppers will be able to purchase JD.com goods within Baidu mobile apps.

detailed study (Study_of_JD_Dec_2017)

China’s JD.com isn’t in a rush to list its finance arm

Alibaba-Rival JD to Get $2.1 Billion in Finance Arm Spinoff

youtube videos on JD and Richard Liu

20160717 对话 “异类”刘强东: 重情重义的耿直汉子

JD.Com Inc(ADR) Stock Highlights the Advantages of Being No. 2

one recent comparison between JD and BABA

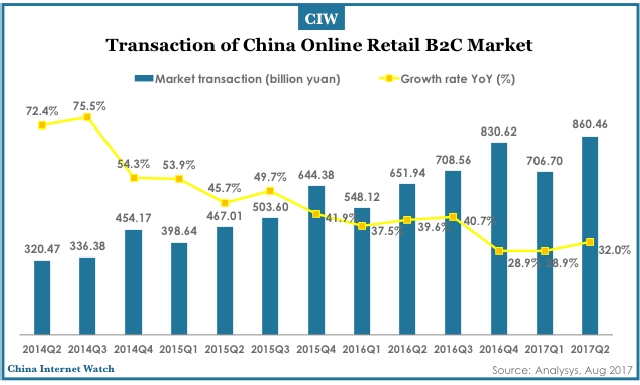

China B2C retail market, as of 2Q17, Tmall Tmall had captured 51.3% of the online B2C retail market, with JD.com as its primary competitor with 32.9%.

As of 3Q17, The total transactions on Tmall grew by 47% YoY in Q3 2017 or 7.4% QoQ, accounting for 59% of total transactions. In comparison, JD grew by 41% YoY or 3.9% QoQ with 26.9% market share in Q3 2017, followed by Vipshop, Suning, and GOME.

China Online B2C Retail Overview Q2 2017