here is a good recap of GSE storyinvestment in GSE common’s strategy

- common stock

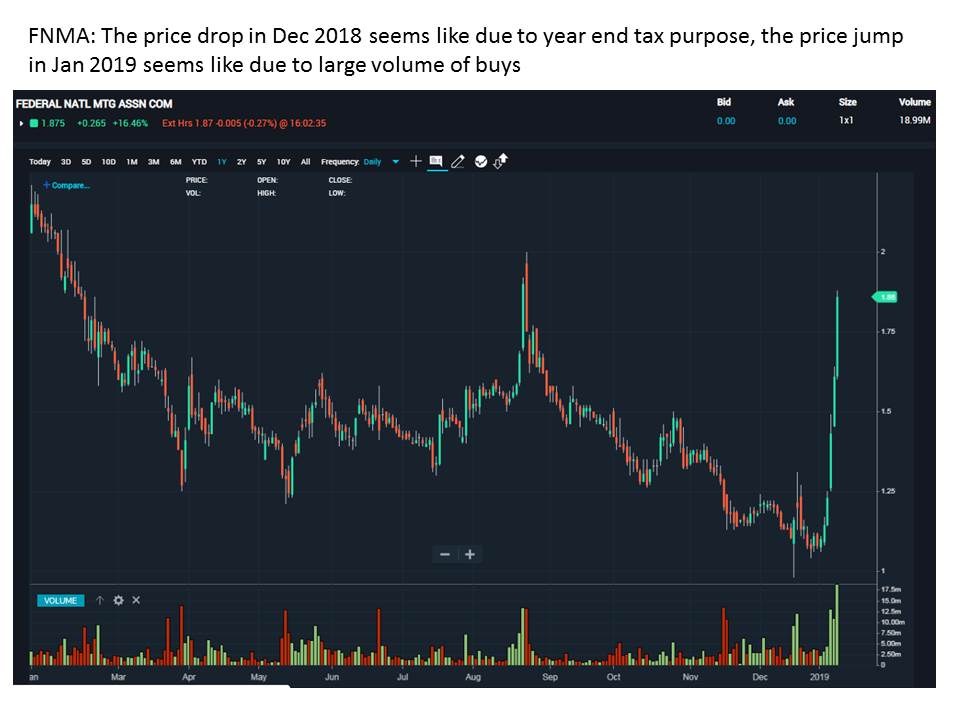

- buy common before recap (now) and sell them soon (and/or) buy put after re-ipo (relisting) because of the reference price history of AIG

- right before or after completion of IPO, buy call of common

Should I buy OTC options?Options trading | Options liquidity and trading solutions | GAIN Capital or this one Best Options Brokers for OTC Options. I have called Etrade and Gain Capital customer service, they do not offer OTC options.

- preferred

- sell once start recap? do I need to wait for them to convert to common? or do I need to hold them for longer term?

- Once reach 50%, sell some amount to make sure I do not lose the original investments?

- 09/21/2019 – great discussion on C pref to commons conversion rate

I finally got around to doing my analysis of the Citi conversion.

Citi’s official announcement: https://www.citigroup.com/citi/news/2009/090227a.htm

Citi’s summary of the terms: https://www.citigroup.com/citi/news/2009/090227a.pdf?ieNocache=262Series AA, E, F, and T were offered conversions. According to this link (https://preferredstockinvesting.blogspot.com/2009/09/citi-preferred-stock-conversion-rare.html) the conversion was voluntary, and it appears that each shareholder could choose which shares to convert. Another story I found (https://www.forbes.com/sites/dividendchannel/2014/10/30/citigroup-non-cumulative-preferred-stock-series-aa-ex-dividend-reminder/#666b206069c6) shows that C.PRP (Series AA) traded at $28.60 on 11/3/14 and was still paying dividends, so evidently it wasn’t called before then. This series pays 8.125% dividends, and given the low interest rate environments prevailing at the time and now, I would expect the high-div FnF series to similarly trade above par post-release.

I misplaced the link that said this, but it said that series T (6.50% rate) was converted at 85% of par at $3.25, and the other three (AA 8.125%, E 8.4%, F 8.5%) were converted at 95% of par at $3.25. This link also calculated $3.25 as a 20-day average; the closest I could get was $3.24 as the average of the 20 closing prices up to and including Feb 25. But HoldenWalker on Twitter said that the 22 days up to and including Feb 26 average to $3.2495, so I think this is more accurate.

That means that the market was not given a chance to react to the conversion at all. On Feb 27, the day of the announcement, the prefs spiked and the commons tanked. Of course that hurt the converted prefs, but the commons eventually got back to the $3.25 mark after a few months. Also, they still came out way ahead even in the immediate term as shown below.

On Feb 26, Series AA ($25 par) closed at $5.48. Historical prices on these are really, really hard to find. The only source I found was this page (https://www.preferredstockchannel.com/symbol/c.prp/), and the only way to get Feb 26’s closing price was to put in 2/26/09 and 2/28/09 in the Performance part on the top right, and then click “Chart $10K invested in C.PRP”. Citi commons closed at $2.46 on Feb 26, for a ratio of 2.3:1 the day before the conversion. At 95% of par at $3.25, Series AA holders ended up with 7.31 commons for each $25 in par value, more than 3 times the previous day’s ratio.

For Series T ($50 par, https://www.preferredstockchannel.com/symbol/c.pri/), the Feb 26 closing price was $10.54, for a ratio of 2.14:1 (normalized to $25-par). The conversion ratio was 85% of par at $3.25, or 6.54:1. This again represents a bit more than 3 times the previous day’s ratio.

I couldn’t even find price data for Series E and F, but I would imagine that their conversion ratios were similar.

This means that if Treasury and FHFA follow this playbook, current junior pref holders can expect to receive roughly 3 times as many commons in a conversion than they would by converting in the open market by selling the prefs and buying commons. And the commons wouldn’t necessarily have time to react to the possibility, given the relative price movement immediately following Citi’s conversion.

I think Dick Bove has it exactly right, that owning the juniors now is a (potentially much) cheaper way to own commons in the future, compared to owning commons now.

Of course the current litigation complicates things, but a payout to common shareholder plaintiffs plus a generous conversion (perhaps really generous) could get things done pretty fast. It appears that Treasury is no stranger to really generous pref-to-common conversions.

- 09/20/2019 – tweeters

the correct answer is: 1. letter agreement, 2. final capital rule, 3. pspa mod, 4. settlement 5. capital raise #fanniegate — so it appears that most of you still don’t know what’s going on…..

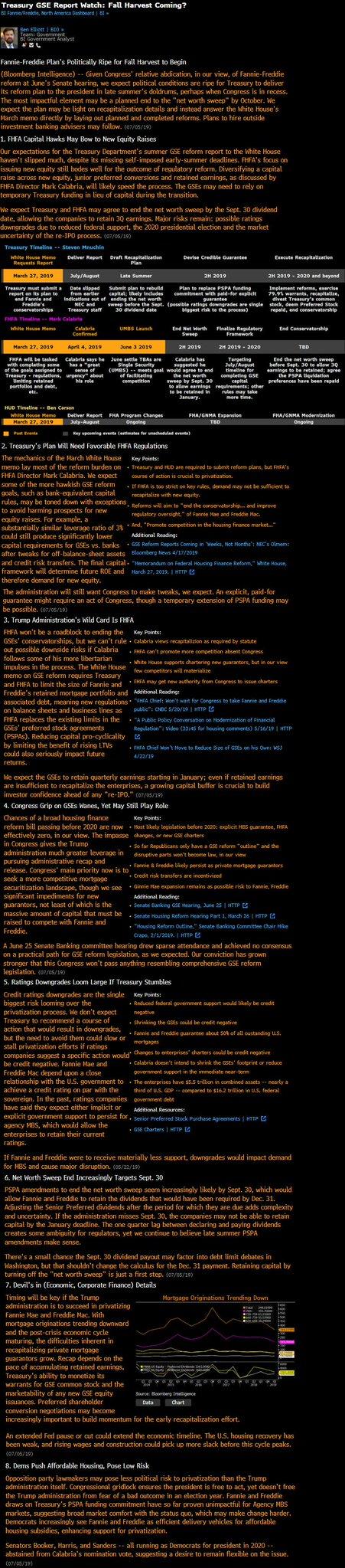

- 09/20/2019 – GSE Reform moves out of the starting gate

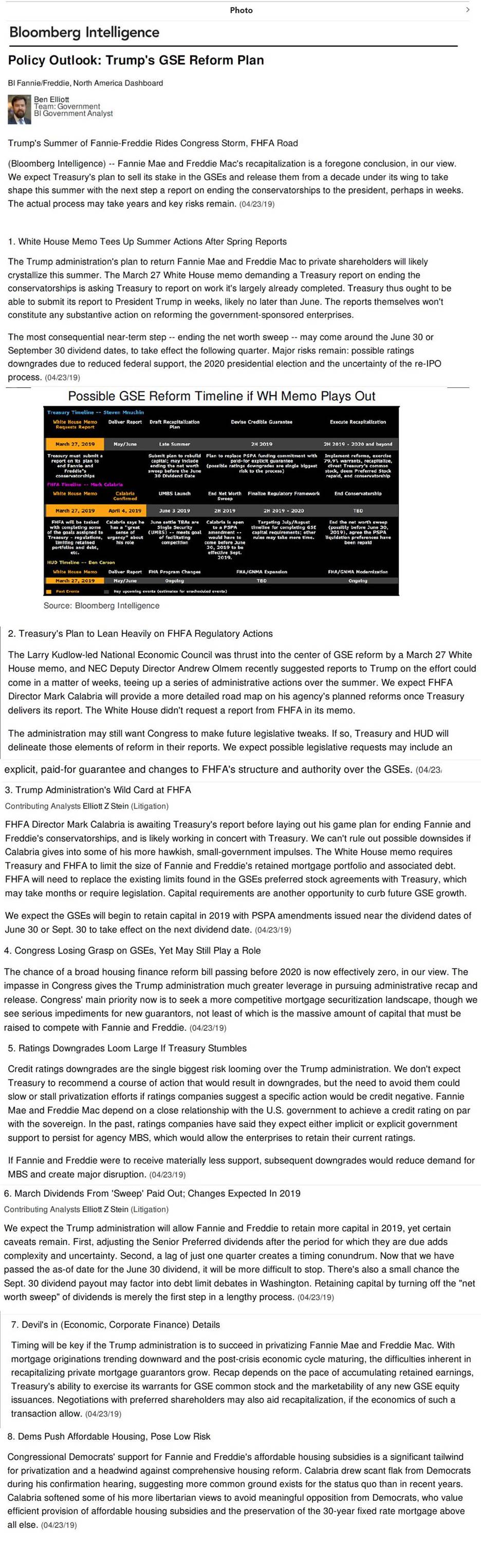

The GSE reform plan outlines four core objectives in conjunction with its recommendation to terminate the conservatorships. As detailed by CREFC, they include the following:

• Recapitalize the GSEs in the near term and set the stage for an orderly transition out of conservatorship to avoid unnecessary market disruptions and minimize systemic risk

• Shrink the overall size of the GSEs, with a heightened emphasis on mission-driven lending

• Require the GSEs to pay for their federal government guarantees

• Promote a more level playing field among the GSEs and the private marketplace

CREFC notes that in order to advance these four core (and inter-related) objectives, the GSE reform plan enumerates 49 separate recommendations that can be addressed variably through:

• Potentially immediate regulatory and other administrative actions

• Legislative proposals (that would require Congressional approval)

• Directives to study other issues to evaluate potential regulatory and legislative initiatives, such as a review of the benefits of Regulation AB II and the viability of requiring loan-level disclosures for GSE-issues

“Based on statements and actions made by Secretary Mnuchin and FHFA Director Calabria over the past week, the Administration has already begun to reform the GSEs on three fronts,” according to the CREFC report. “The ultimate goal of the Administration is to complete the following items by the end of first-quarter 2020:

• Reframing the GSE’s footprint by contemplating revisions to the multifamily caps and exemptions, including potentially minimizing green programs and lending in areas burdened by regulation such as rent control and strict zoning requirements

• Cessation of Treasury’s net sweep, effectively allowing the GSEs to build capital bases that now stand at a fraction of their pre-crisis levels

• A re-proposed or finalized rule framing out regulatory capital requirements similar to those applied to banks

As Connect Media has already reported, Calabria moved quickly on the caps for agency multifamily loan purchases. The FHFA eliminated all exclusions and set the cap at a total of $100 billion apiece for Fannie and Freddie over five quarters, compared with the previous $35 billion over a 12-month period for each GSE.

- 09/19/2019 – IMF newsFHFA: The End of the Net Worth Profit Sweep is Imminent

dhollier@imfpubs.comThe Federal Housing Finance Agency and the Treasury Department are close to signing a letter agreement that will eliminate the net worth sweep by the end of September, FHFA Director Mark Calabria told Inside Mortgage Finance this week.The settlement will allow Fannie Mae and Freddie Mac to retain most of their earnings beginning with the third quarter.The letter agreement is not a complete replacement of the preferred stock purchase agreement, Calabria said. It’s a temporary expedient to end the sweep as quickly as possible. - 09/18/2019 – tweets

Good point from @RuleofLawGuy1. How could it play out? Government wipes out SPS balance in SPSPA, convert JPS in restructuring (needed for more JPS in future @ lower rates) & JPS rights offering to reach minimum capital. That’s probably enough to end all lawsuits. $FNMA $FMCC https://twitter.com/DoNotLose/status/1174203568129228800

Cases challenging the NWS will be settled/dropped upon administrative action. The rest don’t have much of a chance in any court, but wait for SCOTUS victory in another 5 years if that’s what you want to do.

Conversion of existing JPS is a critical step in recapitalization in that it is core capital neutral & opens the capital structure to give GSEs flexibility to raise another $30-40b at lower market rates to help recapitalize or in downturn. $FNMA $FMCC

Without NWS, GSEs would have been able to recapitalize in 2013 when they returned to profitability (or, if you want to be conservative, after “10% moment”) and start paying dividends again. Damages of 2-5 years back dividends aren’t unreasonable and how JPS get par+. $FNMA $FMCC

Freddie’s Don Layton (ex-CEO) says 3 barriers create an insurmountable economic moat for the GSEs.

1. Scale

2. lender economics for Automated Underwriting Systems (AUS)

3. MBS investor preferences

Investors won’t fund competitors. Utility like g-fee regs way to go.$fnma $fmcc https://twitter.com/Harvard_JCHS/status/1174336686307721216

As such, I am trying to understand how on earth preferred shareholders don’t get par plus. Why would they settle for less? They hold the keys to start the recapitalization engine. https://twitter.com/DoNotLose/status/1174295962178793473

What he didn’t say: agreement essential to conducting public offerings since no new money will want to invest in conservatorship with HERA powers

- 09/18/2019 – great articles from Don Layton

HOW DEEP IS THE GSE ‘ECONOMIC MOAT’?

Wednesday, September 18, 2019 | Don Layton

full paper by Layton (GSEs_economic_moat_layton_2019)

WHY IS THE ADMINISTRATION NOT TALKING ABOUT UTILITY-STYLE REGULATION OF G-FEES?

Tuesday, July 16, 2019 | Don Layton

- 09/17/2019 – HOUSING FINANCE REFORM UPDATE from Boyle Capital

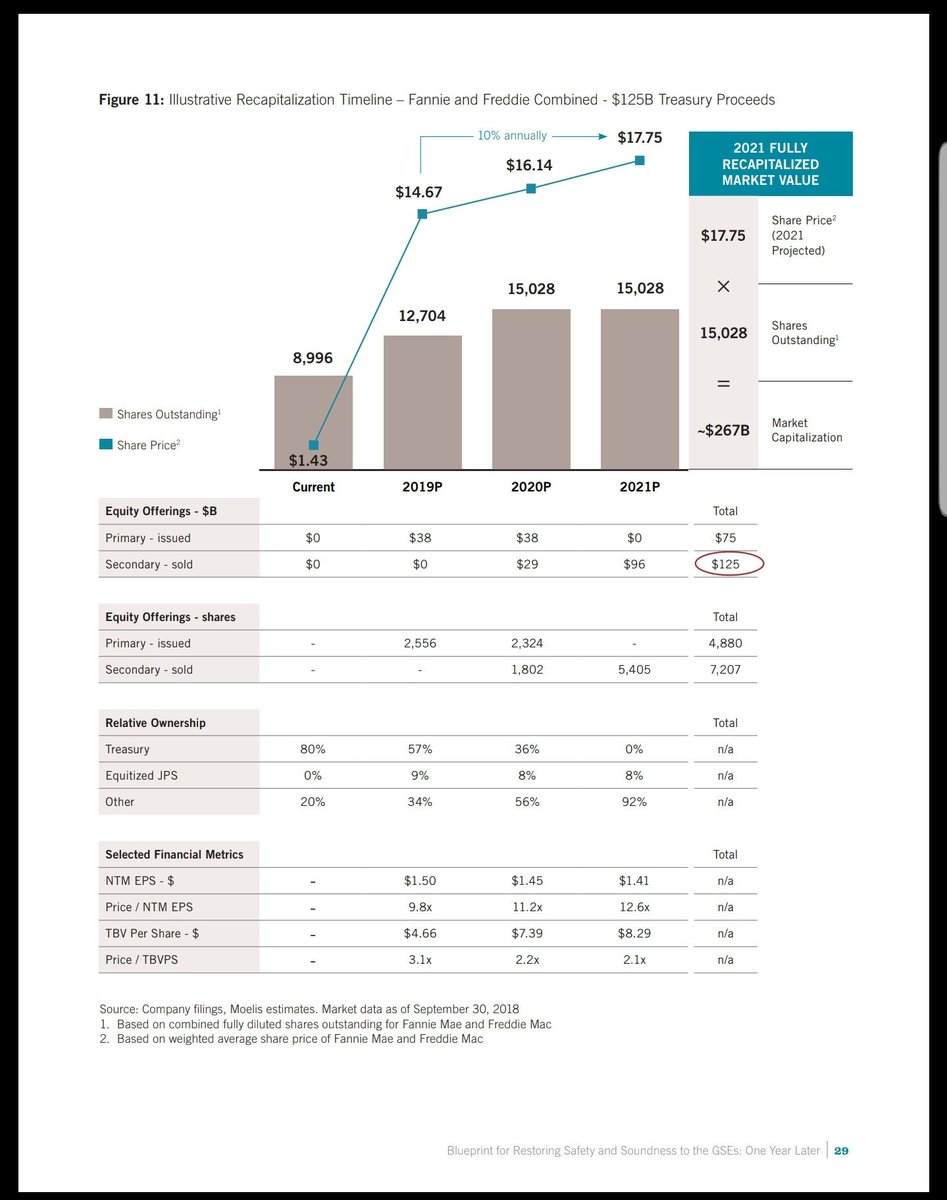

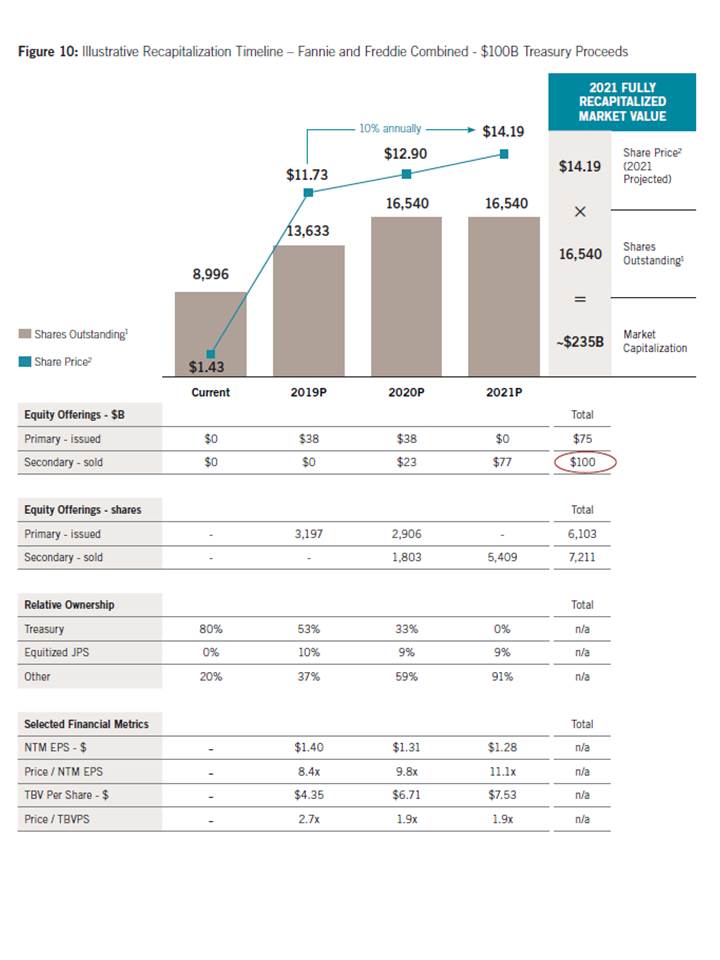

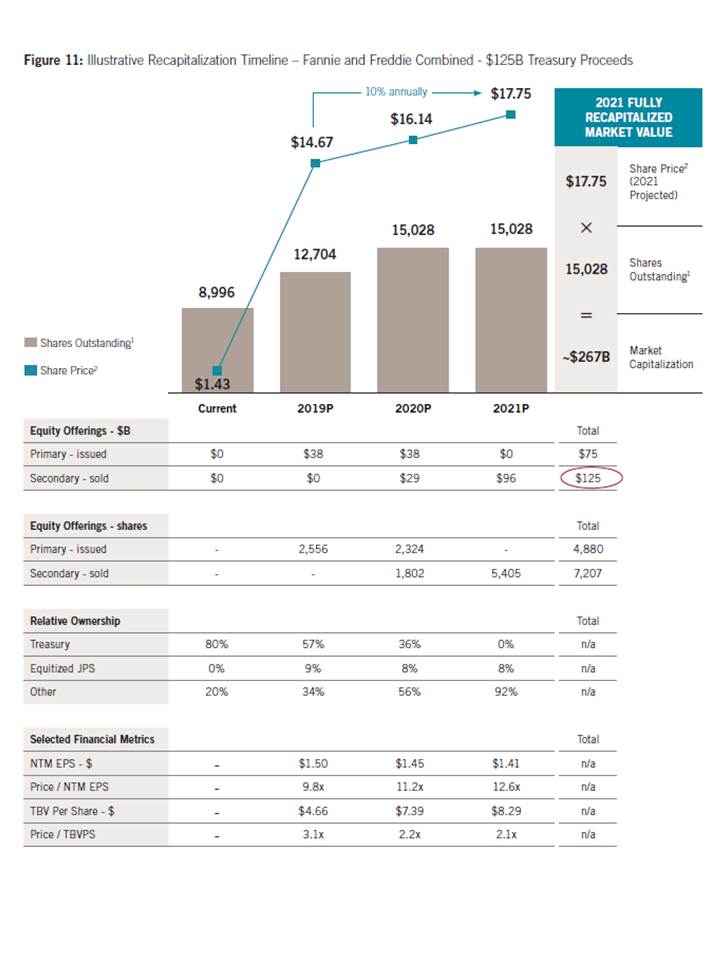

In order to accomplish the Administration’s stated goal of ending the conservatorships of Fannie and Freddie, the entities will need upwards of $125 billion in capital compared to the $3 billion they each have today. An agreement between Treasury and the FHFA is likely to be reached by the end of September which will allow for the entities to retain additional capital, however; at a run rate of $20 billion a year it will take years to retain the required level, and that assumes there isn’t an economic downturn along the way. As a result, the Treasury plan released last week instructed Treasury and FHFA to develop a recapitalization plan for each GSE “as promptly as practicable.”

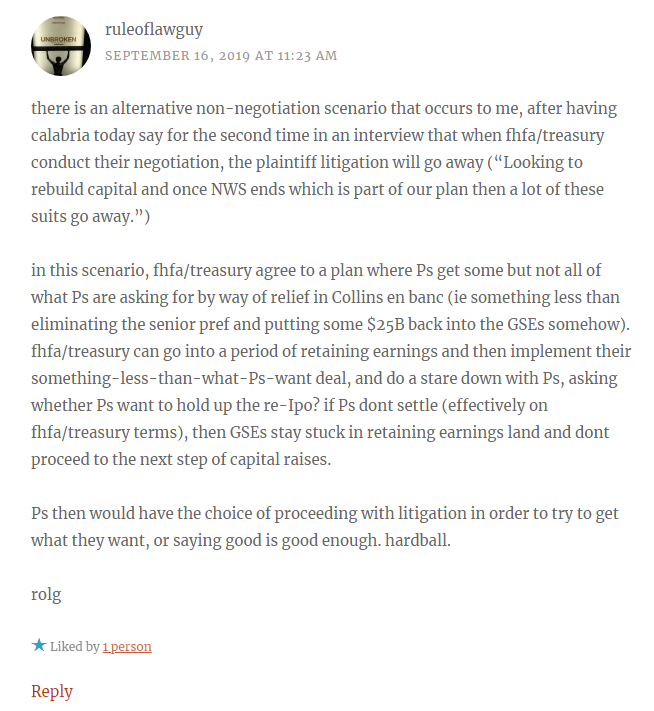

The plan contemplates a number of approaches for recapitalizing the GSEs, but ultimately no institutional investor is putting new capital into these entities until the outstanding legal issues with the existing shareholders are resolved. In addition to the net worth sweep ruling last week by the 5th Circuit in which the plaintiffs are entitled to backward looking relief from Treasury, there are several other cases still pending before the courts, including the breach of implied covenant case (aka the Fairholme case) in which Fannie and Freddie (not Treasury) could be liable for tens of billions in damages. Thus, given legal rulings to date and the timing of future hearings/decisions, Treasury has little option but to eventually settle with current shareholders if it is going to end the conservatorships using outside third party capital as contemplated by the plan and reiterated by Treasury Secretary Mnuchin during his testimony in front of the Senate Banking Committee.

So, what’s next? On the legal front, Treasury has up to 90 days to petition the Supreme Court of the United States to hear the Collins case. Given that the 5th Circuit ruling was not final, it is not certain if the Supreme Court would even take the case at this point in time. If they did, it is unlikely there would be a ruling before June 2020. If Treasury instead chooses to defend the remand in district court, it is likely to take up to two years for a final decision when considering the losing side would be likely to appeal. Regardless of the path, the strongly worded majority opinion of the 5th Circuit means it is highly likely that Treasury will eventually lose, and the net worth sweep will ultimately be overturned.

In the coming months, we expect Treasury and the FHFA to not only allow the entities to retain substantially more capital than the current $3 billion buffer, but also negotiate an amendment to the Treasury’s Senior Preferred Stock Purchase Agreement (SPSPA) that ends the net worth sweep and sets the stage for a capital raise in the second half of 2020. Prior to initiating a capital raise, however; Treasury must absolutely deal with the preferred shareholders or it can’t get off go. Last weeks court ruling gives Treasury the cover it needs to settle with shareholders. Given the 5th circuit ruling and directives of the Treasury plan to end the conservatorships by recapitalizing, shareholders have likely never been in a better position than they are today. Despite recent gains, preferred shares remain at roughly 50% of par value. Consequently, we expect further gains from our investments as Treasury and the FHFA continue to execute on their plan to recapitalize Fannie Mae and Freddie Mac.

Takeaways:

- Interim letter agreement w/@USTreasury to end NWS by end of month before a permanent agreement to end #conservatorship.

- Retain earnings 6-12 months before equity offering as early as Q4 2020.

- Modest footprint reductions focused on safety & soundness.

- 09/16/2019 – FHFA Director Mark Calabria (Audio)Host June Grasso features the best stories of the day from Bloomberg Radio, Bloomberg Television, and over 120 Bloomberg News bureaus around the world on Bloomberg Radio’s Bloomberg Best.Guests include: Michael O’Hanlon of the Brookings Institution. FHFA Director Mark Calabria. David Marcus, Evermore Global Advisors CEO and Evermore Global Value Fund Portfolio Manager. IBM Chair and CEO, Ginni Rometty.Hosts: June Grasso Producer: Karoline O’BrienRunning time 25:29

- 09/14/2019 – Citi to Exchange Preferred Securities for Common, Increasing Tangible Common Equity to as Much as $81 Billion – summarize the history of Citi to understand the common equity

https://www.citigroup.com/citi/news/2009/090227a.htm

- 09/13/2019 – How Once-Doomed Mortgage Giants Gained New Lease on Life

Fannie Mae and Freddie Mac cranked out profits as housing recovered after the financial crisis, and Congress couldn’t come up with a very good alternative to them - 09/13/2019 – BlackPacificCapital @BlackPacificCap

- 09/12/2019 – Katy O’Donnell @KatyODonnell_

Calabria talked next steps in an all-staff mtg today — raising capital buffer in a limited way and having GSEs operate under a consent agreement at point where they have enough $ to leave conservatorship but not enough to fully comply w/ new capital rules https://subscriber.politicopro.com/financial-services/whiteboard/2019/09/calabria-details-next-steps-on-fannie-freddie-in-internal-staff-meeting-3832206Replying to @KatyODonnell_Makes total sense. It’s a durable option that makes it difficult for other admins or Directors to reverse or revise terms of the release from conservatorship if the GSEs have been meeting the req’s of the consent order. Josh Rosner has been spot on this concept.

- 09/12/2019 – Fannie & Freddie regulator on next steps in mortgage market reform

- 09/12/2019 – A Full Short Week from Tim Howard

- 09/12/2019 – September 11, 2019: Investors Unite Collins vs. FHFA Legal Updates Teleconference

- 09/12/2019 – Fannie Mae: The Road to Recapitalization

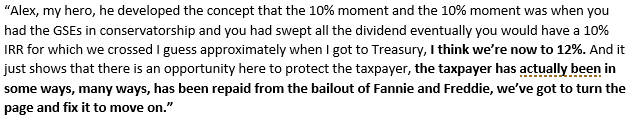

Gaby Heffesse, CFA, chief operating officer at ACG Analytics, provides an update to her winning trades on Fannie Mae. In this interview with Alex Rosenberg, Heffesse breaks down the Treasury’s plan for recapitalization, highlights the significance of the recent court rulings, and reviews how much upside she sees for both common and preferred shares. Filmed on September 10, 2019. Please find Gaby’s previous two interviews here:

https://www.realvision.com/tv/shows/trade-ideas/videos/opportunity-in-fannie-and-freddie

https://www.realvision.com/tv/shows/trade-ideas/videos/a-new-fannie-mae-play

During the interview, Gaby thinks common will go to $6~$14, and might dip when IPO starts; preferred will go to par or a bit higher.

To have a settlement through the court is very important because it is irreversible. Can not be changed by the next administration.

WASHINGTON (Reuters) – U.S. housing regulators and the Treasury Department were actively negotiating a profit sweep of mortgage giants Fannie Mae and Freddie Mac, U.S. Treasury Secretary Steven Mnuchin said on Thursday.

“That’s something that the FHFA (Federal Housing Finance Agency) and we are working on. We are actively negotiating an amendment, and I think our objective is to try to get it done by the end of the month,” Mnuchin told CNBC in an interview.

- 09/12/2019 – Treasury Secretary Mnuchin says Trump has approved reform plan for Fannie Mae and Freddie Mac

“We are actively negotiating an amendment try to get it done by the end of the month,”

Congress is working on the legislation for the next 90 days.

- 09/11/2019 – Todd’s tweet

Todd Sullivan @ToddSullivan

Bove: $FNMA “Senate hearing inconclusive, common may be overpriced, preferred still good long term buy”

@vascular08

5h5 hours ago

More

Replying to @ToddSullivan

I wonder if he still thinks preferreds fetch only 75-90% par after En Banc?

@ToddSullivan

5h5 hours ago

More

I do t think he’s said anything post decision. Prior to it he said “slight discount” which I read more like 90% par. He had recap raise at $2.50 share common

@vascular08

4h4 hours ago

More

If common goes higher, say $10, there would be absolutely no reason to not convert at 100% par, right?

@ToddSullivan

4h4 hours ago

More

Don’t think the two are related. I have not seen conversions scenarios where conversion happens >$4. I think huge upside to common post cap raise and conversion which current preferred holders will participate in. I think common a roller coaster until then.

@ToddSullivan

3h3 hours ago

More

A win in Lambreth court would be huge as it would provide for par plus interest “from date of injury”. That typically runs 6% and courts are divided whether simple or compound.

@ToddSullivan

3h3 hours ago

More

Even in just a simple interest scenario, we are talking 6% annually for 7 years or 42%. But who knows if we even get that far and this settles before then

@HoldenWalker99

5h5 hours ago

More

Replying to @ToddSullivan

Bove among the cynics who believe that the @USTreasury will monetize both their senior preferred shares and warrants. $FNMA $FMCC

@SleipnirPerkins

4h4 hours ago

More

Replying to @ToddSullivan

Pre 5th circuit ruling he was correct. Common is in a better seat now that NWS is illegal.

@llamas_78

5h5 hours ago

More

Replying to @ToddSullivan

Common overpriced, joke

@ethan2369

4h4 hours ago

More

Replying to @ToddSullivan

@USTreasury steals this quarter it could face another round of lawsuits.

@bulrun100

4h4 hours ago

More

Replying to @ToddSullivan

Bove & his stupid Preferred BIAS 💩

- 09/10/2019 – Banking committee meeting

some takeways from listeners

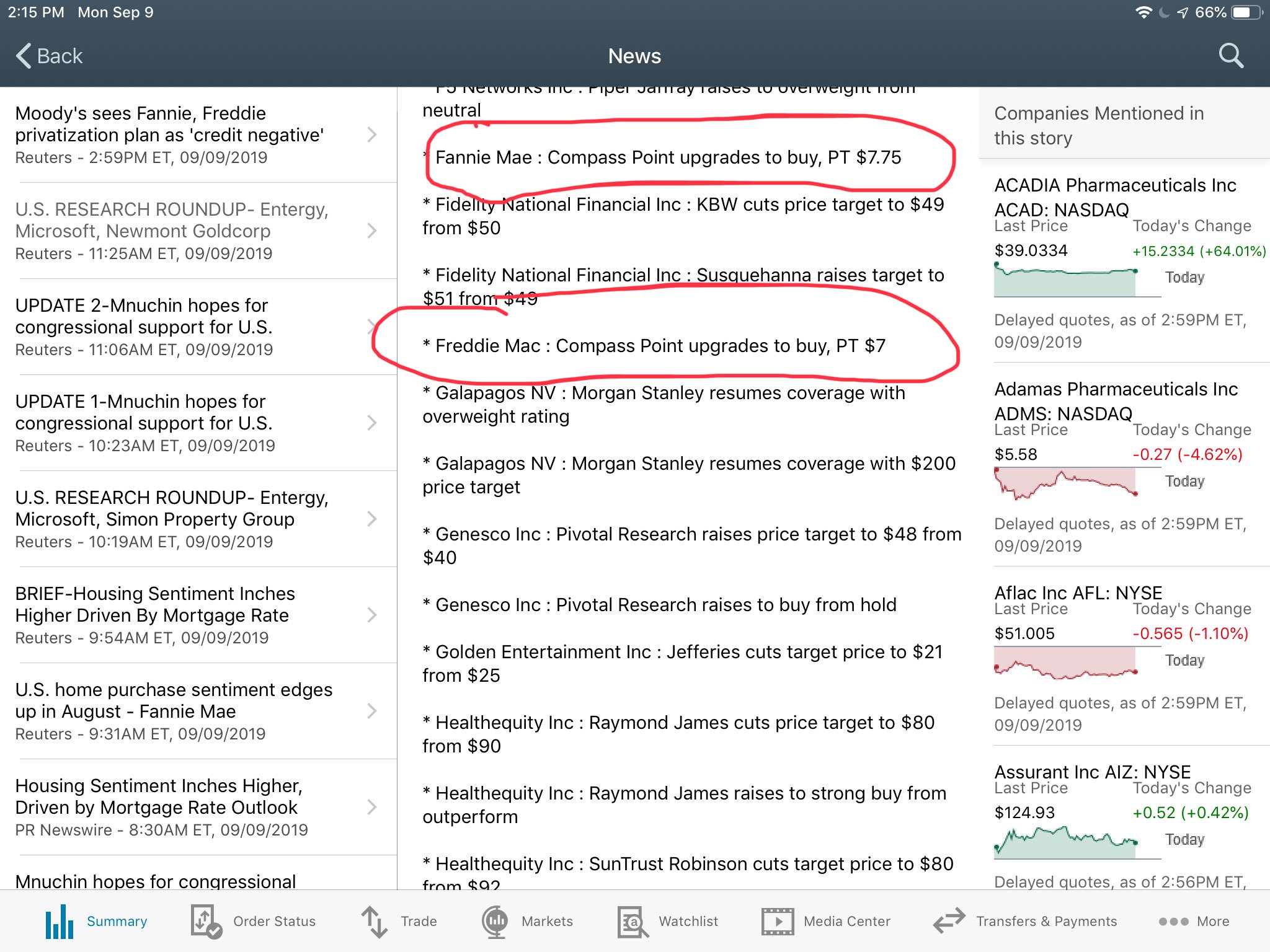

- 09/09/2019 – some valuation of FNMA/FMCC – about half of that of Moelis, is this still too high?

- 09/09/2019 – Steven Mnuchin on Fox Business News – Fannie, Freddie: They’ve been in conservatorship for too long

Sep. 09, 2019 – 7:10 – Treasury Secretary Steven Mnuchin on the Trump administration’s efforts to privatize Fannie Mae and Freddie Mac. - 09/09/2019 – Mnuchin: Fannie, Freddie overhaul key for future of housing

U.S. Treasury Secretary Steven Mnuchin told FOX Business Monday that he expects a deal on mortgage finance giants Fannie Mae and Freddie Mac – which have been under conservatorship for the past 11 years – very soon.

“I think we’re going to work with Congress on the first part of this. I’d hope that if we’re going to get congressional support it’ll be in the next three to six months. And if we can’t do that we’ll move on the administrative front,” he told Maria Bartiromo in an exclusive interview on “Mornings with Maria”.

“We think now is the time to recapitalize them, make them stronger and make sure that taxpayers aren’t at risk and eventually raise third-party capital so that we restructure them and that in another housing downturn taxpayers are not at risk,” he said.

Mnuchin said the first steps are negotiating with the Federal Housing Financing Agency (FHFA).

“We expect in the near term we’ll have an agreement where we will allow both Fannie Mae and Freddie Mac to retain their earnings which will be a significant increase in capital and a step in the right direction to us ultimately raising third-party capital,” he explained.

Mnuchin said the other issue he “looks forward” to testifying about at the Senate on Tuesday will be bipartisan legislation to get approval to put a full faith in credit on the securities.

“We think that the government should be paid for that wrap and we think there should be significant private capital in front of it – so something similar to the FDIC model or the Ginnie Mae [Government National Mortgage Association] wrap,” he explained.

Taking the two government-sponsored enterprises out from under government control could be a win for some investors, as companies could begin to turn a profit.

When Bartiromo asked about the federal appeals court ruling in New Orleans that concluded the FHFA structure is unconstitutional and backed the government’s rights to take all of the mortgage giants’ profits, Mnuchin said, “we’re not going to let this stand in the way of housing reform.”

“So as I say, there is an investor issue here which will continue to go through the legal process. But the most important issue is, regardless of that case, we will restructure Fannie Mae and Freddie Mac so that they have private capital in front of any taxpayer risk,” he explained.

Bartiromo also asked: “One investor wants to know, given the ruling that the net worth sweep that we now know was illegal, is the September sweep going to be halted? Are we going to see money go back to the investors?”

“The money wouldn’t go back to the investors, the money would stay in the companies and then obviously the legal process will go forward and obviously the Treasury has very significant claims for the money that we’ve outlaid,” he replied. “But, you know, I expect we’re… in the process of working with the FHFA and we’re going to try to see if we can do it in September. If not, it’ll be very soon after that.”

- 09/09/2019 – some background knowledge from Josh Rosner

- 09/09/2019 – another background knowledge 11k documents

- 09/08/2019 – How Fannie and Freddie Have Changed Since the Crisis

The two mortgage giants have shed some risk, paid back their bailout and now report billions in income

another reference: year 2015, Exclusive: Josh Rosner and Glen Corso on why it’s time for true GSE reform, Industry insiders weigh in on the future of Fannie Mae and Freddie Mac

some interpretation on the court document

- 09/06/2019 – Investors Notch Victory Over Fannie, Freddie Profits

An appellate court overturned a ruling that supported a government decision in 2012 to sweep all the mortgage-finance giants’ profits to the Treasury Department - 09/05/2019 – Trump administration seeks major mortgage finance overhaul

Treasury said the government would continue its financial backstop for Fannie and Freddie and called on Congress to charter new companies to compete with them. Still, it left many of the details of releasing the companies — such as the capital levels they would need and what would happen to Treasury’s holdings in the companies — to be hashed out in talks with their regulator, the Federal Housing Finance Agency, starting this fall.

Those details, the official said, “are left to the recapitalization plan. As a result, I think it would be a bad assumption by any of the various interested parties to try to assume how they would fare under that recapitalization plan.”

FHFA is expected to release a rule on Fannie and Freddie’s capital requirements this fall, a condition of their release.

WASHINGTON – The U.S. Department of the Treasury today released its plan to reform the housing finance system. The Treasury Housing Reform Plan (Plan) consists of a series of recommended legislative and administrative reforms that are designed to protect American taxpayers against future bailouts, preserve the 30-year fixed-rate mortgage, and help hardworking Americans fulfill their goal of buying a home.

“The Trump Administration is committed to promoting much needed reforms to the housing finance system that will protect taxpayers and help Americans who want to buy a home,” said U.S. Treasury Secretary Steven T. Mnuchin. “An effective and efficient Federal housing finance system will also meaningfully contribute to the continued economic growth under this Administration.”

Treasury also consulted with the Federal Housing Finance Agency, the Department of Housing and Urban Development, and other government agencies. The Plan was submitted to the President for approval through the Assistant to the President for Economic Policy.

Read the Treasury Housing Reform Plan .

Read the HUD Housing Reform Plan.

- 09/05/2019 – Treasury plan is out here (Treasury_plan_on_FNMA_FMCC)

The document recommends 49 administrative and legislative reforms. It has a clear preference for lawmakers to reach a deal on comprehensive changes, but also includes suggestions of what federal agencies can do in the meantime. The Department of Housing and Urban Development released its own set of recommendations, including that Congress give more autonomy to the Federal Housing Administration.

- 09/05/2019 – Cheat sheet: Trump administration’s road map for GSE overhaul

- 09/05/2019 – Dick Bove’s recommendation on FNMA/FMCC – my strategy on FNMA/FMCC, once plan announces, sell 50% preferred once it reaches 75% par, sell all once it reaches 90% par; sell 50% common once it reaches $5.00, sell all once it reaches $6.00 or higher (remember AIG chart). Sell my 401k once plan announces.

What then is the appropriate investment strategy?

1. Junior preferreds

Buy them now.

Sell them as the Administration puts its program in place.

2. Common stock

Avoid it at present.

Buy it 6 to 12 months following any stock offering.

Preferred

It is my assumption that the preferreds will increase to 75% to 90% of stated par when indications are made public that some payment will be made. Then they may drop back in value if the payments are to be in common stock.

The likelihood is that all preferred shareholders will receive the same amount irrespective of terms or coupons. Therefore, it may make sense to buy the low-coupon, off-the-run preferreds if it is expected that the preferreds will receive payments. The illiquidity risk is higher here but it may be worth the risk.

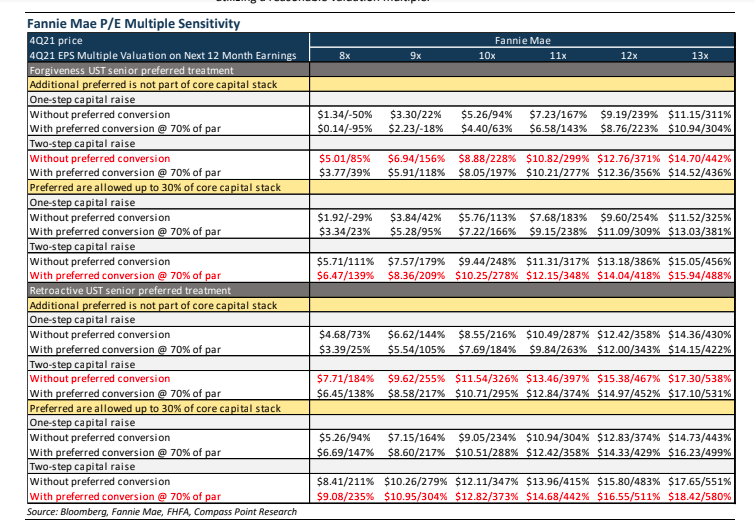

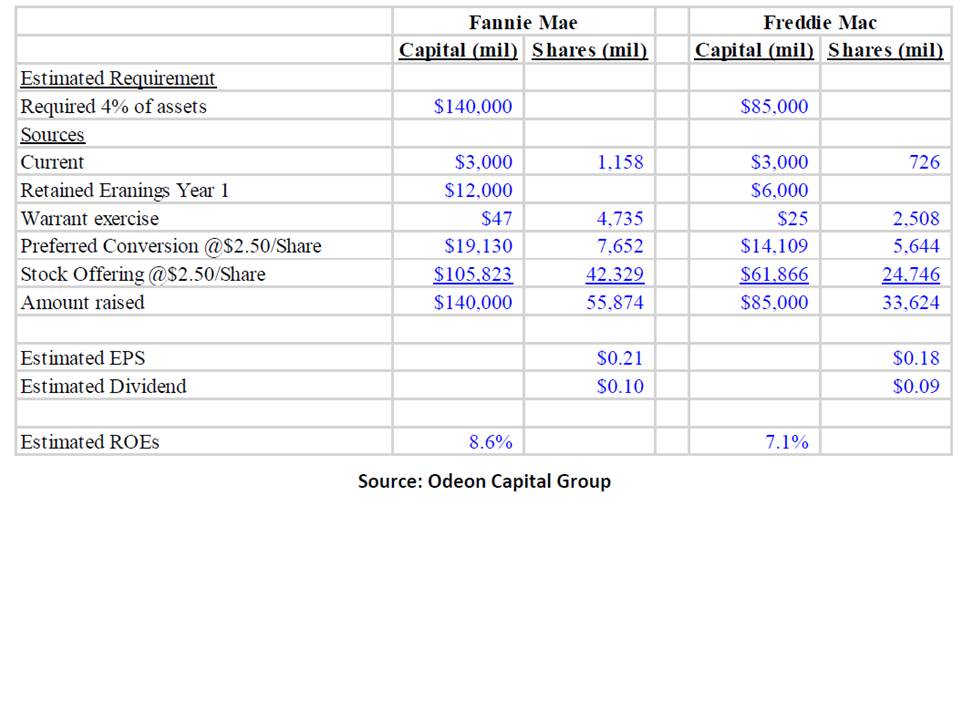

Common

This is a more complex transaction. In the table below I assumed that

• The required capital will be equal to 4% of assets. This is based on what the current requirement is at present at Fannie Mae.

• The retained earnings at each company will be 2 times H1 2019 net income.

• The junior preferreds will be converted into common at $2.50 per share.

• The common stock offering will also be at $2.50 per share or approximately 12x after my all event earnings estimates.

The numbers are shown in the table on the following page. One can adjust them for any series of reasons but these are the key concepts that must be dealt with. Plus, of course, these numbers assume that once the decision is made to pay the preferred shareholders, all of the court cases disappear.

Experts have pointed to four areas in particular to look out for when the reports are released that should provide valuable insight into the administration’s direction on housing finance reform.

- Strengthening Fannie and Freddie’s capital

- The timeline for reform

- A role for Congress

- How GSE reform will affect the Federal Housing Administration

- 08/27/2019 – Trump administration to release plan for Fannie, Freddie after Labor Day, Here’s what to expect

Now, the administration is preparing to release its comprehensive plan for the GSEs. It is expected to release the plan shortly after Labor Day.

“I’m expecting that Treasury and the administration will lay out their vision of what they think Congress should do, what they think I should do and what they think the Treasury and I should be able to do together in terms of amendments to the share agreements that allow an exit out of conservatorship,” Federal Housing Finance Agency Director Mark Calabria said in an exclusive sit down with HousingWire.

Calabria explained the plan will include parts directed at the U.S. Department of the Treasury, the U.S. Department of Housing and Urban Development, the Federal Housing Administration and FHFA.

“I’m hopeful that it will lay the groundwork so that we can all engage with Congress and continue to do my work with Treasury as well as my work as an independent agency,” Calabria said.

So what will be in the administration’s report? Calabria explained he is expecting to see a suggested blueprint for GSE reform.

“There will be suggestions, of course we’re an independent regulator, so Treasury will likely make suggestions on things that they think I should do, and being an independent regulator I will give those to consideration and see what makes sense for us to do,” Calabria said. “There will be a bit of a blueprint that will be a suggested roadmap for Congress.”

“I don’t expect to see legislative language, but I expect to see conceptual language that lays out a vision and a set of principles from the administration of what they think Congress should put in place in terms of a new model,” he said. That’s my expectation of what I think we’re likely to see.”

The plans released previously by the administration also give some idea of what to expect.

According to the administration, the GSEs play an outsized role in the country’s mortgage finance system and stand in the way of competition in the market. Under the previous proposal in June 2018 which is from Office of Budget and Management, not the Department of the Treasury, Fannie and Freddie would be converted to “fully private entities.”

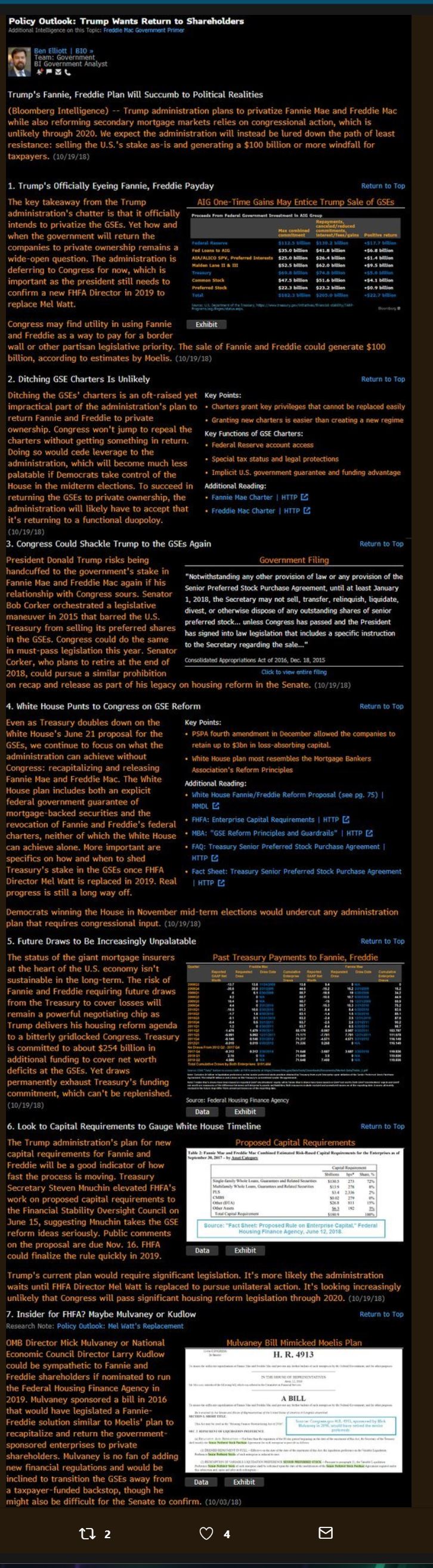

- 08/27/2019 – A Primer on the Future of Fannie, Freddie

What to expect from the Trump administration’s housing-finance overhaul - 08/21/2019 – Fannie and Freddie Plan Is Likely Released Next Month

Trump administration favors returning mortgage-finance firms to private-shareholder ownership

The plan, which could be floated shortly after the Labor Day holiday, is expected to envision a version of what has been called “recap and release,” which would ensure the firms have adequate capital to absorb loan losses in a future housing slump. Its provisions aren’t expected to give details for initial public offerings for the firms, the people said.

In the video he cites a source from the US Treasury that says their recap and release plan will be out Sept/Oct. He also takes credit for the 8% bump we saw today before close.

video of foxbusiness

The Treasury Department is expected to have its reform plan in place and ready for public release sometime by September or October, according to people with direct knowledge of the matter. Treasury has submitted a draft reform plan to the White House that includes suggestions to end the government control of the mortgage companies, known as Government Sponsored Enterprises (GSEs), sources say. The White House is expected to provide input as soon as this week, these people add.

Once the White House has signed off on Treasury’s plan, it could kick into high gear the long-awaited and promised reform effort by the Trump Administration to release both mortgage entities from government control. Also, the plan would also feature a recapitalization of both companies which would likely include the end of the government extracting all of the GSEs profits, and possibly a public stock offering to bolster Fannie and Freddie’s balance sheets.

While the Treasury report is expected to discuss recapitalization of the companies it is not expected to address the possibility of a stock issuance, these people say. Under the Treasury’s proposal, it’s unclear how shareholders would fare. A public offering could dilute common shareholders, meaning the value of their shares could fall from their current penny stock levels, but an end to the net-worth sweep might bolster shares.

Those investors holding preferred stock, which offers more protection from dilution, may benefit from any recapitalization.

The Treasury Plan – and a separate plan to be issued by the Department of Housing and Urban Development – may be light on specifics on exactly when these changes will take place, but at least on paper, both will provide the first tangible steps in the reforming GSE’s and their giant share of the housing market.

- 08/19/2019 – Add another 6 months to Fannie, Freddie recap and release timeline

FHFA will be forced to reissue rule to avoid lawsuits, Cowen’s investors note says

The Federal Housing Finance Agency issued a proposed capital requirements rule for the privatization of Fannie Mae and Freddie Mac last year. Since then, Mark Calabria has replaced Mel Watt as head of the FHFA, and several of Watt’s senior staffers have been replaced with people chosen by Calabria. By now, the final product is probably different enough that it will require the process to start again, Cowen said.

That means publishing it in the Federal Register and allowing at least a 60-day period for comment. Because Fannie Mae and Freddie Mac play such a critical role in the U.S. mortgage-financing system, the comment period last year was extended. The two mortgage companies purchased almost half of all single-family mortgages originated in the U.S. last year, according to FHFA data.

“We suspect FHFA will reissue the rule out of an abundance of caution,” Jaret Seiberg, Cowen’s managing director, said in the note issued on Friday. “The last thing the agency wants is for the courts to strike down the capital rule because FHFA made enough changes from the proposal that the public needed another opportunity to comment. Such a court ruling could come just as the enterprises were trying to raise between $100 billion and $150 billion of capital.”

- 08/15/2019 – FHFA Announces Results of Fannie Mae and Freddie Mac Dodd-Frank Act Stress Tests, 8/15/2019

stress test results

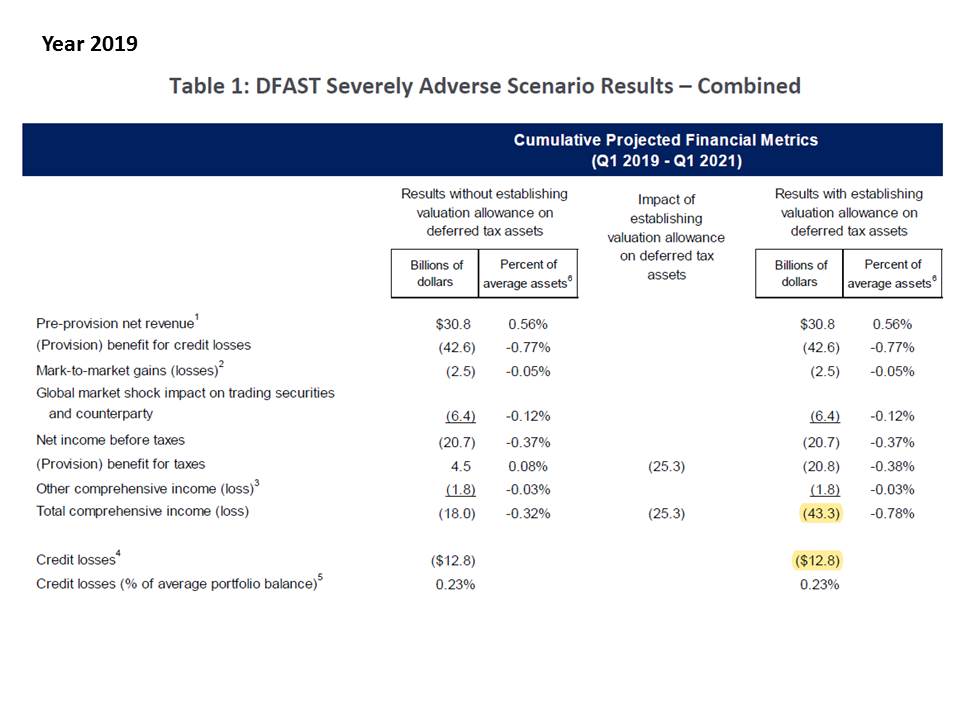

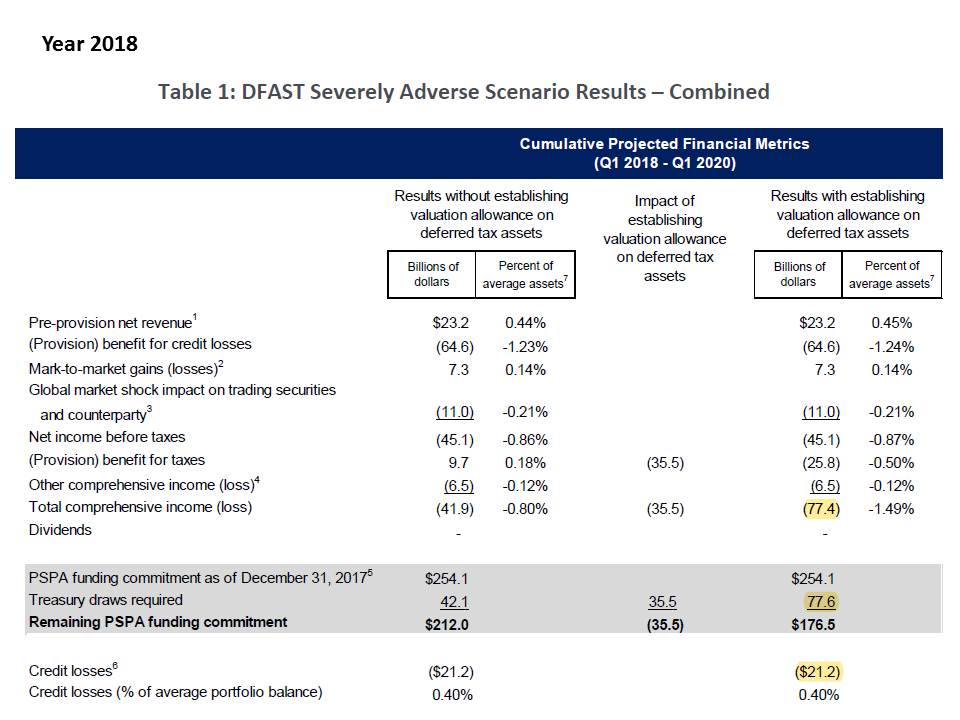

- 2019: combined loss $43.3 bil, credit loss $12.8 bil, total $56.1 bil (2019_DFAST_Severely-Adverse-Scenario)

- 2018: combined loss $77.4 bil, credit loss $21.2 bil, total $98.6 bil (2018_DFAST_Severely-Adverse-Scenario)

It seems like the required capital is less than we expected ($150 ~$200 bil), is it a good sign for recapitalization and commons?

Washington, D.C. – The Federal Housing Finance Agency (FHFA) today released a report providing the results of the annual stress tests Fannie Mae and Freddie Mac (the Enterprises) are required to conduct under the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). The Dodd-Frank Act requires certain financial institutions with more than $10 billion in assets to conduct annual stress tests to determine whether they can absorb losses as a result of adverse or severely adverse economic conditions. The report, Dodd-Frank Act Stress Tests – Severely Adverse Scenario, provides updated information on possible ranges of future financial results of the Enterprises under severely adverse economic conditions.

Link to Dodd-Frank Act Stress Tests – Severely Adverse Scenario

- 07/31/2019 -Notes:

- FHFA can and will act administratively

- Needs Congress’ help also

- Is going to work with Congress

- A consensus that the issues need to be fixed

- Best time to reform the system in before, not during a crisis

- Kennedy: “Best time to fix the roof is before it is raining”

- Hopes plan “comes out soon, before the end of the month”

- Having worked on HERA I never expected any conservatorship to last over 6 months

- What has happened to the GSE’s is “at odds with the statute” (HERA)

- Wants to end NWS to starts to rebuild capital

- Offering coming ~$100B

- Not calendar dependent

- FNMA/FMCC should hold capital level the same as other large institutions in the long run

- I am a strong believer of competitive level playing ground

- I wish congress will issue more charters to have the market competitive

- want a limited explicit guarantee approved by congress

From 6/13/19

- 07/19/2019 – Sources say FHFA’s Calabria wants massive public offering of Fannie, Freddie: Charlie Gasparino

Fox Business Videos•July 19, 2019

FOX Business’ Charlie Gasparino on Sen. Elizabeth Warren’s (D-Mass.) plan to regulate the private equity industry and Mark Calabria’s plan to reform Fannie Mae and Freddie Mac.

-

Charles Gasparino@CGasparino

- 07/19/2019 – Nice review of the current legal state of GSE litigation with David Thompson who leads Fairholme’s legal team

- 07/18/2019 – Fannie Mae, Freddie Mac shares down on 5-year timeline overhaul

- 07/18/2019 – Fannie Mae, Freddie Mac still in conservatorship in 2024? Calabria says it’s possible, Tells Reuters that he hopes to have GSEs out of conservatorship by 2024

At the MBA Secondary Conference in Manhattan in May, Calabria said ending the net worth sweep is the first step toward privatization, and then setting up an IPO for the GSEs to raise capital may follow.

Later, Calabria told Reuters that Fannie and Freddie may not be privatized in unison, as the government might choose to release one and then the other. “It may be preferable to stagger that process due to the complexities involved in getting the government-backed firms,” he said.

As for the administration’s plan for GSE reform, Calabria told Reuters this week that the plan may not be released until September, due to the other issues the administration is currently dealing with, which echoes Bloomberg’s reporting on the matter.

Calabria, in the interview, also hinted at one of the potential reforms to the GSEs’ operations. According to the Reuters report, the Treasury report will call for continued government backing of the GSEs, but not in the current form. Calabria told Reuters that he plans to call for a government guarantee of the mortgage-backed securities issued by Fannie and Freddie, instead of the companies themselves.

- 07/18/2019 – U.S. reform plan for Fannie, Freddie seen by Sept.: housing regulator, by Pete Schroeder and Richard Leong

NEW YORK/WASHINGTON (Reuters) – The Trump administration’s hotly anticipated blueprint for overhauling mortgage guarantors Fannie Mae and Freddie Mac may not be published until September as the U.S. Treasury juggles several other pressing issues, the housing regulator told Reuters.

Mark Calabria, director of the Federal Housing Finance Agency (FHFA), which oversees the government-sponsored enterprises, said in an interview it was his “hope” that they would have exited or be ready to exit conservatorship before his term ends in 2024.

However, Calabria is not operating toward a hard deadline, he noted.

“That’s my time horizon,” he said, referring to the end of his term. “I’m under no expectation to try to get all this done. … So if in four years, nine months they’re not out of conservatorship, I’m not pushing them out.”

Calabria’s comments will temper market expectations for a speedy overhaul of Fannie and Freddie before the 2020 presidential election.

Fannie and Freddie, which guarantee over half of all U.S. mortgages, have operated under government conservatorship since their bailout during the 2008 subprime mortgage crisis. Washington has struggled for years to devise a plan to safely return them to the private sector.

The Trump administration has said it is eager to push ahead with housing finance reform and industry analysts and insiders had expected a Treasury-led proposal for removing them from conservatorship to be published by this month. Calabria said the report was “essentially done,” that he had seen a draft, and expected it to be published in August or September.

Treasury Secretary Steven Mnuchin, who has led the push for reforming Fannie and Freddie within the administration, is “juggling a number of balls,” Calabria said. Mnuchin is involved in the ongoing trade war with China, debt ceiling negotiations with Congress and imposing sanctions on Iran. Craig Phillips, Mnuchin’s adviser who had been closely involved in the reform plan, also left in June.

Despite his heavy workload Mnuchin continues to work with his team on housing finance issues on a weekly basis, a person familiar with the matter told Reuters.

Calabria said he expected the Treasury will in the report back some form of government guarantee for Fannie and Freddie. But he said he planned to advocate for a guarantee limited to the mortgage-backed securities issued by the pair, rather than a government backstop for the companies themselves.

While Calabria sketched a potential five-year time horizon for removing Fannie and Freddie from conservatorship, he added that the government did not have forever to overhaul them and needs to progress while the housing market remains stable.

“The market looks pretty strong now, so that to me is the time when we want to make real repairs, he said.

- 07/16/2019 – WHY IS THE ADMINISTRATION NOT TALKING ABOUT UTILITY-STYLE REGULATION OF G-FEES? – great article by Layton

Tuesday, July 16, 2019 | Donald Layton - 07/15/2019 – latest report from Foxbiz Charlie G: Treasury reportedly unlikely to advocate privatization of Fannie, Freddie

Jul. 15, 2019 – 3:25 – FBN’s Charlie Gasparino on the debate within the Treasury Department’s efforts to figure out how to handle Fannie Mae and Freddie Mac.

- Treasury is not going to FULLY privatize FNMA/FMCC, this is probably a great news.

- Also, Charlie said Treasury will come out one day, but with delay.

- 07/11/2019 – news from Tim Pagliara – still there is no act so far

@timpagliara

Follow Follow @timpagliara More Tim Pagliara Retweeted 2019 Glen

Thanks to Dick Bove’ and Odeon Capital Group for hosting a panel discussion with David Thomson, Cooper Kirk, Dan Schmerin , and me to provide a status update on all things recap and release

- Meaningful action expected H2 2019

- Court Development appear to indicate Plaintiffs have turned the corner. Judges are seeing the light… Emboldened by rulings form SCOTUS on other cases that touch on similar principles.

- Congress unable to act.

- Calabria intends to act.

- 07/09/2019 – FHFA’s new appeal – it does not look too good since Calabria wants to uphold the constitutionality and validity of NWS. – from my understanding of the letter, validity of NWS is always upheld by FHFA, no matter who is the director. So it seems like this letter does not change anything.Dear Mr. Cayce:The Federal Housing Finance Agency (FHFA) Defendants-Appellees

write to advise the Court (a) of a leadership change at FHFA that necessitates

substitution of parties under Fed. R. App. P. 43(c)(2), and (b) that under its

new leadership FHFA has reconsidered the constitutional issue in this case,

presently taking the position that HERA’s for-cause removal provision is

constitutional, and urges the Court to uphold the constitutionality of the

structure Congress chose for FHFA.

1. In April, Mark A. Calabria was sworn in to serve a five-year term as

FHFA Director following presidential nomination and Senate confirmation.

Pursuant to Rule 43(c)(2), Director Calabria should be substituted for Acting

Director Joseph Otting as a defendant-appellee.

2. In this case, Plaintiffs-Appellants challenged the validity of a

transaction known as the Third Amendment in part as it is unconstitutional for

FHFA to be led by a single Director removable by the President only for

cause. Before the district court and the Panel, and in its petition for rehearingJuly 9, 2019

Page 2

en banc, FHFA defended the constitutionality of this provision. Shortly after

this Court granted rehearing en banc, the term of the prior Senate-confirmed

Director expired. Under interim leadership between January and April 2019,

including during en banc briefing and oral argument, FHFA elected not to

defend the constitutionality of its structure. At all relevant times FHFA argued

and continues to argue the issue does not affect the Third Amendment’s

validity.

Under its new Director, FHFA has considered this issue. FHFA now

advises the Court FHFA takes the position going forward that HERA’s

structure is constitutional. FHFA respectfully requests that the Court consider

the arguments on that issue presented at pages 46-56 of FHFA’s Panel brief,

and pages 10-15 of FHFA’s en banc petition, as presenting FHFA’s operative

position. FHFA withdraws the statements relating to this issue at page 3 of

FHFA’s supplemental en banc brief and to similar effect at en banc argument.

FHFA respectfully requests that, to the extent the Court finds it necessary to

reach the constitutional issue, the Court uphold FHFA’s structure and

otherwise affirm the judgment below as to the Third Amendment.Respectfully Submitted,

/s/ Robert J. Katerberg

Robert J. Katerberg

Counsel for Defendants-AppelleesFederal Housing Finance Agency and

Director Mark A. Calabria - 07/09/2019 – Why The Government Must Get Fannie And Freddie Out Of Conservatorship

Brian Boyle, CFA, the president and portfolio manager of Boyle Capital, and Erik Ritland, CFA, the research analyst at Boyle Capital, discuss their investment in Fannie Mae and Freddie Mac, what will it take getting Fannie and Freddie out of conservatorship.

See the rest of the interview on ValueWalkPremium

Out Of ConservatorshipBy User:AgnosticPreachersKid (Own work) [CC BY-SA 3.0], via Wikimedia CommonsRaul: Yes, can you tell me more about the Fannie Mae and Freddie Mac situation, just beginning with a primer to understand this investment and the out of conservatorship side of the argument?

Brian: Sure, so we could probably spend two/three hours, I’ll try to truncate it as much as I can. 2008, you had the financial crisis, obviously, a lot of distress in the environment at that time. A number of financial institutions were bailed out, including both Fannie Mae and Freddie Mac, which were the pillars of United States mortgage market. At the time, they were given a line of credit essentially from the treasury that would require them to, whatever they borrowed on, pay the government ten percent interest and then ultimately, they’d have to pay back whatever they borrowed. The line of credit ultimately got to 400 billion dollars.

They borrowed against that somewhere in the neighborhood of 189 billion dollars. Then in the summer of 2012, in August of 12’, on a Friday afternoon at 5:00, which is when you would want to drop bad news, the treasury and the regulator at the time, the FHFA unilaterally decided to change the terms of the original agreement and instead of ten percent interest on the outstanding balance, they were just going to take 100 percent of the profits in perpetuity. All but making the investments worthless because there was no opportunity for investors to participate in the recovery as it occurred.

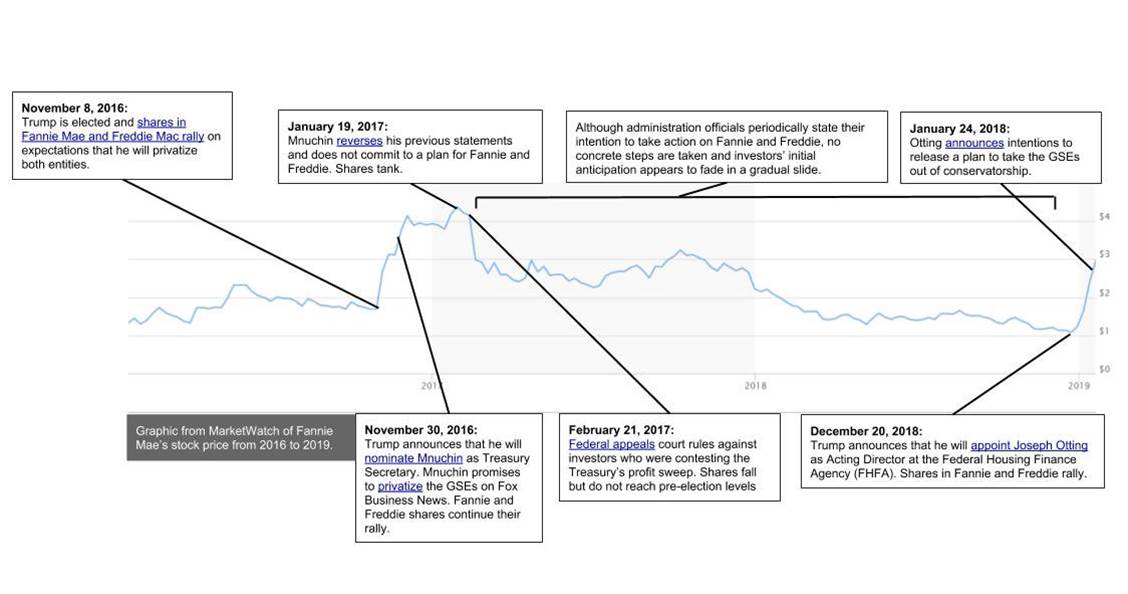

That action, of course, was challenged in the courts by a number of different parties and a number of different venues and a number of different arguments. From 2012 to the present, those cases have found their way through the various court systems, from the court of claims to circuit courts, district courts, and everything in between. We started looking at the opportunity in 14’, really started leaning into the investment from a weighting standpoint in the summer of 16’.

I would say at times, it felt like we were the only buyers in these securities. Our participation at that time was almost entirely in the preferred securities of Fannie Mae and Freddie Mac. Our premise was not necessarily the legal cases would be successful, but we do think that the legal arguments in support of the shareholders are stronger. We recognize that winning a case against the government is always an uphill battle.

So, we went into it recognizing that that part of it would be a wildcard. At the end of the day, we just felt like you have the linchpins of the U.S. mortgage market, that at times are anywhere from 50 to 80 percent of the overall market. Some administration is going to look at the situation and say, it makes no sense to have these two linchpins of the mortgage market with no capital and essentially in bankruptcy. We believed at some point, some administration, it wasn’t going to be the Obama administration, would come in and address that.

Obviously, Trump won in November of 16’, and these securities have benefited a great deal from his overall victory in 2016. Now, here we are in May of 2019, the securities have been like a rocket so far this year. Our portfolios have been up very strong this year as a result of that investment, primarily. We believe that more so than at any point during the life of this investment for us, the probability of a successful resolution is the greatest that it’s ever been. Where we’re at today is this, in April of 2019, Mark Calabria stepped in as director of the FHFA, this was the first time that the Trump administration was able to appoint their own person in that role.

Mark Calabria is extremely well-regarded, has a great background in the mortgage markets, was also heavily involved in putting together the law that oversees the conservatorship of Fannie Mae and Freddie Mac. The right man, at the right time for this job. Calabria in recent weeks has talked about the government’s interest in getting Fannie Mae and Freddie Mac out of conservatorship and this would piggy-back off of a memorandum that the Trump administration issued on March 27th, that memo had a number of items that it wanted to see as part of broad housing reform, but at the very top of that was exiting this conservatorship that Fannie Mae and Freddie Mac have been in since 2008.

Based on comments that have been made in the last couple of weeks, we’ve seen the securities continue to move up from as low as six dollars in October, to around thirteen dollars today. Really, why we’re positive on the situation from here is, we believe over the next couple of months, the administration’s plan will be crystalized and more and more of the details will be filled in.

By the time we get to the fall, the expectation would be that they’re going to be in a position to stop the current network sweep of 100 percent of the profits. They’ll reach an agreement with treasury that would enable Fannie Mae and Freddie Mac also to exit conservatorship. That would put them in a position to ultimately move down the path of recapitalizing Fannie Mae and Freddie Mac and doing some kind of public offering.

At the end of the day, you have these securities at 13, par value on the securities would be 25 dollars pers share. We don’t know if par value is going to be the endgame, we think that there’s going to be a high probability that that’s the case, but we feel like the risk/reward here is certainly attractive. The downside is probably pretty low, if you believe that they’re going to get this plan done. They need capital in these entities, and in order to get capital in the entities, you have to cut off the tail risk of litigation. The only way you do that is to solve the outstanding litigation. You settle it with the plaintiffs.

They’re not going to go away for 15 dollars a share, they’re probably going to go way for closer to 25 Out Of Conservatorship. That’s ultimately where we’re at. The securities are probably the biggest special situation that you could find and a very uncorrelated investment to the broader market. In a month like May, where the Dow has been down every week, it’s been down five of the last six weeks. This is an investment that has continued to move higher. We think that through the summer months, that upward movement will continue, but regardless, it will do so regardless of what the broader market does. At a time when people have concerns about valuations and trade talk, this is an attractive opportunity in our opinion.

Raul: Yes, it’s very hard to argue against that. Man. Do you think it will play out by fall-time? If not, when do you think the resolution will be resolved?

Brian: Well, it’s important to distinguish between a resolution and the factors that are going to move the stock price. If you look at what’s going to move the stock price, it’s going to be more clarity around the legal cases, and there are some legal cases that could have some favorable decisions this summer, or the most likely driver would be more clarity around the administration’s plan to exit conservatorship. We do think, based on comments that have been provided by Mark Calabria, the director, that by the fall, he will have negotiated a settlement with treasury as it regards to the government’s ownership in these entities.

At that time, it would make sense for them to ultimately resolve the outstanding issues surrounding litigation because you cannot go and do a road show to raise capital, if there’s just potential liability of 100 plus billion dollars hanging out there. The administration indicated that they’d like to be doing that road show sometime early next year, so our view would be, before you go and do that, you have to resolve how you’re going to treat the preferred securities.

In terms of actually getting out of conservatorship, it’s going to be a process, they’re going to need 100 to 150 billion dollars of capital. There’s never been a raise in the history of the markets of that size. You cannot eat an elephant like that in one bite, it will take three/four bites in order to do that. That will be something that will play out over a multitude of years. In terms of realizing the investment potential, we do believe that the next six to twelve months would be the timeline with respect to the securities, where they’re at today to closer to that par value level.

- 07/09/2019 – What to expect when you’re expecting a report on GSE reform (from Hannah Lang) – “Calabria has also said that he would begin negotiating changes to the preferred stock purchase agreements governing Treasury’s shares in Fannie and Freddie in September or October, if the reports are completed during the summer as expected.“

WASHINGTON — Recent expectations have grown that the Trump administration may prepare aggressive action to end the conservatorships of Fannie Mae and Freddie Mac, but some mortgage policy observers are speculating that a much-anticipated Treasury Department report on housing finance reform plans could be short on details.

A March directive by President Trump called on on Treasury, as well as the Department of Housing and Urban Development, to report on both administrative and legislative reform options “as soon as practicable.” The findings, which will either be released in one or several reports, are expected to come out starting as early as this month.

“This feels like the most significant movement in GSE or housing finance reform in the last decade,” said Thomas Wade, the director of financial services policy at the American Action Forum. “A lot of what I think this debate has been missing is an articulation as to what the appropriate or desired role of government in housing should be and some degree of urgency from the top.”

Treasury Department building

A March directive by President Trump called on Treasury, as well as the Department of Housing and Urban Development, to report on both administrative and legislative reform options “as soon as practicable.”

Bloomberg News

Federal Housing Finance Agency Director Mark Calabria has said he is waiting to see those reports before proceeding to make any decisions about how to supervise the government-sponsored enterprises’ exit from conservatorship.

But there is some skepticism about how much the Treasury and HUD findings might change the narrative around charting a future path for the GSEs. A report or series of reports could lay out goals that Calabria and other officials have already outlined without offering clear details about the mechanics to accomplish them.

Several observers stress the limitations on the administration to make lasting reforms without congressional involvement to create more competition in the mortgage market.

“These are very difficult things to do with administrative action — level[ing] the playing field and doing this without really increasing interest rates and facing any political blowback,” said Michael Bright, the CEO of the Structured Finance Association.

The report might merely be a vehicle for the administration to put priorities that officials such as Calabria have already articulated on paper, said Mark Zandi, the chief economist at Moody’s Analytics.

“So far it’s been some speeches, some interviews, some conferences, but nothing comprehensive or consistent,” he said. “I’m not sure we’re going to learn anything new, but I do think we’ll get a more consistent comprehensive sense of what they have in mind.”

Wade agreed that the report will likely not include much beyond “broad mission statements,” especially in some areas that administration officials have already highlighted as top agenda items.

“The capital plan and potentially amending the [preferred stock purchase agreements] later this year could potentially be much more important than the results of this report, where I just expect to see fleshing out some of the minor details of the administration’s desired direction without necessarily going into the real crunchy details of something so specific as the [qualified mortgage] patch or the desired amount of capital for the GSEs,” he said.

But if there is any detail provided in the reports, it will likely be about capital and ensuring equal access for all lenders in a future housing finance system, said Ed Wallace, the executive director of the Community Mortgage Lenders of America.

“I don’t think it will go into great detail of the specifics, but it will give you a few specifics from the overall perspective,” he said. “It’s going to look at the generalities, and I think from a 40,000-foot view, but I think in certain instances like retained earnings and equality across the secondary market as far as pricing is concerned, we’re hoping it will be more specific in that.”

Wallace suggested that the report could lay out significant reforms that the FHFA could make administratively to ensure equal access for lenders, such as locking in level pricing or establishing a commitment fee to preserve government backstops.

Any mention of capital retention or capital building in the Treasury and HUD reports will be worth paying attention to, said Wade.

“Dr. Calabria has made it clear that he sees effective capital for the GSEs as being the necessary prerequisite for recap and release or any form of flotation of the GSEs into the market, and so having said that, I think it is absolutely certain that the Treasury and HUD plans will widely have some sort of capital retention plan,” he said.

The FHFA has yet to finalize a proposed capital framework that would be implemented upon the GSEs’ exit from conservatorship. Former FHFA Director Mel Watt proposed the risk-based capital requirements last year, and Calabria has said he is still reviewing the framework.

Calabria has also said that he would begin negotiating changes to the preferred stock purchase agreements governing Treasury’s shares in Fannie and Freddie in September or October, if the reports are completed during the summer as expected.

In 2012, the FHFA and Treasury altered the senior agreements to require Fannie and Freddie to deliver nearly all of their profits to the Treasury Department in an effort to repay taxpayers, leaving the GSEs with an incredibly small capital cushion of $3 billion each.

“Assuming the report is released in the next few weeks, the next step would be for the FHFA to put forward its capital framework for Fannie and Freddie … and then by early next year in 2020 they’ll end the profit sweep and allow the GSEs to start retaining earnings and building capital,” said Zandi.

The priority of capital rebuilding could even supersede the administration’s other priority of limiting the scope of Fannie and Freddie in the market, Wade said.

“I think we’re going to see significantly less in the way of this footprint reduction than many in the industry would like, because I think systemic risk will be sacrificed at the altar of profitability and capital retention,” he said.

The administration will also need to answer the question of what would qualify as capital for the GSEs, said Bright.

“You want to de-risk them, you say that you want them to play a smaller role in the economy, but that you also want them to have more capital and it’s unclear exactly yet what counts as capital,” he said.

The report will also most likely preserve a role for Congress in the reform process, while still outlining what administrative actions don’t require legislation, said Wallace.

“I think Congress will have to play a role for it to be accepted,” he said. “From where I sit, Congress wants to be a part of a solution and I think from what I’ve heard Director Calabria wants Congress to be a part of the solution.”

Bright said the administration would be overshooting if the report minimized a congressional role. There would be a “pretty significant market reaction” if the report were to insist that the administration unilaterally privatize Fannie and Freddie, he said.

“I hope that it’s a thoughtful addition to the discussion that adds an element that says there’s a lot that Congress has to do, but there are some things that make sense to be done administratively and those are as follows and we’ve thought through a few of them and we think we can take some steps,” he said. “That would be a good outcome, if it’s something along those lines, so it’s sort of measured in terms of its goals.”

Ultimately, some sort of compromise is essential for any reform plan to work, said Wallace.

“I think it’s so anticipated people on both sides of the fence are going to have their opinions of it,” he said. “The key will be whether or not the sides can objectively move forward. … If they don’t try and work together, it’s not going to.”

In a letter submitted to the Fifth Circuit on Monday, the FHFA said that under the direction of its new chief, Mark Calabria, the agency had reconsidered the constitutionality question and is now urging the en banc panel to uphold the single director structure. The previous position was put in place by Joseph Otting, who was serving as acting director prior to Calabria’s appointment and confirmation. Otting’s predecessor, Mel Watt, had consistently defended the agency against legal attacks on its structure.

“FHFA now advises the Court FHFA takes the position going forward that HERA’s structure is constitutional,” wrote Robert J. Katerberg, an attorney at the law firm Arnold & Porter that represents the FHFA, in a letter dated July 9, 2019.

The FHFA also called upon the court to uphold a lower court ruling that gave the green light to a 2012 amendment–often called the third amendment because it came after two earlier revisions–to Fannie and Freddie’s bailout agreement. That amendment created a flexible dividend to be paid to the Treasury, known as the “net worth sweep,” essentially forcing the mortgage giants to pay nearly all of their profits to the government but allowing them to pay nothing in quarters where they suffer losses.

- 07/09/2019 – Recap of Fannie and Freddie must protect shareholder rights – is this a good news for commons than that for pref?

The administration will soon announce plans to release Fannie Mae and Freddie Mac from government conservatorship, and potentially recapitalize them with private investment.

First, Treasury should treat the payments it received in excess of the 10% dividend it was originally promised as a buy-down of principal in its senior preferred stock. That would result in its senior preferred stock being fully redeemed, with Treasury still holding over $18 billion in cash beyond the repayment of its principal, plus its 10% dividend. Treasury should return that excess amount.

Second, Treasury should exercise its warrants to acquire 80% of the common stock in the enterprises. That will ensure taxpayers obtain the maximum return on Treasury’s investment in the manner originally agreed, rather than through an unlawful appropriation.

Third, there should be an explicit deal under which the enterprises pay an insurance premium to the Treasury each year in exchange for Treasury holding open its current funding commitment (limited to $200 billion) as a liquidity line of last resort. This converts the nebulous “implicit government guarantee” into something explicit, clear and limited.

Fourth, the enterprises should rebuild capital. This should be possible through a new share issuance and through retaining earnings for a few years, if necessary.

Fifth, the government should not play favorites among private shareholders. There have been rumors about allowing preferred shareholders to convert into common stock, or allowing a limited rights offering to certain shareholders. This will lead to disputes and delay.

The contractual and legal rights of all shareholders should be left in place and respected equally. Anything else will be seen as playing favorites to Wall Street hedge funds that have invested disproportionately in the junior preferred stock. The contractual rights of those shares should be respected, but not favored over those of common shareholders.

Following these five steps will show that the government respects private property rights. It will also promote the confidence investors need to invest in Fannie and Freddie at a good price. That in turn will boost the value of the common stock held by Treasury, which will benefit taxpayers lawfully. And it will delineate explicitly the role of government and the private markets in funding these two institutions.

Fannie and Freddie exist to promote homeownership. The American dream, at the heart of which is owning private property. Corporate stock is also property, and close to the American Dream. Dear administration: You have a great opportunity to send a powerful message about the sanctity of private property rights and to make a profit while doing so. Don’t blow it.

- 07/05/2019 – Bloomberg intelligent great analysis

- 07/01/2019 – US to build capital and to stop taking Fannie, Freddie profits this year: Charlie Gasparino

- 07/01/2019 – S&PGR Affirms Rankings On Fannie Mae; Outlook StableJuly 01, 2019 13:53 ET (17:53 GMT)Press Release: S&PGR Affirms Rankings On Fannie Mae; Outlook StableThe following is a press release from S&P Global Ratings:OVERVIEW– We affirmed our overall ABOVE AVERAGE rankings on Fannie Mae(r) as a commercial mortgage loan master and special servicer.- The charter for The Federal National Mortgage Association (Fannie Mae), established by Congress in 1938, was expanded in 1984 when it formed its multifamily commercial lending business. Fannie Mae has been an active purchaser of multifamily mortgage loans since 1987.– The outlooks on the rankings are stable. FARMERS BRANCH, TEXAS (S&P Global Ratings) July 1, 2019–S&P Global Ratings today affirmed its ABOVE AVERAGE rankings on Fannie Mae as a commercial mortgage loan master and special servicer. The outlooks on the rankings are stable.Our rankings reflect:– The solid depth and breadth of management and staff, with significant industry experience and meaningful company tenure; — The dedicated focus on technology platform and applications, along with extensive data loss protection and oversight; — The comprehensive quality control and audit environment; — The solid multifamily underwriting guidelines and servicer oversight, which benefit from a unique risk-sharing model; — The lengthy track record of special servicing loan resolution activity, though it is predominately limited to the traditional multifamily product; — The historical low level of multifamily delinquencies; — The continued financial support and implicit guarantee from the U.S. government; and — Fannie Mae’s position in the Federal Housing Finance Agency (FHFA) conservatorship, with an uncertain future.Since our prior review (see “Servicer Evaluation: Fannie Mae,” published March 14, 2018), the following changes and/or developments have occurred: — Lending activity remained steady at $65 billion in 2018, including over $20 billion in green bond issuance. — The FHFA issued its 2019 Conservatorship Scorecard, keeping the annual multifamily lending cap to $35 billion for 2019 (the same level as in 2018, excluding carve-outs for certain targeted business segments). — The Director of Portfolio and Partner Surveillance left the company in May 2018. In the interim, those duties are being handled by the Vice President of Debt and Equity Asset Management. Fannie Mae is strategically approaching backfilling this position and anticipates completing this in the coming months.– The Multifamily Chief Credit Officer retired in December 2018, and the position was filled with an experienced industry new hire. — The company replaced the legacy disclosure system in November 2018 with DUS Disclose(r), which includes more data points for servicers. — The company consolidated from five locations in Washington D.C. to one location in Washington D.C. during the third quarter of 2018. — The company relocated its Dallas operations to a Plano office campus, which is approximately 10 miles north of the prior location, in November 2018. — The CEO retired in October 2018, and the position was temporarily filled by a board member who was subsequently appointed as the new CEO on March 26, 2019, following a national search. — The director of special servicing role was split into two roles in October 2018: the director of REO and disposition and the director of special asset management. The previous director of special servicing transitioned to the director of REO and disposition, while an internal team manager was promoted to the director of special asset management. — The Risk & Compliance portal was developed as a repository for policies and procedures in the fourth quarter of 2018, replacing the COPPER application. — KPMG was selected as bond administrator, outsourcing duties previously performed by the internal securities management team. The stable outlooks on the rankings reflect our view that Fannie Mae will continue to serve as a fully capable master and special servicer for commercial mortgage loans with a multifamily focus. Although Fannie Mae’s future existence and role have been under discussion internally and externally within various levels of the U.S. government recently, we assume it will conduct business as usual for the foreseeable future.The financial position is SUFFICIENT.

- 06/29/2019 – Possible Fannie, Freddie IPO whets Wall Street’s appetite

The nation’s largest bank, J.P. Morgan Chase & Co., hosted a private meeting on Tuesday with 75 investors to discuss efforts to overhaul both outfits, which play a critical role in housing financing, but have been wards of the government since the 2008 financial crisis, according to people with knowledge of the matter. The meeting also included members of investment bank Moelis & Co., which has long advocated ending Fannie and Freddie’s conservatorship and allowing the outfits to raise capital and return to their former status as private companies, these people say. A partner at the law firm of Kirkland & Ellis LLP, who specializes in mergers and acquisition, also presented to the group, they add.

********************************************

However, Joshua Rosner comments later as follow,

I spoke to several people in the room. I think the characterization is not quite right. They said there was no suggestion it would look like Moellis or of what UST or WH might do and that is it was nothing more than JPM asking Moellis to explain their proposal to clients.

- 06/25/2019 – IMF newsAs IMFnews went to press Tuesday, the Senate Banking Committee was holding a hearing on whether Fannie Mae and Freddie Mac should receive “systemically important financial institution” designation from the Financial Stability Oversight Council. If that happens, the GSEs would be subject to enhanced risk-based and leverage capital requirements…Of course, the whole point is moot though, isn’t it? Fannie and Freddie continue to be wards of the federal government. If they fail to meet a capital test, what’s the worst Uncle Sam can do? Put them in conservatorship? They’re already there. And isn’t Uncle Sam the one that’s prohibited the two from building capital?…Meanwhile, the Federal Housing Finance Agency is working on new capital standards for the two mortgage giants. A proposal is expected this summer…In his opening statement before the hearing, SBC Chairman Mike Crapo, R-ID, said his strong preference is for Congress to pass GSE reform legislation, though he added: “However, we are also interested in analyzing some of the options currently available to the administration to protect taxpayers and put our housing finance system on stronger financial footing…”

- 06/25/2019 – Wall Street insider Craig Phillips leaves Treasury without Fannie, Freddie reform

Phillips was “one of the few senior folks at Treasury with clout” to negotiate on GSEs

Federal Housing Finance Agency Director Mark Calabria said earlier this month that he hoped Treasury’s plan to release Fannie Mae and Freddie Mac would come by the end of June. The White House is reviewing a draft of the proposal, Bloomberg reported last week, citing people familiar with the matter. The two mortgage giants guarantee more than half of the outstanding residential mortgages in the U.S., according to Federal Reserve data.

The departure of Phillips “matters” to the prospects of getting Fannie and Freddie back to anything resembling the footing they had before the housing crisis a decade ago, Jaret Seiberg, Managing Director at Cowen Group, said in a note to clients on Friday.

“Phillips was one of the few senior folks at Treasury with the clout to negotiate on GSE reform,” Seiberg wrote in the note. “While we believe he finished the Treasury white paper on GSE reform before he left, his departure means that Phillips cannot push the National Economic Council to approve the document. More broadly, Mnuchin has few other senior advisers and he devotes much of his time to trade disputes. The argument is that Mnuchin simply lacks the time and energy needed to advance a housing finance reform plan given the controversy that will surround any plan to recap and release Fannie and Freddie.”

- 06/25/2019 – Push to Overhaul Fannie, Freddie Nudges Up Mortgage Costs

Some investors are wary that any big changes could reduce or eliminate the federal backstop – WH is reviewing the draft and might be completed by July

White House staff are reviewing a draft of the plan, written by the Treasury Department, and it could be completed as early as July, according to people familiar with the matter. Only Congress can create a federal guarantee for the Fannie and Freddie’s securities, but the chances of lawmakers acting are slim.

Officials from large asset-management firms, including BlackRock Inc. and Pacific Investment Management Co., met privately on June 7 with Mr. Calabria. People familiar with the meeting said attendees left the session concerned about a lack of clarity over how the Fannie and Freddie would be backstopped in any move to privatize the firms.

- 06/18/2019 – Craig Phillips Leaves Treasury Before Fannie Report Is Finished – another surprise on this topic, and it seems like WH is reviewing his proposal and we will see when they can finish the review and then release it

Craig Phillips, a top aide to Treasury Secretary Steven Mnuchin, left the agency last week before the release of a housing-finance plan he was expected to finish, according to people familiar with the matter. Phillips, who said in May that he was planing to step down, led the Treasury Department’s effort to draft a plan to get Fannie Mae and Freddie Mac out of U.S. conservatorship. Federal Housing Finance Agency Director Mark Calabria said last week that he hoped Treasury’s plan to return the companies to private ownership would come by the end of the month. The White House is reviewing a draft of the proposal, people familiar with the matter have said.

Almost 50% of all mortgage originations sold to Fannie Mae or Freddie Mac last year came from non-depository institutions, FHFA Director Mark Calabria said today at an industry event in Washington, D.C. Noting that “there are some key differences between banks and non-banks that we need to address in a responsible way,” Calabria said that under his leadership, FHFA will work to improve counterparty risk standards at Fannie and Freddie. “Our goal is to ensure that originators have the financial strength to continue lending through any market weakness or stressed environment,” he said.